Overview

Navigating the process of applying for long-term disability benefits can feel overwhelming, but we're here to help. This article outlines a four-step approach designed to support you through this journey.

- First, it's essential to understand the eligibility criteria that apply to your situation.

- Next, gather the necessary documentation, including comprehensive medical records that illustrate your condition.

- Completing the application form is the third step, where you clearly articulate how your disability impacts your daily life. This clarity is crucial, as it significantly increases your chances of approval.

- Finally, don’t forget to follow up on your submission.

Remember, thorough preparation and attention to detail can make all the difference in your application process.

You are not alone in this journey, and taking these steps can lead to a brighter future. With care and dedication, you can navigate this process successfully.

Introduction

Navigating the maze of long-term disability benefits can often feel daunting. We understand that for many, grappling with debilitating conditions adds to the challenge. It's crucial to grasp the eligibility criteria and application process, as this knowledge can significantly impact your financial stability during these trying times.

What if a simple misstep in documentation or application details could mean the difference between approval and denial? This guide unveils the essential steps to master the application process, empowering you to confidently pursue the benefits you deserve.

Remember, you're not alone in this journey; we're here to help.

Understand Long-Term Disability Benefits and Eligibility Criteria

Long-term disability assistance is a vital source of financial support for those who cannot work due to disabling conditions. We understand that navigating this process can feel overwhelming, but knowing the qualifications can empower you.

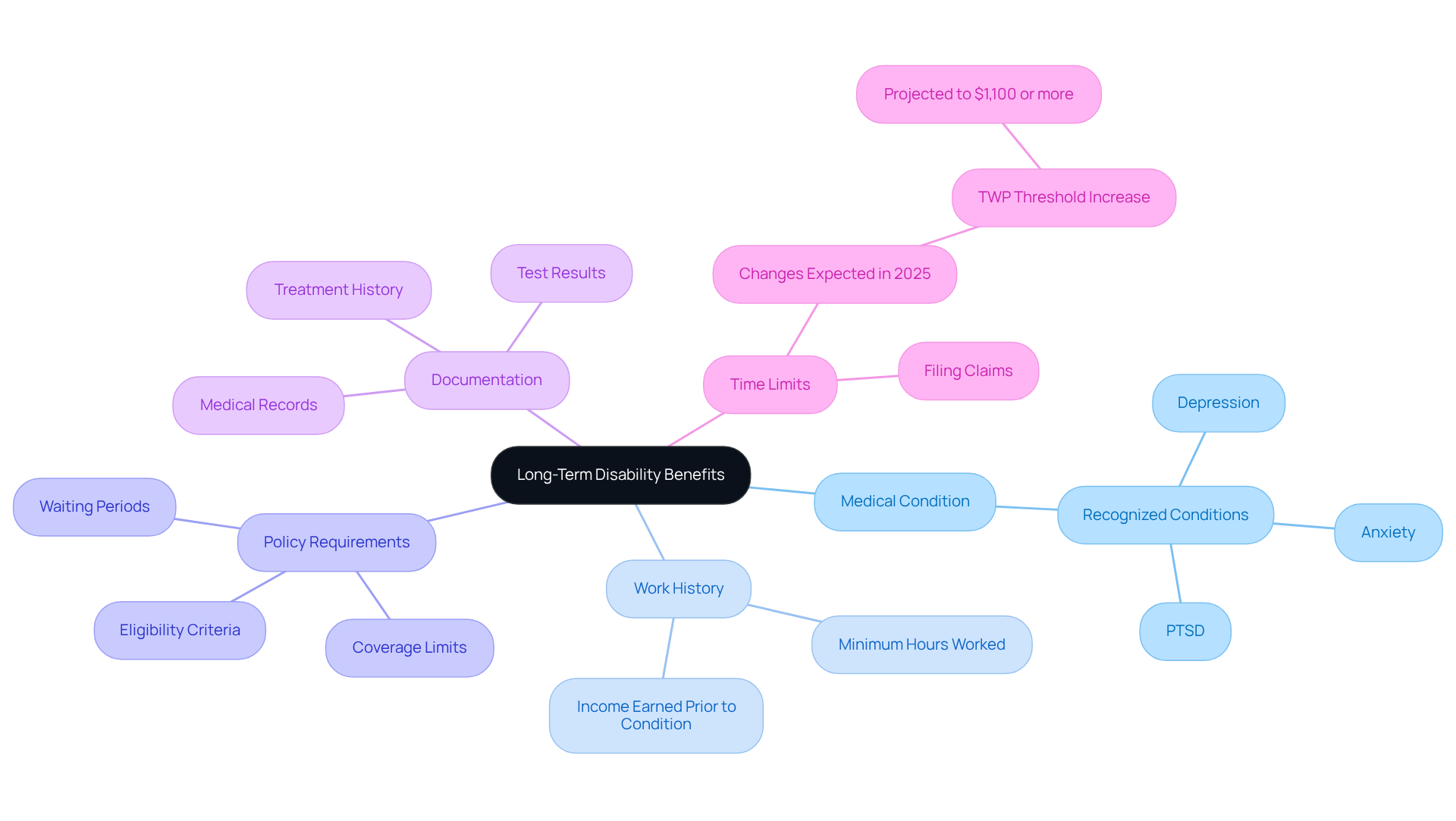

To qualify for these benefits, applicants typically need to meet specific criteria:

-

Medical Condition: It's essential to have a documented medical condition that significantly impairs your ability to perform job duties. Conditions such as depression, anxiety, and PTSD are recognized under the Social Security Administration’s guidelines.

-

Work History: Many policies require that candidates possess a specific work history, often necessitating a minimum amount of hours worked or income earned prior to the onset of the condition.

-

Policy Requirements: Each insurance policy has unique eligibility criteria, including definitions of disability, waiting periods, and coverage limits. For example, the Long-Term Disability Plan typically offers benefits equal to 70% of your salary, subject to IRS limits, with a minimum monthly benefit of $50.

-

Documentation: Providing adequate health-related evidence is crucial to support your claims. This includes comprehensive medical records, treatment history, and relevant test results. While the percentage of applicants who successfully meet these requirements can vary, thorough documentation significantly enhances your chances of approval.

-

Time Limits: It's essential to be aware of any time limits for filing claims, as these can differ by policy. Staying informed about changes to long-term disability support requirements, especially those expected in July 2025, is vital for timely submissions. Additionally, the anticipated Trial Work Period (TWP) threshold for 2025 may increase to $1,100 or more, which could impact those considering a return to work while receiving assistance.

By understanding these criteria, you can better assess your eligibility and prepare effectively for the application for long term disability. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Gather Required Documentation for Your Application

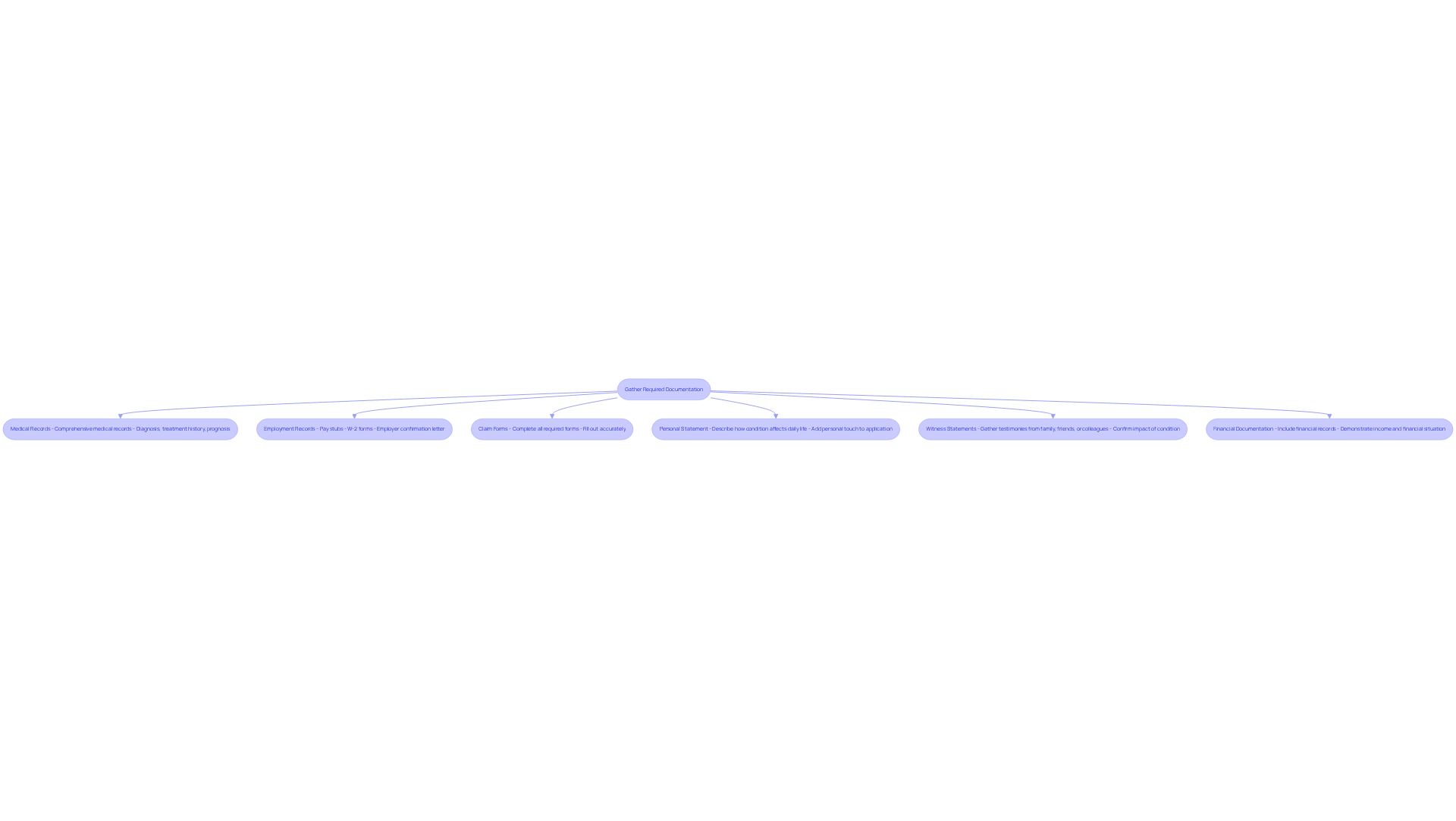

Applying for long-term disability benefits can feel overwhelming, but gathering the right documents can make the process smoother. Here are some essential items you'll need:

-

Medical Records: Start by obtaining comprehensive medical records from your healthcare providers. These records should detail your diagnosis, treatment history, and prognosis. This documentation is vital, as it forms the cornerstone of your claim, as emphasized by the Social Security Administration.

-

Employment Records: Next, collect documentation related to your employment. This includes pay stubs, W-2 forms, and a letter from your employer confirming your job title and responsibilities. This information helps to document your employment history and earnings prior to your condition.

-

Claim Forms: Make sure to complete any required claim forms provided by your insurance company. It's important to fill out all sections accurately to avoid any processing delays.

-

Personal Statement: Consider writing a personal statement that describes how your condition affects your daily life and ability to work. This narrative adds a personal touch to your application and can significantly strengthen your case.

-

Witness Statements: If relevant, gather testimonies from family, friends, or colleagues who can confirm how your condition impacts your life. These testimonials can provide additional context and support for your claim.

-

Financial Documentation: Lastly, include any financial documents that may be required to demonstrate your income and financial situation. This can help illustrate the economic impact of your disability.

On average, applicants submit a comprehensive set of documents, typically ranging from 10 to 15 items. By ensuring you have all necessary documentation prepared, you can streamline the submission process and significantly decrease the chances of delays. Remember, it's common to feel anxious about this process, but you're not alone. It's crucial to recognize that LTD benefits generally commence after short-term incapacity or any other income assistance has been depleted, which is typically around 17 weeks. Be aware that insurance companies may take up to two 30-day extensions if additional time is needed for a decision. We're here to help you through this journey.

Complete the Long-Term Disability Application Form

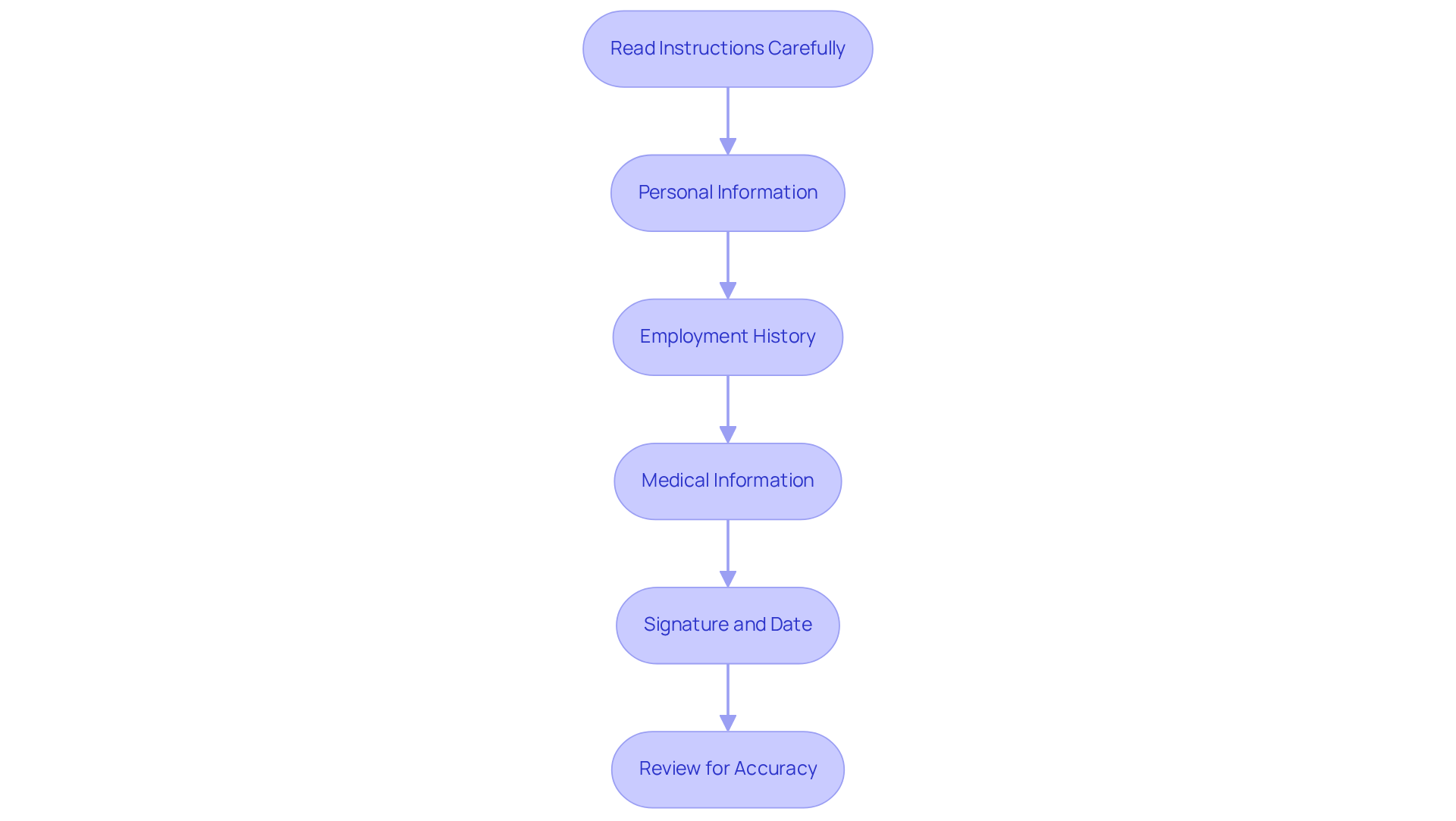

Filling out the application for long term disability can feel overwhelming, but with careful attention to detail, you can enhance your chances of approval. We understand that this process can be challenging, and we're here to help. Follow these essential steps to guide you through:

- Read Instructions Carefully: Take your time to thoroughly review all guidelines that accompany the submission form. Understanding the required information is crucial.

- Personal Information: Accurately enter your personal details, including your name, address, Social Security number, and contact information. This is your first step in ensuring a complete application.

- Employment History: Provide a comprehensive account of your employment history. Detail your job titles, dates of employment, and descriptions of your job duties. This information is vital for your claim.

- Medical Information: Clearly articulate your medical condition. Include the diagnosis, treatments received, and how these affect your ability to work. Avoid vague statements; instead, use specific language to describe your limitations. For example, you might say, 'When I sit for more than 20 minutes, my lower back starts to really hurt.' Remember, it’s important to avoid absolute statements unless they are always true.

- Signature and Date: Don’t forget to sign and date the form. An unsigned document may be considered incomplete, which can delay your application.

- Review for Accuracy: Before submission, take a moment to meticulously examine the entire document for accuracy and completeness. It can be beneficial to have someone else review it as well.

It's common to feel anxious about the application for long term disability process, especially when frequent errors in benefit requests stem from neglecting to supply thorough medical documentation or not adequately describing how your condition affects your daily tasks. For instance, many applicants overlook the importance of including examples of how their disabilities limit their daily functions, which can significantly affect the outcome of their claims.

Real-world examples show that thorough and precise implementations lead to higher approval rates. Insurance experts stress that clarity and detail are essential; ambiguous or incomplete submissions can lead to delays or refusals. Typically, the average duration required to obtain a decision on a long-term disability request is three to five months. By following these steps, you can create a thorough and well-prepared application for long term disability, significantly increasing your chances of receiving the benefits you deserve.

Additionally, if your claim is denied, remember that you have the right to appeal within 180 days. This is an important option to consider. Lastly, ensure that you include a medical authorization form with your submission, as this allows insurers to request the necessary medical records. You're not alone in this journey, and with careful preparation, you can navigate this process with confidence.

Follow Up on Your Application and Address Potential Issues

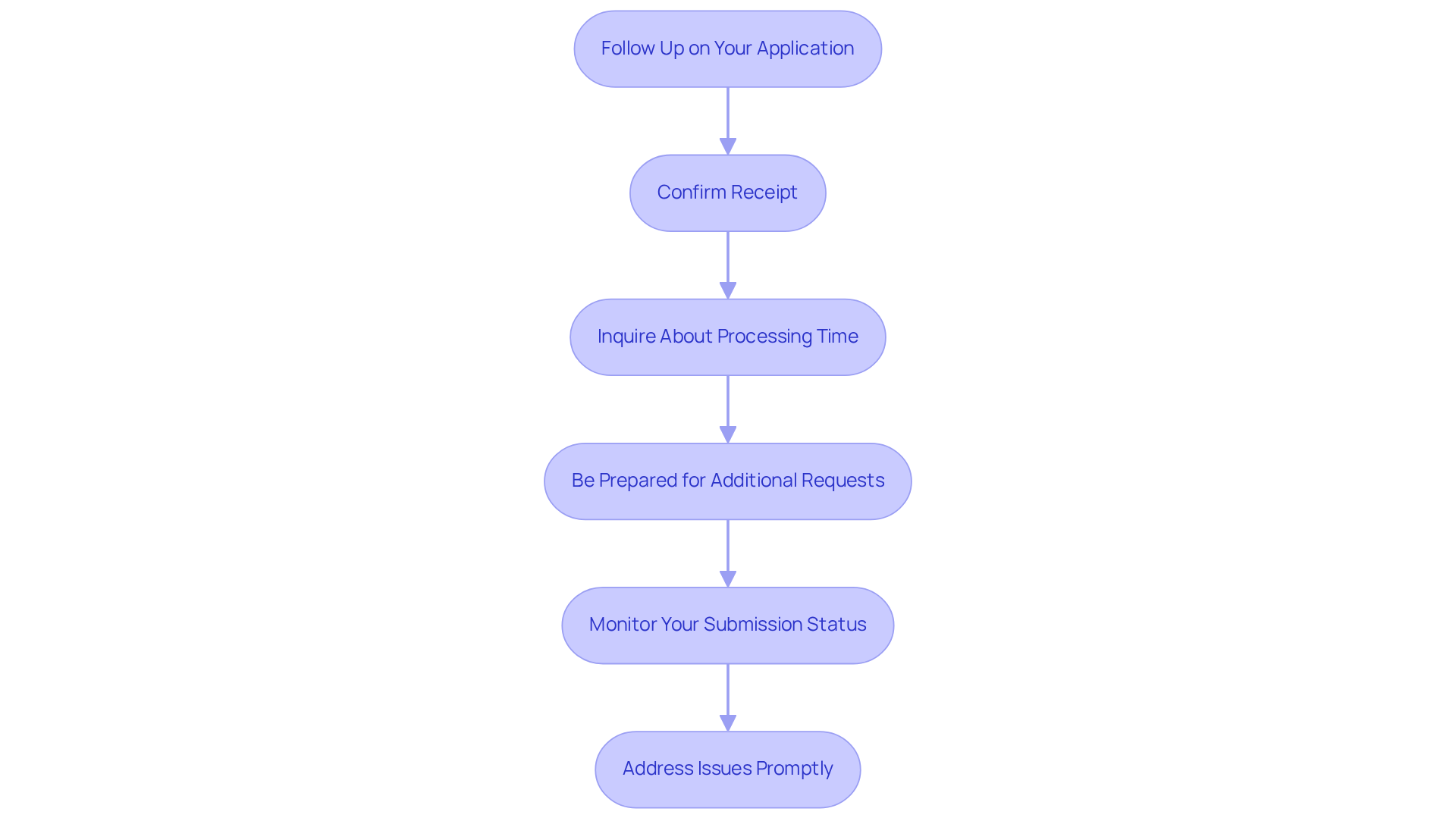

After submitting your application for long term disability, it's important to follow up to ensure that it is being processed smoothly. We understand that this can be a challenging time, and staying engaged can make a difference.

-

Confirm Receipt: Reach out to the insurance company to verify that your submission has been received. It’s helpful to ask for a reference number for your claim, so you can keep track of it easily.

-

Inquire About Processing Time: It's common to wonder how long the review process typically takes. Don’t hesitate to ask when you can expect a decision.

-

Be Prepared for Additional Requests: Sometimes, the insurance company may request additional information or documentation. Responding promptly to any requests can help avoid delays in your application for long term disability.

-

Monitor Your Submission Status: Regularly check the status of your submission, either online or by calling the insurance company. Staying informed can ease your worries.

-

Address Issues Promptly: If your application is denied, take a moment to carefully review the denial letter. Understanding the reasons behind it is crucial. Gather any additional documentation you may need, and consider filing an appeal if necessary.

By staying proactive and engaged throughout this process, you can help ensure a smoother experience. Remember, you are not alone in this journey, and we’re here to help you increase your chances of receiving the benefits you need.

Conclusion

Navigating the application process for long-term disability benefits can feel overwhelming. We understand that this journey is filled with challenges, but knowing the essential steps can truly ease your experience. This article outlines a comprehensive four-step approach, highlighting the importance of:

- Understanding eligibility criteria

- Gathering necessary documentation

- Completing the application accurately

- Following up diligently

Key insights include the critical nature of having well-documented medical conditions, a solid employment history, and the specific requirements of each insurance policy. It's common to feel anxious about preparation, but thoroughness—from collecting medical records to writing a personal statement that vividly illustrates how your disability affects daily life—can make a significant difference. Attention to detail during the application process can boost approval rates, and staying proactive after submission is vital to addressing any potential issues that may arise.

Ultimately, pursuing long-term disability benefits is not just about financial support; it’s about reclaiming a sense of stability and security during challenging times. By following the outlined steps and remaining engaged throughout the application process, you can empower yourself to navigate this complex system with confidence. Remember, support is available, and taking informed action can lead to a successful outcome in securing the benefits you deserve. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What are long-term disability benefits?

Long-term disability benefits provide financial support for individuals who cannot work due to disabling conditions.

What are the main eligibility criteria for long-term disability benefits?

To qualify for long-term disability benefits, applicants typically need to meet criteria such as having a documented medical condition, a specific work history, adherence to policy requirements, providing adequate documentation, and being aware of time limits for filing claims.

What kind of medical conditions qualify for long-term disability benefits?

Conditions such as depression, anxiety, and PTSD are recognized under the Social Security Administration’s guidelines as qualifying medical conditions.

Is there a required work history to qualify for benefits?

Yes, many policies require candidates to have a specific work history, which often includes a minimum amount of hours worked or income earned prior to the onset of the disabling condition.

What should I know about policy requirements for long-term disability?

Each insurance policy has unique eligibility criteria, including definitions of disability, waiting periods, and coverage limits. For example, the Long-Term Disability Plan typically offers benefits equal to 70% of your salary, subject to IRS limits, with a minimum monthly benefit of $50.

Why is documentation important when applying for long-term disability benefits?

Providing adequate health-related evidence, such as comprehensive medical records and treatment history, is crucial to support your claims and significantly enhances your chances of approval.

Are there time limits for filing long-term disability claims?

Yes, it is essential to be aware of any time limits for filing claims, as these can differ by policy. Staying informed about changes to long-term disability support requirements, especially those expected in July 2025, is vital for timely submissions.

What is the anticipated Trial Work Period (TWP) threshold for 2025?

The anticipated Trial Work Period threshold for 2025 may increase to $1,100 or more, which could impact individuals considering a return to work while receiving long-term disability assistance.