Overview

This article is dedicated to you, the taxpayer, and the various IRS payment plan options that can help you manage your tax obligations effectively. We understand that navigating tax responsibilities can be overwhelming, and we want to provide you with the support you need.

You'll find different plans available, such as:

- Short-Term Payment Plans

- Long-Term Installment Agreements

- The new Simple Financial Arrangement

Each option is designed to cater to your unique financial circumstances. It’s important to choose a plan that aligns with your ability to pay and your future financial goals.

We believe that understanding these options is crucial for your peace of mind. Remember, you're not alone in this journey, and we're here to help guide you through the process of selecting the right plan for your needs.

Introduction

Navigating the complexities of tax obligations can often feel overwhelming. We understand that many individuals face this daunting task. Thankfully, the IRS offers a variety of payment plan options, allowing taxpayers to regain control over their financial situations. But with so many choices available, how do you find the best fit for your unique circumstances?

This article explores the diverse IRS payment plans available to you. We aim to provide essential insights that will help you make informed decisions. After all, managing your tax responsibilities doesn't have to add to your stress. Remember, you're not alone in this journey; we're here to help.

Overview of IRS Payment Plan Options

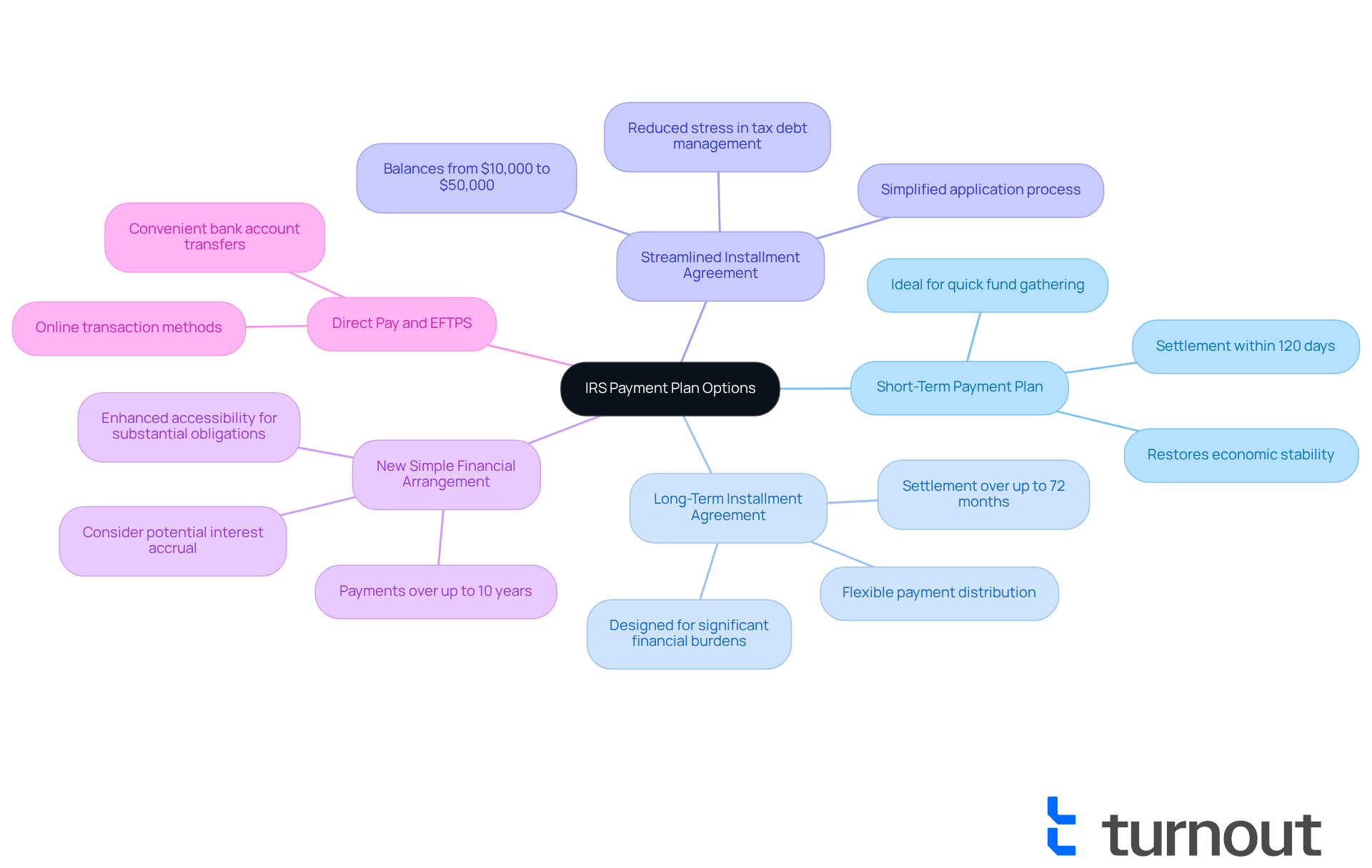

The IRS provides various IRS payment plan options to assist taxpayers in efficiently managing their tax obligations. We understand that managing taxes can be overwhelming, and we're here to help. These options include:

-

Short-Term Payment Plan: This option enables taxpayers to settle their tax obligation in full within 120 days. It’s ideal for those who can quickly gather the necessary funds. Many individuals who choose short-term payment arrangements find that they can resolve their financial obligations rapidly, allowing them to restore their economic stability.

-

Long-Term Installment Agreement: This plan allows taxpayers to settle their obligations over an extended timeframe, typically up to 72 months. It’s designed for individuals facing significant financial burdens. With IRS payment plan options, tax obligations can be distributed over a manageable period, providing flexibility for those in need.

-

Streamlined Installment Agreement: For balances ranging from $10,000 to $50,000, this option simplifies the application process by eliminating the need for extensive financial documentation. This can significantly reduce the stress associated with tax debt management.

-

New Simple Financial Arrangement: Launched in 2025, this arrangement allows costs to be distributed over up to 10 years, enhancing accessibility for individuals with substantial tax obligations. While this option provides extended time for repayment, it’s essential to consider the potential interest that may accrue over such a long period.

-

Direct Pay and EFTPS: These online transaction methods enable taxpayers to make transfers directly from their bank accounts, offering a convenient way to manage their obligations.

By 2025, about 4 million taxpayers are using IRS payment plan options, demonstrating their effectiveness in offering assistance to individuals facing tax debt. Maria D. mentions, "The IRS takes your financial circumstances into account when deciding on the payment structure and might even propose a lowered installment sum in instances of financial difficulty." This flexibility is crucial for taxpayers navigating their financial obligations. Remember, you are not alone in this journey. The IRS's adaptable financial options, such as IRS payment plan options, are intended to meet diverse economic circumstances, ensuring that taxpayers can find an appropriate strategy to handle their tax obligations.

Criteria for Choosing the Right Payment Plan

When selecting an IRS payment plan, it’s important to consider several factors that can help ease your burden:

-

Total Tax Debt: The amount you owe plays a significant role in determining your options. For instance, the IRS payment plan options include the Guaranteed Installment Agreement (GIA) for total tax debts of $10,000 or less, and the Streamlined Installment Agreement (SLIA) which caters to assessed tax balances of $50,000 or less. Understanding these thresholds can empower you to make informed decisions.

-

Ability to Pay: We understand that evaluating your monthly income and expenses can feel overwhelming. However, it's crucial to ensure that the plan you choose is sustainable. Taxpayers are required to provide financial information that demonstrates their monthly disposable income to set up ability-to-pay installment agreements. Interestingly, more than 70% of taxpayers who cannot pay their IRS bills choose IRS payment plan options, highlighting the importance of being aware of your financial situation.

-

Timeframe for Payment: Reflect on how quickly you can pay off your debt. Short-term strategies may be ideal if you can settle your balance swiftly. On the other hand, long-term options such as the Full-pay Non-Streamlined Installment Agreement (NSIA) are included in the IRS payment plan options that allow payments before the collection statute expires—typically up to 120 months—making them suitable for those who need extended repayment periods.

-

Interest and Penalties: It’s vital to familiarize yourself with how interest accumulates on unpaid taxes, as this can affect the total cost of your arrangement. For example, the Guaranteed Installment Agreement (GIA) allows for installments over a maximum of 36 months for debts of $10,000 or less, without the IRS filing a Notice of Federal Tax Lien. This can be a beneficial option for smaller debts, particularly through IRS payment plan options, providing peace of mind.

-

Future Financial Goals: As you consider your financing arrangement, think about how it aligns with your broader financial aspirations, such as saving for retirement or making significant purchases. This reflection can help ensure that your chosen strategy supports your long-term financial health.

Remember, you are not alone in this journey. We’re here to help guide you through these decisions, ensuring you find a plan that works for you.

Comparative Analysis of Common IRS Payment Plans

When facing tax obligations, it’s essential to explore the IRS payment plan options that are available to you. We understand that managing finances can be overwhelming, but the IRS payment plan options are designed to ease your burden.

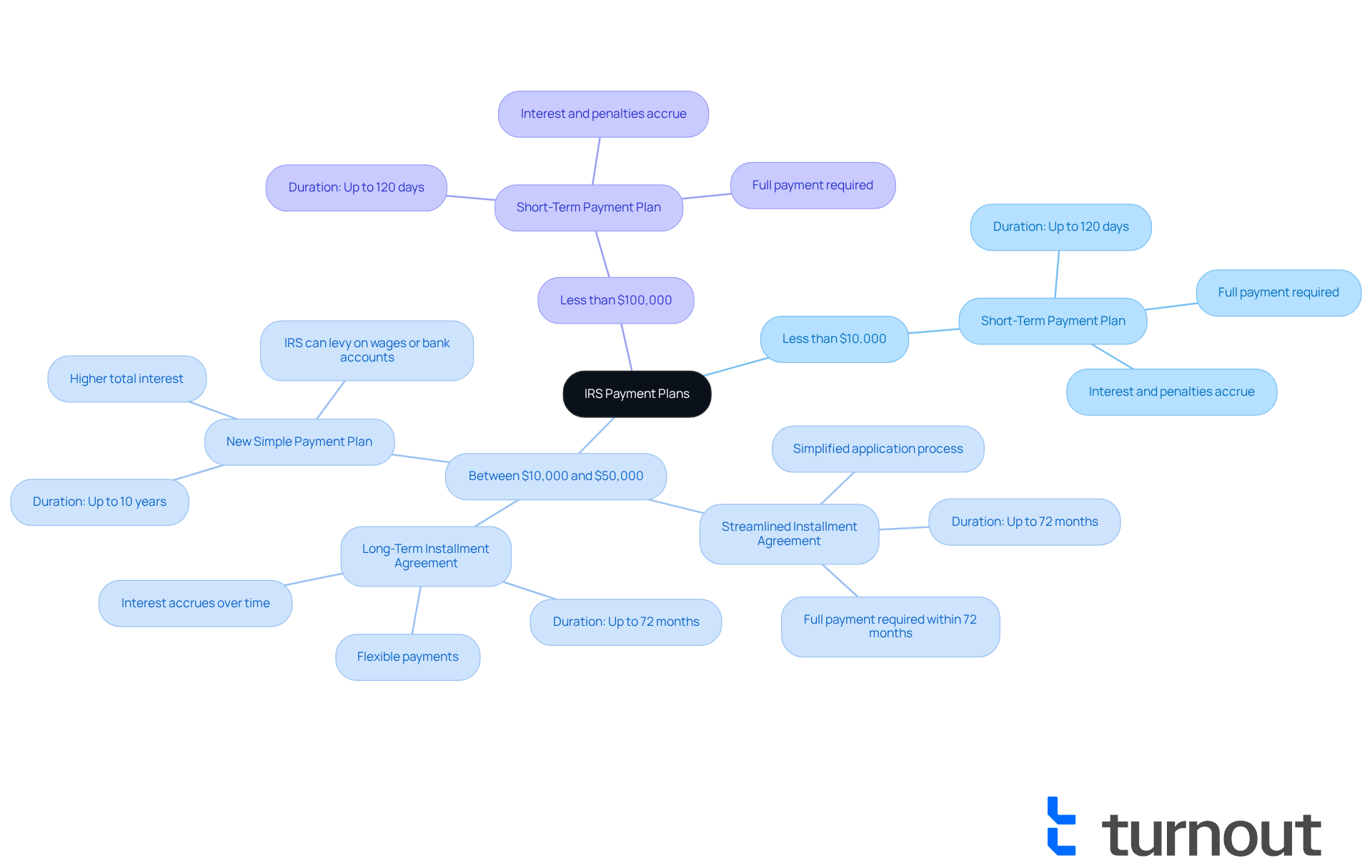

If you owe less than $100,000, the IRS payment plan options include a Short-Term Payment Plan that allows you to settle your debt within up to 120 days. It offers a quick resolution without a long-term commitment. However, please note that full payment is required within a short time, and penalties and interest will continue to accrue until your tax liability is fully paid.

For those who owe less than $50,000, the IRS payment plan options include a Long-Term Installment Agreement that provides a more manageable approach with a duration of up to 72 months. It allows for flexible payments, making it easier to fit into your budget. Just remember, interest will accrue over time, and it’s important not to incur any new liabilities while on this plan.

If your tax debt falls between $10,000 and $50,000, the streamlined installment agreement is one of the IRS payment plan options that offers a simplified application process and can be a great fit. You can enjoy the same 72-month payment period, but be aware that full payment of your tax debt is required within this timeframe.

The New Simple Payment Plan is one of the IRS payment plan options available for those owing less than $50,000, offering an extended payment period of up to 10 years. While it provides accessibility, it may come with a higher total interest, and the IRS retains the right to levy on wages or bank accounts.

Direct Pay and EFTPS: This immediate option is available to any taxpayer. It allows for instant payments without fees, but it does require access to a bank account and timely payments once an installment agreement is approved.

We’re here to help you navigate the IRS payment plan options, ensuring you find a plan that suits your needs. Remember, you are not alone in this journey, and there are solutions available to support you.

Additional Considerations and Alternative Options

We understand that navigating tax obligations can be overwhelming, and we want to guide you through this process. In addition to the primary payment plans, consider these supportive options:

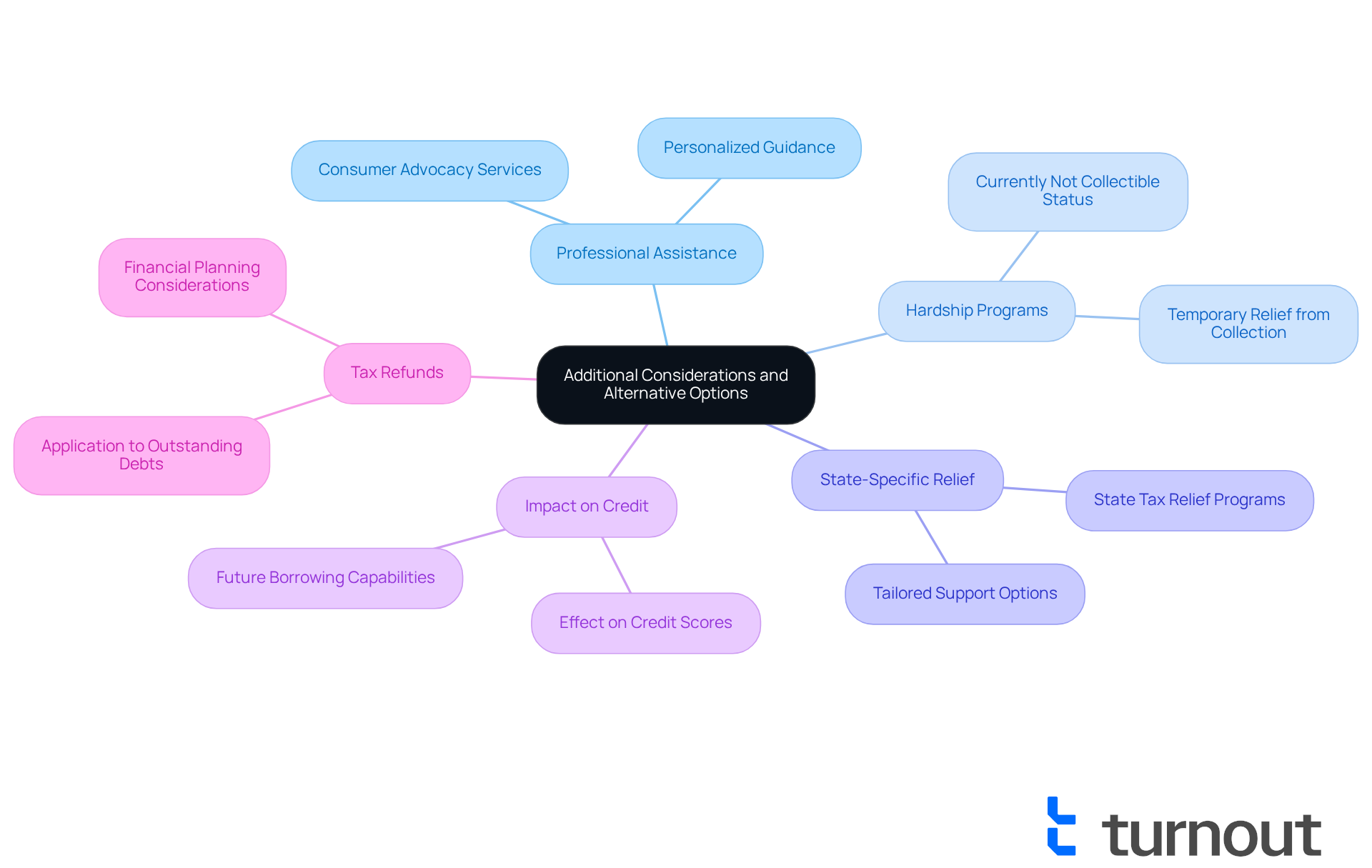

- Professional Assistance: Engaging with a consumer advocacy service can provide you with personalized guidance and support as you navigate the complexities of IRS processes. You're not alone in this journey.

- Hardship Programs: If you're facing financial difficulties, the IRS payment plan options include alternatives such as Currently Not Collectible status. This can temporarily halt collection efforts, giving you some much-needed relief.

- It's worth investigating state-specific tax relief programs as well as IRS payment plan options that may offer additional support or benefits tailored to your situation. Every bit of help counts.

- Impact on Credit: It's important to understand how choosing IRS payment plan options may affect your credit scores and future borrowing capabilities. Being informed can empower your financial decisions.

- Tax Refunds: Be aware that any future tax refunds may be applied to outstanding tax debts. This knowledge can significantly impact your financial planning.

Remember, we're here to help you find the best path forward. Don't hesitate to reach out for assistance as you explore these options.

Conclusion

Navigating the various IRS payment plan options can truly lighten the load of tax obligations for many individuals. We understand that these plans—from short-term arrangements to long-term installment agreements—offer the flexibility needed to manage financial commitments effectively. The IRS has thoughtfully designed these options to cater to a wide range of financial situations, ensuring support is available for those who need it most.

Key insights from the article emphasize the importance of evaluating total tax debt, your ability to pay, and the timeframe for repayment when selecting the right payment plan. Each option presents unique benefits, such as a streamlined application process for certain debt ranges and the extended repayment terms introduced by newer plans. By reflecting on these factors, you can make informed decisions that align with your financial capabilities and goals.

Ultimately, the significance of understanding IRS payment plan options cannot be overstated. Whether you are facing immediate tax obligations or planning for future financial stability, exploring these options can pave the way to relief. Engaging with professional assistance or considering additional support programs can further enhance your financial well-being. Taking proactive steps today can lead to a more secure financial future, empowering you to navigate your tax obligations with confidence.

Frequently Asked Questions

What are the IRS payment plan options available to taxpayers?

The IRS offers several payment plan options, including a Short-Term Payment Plan, Long-Term Installment Agreement, Streamlined Installment Agreement, New Simple Financial Arrangement, and online payment methods like Direct Pay and EFTPS.

What is a Short-Term Payment Plan?

A Short-Term Payment Plan allows taxpayers to pay their tax obligation in full within 120 days. It is suitable for those who can quickly gather the necessary funds.

What is a Long-Term Installment Agreement?

A Long-Term Installment Agreement enables taxpayers to settle their obligations over an extended period, typically up to 72 months, making it ideal for individuals facing significant financial burdens.

What is the Streamlined Installment Agreement?

The Streamlined Installment Agreement simplifies the application process for tax balances between $10,000 and $50,000 by eliminating the need for extensive financial documentation.

What is the New Simple Financial Arrangement?

Launched in 2025, the New Simple Financial Arrangement allows taxpayers to distribute their tax obligations over up to 10 years, providing extended time for repayment but potentially accruing interest over that period.

How can taxpayers make payments online?

Taxpayers can make payments online using Direct Pay and the Electronic Federal Tax Payment System (EFTPS), which allow for direct transfers from their bank accounts.

How many taxpayers are expected to use IRS payment plan options by 2025?

By 2025, approximately 4 million taxpayers are expected to utilize IRS payment plan options, indicating their effectiveness in assisting individuals with tax debt.

Does the IRS consider individual financial circumstances when setting up payment plans?

Yes, the IRS takes financial circumstances into account when determining payment structures and may propose a lower installment amount for individuals experiencing financial difficulty.