Overview

This article delves into the historical context and significance of cost-of-living adjustments (COLA) in Social Security payments. We understand that many individuals rely on these benefits, and it’s essential to know how these adjustments are determined and the impact they have on your financial well-being.

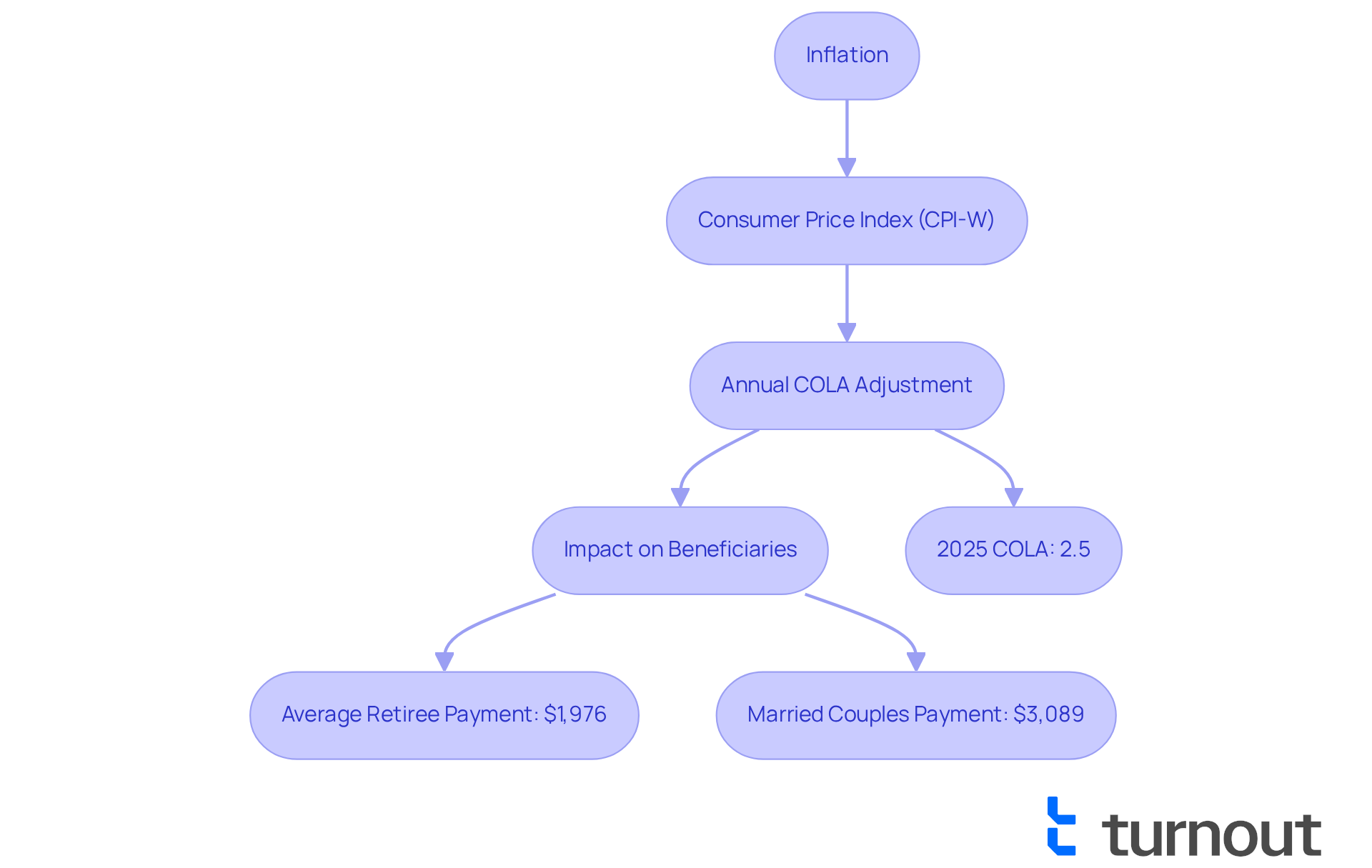

The upcoming 2.5% COLA for 2025 is particularly important. It plays a crucial role in helping maintain the purchasing power of Social Security benefits amidst rising inflation. This adjustment is calculated based on the Consumer Price Index, a measure that reflects the economic conditions affecting the cost of living for millions of Americans.

We recognize that navigating financial challenges can be overwhelming. Knowing that adjustments are made to support you can provide some peace of mind. Remember, you are not alone in this journey; we’re here to help you understand how these changes affect your benefits.

Introduction

Understanding the intricacies of Social Security's cost-of-living adjustments (COLA) is essential for millions who rely on these benefits to navigate the challenges posed by inflation. We understand that as prices rise, the importance of these adjustments becomes increasingly evident. They provide crucial support to retirees, disabled individuals, and survivors during these trying times.

However, with the recent announcement of a modest 2.5% increase for 2025, it's common to feel uncertain about whether this adjustment is sufficient to maintain purchasing power in an ever-changing economic landscape. How do historical trends in COLA reflect the ongoing battle against inflation? What implications do they hold for the financial stability of beneficiaries? These questions are vital as we seek to understand the impact on our lives and those we care about.

Define Cost-of-Living Adjustment (COLA)

A cost-of-living adjustment is a vital increase in Social Security payments designed to combat the effects of inflation. This adjustment is essential for preserving the purchasing power of benefits over time, helping recipients afford basic necessities despite rising costs. Typically, the cost-of-living adjustment is determined using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the prices of a specific set of goods and services.

In 2025, the Social Security Administration announced a COLA of 2.5%, marking the smallest increase since 2020. For the typical retiree, this change translates to an additional $49, raising their monthly payment from $1,927 to $1,976. For married couples, the average increase will be $75, boosting their monthly payment from $3,014 to $3,089. These adjustments are crucial for beneficiaries, especially those with disabilities, as they help maintain their standard of living amid inflationary pressures.

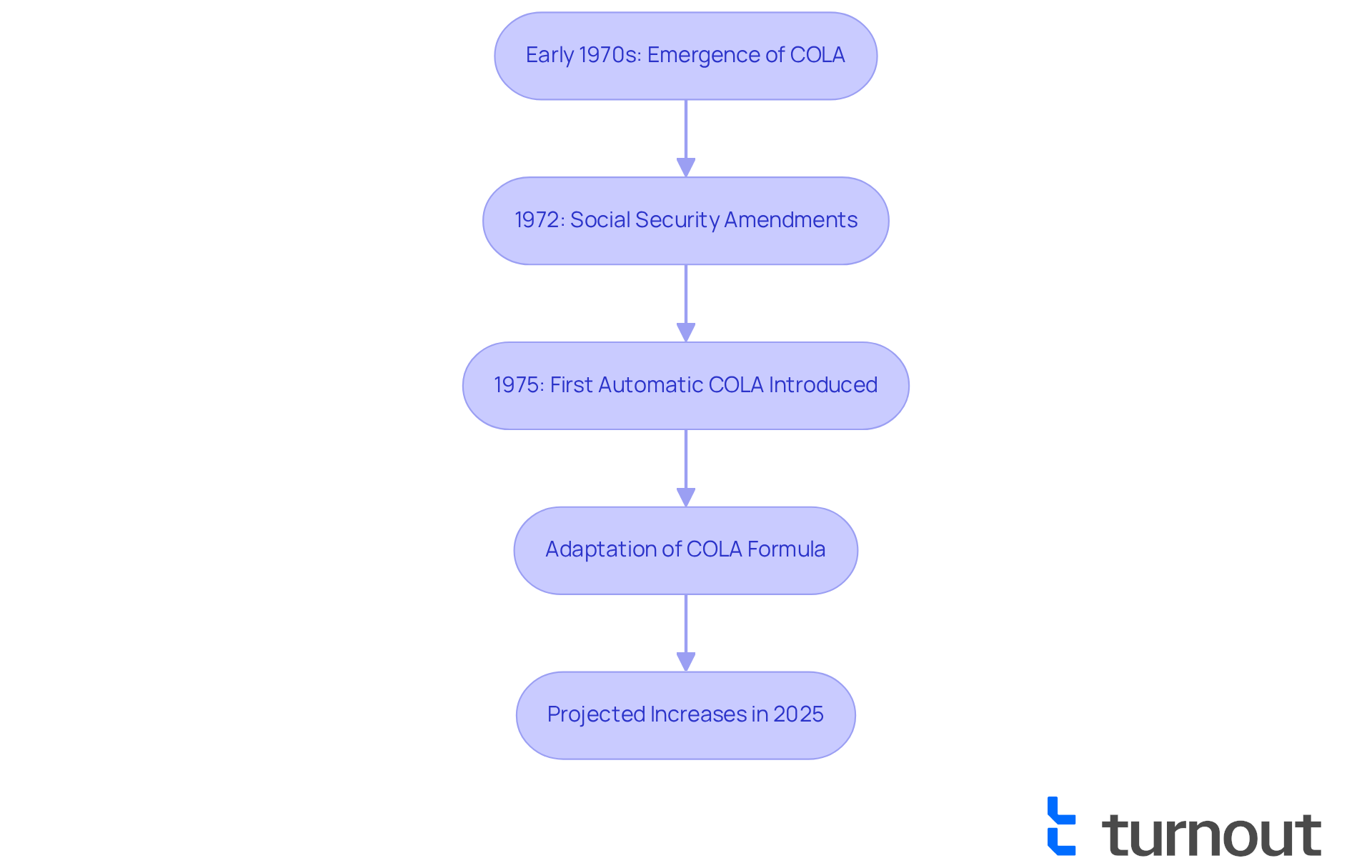

The impact of inflation on security payments is significant. Historical data reveals that the fluctuations in the social security cost-of-living increase history reflect changes in inflation rates. The introduction of automatic COLAs in 1975 was a landmark moment in social security cost-of-living increase history, ensuring that inflation would not erode the value of Social Security payments. This mechanism has been essential for millions of Americans, allowing them to navigate rising living costs without losing the real value of their benefits.

Real-world examples illustrate how cost-of-living adjustments directly affect the purchasing power of individuals with disabilities. For many, these increases can be the difference between affording essential items like groceries and medications or facing financial hardship. As inflation continues to rise, the importance of cost-of-living adjustments in safeguarding the financial stability of beneficiaries cannot be overstated. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Contextualize COLA in Social Security

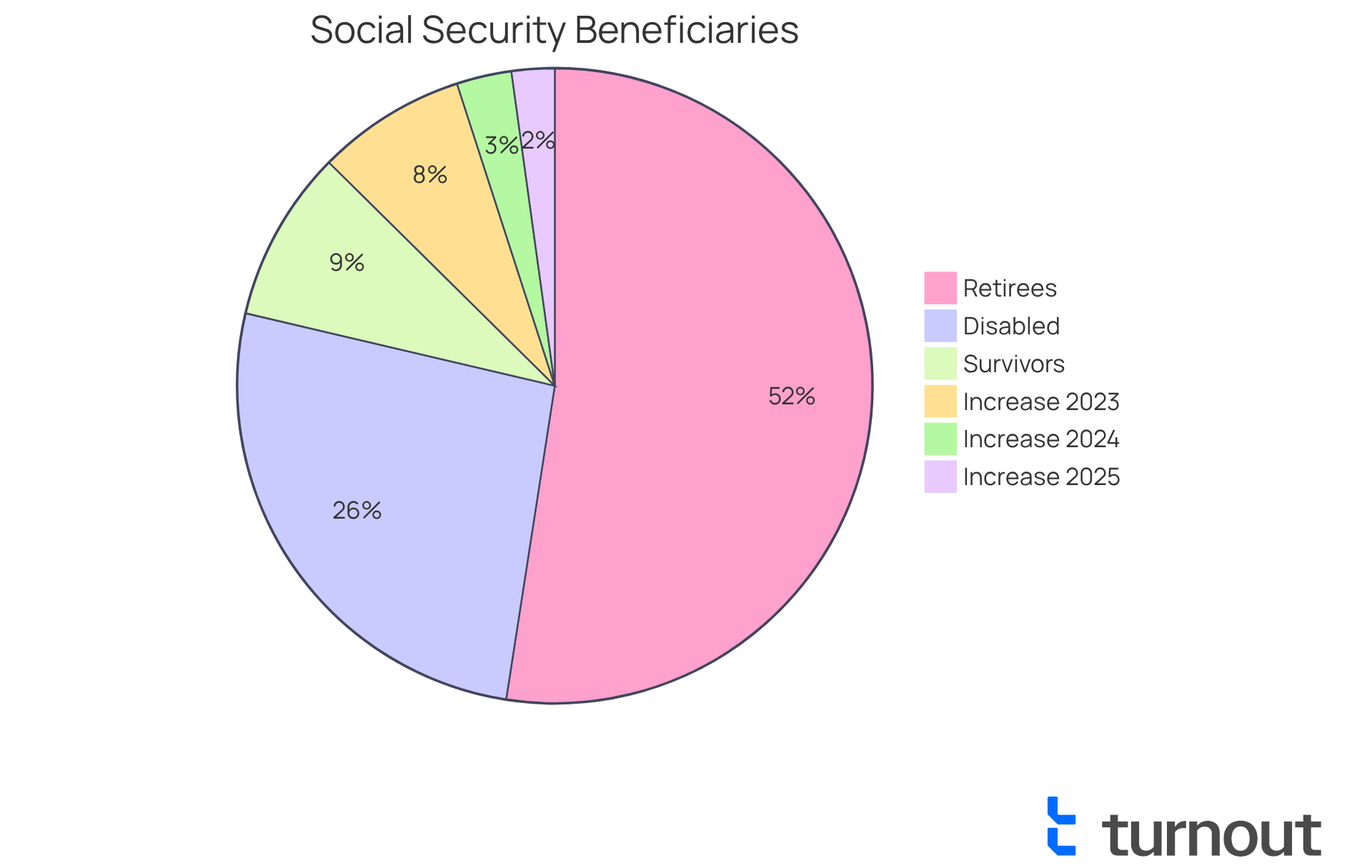

Cost-of-Living Adjustments (COLA) are vital to the security system, providing essential financial assistance to retirees, disabled individuals, and survivors of deceased workers. Since 1975, these payments have been adjusted annually based on the social security cost-of-living increase history, which ensures that recipients can keep pace with inflation. This adjustment is especially crucial for at-risk groups, such as the elderly and disabled, many of whom rely entirely on these resources for their sustenance. Approximately 72.5 million individuals receive Social Security payments, with a significant percentage depending solely on these disbursements to meet their basic needs.

The recent 2.5% cost-of-living adjustment, effective in 2025, results in an average monthly benefit increase from $1,483 to $1,520 for disabled workers, and from $1,800 to $1,845 for retirees. Financial analysts emphasize that such adjustments are essential for vulnerable populations, as they help mitigate the effects of rising living costs, particularly in housing, food, and healthcare. For instance, Sherri Myers, an 82-year-old retiree, shared her concerns about the sufficiency of the increase, highlighting the ongoing struggle to afford basic groceries amidst inflation.

Historically, the social security cost-of-living increase history has played a critical role in supporting these populations. They ensure that the purchasing power of security benefits does not diminish over time, allowing beneficiaries to maintain a stable quality of life. The 8.7% rise in 2023 and the 3.2% rise in 2024 reflect a trend of moderating inflation, as seen in the social security cost-of-living increase history. However, as inflation continues to climb, the significance of these adjustments becomes even clearer, especially for those who depend primarily on Security for their income. The 2.5% rise aims to provide some relief, but it's essential for beneficiaries to plan their budgets carefully to maximize the impact of these adjustments, particularly in light of potential hikes in Medicare premiums, projected to reach $185 per month in 2025.

Trace the Historical Development of COLA

The concept of the Cost-of-Living Adjustment, which is part of the social security cost-of-living increase history, emerged in the early 1970s to address the pressing issue of rising inflation rates that diminished the purchasing power of retirement payments. In 1975, the first automatic cost-of-living adjustment was introduced, which is a significant event in the social security cost-of-living increase history, following the Social Security Amendments of 1972. This pivotal change linked payment adjustments directly to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Over the years, the COLA has adapted, incorporating a formula that aims to reflect actual inflation rates accurately. For instance, the average CPI-W for the third quarter of 2024 was 2.5 percent higher than in 2023, leading to a corresponding 2.5 percent increase in allowances for 2025. This means that the projected average monthly retirement payment will rise from $1,927 to $1,976 in January 2025. Similarly, the typical payment for individuals with disabilities is set to increase from $1,542 to $1,580.

However, we understand that there have been challenging years, such as 2010, 2011, and 2016, when no cost-of-living adjustment was made due to stagnant inflation. This highlights the program's ability to adapt to changing economic conditions. As the Social Security Administration states, the social security cost-of-living increase history indicates that since 1975, Social Security's general benefit increases have been based on increases in the cost of living, as measured by the Consumer Price Index.

This historical context emphasizes how inflation rates have profoundly influenced cost-of-living adjustments, ultimately affecting the financial stability of beneficiaries. Looking ahead, the upcoming cost-of-living adjustment will be announced in October 2025, providing valuable insight into future changes. Remember, you are not alone in navigating these adjustments; we're here to help you understand how they may impact your financial well-being.

Analyze COLA Calculation Methods

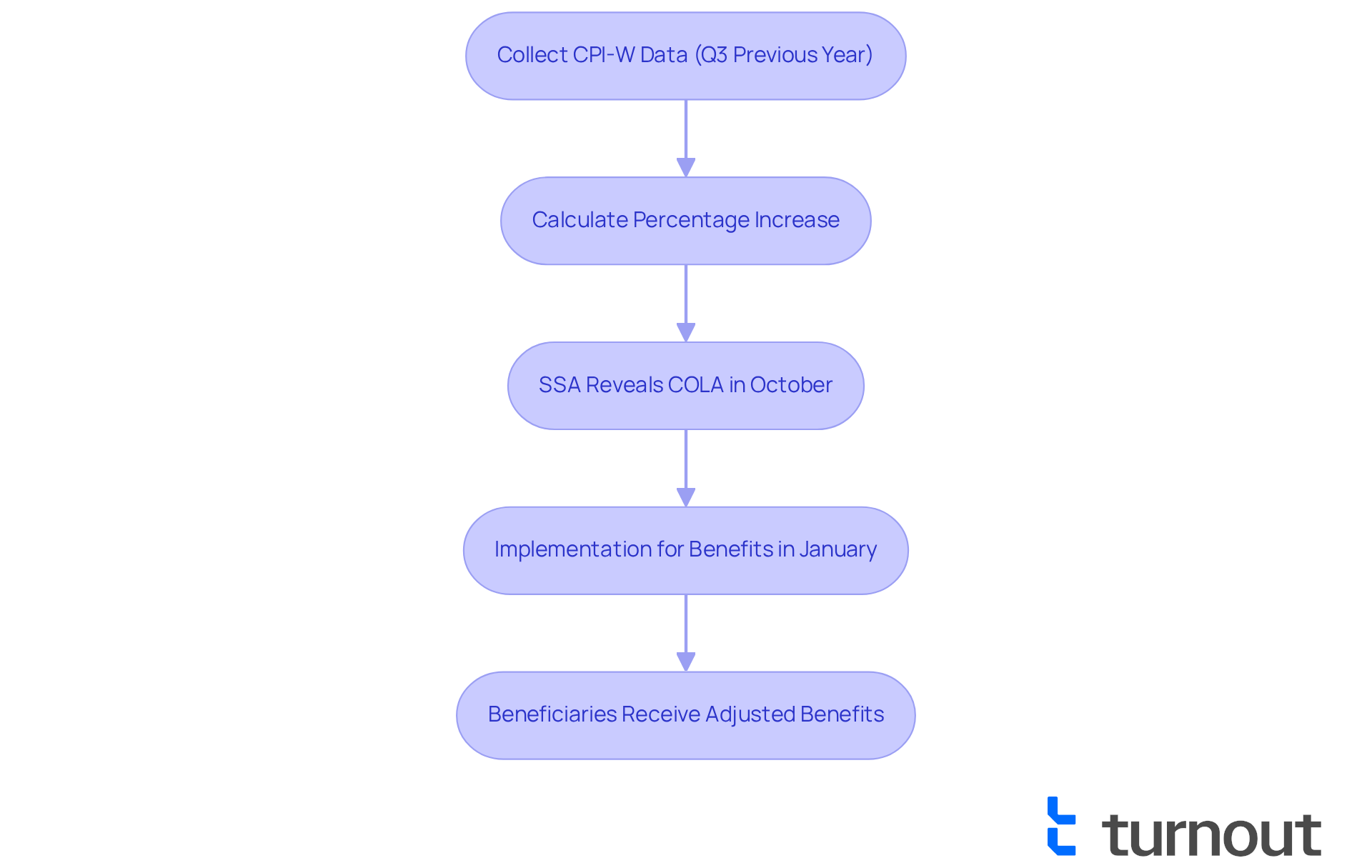

We understand that navigating financial adjustments can be challenging. The computation of the cost-of-living adjustment (COLA), which reflects the social security cost-of-living increase history, is based on the percentage rise in the CPI-W from the third quarter of the prior year to the third quarter of the current year.

Every October, the Social Security Administration (SSA) reveals the social security cost-of-living increase history for the upcoming year, which is implemented for benefits starting in January. For instance, the social security cost-of-living increase history shows that the COLA for 2025 was determined to be 2.5%, reflecting the inflation trends observed in the preceding year.

This method ensures that adjustments are timely and relevant. It's comforting to know that these adjustments allow beneficiaries to receive increases that align with current economic conditions. We’re here to help you understand these changes and how they may affect you. Remember, you are not alone in this journey; we are committed to supporting you every step of the way.

Conclusion

Understanding the history and significance of cost-of-living adjustments (COLA) in Social Security is crucial for beneficiaries who rely on these payments to maintain their quality of life amidst inflation. We understand that as inflation continues to impact living costs, the adjustments made to Social Security payments serve as a buffer, ensuring that recipients can afford essential goods and services. The recent 2.5% increase for 2025, while modest, highlights how important these adjustments are in preserving the purchasing power of millions of Americans.

Throughout this article, we have highlighted key points regarding:

- The historical context of COLA

- Its calculation methods

- The direct effects of inflation on Social Security benefits

The introduction of automatic COLAs in 1975 marked a pivotal change that has helped safeguard the financial stability of retirees, disabled individuals, and survivors. Real-world examples, such as the experiences of vulnerable beneficiaries, illustrate the tangible impact these adjustments have on their daily lives. The ongoing evolution of COLA reflects not only economic conditions but also our commitment to support those who depend on Social Security.

Ultimately, understanding the intricacies of COLA is essential for beneficiaries to navigate their financial futures effectively. As inflation rates fluctuate, it's common to feel uncertain about managing expenses. Staying informed about these adjustments and planning accordingly can make a significant difference. Engaging with resources that provide insights into Social Security COLA can empower you to make informed decisions and advocate for your needs in this ever-changing economic landscape. Remember, you are not alone in this journey—we're here to help.

Frequently Asked Questions

What is a cost-of-living adjustment (COLA)?

A cost-of-living adjustment (COLA) is an increase in Social Security payments designed to counteract the effects of inflation, helping recipients maintain their purchasing power and afford basic necessities.

How is the COLA determined?

The COLA is typically determined using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the prices of a specific set of goods and services.

What was the COLA announced for 2025?

In 2025, the Social Security Administration announced a COLA of 2.5%, which is the smallest increase since 2020.

How does the 2025 COLA affect typical Social Security recipients?

For the typical retiree, the 2.5% COLA translates to an additional $49, raising their monthly payment from $1,927 to $1,976. For married couples, the average increase will be $75, boosting their monthly payment from $3,014 to $3,089.

Why are COLAs important for beneficiaries, especially those with disabilities?

COLAs are crucial for beneficiaries, particularly those with disabilities, as they help maintain their standard of living amid inflationary pressures and ensure they can afford essential items.

When were automatic COLAs introduced, and why are they significant?

Automatic COLAs were introduced in 1975, marking a significant moment in Social Security history by ensuring that inflation would not erode the value of Social Security payments for millions of Americans.

How do cost-of-living adjustments impact the purchasing power of individuals with disabilities?

Cost-of-living adjustments directly affect the purchasing power of individuals with disabilities by helping them afford essential items like groceries and medications, preventing financial hardship as inflation rises.