Overview

When an employee goes on long-term disability, it can be a challenging time. They typically receive financial assistance to help maintain their income while focusing on recovery from serious health conditions. As of July 2024, the average monthly payment is $1,539. We understand that navigating this process can feel overwhelming.

It's essential to grasp the application process, your rights under the Family and Medical Leave Act (FMLA), and the potential outcomes of claims. This knowledge empowers you to effectively manage your circumstances and access the support you need. Remember, you are not alone in this journey; we're here to help you every step of the way.

Introduction

Long-term disability can significantly impact an employee's professional landscape, often leaving them feeling uncertain about their future. We understand that this can be a challenging time, filled with questions and concerns. This article explores the complexities of long-term disability, offering insights into the benefits available, the application process, and the essential rights that you should be aware of.

As many workers face the reality of needing extended leave due to serious health issues, it’s common to wonder: what steps can you take to ensure you receive the support you deserve while navigating these complexities?

We're here to help you find clarity and guidance during this journey.

Define Long-Term Disability and Its Importance in Employment

Long-term impairment signifies what happens when an employee goes on long-term disability, which prevents a worker from fulfilling their duties for an extended period, typically lasting more than six months. This can stem from serious illnesses, injuries, or chronic health conditions. The importance of long-term health issues in the workplace is highlighted by what happens when an employee goes on long-term disability, as it provides financial assistance to those who can no longer work due to these challenging conditions. As of July 2024, the average monthly assistance payment was $1,539, underscoring the vital role these payments play in ensuring financial stability during recovery.

Long-term assistance programs ensure that individuals can maintain an income while focusing on their health, which is crucial for understanding what happens when an employee goes on long-term disability, alleviating financial stress during tough times. It's important to recognize what happens when an employee goes on long-term disability, as statistics reveal that over one in four individuals aged 20 will face a disability before retirement. Understanding what happens when an employee goes on long-term disability empowers employees to effectively know their rights and entitlements.

Moreover, case studies illustrate the impact of these benefits. For instance, Turnout's support for over 5 million Americans seeking Social Security Disability assistance highlights the obstacles individuals face when pursuing such aid. By leveraging technology and skilled non-professional advocates—who provide guidance throughout the application process—Turnout simplifies the journey toward accessing life-changing benefits.

In 2025, the financial assistance from extended incapacity programs remains essential. It not only aids recovery but also helps individuals manage their financial obligations during periods of inability. This awareness is crucial for employees to advocate for their rights and understand what happens when an employee goes on long-term disability to ensure they receive the support they deserve. Remember, you are not alone in this journey, and we are here to help.

Outline the Application Process for Long-Term Disability Benefits

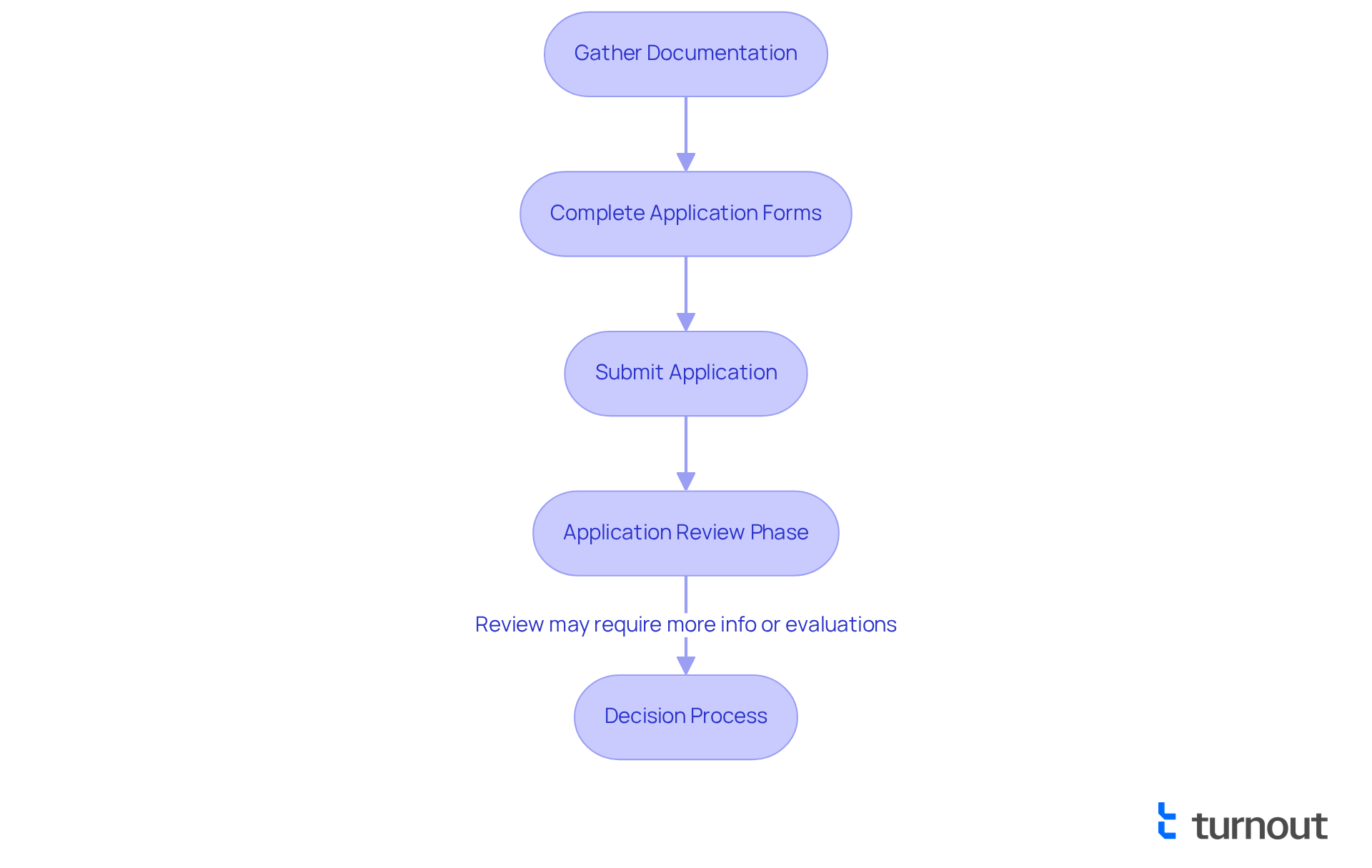

Requesting permanent support benefits can feel overwhelming, and we understand that taking the first step is crucial. Initially, you’ll need to gather important documentation, such as:

- Medical records

- Employment history

- Relevant insurance policies

Completing the application forms provided by your employer's insurance provider or the Social Security Administration is the next critical step. It’s essential to include comprehensive details about your medical condition and how it affects your ability to work.

Once you submit your application, it enters a review phase. This may require additional information or medical evaluations, which can add to the stress of the process. Typically, a decision on a prolonged incapacity claim is reached within 45 days of receipt. However, this timeframe can be extended by up to 30 days due to circumstances beyond the plan's control, potentially leading to a total processing duration of up to 105 days. We encourage you to follow up regularly after submitting your claim to help expedite the decision process.

Understanding what happens when an employee goes on long-term disability is crucial. Thorough preparation and adherence to best practices can significantly enhance your chances of approval. You are not alone in this process. For those navigating this complex system, Turnout offers assistance through trained nonlawyer advocates. They can help guide you through the SSD claims process, ensuring you have the support needed to effectively manage your application.

Examine Employment Rights While on Long-Term Disability

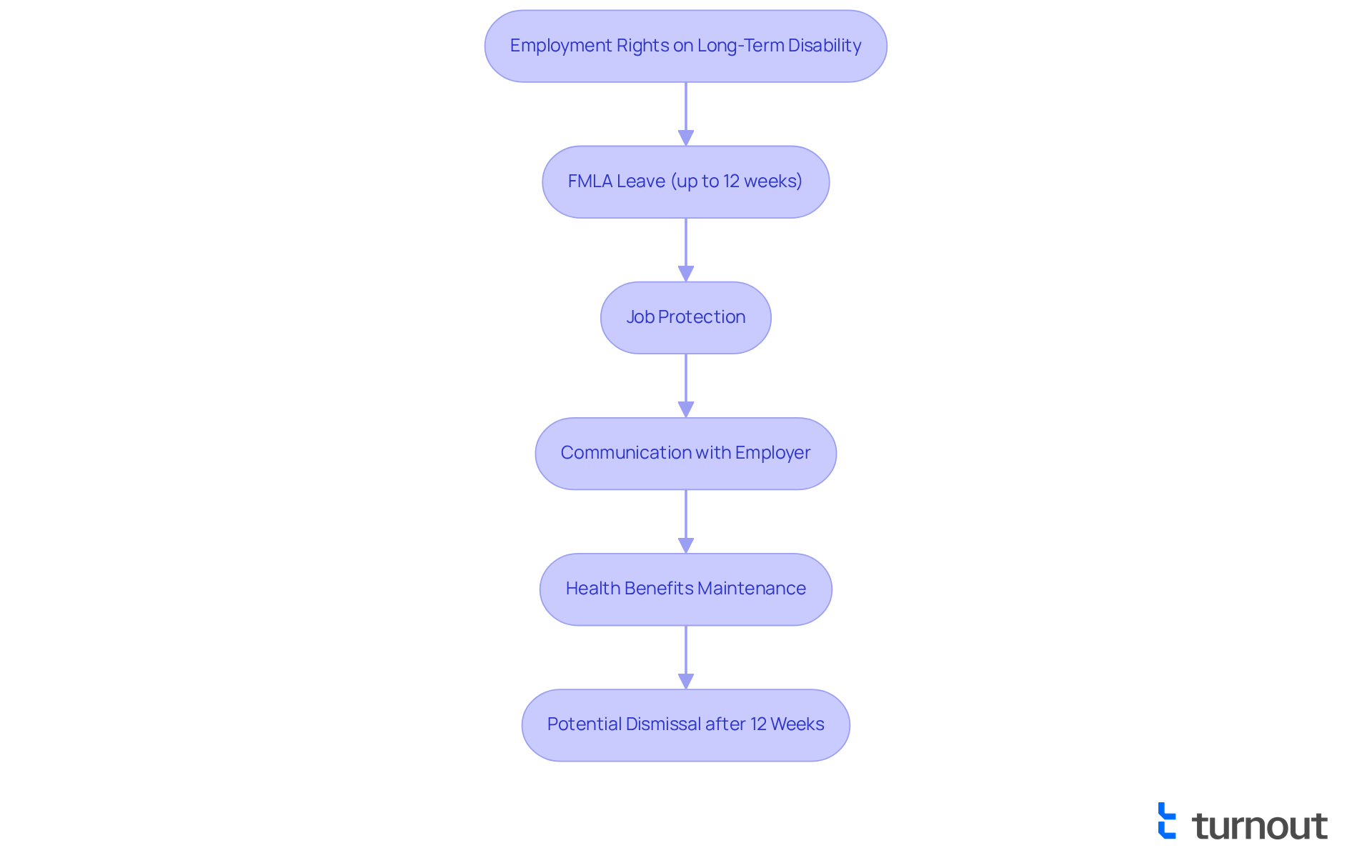

Employees on long-term disability deserve specific protections that clarify what happens when an employee goes on long-term disability, ensuring their rights are safeguarded during their time away from work. We understand that navigating this situation can be challenging. The Family and Medical Leave Act (FMLA) allows qualified individuals to take up to 12 weeks of unpaid leave for serious health issues without the fear of job loss. This protection is essential, as it ensures that you can focus on your recovery without the added pressure of job instability.

Moreover, many employers provide extended illness coverage, typically replacing 50-70% of a worker's wages during their recovery phase. Effective communication with your employer is crucial during this time. It's important to keep them informed about your condition and any accommodations you may need to help facilitate your return to work. For instance, upon returning from FMLA leave, you should be reinstated to your previous or a similar role with the same compensation and benefits.

FMLA protections include the right to maintain health benefits while on leave and assurance that you cannot be dismissed solely due to your disability. However, it's important to recognize what happens when an employee goes on long-term disability, as staff members can be legally let go if they do not return to work after 12 weeks of FMLA leave or if they are unable to perform essential job functions, even with reasonable accommodations.

Understanding these rights empowers you to navigate your situation with confidence. Remember, you are not alone in this journey, and knowing your rights ensures you receive the necessary support during your recovery.

Discuss Outcomes and Next Steps After Filing for Long-Term Disability

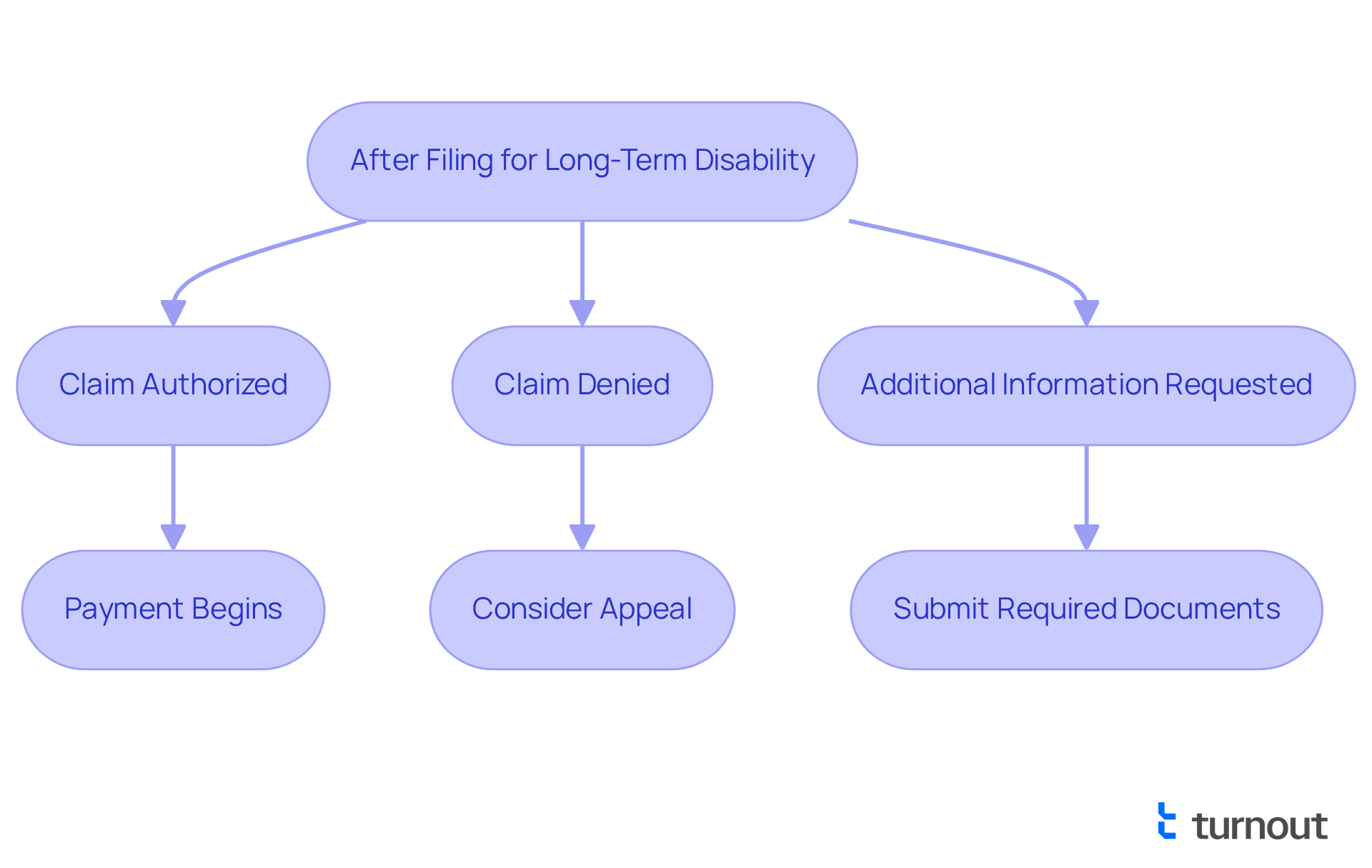

After applying for long-term disability assistance, we understand that you may be feeling anxious about the outcome. Applicants can anticipate one of several results:

- The insurance company may authorize the claim, which means payment disbursements will begin.

- Alternatively, the claim could be denied, leading to the need for an appeal.

- In some cases, the provider might request additional information or medical evaluations before making a decision.

During this time, it’s crucial to stay proactive. Maintaining communication with your advocate from Turnout can help you navigate the complexities of the SSD claims process. While Turnout is not a law firm and does not provide legal representation, we have trained nonlawyer advocates ready to support you through this journey. Ensuring all requested documentation is submitted promptly is essential.

Understanding what happens when an employee goes on long-term disability allows you to prepare for the next steps. Whether that involves receiving benefits or navigating the appeals process, remember that you are not alone in this journey. Our advocates are here to help you every step of the way.

Conclusion

Understanding the implications of long-term disability is crucial for both employees and employers. This article highlights the significance of long-term disability benefits, which provide essential financial support to individuals unable to work due to serious health conditions. We recognize that navigating this challenging period can feel overwhelming, but by understanding the rights and protections available, employees can approach it with greater confidence and security.

Key insights discussed include:

- The importance of thorough preparation when applying for benefits

- The legal protections afforded to employees under the Family and Medical Leave Act (FMLA)

- The various outcomes that may arise after filing a claim

The support offered by organizations like Turnout can significantly ease the process, ensuring that individuals receive the assistance they need while managing their health and financial responsibilities.

Ultimately, awareness and understanding of long-term disability rights and processes empower employees to advocate for themselves during this vulnerable time. It’s common to feel uncertain, but remaining informed and proactive in seeking the support necessary for recovery is vital. Effective communication with employers can also make a significant difference. The journey may be daunting, but with the right resources and knowledge, you are not alone in this journey. Together, we can navigate long-term disability with resilience and hope for a brighter future.

Frequently Asked Questions

What is long-term disability?

Long-term disability refers to a situation where an employee is unable to perform their job duties for an extended period, typically longer than six months, due to serious illnesses, injuries, or chronic health conditions.

Why is long-term disability important in employment?

Long-term disability is important because it provides financial assistance to employees who can no longer work due to health issues, helping them maintain an income while they focus on their recovery.

How much is the average monthly assistance payment for long-term disability as of July 2024?

As of July 2024, the average monthly assistance payment for long-term disability was $1,539.

What percentage of individuals aged 20 will face a disability before retirement?

Statistics indicate that over one in four individuals aged 20 will face a disability before they retire.

How do long-term assistance programs help individuals?

Long-term assistance programs help individuals by alleviating financial stress during difficult times, allowing them to focus on their health while maintaining an income.

What challenges do individuals face when seeking Social Security Disability assistance?

Individuals seeking Social Security Disability assistance often encounter obstacles, which organizations like Turnout aim to address by providing guidance and support throughout the application process.

How does Turnout assist those seeking disability benefits?

Turnout assists individuals by leveraging technology and skilled non-professional advocates to simplify the application process for Social Security Disability benefits.

Why is it important for employees to understand their rights regarding long-term disability?

Understanding their rights regarding long-term disability empowers employees to advocate for themselves and ensure they receive the support and benefits they are entitled to during challenging times.