Overview

Navigating the process of securing Supplemental Security Income (SSI) benefits can feel overwhelming. We understand that you may be facing challenges, whether due to age, blindness, or disability. To qualify for these benefits, it’s essential to meet specific eligibility criteria, which include:

- Being aged 65 or older

- Being blind

- Being disabled

Additionally, you must adhere to strict income and resource limits.

It’s common to feel uncertain about the application process. That’s why we’re here to help you understand what’s required. Gathering the necessary documentation is crucial to enhance your chances of receiving the financial support you need. By taking these steps, you can navigate the application process more successfully.

Remember, you are not alone in this journey. We encourage you to familiarize yourself with the requirements and take action. With the right information and support, you can move forward with confidence.

Introduction

Understanding the intricacies of Supplemental Security Income (SSI) is crucial for those seeking financial support due to age, blindness, or disability. We recognize that navigating this process can feel overwhelming, especially with nearly a million recipients in California alone. This program plays a vital role in sustaining the livelihoods of vulnerable individuals, and we’re here to help you through it.

In this guide, you will find a comprehensive roadmap to mastering SSI eligibility. We detail the essential steps and documentation necessary to secure these benefits. However, it’s common to feel uncertain with stringent income and resource limits that have remained stagnant for decades.

How can you effectively navigate the complexities of the application process and ensure your needs are met? Together, we will explore the answers.

Understand Supplemental Security Income (SSI)

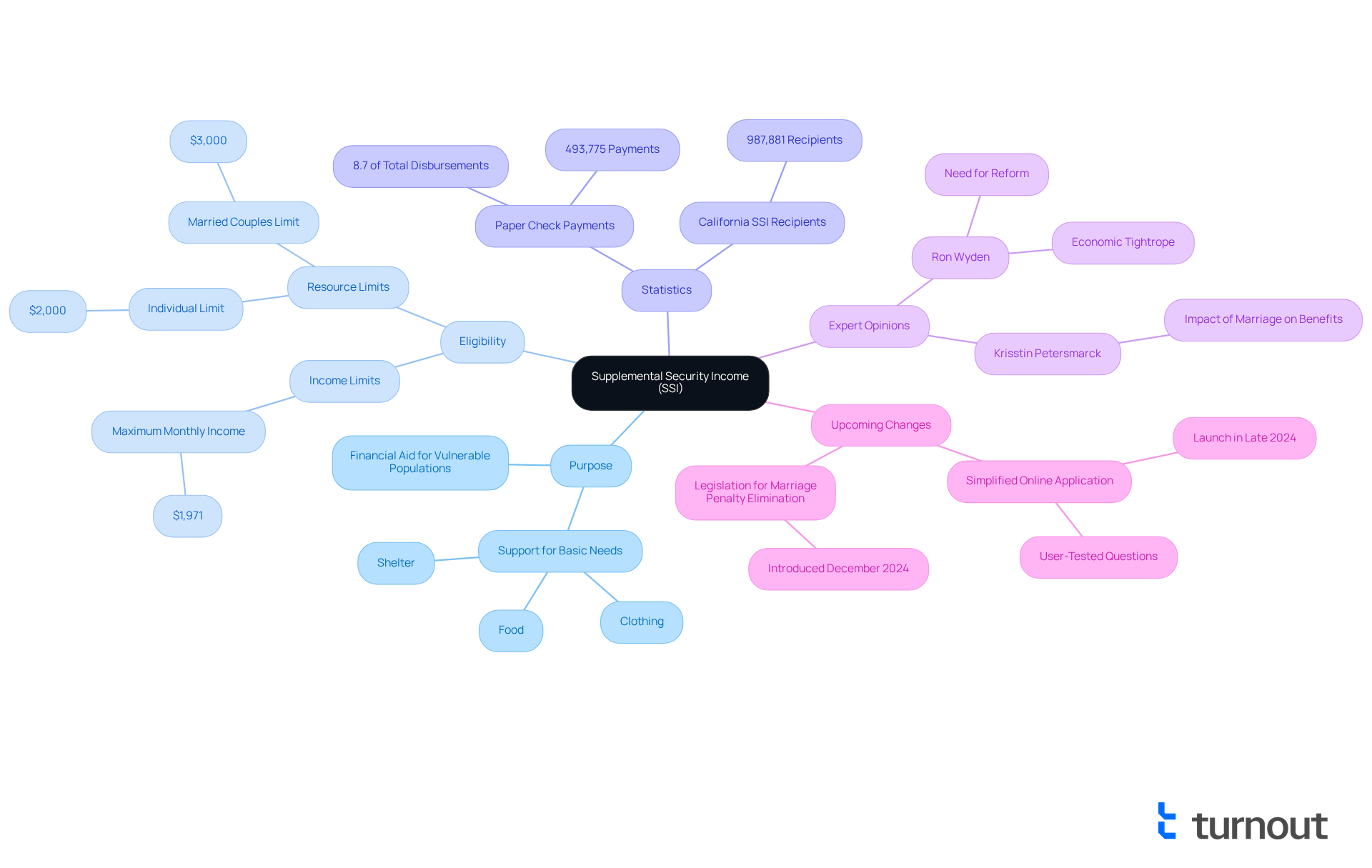

Supplemental Security Income (SSI) is a vital federal program designed to provide financial aid to individuals who are aged, blind, or disabled, and who have limited income and resources. The primary goal of SSI is to help these individuals meet their essential needs for food, clothing, and shelter. As we look ahead to 2025, California stands out with approximately 987,881 SSI recipients, underscoring the program's crucial role in supporting vulnerable populations.

Understanding SSI's purpose is essential for applicants, as it lays the groundwork for recognizing their SSI eligibility and the benefits they may receive. In 2025, individuals can receive a maximum benefit of $943 per month, which is vital for many in managing their daily expenses. However, it’s important to note the strict resource limits; individuals cannot have countable assets exceeding $2,000, while married couples face a limit of $3,000. Additionally, to achieve SSI eligibility, individuals must earn less than $1,971 monthly. This limitation has remained unchanged since 1989, despite regular adjustments to benefit amounts for cost-of-living increases, leading to ongoing discussions about the need for reform.

Experts stress the importance of understanding SSI's framework. For instance, Ron Wyden, Chair of the Senate Finance Committee, has remarked that American families who rely on Supplemental Income often find themselves balancing on an economic tightrope. Real-world examples show how SSI assists disabled individuals in meeting their basic needs. Many recipients depend on these benefits to purchase essential items, such as groceries and medical care, which are crucial for their well-being. Furthermore, SSI recipients have faced penalties for receiving Federal Stimulus payments during the pandemic, compounding their financial challenges.

As the Social Security Administration prepares to introduce a simplified online SSI request in late 2024, it aims to alleviate the burdensome process that many applicants currently endure. This new program will feature user-tested, plain-language questions and prepopulated answers, making it more accessible for those seeking assistance. By understanding SSI's purpose and navigating the application process effectively, individuals can secure the support they need to enhance their quality of life.

Identify Eligibility Requirements for SSI

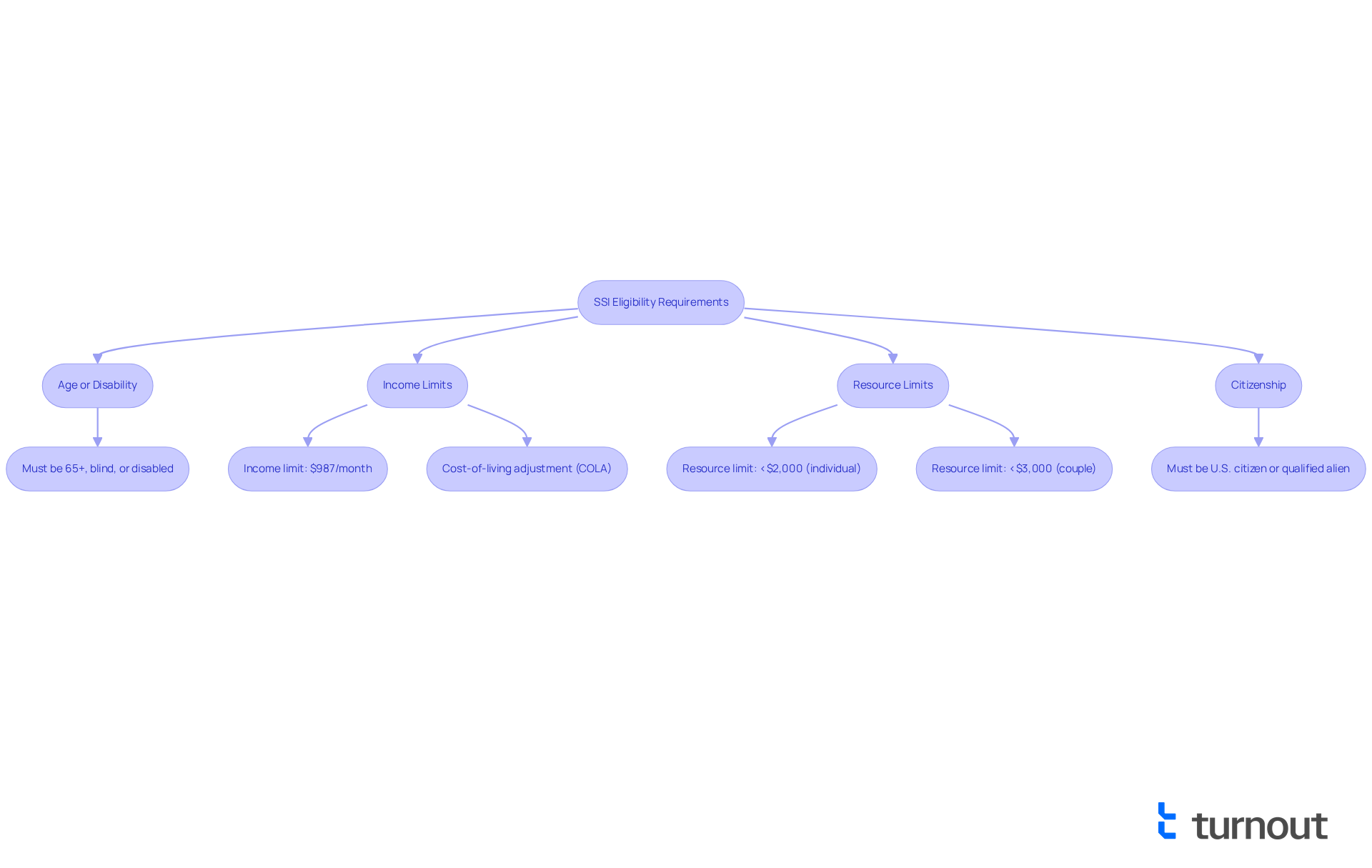

To qualify for Supplemental Security Income (SSI), it’s important to understand the essential criteria that can impact your eligibility:

- Age or Disability: You must be aged 65 or older, blind, or disabled.

- Income Limits: For 2025, the income limit is set at $987 per month for individuals. This figure is crucial for determining SSI eligibility and has remained unchanged since 1974. It’s significant to note that nearly 73 million Social Security and SSI recipients will see their benefits increase by 2.5% in 2025, thanks to the cost-of-living adjustment (COLA) issued by the SSA, which helps keep pace with inflation.

- Resource Limits: Individuals should have less than $2,000 in countable resources, while couples must keep their resources under $3,000. These limits have not changed since 1989, making it essential to manage your assets carefully. Remember, giving away resources can lead to ineligibility for up to 36 months.

- Citizenship: You must be a U.S. citizen or a qualified alien, as defined by immigration regulations.

We understand that navigating these requirements can feel overwhelming, but comprehending them is vital for ensuring your SSI eligibility before you proceed with your submission. Many individuals who successfully qualify for SSI demonstrate careful management of their income and resources, which is essential for meeting SSI eligibility limits. It’s common to feel uncertain about these processes, but with the right support, you can secure the benefits you need. Remember, you are not alone in this journey, and we’re here to help guide you through it.

Gather Required Documentation for Your Application

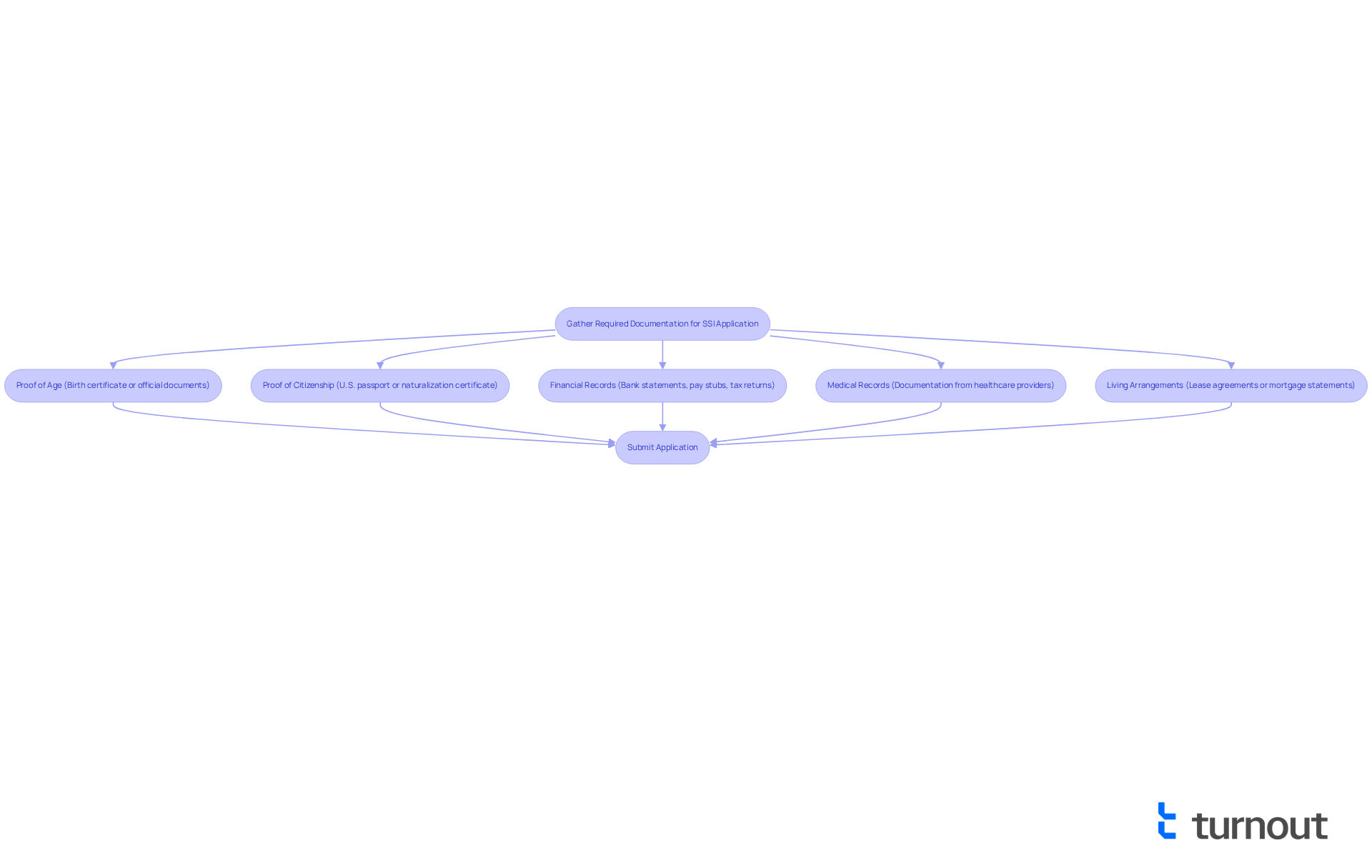

Before you apply for SSI eligibility, it’s important to gather a few key documents that can help smooth your application process. We understand that this can feel overwhelming, but having everything ready can ease your worries.

- Proof of Age: This could be a birth certificate or other official documents that show your date of birth.

- Proof of Citizenship: You can use a U.S. passport or a naturalization certificate as acceptable proof.

- Financial Records: Prepare your bank statements, pay stubs, and tax returns to demonstrate your income clearly.

- Medical Records: It’s crucial to obtain documentation from your healthcare providers that detail your disability or condition.

- Living Arrangements: Include lease agreements or mortgage statements to verify your living situation.

Having these documents ready can significantly reduce processing delays, especially those related to SSI eligibility, which often stem from missing information. It’s common for applicants to experience extended processing times when their SSI eligibility is affected by incomplete documentation. In fact, statistics show that these delays can be substantial.

For the latest updates on SSI paperwork documentation requirements in 2025, we encourage you to refer to the Social Welfare Administration's official resources at www.ssa.gov/ssi/ssi-law-regs.htm. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Navigate the SSI Application Process

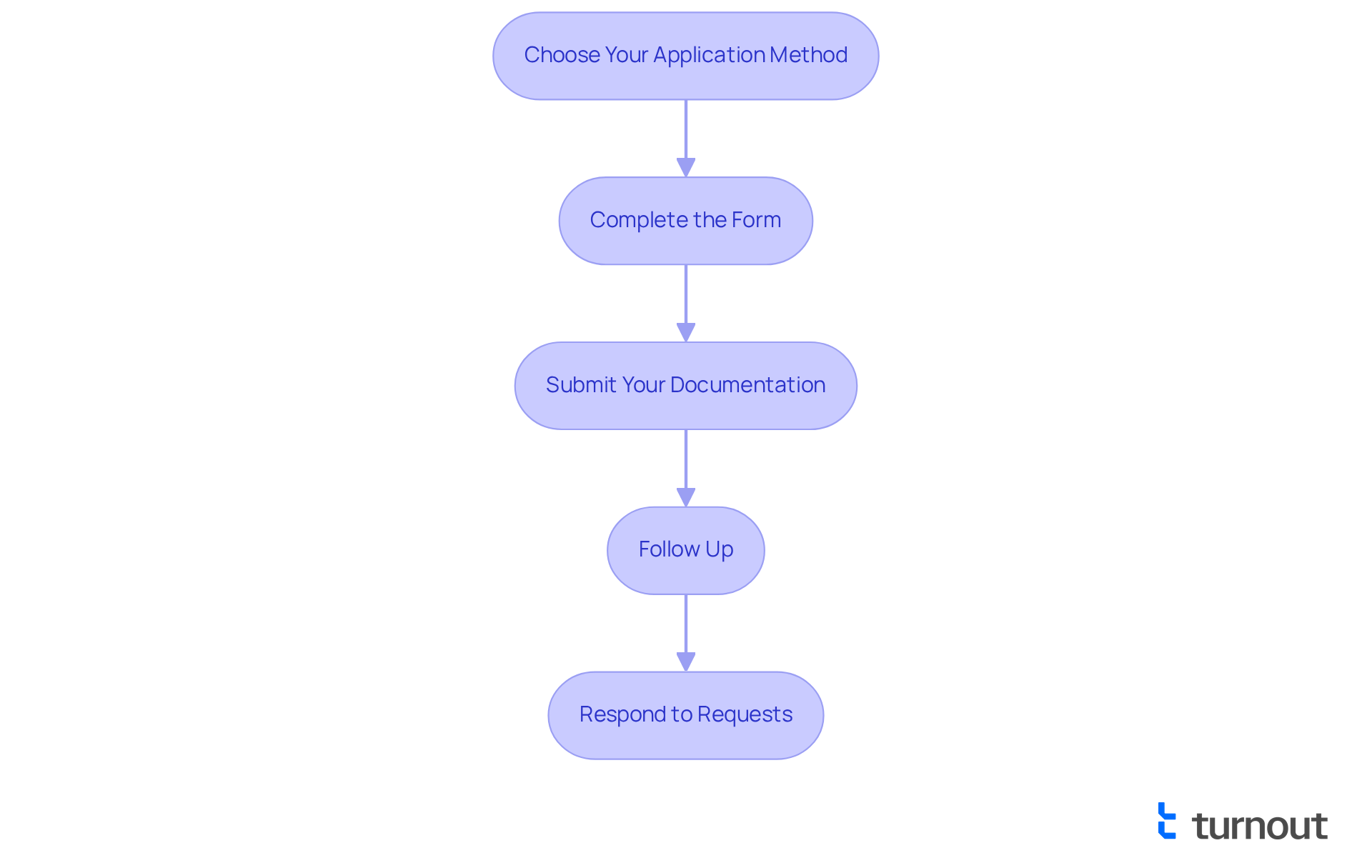

Applying for SSI eligibility in 2025 can feel overwhelming, but we're here to help you navigate the process. Follow these essential steps to ease your journey:

-

Choose Your Application Method: You can apply online, by phone, or in person at your local Social Security office. For online submissions, visit the SSA online submission portal. This flexibility allows you to choose what feels most comfortable for you.

-

Complete the Form: Fill out the new streamlined form, which has been simplified to as few as 12 questions, down from 54. We understand that filling out forms can be daunting, so ensure you provide all required information accurately to avoid delays.

-

Submit Your Documentation: Attach all necessary documents that support your request, including medical records and proof of income. The SSA now accepts digital signatures, which can significantly reduce your paperwork burden.

-

Follow Up: After submitting your request, monitor its status by contacting the SSA or checking online. It’s common to feel anxious during this waiting period, as the average processing duration for SSI requests is currently about seven-and-a-half months. Staying informed can help ease your concerns.

-

Respond to Requests: Be prepared to provide additional information or documentation if requested by the SSA. Prompt replies can assist in speeding up your request, showing that you are proactive in your pursuit of benefits.

By adhering to these steps, you can navigate the SSI eligibility application process more effectively. Remember, you are not alone in this journey, and following these guidelines can enhance your chances of receiving the benefits you deserve.

Conclusion

Understanding the intricacies of Supplemental Security Income (SSI) is crucial for those seeking financial support. This federal program plays a vital role in assisting individuals who are aged, blind, or disabled, ensuring they can meet their basic needs. By grasping the eligibility requirements, gathering the necessary documentation, and effectively navigating the application process, individuals can position themselves to secure the benefits that are essential for enhancing their quality of life.

We understand that the journey to obtaining SSI benefits may seem daunting. However, it is a vital endeavor for those in need. By taking proactive steps, understanding the requirements, and utilizing available resources, individuals can navigate the complexities of the SSI application process with confidence. It is crucial to stay informed and prepared, as these benefits can significantly impact the lives of many, providing the support necessary to thrive despite financial challenges.

The article outlines several key points regarding SSI:

- It emphasizes the importance of knowing income and resource limits, which remain unchanged for decades.

- It highlights the significance of proper documentation to avoid delays in processing applications.

- The introduction of a simplified application process in 2024 is a significant step toward making SSI more accessible. This change allows applicants to complete forms with less complexity and more clarity.

Ultimately, by understanding the requirements and taking action, you are not alone in this journey. We’re here to help you navigate the process and secure the support you deserve.

Frequently Asked Questions

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal program that provides financial aid to individuals who are aged, blind, or disabled, and who have limited income and resources, helping them meet essential needs for food, clothing, and shelter.

How many SSI recipients are there in California as of 2025?

As of 2025, there are approximately 987,881 SSI recipients in California.

What is the maximum benefit amount for SSI recipients in 2025?

In 2025, individuals can receive a maximum benefit of $943 per month.

What are the resource limits for SSI eligibility?

Individuals cannot have countable assets exceeding $2,000, while married couples face a limit of $3,000.

What is the income limit for SSI eligibility?

To qualify for SSI, individuals must earn less than $1,971 monthly.

Why is there ongoing discussion about SSI income limits?

The income limit of $1,971 has remained unchanged since 1989, even though benefit amounts have been adjusted for cost-of-living increases, leading to discussions about the need for reform.

How does SSI assist recipients in their daily lives?

SSI helps disabled individuals meet their basic needs, such as purchasing essential items like groceries and medical care.

Have SSI recipients faced any penalties related to Federal Stimulus payments?

Yes, SSI recipients have faced penalties for receiving Federal Stimulus payments during the pandemic, which has added to their financial challenges.

What changes are expected for the SSI application process in late 2024?

The Social Security Administration plans to introduce a simplified online SSI request process that will feature user-tested, plain-language questions and prepopulated answers to make it more accessible for applicants.