Overview

The primary aim of this article is to serve as a comprehensive guide for those seeking to effectively utilize the SSI and SSDI back pay calculator. We understand that navigating disability claims can be overwhelming, and this guide is designed to ease that burden. By detailing the calculator's purpose and the essential information needed for accurate calculations, we hope to empower you. Our step-by-step instructions are crafted to help you approach your claims with greater confidence and clarity, ensuring you feel supported throughout this journey.

Introduction

Navigating the complexities of disability benefits can often feel overwhelming, much like finding your way through a labyrinth. This is particularly true when it comes to calculating potential back pay from SSI and SSDI. We understand that this essential tool is not just a means to estimate retroactive payments; it serves as a beacon of clarity during the often tumultuous waiting period for benefits.

However, many individuals face challenges in accurately using this calculator, leading to confusion and missed opportunities. How can you effectively harness this resource to ensure you receive the financial support you rightfully deserve? We're here to help you find your way.

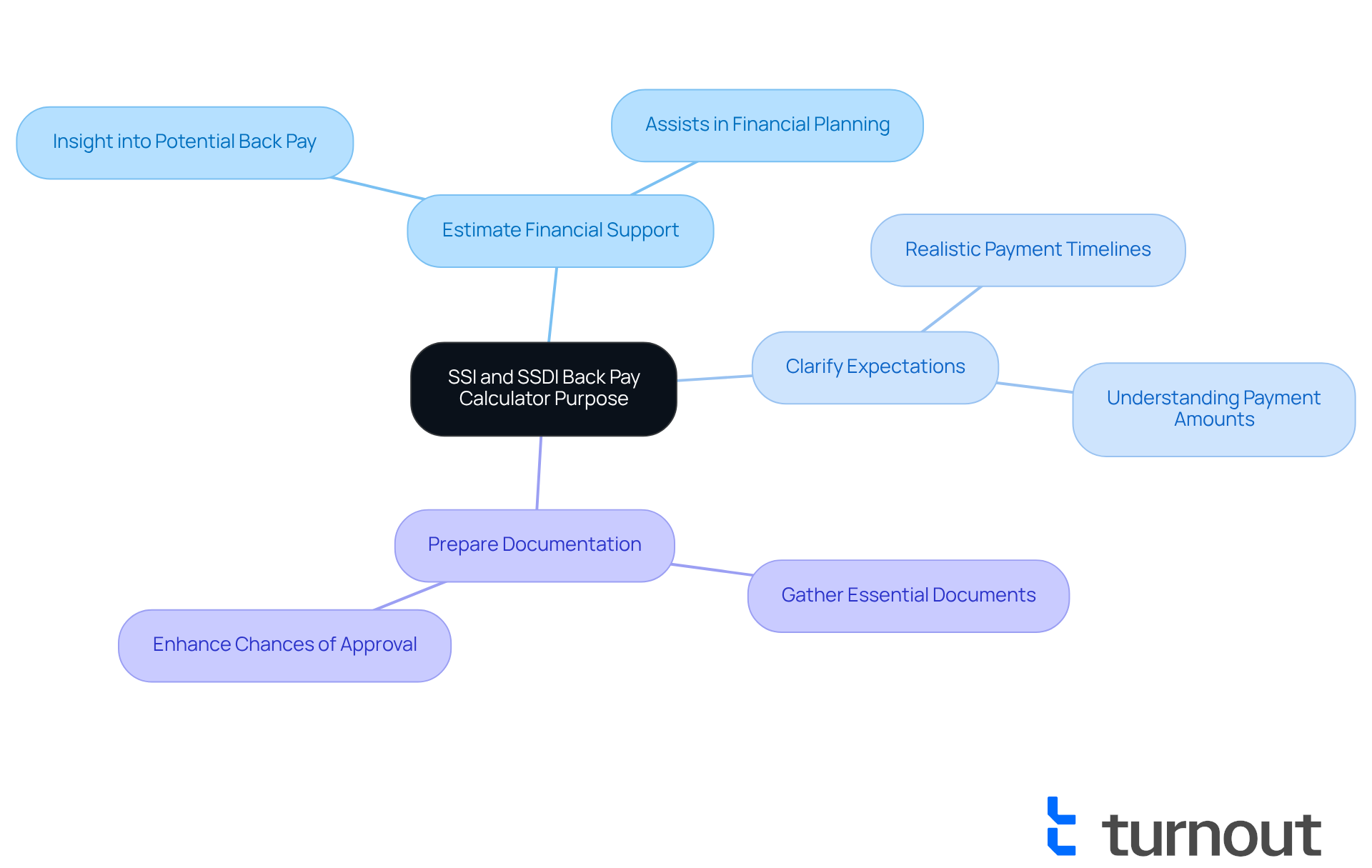

Understand the Purpose of the SSI and SSDI Back Pay Calculator

The ssi and ssdi back pay calculator is a vital resource for individuals seeking to estimate the retroactive payments they may qualify for after their disability claims are approved. Understanding its purpose is essential, as it offers several key benefits:

- Estimate Financial Support: Gaining insight into potential back pay can significantly assist in financial planning during the often lengthy waiting period for benefits.

- Clarify Expectations: The calculator helps set realistic expectations regarding payment timelines and amounts from the Social Security Administration (SSA), reducing uncertainty.

- Prepare Documentation: Familiarity with the calculation process encourages users to gather essential documentation that supports their claims, enhancing their chances of approval.

We understand that navigating the complexities of disability claims can be overwhelming. Utilizing this calculator empowers individuals to approach the process with greater confidence. Many recipients have shared how they used the calculator to assess their compensation, which can include payments for up to 12 months prior to their application date, provided they meet the eligibility criteria. In fact, the SSA has paid over $7.5 billion in retroactive payments to more than 1.1 million individuals, underscoring the importance of understanding these benefits.

Real-world examples highlight the calculator's impact: one individual, Marcus C., used the tool to anticipate a retroactive payment of $16,000, which greatly influenced his financial planning. By leveraging the ssi and ssdi back pay calculator, you can clarify the process and make informed decisions about your financial future. Remember, you are not alone in this journey; we’re here to help you every step of the way.

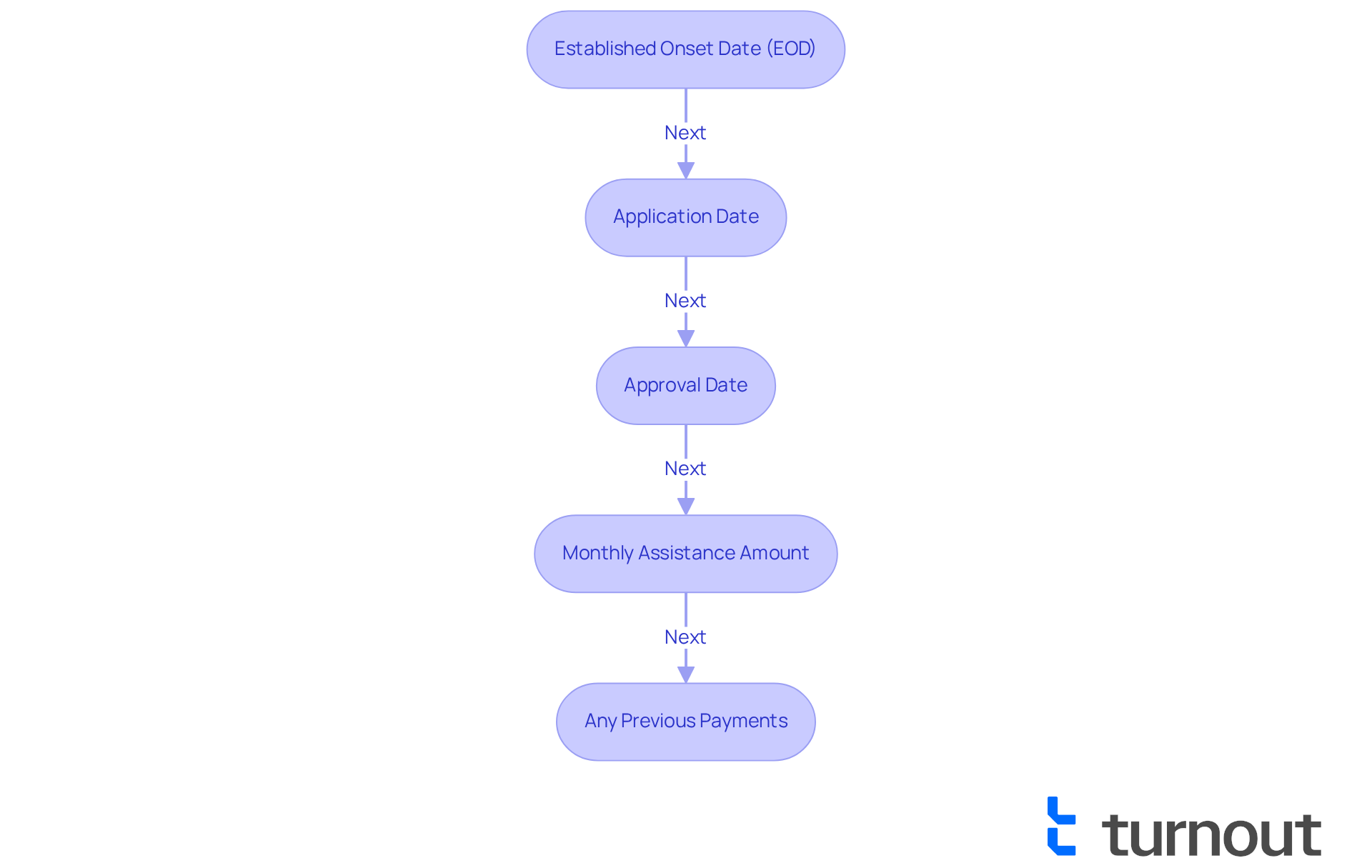

Gather Required Information for Accurate Calculations

To accurately calculate your back pay, it's essential to gather some key information that can make a significant difference in your experience:

- Established Onset Date (EOD): This is the date when your disability began, as recognized by the Social Security Administration (SSA). We understand that the EOD is crucial, as it directly influences the amount of back pay you may receive.

- Application Date: This refers to the date you submitted your application for disability assistance.

- Approval Date: This is the date your claim was officially approved by the SSA.

- Monthly Assistance Amount: This is the sum you are authorized to receive each month once your payments begin.

- Any Previous Payments: If you received any interim payments or other advantages during the waiting period, be sure to document these, as they may affect your total compensation.

Having this information organized can truly streamline the process of using the ssi and ssdi back pay calculator and enhance the accuracy of your results. It’s common to feel overwhelmed, but being prepared with these details can significantly expedite your claim process. Remember, applicants who provide precise and complete information often see higher success rates in their applications. We're here to help you navigate this journey.

Follow Step-by-Step Instructions to Calculate Your Back Pay

To calculate your back pay using the SSI and SSDI Back Pay Calculator, please follow these steps:

- Determine Your Established Onset Date (EOD): Start by identifying the date when your disability began. This is a crucial first step in understanding your entitlements.

- Eliminate the Five-Month Waiting Period: The SSA generally requires a five-month waiting period before payments begin. For example, if your EOD is June 1, 2025, your benefits would commence on November 1, 2025. It's common to feel uncertain about this timeline, but knowing it can help you plan better.

- Count the Months from EOD to Approval Date: Next, calculate the total number of months from your EOD (after the waiting period) to your approval date. If your approval date is January 1, 2026, you would count the months from November 2025 to January 2026, totaling two months. This step can clarify how long you may expect to wait for your payments.

- Multiply by Your Monthly Payment Amount: Take the total number of qualifying months and multiply it by your approved monthly payment amount. For instance, if your monthly payment is $1,200 and you qualify for two months of retroactive compensation, your overall retroactive amount would be $2,400. This calculation is vital for understanding your finances.

- Review for Accuracy: Finally, double-check your calculations and ensure all dates and amounts are correct. This careful review can help you avoid any discrepancies down the line.

Furthermore, it’s essential to recognize that you might qualify for back payments for as much as 12 months before your application date if you can demonstrate that your disability began at least 17 months before applying. Engaging with a specialist, like Turnout's trained nonlegal advocates, can provide a more precise evaluation of your circumstances and help navigate the complexities of the SSI and SSDI back pay calculator.

For example, if your disability started in January 2024 and you received approval in January 2025, your retroactive payments would commence from June 2024 until January 2025, possibly amounting to $9,600 based on a monthly payment of $1,200. Remember, SSI recipients may receive retroactive payments in installments, which can vary based on individual circumstances. Understanding the five-month waiting period is essential, as it can greatly influence the schedule for obtaining assistance.

We encourage you to frequently review your claim status with the SSA to stay updated about your overdue payments. Maintaining meticulous records of all documentation and correspondence with the SSA throughout the process is crucial to ensure a smooth claims experience. You're not alone in navigating this journey; we're here to help you every step of the way.

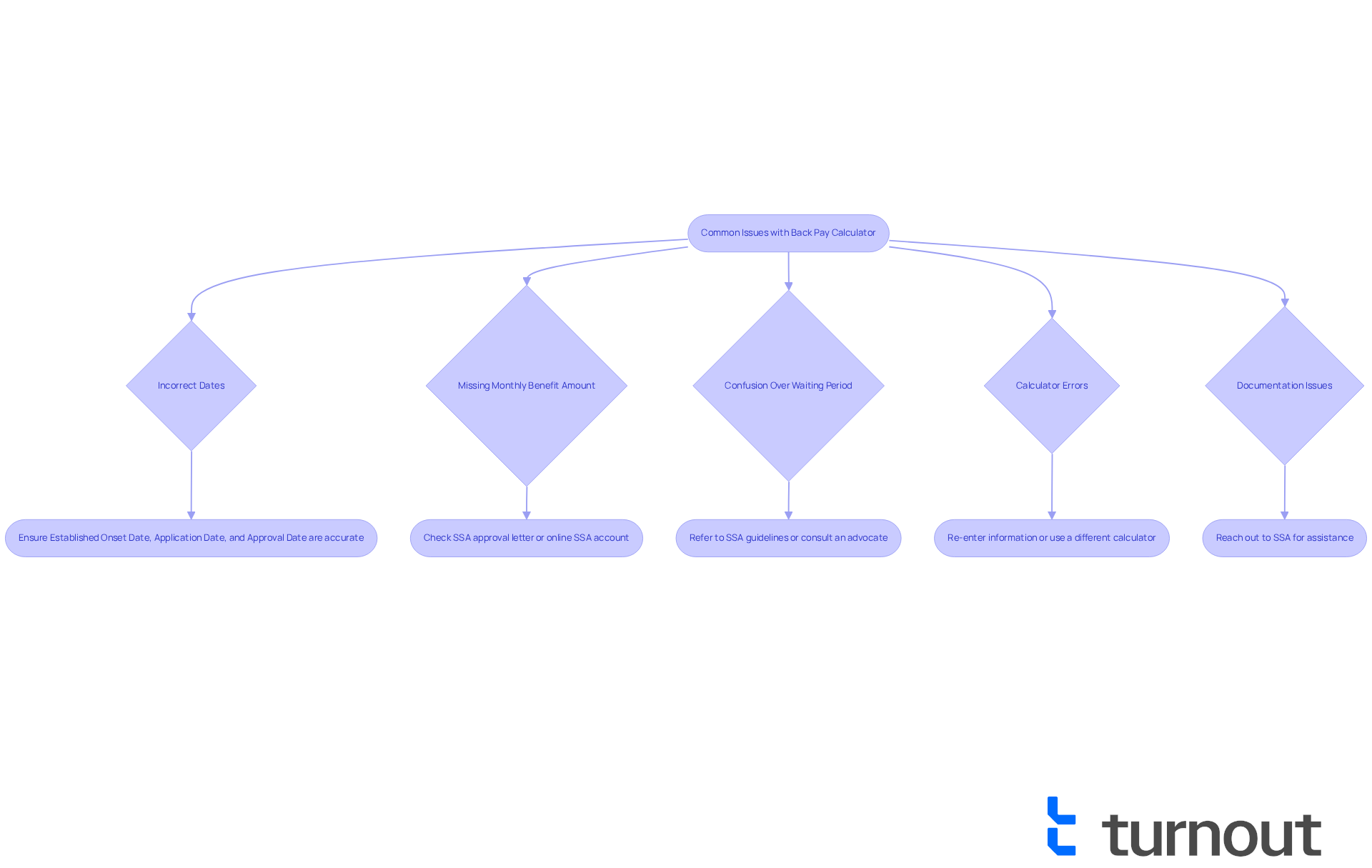

Troubleshoot Common Issues with the Back Pay Calculator

Using the ssi and ssdi back pay calculator can sometimes feel overwhelming, but you're not alone in this journey. Here are some common issues you might encounter and how to address them:

- Incorrect Dates: It’s important to ensure that the Established Onset Date, Application Date, and Approval Date are accurate. Even small mistakes in these dates can lead to unexpected calculations.

- Missing Monthly Benefit Amount: If you’re unsure of your approved monthly benefit amount, don’t hesitate to check your SSA approval letter or log into your online SSA account for clarity.

- Confusion Over the Waiting Period: Remember, the five-month waiting period is standard. If you’re feeling uncertain about how this applies to your situation, we encourage you to refer to SSA guidelines or consult with a knowledgeable advocate who can help.

- Calculator Errors: If the calculator provides results that seem off, try re-entering your information. Sometimes, using a different calculator for comparison can provide more clarity.

- Documentation Issues: If you find yourself lacking certain documents, reach out to the SSA for assistance. They can guide you on how to obtain the necessary records.

By being aware of these common challenges and their solutions, you can approach the process of using the ssi and ssdi back pay calculator with greater confidence. Remember, we’re here to help you every step of the way.

Conclusion

Understanding the SSI and SSDI back pay calculator is crucial for individuals navigating the often complex landscape of disability benefits. This tool not only sheds light on potential retroactive payments but also empowers you to make informed financial decisions during the waiting period for your claims. By utilizing the calculator, you can clarify your expectations, prepare necessary documentation, and enhance your chances of receiving the support you deserve.

The article outlines essential steps to effectively use the back pay calculator, emphasizing the importance of accurate information such as the Established Onset Date, Application Date, and Monthly Assistance Amount. It highlights common challenges you may face and offers practical solutions to overcome these issues. By following the step-by-step instructions and being prepared with the right documentation, you can streamline your claims process and gain a clearer understanding of your financial entitlements.

Ultimately, leveraging the SSI and SSDI back pay calculator is not just about calculating potential payments; it is about gaining control over your financial future. For those embarking on this journey, the message is clear: preparation and knowledge are key. Take the time to gather your information, familiarize yourself with the process, and seek assistance when needed. By doing so, you can navigate the complexities of disability benefits with greater confidence and clarity, ensuring that you are well-equipped to secure the financial support you need.

Frequently Asked Questions

What is the purpose of the SSI and SSDI back pay calculator?

The SSI and SSDI back pay calculator is designed to help individuals estimate the retroactive payments they may qualify for after their disability claims are approved.

How can the back pay calculator assist with financial planning?

The calculator provides insights into potential back pay, which can significantly aid in financial planning during the often lengthy waiting period for benefits.

What expectations can the calculator help clarify?

The calculator helps set realistic expectations regarding payment timelines and amounts from the Social Security Administration (SSA), reducing uncertainty for users.

How does using the calculator prepare individuals for their claims?

Familiarity with the calculation process encourages users to gather essential documentation that supports their claims, enhancing their chances of approval.

What kind of payments can individuals potentially receive through back pay?

Individuals may receive payments for up to 12 months prior to their application date, provided they meet the eligibility criteria.

How much has the SSA paid in retroactive payments to individuals?

The SSA has paid over $7.5 billion in retroactive payments to more than 1.1 million individuals.

Can you provide an example of how the calculator has helped someone?

One individual, Marcus C., used the calculator to anticipate a retroactive payment of $16,000, which greatly influenced his financial planning.

How does the calculator empower individuals navigating the disability claims process?

By using the SSI and SSDI back pay calculator, individuals can clarify the process and make informed decisions about their financial future, approaching the claims process with greater confidence.