Overview

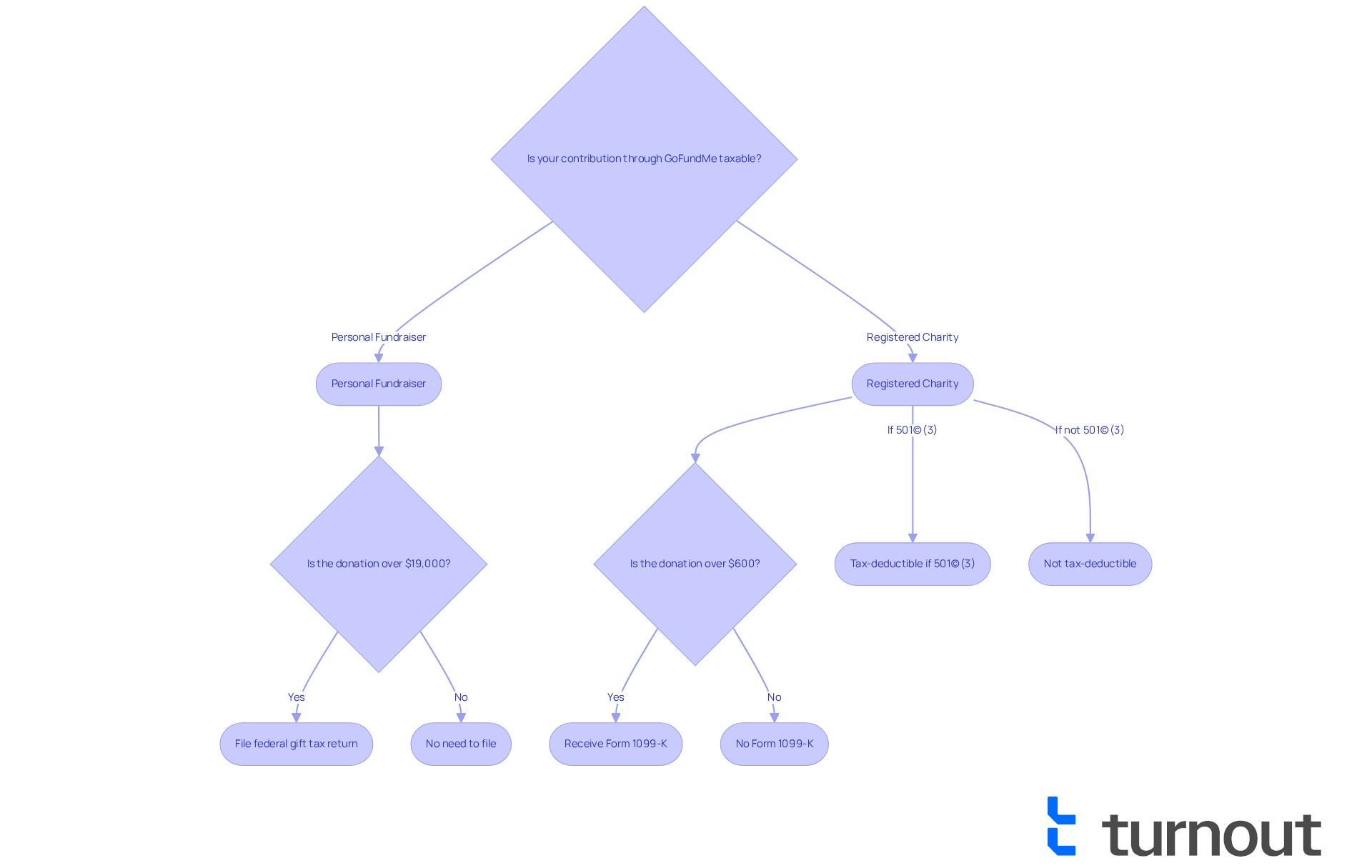

We understand that navigating the financial aspects of GoFundMe contributions can be overwhelming. Generally, these contributions are not taxable, as they are treated as personal gifts. However, it's important to note that donations made to registered charities may qualify for tax deductions, providing a potential benefit for your generosity.

While personal contributions typically do not incur taxes, exceeding certain thresholds might require you to file a gift tax return. The nature of your fundraiser is crucial in determining the tax implications. Therefore, we encourage you to familiarize yourself with IRS guidelines and maintain proper documentation to ensure a smooth process.

Remember, you're not alone in this journey. We're here to help you navigate these complexities with confidence. Understanding these details can empower you to make informed decisions as you seek assistance for your cause.

Introduction

Navigating the world of crowdfunding can feel overwhelming, especially when it comes to understanding the tax implications of platforms like GoFundMe. As more individuals turn to these platforms for personal emergencies or charitable causes, the question of whether GoFundMe contributions are taxable becomes a significant concern.

We understand that this can be a confusing topic, and we’re here to help. This article delves into the nuances of GoFundMe donations, offering clarity on what donors need to know to ensure compliance with IRS regulations. With potential pitfalls lurking in the complexities of tax law, it’s common to feel uncertain about your obligations.

How can you confidently determine your responsibilities and maximize your contributions without falling afoul of the taxman? Let’s explore this together.

Understand GoFundMe and Its Tax Implications

This platform serves as a popular crowdfunding service, enabling individuals to raise funds for various purposes, from personal expenses to charitable initiatives. However, we understand that navigating the tax implications of whether GoFundMe is taxable for contributions through crowdfunding can be daunting. It's essential for donors to understand whether GoFundMe is taxable to ensure compliance with IRS regulations.

Typically, contributions to individual fundraisers are treated as private gifts, which raises the question of whether GoFundMe is taxable, meaning they are not subject to income tax. This means that if you choose to support a personal fundraising campaign, you generally don’t need to worry about whether GoFundMe is taxable. On the other hand, donations made to registered charities via the platform may qualify for tax deductions, provided the organization meets the criteria of a 501(c)(3). It's vital to verify the fundraiser's status to understand if the question of whether GoFundMe is taxable affects how your contribution will be taxed.

The IRS has outlined specific guidelines regarding whether GoFundMe is taxable, which is particularly relevant in 2025. For instance, if someone donates over $19,000 to a private crowdfunding campaign, they may need to determine if GoFundMe is taxable and file a federal gift tax return, although they typically won’t owe taxes. This amount reflects the annual gift exclusion for 2025. Furthermore, if a crowdfunding campaign raises more than $600, the platform will issue Form 1099-K to the organizer, prompting the inquiry of whether GoFundMe is taxable, detailing the total funds raised. This form is also sent to the IRS, highlighting the importance of accurate reporting.

We know that tax compliance in crowdfunding can be complex, especially when considering if GoFundMe is taxable, as illustrated by various case studies. For example, funds raised for business purposes may have different tax implications compared to personal campaigns, making it crucial to seek expert guidance to navigate potential liabilities. Additionally, contributions from employers to crowdfunding campaigns for employees are considered taxable income, leading to the question of whether GoFundMe is taxable, which the recipient must report.

To help you avoid any potential tax issues, we recommend keeping thorough records of your contributions and consulting a tax professional for personalized advice on whether GoFundMe is taxable and how to optimize your tax situation related to crowdfunding. Familiarizing yourself with IRS guidelines on crowdfunding, particularly regarding if GoFundMe is taxable, will empower you to make informed choices when participating in fundraising campaigns. Remember, you are not alone in this journey; we're here to help.

Identify Taxable vs. Non-Taxable Donations

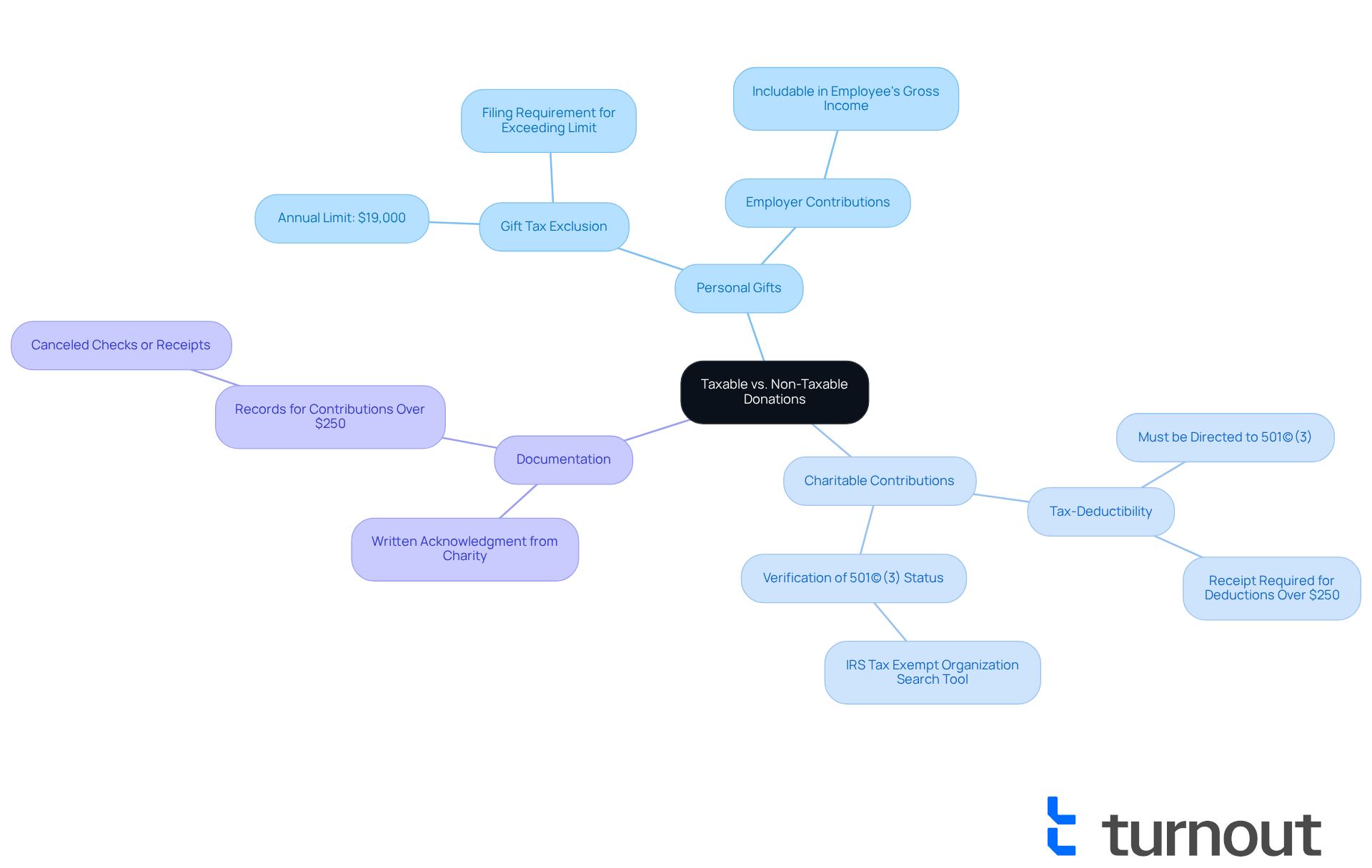

To determine whether your GoFundMe donation is taxable or non-taxable, it’s important to consider a few key criteria that can help clarify your situation:

-

Personal Gifts: Donations made to personal fundraisers are generally classified as personal gifts. According to IRS guidelines, these gifts are not considered taxable income for the recipient. However, if you exceed the annual gift tax exclusion limit of $19,000 in 2025, you may need to file a gift tax return. Remember, contributions from employers to employees are typically includible in the employee's gross income.

-

Charitable Contributions: If your gift supports a GoFundMe campaign directed towards a registered charity, it may be tax-deductible. Ensure that the organization is recognized by the IRS as a 501(c)(3) entity. You can verify this status using the IRS Tax Exempt Organization Search tool at IRS.gov. In this case, obtaining a receipt for your contribution is crucial, as it can be utilized for tax deduction purposes.

-

Documentation: Always keep records of your contributions, especially if they exceed $250. For charitable contributions, a written acknowledgment from the charity confirming the amount donated and stating that no goods or services were provided in exchange is necessary. Additionally, cash contributions require documentation, such as canceled checks or receipts, to be deductible.

By recognizing these differences and maintaining precise records, you can effectively manage the tax consequences of your contributions while addressing whether GoFundMe is taxable and ensuring adherence to IRS regulations. We understand that navigating these rules can be overwhelming, so consulting a tax professional for guidance on treating amounts received from crowdfunding is highly recommended. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Document and Report Your GoFundMe Donations

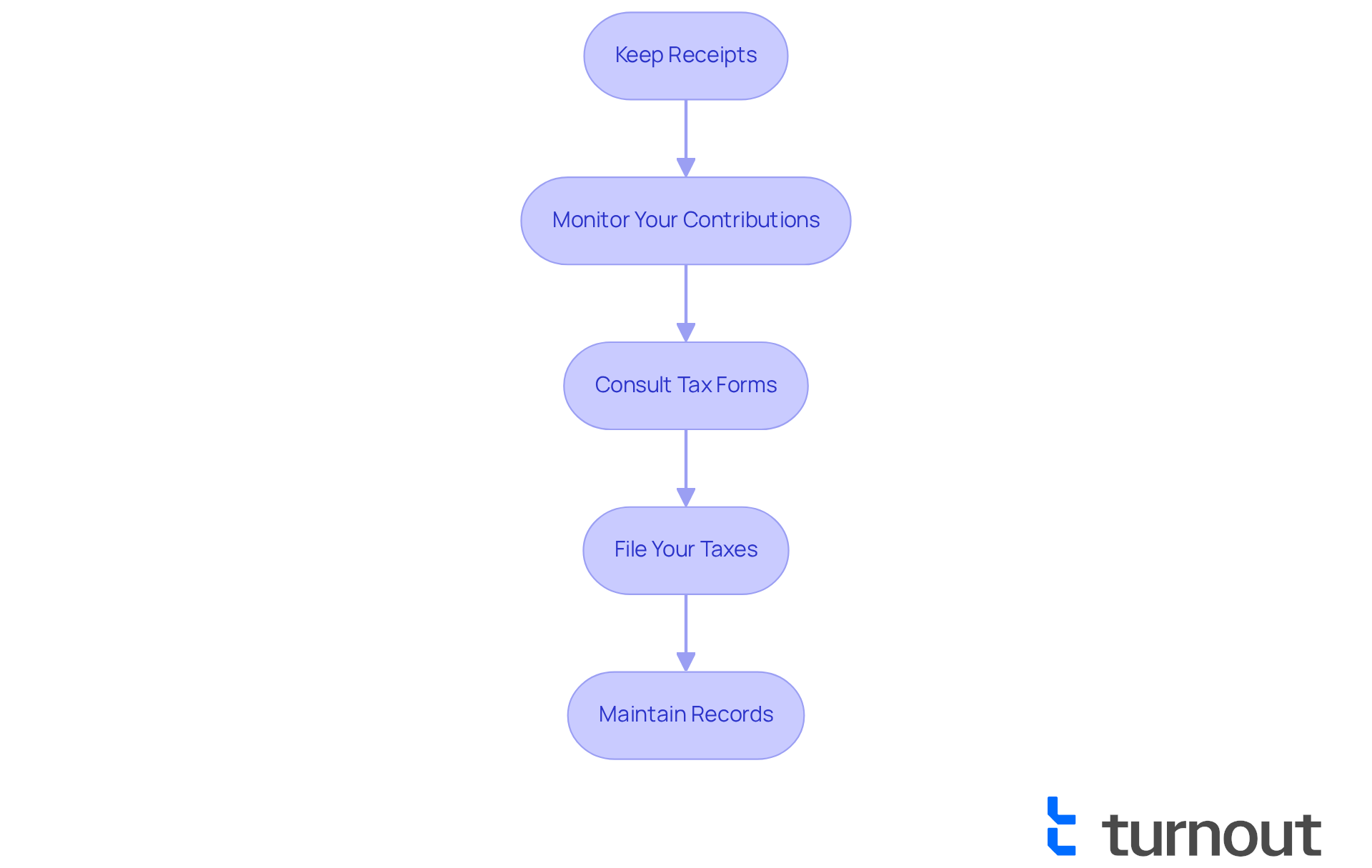

To effectively document and report your GoFundMe donations, we understand that you may have questions and concerns. Follow these steps to make the process smoother:

-

Keep Receipts: Always retain receipts for your contributions, especially for significant amounts. For contributions over $250, be sure to obtain a written acknowledgment from the organizer or charity. This is crucial for your records.

-

Monitor Your Contributions: It’s helpful to keep a comprehensive log of all contributions made through the fundraising platform. Include the date, amount, and purpose of each contribution. This will assist you when preparing your tax return and provide clarity on your giving.

-

Consult Tax Forms: If you receive a Form 1099-K from GoFundMe, it indicates that you have received over $600 in gross payments. This form is issued when your total payments exceed this threshold. While it does not automatically imply that your funds are taxable, it is essential to accurately report whether is gofundme taxable on your tax return.

-

File Your Taxes: When it comes time to submit your taxes, ensure that you report your contributions accurately. If you are claiming deductions for charitable contributions, having the necessary documentation to support your claims will make the process easier.

-

Maintain Records: We recommend keeping detailed records of your contributions for a minimum of three years. This will help ensure compliance with tax regulations and provide necessary documentation if needed in the future.

By following these steps, you can feel confident in your compliance with tax regulations and maximize any potential deductions for your charitable contributions. Remember, we're here to help you navigate this journey.

Address Common Questions About GoFundMe Taxation

Here are some common questions regarding the taxation of GoFundMe donations:

-

Are all GoFundMe contributions subject to taxation, and is GoFundMe taxable?

- We understand that this is a common concern. Donations made to personal fundraisers are generally considered personal gifts, which leads to the question: is GoFundMe taxable? However, donations to registered charities may be tax-deductible, which leads to the question of is GoFundMe taxable.

-

What if I exceed the gift tax exclusion limit?

- It's natural to worry about this. If your total gifts to an individual exceed the annual exclusion limit of $19,000 in 2025, you may need to file a gift tax return. Typically, you won't owe taxes unless you exceed the lifetime exemption amount of $13.99 million, which is quite a significant threshold.

-

How do I know if a GoFundMe campaign is for a charity?

- We encourage you to check the campaign description for information about the organization. If it is a registered 501(c)(3) charity, your contribution may be tax-deductible, allowing you to support a cause while also benefiting financially.

-

What documentation do I need for tax deductions?

- For donations over $250, it's important to have a written acknowledgment from the charity. We recommend retaining all receipts and records of your contributions for your tax submissions. The IRS suggests maintaining records for at least three years to substantiate the taxability of the funds raised, ensuring you are prepared.

-

What occurs if I obtain something valuable in exchange for my contribution?

- It's common to wonder about this. If you receive something of value in return for your donation, the IRS may classify it as a sale, making any profits taxable as personal income. Understanding this can help you navigate your contributions more effectively.

-

What is the 1099-K form?

- If a crowdfunding campaign raises more than $5,000, a 1099-K form will be issued the following year, detailing the total amount raised and sent to the IRS. This form is essential for your records.

By addressing these common questions, we hope you feel more confident in your understanding of whether GoFundMe is taxable and your responsibilities as contributors. Remember, consulting a tax professional for personalized guidance is always a wise step. You're not alone in this journey, and we're here to help.

Conclusion

Understanding the tax implications of GoFundMe donations is crucial for donors who want to comply with IRS regulations while supporting various causes. We recognize that navigating these regulations can feel overwhelming. Contributions to personal fundraisers are generally treated as non-taxable gifts, whereas donations made to registered charities may offer tax deductions. This distinction highlights the importance of verifying the status of the fundraiser to determine any potential tax obligations.

It's essential to maintain thorough records of your contributions. We encourage you to familiarize yourself with IRS guidelines, as this knowledge can help you avoid any surprises. If your donations exceed certain thresholds, you may need to file a gift tax return. Additionally, the issuance of Form 1099-K for campaigns raising over $600 serves as a reminder for accurate reporting. By understanding these factors, you can navigate the complexities of crowdfunding taxation more effectively.

Ultimately, being informed about whether GoFundMe is taxable empowers you to make educated decisions and optimize your tax situation. Engaging with a tax professional for personalized advice can further clarify any uncertainties, ensuring compliance and maximizing the impact of your charitable contributions. As crowdfunding continues to grow, staying informed about tax implications will be pivotal for both donors and recipients alike. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What is GoFundMe?

GoFundMe is a popular crowdfunding platform that allows individuals to raise funds for various purposes, including personal expenses and charitable initiatives.

Are contributions to GoFundMe taxable?

Typically, contributions to individual fundraisers on GoFundMe are treated as private gifts and are not subject to income tax. Therefore, if you support a personal fundraising campaign, you generally do not need to worry about tax implications.

Can donations to registered charities on GoFundMe qualify for tax deductions?

Yes, donations made to registered charities via GoFundMe may qualify for tax deductions, provided the organization meets the criteria of a 501(c)(3). It is important to verify the fundraiser's status to understand the tax implications.

What should I know about the IRS guidelines regarding GoFundMe and taxes?

The IRS has specific guidelines regarding whether GoFundMe is taxable. For instance, if someone donates over $19,000 to a private crowdfunding campaign in 2025, they may need to file a federal gift tax return, although they typically won’t owe taxes. Additionally, if a campaign raises more than $600, GoFundMe will issue Form 1099-K to the organizer, which is also sent to the IRS.

What tax implications exist for funds raised for business purposes on GoFundMe?

Funds raised for business purposes may have different tax implications compared to personal campaigns. It is crucial to seek expert guidance to navigate potential liabilities related to these funds.

Are contributions from employers to crowdfunding campaigns considered taxable income?

Yes, contributions from employers to crowdfunding campaigns for employees are considered taxable income, and the recipient must report this income.

What should I do to avoid potential tax issues with GoFundMe contributions?

It is recommended to keep thorough records of your contributions and consult a tax professional for personalized advice on tax implications related to GoFundMe and crowdfunding.

How can I familiarize myself with IRS guidelines on crowdfunding?

Familiarizing yourself with IRS guidelines on crowdfunding, particularly regarding whether GoFundMe is taxable, will help you make informed choices when participating in fundraising campaigns.