Overview

Navigating tax obligations can feel overwhelming, especially for those who are unemployed. This article offers a comprehensive, step-by-step guide designed to support you through this process. It’s important to recognize that reporting unemployment benefits as taxable income is a necessity, and we’re here to help you understand how to do it effectively.

To make things easier, we’ll detail the required documentation and outline the filing process. It's common to face challenges along the way, but knowing what to expect can alleviate some of that stress. By adhering to IRS guidelines, you can ensure that you're well-informed and prepared for your tax filings.

Remember, you are not alone in this journey. We understand that tax season can bring a mix of emotions, and we’re here to guide you every step of the way. Take a deep breath and let’s tackle this together.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially for those facing unemployment. It's important to recognize that unemployment benefits are considered taxable income, which can lead to unexpected challenges when filing taxes. We understand that this can be a stressful time, and this guide is designed to provide you with a clear roadmap. Here, you'll find support in understanding your tax responsibilities, gathering necessary documentation, and following a straightforward process for filing.

What happens when confusion arises during this process? It's common to feel uncertain, but rest assured, we’re here to help you ensure compliance while maximizing your potential benefits. You're not alone in this journey; together, we can navigate these challenges.

Understand Your Tax Obligations as an Unemployed Individual

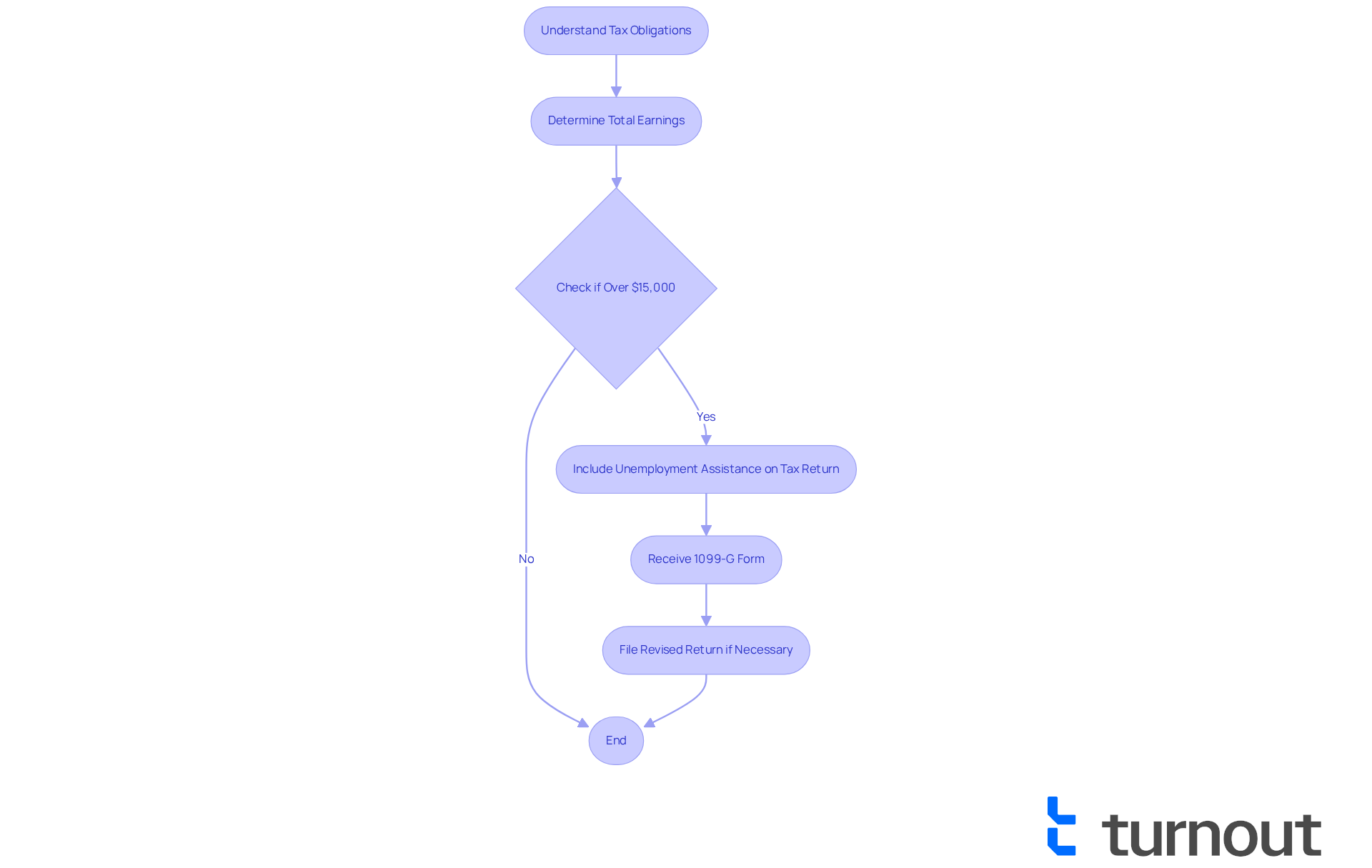

As someone who is unemployed and facing taxes, understanding your tax obligations is crucial for your peace of mind. We know that dealing with finances can be overwhelming, especially when it comes to taxes. If you are unemployed and taxes are a concern, you should know that unemployment assistance is considered taxable earnings, meaning you need to report this amount on your federal tax filing.

For the 2025 tax year, if your total earnings exceed the filing threshold of $15,000 for individual filers under 65, you are required to submit a tax return. This includes any additional income sources, such as freelance work or side jobs. It's common to feel uncertain about what this entails, so familiarizing yourself with the specific IRS requirements that apply to your situation is essential.

If you received unemployment benefits, you can expect to receive a 1099-G form detailing the amount you've received. This amount must be included in your taxable earnings. It's important to note that for those unemployed and taxes regarding unemployment benefits received in 2021, there is no tax break, making it vital to report these amounts accurately. If you filed your 2021 returns without including your unemployment compensation income, don’t worry—you can file a revised return.

Additionally, if you receive a 1099-G form without having applied for benefits, it may indicate identity theft. If this happens, please report it immediately. Remember, you are not alone in this journey, and we're here to help you navigate these challenges. To stay informed about filing requirements and guidelines, regularly check the IRS website for the latest information. Your financial well-being is important, and taking these steps can help you feel more secure.

Gather Necessary Documentation for Tax Filing

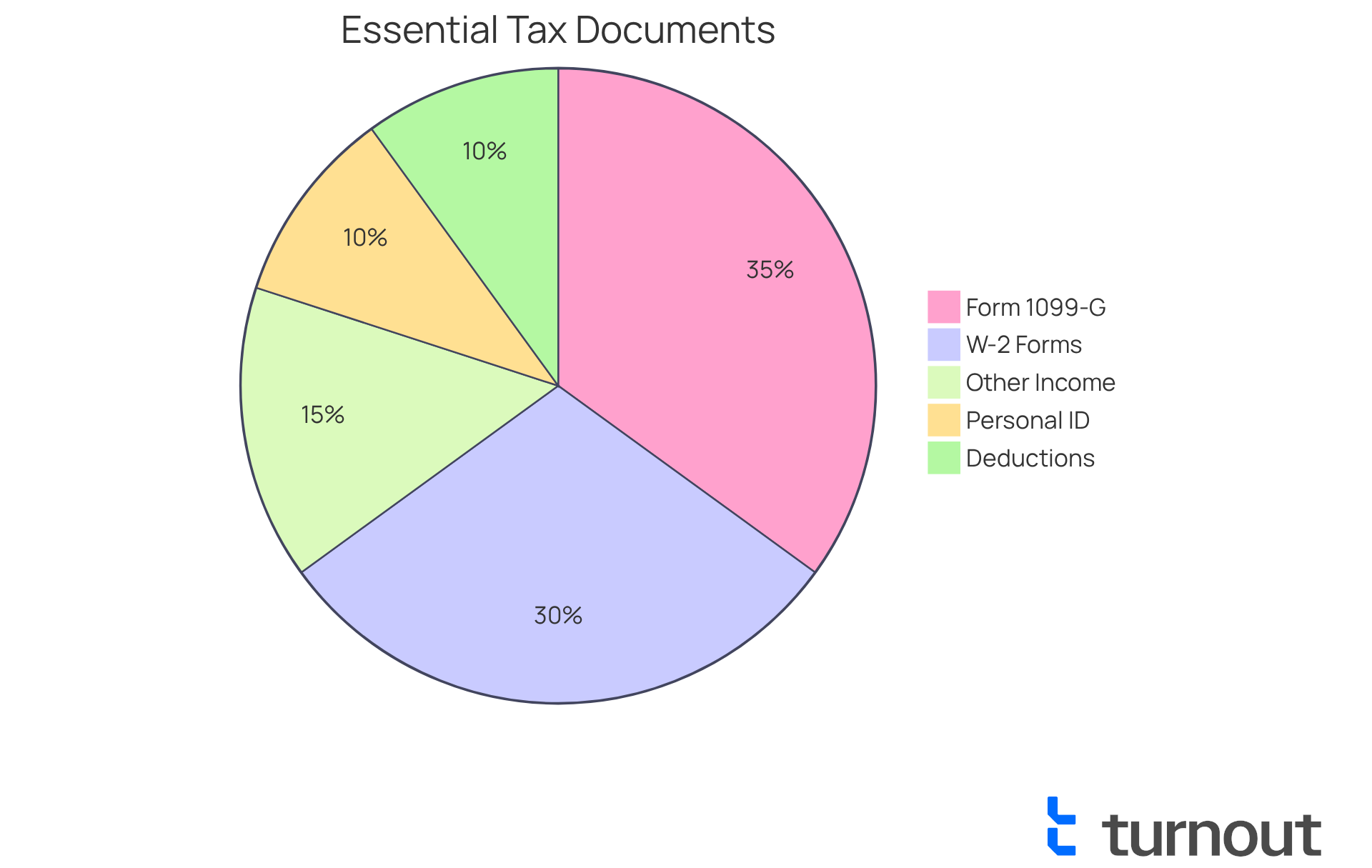

Filing your taxes accurately can feel overwhelming, but gathering all necessary documentation is a crucial first step. Let’s take a look at some key documents you’ll need:

- Form 1099-G: This important form reports the total amount of unemployment benefits you received throughout the year. For 2025, if you claimed unemployment insurance benefits in 2024, rest assured that your 1099-G forms will be sent automatically by the end of January. You can also access your 1099-G tax forms on the NYSDOL website by mid-January 2025. It’s essential to have this form from your state’s unemployment office, as it plays a vital role in reporting your earnings accurately.

- W-2 Forms: If you had any employment during the year, be sure to collect your W-2 forms from your employers to report your earnings properly.

- Other Income Statements: If you earned income from freelance work or side jobs, gather any 1099 forms or records of income to ensure all sources are accounted for.

- Personal Identification: Have your Social Security number and a government-issued ID ready to confirm your identity during the application process.

- Deductions and Credits: Collect receipts or documentation for any deductions or credits you plan to claim, such as job search expenses or educational costs.

By organizing these documents ahead of time, you’ll find that the filing process becomes much smoother. It can help you navigate the complexities of tax filing with greater ease. Remember, having all required documents organized can prevent delays and potential issues with your tax filing.

If you suspect any discrepancies in your Form 1099-G due to unemployment fraud, it’s important to report it to the relevant state agency and correct any taxes associated with being unemployed. You are not alone in this journey; we’re here to help you every step of the way.

Follow the Step-by-Step Process to File Your Taxes

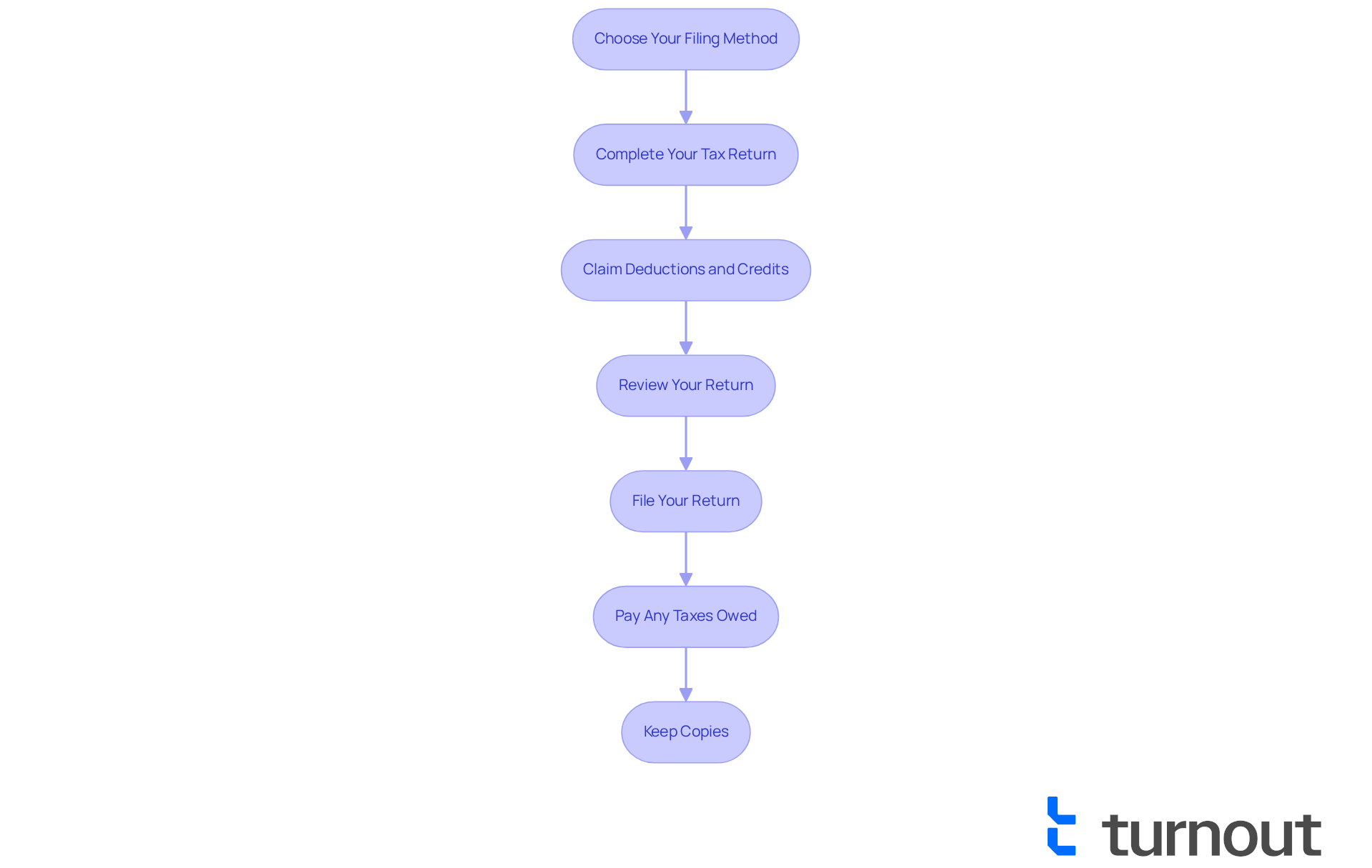

Filing your taxes can feel overwhelming, especially when considering the implications of being unemployed and taxes. But don't worry; we're here to help you navigate this process with confidence and ease. Just follow these simple steps:

-

Choose Your Filing Method: Start by deciding how you want to file. You can choose to do it online using tax software, through a tax preparation service, or by mailing a paper submission. Online filing is often the quickest and most efficient option, with the IRS typically processing electronic submissions within 21 days.

-

Complete Your Tax Return: Gather your documentation and begin filling out your tax return. If you're using tax software, it will guide you through each step. Remember to declare your unemployment benefits as earnings on Schedule 1 of Form 1040.

-

Claim Deductions and Credits: If you qualify, don't forget to claim deductions for job search expenses or other applicable credits. This can significantly reduce your taxable income, so it’s essential to explore all your options.

-

Review Your Return: Take a moment to carefully double-check all your entries. Ensure that every income source and deduction is reported accurately. This step is crucial to prevent any delays or complications with your refund.

-

File Your Return: Once everything looks good, submit your tax return electronically or send it to the appropriate IRS address. If you file electronically, you'll receive confirmation of receipt, which can provide peace of mind.

-

Pay Any Taxes Owed: If you find that you owe taxes, make sure to submit your payment by the deadline to avoid any penalties. You can pay online, by mail, or set up a payment plan if necessary.

-

Keep Copies: Finally, remember to keep copies of your submitted forms and all supporting documents. This is important for your records and in case the IRS has any questions.

In 2025, the IRS processed 138,057,000 returns, reflecting a 1.5% increase from the previous year. This highlights the effectiveness of online submission methods. By following these best practices, you can approach your tax submission with assurance, knowing that you're taking the right steps.

Troubleshoot Common Tax Filing Issues for the Unemployed

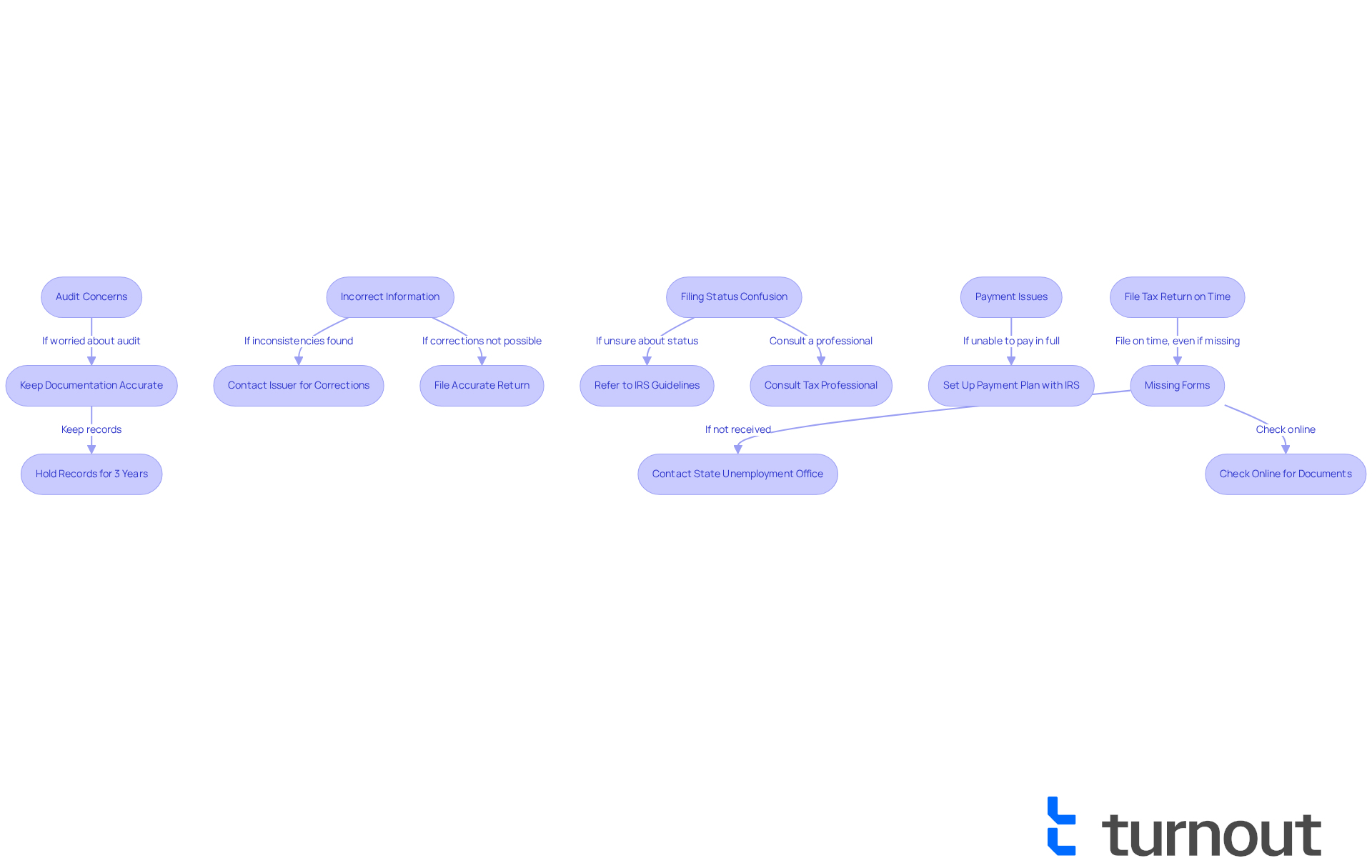

Navigating the tax filing process can be challenging, and we understand that you may encounter some common issues. Here’s how to troubleshoot them with care:

-

Missing Forms: If you haven’t received your Form 1099-G, it’s important to reach out to your state’s unemployment office to request a copy. Many states offer electronic access to tax documents online, so checking there can be helpful too. Remember, most taxpayers should have their tax documents by January 31, so acting promptly is key.

-

Incorrect Information: If you notice any inconsistencies in your forms, such as incorrect amounts or missing earnings, don’t hesitate to contact the issuer for corrections before you submit. If obtaining a timely corrected Form 1099-G isn’t possible, ensure that you file an accurate tax return that reflects only the income you actually received.

-

Filing Status Confusion: If you’re unsure about your filing status—whether single, married, or something else—consider referring to IRS guidelines or consulting with a tax professional. It’s completely normal to seek clarity in this area.

-

Payment Issues: If paying the full amount owed feels overwhelming, remember that you can set up a payment plan with the IRS. They offer various options for individuals who find themselves unable to pay their taxes in full.

-

Audit Concerns: If the thought of being audited worries you, it’s important to keep your documentation accurate and complete. Holding onto records for at least three years can provide peace of mind in case of an audit.

As a gentle reminder, it’s crucial for taxpayers to file their tax returns on time, even if some documents are still missing or incorrect. By staying proactive and informed, you can effectively navigate these common challenges. Remember, you are not alone in this journey—we're here to help.

Conclusion

Understanding tax obligations while unemployed can feel overwhelming, but it is crucial for your financial well-being. This article serves as a caring guide to help you navigate the complexities of tax filing in 2025 if you find yourself without a job. By recognizing the importance of reporting unemployment benefits and gathering necessary documentation, you can approach your tax responsibilities with clarity and confidence.

It’s essential to know that if your total earnings exceed the filing threshold, you must file a tax return. Collecting forms like the 1099-G and W-2 is also vital. The step-by-step process outlined here simplifies the filing experience, ensuring that you can claim all necessary deductions and credits while keeping accurate records. If you encounter common issues, the troubleshooting section reassures you that help is available.

Being proactive and informed about your tax obligations can significantly reduce the stress associated with unemployment and taxes. By understanding and fulfilling these responsibilities, you can regain a sense of control over your financial situation. Embracing this knowledge empowers you to file your taxes correctly and underscores the importance of seeking help when needed. Remember, you are not alone in this journey, and taking these steps fosters a more secure financial future.

Frequently Asked Questions

What are my tax obligations as an unemployed individual?

As an unemployed individual, you must report any unemployment assistance received as taxable earnings on your federal tax filing.

What is the filing threshold for the 2025 tax year?

For the 2025 tax year, the filing threshold is $15,000 for individual filers under 65. If your total earnings exceed this amount, you are required to submit a tax return.

What should I do if I received unemployment benefits?

If you received unemployment benefits, you will receive a 1099-G form detailing the amount received, which must be included in your taxable earnings.

Are there any tax breaks for unemployment benefits received in 2021?

No, there is no tax break for unemployment benefits received in 2021, so it is essential to report these amounts accurately.

What if I filed my 2021 tax return without including my unemployment compensation income?

If you filed your 2021 return without including your unemployment compensation income, you can file a revised return to correct this.

What should I do if I receive a 1099-G form without having applied for benefits?

If you receive a 1099-G form without having applied for benefits, it may indicate identity theft. You should report this immediately.

Where can I find the latest information on tax filing requirements?

To stay informed about filing requirements and guidelines, regularly check the IRS website for the latest information.