Overview

This article offers a compassionate overview of Social Security Disability Insurance (SSDI), focusing on its purpose, eligibility requirements, application process, and how it differs from other disability programs. We understand that navigating these systems can be overwhelming, especially for those unable to work due to long-term disabilities. SSDI serves as a vital financial support system, helping to alleviate poverty and ensure financial stability for millions of Americans. By exploring the details of SSDI, we hope to provide you with the information you need to feel empowered in your journey.

Introduction

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for millions of Americans facing the challenges of long-term disabilities. We understand that this vital program not only provides financial support to those unable to work due to medical conditions but also extends its benefits to family members, ensuring a safety net during difficult times. However, it's common to feel overwhelmed by the eligibility requirements and application process. Many individuals may wonder:

- How can you effectively access these crucial benefits without falling victim to common pitfalls?

We're here to help you navigate this journey with confidence.

Define SSDI: Purpose and Function

The ssdi definition highlights that Social Security Disability Insurance is a national initiative providing crucial financial support to individuals unable to work due to a medical issue expected to last at least one year or lead to death. Funded by payroll taxes, this program assists employees who have contributed to the Social Security system and find themselves unable to support themselves due to significant disabilities. Not only does it offer monthly assistance to those who qualify, but it also extends support to certain family members based on the worker's earnings history. This safety net is vital for millions of Americans grappling with the challenges of long-term disabilities, ensuring they have access to necessary resources during difficult times.

The impact of the SSDI definition on the financial stability of disabled Americans is profound. For many, these benefits are a lifeline, covering essential expenses like housing, healthcare, and daily living costs. Research indicates that disability benefits play a crucial role in alleviating poverty among disabled individuals, with approximately 70% of recipients relying on these payments as their primary source of income.

Real-world examples highlight the significant effect that the ssdi definition has on families of disabled workers. Imagine a family facing financial strain when a primary earner becomes disabled. Disability support can alleviate some of this burden, allowing families to maintain their quality of life and access necessary medical care.

As a financial safety net, the program described by the ssdi definition provides monthly assistance that helps disabled individuals navigate the complexities of life without a stable income. Turnout offers tools and services to assist consumers in managing the disability claims process, ensuring individuals can obtain the support they need without the added challenges of legal representation. It's important to note that Turnout is not a law firm and is not affiliated with or endorsed by any law firm or government agency. The program is designed to be responsive to the needs of its beneficiaries, ensuring that those who qualify receive timely support. However, the Social Security Administration is currently facing significant staffing challenges, with plans to cut approximately 7,000 employees. This reduction raises concerns about processing times and service quality, potentially impacting recipients' access to assistance. Tragically, around 10,000 claimants have died while waiting for their benefits to be resolved in recent years, highlighting the urgency of this program.

Experts emphasize the importance of the ssdi definition within the broader framework of social safety nets. As one expert remarked, 'The SSDI definition shows that the Social Security Disability Insurance is not merely a program; it is an essential support system that allows those with disabilities to live with dignity and security.' This statement underscores the program's role in fostering financial stability and promoting the well-being of disabled Americans.

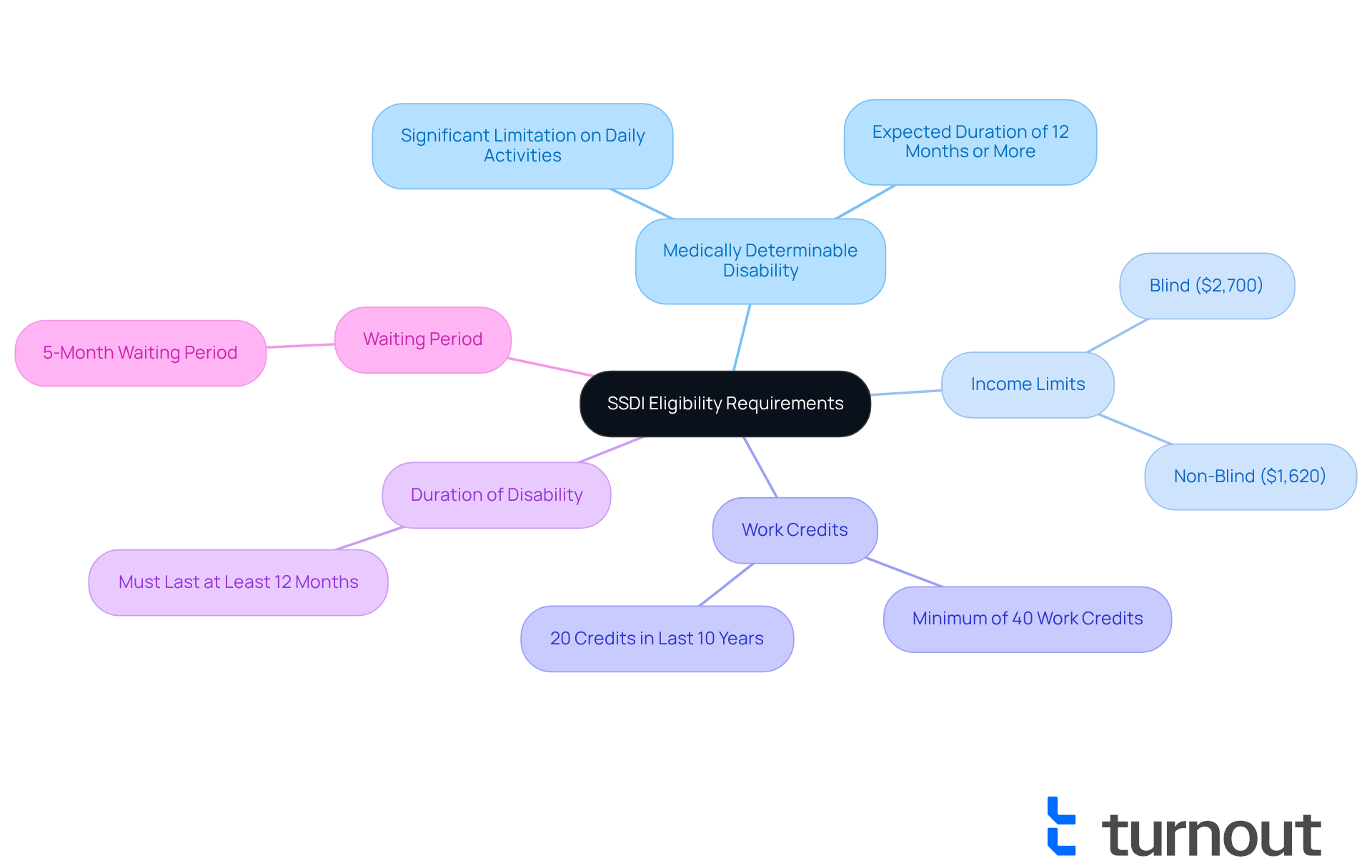

Eligibility Requirements for SSDI Benefits

To qualify for SSDI benefits, it’s essential to understand the SSDI definition and the specific criteria established by the Social Security Administration (SSA). A medically determinable disability must prevent you from engaging in substantial gainful activity (SGA). For 2025, this means earning over $1,620 per month if you are non-blind, or $2,700 if you are blind. Additionally, you typically need a minimum of 40 work credits, with 20 of those credits acquired in the last 10 years before your disability began. Importantly, your disability must be expected to last at least 12 months or lead to death. Understanding these requirements is crucial as you navigate the system effectively, particularly in relation to the SSDI definition.

Real-life examples can illustrate how individuals meet these criteria. For instance, someone diagnosed with chronic heart failure may qualify if their condition significantly limits their daily activities and prevents them from performing SGA. Similarly, if you have been unable to work due to severe disabilities for over a year, you may find yourself eligible for benefits.

Statistics reveal that a significant number of disability benefit seekers meet the work credit criteria, highlighting the importance of maintaining a steady employment record. According to SSA representatives, many individuals who initially face denials can successfully appeal their cases. This underscores the importance of perseverance and understanding the SSDI definition process. With this knowledge, you can navigate the complexities of the system and increase your chances of obtaining the benefits you deserve.

It’s also important to note that if you do not meet the legal definition of blindness, you may still qualify for assistance if your vision issues hinder your ability to work. Additionally, be aware that there is a 5-month waiting period before the first benefit is paid, which occurs in the 6th full month after your disability onset. Turnout is not a law firm and does not provide legal advice; instead, we utilize trained nonlawyer advocates to assist you in understanding and meeting these eligibility criteria without the need for legal representation. Remember, you are not alone in this journey, and we are here to help.

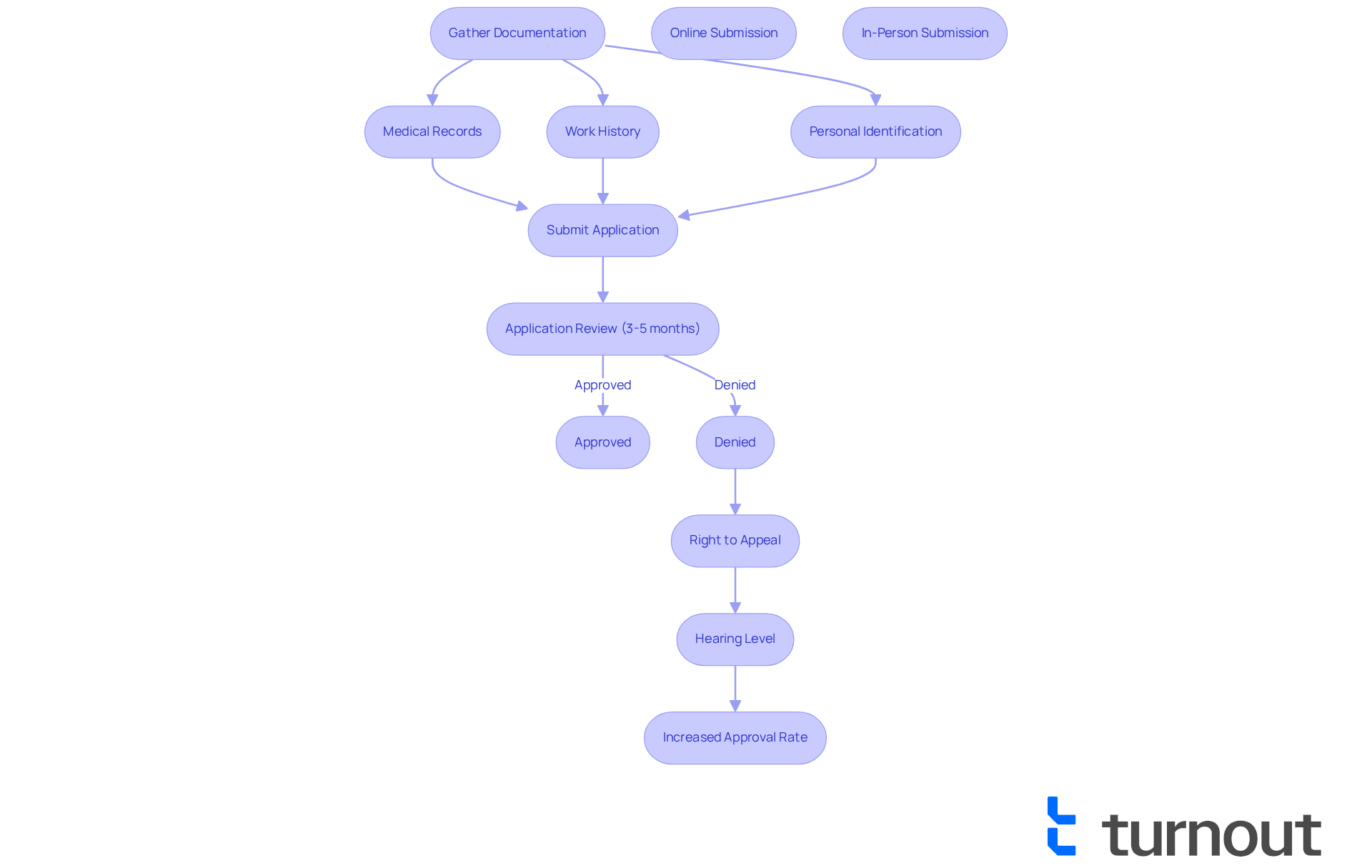

Navigating the SSDI Application Process

Navigating the disability benefits application process can feel overwhelming, and we understand that it requires careful attention to detail. To start this journey, gather essential documentation such as:

- Medical records

- Work history

- Personal identification

You can submit your application online or in person at a local Social Security office, as the option to apply by phone is no longer available. This change can be particularly challenging for individuals without internet access or those living in rural areas.

Once you've submitted your application, the Social Security Administration (SSA) typically reviews applications within three to five months to determine eligibility. However, it's important to note that denial rates remain high; approximately 84% of SSDI applications were rejected at the reconsideration stage in 2024. This stage can be especially difficult for those seeking approval. If your application is denied, remember that you have the right to appeal. This process involves additional steps and may require further documentation.

Statistics show that having experienced support during the appeal process can significantly improve your chances of success, particularly at the hearing level, where approval rates can rise to 51%. Turnout provides assistance through trained non-professional advocates who can help you navigate these complexities without requiring legal representation. Importantly, Turnout is not affiliated with any law firms or government agencies.

Additionally, individuals must now undergo a new identity verification process through the SSA, which is essential for obtaining assistance. Understanding each phase of this procedure is crucial for you to successfully maneuver through the system and obtain the support you need. Remember, you are not alone in this journey; we’re here to help you every step of the way.

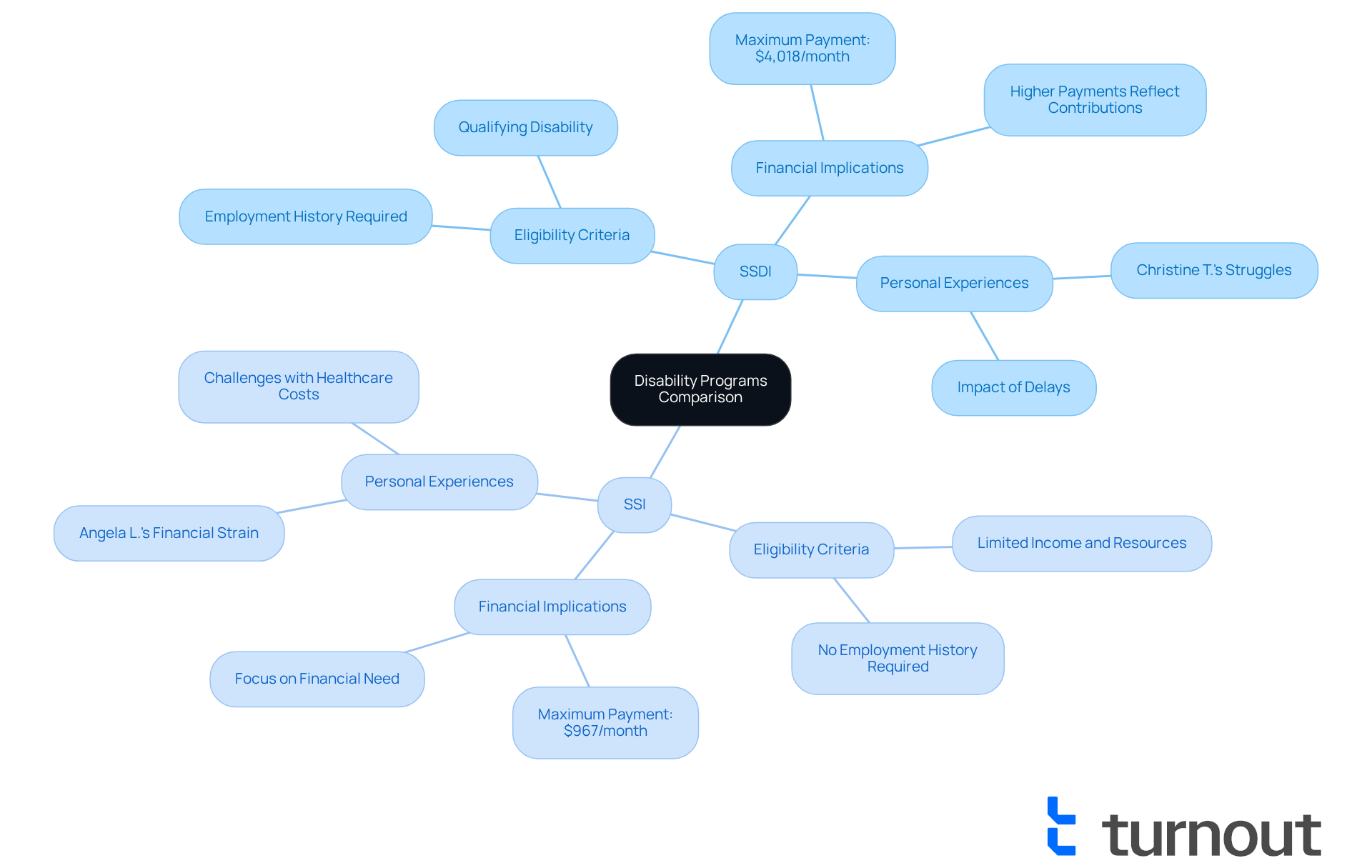

SSDI vs. Other Disability Programs: Key Differences

The ssdi definition indicates that Social Security Disability Insurance and SSI serve distinct purposes within the Social Security framework, catering to different populations. We understand that navigating these options can be challenging. Disability assistance relies on a person's employment history and contributions to the Social Security system, requiring applicants to demonstrate a qualifying disability along with an adequate work record. In contrast, SSI focuses on individuals with limited income and resources, regardless of their employment history, emphasizing financial need as the primary criterion for eligibility.

The financial implications of these programs are significant. Disability payments are typically greater than supplemental income disbursements, reflecting the contributions made by the worker during their career. For instance, in 2025, the highest payment from Social Security Disability Insurance will reach $4,018 per month, while the maximum SSI disbursement will be $967. This disparity highlights the importance of understanding which program aligns best with your circumstances.

Currently, over 11 million disabled Americans under 65 rely on support from the Social Security Administration. Many are managing the complexities of both Social Security Disability Insurance and Supplemental Security Income. Personal situations, such as health concerns and financial security, can influence the decision between these programs, as seen in the experiences of individuals like Christine T. and Angela L. Christine has faced challenges in managing her health care costs while seeking assistance through Social Security, underscoring the critical need for clarity in these processes.

Experts emphasize that understanding the SSDI definition and the differences between SSDI and SSI is crucial for maximizing benefits and avoiding complications. Turnout, which is not a law firm and does not provide legal representation, offers valuable support in navigating these processes. They utilize trained nonlawyer advocates to assist clients with SSD claims, ensuring that individuals receive the guidance they need without the complexities of legal representation. Turnout provides tools and services designed to help consumers effectively navigate these systems. As the Social Security Administration continues to adapt its policies, including recent changes to streamline the application process, beneficiaries must stay informed about their options to ensure they receive the support they need.

Moreover, the urgency of timely assistance is underscored by the fact that 30,000 people died while waiting for a decision on their disability claim in fiscal year 2023. We recognize how distressing this can be. Commissioner Martin O'Malley has expressed a commitment to reducing wait times for disability claims, reinforcing the importance of these programs in providing essential support. Remember, you are not alone in this journey—we're here to help.

Conclusion

Social Security Disability Insurance (SSDI) plays a critical role in providing financial assistance to individuals who are unable to work due to long-term disabilities. This program not only offers essential monthly benefits to eligible workers but also extends support to their families, ensuring that those affected by significant medical challenges have access to necessary resources. The SSDI definition encapsulates its importance as a vital safety net that helps millions of Americans maintain a semblance of financial stability during difficult times.

We understand that navigating the complexities of SSDI can be overwhelming. Throughout this article, we’ve discussed key insights into the SSDI eligibility requirements, the application process, and the distinctions between SSDI and Supplemental Security Income (SSI). Understanding the criteria for qualifying, including the necessity for a medically determinable disability and work credits, empowers individuals to effectively navigate the system. Additionally, the challenges faced by the Social Security Administration, such as staffing shortages and high denial rates, emphasize the urgency of timely assistance for those in need.

Ultimately, the significance of SSDI extends beyond mere financial support; it is a lifeline that fosters dignity and security for disabled individuals. As the landscape of disability assistance continues to evolve, staying informed about options and seeking guidance can make a crucial difference. Engaging with resources like Turnout can provide valuable support in navigating the SSDI process, ensuring that eligible individuals receive the assistance they deserve.

You are not alone in this journey. It is essential to advocate for timely and accessible support systems that uphold the well-being of disabled Americans, reminding us all of the importance of compassion and understanding within our communities.

Frequently Asked Questions

What is SSDI and what is its purpose?

SSDI, or Social Security Disability Insurance, is a national initiative that provides financial support to individuals unable to work due to a medical issue expected to last at least one year or lead to death. It assists employees who have contributed to the Social Security system and find themselves unable to support themselves due to significant disabilities.

How is SSDI funded?

SSDI is funded by payroll taxes collected from workers and their employers.

Who can receive SSDI benefits?

SSDI benefits are available to individuals who qualify due to significant disabilities, as well as certain family members based on the worker's earnings history.

What is the impact of SSDI on disabled Americans?

SSDI plays a crucial role in providing financial stability for disabled Americans, covering essential expenses such as housing, healthcare, and daily living costs. Approximately 70% of SSDI recipients rely on these payments as their primary source of income, helping to alleviate poverty among disabled individuals.

How does SSDI support families of disabled workers?

SSDI can alleviate financial strain on families when a primary earner becomes disabled, allowing them to maintain their quality of life and access necessary medical care.

What services does Turnout offer in relation to SSDI?

Turnout offers tools and services to assist consumers in managing the disability claims process, helping individuals obtain support without the added challenges of legal representation. However, it is not a law firm and is not affiliated with any law firm or government agency.

What challenges is the Social Security Administration facing?

The Social Security Administration is currently facing significant staffing challenges, with plans to cut approximately 7,000 employees, which may impact processing times and service quality for SSDI recipients.

Why is the SSDI program considered essential?

Experts highlight that SSDI is not merely a program but an essential support system that allows those with disabilities to live with dignity and security, fostering financial stability and promoting the well-being of disabled Americans.