Overview

Navigating the world of GoFundMe funds can be overwhelming, especially when it comes to understanding tax implications. It's essential to know that these donations are generally classified as personal gifts, which may not be tax-deductible. We understand that this can raise questions and concerns.

The IRS guidelines on gift taxes provide valuable insights. Maintaining accurate records is crucial, as it helps you manage your tax responsibilities effectively. Additionally, be aware of potential reporting requirements for contributions that exceed certain thresholds. This knowledge can empower you in your financial journey.

Remember, you are not alone in this. We’re here to help you navigate these complexities with confidence. By staying informed and organized, you can ensure that you are handling your tax responsibilities appropriately.

Introduction

Navigating the world of crowdfunding can feel both empowering and overwhelming, especially when it comes to understanding the tax implications of platforms like GoFundMe. We understand that many individuals turn to this popular fundraising tool to cover everything from medical expenses to community projects. This raises an important question: how are these funds treated by the IRS?

As recipients, you stand to gain valuable insights into managing your contributions. However, it’s common to feel uncertain about the complexities of potential tax obligations. What happens when generous donations cross certain thresholds? How can you ensure compliance while maximizing the support you receive?

We’re here to help you navigate these challenges with clarity and confidence.

Explore How GoFundMe Works: A Foundation for Fundraising

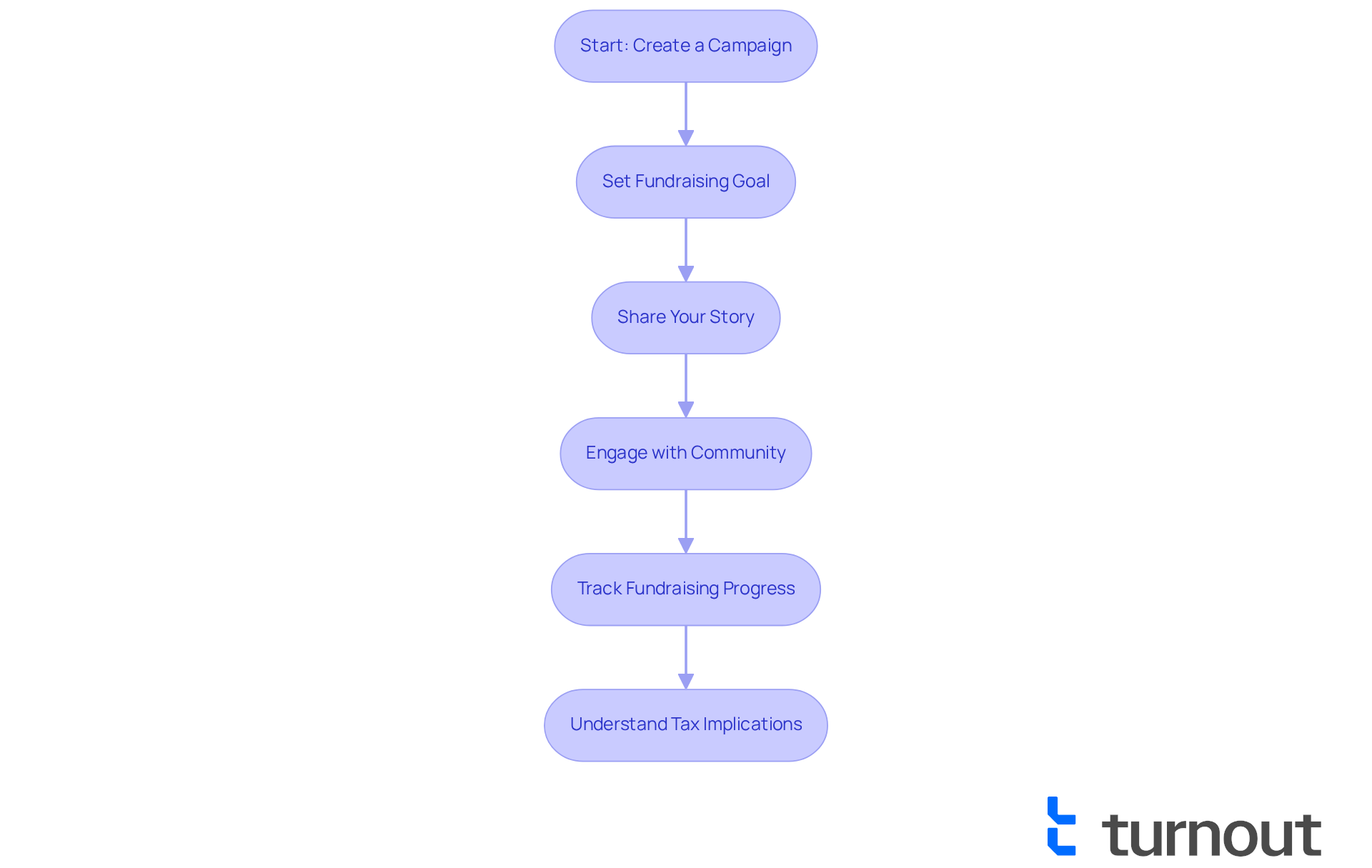

GoFundMe is a well-known crowdfunding platform that empowers individuals to raise funds for a range of personal causes, such as medical expenses, education, and community projects. You can create a campaign page, set a fundraising goal, and share your unique story to attract donations. The platform operates on the understanding that donors contribute without expecting anything in return, viewing these contributions as personal gifts. This foundational understanding is vital for recipients, as it directly influences their approach to fundraising and managing the funds raised.

In 2025, this crowdfunding platform continues to be a popular choice for personal fundraising, with millions of users relying on it to support various causes. It's important to recognize that more than 50% of crowdfunding campaigns are initiated for medical costs, highlighting the platform's role in addressing critical financial needs. Numerous success stories illustrate how individuals have effectively utilized crowdfunding to meet their financial challenges. Campaigns that share compelling narratives and engage with their communities often receive higher levels of support. For instance, a campaign that raised over $10,000 for a medical procedure included heartfelt updates and community engagement, showcasing the power of storytelling in fundraising.

However, it's essential to be aware that GoFundMe taxes do not guarantee tax-deductibility for personal fundraisers on this crowdfunding platform. While donors may not expect a return, those receiving should understand their potential GoFundMe taxes obligations. Donations obtained through crowdfunding, including GoFundMe, are generally considered personal contributions, which can have varying GoFundMe taxes implications depending on the total amount collected and the beneficiary's financial situation. As crowdfunding expert Jane Doe wisely states, "Understanding the tax implications of your fundraising efforts is essential to ensure you are prepared for any obligations that may arise."

The platform's key features, such as easy campaign setup, social sharing capabilities, and real-time fundraising progress tracking, empower you to maximize your outreach and fundraising potential. As you consider starting a crowdfunding campaign, remember that understanding these components will not only enhance your fundraising strategy but also prepare you for any GoFundMe taxes that may arise from the funds you collect. You're not alone in this journey; we're here to help you navigate your fundraising efforts with confidence.

Determine Tax Deductibility of GoFundMe Donations

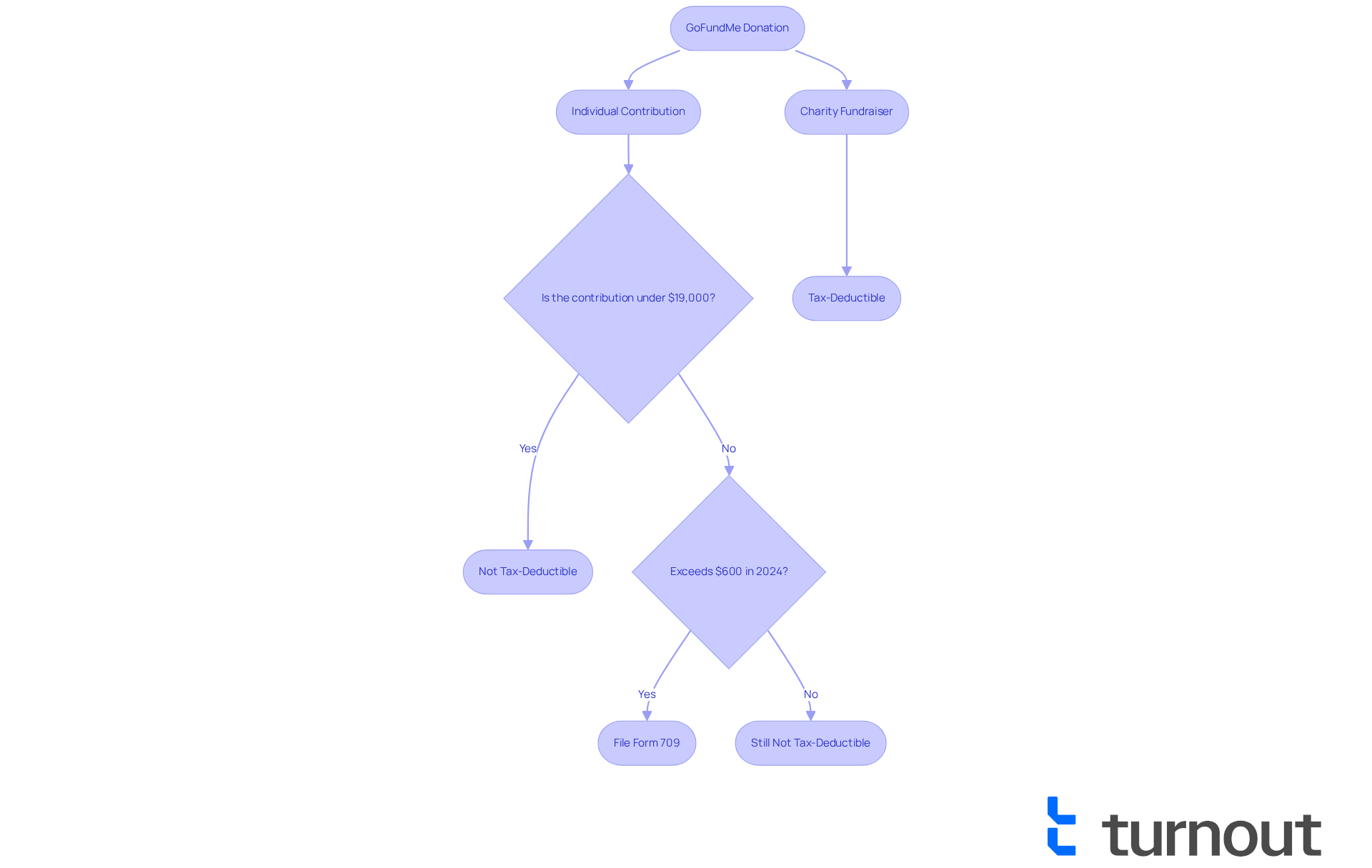

Contributions made to individual crowdfunding campaigns, including those on GoFundMe, are typically not tax-deductible for the giver, as these donations are subject to GoFundMe taxes and categorized as personal gifts according to IRS regulations. We understand that this can be confusing, especially when it comes to managing your finances. In contrast, contributions directed to crowdfunding charity fundraisers are guaranteed to be tax-deductible in several countries, including the US, UK, Canada, Ireland, and Australia. It's crucial for recipients to communicate this distinction to their donors to prevent any misunderstandings. Personal GoFundMe contributions do not receive tax receipts, which further highlights their classification as personal donations concerning GoFundMe taxes.

For 2025, the yearly tax exclusion for presents has risen to $19,000. This means individuals can provide this sum without causing tax consequences. However, if a donor surpasses this limit, they may need to file Form 709 to report the contribution for GoFundMe taxes to the IRS. Most Americans will not face gift tax due to the high lifetime exemption of $13.99 million, providing reassurance regarding the implications of exceeding the annual gift limit. You are not alone in navigating these complexities.

Furthermore, the IRS has modified the 1099-K reporting limit to $600 for the 2024 tax year, which affects the reporting of GoFundMe taxes. This change is pertinent for individuals who might receive considerable sums through crowdfunding, especially in relation to GoFundMe taxes. It’s common to feel overwhelmed by these regulations, and we encourage donors to consult with a tax professional to navigate their specific situations regarding GoFundMe taxes, particularly when considering substantial contributions. Recipients should maintain meticulous records of all donations received, as this documentation will be invaluable for any future tax inquiries or audits concerning GoFundMe taxes.

For further assistance, users can interact with Ray, an AI-powered HelperBot, designed to help with tax-related inquiries. Grasping these subtleties can assist both donors and beneficiaries in efficiently managing their GoFundMe taxes responsibilities. Remember, we're here to help you through this journey.

Understand Tax Obligations for GoFundMe Recipients

As a beneficiary of funds raised through GoFundMe, you may have questions about GoFundMe taxes and how these funds are treated by the IRS. It's important to understand that the IRS typically classifies these funds as non-taxable gifts when they are given without expectation of return and intended for personal use. However, we recognize that navigating GoFundMe taxes can be complex.

If you use the funds for business purposes or if the total contributions exceed certain thresholds, this may affect your GoFundMe taxes. For instance, if you receive a Form 1099-K—issued when gross payments exceed $600 in a calendar year—you might need to report these funds as taxable income, which could include GoFundMe taxes. It's common to feel uncertain about this, but receiving a Form 1099-K does not automatically mean you owe GoFundMe taxes; it simply serves to notify the IRS of the payments made.

That said, keeping meticulous records of how you use these funds is vital for understanding GoFundMe taxes. This practice can significantly influence the GoFundMe taxes you may owe. Looking ahead, in 2025, the IRS will continue to enforce these guidelines, with the threshold for Form 1099-K set to increase to $5,000. Staying informed about GoFundMe taxes and these changes is crucial for your financial well-being.

We encourage you to consult with a tax professional about GoFundMe taxes. You're not alone in this journey, and seeking guidance can help you navigate these complexities with confidence.

Navigate Gift Tax Considerations for GoFundMe Contributions

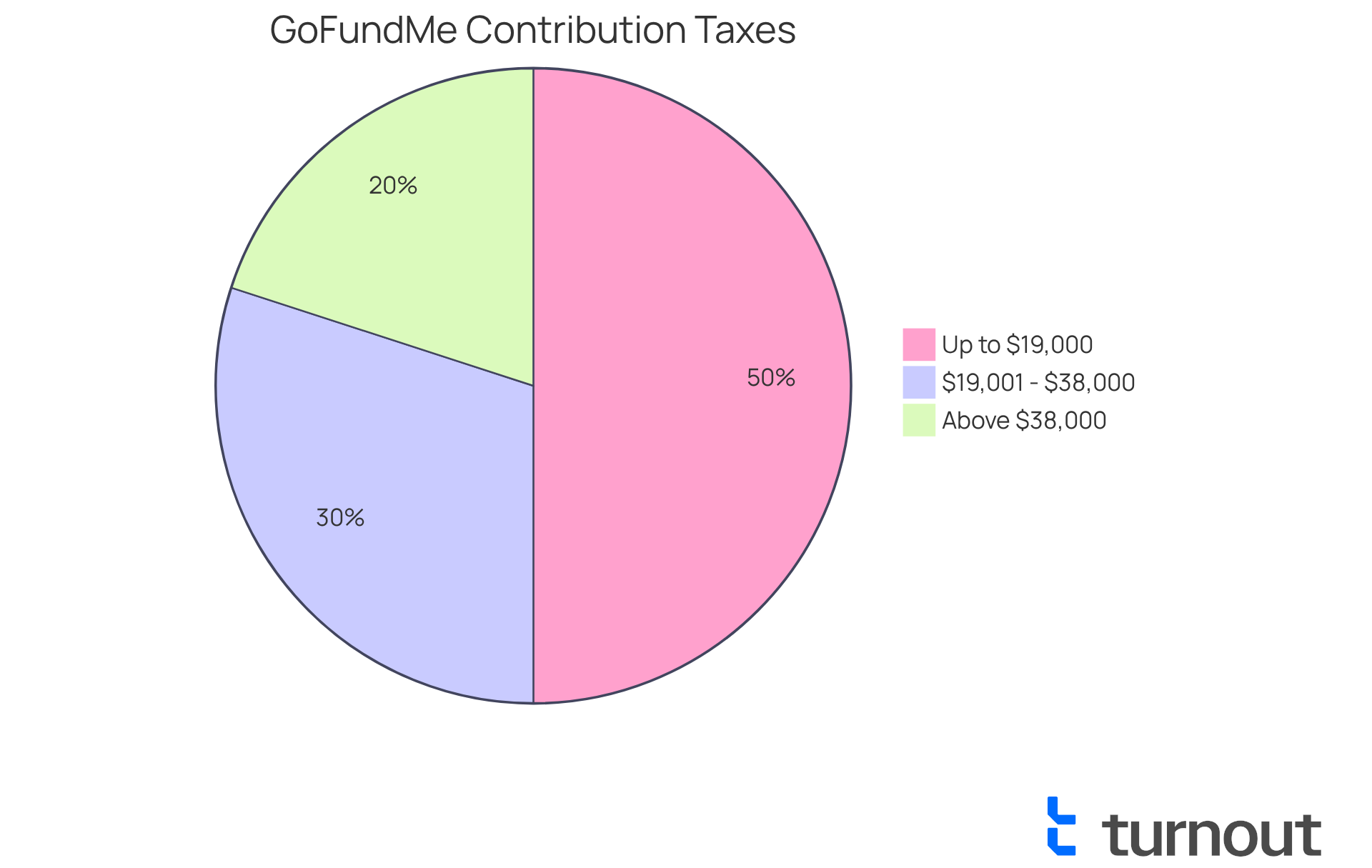

When individuals support a GoFundMe campaign, it’s important to understand that gofundme taxes may apply to these contributions. We recognize that navigating these rules can be overwhelming. In 2025, the federal tax exclusion allows a donor to provide up to $19,000 to an individual without needing to report it to the IRS. For married partners, this exclusion increases to $38,000 for each recipient, enabling them to give more without facing tax responsibilities.

If a contributor exceeds these thresholds, they might need to submit a tax return for their contributions. However, they may not owe any tax due to the lifetime tax exemption, which is set at around $13.99 million for each individual. While recipients do not owe taxes on the gifts received, it's vital for donors to be aware of their potential gofundme taxes responsibilities. The tax rates on gifts can range from 18% to 40%, depending on the amount that surpasses the exclusion threshold.

Clear communication between donors and recipients can help manage expectations and ensure compliance with tax regulations. We understand that in 2025, many gift tax returns will likely be filed as individuals navigate these new thresholds. This highlights the importance of understanding these rules in the context of crowdfunding, particularly in relation to gofundme taxes. Remember, you are not alone in this journey; we’re here to help you make sense of it all.

Conclusion

Understanding the intricacies of GoFundMe taxes is essential for recipients who want to navigate their fundraising efforts effectively. We recognize that this can be a daunting task, but it’s important to grasp how funds raised through GoFundMe are classified and the potential tax obligations that may arise. By understanding tax deductibility, gift tax limits, and IRS reporting requirements, you can better prepare for the financial responsibilities linked to your campaigns.

Key insights include the distinction between personal contributions and charitable donations. It’s significant to maintain accurate records, especially with recent IRS changes affecting reporting thresholds. As the crowdfunding landscape evolves, staying informed about these regulations is crucial for ensuring compliance and avoiding unexpected tax liabilities.

Ultimately, clear communication between donors and recipients, along with proactive engagement with tax professionals, can empower you to manage your GoFundMe taxes with confidence. Remember, you are not alone in this journey. By taking these steps, you can focus on what truly matters: the support and community engagement that make your fundraising efforts successful.

Frequently Asked Questions

What is GoFundMe?

GoFundMe is a crowdfunding platform that allows individuals to raise funds for personal causes, including medical expenses, education, and community projects.

How does GoFundMe work?

Users can create a campaign page, set a fundraising goal, and share their story to attract donations from supporters. Donors contribute without expecting anything in return, viewing their contributions as personal gifts.

What types of causes are commonly funded on GoFundMe?

Over 50% of campaigns initiated on GoFundMe are for medical costs, but the platform is also used for education, community projects, and other personal financial needs.

What factors contribute to a successful fundraising campaign on GoFundMe?

Campaigns that share compelling narratives and engage with their communities tend to receive higher levels of support, as illustrated by success stories where heartfelt updates and community involvement played a key role.

Are donations made through GoFundMe tax-deductible?

No, donations made through GoFundMe do not guarantee tax-deductibility for personal fundraisers. Recipients should be aware of potential tax obligations related to the funds raised.

What are the tax implications of using GoFundMe?

Donations obtained through GoFundMe are generally considered personal contributions, which can have varying tax implications based on the total amount collected and the beneficiary's financial situation.

What features does GoFundMe offer to users?

GoFundMe provides features such as easy campaign setup, social sharing capabilities, and real-time fundraising progress tracking to help users maximize their outreach and fundraising potential.

How can one prepare for potential tax obligations when using GoFundMe?

It is essential for recipients to understand the tax implications of their fundraising efforts to ensure they are prepared for any obligations that may arise from the funds collected.