Overview

This article offers a compassionate step-by-step guide to navigating the application process for Social Security Disability Insurance (SSDI). We understand that seeking assistance can be overwhelming, and it's crucial to grasp the eligibility requirements, gather the necessary documentation, and address common challenges along the way.

By detailing the specific criteria for qualification and the essential documents needed, we aim to provide you with practical solutions for overcoming obstacles. Remember, you are not alone in this journey; we’re here to help you improve your chances of a successful application.

As you embark on this process, take comfort in knowing that with the right information and support, you can navigate these challenges more effectively. Your journey matters, and understanding what lies ahead can empower you to take the next steps confidently.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can often feel like an uphill battle for those facing the hardships of a disability. We understand that this federal program is designed to provide essential financial support, yet many individuals remain uncertain about the application process and eligibility requirements.

By delving into the step-by-step guide presented in this article, you will uncover the critical information needed to successfully navigate your SSDI application journey.

What challenges might you encounter along the way? It's common to feel overwhelmed, but know that there are effective ways to overcome these obstacles and secure the benefits you deserve.

Understand Social Security Disability Insurance (SSDI)

Navigating the challenges of a disability can be overwhelming, and we understand that many individuals may feel uncertain about their options. SSDI, or Social Security Disability Insurance, is a federal program designed to offer financial support to those who cannot work due to a qualifying disability. To qualify, it is essential to have a sufficient work history and have paid Social Security taxes.

These disability benefits aim to replace a portion of lost earnings, helping you maintain financial stability during these difficult times. Understanding how the SSDI program is structured—particularly its financing through payroll taxes and the criteria for disability—is crucial for effectively navigating the application process.

You are not alone in this journey. We’re here to help you every step of the way. By familiarizing yourself with the requirements and seeking assistance, you can take an important step toward securing the support you need.

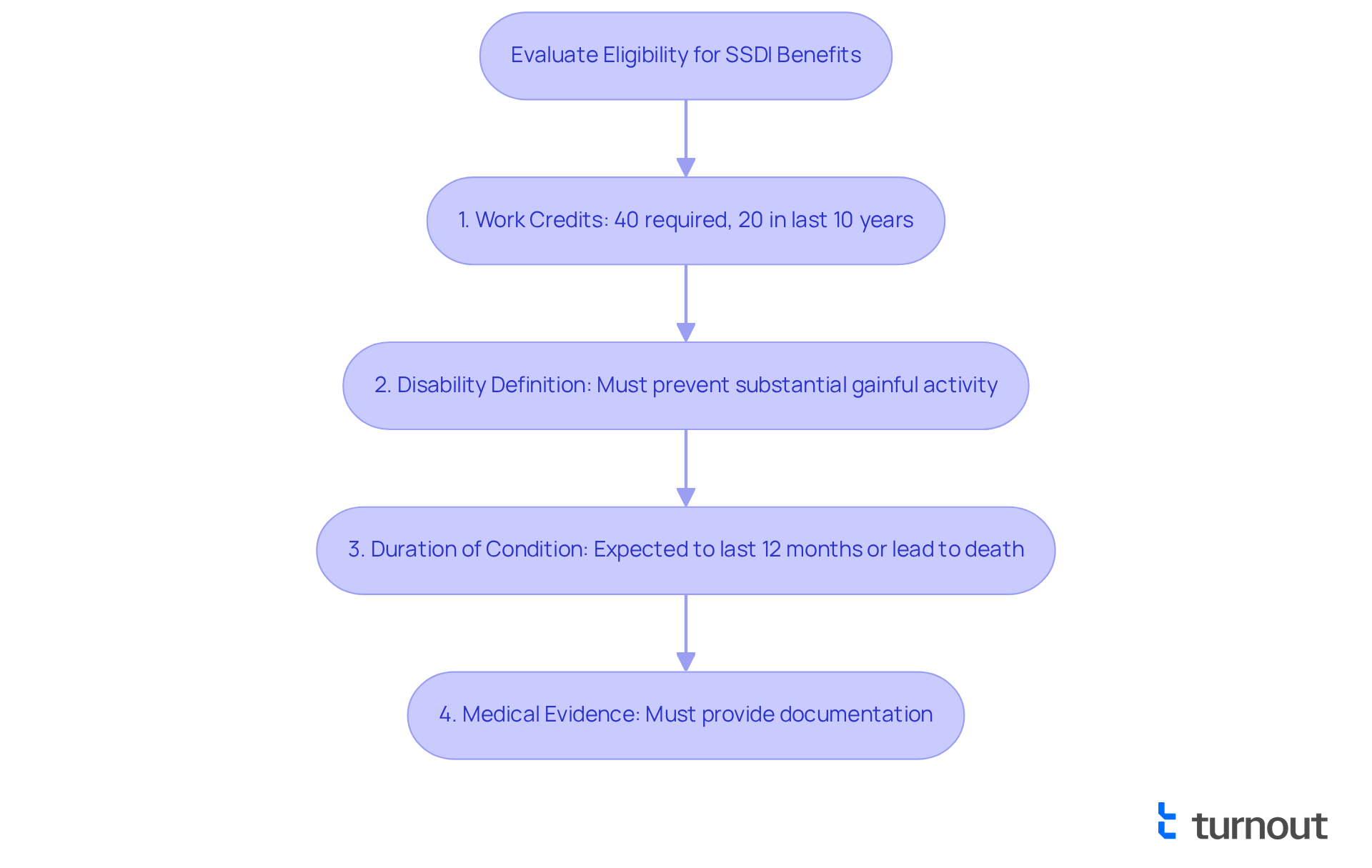

Determine Your Eligibility for SSDI Benefits

Navigating the path to SSDI benefits can feel overwhelming, but understanding the eligibility criteria for SSDI is a vital first step. Here’s what you need to know:

-

Work Credits: To qualify, you generally need to have earned 40 work credits, with at least 20 of those credits accumulated in the last 10 years prior to the onset of your disability.

-

Disability Definition: It’s essential that your health condition aligns with the SSDI definition of disability. This means that your condition prevents you from engaging in substantial gainful activity.

-

Duration of Condition: Your disability should be expected to last for a minimum of 12 months or lead to death.

-

Medical Evidence: Supporting your claim with medical documentation is crucial.

We understand that gathering this information can be challenging, but evaluating these factors early on can save you time and effort in the long run. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Gather Required Documentation for Your Application

Before you begin your SSDI application, we understand that gathering all the necessary documents for SSDI can feel overwhelming. To help you through this process, here are some essential documents you’ll need:

-

Personal Information: This includes your Social Security number, birth certificate, and proof of U.S. citizenship or lawful alien status.

-

Work History: Please prepare the names and addresses of all employers from the past 15 years, along with your W-2 forms or self-employment tax returns.

-

Medical Records: It's important to have detailed medical records from your healthcare providers that document your condition, treatment history, and prognosis.

-

Other Relevant Documents: Consider any additional documentation that may support your claim, such as disability reports or statements from family members or friends regarding your limitations.

Having these documents prepared will ease your submission process, making it smoother and less stressful. Remember, you are not alone in this journey; we’re here to help you every step of the way.

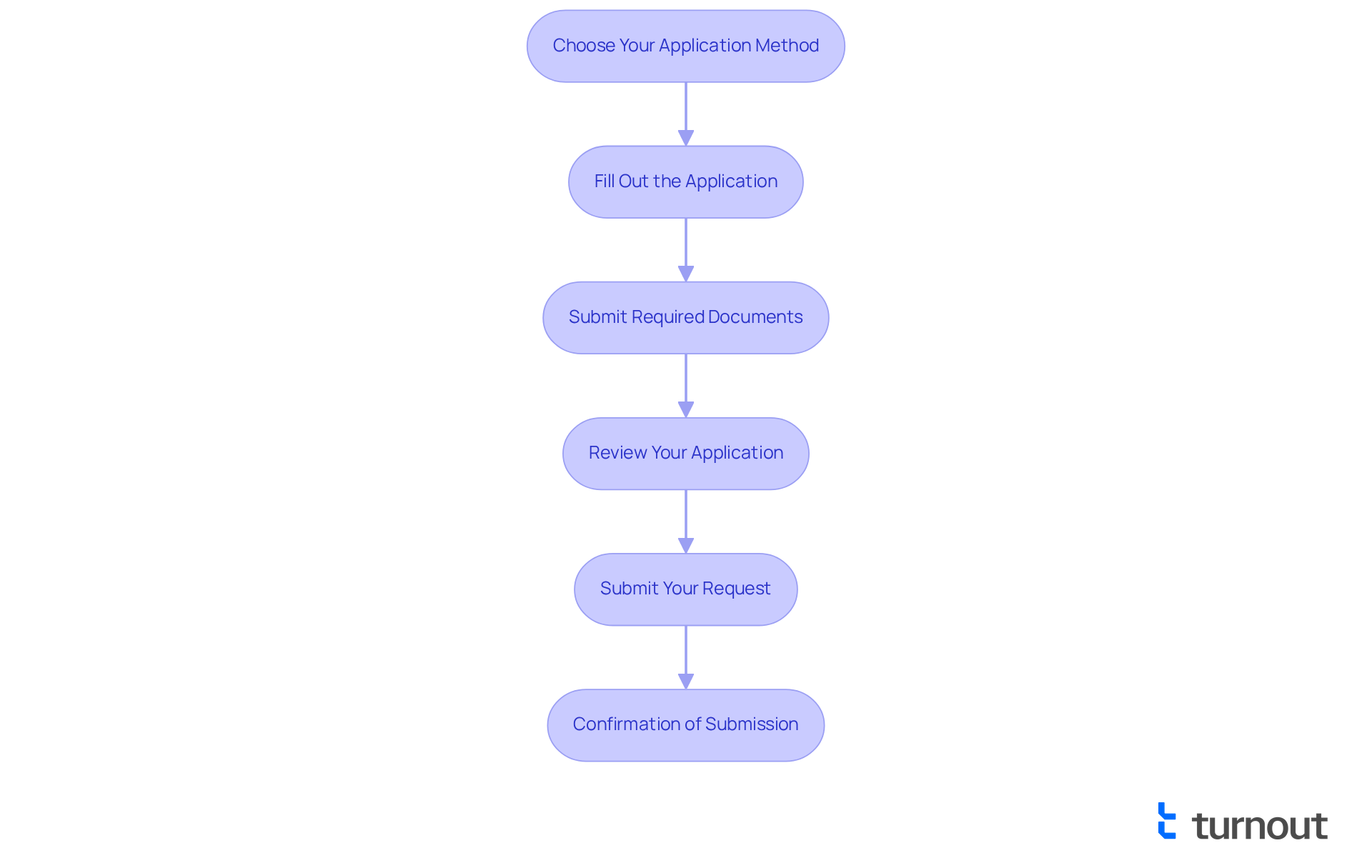

Complete Your SSDI Application Process

To successfully complete your SSDI application, we invite you to follow these essential steps:

-

Choose Your Application Method: You have the option to apply online through the SSA website, by phone, or in person at your local SSA office. Many find that online applications are the fastest, providing immediate access to the necessary tools and information.

-

Fill Out the Application: If you decide to apply online, please create an account on the SSA website and complete the Adult Disability Application (Form SSA-16). It’s important to ensure that all information is accurate and comprehensive, as errors can lead to significant delays.

-

Submit Required Documents: Make sure to attach all necessary documentation, including medical records and work history. When submitting online, you can easily upload documents directly, which enhances the efficiency of the process.

-

Review Your Application: Before submitting, we encourage you to meticulously double-check all entries for accuracy. Incomplete or incorrect information can lead to processing delays, which have increased by 86% from four months in November 2019 to over seven months in November 2023, averaging 225 days for initial decisions as of 2025.

-

Submit Your Request: Once everything is in order, please submit your request. You will receive a confirmation of submission, which is crucial to keep for your records.

Navigating the disability benefits request procedure can feel overwhelming. However, utilizing the SSA's online services allows you to apply for SSDI benefits and manage your accounts without the need to visit a local office, significantly improving your chances of a favorable outcome. Advocates emphasize that focusing on detail during the submission process is essential, as even small errors can extend the wait for benefits. The Social Security Administration has acknowledged that increased wait times are 'unacceptable' and that they cause significant financial hardship for vulnerable individuals. Additionally, it's important to remember that employee turnover in DDS offices reached over 25% during the pandemic, which has contributed to these delays. Remember, you are not alone in this journey; we are here to help.

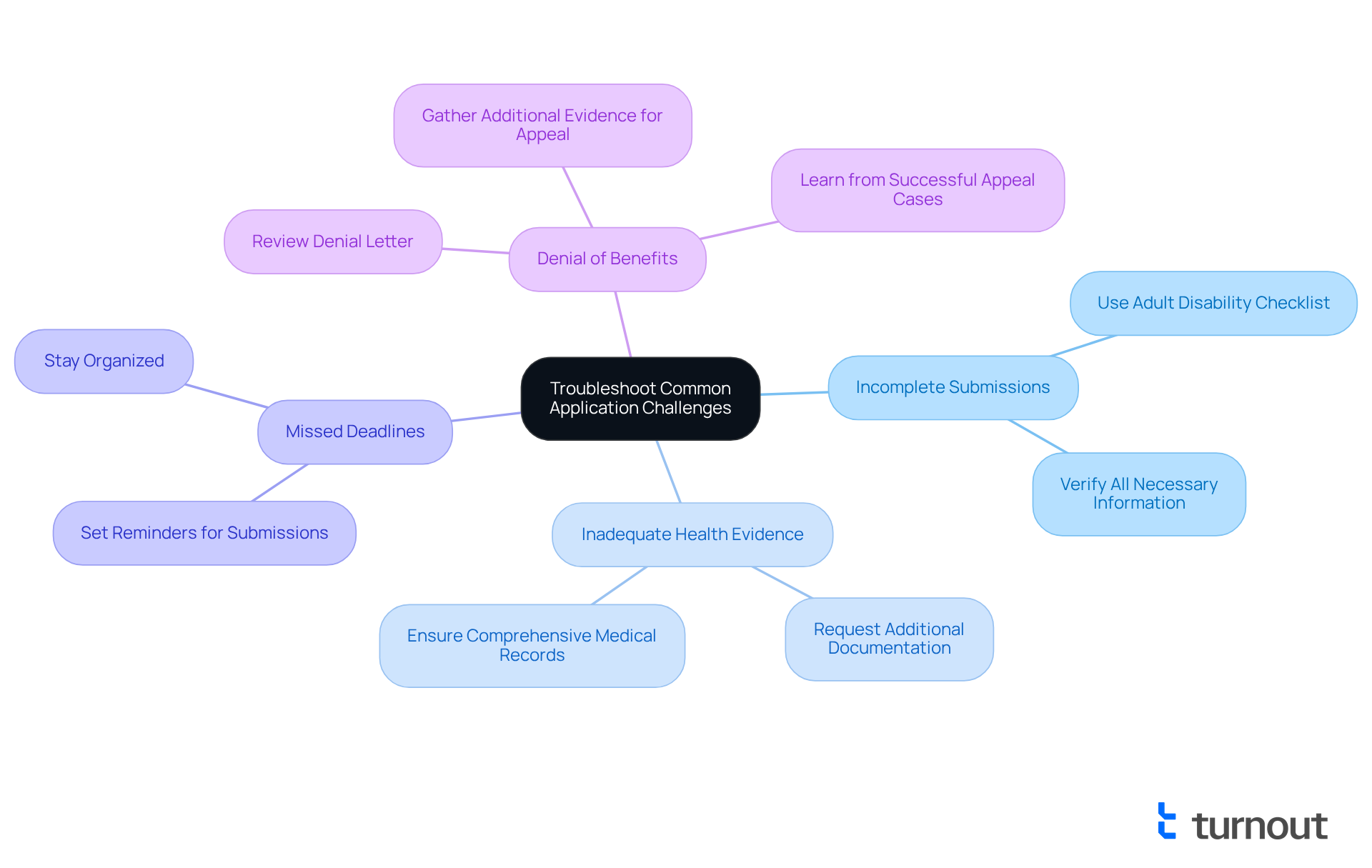

Troubleshoot Common Application Challenges

Navigating the process of applying for disability benefits can be daunting, and it's completely normal to face challenges along the way. Here are some supportive solutions to help you through:

-

Incomplete Submissions: We understand that filling out forms can feel overwhelming. To ensure your application is complete, take advantage of the Adult Disability Checklist provided by the SSA. This tool can help you verify that all necessary information is included. Remember, statistics show that about 30% of SSDI requests are denied due to incomplete information, highlighting the importance of thoroughness in the SSDI application process.

-

Inadequate Health Evidence: If your request has been rejected due to insufficient health evidence, don’t be discouraged. Reach out to your healthcare providers for additional documentation that clearly outlines your condition and limitations. Disability advocates remind us that comprehensive medical records can significantly enhance your chances of approval.

-

Missed Deadlines: It's easy to lose track of deadlines when you're managing so much. To stay on top of your submissions, consider setting reminders for yourself. Missing deadlines can lead to unnecessary delays or even denials, so keeping organized is key.

-

Denial of Benefits: If your SSDI application is denied, please don’t lose hope. You have every right to appeal the decision. Carefully review the denial letter to understand the reasons behind it, and gather additional evidence to support your case during the appeal process. Many applicants have successfully overturned initial denials by providing new information or clarifying existing evidence. For instance, a recent case study highlighted an applicant who secured benefits after appealing with additional medical documentation that was initially overlooked.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and support you every step of the way.

Conclusion

Navigating the Social Security Disability Insurance (SSDI) application process can feel overwhelming, but understanding the essential steps and requirements can truly lighten this journey. SSDI serves as a vital safety net for those unable to work due to qualifying disabilities, offering crucial financial support. By familiarizing yourself with the eligibility criteria, gathering necessary documentation, and following a structured application process, you can enhance your chances of securing the benefits you deserve.

We understand that this journey can be challenging. Key points to consider include:

- The importance of understanding work credits

- The definition of disability

- The need for comprehensive medical evidence

It's common to face challenges such as incomplete submissions or inadequate health documentation. However, there are practical solutions to these issues. By being proactive and organized, you can navigate the SSDI application process more effectively, leading to a smoother experience.

The significance of SSDI is immense, as it provides essential support for those facing financial uncertainty due to disabilities. For anyone considering applying for SSDI, approaching the process with diligence and confidence is crucial. Remember, you are not alone in this journey. Utilize the resources available, seek guidance when needed, and know that perseverance is key. Taking these steps not only facilitates a better application experience but also reinforces the importance of access to disability benefits for those in need.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program designed to provide financial support to individuals who cannot work due to a qualifying disability. It aims to replace a portion of lost earnings to help maintain financial stability.

What are the basic eligibility requirements for SSDI?

To qualify for SSDI, you generally need to have earned 40 work credits, with at least 20 of those credits accumulated in the last 10 years prior to the onset of your disability. Additionally, your health condition must prevent you from engaging in substantial gainful activity and is expected to last for at least 12 months or lead to death.

How is SSDI funded?

The SSDI program is financed through payroll taxes paid by workers.

What kind of medical evidence is needed to support an SSDI claim?

It is crucial to provide medical documentation that supports your claim and demonstrates how your condition aligns with the SSDI definition of disability.

How long does a disability need to last to qualify for SSDI?

Your disability must be expected to last for a minimum of 12 months or result in death to qualify for SSDI benefits.

What steps can I take if I feel overwhelmed by the SSDI application process?

Familiarizing yourself with the eligibility requirements and gathering necessary documentation early on can help streamline the application process. Seeking assistance from knowledgeable sources can also provide support throughout your journey.