Overview

Navigating tax burdens can be overwhelming, and we understand that many individuals and small businesses are seeking relief. The IRS Fresh Start Tax Program is here to help you find that relief by streamlining repayment processes, reducing penalties, and expanding eligibility for settlement options.

This program offers key features that can make a significant difference in your financial journey:

- Streamlined installment agreements

- Broadened Offers in Compromise

It has successfully assisted over 1.5 million taxpayers in regaining their financial stability. This demonstrates its effectiveness in addressing the challenges you may face.

You are not alone in this journey, and there are supportive options available to help you move forward. If you’re feeling the weight of tax burdens, consider exploring the Fresh Start Tax Program. Together, we can work towards a brighter financial future.

Introduction

The IRS Fresh Start Tax Program stands as a beacon of hope for individuals and small businesses overwhelmed by tax obligations. Launched in 2011 and updated in 2025, this initiative simplifies the repayment process and significantly reduces penalties. It offers a lifeline for those in dire financial straits.

Yet, we understand that many potential participants encounter challenges, especially with the low acceptance rates for Offers in Compromise. It's common to feel uncertain about navigating these complexities.

How can you fully benefit from this program and regain your financial footing? We're here to help you explore the options available to you.

Define the IRS Fresh Start Tax Program

The IRS Fresh Start Tax Program serves as a vital tax relief initiative aimed at assisting individuals and small businesses facing tax obligations. Introduced in 2011 and revised in 2025, the IRS Fresh Start Tax Program streamlines the repayment process, reduces penalties, and offers various alternatives for taxpayers to effectively resolve their obligations.

Key features include:

- Streamlined installment agreements for taxpayers owing up to $50,000. These agreements require minimal documentation and allow for manageable payment plans over several years.

- Broadened eligibility for Offers in Compromise (OIC), enabling more taxpayers to settle their obligations for less than the total amount due.

Since its inception, the Fresh Start program has helped over 1.5 million individuals find a path to economic stability amid significant tax burdens. For instance, taxpayers with obligations under $25,000 can avoid or remove tax liens by entering into a Direct Debit Installment Agreement, significantly alleviating their financial strain. Experts emphasize that the IRS Fresh Start Tax Program's flexibility and penalty relief measures make tax resolution more attainable, especially for first-time offenders who may have faced penalties for late submissions or payments. As lawyer Alex Mitchell notes, 'It’s essential for individuals facing tax challenges to act swiftly and consider their alternatives under the IRS Fresh Start Tax Program.'

Real-life examples illustrate the program's success; many individuals have successfully navigated the complexities of tax obligations through the Fresh Start initiative, regaining control over their financial situations. However, it’s important to recognize that the acceptance rate for Offer in Compromise applications remains low, even with expanded criteria, which can present challenges for some taxpayers. As the IRS continues to refine the program, it remains a crucial resource for those seeking relief from tax obligations. Yet, potential participants should be aware of ongoing interest charges associated with installment agreements and the program's limitations. Remember, you are not alone in this journey, and there are options available to help you find relief.

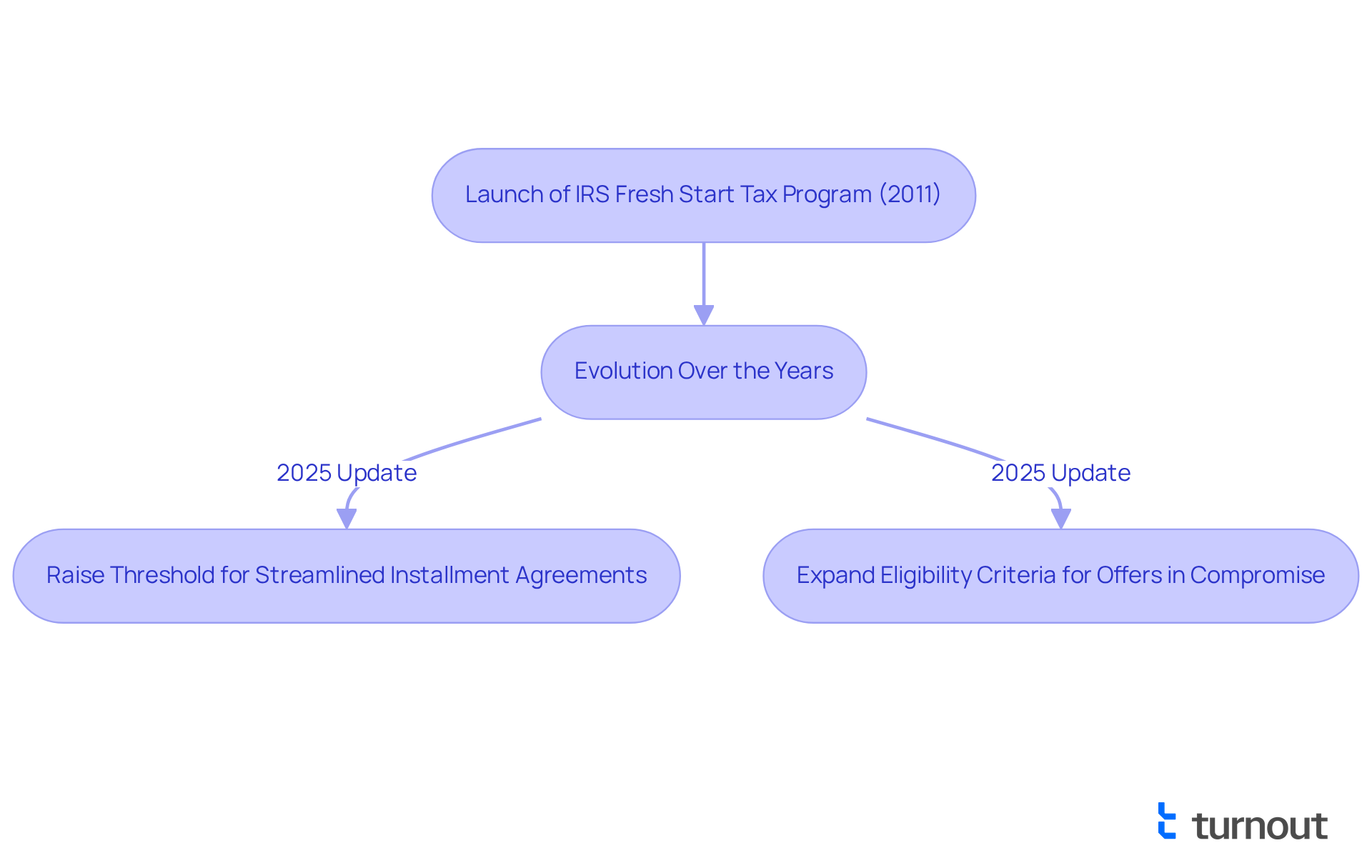

Explore the History and Evolution of the Fresh Start Program

The IRS Fresh Start Tax Program was launched in 2011 as a compassionate response to the economic crisis, designed to support taxpayers facing significant burdens. We understand that financial challenges can be overwhelming, and this program aims to offer a helping hand. Over the years, it has evolved through several revisions to enhance its effectiveness, ensuring it meets the needs of those it serves.

In 2025, the IRS implemented important updates as part of the IRS Fresh Start Tax Program, which included:

- Raising the threshold for streamlined installment agreements

- Expanding eligibility criteria for offers in compromise

These changes reflect the IRS's dedication to helping you regain control of your financial situation and avoid aggressive collection actions. Remember, you are not alone in this journey; we are here to assist you every step of the way.

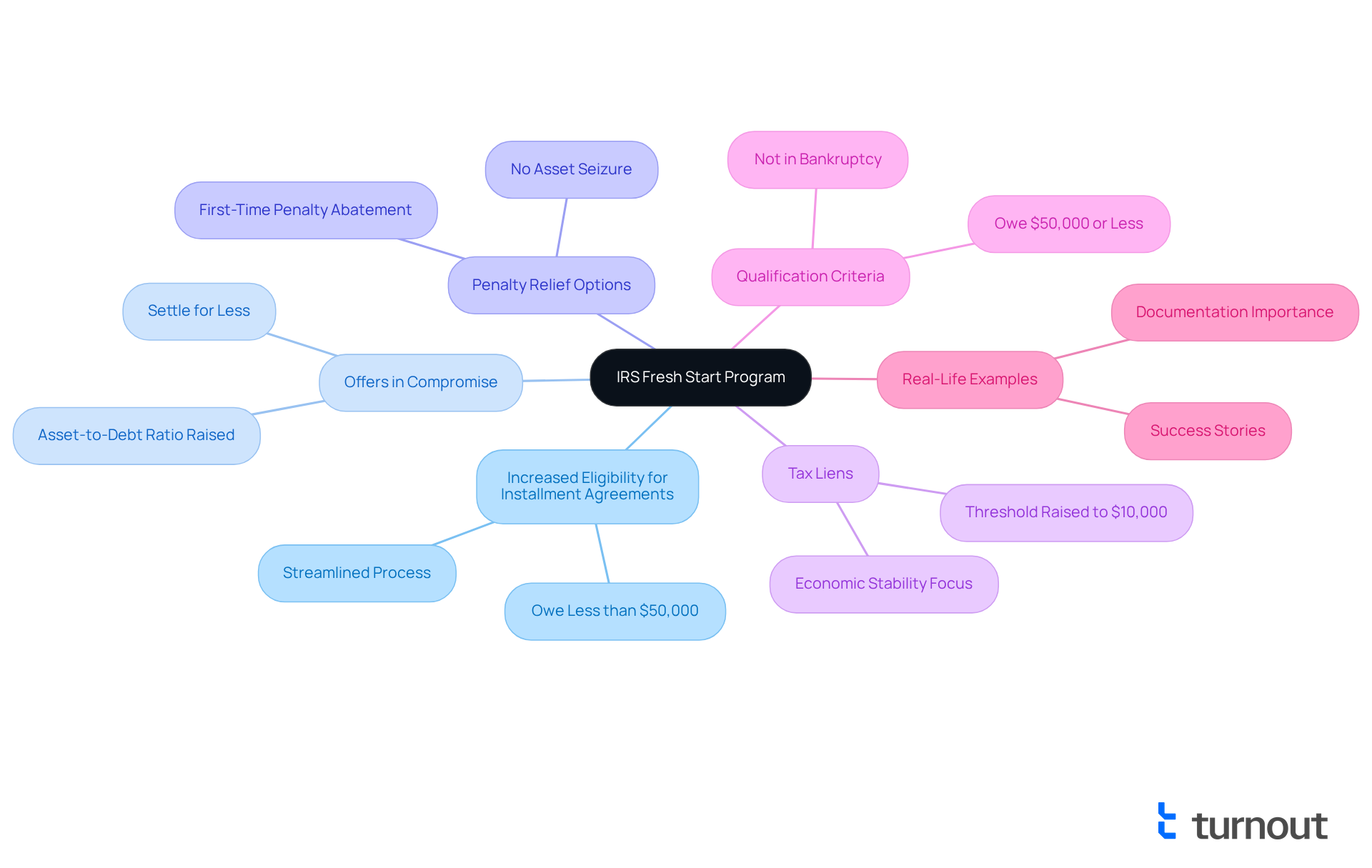

Identify Key Features of the IRS Fresh Start Program

Key features of the IRS Fresh Start Program include:

- Increased Eligibility for Installment Agreements: We understand that financial struggles can be overwhelming. Taxpayers who owe less than $50,000 or demonstrate an inability to make larger payments can qualify for streamlined installment agreements. This change simplifies the payment process, making it more manageable for you.

- Offers in Compromise: Under the IRS Fresh Start Tax Program, if you're facing economic difficulties, this provision allows eligible taxpayers to settle their tax debts for less than the total amount owed. Many have found success with Offers in Compromise, especially when they effectively document their financial situations. As of Q1 2025, the IRS has temporarily raised the asset-to-debt ratio for OIC approvals, providing additional support for middle-income taxpayers.

- Penalty Relief Options: It's common to feel anxious about missed deadlines for filing or payment, but the IRS Fresh Start tax program offers penalty relief options. The program offers first-time penalty abatement, significantly lowering overall tax liabilities and easing the burden of past due amounts. Under this program, you can request penalty relief without fearing asset seizure or wage garnishment.

- Tax Liens: We recognize that tax obligations can be daunting, but the IRS Fresh Start tax program can help alleviate some of that burden. The threshold for issuing tax liens has been raised, meaning the IRS generally only issues federal tax liens if you owe $10,000 or more. This change helps ensure economic stability for those already struggling.

- Qualification Criteria: To qualify for these agreements under the IRS Fresh Start tax program, taxpayers must owe $50,000 or less in combined tax, penalties, and interest. This makes the program accessible for many individuals seeking relief.

- Real-Life Examples: Many taxpayers have successfully utilized the Offers in Compromise to settle their financial obligations. Their experiences demonstrate the program's effectiveness when approached with proper documentation and guidance from tax professionals. Remember, you are not alone in this journey; we're here to help.

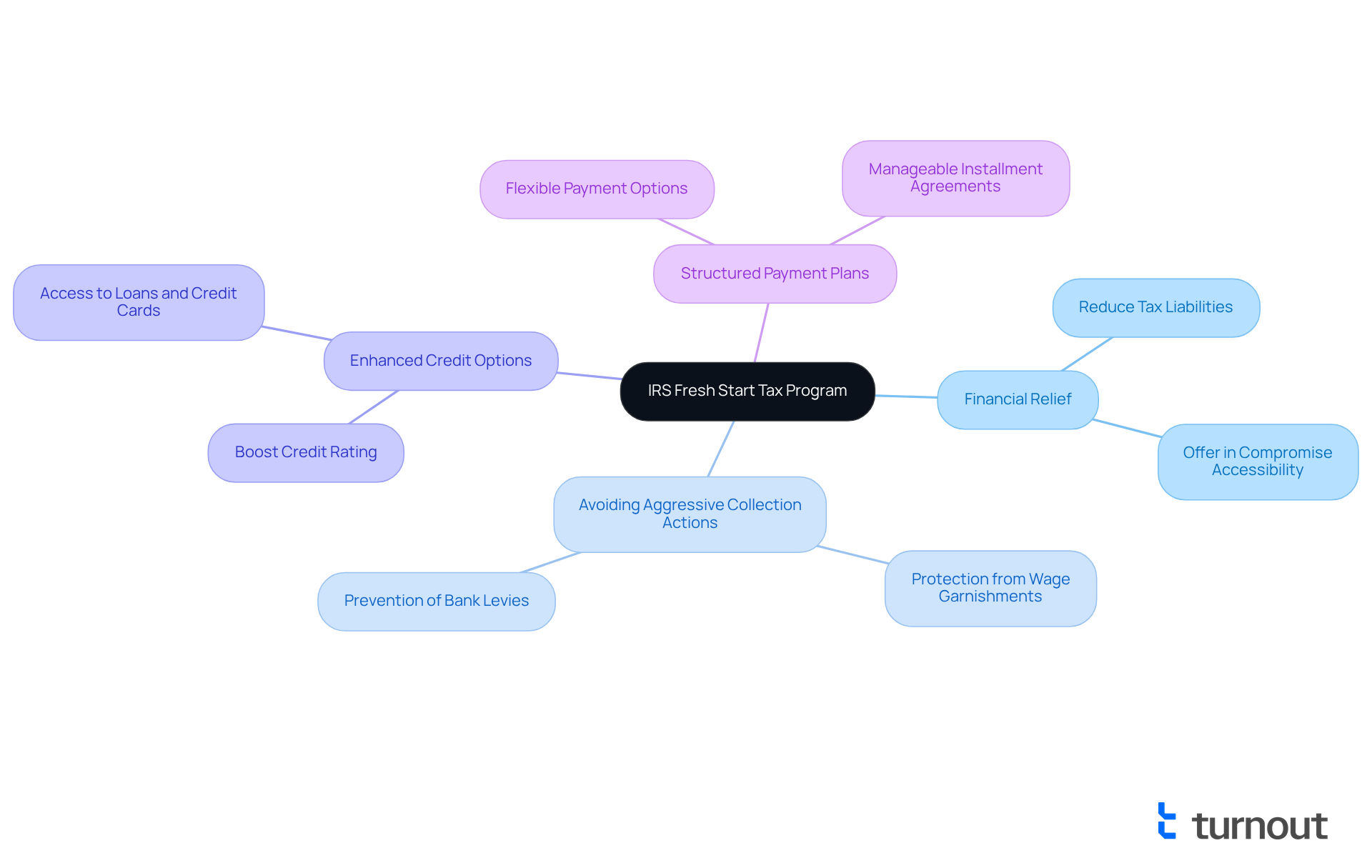

Highlight the Benefits of Participating in the Fresh Start Program

Participating in the IRS Fresh Start tax program offers numerous benefits that can significantly enhance your financial situation.

-

Financial Relief: We understand that financial challenges can be overwhelming. The IRS Fresh Start tax program enables you to substantially reduce your tax liabilities, paving a smoother path to regaining stability. You can resolve your obligations for less than the total amount required, making it a practical choice for many. For instance, the IRS has broadened the criteria for Offer in Compromise submissions, making it more attainable for those facing economic difficulties.

-

Avoiding Aggressive Collection Actions: It's common to feel anxious about collection measures, such as wage garnishments and bank levies. The IRS Fresh Start Tax Program is designed to help prevent these severe actions. This protection can offer you reassurance as you work to settle your financial obligations. Money experts emphasize that utilizing the IRS Fresh Start Tax Program can significantly reduce the stress associated with tax obligations.

-

Enhanced Credit Options: By effectively resolving your tax obligations, you can boost your credit rating, which opens doors to improved opportunities, including loans and credit cards. Economic specialists highlight that addressing tax problems can enhance your creditworthiness, crucial for your future monetary pursuits.

-

Structured Payment Plans: We know that managing payments can be daunting. The program provides flexible payment options, allowing you to settle your obligations in manageable installments. This framework alleviates pressure and financial strain, enabling you to remain compliant with current tax responsibilities while managing past obligations. You can establish streamlined installment agreements through the IRS Fresh Start tax program, which generally requires minimal documentation.

Practical instances demonstrate the efficacy of the IRS Fresh Start Tax Program; many taxpayers have successfully avoided harsh collection measures by taking advantage of it, resulting in considerable relief. For example, clients have reported positive outcomes after engaging with tax professionals who guided them through the process. Financial consultants stress that the program's organized method not only helps in resolving obligations but also encourages long-term economic well-being. Remember, you are not alone in this journey—we're here to help.

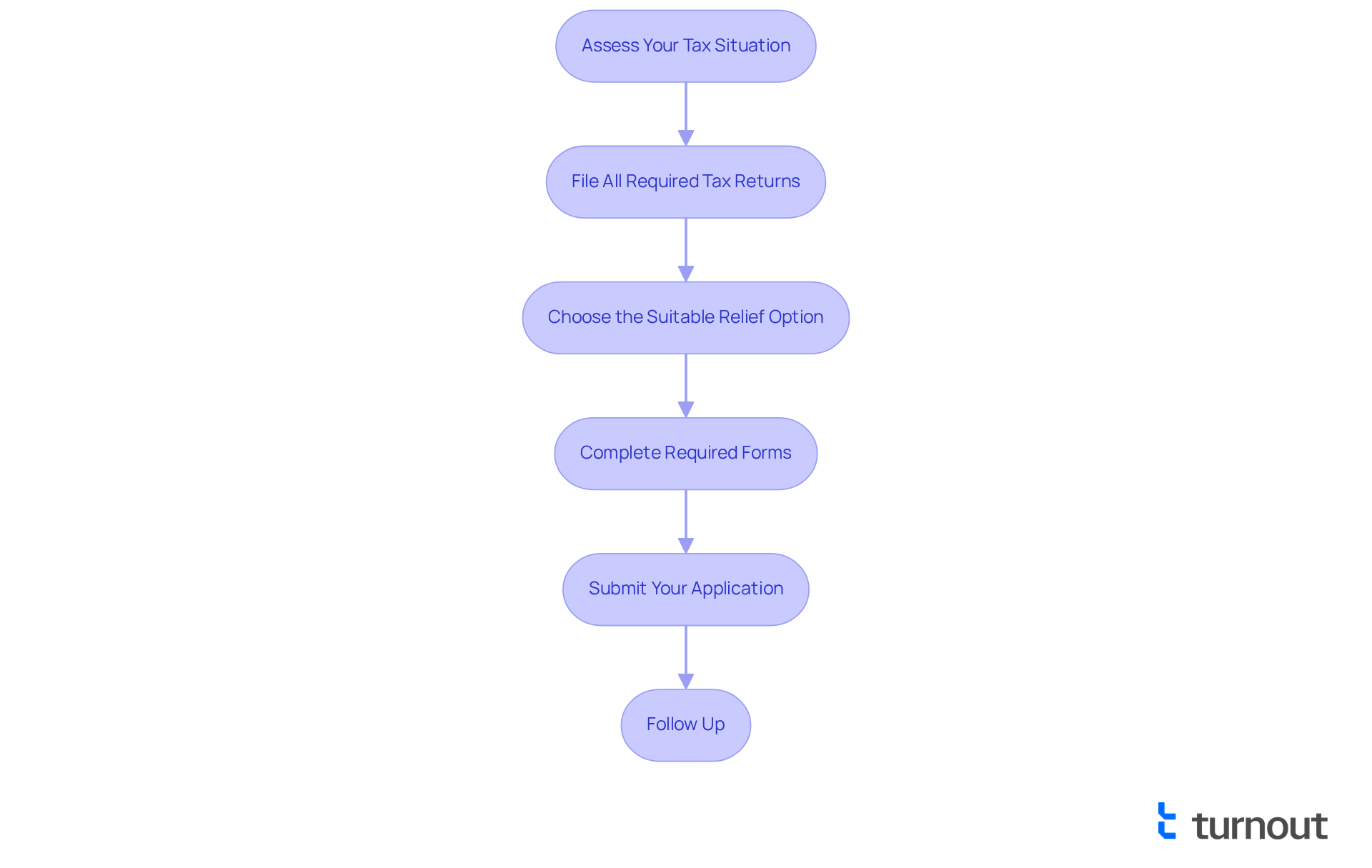

Outline the Application Process for the IRS Fresh Start Program

Applying for the IRS Fresh Start Tax Program can feel overwhelming, but we are here to assist you throughout the process. By following these essential steps, you can ensure a smoother process:

-

Assess Your Tax Situation: Begin by determining the total amount of tax debt you owe. Collect important financial documents, including income statements and expense records, to provide a clear picture of your economic situation.

-

File All Required Tax Returns: It's crucial to file all tax returns, as this is a prerequisite for eligibility. The IRS requires that individuals stay current with their tax filings to qualify for relief options.

-

Choose the Suitable Relief Option: Depending on your financial situation, consider whether to request an installment agreement, an offer in compromise, or another relief choice. Each option has specific eligibility criteria and benefits. For instance, the Streamlined Installment Agreement allows payments over up to 72 months for those who owe $50,000 or less.

-

Complete Required Forms: Accurately fill out the necessary IRS forms. For installment agreements, use Form 9465, and for offers in compromise, complete Form 433-A. Providing precise documentation that reflects your economic situation is essential for a successful application.

-

Submit Your Application: Once you've completed the forms, send them along with supporting documentation to the IRS, either electronically or by mail. Make sure all required paperwork is included to avoid any delays in processing.

-

Follow Up: After submission, keep an eye on the status of your application. Maintain open communication with the IRS and respond quickly to any requests for additional information to prevent processing delays.

It's common to feel challenged during this process, often due to incomplete documentation or misunderstandings about eligibility requirements. In 2025, the IRS increased allowable living expenses for food, rent, and healthcare, which means more individuals may qualify for Offer in Compromise or Currently Not Collectible status. Seeking professional guidance can simplify your application and increase your chances of approval, especially if you're navigating the complexities of tax relief options.

Real-life examples show that individuals who carefully follow these steps and provide thorough documentation often achieve successful outcomes, regaining control over their financial situations. The IRS Fresh Start Tax Program, which was launched in 2011, offers four types of tax relief, each with specific eligibility requirements and application processes. This structured approach helps you manage tax obligations and avoid severe penalties, reminding you that you are not alone in this journey.

Conclusion

The IRS Fresh Start Tax Program offers a meaningful opportunity for individuals and small businesses weighed down by tax obligations. By simplifying repayment processes and broadening eligibility for various relief options, this program seeks to illuminate a path toward financial stability. Its introduction in 2011, along with updates in 2025, reflects the IRS's dedication to evolving its support systems to better serve taxpayers grappling with economic challenges.

Key features of the program include:

- Streamlined installment agreements

- Expanded eligibility for Offers in Compromise

- Penalty relief options

These features empower taxpayers to take control of their financial situations. This initiative helps them avoid aggressive collection actions and improve their credit standings. Real-life success stories highlight the program's effectiveness, showcasing how many have successfully navigated their tax burdens with the support of this initiative.

Ultimately, the IRS Fresh Start Tax Program is more than just a tax relief measure; it serves as a lifeline for those in financial distress. By understanding its features and benefits, individuals can make informed decisions about their tax obligations. Engaging with this program could be the first step toward reclaiming financial stability. It's important to act promptly and explore the options for relief available to you. Remember, help is within reach, and taking action now can pave the way for a brighter financial future.

Frequently Asked Questions

What is the IRS Fresh Start Tax Program?

The IRS Fresh Start Tax Program is a tax relief initiative designed to assist individuals and small businesses facing tax obligations. It simplifies the repayment process, reduces penalties, and offers various options for taxpayers to resolve their tax issues.

When was the IRS Fresh Start Tax Program introduced and revised?

The program was introduced in 2011 and revised in 2025 to enhance its effectiveness and support for taxpayers.

What are the key features of the IRS Fresh Start Tax Program?

Key features include streamlined installment agreements for taxpayers owing up to $50,000, which require minimal documentation and allow for manageable payment plans, and broadened eligibility for Offers in Compromise (OIC), enabling more taxpayers to settle their obligations for less than the total amount due.

How has the Fresh Start Program impacted taxpayers?

Since its inception, the program has helped over 1.5 million individuals find economic stability amid tax burdens. Taxpayers with obligations under $25,000 can avoid or remove tax liens by entering into a Direct Debit Installment Agreement.

What should individuals facing tax challenges do?

Individuals facing tax challenges are encouraged to act swiftly and consider their options under the IRS Fresh Start Tax Program, as it provides flexibility and penalty relief measures, especially for first-time offenders.

What are the challenges associated with the Offer in Compromise?

Despite expanded eligibility criteria, the acceptance rate for Offer in Compromise applications remains low, which can pose challenges for some taxpayers seeking to settle their obligations.

What updates were made to the program in 2025?

The updates in 2025 included raising the threshold for streamlined installment agreements and expanding eligibility criteria for offers in compromise.

Are there any ongoing charges associated with installment agreements?

Yes, potential participants should be aware of ongoing interest charges associated with installment agreements within the IRS Fresh Start Tax Program.

What is the overall goal of the IRS Fresh Start Tax Program?

The overall goal of the program is to help taxpayers regain control of their financial situations and avoid aggressive collection actions, providing a crucial resource for those seeking relief from tax obligations.