Overview

This article serves as a compassionate guide to mastering the qualifications for Supplemental Security Income (SSI). We understand that navigating the eligibility requirements, necessary documentation, and the application process can be overwhelming. It’s crucial to grasp these qualifications to secure the financial assistance you need, especially if you are elderly, blind, or disabled. By being well-prepared and aware of the rules, you can significantly improve your chances of a successful application.

You are not alone in this journey. Many individuals face similar challenges, and thorough preparation can make a world of difference. Remember, understanding the qualifications is the first step toward achieving the support you deserve. We’re here to help you every step of the way.

Introduction

Navigating the complexities of Supplemental Security Income (SSI) can feel overwhelming for many individuals seeking financial support. We understand that this federal program is designed to assist those who are elderly, blind, or disabled, and grasping the qualifications and application process is essential for accessing this vital resource. With strict eligibility requirements and necessary documentation, it’s common to feel uncertain about your chances of approval. How can you ensure that you meet the criteria and successfully secure the assistance you need?

This guide offers a comprehensive, step-by-step approach to mastering the qualifications for SSI. We’re here to help you confidently navigate the application process, empowering you to enhance your quality of life. You are not alone in this journey, and together, we can work towards securing the support you deserve.

Define Supplemental Security Income (SSI) and Its Purpose

Supplemental Security Income (SSI) is a federal program designed to provide financial assistance to individuals who meet the qualifications for SSI, including those who are 65 years or older, blind, or disabled, and who face limitations in income and resources. We understand that many in these vulnerable groups struggle to meet their basic needs for food, clothing, and shelter. The primary goal of SSI is to ensure that they have the support necessary to navigate these challenges.

Unlike Social Security Disability Insurance (SSDI), which requires a work history, the qualifications for SSI are based on need and do not require prior work credits. This means that a broader range of individuals can access this crucial support, including children with disabilities and older adults who may not have worked enough to meet the qualifications for SSI. Starting on December 31, 2024, around 7.5 million SSI recipients will see a 2.5% increase in their payments, a testament to the program's commitment to helping those in need.

In 2025, the maximum monthly SSI payment will rise to $967 for individuals and $1,450 for couples. Currently, nearly 73 million Americans depend on Social Security and SSI benefits, with a significant portion of SSI beneficiaries being disabled. Real-life stories illustrate how SSI plays a vital role in assisting disabled individuals with their basic living expenses, ultimately enhancing their quality of life and providing a safety net during tough times.

As social welfare experts highlight, SSI is essential for supporting vulnerable populations. We want you to know that you are not alone in this journey; help is available to ensure you have the necessary resources to thrive. If you or someone you know is in need, don’t hesitate to reach out for assistance. Together, we can navigate these challenges.

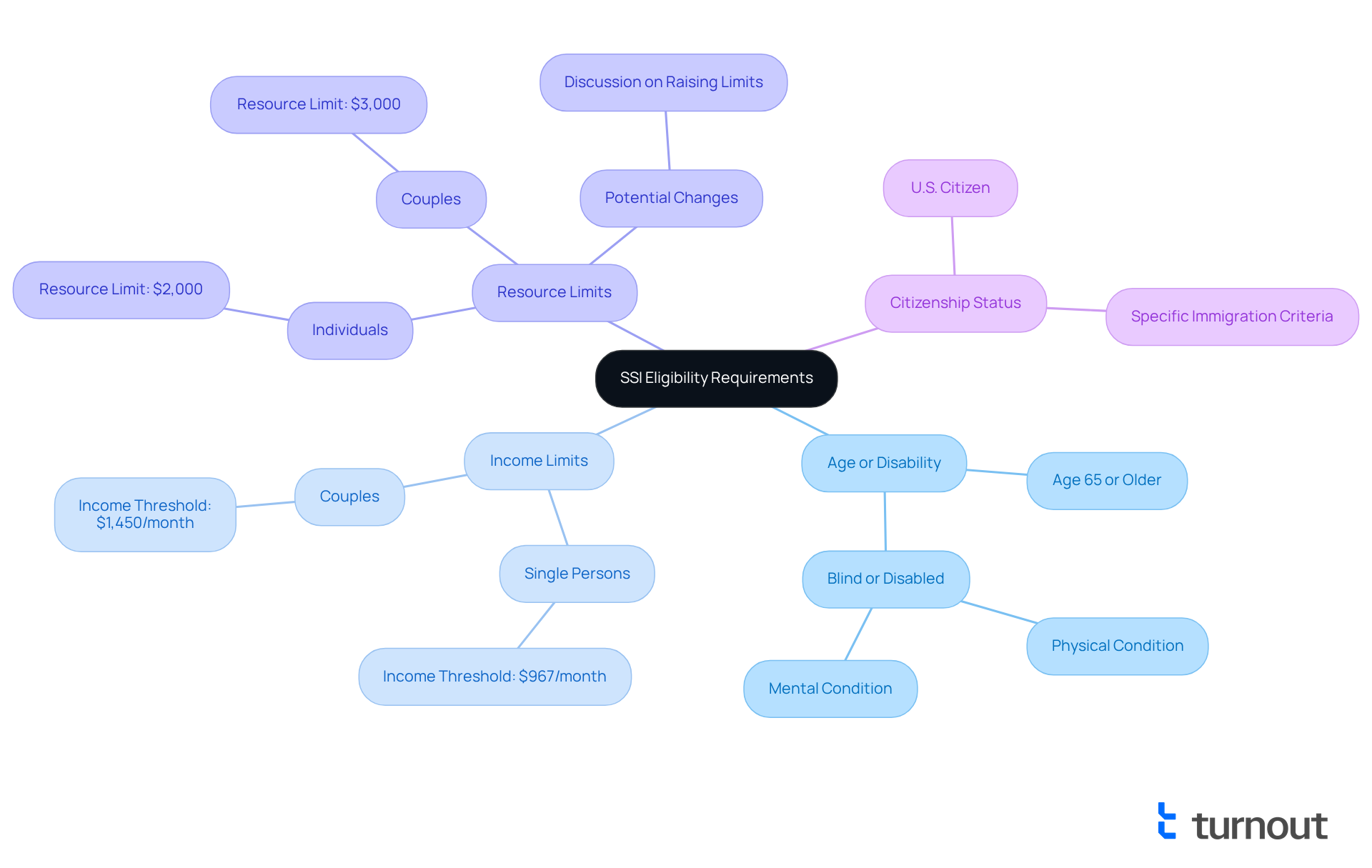

Outline Eligibility Requirements for SSI Benefits

To qualify for Supplemental Security Income (SSI) benefits, applicants must meet the qualifications for SSI, which include several essential eligibility requirements.

-

Age or Disability: You must be aged 65 or older, or you must be blind or disabled. Disability is defined as a physical or mental condition that significantly impairs your ability to perform basic work activities.

-

Income Limits: SSI imposes strict income limits. For 2025, the income threshold is set at $967 per month for single persons and $1,450 for couples. This includes all forms of income, such as wages, pensions, and other financial sources.

-

Resource Limits: You must have limited resources, which include cash, bank accounts, stocks, and other assets. The resource limit is $2,000 for individuals and $3,000 for couples. It’s crucial to manage your assets carefully. There are ongoing discussions about potentially raising these resource limits, which could affect eligibility for many candidates.

-

Citizenship Status: To qualify for SSI benefits, you must be a U.S. citizen or meet specific immigration criteria.

We understand that navigating these requirements can be daunting. Many candidates struggle to stay within the income limits, as even part-time work can jeopardize their eligibility. Disability advocates stress that the intricacy of the qualifications for SSI often leads to confusion and frustration among applicants. As one advocate noted, "The system can feel like an uphill battle for many who are just trying to secure the support they need."

Real-life examples illustrate this challenge: individuals who have worked hard to secure a stable income may find themselves unexpectedly ineligible for benefits due to minor fluctuations in their earnings. For instance, a single mother working part-time may exceed the income limit by a small margin, disqualifying her from receiving vital assistance.

In 2025, the SSI program is expected to see adjustments, including an increase in the Federal Benefit Rate due to the 3.2% Cost-of-Living Adjustment (COLA). This increase may provide some relief to those who qualify. Staying informed about these changes is vital for prospective candidates to understand the qualifications for SSI to ensure they meet the necessary criteria and maximize their benefits. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

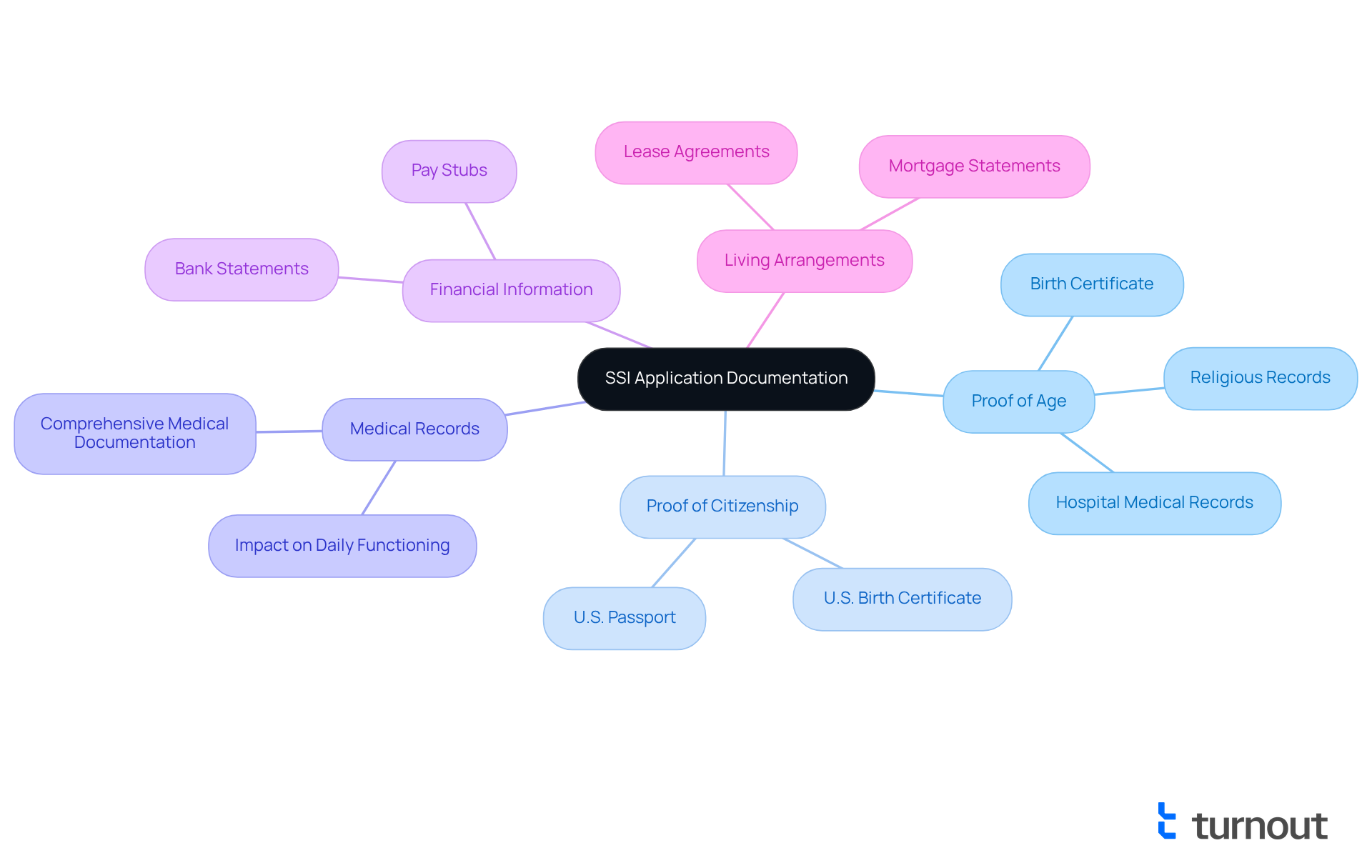

Detail Required Documentation for SSI Applications

When applying for SSI benefits, we understand that the qualifications for SSI can be overwhelming. It’s essential to provide specific documentation to support your qualifications for SSI. Missing documentation is a common reason for rejections, underscoring the importance of thorough preparation. Here’s a detailed list of the necessary documents:

- Proof of Age: Acceptable documents include a birth certificate or other official records that confirm your date of birth. If these are unavailable, alternatives like religious records created before age five or hospital medical records may suffice.

- Proof of Citizenship or Immigration Status: You must provide documentation that verifies your citizenship or legal residency. Valid options include a U.S. birth certificate or a U.S. passport.

- Medical Records: For individuals asserting disability, comprehensive medical records are vital. These should detail your condition and its impact on daily functioning. Social workers emphasize that thorough medical documentation can significantly strengthen your claim. As one social worker noted, "Having complete medical records is crucial; they provide the evidence needed to support your disability claim."

- Financial Information: This includes bank statements, pay stubs, and any other documents that reflect your income and resources. Accurate financial records are crucial for demonstrating qualifications for SSI.

- Living Arrangements: Documentation such as lease agreements or mortgage statements may be required to verify your living conditions.

Statistics indicate that a substantial proportion of SSI requests are denied due to absent documentation, highlighting the stakes involved in the submission process. It’s common to feel anxious about this. Real-world examples show that candidates who carefully collect and arrange their paperwork often encounter smoother submission processes. For instance, individuals who proactively gather their medical records and financial statements tend to have higher success rates in securing benefits. Remember, maintaining copies of all submitted documents and monitoring correspondence with the Social Security Administration (SSA) can further optimize your process. We’re here to help you navigate this journey.

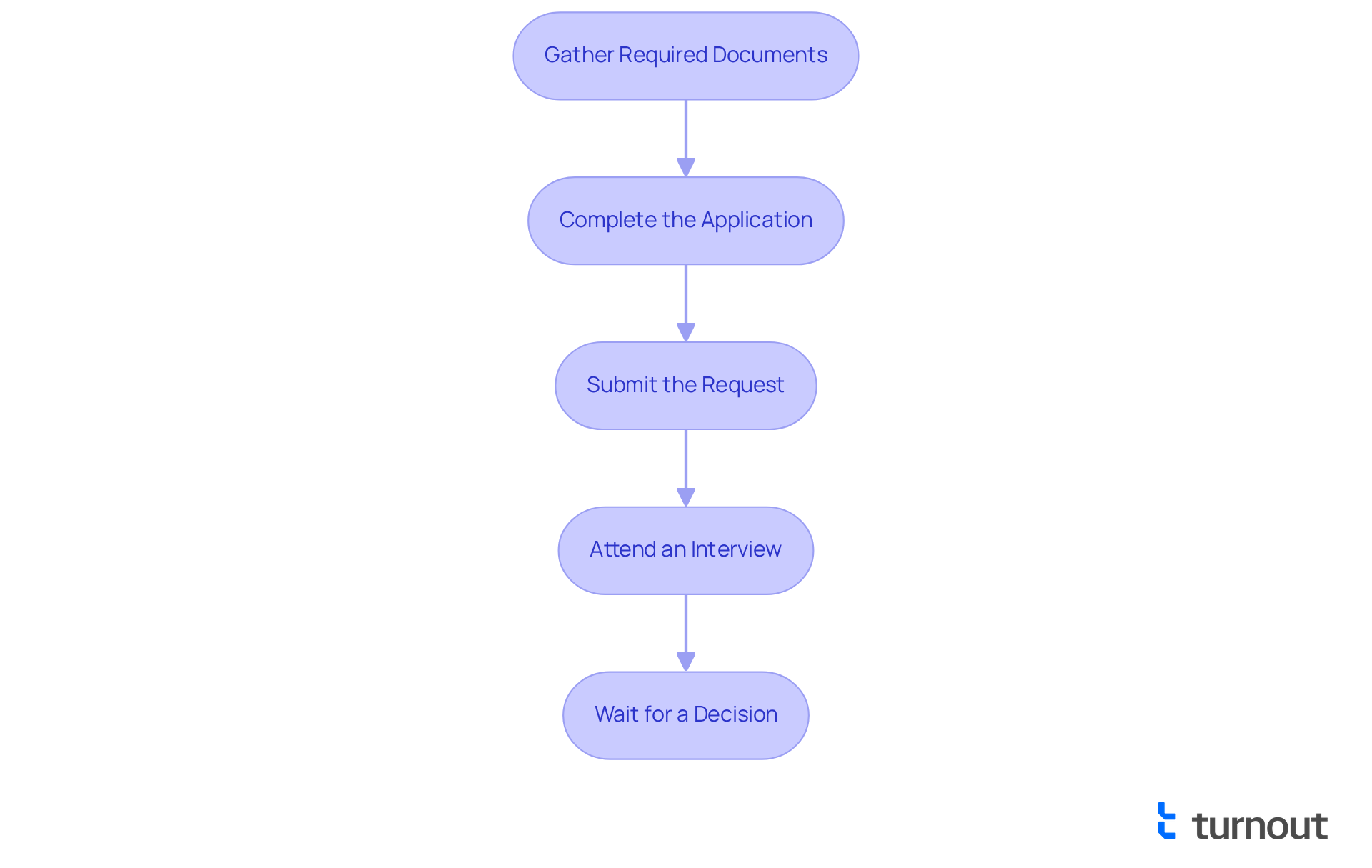

Explain the Application Process for SSI Benefits

The application process for Supplemental Security Income (SSI) can feel overwhelming, but we’re here to help you navigate it step by step. Understanding the qualifications for SSI can alleviate some of the stress you may be experiencing.

-

Gather Required Documents: Before you begin, take a moment to collect all necessary documents. This includes proof of age, citizenship, medical records, and financial information. Having everything ready can make the process smoother.

-

Complete the Application: You can apply online through the Social Security Administration (SSA) website, by phone, or in person at your local SSA office. The form (SSA-8000) needs to be filled out accurately, providing detailed information about your income, resources, and medical conditions. Recent updates, including the iClaim expansion, aim to simplify this process by adding SSI-specific questions and prepopulating answers based on existing records, making it easier for you.

-

Submit the Request: After completing your application, submit it along with all required documentation. If you’re applying online, follow the prompts to upload your documents. Many people find that online submissions lead to faster processing times, which can be a relief.

-

Attend an Interview: After submission, you might be asked to attend an interview, either in person or via phone. This is an opportunity to discuss your application and provide any additional information if needed. It’s common to feel anxious about this step, but remember, it’s a normal part of the process.

-

Wait for a Decision: The SSA will review your submission and typically make a decision within three to five months. You will be notified by mail. We understand that waiting can be frustrating and emotionally taxing. Many candidates share this experience, which highlights the importance of thorough documentation and timely submissions to meet the qualifications for SSI and improve your chances of a favorable outcome. Advocates note that the SSA plans to expand the streamlined submission process to all individuals in 2025, which is expected to enhance accessibility.

Real-life experiences shed light on the challenges of this journey. For example, individuals like Matthew P. have reported waiting nearly five years for acceptance, even when they met the criteria. This underscores the need for patience and persistence. We want you to know that you are not alone in this journey. With the SSA’s commitment to improving the application process, there is hope for a more efficient experience ahead.

Conclusion

Supplemental Security Income (SSI) is more than just a financial program; it serves as a crucial lifeline for those facing hardships due to age, disability, or blindness. This program aims to provide essential support to individuals who may struggle to meet their basic needs. We understand that navigating the qualifications for SSI—such as age or disability criteria, income and resource limits, and required documentation—can be overwhelming. However, this knowledge empowers you to effectively navigate the complexities of the application process.

As you prepare to apply for SSI benefits, remember that thorough preparation is key. Gathering necessary documents, understanding eligibility requirements, and familiarizing yourself with the application process are all vital steps. Each of these plays a pivotal role in securing the financial support that many depend on. Real-life examples illustrate the challenges faced by applicants, emphasizing the importance of diligence and persistence in overcoming potential obstacles.

Ultimately, the significance of SSI extends beyond mere financial assistance; it represents hope and stability for millions of Americans. For those who qualify, taking action to understand and complete the application process can lead to an improved quality of life. By staying informed and seeking help when needed, you can navigate the path to SSI benefits with confidence, ensuring you receive the support essential for your well-being.

Frequently Asked Questions

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal program that provides financial assistance to individuals who are 65 years or older, blind, or disabled, and who have limited income and resources.

What is the primary purpose of SSI?

The primary purpose of SSI is to ensure that vulnerable individuals have the financial support necessary to meet their basic needs for food, clothing, and shelter.

How does SSI differ from Social Security Disability Insurance (SSDI)?

Unlike SSDI, which requires a work history, SSI qualifications are based on need and do not require prior work credits, allowing a broader range of individuals, including children with disabilities and older adults, to access support.

Will SSI payments increase in the future?

Yes, starting on December 31, 2024, around 7.5 million SSI recipients will see a 2.5% increase in their payments.

What will the maximum monthly SSI payment be in 2025?

In 2025, the maximum monthly SSI payment will rise to $967 for individuals and $1,450 for couples.

How many Americans depend on Social Security and SSI benefits?

Nearly 73 million Americans depend on Social Security and SSI benefits, with a significant portion of SSI beneficiaries being disabled.

Why is SSI considered essential for vulnerable populations?

SSI is essential for supporting vulnerable populations by providing a safety net that helps them cover basic living expenses, thereby enhancing their quality of life during tough times.

What should someone do if they need assistance related to SSI?

If you or someone you know is in need of assistance, it is encouraged to reach out for help to ensure access to necessary resources and support.