Overview

This article serves as a compassionate guide on how to effectively use the SSDI calculator to estimate your Social Security Disability Insurance benefits. We understand that navigating this process can be overwhelming, which is why we emphasize the importance of accurate input data and a clear understanding of the calculation process.

You'll find essential information needed for calculations, along with step-by-step instructions for using the calculator. Additionally, we provide troubleshooting tips for common issues you may encounter. Our aim is to empower you to confidently navigate the complexities of disability benefit estimates. Remember, you're not alone in this journey; we're here to help you every step of the way.

Introduction

Understanding the intricacies of Social Security Disability Insurance (SSDI) can feel overwhelming. We recognize that navigating this complex landscape is not easy. However, the SSDI calculator stands out as a helpful tool, offering clarity and guidance. These calculators provide preliminary benefit estimates based on factors like average indexed monthly earnings and work history, empowering you to take control of your financial future.

Yet, with potential changes on the horizon and the nuances of eligibility requirements, how can you ensure that your calculations are accurate? It's common to feel uncertain about this process. This guide will walk you through essential steps for mastering the SSDI calculator. We’re here to equip you with the knowledge needed to navigate your disability benefits with confidence.

Understand SSDI Calculators and Their Purpose

These tools serve as vital instruments for evaluating potential Social Security Disability Insurance benefits based on your work history and income with an ssdi calculator. They consider essential factors such as average indexed monthly earnings (AIME) and total years of employment, providing you with a preliminary assessment of your benefits. Understanding this information is crucial for your financial planning, as it empowers you to gauge what to expect when using the ssdi calculator for disability support.

We recognize that many Americans are increasingly using the ssdi calculator as a disability assistance tool to evaluate their benefits, reflecting a growing awareness of the importance of financial readiness. For instance, if your AIME is $3,500, you can anticipate a primary insurance amount (PIA) of around $1,676.80. Typically, individuals receiving disability payments receive between $800 and $1,800 each month, with an average of $1,258. This illustrates how the ssdi calculator and other resources can help you better understand your potential benefits.

While the ssdi calculator provides helpful approximations for disability insurance, it's essential to remember that the actual payment amount may vary due to additional factors considered by the Social Security Administration (SSA). Financial consultants emphasize the importance of using these tools as part of a broader financial strategy, especially with potential changes to disability policies in 2025 that could impact eligibility and payment amounts. For example, projected SGA limits for 2025 are expected to increase to $1,530 for non-blind individuals and $2,550 for blind individuals.

Real-life examples show that those who actively use the ssdi calculator often feel more prepared to navigate the complexities of the application process and manage their finances effectively. Moreover, the SSA provides an online tool to evaluate monthly disability payments based on your complete earnings history, which can be an invaluable resource for applicants. Remember, you're not alone in this journey, and we're here to help you every step of the way.

Gather Required Information for Accurate Calculations

To effectively use the SSDI calculator and obtain accurate benefit estimates, it's essential to gather the following information:

- Birth Year: Your year of birth is a crucial element in assessing both your eligibility and the extent of assistance you may obtain.

- Average Annual Income: Record your typical earnings over your career, especially during your highest-earning years, as this greatly affects your calculation of advantages.

- Work History: Provide a comprehensive account of your work history, detailing the number of years worked and the types of jobs held. This information is vital for accurate assessments.

- Social Security Statement: If accessible, your Social Security statement will give you a detailed summary of your earnings history and anticipated advantages. This document is crucial as it reflects your contributions and possible advantages, underscoring the importance of precise documentation.

- Disability Onset Date: Knowing the date your disability began is essential for understanding your eligibility and any potential back pay you may be entitled to.

We understand that navigating this process can feel overwhelming. It's important to note that the maximum monthly payment for SSDI in 2025 is $4,018, highlighting the potential advantages available to claimants. Additionally, the significant gainful activity limit for 2025 is set at $1,620 monthly, which impacts eligibility and assistance calculations.

Having this information readily accessible will simplify the process and improve the precision of the calculations produced by the SSDI calculator tool. Remember, precise information is crucial; as specialists highlight, 'The accuracy of your input directly affects the dependability of your benefit estimates.' You're not alone in this journey—we're here to help you every step of the way.

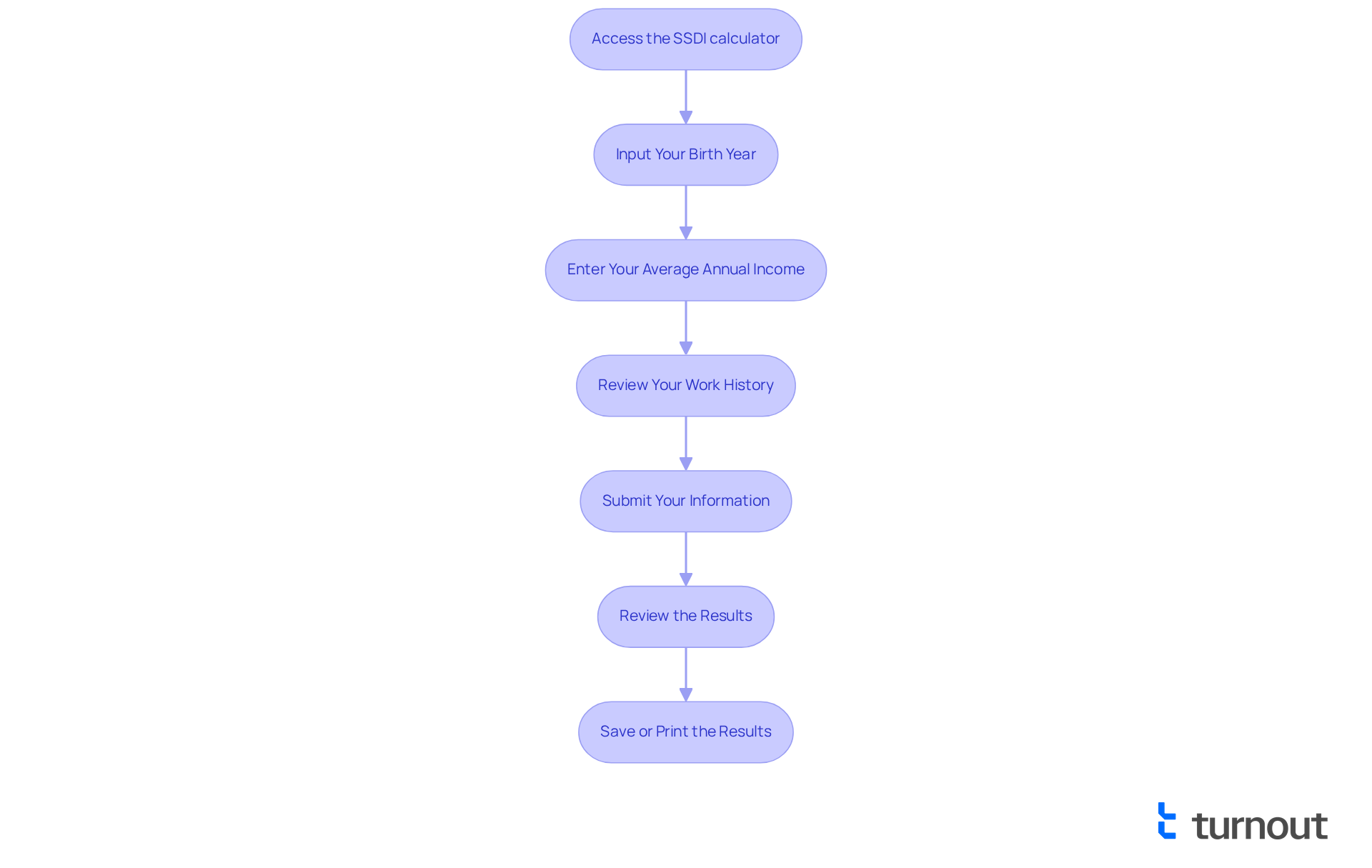

Follow Step-by-Step Instructions to Use the SSDI Calculator

To effectively utilize the SSDI calculator, please follow these supportive steps:

- Access the SSDI calculator by navigating to the Social Security Administration's official website or a reputable platform. This ensures you are using a reliable source for your calculations.

- Input Your Birth Year: Enter your birth year in the specified field. This is essential as it helps determine your eligibility, affecting the computation of your benefits.

- Enter Your Average Annual Income: Provide your average annual income, focusing on your highest-earning years—typically from jobs where you contributed to Social Security. Precise input here is crucial, as it directly influences your projected benefits.

- Review Your Work History: If prompted, detail your work history, including the number of years worked and types of jobs held. This information is vital for the SSDI calculator to deliver an accurate assessment.

- Submit Your Information: After inputting all required data, submit it to create an estimate of your disability support. This step is straightforward yet critical for obtaining your results.

- Review the Results: Carefully examine the estimated benefits provided by the SSDI calculator. Take note of any additional insights or recommendations. Understanding these results can significantly enhance your chances of approval, as highlighted by experts in the field.

- Save or Print the Results: For future reference, save or print the results of your calculation. This can be helpful when preparing your disability benefits application. Keeping a record of your estimates can aid in discussions with advocates or during the application process.

By following these steps, you can gain valuable insights into your potential disability benefits. This understanding can improve your knowledge of the application process and enhance your chances of approval. As Brian Figeroux, Esq. notes, 'Preparation is essential for a seamless application process.' Remember, you are not alone in this journey, and we are here to help you navigate the complexities of disability benefit calculations.

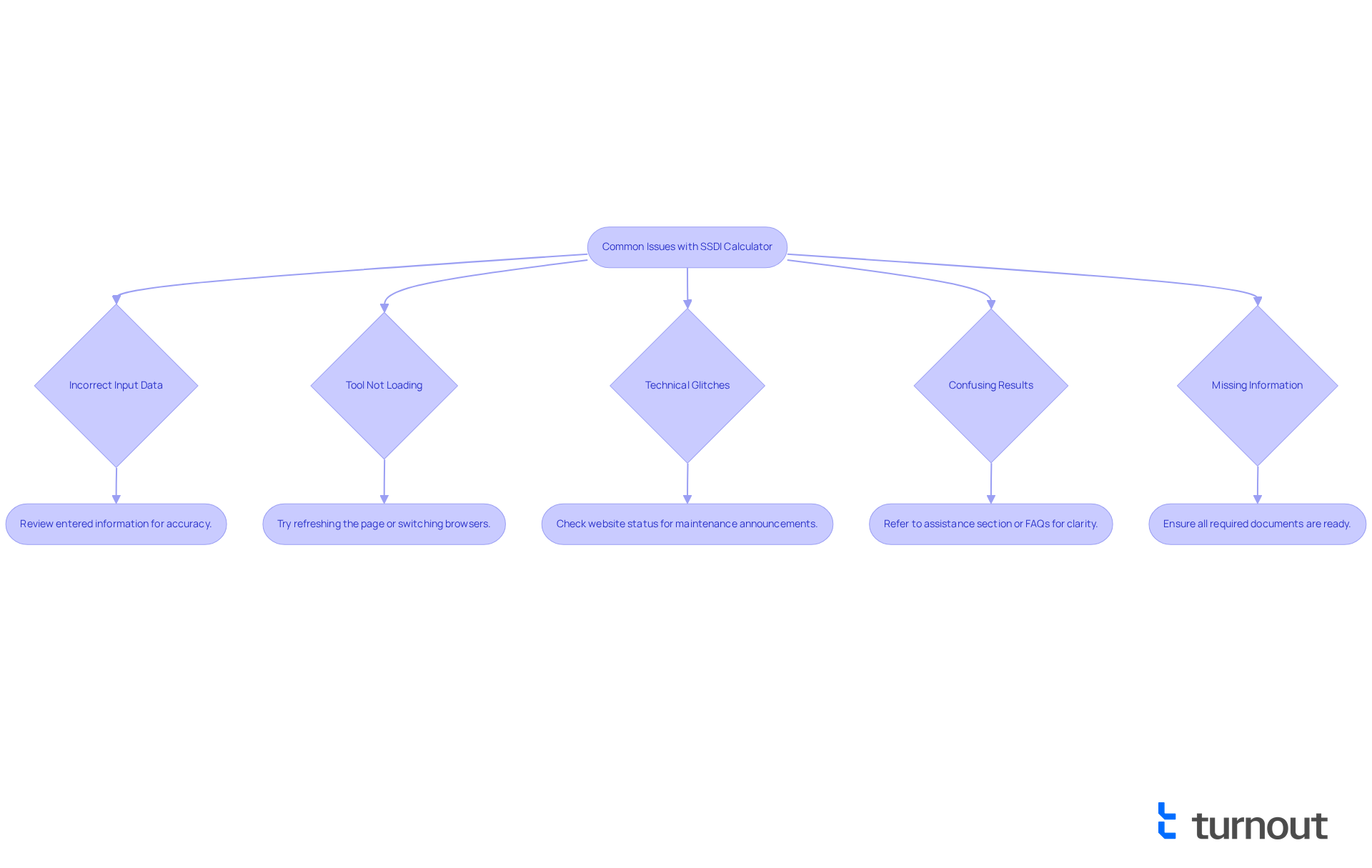

Troubleshoot Common Issues When Using the Calculator

Navigating the ssdi calculator can sometimes feel overwhelming, and we understand that you might encounter a few common challenges. Here are some supportive troubleshooting tips to help you overcome these hurdles:

-

Incorrect Input Data: It's important to carefully review all entered information for accuracy. Ensure that your birth year and income figures are correct, as even minor errors can lead to misleading estimates. Remember, in 2025, the average SSDI payment for individuals is $1,580, which underscores the importance of accurate calculations.

-

Tool Not Loading: If the tool isn't loading, don't worry. Try refreshing the page or switching to a different web browser. Clearing your browser's cache can also resolve loading issues, making it easier for you to access the tool.

-

Technical Glitches: If you encounter any technical problems, check the website's status or look for announcements regarding maintenance or outages that might affect functionality. Many users have faced similar issues, so staying informed can help you troubleshoot effectively.

-

Confusing Results: If the results seem unclear, we encourage you to refer to the assistance section or FAQs for definitions and explanations of the terms and figures presented. As attorney Bethany K. Laurence notes, the precise amount of social security disability benefits is unique for each individual, making clarity essential.

-

Missing Information: If you’re prompted for more details, ensure you have all required documents and data ready before trying to use the tool again. This preparation can make your experience smoother.

By following these helpful suggestions, you can manage any issues that arise while using the system, leading to a more seamless and accurate experience. Remember, Turnout advocates for over 5 million Americans seeking SSDI benefits, emphasizing the importance of using tools like the calculator correctly. You're not alone in this journey, and we're here to help you every step of the way.

Conclusion

Mastering the SSDI calculator is an essential step for anyone seeking to understand their potential Social Security Disability Insurance benefits. We recognize that navigating this process can feel overwhelming, but these calculators provide a preliminary estimate based on critical factors like your work history and income. They empower you to take charge of your financial future. By utilizing this tool effectively, you can gain clarity on what to expect and prepare for the complexities of the application process.

Throughout this article, we shared key insights, including the importance of gathering accurate information, such as your birth year, average annual income, and work history. This ensures reliable benefit estimates. The step-by-step instructions offered a clear pathway for you to navigate the calculator, while troubleshooting tips addressed common challenges that may arise. Each of these components plays a vital role in improving the accuracy of the calculations and enhancing your overall experience.

Ultimately, the significance of understanding and utilizing the SSDI calculator cannot be overstated. It serves as a crucial resource for individuals like you navigating the disability benefits landscape, equipping you with the knowledge needed to make informed decisions. Engaging with these tools fosters preparedness and reinforces the importance of financial readiness in the face of potential changes to disability policies. Remember, taking the time to master the SSDI calculator today can pave the way for a more secure tomorrow. You're not alone in this journey, and we're here to help you every step of the way.

Frequently Asked Questions

What is the purpose of an SSDI calculator?

An SSDI calculator is a tool used to evaluate potential Social Security Disability Insurance benefits based on an individual's work history and income, considering factors such as average indexed monthly earnings (AIME) and total years of employment.

How does an SSDI calculator help with financial planning?

By providing a preliminary assessment of potential benefits, an SSDI calculator helps individuals gauge what to expect from disability support, which is crucial for financial planning.

What factors are considered by the SSDI calculator?

The SSDI calculator considers average indexed monthly earnings (AIME) and total years of employment to estimate potential benefits.

What is the average primary insurance amount (PIA) based on an AIME of $3,500?

If your AIME is $3,500, you can anticipate a primary insurance amount (PIA) of around $1,676.80.

What is the typical range of monthly disability payments?

Individuals receiving disability payments typically receive between $800 and $1,800 each month, with an average payment of $1,258.

Are the estimates provided by the SSDI calculator guaranteed?

No, the estimates provided by the SSDI calculator are approximations, and the actual payment amount may vary due to additional factors considered by the Social Security Administration (SSA).

What changes to disability policies are expected in 2025?

Projected substantial gainful activity (SGA) limits for 2025 are expected to increase to $1,530 for non-blind individuals and $2,550 for blind individuals, which could impact eligibility and payment amounts.

How can using an SSDI calculator benefit applicants?

Individuals who actively use the SSDI calculator often feel more prepared to navigate the application process and manage their finances effectively.

Does the SSA provide additional resources for evaluating disability payments?

Yes, the SSA offers an online tool to evaluate monthly disability payments based on a complete earnings history, which can be very helpful for applicants.