Overview

Navigating tax settlements can be overwhelming, and we understand that you may feel anxious about managing your liabilities. This article offers strategies to help you effectively handle these challenges, aiming to reduce your tax burdens while avoiding common pitfalls in reporting.

Understanding tax agreements is crucial. Programs like the IRS's Offer in Compromise can be a lifeline, providing you with options to settle your tax debts for less than the full amount owed. We encourage you to explore these opportunities, as they can significantly ease your financial stress.

Additionally, implementing strategies such as structured payments and ensuring proper classification of income can optimize your tax outcomes. It’s common to feel uncertain about these processes, but remember, you are not alone in this journey. We’re here to help you navigate these complexities with confidence.

By taking proactive steps, you can minimize the risk of penalties and secure a more stable financial future. We invite you to reflect on your current situation and consider how these strategies can empower you to take control of your tax obligations.

Introduction

Tax settlements can serve as a lifeline for those grappling with overwhelming financial obligations. They offer a pathway to resolve debts for less than what is owed, providing hope in challenging times. By exploring the intricacies of tax agreements, such as the IRS's Offer in Compromise program, you can uncover strategies that may significantly reduce your liabilities and help you regain control over your finances.

We understand that the process can be fraught with potential pitfalls and misconceptions. It's common to feel overwhelmed by the complexities involved. How can you navigate these challenges to ensure compliance and maximize the benefits? You're not alone in this journey, and we're here to help you find a way forward.

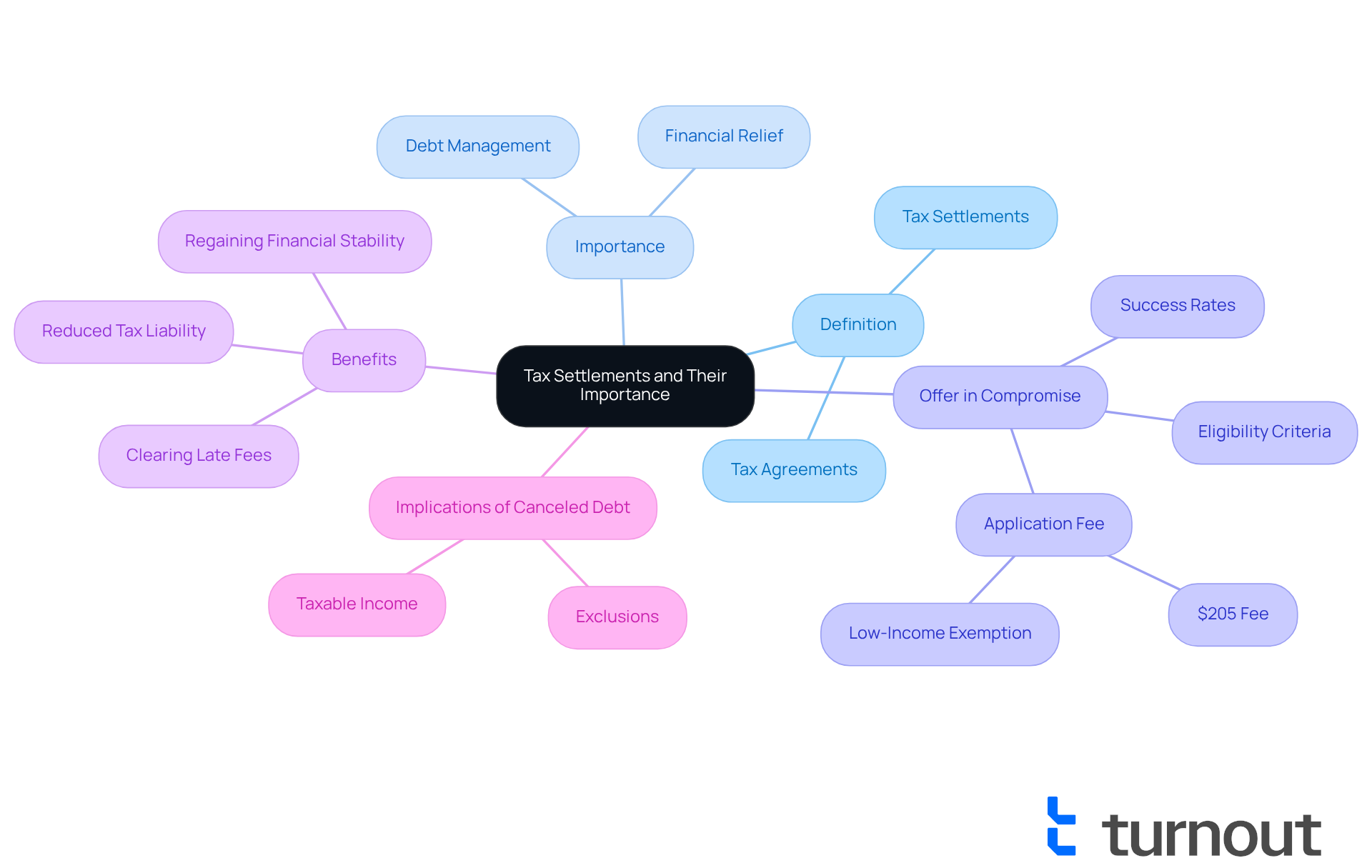

Define Tax Settlements and Their Importance

Tax agreements, often referred to as tax settlements, are arrangements between taxpayers and tax authorities, such as the IRS. They allow individuals to resolve unpaid tax obligations with a tax settlement for less than the full amount due. For many facing financial difficulties, these agreements provide a practical way to manage debts that may feel overwhelming. By understanding tax agreements, you can take proactive steps to negotiate your tax settlement responsibilities, potentially saving significant amounts of money and alleviating the stress associated with tax debt.

Consider the IRS's Offer in Compromise program, which enables qualified taxpayers to achieve a tax settlement for an amount lower than what is fully owed. This option is crucial for those who cannot meet their complete tax responsibilities. The current application fee for this program is $205, although low-income taxpayers are exempt from this fee. Recent updates in 2025 have streamlined the application process, increasing accessibility for those seeking relief. Statistics indicate that a notable proportion of taxpayers who engage in negotiations successfully achieve agreements, highlighting the effectiveness of these resolutions.

Practical examples illustrate how tax resolutions can significantly assist individuals in managing their obligations. Many have successfully utilized the Offer in Compromise as a tax settlement to lighten their tax burdens, allowing them to regain financial stability. It's important to remember that while settling tax debts can provide relief, the IRS considers canceled debt as income, which may lead to tax obligations unless exclusions apply. Understanding these options empowers you to take charge of your financial situation and pursue solutions that can lead to a fresh start. We're here to help you navigate this journey.

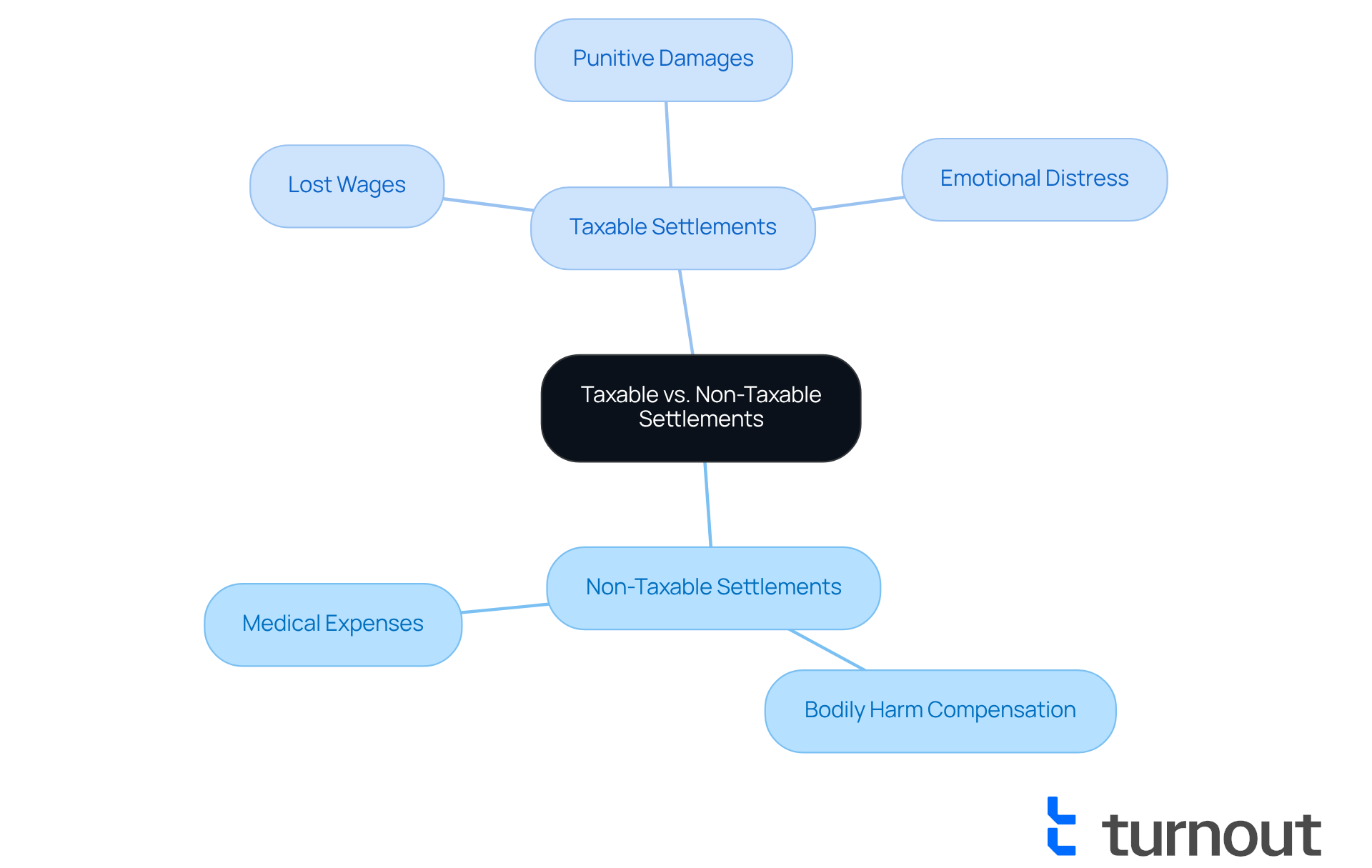

Identify Taxable vs. Non-Taxable Settlements

Understanding the difference between taxable and non-taxable compensations is vital for anyone receiving restitution. We recognize that navigating these financial waters can be challenging. Typically, agreements related to bodily harm or illness are non-taxable as per the Internal Revenue Code. This means that if you receive compensation for medical expenses arising from a physical injury, you generally do not owe taxes on that amount.

However, compensations for lost wages, punitive damages, or emotional distress without a physical injury are usually considered taxable income. For instance, if you receive compensation for lost wages due to an injury, that amount is subject to taxation. It's essential to categorize your agreement correctly to ensure compliance with tax regulations and avoid potential penalties associated with tax settlement.

Recent court cases have highlighted the importance of accurately categorizing compensation payments. Tax specialists emphasize that the nature of the agreement determines its tax settlement implications. For example, agreements that include punitive damages are always taxable, whereas those for physical injuries might not be. As tax specialists remind us, the categorization of a compensation can significantly affect the tax settlement of the recipient.

To help you navigate these complexities, consulting with a tax professional can provide clarity on how to report these amounts correctly. They can assist you in understanding the proportion of agreements classified as taxable versus non-taxable, ensuring you optimize your recovery while minimizing tax obligations. Furthermore, strategies like the Plaintiff Recovery Trust and structured compensation annuities can be beneficial in reducing tax liabilities and enhancing your net recovery. Remember, you are not alone in this journey; we’re here to help you make informed decisions.

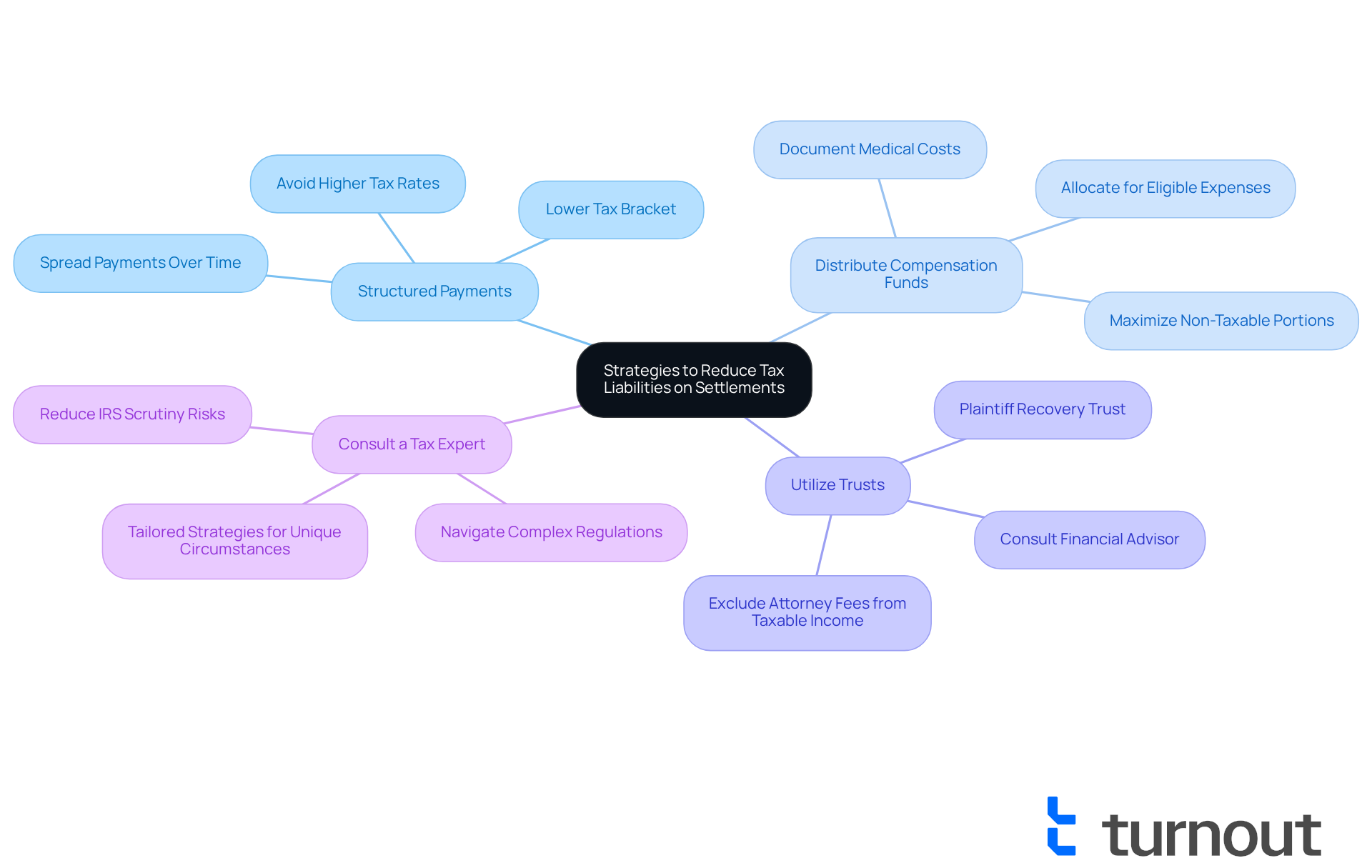

Implement Strategies to Reduce Tax Liabilities on Settlements

To minimize tax liabilities on tax settlements, we understand that navigating this process can be overwhelming. Here are some strategies that may help you feel more secure in your financial decisions:

-

Structured Payments: Choosing a structured payment plan allows you to receive disbursements over time rather than a lump sum. This approach can help keep you in a lower tax bracket, reducing your overall tax liability. Receiving a large taxable compensation in one year can push you into a higher tax bracket, making this strategy particularly beneficial.

-

Distribute Compensation Funds: Properly distributing your compensation funds can also ease tax implications. For example, if part of your compensation covers medical costs, ensure this portion is clearly documented, as it may be non-taxable. Allocating a reasonable percentage for eligible medical expenses can further enhance your tax efficiency.

-

Utilize Trusts: Creating a trust can provide tax advantages and protect your funds from being taxed as income. A Plaintiff Recovery Trust, for instance, allows you to exclude attorney fees from taxable income, which can lead to significant savings. This strategy requires careful planning, so discussing it with a financial advisor is essential to ensure compliance with tax regulations.

-

Consult a tax expert: Working with a tax expert who understands the complexities of tax settlement can guide you through the intricate tax regulations and uncover additional strategies tailored to your unique circumstances. It's common to feel uncertain about tax forms and documentation; having professional guidance can simplify the process, reduce the risk of IRS scrutiny, and help you manage your tax liabilities effectively.

Remember, you are not alone in this journey. We're here to help you navigate these challenges with confidence.

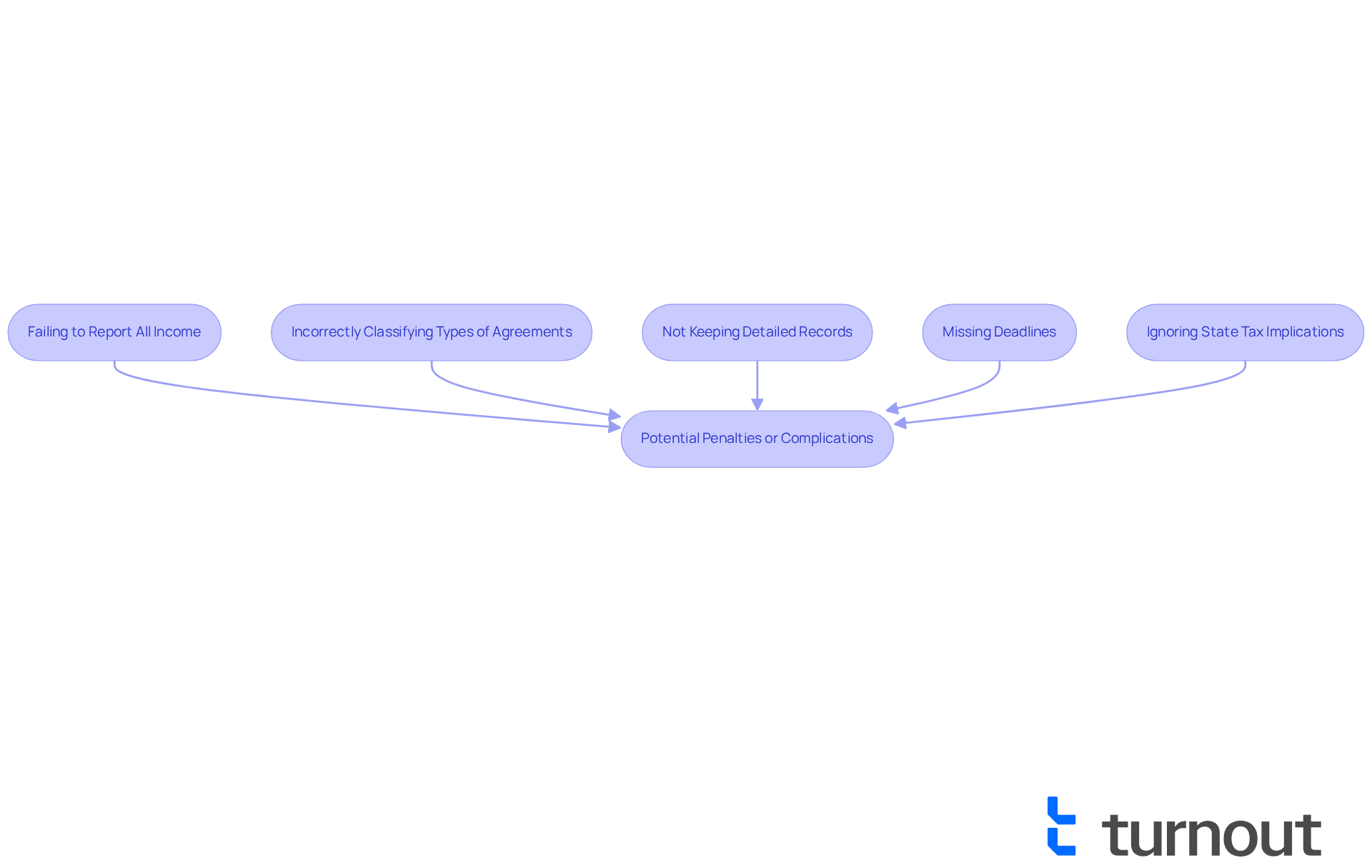

Avoid Common Mistakes in Tax Settlement Reporting

Navigating tax agreements can be challenging, and it's common to encounter pitfalls that complicate interactions with the IRS. Here are some key errors to avoid that can help you feel more secure in your tax reporting:

-

Failing to Report All Income: It’s crucial to report every taxable portion of your compensation. Overlooking income can lead to audits and fines, as the IRS closely monitors reporting of agreements. Remember, each Social Security number on your tax return should match exactly as printed on your Social Security card to prevent processing issues.

-

Incorrectly Classifying Types of Agreements: Misclassifying your arrangement as non-taxable when it is taxable can result in significant tax liabilities. Always double-check the specifics of your agreement to ensure accurate reporting. Seeking guidance from a CPA or tax advisor who understands the taxation of agreements can make a difference in managing these complexities and potentially enhancing your savings.

-

Not Keeping Detailed Records: Keeping thorough documentation of your agreement and any related expenses is essential. This documentation will be invaluable if you need to justify your tax reporting during an audit. The IRS encourages all taxpayers to maintain accurate records to support their claims.

-

Missing Deadlines: Being aware of tax filing deadlines is vital to avoid late fees and penalties. Timely filing helps maintain compliance and prevents unnecessary complications. However, filing too early can lead to processing delays, so ensure you have all necessary documents before submission.

-

Ignoring State Tax Implications: State tax laws can differ from federal regulations, so it's important to understand your state’s requirements regarding reporting. Many taxpayers face penalties due to incorrect reporting, underscoring the importance of comprehending both federal and state obligations.

By being mindful of these common mistakes and seeking expert advice when needed, you can more effectively navigate the complexities of tax settlement. Remember, you are not alone in this journey; we’re here to help you minimize the risk of penalties and feel confident in your tax decisions.

Conclusion

Tax settlements offer a valuable opportunity for those facing financial challenges to negotiate their tax obligations with authorities, often leading to significant savings. We understand that navigating the intricacies of tax agreements, from the IRS's Offer in Compromise program to distinguishing between taxable and non-taxable settlements, can be overwhelming. By proactively engaging in tax settlement strategies, you can regain control over your finances and work towards a fresh start.

In this article, we've discussed key strategies to minimize tax liabilities, such as:

- Structured payments

- Proper distribution of compensation funds

- The creation of trusts

It's essential to consult tax professionals who can guide you through the complexities of tax regulations. This ensures you can make informed decisions and avoid common pitfalls. Recognizing potential mistakes in tax settlement reporting—like failing to report all income or misclassifying agreements—is crucial for maintaining compliance and preventing unnecessary penalties.

Ultimately, empowering yourself with knowledge about tax settlements and implementing effective strategies can lead to a more secure financial future. Taking the time to understand these processes not only reduces stress but also enhances your ability to make sound financial decisions. Engaging with tax professionals and staying informed about current regulations will further support your efforts to minimize tax liabilities and avoid costly errors in reporting. Remember, you are not alone in this journey. Embrace this path towards financial clarity and take proactive steps to secure a more stable economic future.

Frequently Asked Questions

What are tax settlements?

Tax settlements are arrangements between taxpayers and tax authorities that allow individuals to resolve unpaid tax obligations for less than the full amount due.

Why are tax settlements important?

They provide a practical way for individuals facing financial difficulties to manage overwhelming tax debts, potentially saving significant amounts of money and alleviating stress associated with tax obligations.

What is the IRS's Offer in Compromise program?

The Offer in Compromise program allows qualified taxpayers to settle their tax debts for an amount lower than what is fully owed, making it crucial for those who cannot meet their complete tax responsibilities.

What is the application fee for the Offer in Compromise program?

The current application fee for the Offer in Compromise program is $205, but low-income taxpayers are exempt from this fee.

Have there been any recent updates to the Offer in Compromise program?

Yes, recent updates in 2025 have streamlined the application process, increasing accessibility for those seeking relief.

What are the success rates for tax negotiations?

Statistics indicate that a notable proportion of taxpayers who engage in negotiations successfully achieve tax settlements, highlighting the effectiveness of these resolutions.

Can you provide examples of how tax settlements can help individuals?

Many individuals have successfully utilized the Offer in Compromise to lighten their tax burdens, allowing them to regain financial stability.

What should taxpayers be aware of regarding canceled debt?

The IRS considers canceled debt as income, which may lead to additional tax obligations unless exclusions apply.

How can understanding tax agreements empower taxpayers?

By understanding tax agreements, individuals can take charge of their financial situation and pursue solutions that can lead to a fresh start.