Overview

Navigating the application process for Supplemental Security Income (SSI) can feel overwhelming. We understand that many individuals face challenges when seeking assistance, and we’re here to help. This article focuses on the eligibility requirements for SSI and offers a comprehensive guide to support you through each step.

Key criteria such as age, income and asset limits, citizenship, and necessary documentation are outlined. It’s important to prepare thoroughly, as this can significantly improve your chances of approval. Statistics indicate a high rate of application rejections, which can be discouraging, but remember, you are not alone in this journey.

By understanding the requirements and gathering the right documentation, you can approach the application process with confidence. Take heart in knowing that with the right preparation, you can enhance your likelihood of success. Let’s explore these criteria together, so you feel empowered to take the next steps.

Introduction

Navigating the complexities of Supplemental Security Income (SSI) can feel overwhelming. We understand that the evolving eligibility requirements and application processes may add to your concerns. Millions of Americans depend on this vital support to meet their basic needs, making it essential to grasp the nuances of SSI eligibility.

How can you ensure that you meet the necessary criteria and successfully navigate the application maze? This guide offers a step-by-step approach to mastering SSI eligibility, empowering you to confidently pursue the benefits you deserve. Remember, you are not alone in this journey, and we’re here to help.

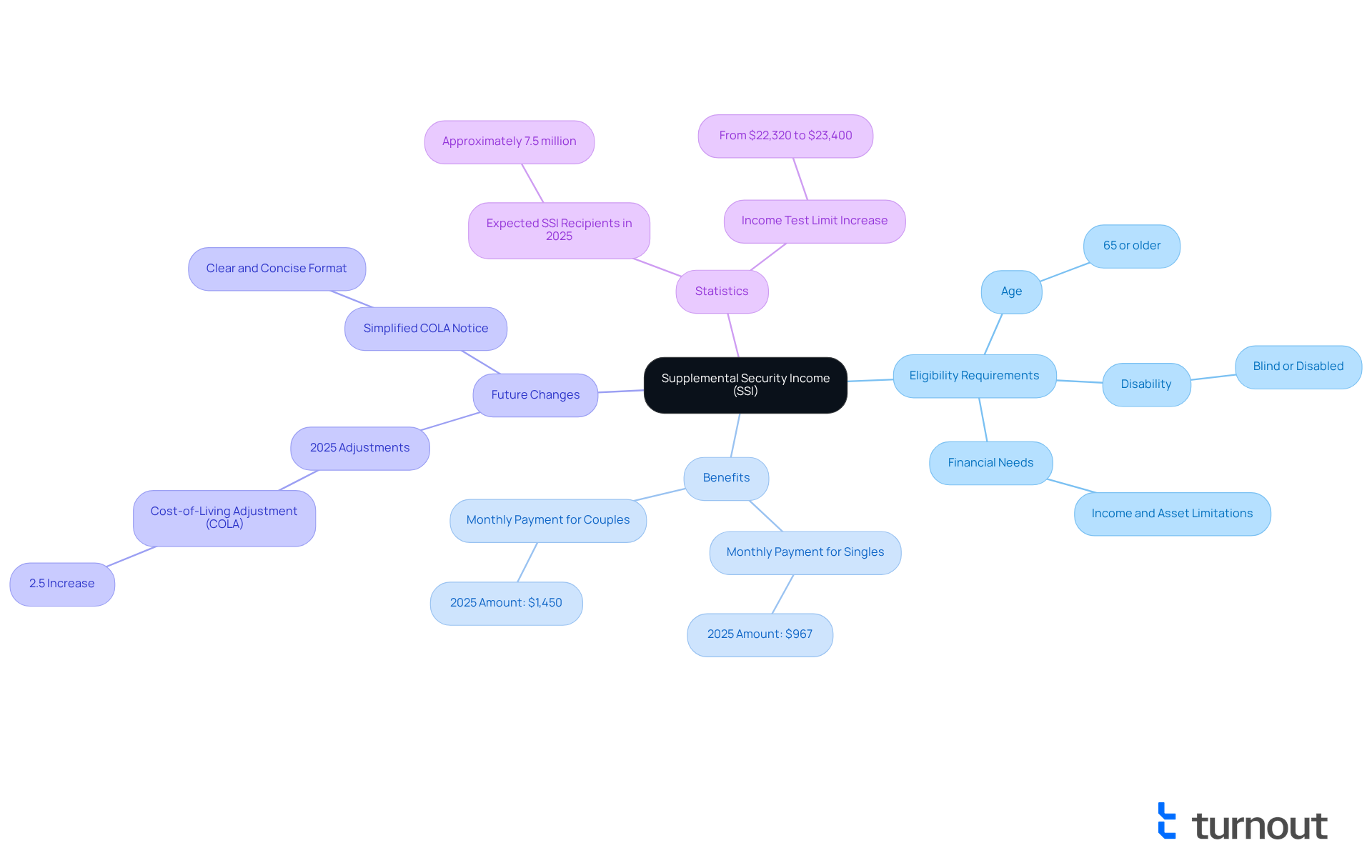

Define Supplemental Security Income (SSI)

Supplemental Income (SSI) is a federal initiative managed by the Administration that provides monthly financial aid to individuals who qualify under the SSI eligibility requirements due to income and asset limitations. This program is designed to support individuals who meet the SSI eligibility requirements, including those aged 65 or older, blind, or disabled, ensuring they can meet their basic needs for food, clothing, and shelter. Unlike Social Security Disability Insurance (SSDI), which relies on work history, the SSI eligibility requirements are focused on financial needs and do not require prior work credits. This accessibility allows a wider array of individuals to benefit, including children with disabilities and seniors who may not have worked enough to meet the SSI eligibility requirements.

As we look ahead to 2025, approximately 7.5 million Americans are expected to receive SSI benefits. This statistic reflects the program's critical role in providing financial support to vulnerable populations. It's heartening to note that the highest federal payment for SSI will rise to $967 monthly for single recipients, an increase from $943. Couples will receive a maximum of $1,450 each month. This adjustment is part of an annual cost-of-living adjustment (COLA), helping beneficiaries keep pace with rising living costs.

In August 2025, recipients will receive notifications about their new benefit amounts, which will take effect on December 31, 2024. The SSA has introduced a simplified COLA notice, designed to be clear and concise. This ensures that beneficiaries can easily understand their new payment amounts and any deductions.

Officials from the SSA have emphasized the significance of these changes, stating that "Social insurance benefits and SSI payments will rise in 2025, assisting tens of millions of individuals in managing expenses even as inflation has begun to ease." This statement underscores the continuous dedication to assist people with disabilities, ensuring they have the necessary resources to fulfill their basic needs. Remember, you are not alone in this journey, and we are here to help you navigate these changes.

Outline SSI Eligibility Criteria

To qualify for Supplemental Security Income (SSI), we understand that navigating the SSI eligibility requirements can often feel overwhelming. Here are the key criteria you need to know:

- Age or Disability: You must be aged 65 or older, or be blind or have a qualifying disability that prevents you from working.

- Income Limits: For 2025, the income threshold is set at $967 per month for individuals and $1,450 for married couples. This includes wages, pensions, and other sources of income.

- Asset Limits: Individuals must have less than $2,000 in countable resources, while couples must have less than $3,000. Countable resources include cash, bank accounts, and property, but do not include the home you live in.

- Citizenship: You must be a U.S. citizen, U.S. national, or a noncitizen who meets specific immigration criteria.

- Residency: It’s important that you reside in the United States.

In 2025, SSI income and asset limits have been adjusted to help you keep pace with rising living costs. The highest Federal SSI payment amounts for this year are $967 for a qualifying individual and $1,450 for a qualifying couple. These adjustments are vital for those of you navigating the complexities of the SSI system, particularly regarding the SSI eligibility requirements, especially as the landscape of benefits continues to evolve.

We want to emphasize the importance of understanding these limits. They play a crucial role in determining your SSI eligibility requirements and ensuring that you receive the necessary support. Remember, you are not alone in this journey; we’re here to help you every step of the way.

List Required Documentation for SSI Applications

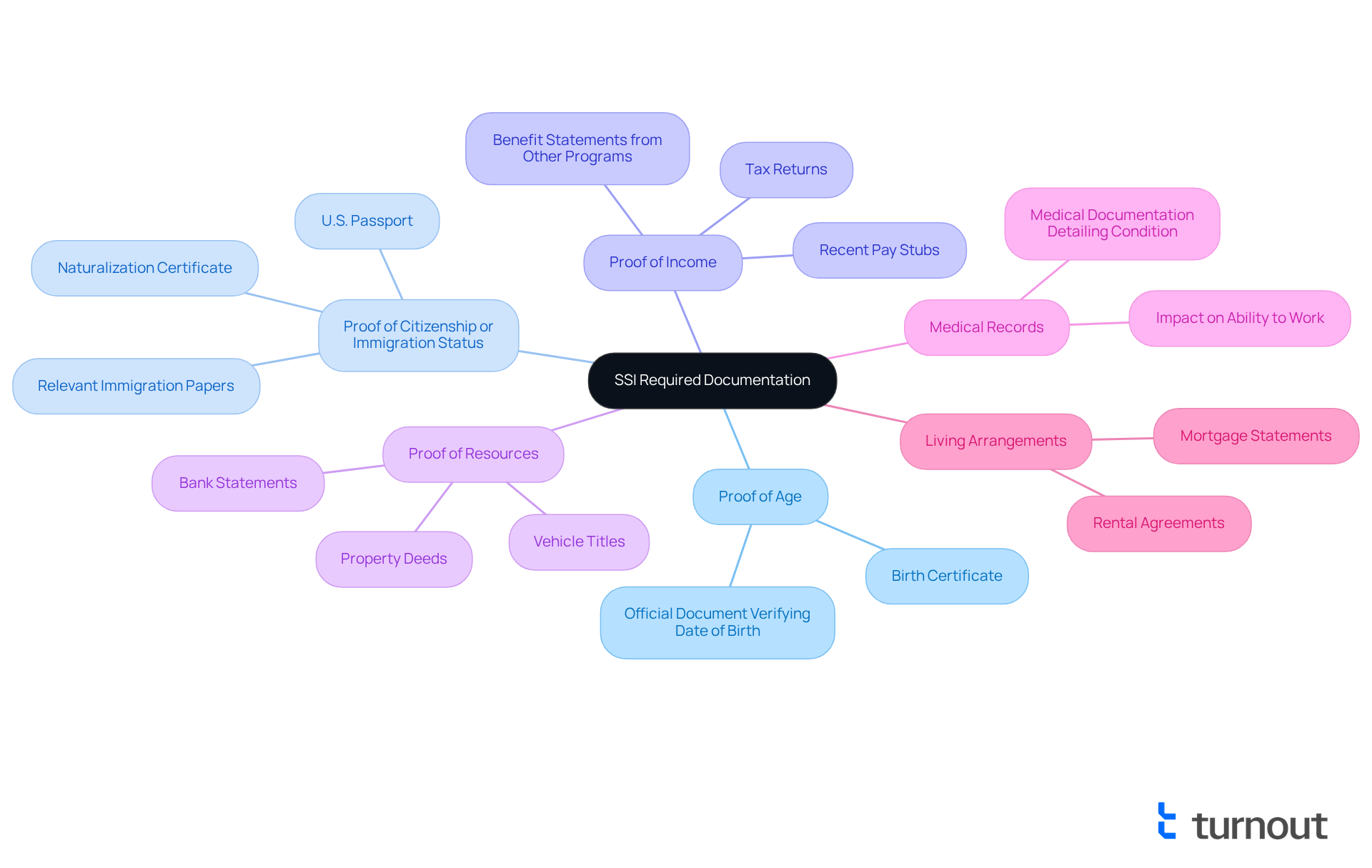

When seeking Supplemental Security Income (SSI), we understand that the SSI eligibility requirements can feel overwhelming. Providing specific documents is crucial to meet the SSI eligibility requirements and effectively support your request. Here are the key documents typically required:

- Proof of Age: A birth certificate or another official document verifying your date of birth.

- Proof of Citizenship or Immigration Status: Acceptable documents include a U.S. passport, naturalization certificate, or relevant immigration papers.

- Proof of Income: Recent pay stubs, tax returns, or benefit statements from other programs are necessary to demonstrate your financial situation.

- Proof of Resources: Bank statements, property deeds, or vehicle titles are needed to illustrate your financial resources.

- Medical Records: If your request is based on a disability, include medical documentation detailing your condition and its impact on your ability to work.

- Living Arrangements: Documentation such as rental agreements or mortgage statements is required to verify your living situation.

In 2025, statistics indicate that approximately 30% of SSI requests are rejected due to missing documentation. This highlights the importance of thorough preparation to meet the SSI eligibility requirements. Recent updates from the Social Security Administration (SSA) aim to simplify the submission process by providing clearer guidelines on the SSI eligibility requirements for documentation. It's common to feel that the process is burdensome. Experts note that typical errors in SSI submissions often arise from insufficient or inaccurate documentation. As Casey Schwarz noted, "The current process is burdensome and challenging for the public; we must reduce this burden and improve access to SSI." To verify age and citizenship, please ensure you possess the required documents prepared, as these are essential for your submission. Remember, you are not alone in this journey, and we’re here to help you navigate through it.

Explain the SSI Application Process

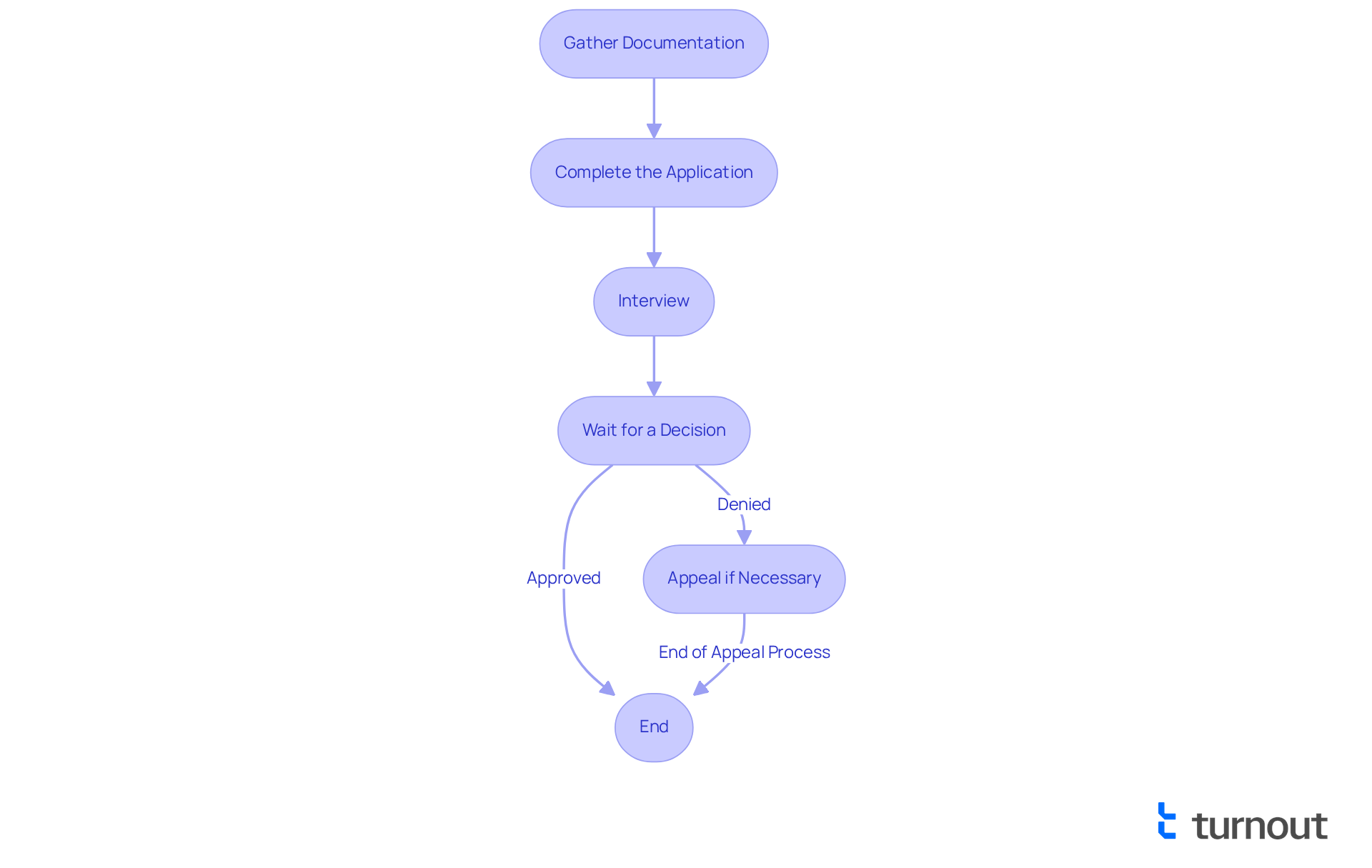

Navigating the SSI eligibility requirements in the application process can feel overwhelming, but we're here to help. It involves several key steps that can guide you through this journey:

-

Gather Documentation: Before you begin your submission, take a moment to gather all necessary documents, such as proof of income, resources, and living arrangements. This preparation is crucial to support your application.

-

Complete the Application: You have options for applying: online through the SSA website, by phone, or in person at your local Social Security office. The application will ask for personal information, including your income, resources, and living arrangements. Remember, it's common to feel uncertain during this step.

-

Interview: After submitting your documents, you may need to participate in an interview, either in person or over the phone. This is an opportunity to discuss your submission and provide any additional information that may be required.

-

Wait for a Decision: The SSA will evaluate your submission and documentation. This process can take several months, with the typical wait for initial submissions often exceeding seven months. You will receive a notice regarding the decision made on your request. We understand that waiting can be stressful, but you're not alone in this.

-

Appeal if Necessary: If your request is denied, remember that you have the right to contest the decision. The notice you receive will include instructions on how to proceed with an appeal. This is an important step in advocating for yourself.

In 2025, statistics suggest that only 21 percent of first-time SSI requests are approved. This highlights the importance of thorough preparation and support to fulfill the SSI eligibility requirements during the submission process. The SSA has acknowledged that the lengthy wait for initial decisions is 'unacceptable' and can lead to significant financial strain for vulnerable individuals. As they work to improve the application process, we encourage you to seek assistance from advocacy organizations. They can provide valuable support to help you navigate these challenges effectively. Remember, you are not alone in this journey.

Conclusion

Understanding the Supplemental Security Income (SSI) program and its eligibility requirements is crucial for those seeking financial assistance. We recognize that navigating this process can feel overwhelming. This guide outlines the essential criteria, documentation needed, and the application process to help you approach SSI with confidence. By demystifying these requirements, we aim to empower you to access the support you need.

Key aspects discussed include specific eligibility criteria such as:

- Age

- Income

- Asset limits

Along with the necessary documentation for a successful application. It's common to feel anxious about missing information, as many applications are denied due to incomplete details. By following the outlined steps, you can significantly enhance your chances of approval and avoid common pitfalls in the application process.

The significance of SSI in providing financial security to millions cannot be overstated. As the program continues to evolve, staying informed about updates and changes in eligibility criteria is essential. If you encounter challenges during the application process, we encourage you to seek assistance from advocacy organizations. Remember, support is available, and taking proactive steps can lead to a more secure future. You are not alone in this journey, and together, we can navigate these complexities.

Frequently Asked Questions

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal program that provides monthly financial aid to individuals who meet specific eligibility requirements based on income and asset limitations. It is designed to support those aged 65 or older, blind, or disabled, ensuring they can meet their basic needs for food, clothing, and shelter.

How does SSI differ from Social Security Disability Insurance (SSDI)?

Unlike SSDI, which requires a work history and prior work credits, SSI eligibility is focused on financial needs and does not require individuals to have worked previously. This allows a broader range of individuals, including children with disabilities and seniors who may not have sufficient work history, to qualify for benefits.

How many Americans are expected to receive SSI benefits in 2025?

Approximately 7.5 million Americans are expected to receive SSI benefits in 2025, highlighting the program's critical role in providing financial support to vulnerable populations.

What will be the maximum SSI payment amounts in 2025?

In 2025, the highest federal payment for SSI will increase to $967 monthly for single recipients and $1,450 monthly for couples. This adjustment is part of an annual cost-of-living adjustment (COLA).

When will recipients be notified of their new SSI benefit amounts?

Recipients will receive notifications about their new benefit amounts in August 2025, which will take effect on December 31, 2024.

What is the purpose of the simplified COLA notice introduced by the SSA?

The simplified COLA notice is designed to be clear and concise, ensuring that beneficiaries can easily understand their new payment amounts and any deductions.

Why are the changes to SSI benefits significant?

The changes are significant because they reflect a commitment to assist individuals with disabilities in managing their expenses, especially as inflation begins to ease. Officials from the SSA emphasize that these adjustments will help tens of millions of individuals fulfill their basic needs.