Overview

Navigating the benefits offered by the Pennsylvania Social Security Administration can be challenging. Many individuals face difficulties in understanding the various programs available, such as Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). We understand that the process can feel overwhelming, but knowing the eligibility requirements and gathering the necessary documentation is crucial.

It's common to feel uncertain about how to effectively complete the application process. By taking it step by step, you can secure the financial support you need. Real-life examples and statistics illustrate the challenges many face, but they also highlight the solutions that can lead to success.

Remember, you are not alone in this journey. We’re here to help you navigate the complexities of these programs and provide the support you deserve.

Introduction

Navigating the complex landscape of benefits provided by the Pennsylvania Social Security Administration can feel overwhelming for many individuals with disabilities. We understand that programs like Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) offer crucial financial support, and grasping the nuances of eligibility and documentation is essential for securing the assistance you need.

It's common to feel discouraged, especially given the staggering percentage of initial applications that face rejection. So, how can you ensure your journey towards obtaining these vital benefits is successful? This guide aims to demystify the application process, empowering you to confidently access the resources available to you.

You're not alone in this journey, and we're here to help.

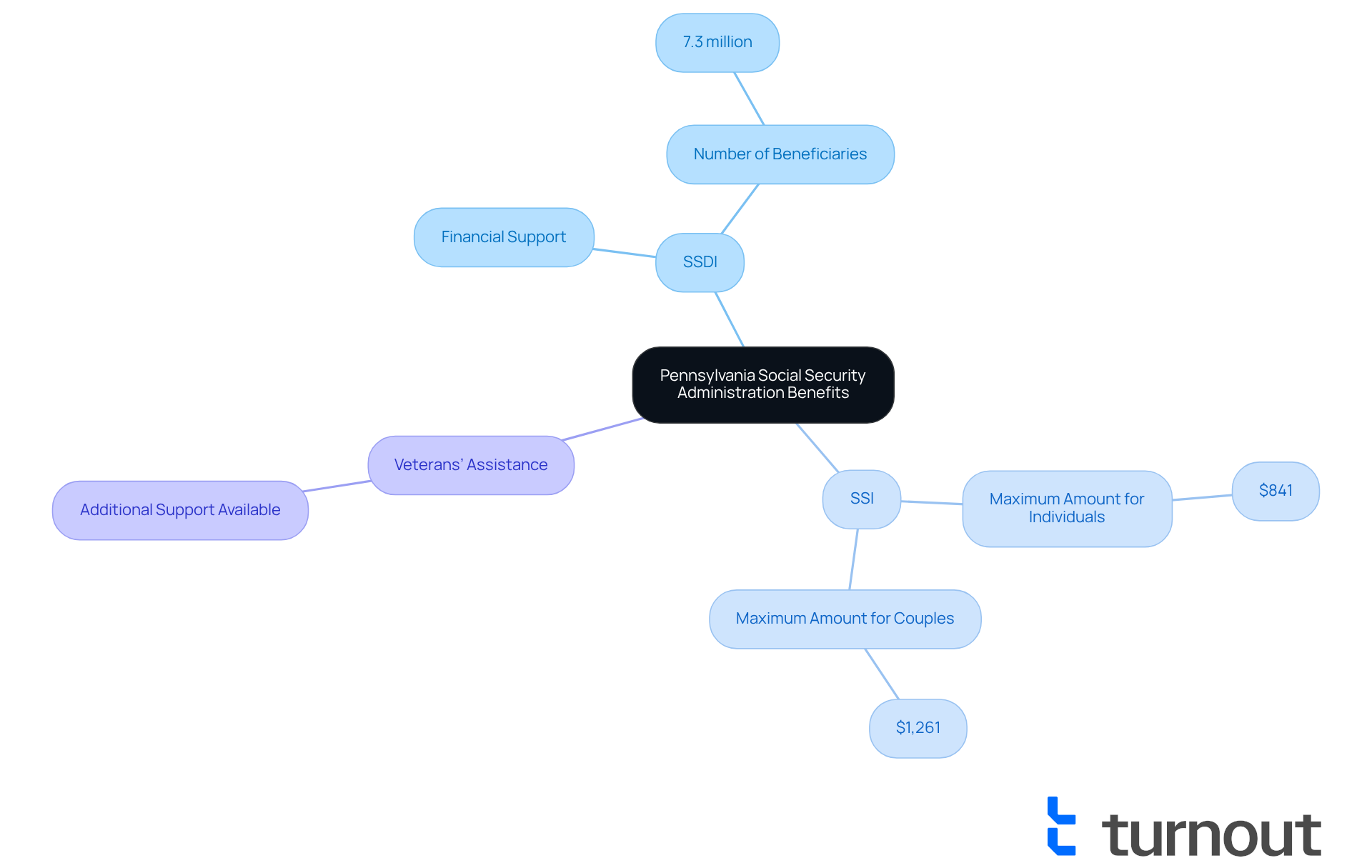

Understand Available Benefits from the Pennsylvania Social Security Administration

The Pennsylvania Social Security Administration provides several key benefits for individuals with disabilities, and we recognize that navigating these options can be overwhelming.

-

Social Insurance Disability Insurance (SSDI): This program provides essential financial support to individuals who have worked and contributed to Social Insurance taxes but can no longer work due to a disability. As of 2025, approximately 7.3 million individuals nationwide receive SSDI assistance. This highlights its critical role in supporting those unable to work due to severe medical impairments.

-

Supplemental Security Income (SSI): Designed for individuals with limited income and resources, SSI offers financial support regardless of work history. According to the Pennsylvania Social Security Administration, the maximum SSI amount for individuals living independently in Pennsylvania is $841 monthly, while couples can receive up to $1,261. This program is vital for low-income individuals with disabilities, ensuring they have the means to meet basic living expenses.

-

Veterans’ Assistance: For veterans who are disabled, additional support is available through the VA, which may complement SSDI or SSI. These advantages are essential for aiding the well-being of veterans encountering disabilities.

Understanding these advantages is the first step in successfully maneuvering through the application process. Many individuals have accessed SSI to alleviate financial strain caused by disabilities, demonstrating the program's positive impact on improving quality of life.

In summary, the Pennsylvania Social Security Administration provides vital financial support through its SSDI and SSI programs to those in need. SSDI focuses on individuals with a work history, while SSI caters to those with limited resources. As the landscape of disability assistance evolves, staying informed about these programs is crucial for maximizing the support available to you. Remember, you are not alone in this journey—we're here to help.

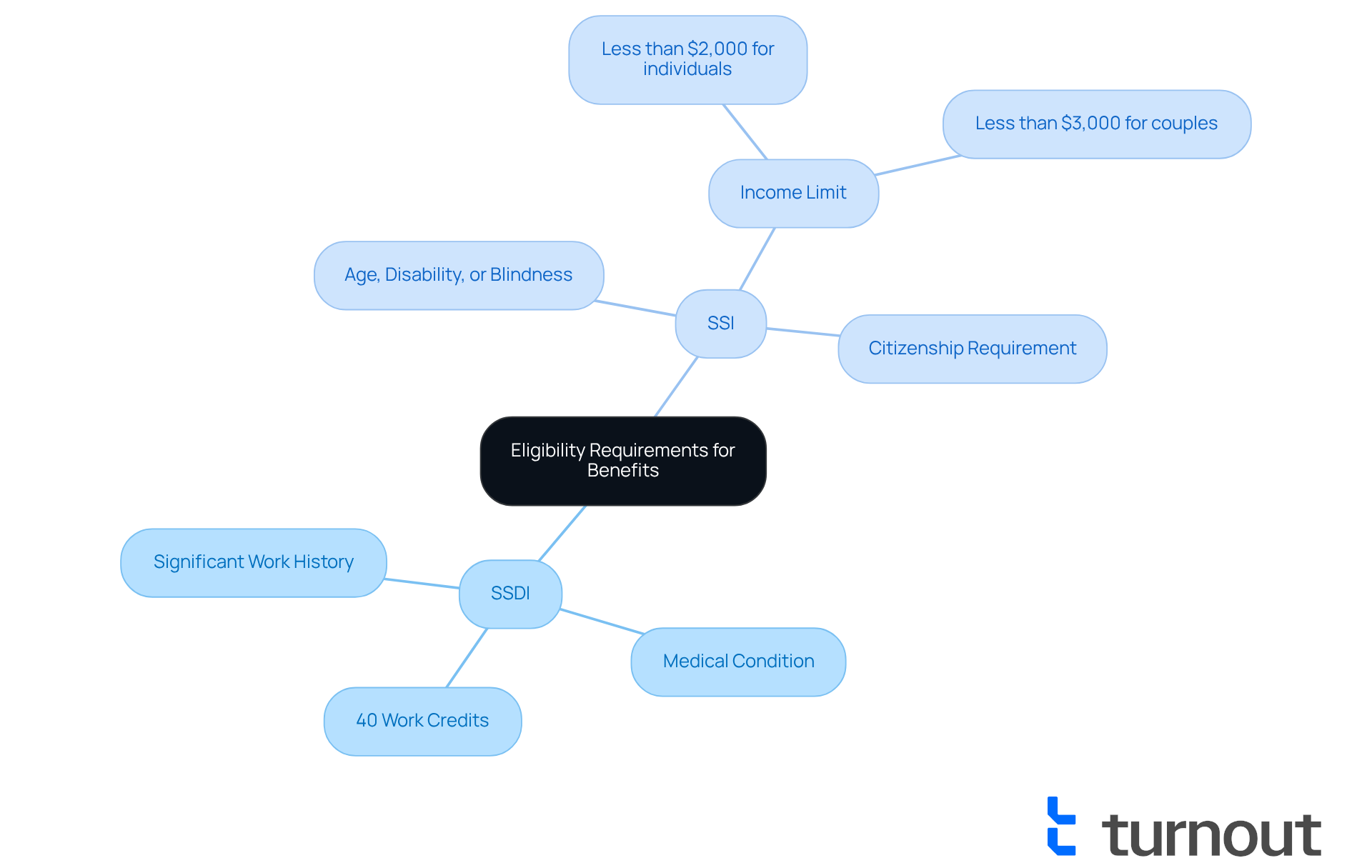

Determine Eligibility Requirements for Benefits

Navigating the benefits from the Pennsylvania Social Security Administration can feel overwhelming, but comprehending the eligibility criteria is the first step towards obtaining the support you need.

For SSDI:

- A significant work history is essential, including Social Security taxes paid.

- Your medical condition must align with the SSA's definition of disability.

- Typically, you will need 40 work credits, with at least 20 earned in the last 10 years.

For SSI:

- You must be aged 65 or older, blind, or disabled.

- It’s important to have limited income and resources—specifically, less than $2,000 for individuals and $3,000 for couples.

- U.S. citizenship or meeting certain non-citizen criteria is necessary.

In 2025, the average SSDI payment for individuals is about $1,580, though many recipients earn less. We understand that comprehending these requirements can be daunting, especially considering that approximately 65% of initial disability requests submitted to the Pennsylvania Social Security Administration are rejected, often due to insufficient medical evidence or unmet work history criteria.

Real-life examples show that individuals who have consistently worked and meet the medical criteria can successfully navigate the application process, significantly enhancing their chances of approval. Remember, you are not alone in this journey. Turnout is here to help, providing invaluable assistance in navigating these complex processes. Our trained nonlawyer advocates support clients with SSD claims and tax debt relief, ensuring you understand the eligibility criteria and necessary documentation.

Additionally, if you qualify for SSI, you will automatically receive Medical Assistance (MA), which provides immediate healthcare coverage. We're here to help you take the next steps toward securing the benefits you deserve.

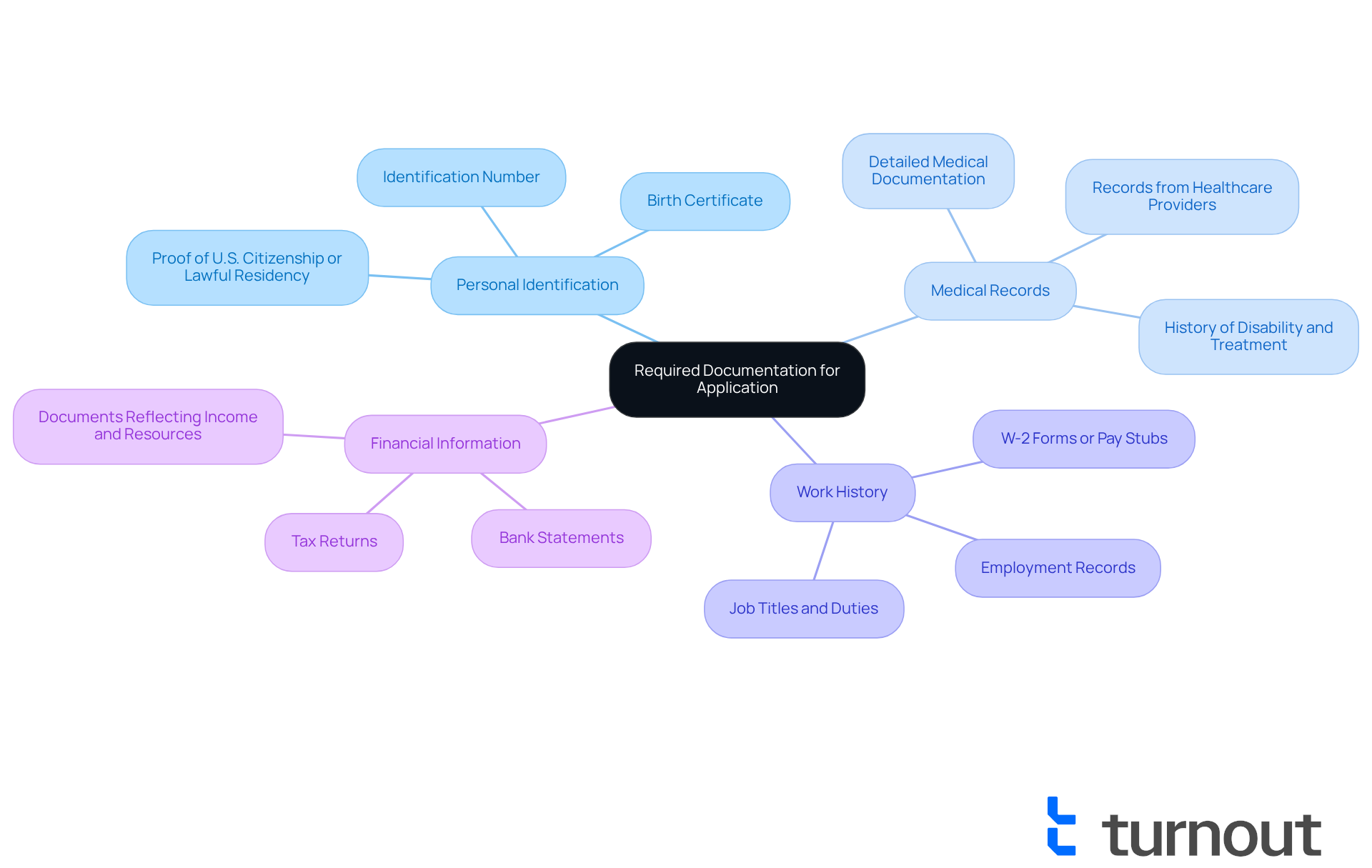

Gather Required Documentation for Your Application

Before applying for benefits, we understand how important it is to gather the necessary documentation. Here are the key items you should prepare:

- Personal Identification: Make sure to include your identification number, birth certificate, and proof of U.S. citizenship or lawful residency. These documents are essential for verifying your identity and eligibility.

- Medical Records: It’s vital to compile detailed medical documentation from your healthcare providers that outlines your disability and treatment history. Incomplete medical records are a common cause of application errors with the Pennsylvania Social Security Administration, which can delay your assistance.

- Work History: Keep a record of your employment, including W-2 forms or pay stubs, to demonstrate your work credits for SSDI. Accurate work history documentation is critical, as SSDI eligibility requires a significant work history and payment of Social Security taxes.

- Financial Information: Gather your bank statements, tax returns, and any other documents that reflect your income and resources for SSI eligibility. This financial documentation is necessary to prove that you meet the strict income and resource limits set by the Pennsylvania Social Security Administration.

At Turnout, we’re here to simplify your access to these essential advantages. Please remember that Turnout is not a law firm and does not provide legal advice. Organizing these documents ahead of time will lead to a smoother application process. Engaging with your healthcare providers early on to request comprehensive medical records can alleviate stress and improve your chances of a successful claim. Remember, having all essential documentation prepared not only speeds up the process but also enhances your chances of obtaining the assistance you require. You are not alone in this journey, and we’re here to help.

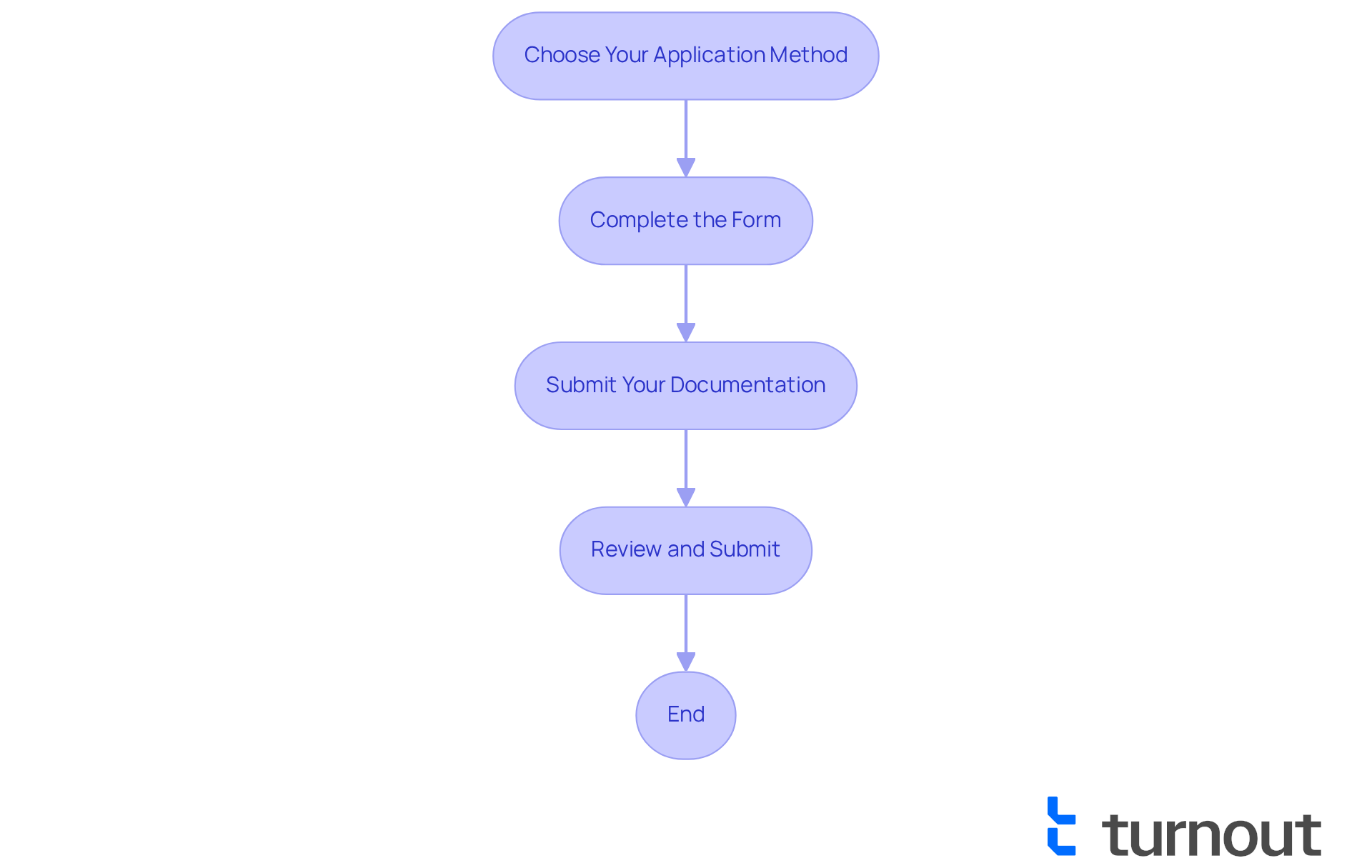

Complete the Application Process Effectively

Applying for benefits can feel overwhelming, but we're here to help guide you through the process. Follow these steps to ensure a smoother experience:

-

Choose Your Application Method: You have options when it comes to applying. Whether you prefer the convenience of applying online through the SSA website, calling 1-800-772-1213, or visiting your local Social Security office in person, know that you’re not alone. It's worth noting that over 40% of retirees favor mobile programs, highlighting the accessibility of this choice.

-

Complete the Form: Take your time to accurately fill out the form. It's important to provide all necessary details about your disability, employment background, and financial status. Recent changes in the submission process mean that attention to detail is crucial; even small errors can lead to frustrating delays.

-

Submit Your Documentation: Be sure to attach all required documents with your submission. If you’re applying online, you may need to upload digital copies. Advocates consistently stress the importance of including every necessary document to avoid processing setbacks, so double-check your paperwork.

-

Review and Submit: Before you send your application, take a moment to double-check your form for accuracy and completeness. We understand that the average processing time for SSDI requests can stretch to several months at the Pennsylvania Social Security Administration. Ensuring your submission is correct from the start can significantly reduce your wait time.

By following these steps, you can feel more confident that your request will be handled effectively. Remember, navigating the complexities of government assistance can be challenging, but you are not alone in this journey.

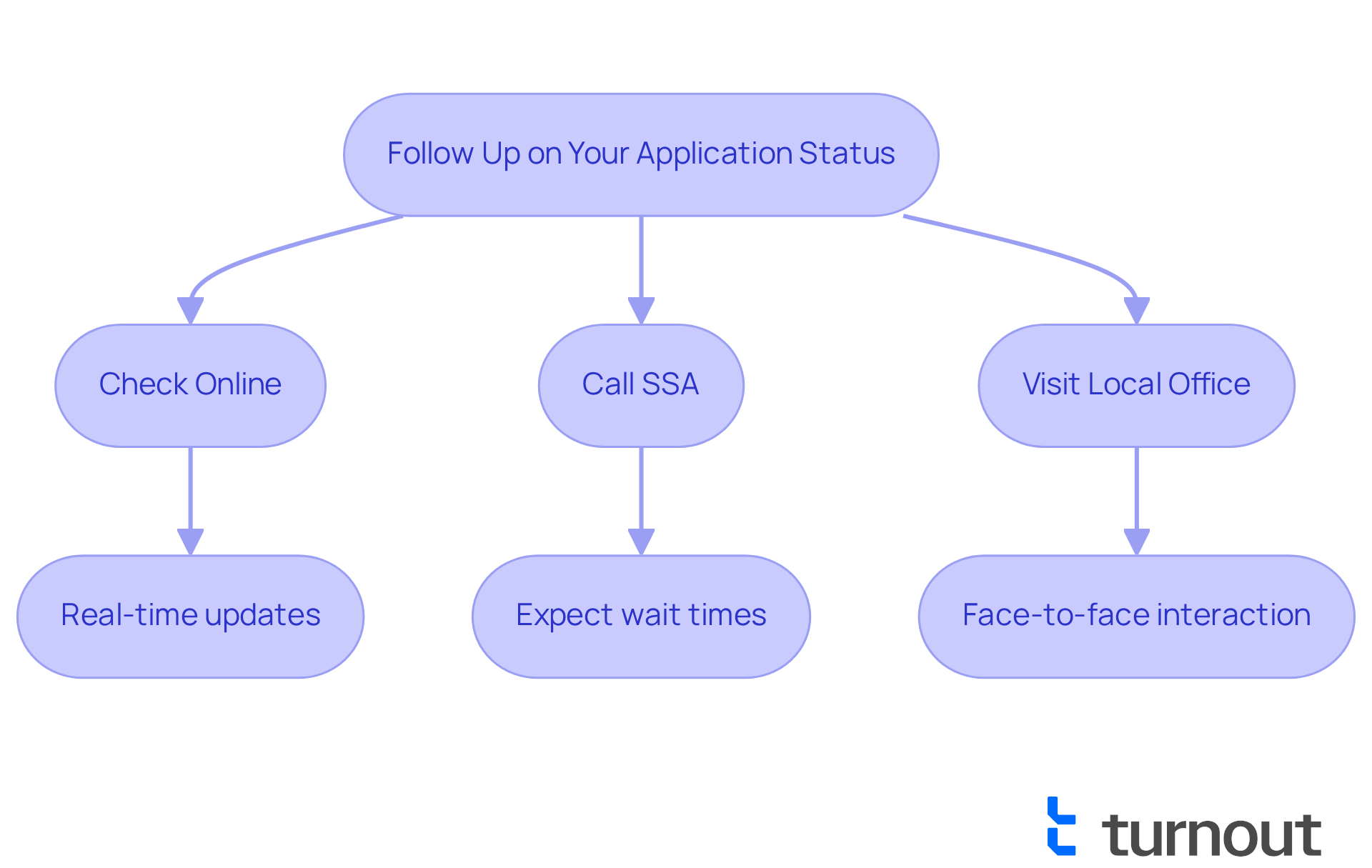

Follow Up on Your Application Status

After submitting your application, following up is crucial to ensure a smooth process. We understand that waiting can be stressful, and we’re here to help you navigate this journey.

-

Check Online: Use your account to track the status of your request. This platform provides real-time updates and is a convenient way to stay informed.

-

Call the Pennsylvania Social Security Administration: If you prefer direct communication, you can call the Pennsylvania Social Security Administration at 1-800-772-1213. It's common to experience wait times, as many callers report significant delays. Be prepared for this, and know that your patience is appreciated.

-

Visit your local Pennsylvania Social Security Administration office: For those who prefer face-to-face interaction, visiting your local Pennsylvania Social Security Administration office can provide you with updates and allow you to address any concerns directly.

Regularly checking your application status is essential. Statistics indicate that nearly half of applicants who follow up on their status are more likely to resolve issues promptly. Given the current average wait time of 225 days for decisions, staying proactive can make a significant difference in your experience.

Additionally, it is important to note that Turnout is not a law firm and does not provide legal advice. However, Turnout offers support through trained nonlawyer advocates who can assist you in navigating the SSD claims process. You are not alone in this journey; we are here to ensure you have the guidance needed during this critical time. After following up, consider discussing your situation with a Turnout advocate to explore further assistance.

Conclusion

Navigating the benefits offered by the Pennsylvania Social Security Administration is essential for individuals seeking financial support due to disabilities. We understand that this journey can be overwhelming, and having a clear understanding of various programs, such as Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), is crucial for making informed decisions about the assistance available to you. This guide has outlined the key benefits, eligibility requirements, documentation needed, and the application process, empowering you to access the help you need.

The article provided insights into the specific eligibility criteria for SSDI and SSI, emphasizing the importance of having a solid work history for SSDI and meeting income limits for SSI. It's common to feel uncertain about what documentation is necessary, but gathering the appropriate materials and following a structured application process can significantly enhance your chances of approval. Remember, staying proactive by regularly following up on your application status can lead to quicker resolutions, which is vital in this process.

In conclusion, while navigating the Pennsylvania Social Security Administration benefits can seem daunting, knowledge and preparation can significantly ease your journey. It is vital for you to take the necessary steps to understand your options, gather the required documentation, and remain engaged throughout the application process. By doing so, you can secure the financial support you deserve and improve your quality of life. Remember, assistance is available, and reaching out for help can make all the difference in this critical pursuit. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What benefits does the Pennsylvania Social Security Administration provide for individuals with disabilities?

The Pennsylvania Social Security Administration offers two main benefits: Social Security Disability Insurance (SSDI) for individuals with a work history who can no longer work due to a disability, and Supplemental Security Income (SSI) for those with limited income and resources, regardless of work history.

What is Social Security Disability Insurance (SSDI)?

SSDI provides financial support to individuals who have worked and contributed to Social Insurance taxes but can no longer work due to a disability. As of 2025, approximately 7.3 million individuals nationwide receive SSDI assistance.

What is Supplemental Security Income (SSI)?

SSI is designed for individuals with limited income and resources, offering financial support regardless of work history. In Pennsylvania, the maximum SSI amount for individuals living independently is $841 monthly, and couples can receive up to $1,261.

Are there additional benefits for veterans with disabilities?

Yes, veterans who are disabled may receive additional support through the VA, which can complement SSDI or SSI benefits.

What are the eligibility requirements for SSDI?

To qualify for SSDI, you must have a significant work history with Social Security taxes paid, meet the SSA's definition of disability, and typically need 40 work credits, with at least 20 earned in the last 10 years.

What are the eligibility requirements for SSI?

To qualify for SSI, you must be aged 65 or older, blind, or disabled, have limited income and resources (less than $2,000 for individuals and $3,000 for couples), and be a U.S. citizen or meet certain non-citizen criteria.

What is the average SSDI payment for individuals?

In 2025, the average SSDI payment for individuals is about $1,580, although many recipients earn less.

What challenges do applicants face when applying for benefits?

Approximately 65% of initial disability requests submitted to the Pennsylvania Social Security Administration are rejected, often due to insufficient medical evidence or unmet work history criteria.

How can individuals get assistance with the application process?

Trained nonlawyer advocates can provide support with SSD claims and navigating the eligibility criteria and necessary documentation, ensuring individuals understand the process.

What additional benefit do SSI recipients receive?

Individuals who qualify for SSI will automatically receive Medical Assistance (MA), which provides immediate healthcare coverage.