Overview

Navigating the Social Security Disability Insurance (SSDI) application process can feel overwhelming, and we understand that. This article aims to equip you with the essential knowledge needed to approach this journey with confidence. By understanding the eligibility criteria, gathering the necessary documentation, and addressing common challenges, you can significantly enhance your chances of securing benefits.

Thorough preparation is key. We encourage you to take the time to gather comprehensive documentation that supports your application. Remember, you are not alone in this process; many have faced similar challenges and found success through careful planning and support.

Ultimately, our goal is to empower you. With the right resources and guidance, you can navigate the SSDI application process more effectively. We’re here to help you every step of the way, ensuring you feel supported and informed as you seek the benefits you deserve.

Introduction

Navigating the intricacies of the Social Security Disability Insurance (SSDI) application process can feel overwhelming. We understand that over 11 million disabled Americans depend on this vital program, making it essential to grasp its nuances. For those seeking financial support during difficult times, this understanding is crucial. Yet, it’s common to face challenges, as nearly 70% of initial applications are denied. This raises an important question: how can you effectively master this complex system to secure the benefits you deserve?

In this article, we will explore the critical steps, eligibility criteria, and common pitfalls to avoid. Our goal is to empower you to approach your SSDI journey with confidence and clarity. Remember, you are not alone in this process, and we’re here to help you every step of the way.

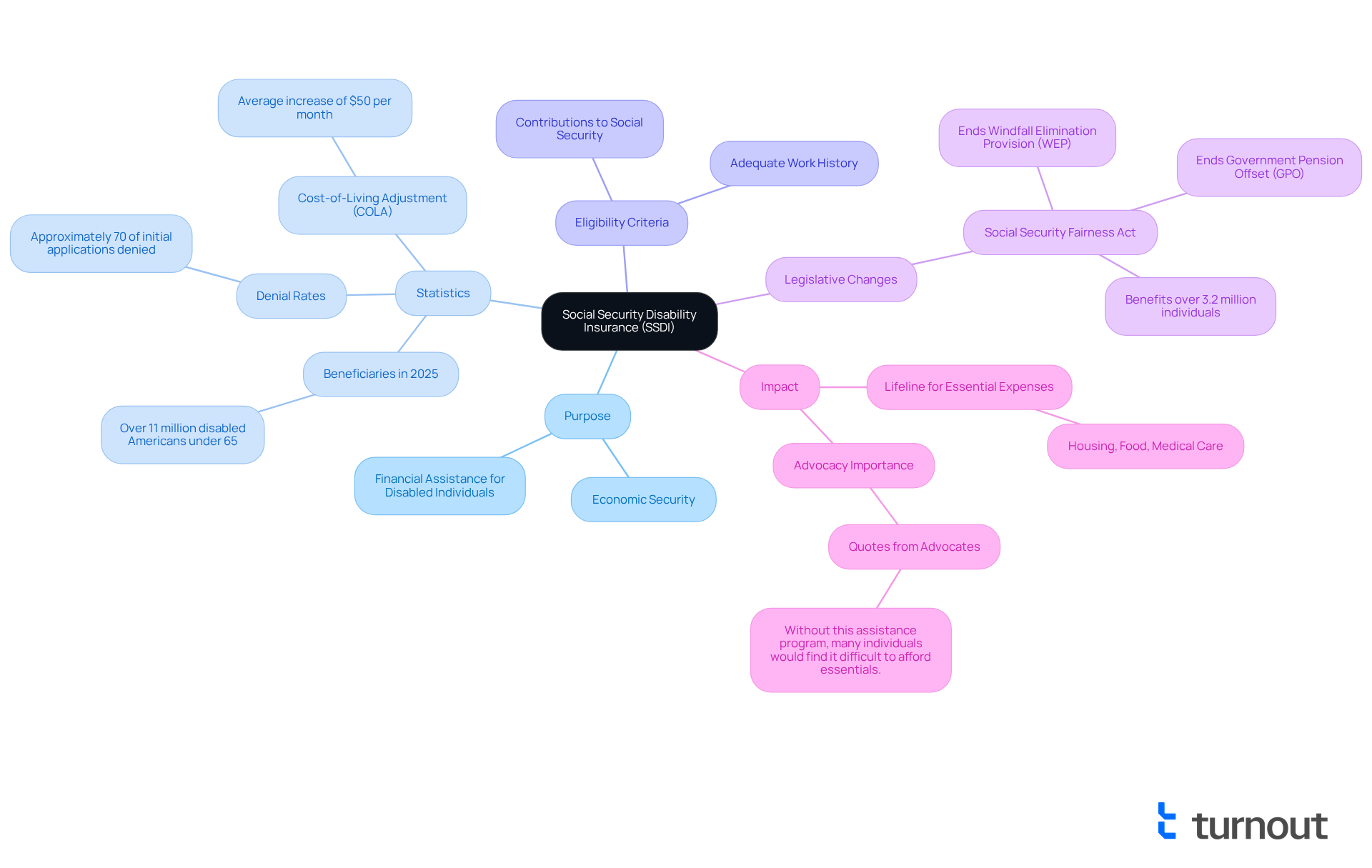

Understand Social Security Disability Insurance (SSDI)

Disability social security insurance is a vital federal program that provides essential financial assistance to individuals unable to work due to qualifying disabilities. In 2025, more than 11 million disabled Americans under 65 will depend on these benefits, highlighting the program's crucial role in offering economic security. However, we understand that approximately 70% of initial disability benefit applications are denied, which underscores the challenges many face during this difficult time. To be eligible for these benefits, applicants must demonstrate an adequate work history and have contributed to Social Security through tax payments. This program is designed to support those who have paid into the system and now encounter unexpected hardships.

The disability support program serves a critical purpose: it aims to assist individuals who have become disabled and are unable to earn a living. In 2025, the highest federal payment for disability benefits will rise, reflecting a 2.5% cost-of-living adjustment (COLA), resulting in an average increase of approximately $50 per month for recipients. This adjustment is vital for helping beneficiaries keep pace with rising living costs.

Changes to disability benefits eligibility criteria in 2025 will also impact applicants. The Social Security Fairness Act, which ends the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), will benefit over 3.2 million individuals, especially those with non-covered pensions, ensuring they receive fairer benefits. This legislative change highlights the importance of advocacy in shaping policies that affect the lives of disabled individuals.

Real-world examples illustrate the significant influence of disability benefits. For many, these payments are a lifeline, covering essential expenses such as housing, food, and medical care. Disability advocates emphasize that disability social security insurance is not just a safety net; it is an essential component of financial stability for millions of Americans. As one supporter poignantly remarked, "Without this assistance program, many individuals would find it difficult to afford essentials, such as food, clothing, or housing."

Understanding the disability insurance program's purpose, eligibility criteria, and benefits is crucial for successfully navigating the application process. With the right information and support, individuals can better advocate for themselves and secure the assistance they truly need. Remember, you are not alone in this journey; we’re here to help.

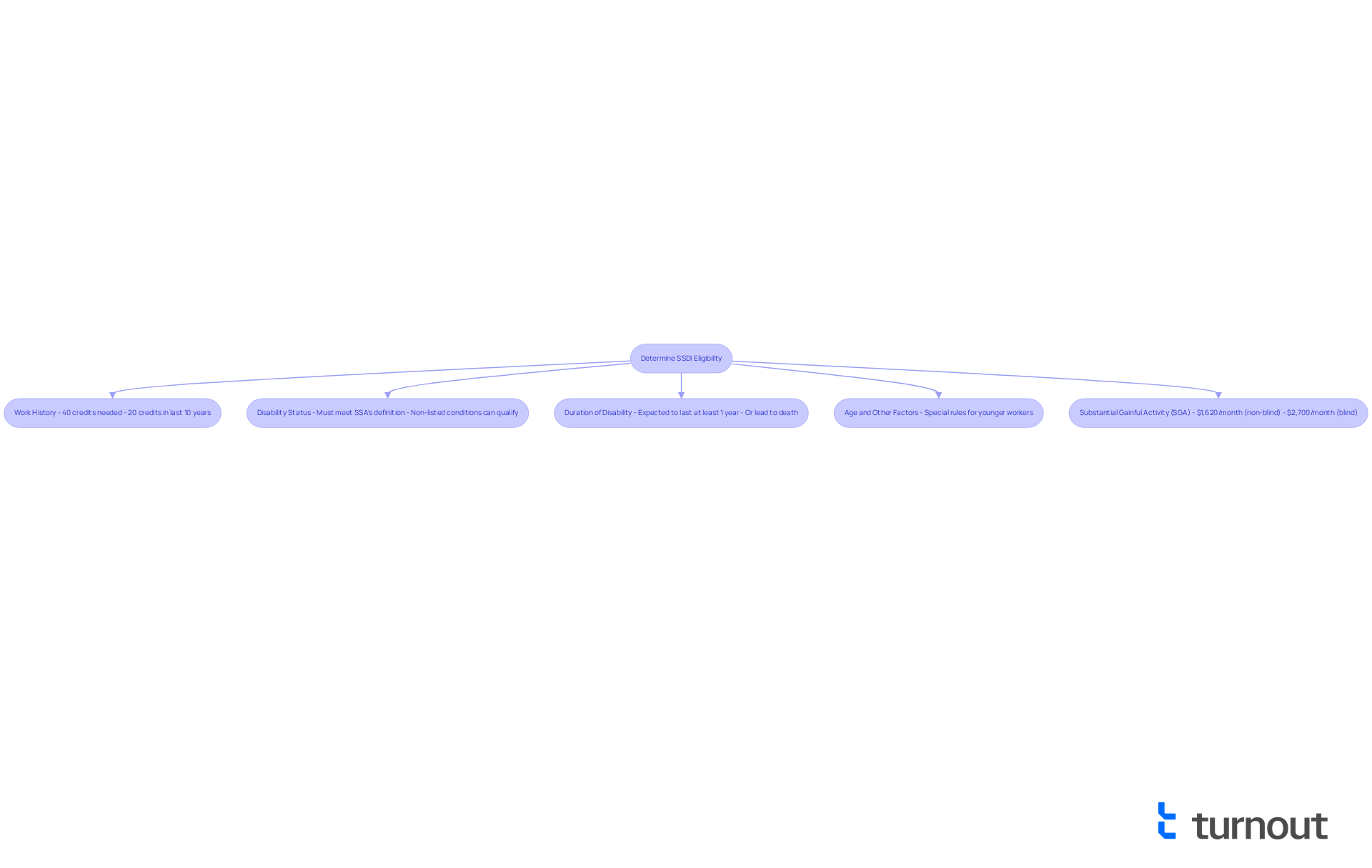

Determine Your Eligibility for SSDI

Determining your eligibility for Social Security Disability Insurance (SSDI) can feel overwhelming, but we’re here to help. Consider these important criteria:

- Work History: You need to have been employed in positions covered by government benefits and earned enough work credits. Typically, this means accumulating 40 credits, with at least 20 earned in the last 10 years.

- Disability Status: Your condition must meet the Social Security Administration's (SSA) definition of disability, which means it significantly limits your ability to perform basic work activities. While the SSA maintains a list of qualifying conditions, it’s important to know that individuals with non-listed conditions can still qualify by demonstrating that their disability prevents them from working.

- Duration of Disability: The disability should be expected to last at least one year or lead to death.

- Age and Other Factors: Special rules may apply for younger workers and those with specific conditions.

- Substantial Gainful Activity (SGA): For 2025, the SGA threshold is $1,620 per month for non-blind individuals and $2,700 for blind individuals. Exceeding these limits could result in application denials.

By thoughtfully evaluating these factors, you can better understand your eligibility to apply for disability benefits. It’s important to recognize that approximately 68% of SSDI applicants meet the disability status criteria. This underscores the need for thorough documentation and a clear understanding of the SSA's requirements. Furthermore, keep in mind that disability claims typically take three to five months for assessment and decision. Consulting with a professional can clarify work history requirements and enhance your chances of a successful application. Remember, you are not alone in this journey, and support is available to guide you through the process.

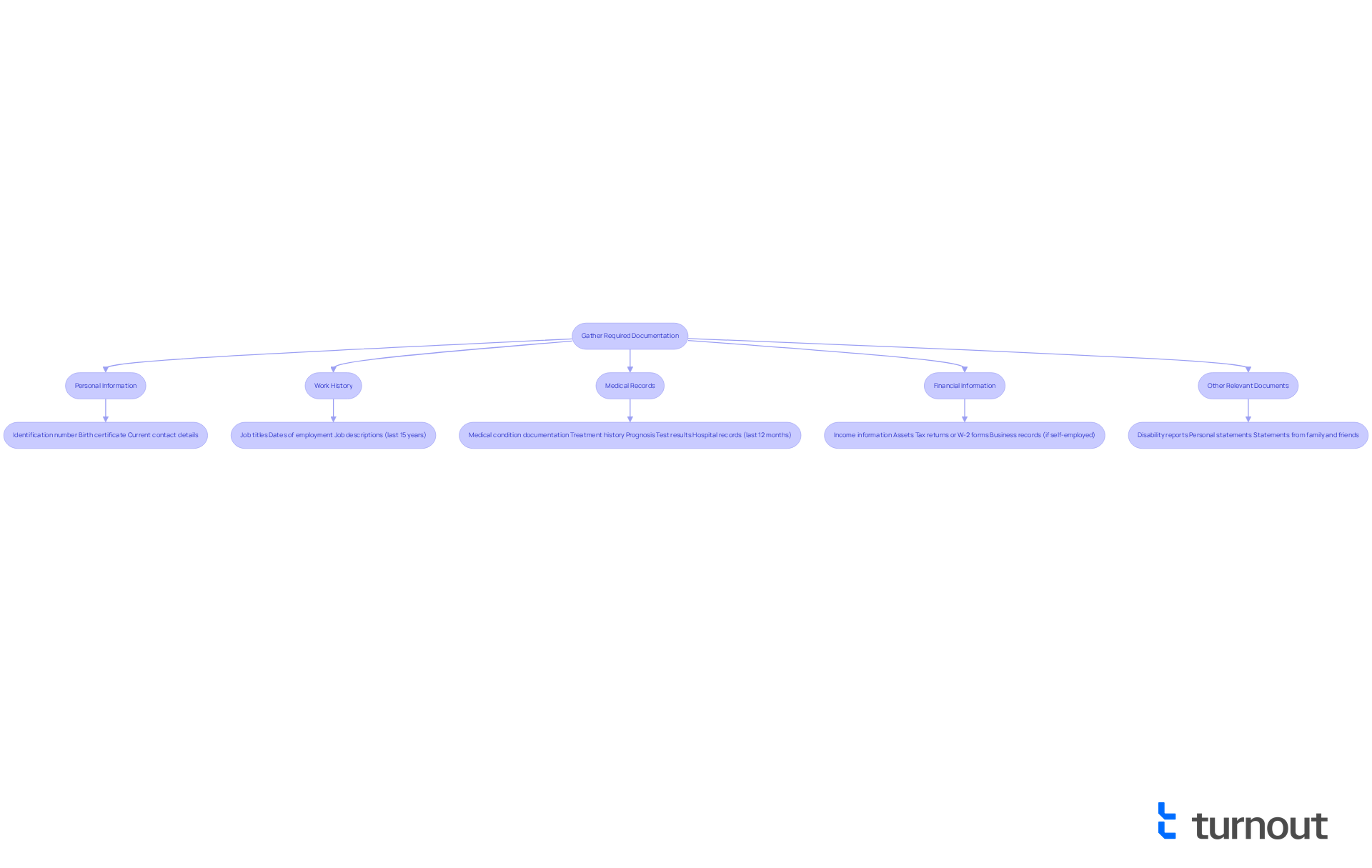

Gather Required Documentation for Your Application

Before applying for SSDI, we understand that gathering the necessary documentation can feel overwhelming. However, taking this step is crucial to enhance your chances of approval. Here’s what you’ll need:

- Personal Information: Make sure to include your identification number, birth certificate, and current contact details.

- Work History: Prepare a detailed work history that outlines job titles, dates of employment, and descriptions of your job duties over the past 15 years. This can help illustrate your work experience.

- Medical Records: Compile comprehensive documentation from healthcare providers that details your medical condition, treatment history, and prognosis. This should encompass test results, diagnoses, and relevant hospital records, ideally covering at least 12 months to demonstrate the persistence and severity of your condition. Remember, medical evidence should be as up-to-date as possible—ideally within 90 days of your submission date. It’s important to note that the Social Security Administration (SSA) reviews medical records, which can take 3-5 months, so timely preparation is essential.

- Financial Information: Provide information about your income, assets, and any other benefits you receive, which may include tax returns or W-2 forms if self-employed. If you are self-employed, please submit additional documentation, including business records and profit and loss statements.

- Other Relevant Documents: Gather any additional paperwork that supports your claim, such as disability reports, personal statements detailing daily limitations, or statements from family members and friends.

Having these documents arranged and prepared will simplify the submission process, greatly enhancing your likelihood of a successful disability claim. Keep in mind, around 65-70% of initial disability claims are rejected, and incomplete medical records are a primary reason for delays and rejections. So, careful preparation is crucial. Remember, you are not alone in this journey; we’re here to help you through it.

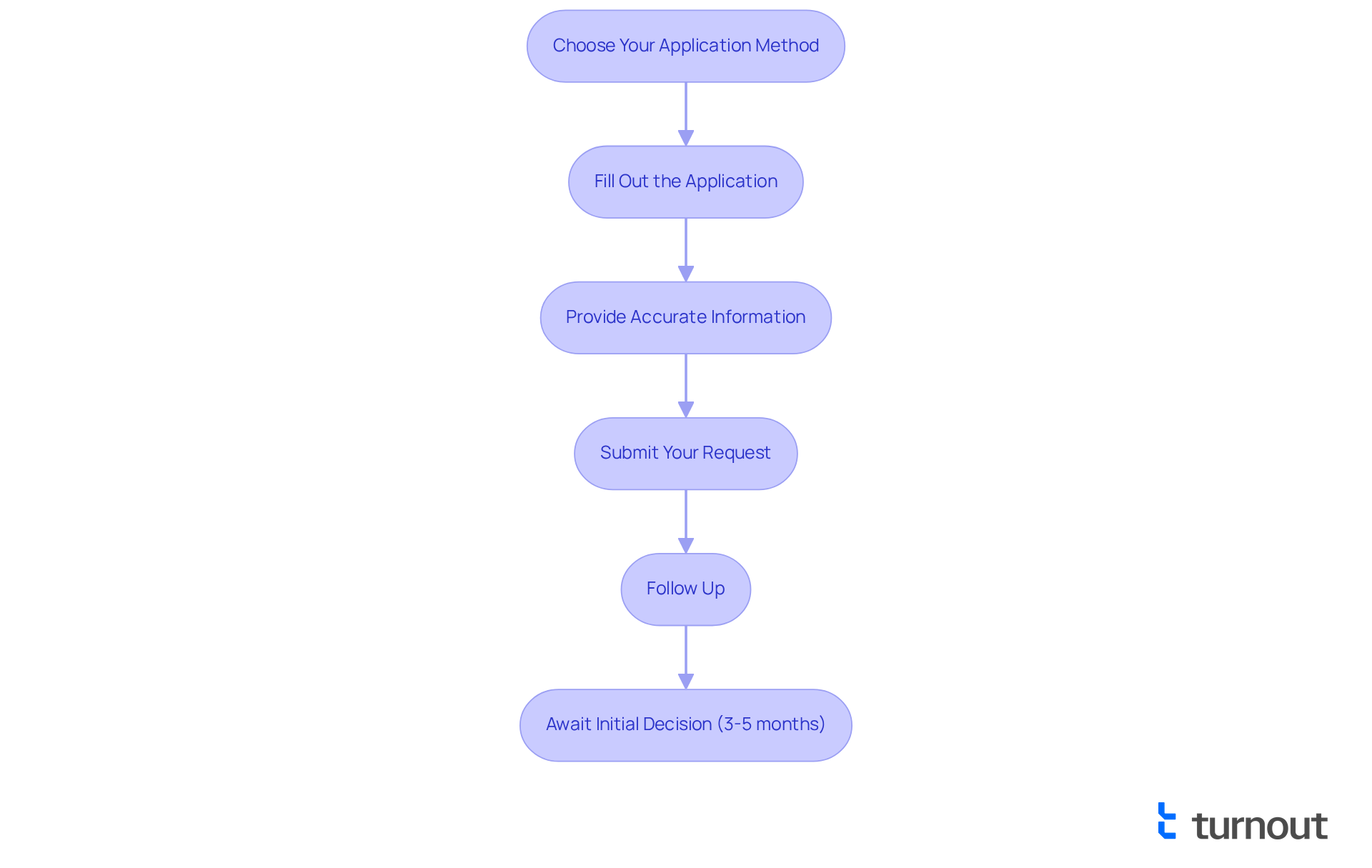

Complete the SSDI Application Process

Navigating the disability social security insurance application process can feel overwhelming, but we’re here to help. By following these essential steps, you can approach this journey with confidence:

-

Choose Your Application Method: You have several options for applying—online through the SSA website, by phone, or in person at your local Social Security office. Online submissions are often the most efficient choice.

-

Fill Out the Application: If you decide to apply online, start by creating an account on the SSA website and completing Form SSA-16. For phone or in-person submissions, simply request the necessary forms from the SSA.

-

Provide Accurate Information: It’s crucial to ensure that all information is accurate and complete. Take the time to carefully review your work history, medical details, and personal information. This attention to detail can help you avoid common errors that lead to delays or denials. Remember, it’s common for over half of all initial requests for disability social security insurance to be denied, so being thorough is essential.

-

Submit Your Request: Once you’ve completed the form, send it along with any necessary documentation. If you’re applying online, follow the prompts to submit electronically and ensure all documents are attached as needed.

-

Follow Up: After submission, it’s important to monitor your status through the SSA website or by contacting the SSA directly. Be prepared to provide additional information if requested; prompt responses can significantly help expedite the process.

Keep in mind that the SSDI request process typically takes three to five months for an initial decision. However, delays can happen, especially if additional information is needed or if an appeal is required. Additionally, after approval, there is a mandatory five-month waiting period before benefits begin. By understanding these steps and being meticulous in your submission, you can greatly enhance your likelihood of approval for disability social security insurance. Remember, thorough documentation illustrating the seriousness of your condition is essential. And if your request is denied, know that you have the right to contest the ruling. You are not alone in this journey, and we are here to support you every step of the way.

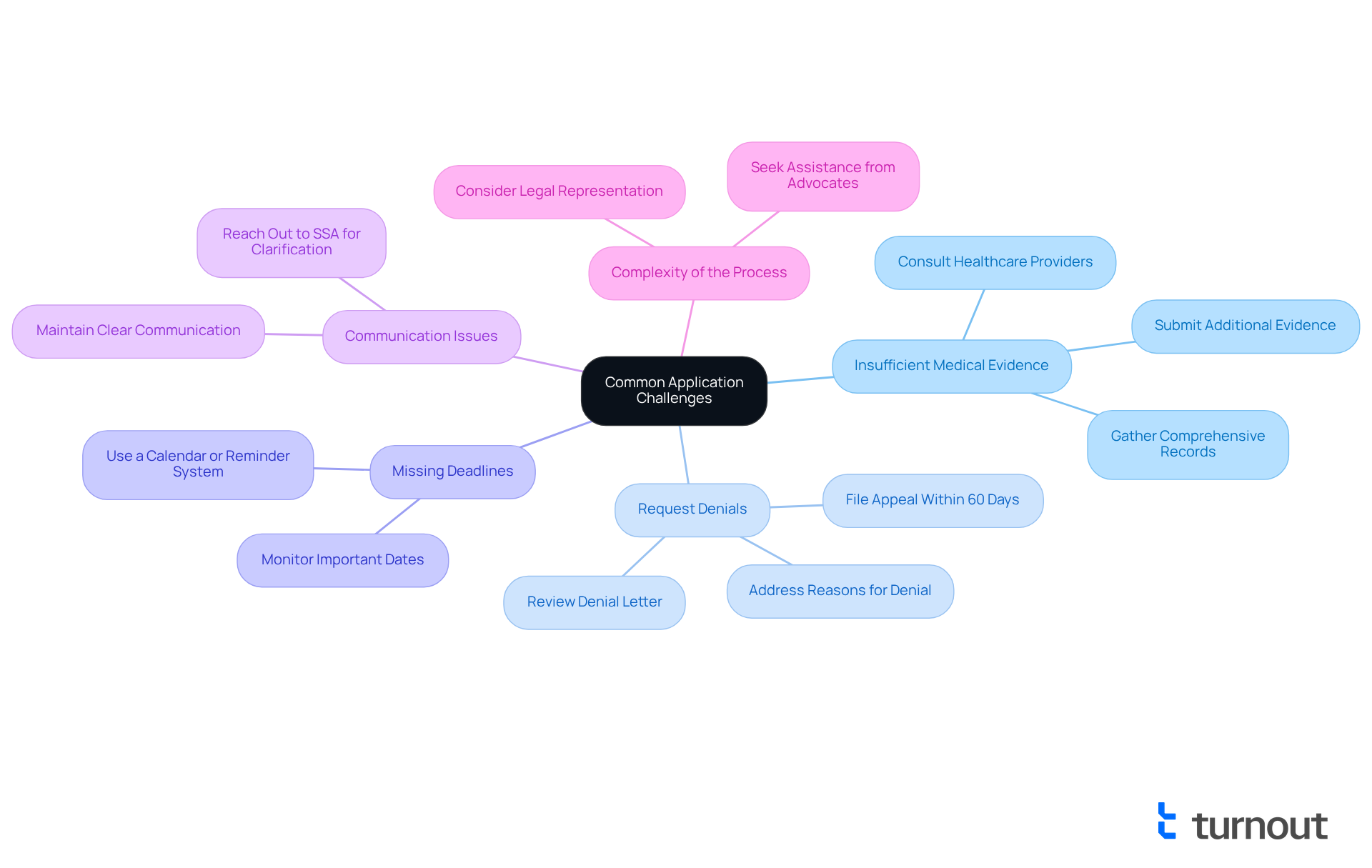

Troubleshoot Common Application Challenges

Navigating the disability social security insurance process can feel overwhelming, and we understand that this journey may be filled with challenges. However, by recognizing typical obstacles and how to address them, you can significantly improve your chances of success. Here are some common issues applicants face, along with supportive strategies to help you through:

-

Insufficient Medical Evidence: One of the most frequent reasons for disability benefits denials is a lack of adequate medical documentation. To bolster your case, it’s essential to gather comprehensive records from recognized healthcare providers. If your request is denied due to insufficient evidence, don’t hesitate to collect additional medical records and consult your healthcare provider for supporting statements that clarify your condition and limitations. Remember, approximately 65-70% of initial disability benefit requests are rejected, highlighting the importance of thorough documentation.

-

Request Denials: If you find your request denied, take a moment to carefully review the denial letter to understand the specific reasons behind it. You have 60 days to file an appeal, so acting promptly is crucial. Many applicants find success in appealing denials by addressing the reasons outlined in the letter and submitting additional evidence. Missing this critical timeframe can lead to case dismissal, so it’s vital to stay on top of your timeline.

-

Missing Deadlines: Keeping track of deadlines is essential in the SSDI process. We encourage you to use a calendar or reminder system to monitor all important dates, including that 60-day window for filing appeals after a denial. Missing these deadlines can lead to case dismissal, so staying organized is key.

-

Communication Issues: If you have questions or need clarification about your request or appeal, please reach out to the Social Security Administration (SSA). Clear and proactive communication can help resolve issues quickly and keep your case moving forward. As Brian Figeroux, Esq. wisely notes, "Preparation is crucial for a seamless submission process."

-

Complexity of the Process: The disability benefits submission process can indeed be daunting. If you’re feeling lost, consider seeking assistance from a disability benefits advocate or a trusted friend or family member who can help guide you through the process. Engaging with experienced advocates can significantly enhance your chances of a successful appeal, as they understand the nuances of the system and can provide invaluable support. Legal representation can also improve your odds of success, as attorneys are skilled at presenting cases effectively and challenging unfavorable testimony.

By addressing these common challenges with diligence and support, you can navigate the disability social security insurance application process more effectively. Remember, you are not alone in this journey, and with the right guidance, you can secure the benefits you deserve.

Conclusion

Navigating the Social Security Disability Insurance (SSDI) application process can feel overwhelming for many individuals facing disabilities. It's important to understand the program's purpose, eligibility criteria, and the necessary steps to apply, as this knowledge can significantly enhance your chances of securing essential financial support. Remember, you are not alone in this complex journey; preparation and thorough documentation are key.

Key insights to consider include:

- Demonstrating a solid work history

- Meeting the SSA's definition of disability

- Gathering comprehensive medical and financial records

We understand that the application process can be challenging, with common reasons for denials and the importance of timely appeals. By staying proactive and organized, you can navigate these hurdles more effectively.

Ultimately, the SSDI program serves as a vital safety net for millions, providing crucial support during difficult times. It’s essential to take charge of your application, seek assistance when needed, and remain persistent in the face of challenges. With the right information and support, securing the benefits you deserve is within reach. Advocacy and preparation are your keys to mastering the SSDI application process, and we’re here to help you every step of the way.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial assistance to individuals who are unable to work due to qualifying disabilities. It plays a crucial role in offering economic security to disabled Americans.

How many people are expected to rely on SSDI benefits in 2025?

In 2025, more than 11 million disabled Americans under the age of 65 are expected to depend on SSDI benefits.

What percentage of initial disability benefit applications are denied?

Approximately 70% of initial disability benefit applications are denied.

What are the eligibility requirements for SSDI?

To be eligible for SSDI, applicants must demonstrate an adequate work history, have contributed to Social Security through tax payments, meet the SSA's definition of disability, and the disability must last at least one year or lead to death.

How does the Social Security Fairness Act impact SSDI benefits?

The Social Security Fairness Act will end the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), benefiting over 3.2 million individuals, particularly those with non-covered pensions, ensuring they receive fairer benefits.

What is the average increase in SSDI payments expected in 2025?

In 2025, SSDI payments will see a 2.5% cost-of-living adjustment (COLA), resulting in an average increase of approximately $50 per month for recipients.

What are the criteria for determining SSDI eligibility?

Key criteria include having a sufficient work history (typically 40 credits, with at least 20 earned in the last 10 years), meeting the SSA's definition of disability, having a disability expected to last at least one year, and not exceeding the substantial gainful activity (SGA) limits for income.

What are the SGA thresholds for 2025?

For 2025, the SGA threshold is $1,620 per month for non-blind individuals and $2,700 for blind individuals.

How long does it typically take to process SSDI claims?

Disability claims typically take three to five months for assessment and decision.

What should applicants keep in mind when applying for SSDI?

Applicants should ensure thorough documentation, understand the SSA's requirements, and consider consulting with a professional to enhance their chances of a successful application.