Overview

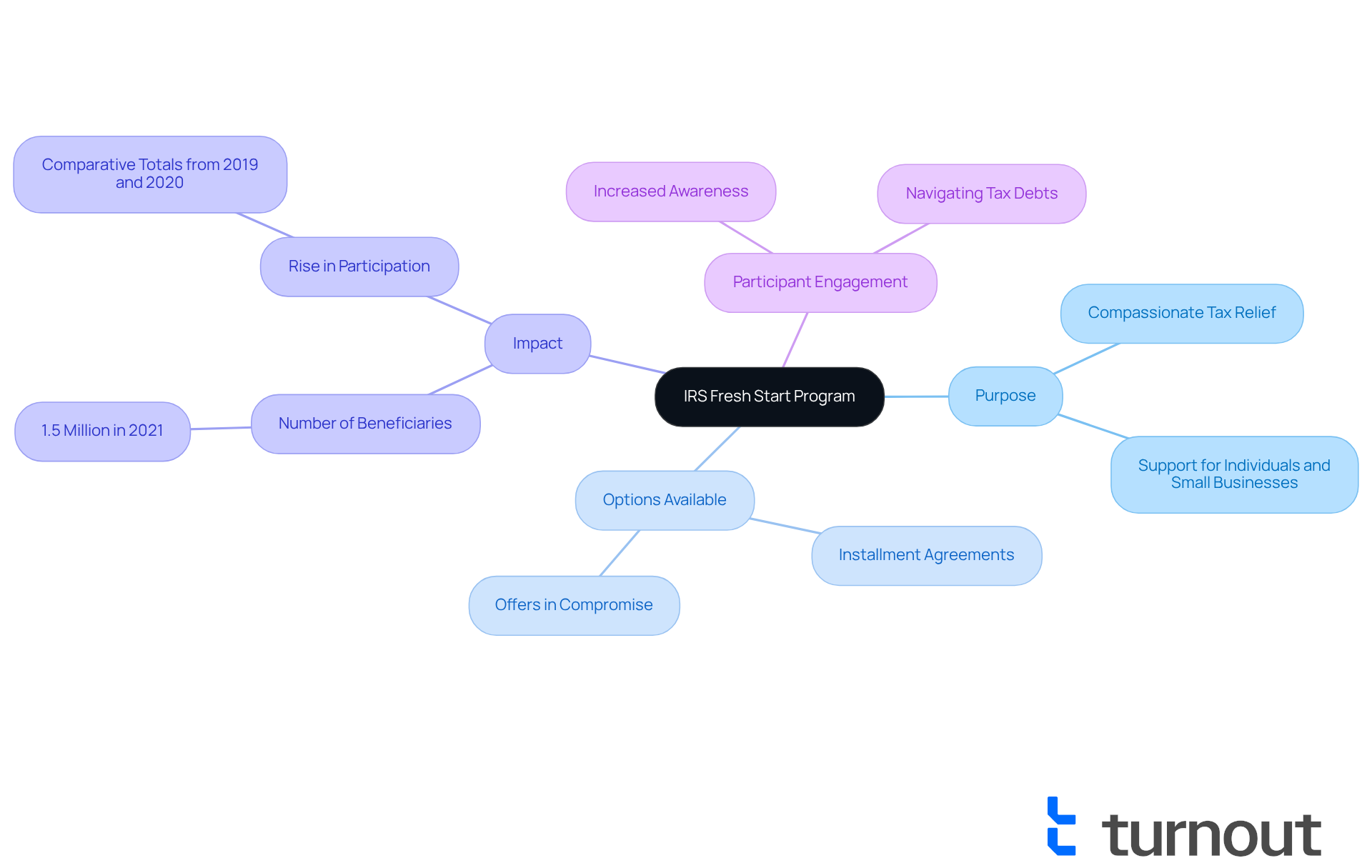

The IRS Fresh Start Program is a compassionate tax relief initiative designed to support individuals and small businesses facing the burden of tax debts. We understand that managing these financial challenges can be overwhelming, which is why this program offers manageable repayment options and reduces the risk of tax liens.

Key features of the program include:

- Streamlined installment agreements

- Offers in compromise

These solutions work together to alleviate the financial strain on millions of taxpayers since the program's launch.

If you're struggling with tax debts, know that you are not alone in this journey. The IRS Fresh Start Program is here to help you find a path to financial relief. Together, we can navigate these challenges and work towards a brighter financial future.

Introduction

The IRS Fresh Start Program has emerged as a beacon of hope for individuals and small businesses grappling with the weight of tax debts, especially in the wake of economic challenges. Launched in 2011, this initiative simplifies the path to tax relief by offering manageable repayment options and reducing the risk of severe collection actions. We understand that navigating tax debt can be overwhelming, and many still wonder: who truly qualifies for this program, and what steps must be taken to secure this vital assistance?

It's common to feel uncertain about where to turn for help. This program has the potential to transform financial futures, providing a supportive lifeline for those in need. As you explore your options, remember that you're not alone in this journey. We're here to help you understand the process and find the relief you deserve.

Define the IRS Fresh Start Program

What is the IRS Fresh Start Program? It is a compassionate tax relief initiative designed to support individuals and small businesses facing the challenges of tax debts. Launched in 2011, the IRS Fresh Start Program is designed to simplify the process of repaying taxes owed to the IRS, offering various options such as installment agreements and offers in compromise. If you owe $50,000 or less, you might be wondering how the IRS Fresh Start Program can help you manage your tax responsibilities more efficiently and avoid serious collection measures like liens and levies.

Since its inception, the IRS Fresh Start Program has significantly impacted countless lives, with millions benefiting from its provisions. For instance, during the 2021 submission period, around 1.5 million individuals took advantage of the Fresh Start options, prompting many to ask how the IRS Fresh Start Program works, which indicates the rising awareness and accessibility of these relief measures. This showcases how effective the program has been in alleviating economic burdens. Furthermore, cumulative and comparative totals from the 2019 and 2020 filing periods suggest a steady increase in participant engagement, highlighting the IRS Fresh Start Program's vital role in helping individuals regain control over their financial situations.

We understand that navigating tax debts can be overwhelming, but you are not alone in this journey. The Fresh Start Program is designed to assist you in understanding how the IRS Fresh Start Program works, helping you take the first step towards financial relief and peace of mind.

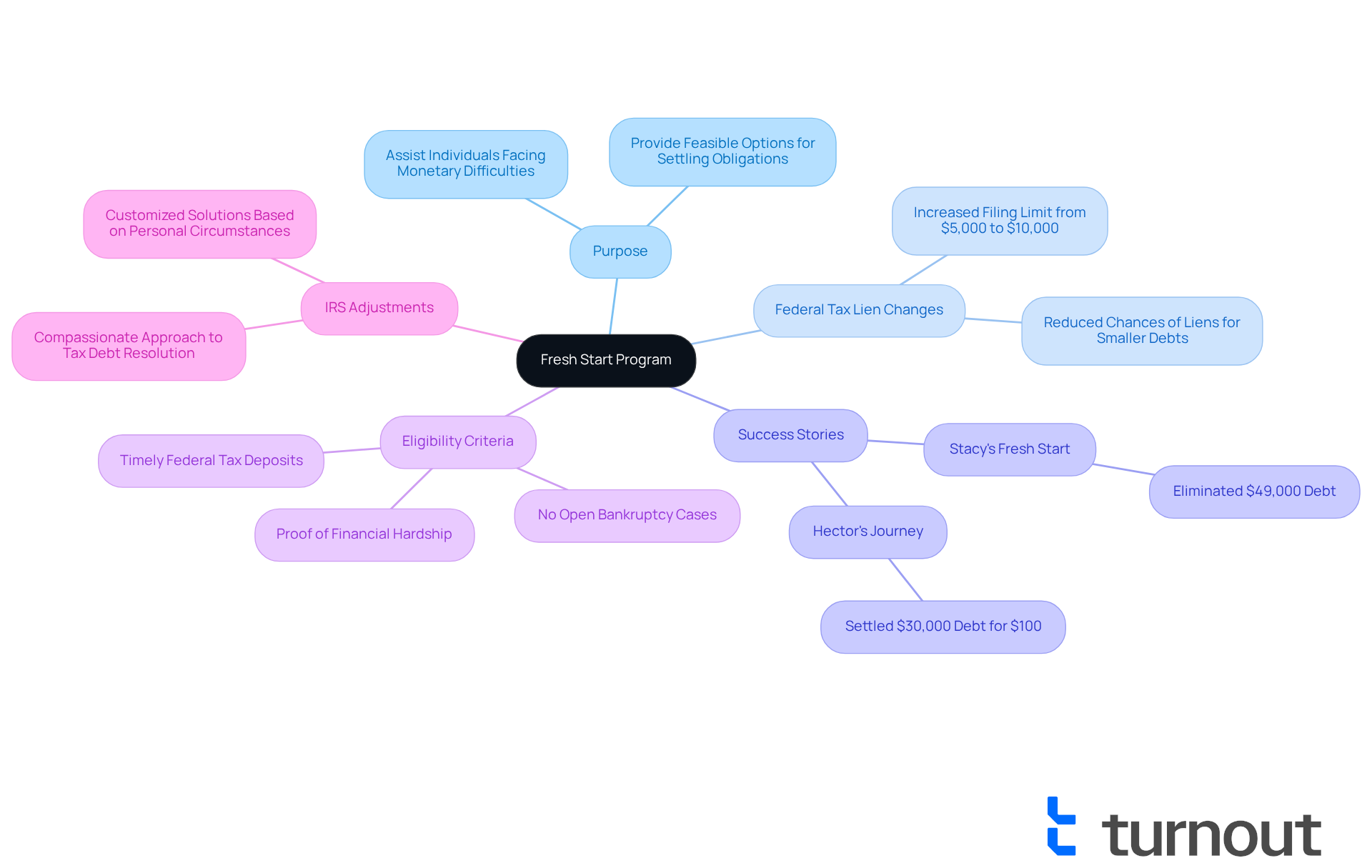

Context and Purpose of the Fresh Start Program

The Fresh Start Program, often referred to as what is the IRS Fresh Start Program, was created to help individuals facing monetary difficulties after the 2008 economic downturn. We understand that traditional tax collection methods can often add to these challenges. In response, the IRS has adopted a more compassionate approach to tax debt resolution, which is what is the IRS Fresh Start Program. This initiative aims to provide struggling individuals with feasible options for settling their obligations, such as what is the IRS Fresh Start Program, assisting them on their path toward economic stability and helping them avoid the long-term consequences of tax delinquency.

By increasing the federal tax lien filing limit from $5,000 to $10,000, the program has significantly reduced the chances of liens for smaller debts. This change simplifies the process for taxpayers to manage their obligations. Tax experts highlight that what is the IRS Fresh Start Program offers customized solutions based on personal monetary circumstances. This means many can resolve their debts for a lower amount than what they owe.

Consider the stories of individuals like Hector and Stacy, who have successfully utilized the program to address significant tax debts. Their experiences illustrate what is the IRS Fresh Start Program and how it can truly change lives and restore peace of mind. However, it’s important to acknowledge that not everyone qualifies for the program. Eligibility is based on strict economic guidelines assessed by the IRS.

As the IRS continues to adjust its policies, it is important to understand what is the IRS Fresh Start Program, as it remains an essential resource for those seeking relief from overwhelming tax burdens. Remember, you are not alone in this journey—we're here to help you navigate these challenges.

Key Features and Components of the Fresh Start Program

The IRS Fresh Start Program, which aims to alleviate the economic burden on individuals who owe taxes, raises the question of what is the IRS Fresh Start Program. We understand that dealing with tax obligations can be overwhelming, and this program is designed to help you navigate those challenges.

-

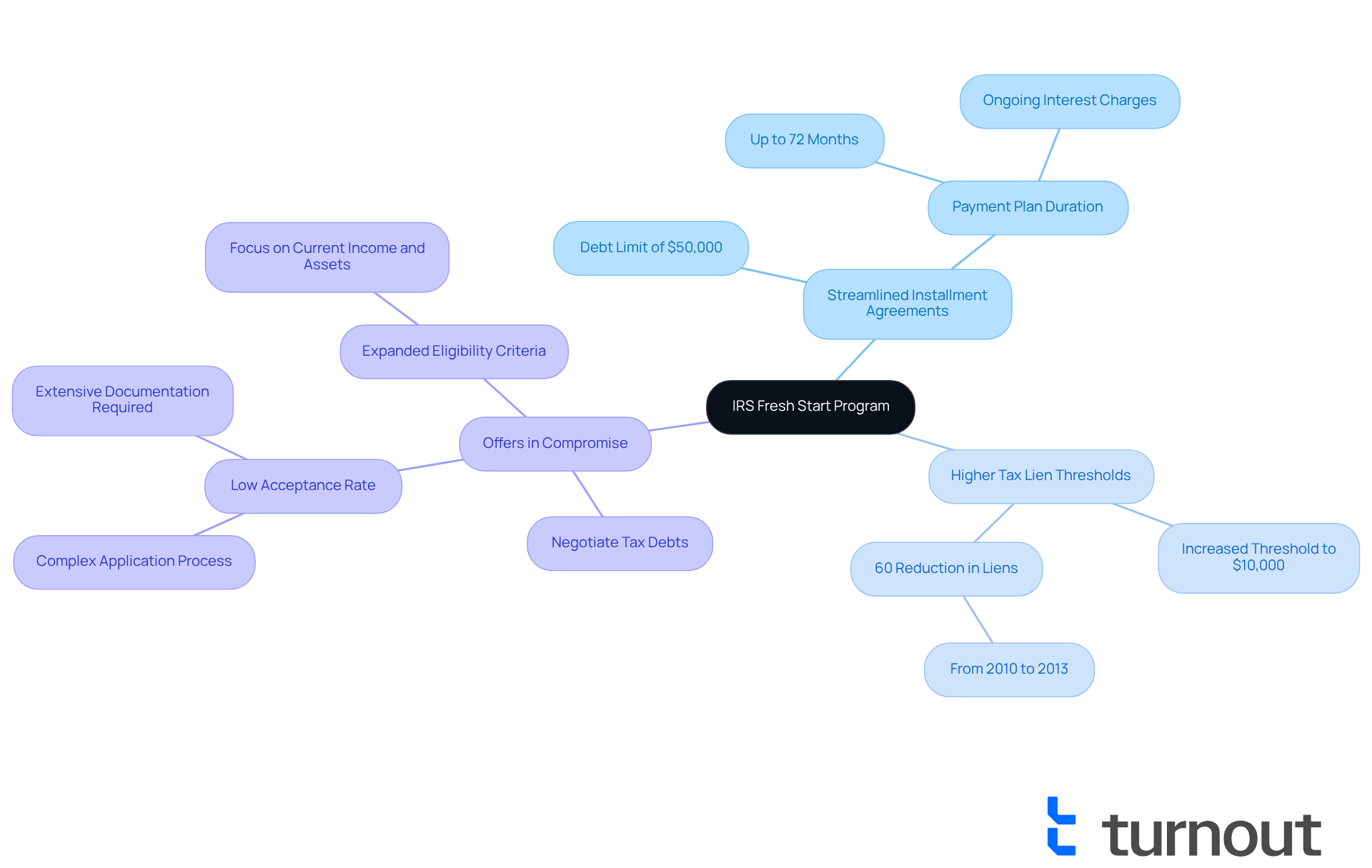

Streamlined Installment Agreements: If you have debts of $50,000 or less, you can set up a payment plan that extends up to 72 months. This allows for manageable monthly payments that can ease your financial strain. However, it's important to remember that ongoing interest charges may apply, which could increase the total amount paid over time.

-

Higher Tax Lien Thresholds: The program raises the threshold for filing tax liens from $5,000 to $10,000. This significant change lowers the risk of liens for many individuals. In fact, from 2010 to 2013, there was a remarkable 60% reduction in liens submitted for individuals with assessed liabilities under $10,000.

-

Offers in Compromise: This provision enables eligible individuals to negotiate their tax debts, settling for less than the total amount owed. This can be a vital pathway toward financial recovery. Despite the expanded criteria, we acknowledge that the acceptance rate for Offers in Compromise remains low, highlighting the complexity of the application process. Thorough preparation and understanding of the requirements are essential.

These improvements have transformed the New Beginnings Program into a valuable resource for individuals who want to learn about what is the IRS Fresh Start Program. Many are now finding it easier to manage their tax responsibilities. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Eligibility Requirements for the Fresh Start Program

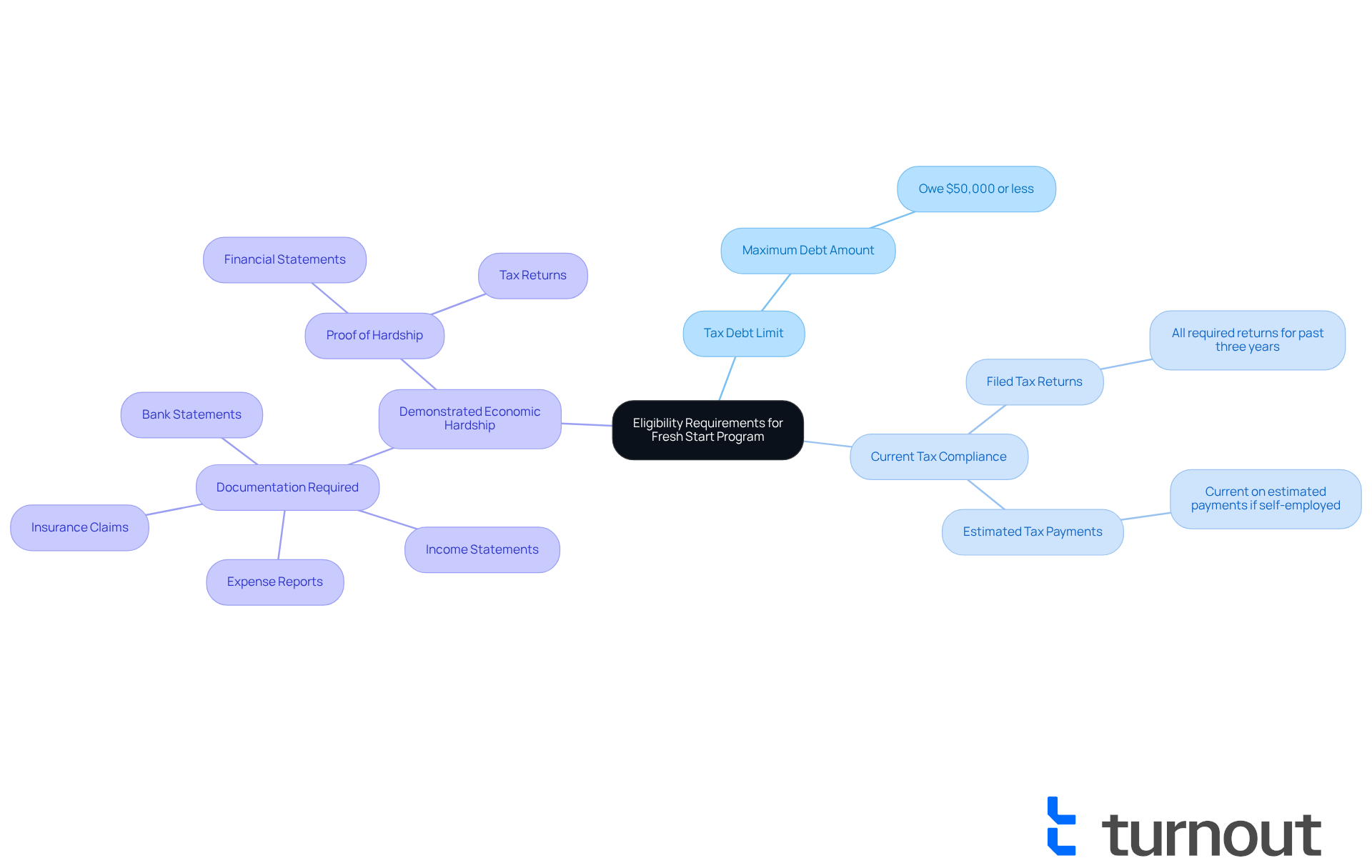

To qualify for the IRS Fresh Start Program, taxpayers must meet several eligibility requirements:

- Tax Debt Limit: Individuals must owe $50,000 or less in total tax debt, including penalties and interest.

- Current Tax Compliance: Applicants must have filed all required tax returns for the past three years and be current on estimated tax payments.

- Demonstrated Economic Hardship: Taxpayers must show that they are experiencing economic difficulties that prevent them from paying their tax debts in full. This may include providing documentation of income, expenses, and assets to support their claims. Acceptable documentation can include pay stubs, bank statements, detailed expense reports, and insurance claims.

We understand that navigating tax debt can be overwhelming, especially during tough times. Based on recent information, many taxpayers find that they fulfill the criteria for what is the IRS Fresh Start Program, especially those facing economic challenges. Tax advisors emphasize the importance of thorough documentation. They often say, 'having comprehensive evidence is crucial for the IRS to accept requests for tax relief under the Fresh Start Initiative.' This highlights the necessity for applicants to prepare detailed financial disclosures. Remember, you are not alone in this journey, and taking these steps can significantly improve your chances of qualifying for relief.

Conclusion

The IRS Fresh Start Program stands as a vital lifeline for individuals and small businesses facing the burden of tax debts, offering a compassionate approach to tax relief. By simplifying the repayment process and providing various options, this initiative empowers taxpayers to regain control over their financial responsibilities and avoid the dire consequences of tax delinquency.

In this article, we explored key features of the Fresh Start Program, including:

- Streamlined installment agreements

- Higher tax lien thresholds

- The option for offers in compromise

These components work together to create a supportive environment for those struggling to meet their tax obligations. Real-life examples, such as the stories of individuals who have successfully navigated the program, underscore its effectiveness and the positive impact it has had on countless lives.

Given the ongoing economic challenges many face, understanding the IRS Fresh Start Program is more important than ever. It not only provides a pathway to financial recovery but also fosters hope for those feeling overwhelmed by their tax debts. By taking the necessary steps to explore eligibility and apply for relief, individuals can embark on a journey toward economic stability and peace of mind. Remember, you are not alone in this journey; we're here to help you take those crucial steps forward.

Frequently Asked Questions

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is a tax relief initiative launched in 2011 to support individuals and small businesses facing tax debts. It aims to simplify the repayment process and offers options like installment agreements and offers in compromise.

Who can benefit from the IRS Fresh Start Program?

The program is designed to assist individuals and small businesses, particularly those who owe $50,000 or less in taxes, helping them manage their tax responsibilities and avoid serious collection measures.

How many people have benefited from the IRS Fresh Start Program?

Since its launch, millions have benefited from the IRS Fresh Start Program. For example, during the 2021 submission period, approximately 1.5 million individuals utilized its options.

What are some options available under the IRS Fresh Start Program?

The program offers various options including installment agreements, which allow taxpayers to pay their debts over time, and offers in compromise, which can reduce the total amount owed.

How has participation in the IRS Fresh Start Program changed over the years?

There has been a steady increase in participant engagement, with comparative totals from the 2019 and 2020 filing periods showing a rise in the number of individuals taking advantage of the program.

What is the purpose of the IRS Fresh Start Program?

The purpose of the IRS Fresh Start Program is to alleviate economic burdens for those facing tax debts and to help them regain control over their financial situations by providing accessible relief measures.