Overview

We understand that failing to file taxes can be a daunting experience. It can lead to significant financial penalties, including a failure-to-file charge of 5% of unpaid taxes per month, which can accumulate to a maximum of 25%. This situation can escalate further with potential legal consequences, such as liens or even criminal charges for tax evasion.

It's crucial to recognize these repercussions, as they can complicate your future tax situations and lead to increased liabilities. We want you to know that timely tax compliance is essential, and seeking assistance is a wise step. Remember, you're not alone in this journey; we're here to help you navigate these challenges with understanding and support.

Introduction

Neglecting to file taxes can lead to a cascade of serious consequences that many individuals may not fully comprehend. We understand that facing tax obligations can be overwhelming, and the stakes are high for those who overlook this critical responsibility. From hefty financial penalties imposed by the IRS to potential legal repercussions, the impact can be significant.

As the deadline approaches, it’s common to feel anxious about what happens if one chooses to ignore their tax responsibilities. Understanding the implications of non-filing is essential, not only to avoid immediate penalties but also to navigate the long-term effects that can complicate your financial future.

Remember, you're not alone in this journey; we're here to help you through it.

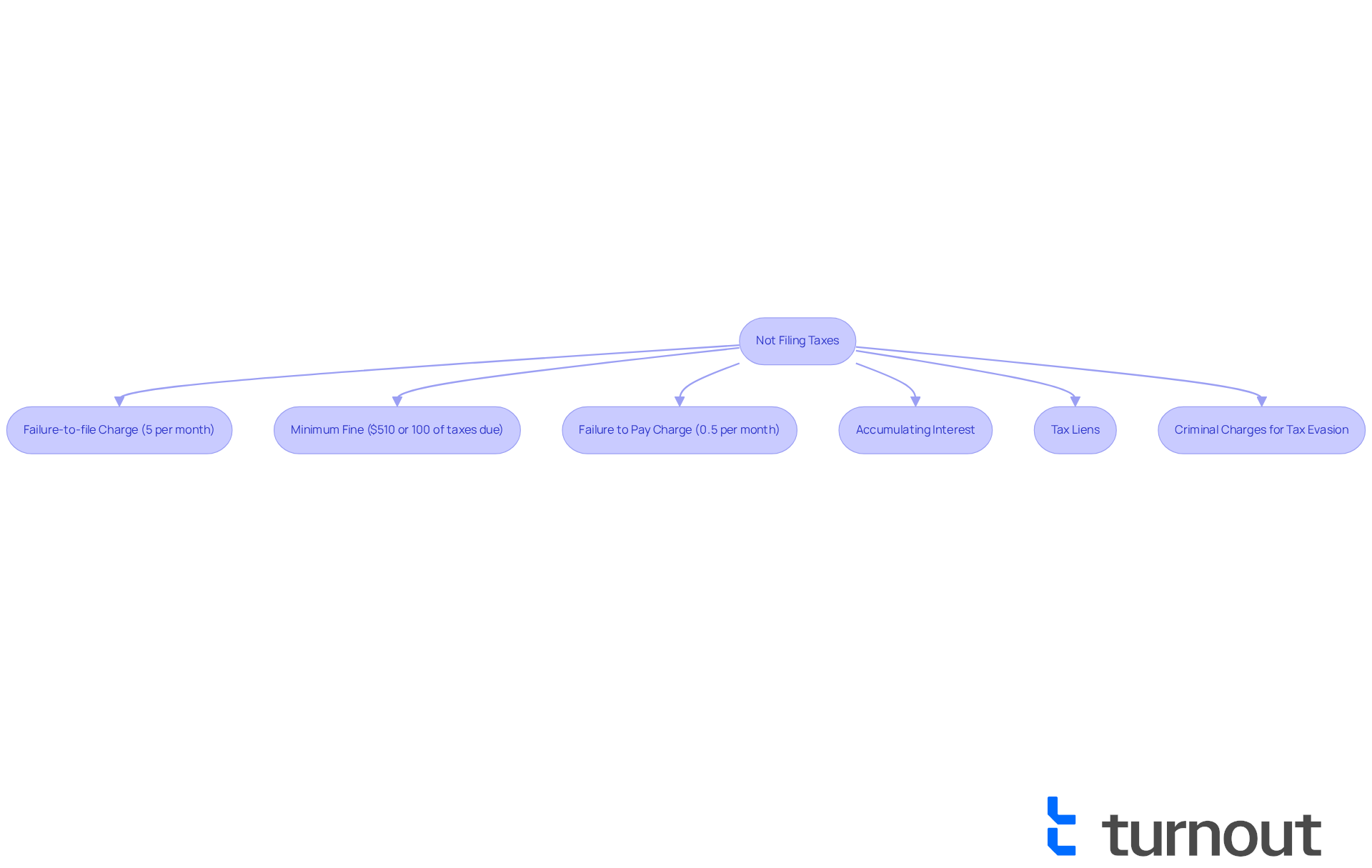

Define the Consequences of Not Filing Taxes

If you are wondering what happens if I don’t file taxes, it's important to know that not filing taxes can lead to a variety of serious consequences, and we understand that this can be a source of stress. Primarily, individuals may encounter financial repercussions enforced by the IRS. The failure-to-file charge typically amounts to 5% of the unpaid tax for each month the return is delayed, capping at 25%. If a return is submitted more than 60 days late, the minimum fine can escalate to $510 or 100% of the taxes due, whichever is smaller.

You can seek an extension to submit your returns by April 15, which may help you avoid certain fines. It’s also important to note that the IRS imposes a 'failure to pay' charge of 0.5% of the outstanding balance each month, which is considerably less than the 'failure to file' charge. In addition to monetary fines, neglecting to submit can lead to accumulating interest on the outstanding dues, further increasing the total amount owed.

In severe cases, persistent non-filing can result in tax liens against property, allowing the IRS to claim assets, or even criminal charges for tax evasion, which can carry serious legal consequences. As CPA Jim Buttonow wisely advises, "If you have a balance due, don’t file late because you will compound your problems." Understanding what happens if I don’t file taxes is crucial for anyone considering their tax obligations. Remember, you are not alone in this journey, and we’re here to help you navigate your options.

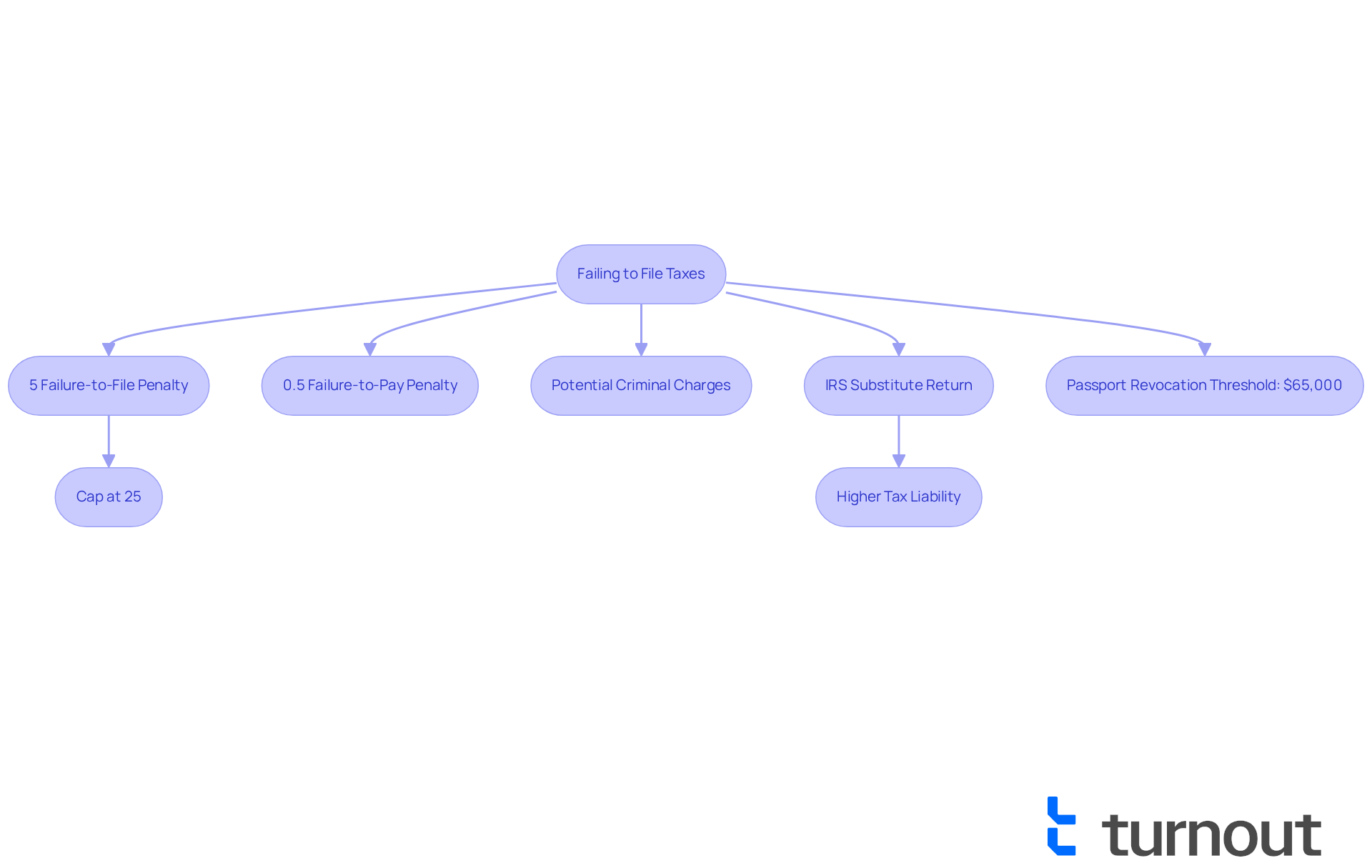

Explore Immediate Penalties and Legal Obligations

We understand that what happens if I don’t file taxes can lead to overwhelming consequences. The IRS imposes a failure-to-file penalty of 5% of the unpaid tax amount for each month or part of a month that the return is overdue, capping at 25%. This penalty is significantly harsher than the failure-to-pay penalty, which is only 0.5% per month. If the IRS determines that a taxpayer has willfully neglected to file, there could be even more serious repercussions, including criminal charges and possible incarceration.

It’s important to remember what happens if I don’t file taxes, as taxpayers are legally required to submit a return even if no taxes are owed. Ignoring this obligation can complicate future tax submissions and lead to questions about what happens if I don't file taxes, which may affect eligibility for refunds or credits. Additionally, the IRS may file a substitute return on your behalf, which typically does not take deductions or credits into account, potentially leading to a higher tax liability.

Looking ahead, in 2025, the threshold for serious tax debt that could result in passport revocation is set at $65,000. This emphasizes the importance of compliance. Moreover, tax protestors may face substantial fines, including a possible $5,000 civil charge for submitting a frivolous tax return.

Grasping these responsibilities and consequences is essential to avoid understanding what happens if I don’t file taxes, which can lead to unnecessary financial burdens. It’s significant to note that around 43 million individuals tend to postpone their financial declarations until the final three weeks. This highlights the importance of understanding the related consequences. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

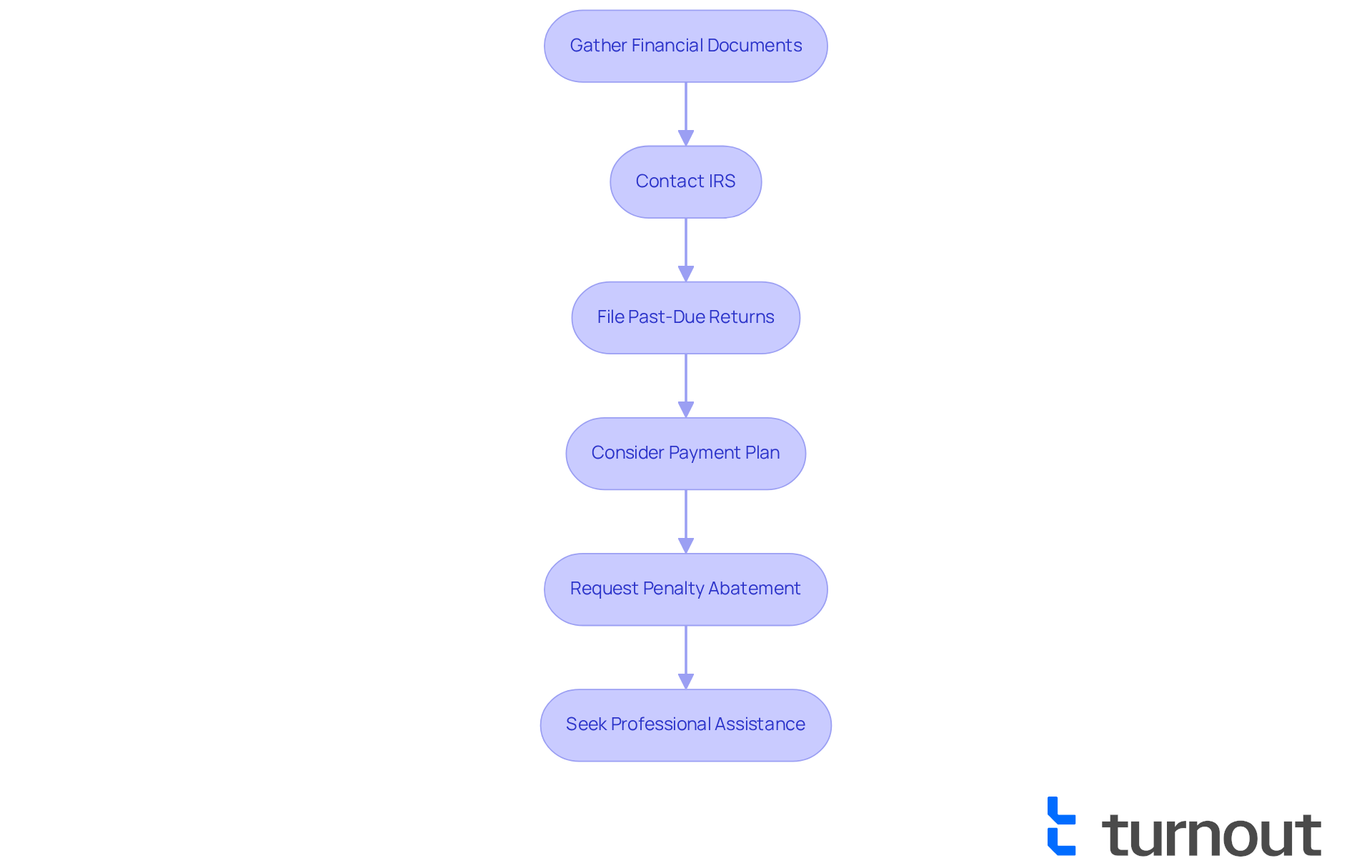

Outline Steps to Take If You Haven't Filed Taxes

If you haven't filed your taxes, we understand that it can feel overwhelming, especially when considering what happens if I don’t file taxes. The first step is to gather all necessary financial documents, such as W-2s, 1099s, and any other relevant income statements. Next, reach out to the IRS to discuss what happens if I don’t file taxes and find out which years you need to submit, along with any possible fines. Filing your past-due returns as soon as possible is crucial; this can help minimize penalties and interest that can accumulate up to 47.5% of your tax bill over time.

It's important to understand what happens if I don't file taxes, as even if you believe you do not owe any payments, failing to submit a return may cause you to miss out on refundable credits. If you owe taxes, consider setting up a payment plan with the IRS to manage your debt more effectively. If you believe you qualify for penalty relief due to reasonable cause, you can request an abatement of penalties. Remember, the IRS typically requires taxpayers to file six years of back tax returns to be in good standing.

Finally, seeking assistance from a tax professional can provide personalized guidance tailored to your specific situation. Filing electronically with direct deposit is also the fastest way to receive any tax refunds you may be owed. You're not alone in this journey, and we're here to help you navigate through it.

Conclusion

Neglecting to file taxes can lead to a cascade of serious consequences that extend beyond mere financial penalties. We understand that the thought of tax obligations can be overwhelming, and recognizing the ramifications of failing to fulfill them is vital for anyone looking to maintain their financial health and legal standing. The implications can range from hefty fines imposed by the IRS to potential legal actions, underscoring the importance of timely tax filing.

Key insights highlighted in the article reveal that the IRS imposes significant penalties for late submissions, including a failure-to-file charge that can accumulate rapidly. It's common to feel anxious about these penalties. Additionally, the potential for tax liens and even criminal charges for persistent non-filing emphasizes the gravity of the situation. It is crucial for individuals to recognize that filing a return is mandatory, even when no taxes are owed, to avoid complications with future tax submissions and eligibility for refunds or credits.

Ultimately, the importance of understanding what happens if taxes are not filed cannot be overstated. Taking proactive steps, such as:

- gathering necessary documents,

- communicating with the IRS, and

- seeking professional assistance,

can mitigate the consequences of non-filing. Remember, you are not alone in this journey. It is essential for individuals to address their tax responsibilities promptly to avoid unnecessary financial burdens and legal issues. By staying informed and taking action, taxpayers can navigate these challenges effectively and secure their financial future.

Frequently Asked Questions

What are the consequences of not filing taxes?

Not filing taxes can lead to serious consequences, including financial repercussions enforced by the IRS, fines, accumulating interest on unpaid taxes, tax liens against property, and potential criminal charges for tax evasion.

What is the failure-to-file charge?

The failure-to-file charge typically amounts to 5% of the unpaid tax for each month the return is delayed, capping at 25%. If a return is submitted more than 60 days late, the minimum fine can escalate to $510 or 100% of the taxes due, whichever is smaller.

Is there a way to avoid fines for late filing?

Yes, individuals can seek an extension to submit their returns by April 15, which may help avoid certain fines.

What is the difference between the failure-to-file charge and the failure-to-pay charge?

The failure-to-file charge is 5% of the unpaid tax for each month the return is late, while the failure-to-pay charge is 0.5% of the outstanding balance each month, which is considerably less than the failure-to-file charge.

What happens if I don't pay my taxes on time?

If taxes are not paid on time, interest will accumulate on the outstanding dues, increasing the total amount owed.

What are the severe consequences of persistent non-filing?

Persistent non-filing can lead to tax liens against property, allowing the IRS to claim assets, or even criminal charges for tax evasion, which can carry serious legal consequences.