Overview

Navigating IRS payment arrangements can feel overwhelming, especially if you're struggling to meet your tax obligations. This article offers a compassionate, step-by-step guide to help you understand the importance of installment agreements, which can be a lifeline for those unable to pay their taxes in full.

We recognize that many taxpayers face difficult situations, and it’s important to know that over 90% of individuals with a balance due qualify for these arrangements. This means that you are not alone in this journey, and there are viable solutions available to help ease your burden.

In this guide, we will walk you through the following:

- Eligibility criteria

- Necessary documentation

- Application processes

- Effective management strategies

By breaking down these steps, we aim to empower you with the knowledge needed to take action and find relief. Remember, we're here to help, and together, we can navigate this path toward financial stability.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when financial strains make it difficult to pay in full. We understand that this situation can be stressful. IRS payment arrangements, often referred to as installment agreements, can serve as a lifeline for those seeking manageable solutions to their tax debts.

This guide explores the various options available, showing how you can leverage these arrangements to ease your burden and take charge of your financial future.

However, with so many pathways to consider, it’s common to wonder how to find the most suitable plan while steering clear of common pitfalls.

Understand IRS Payment Arrangements

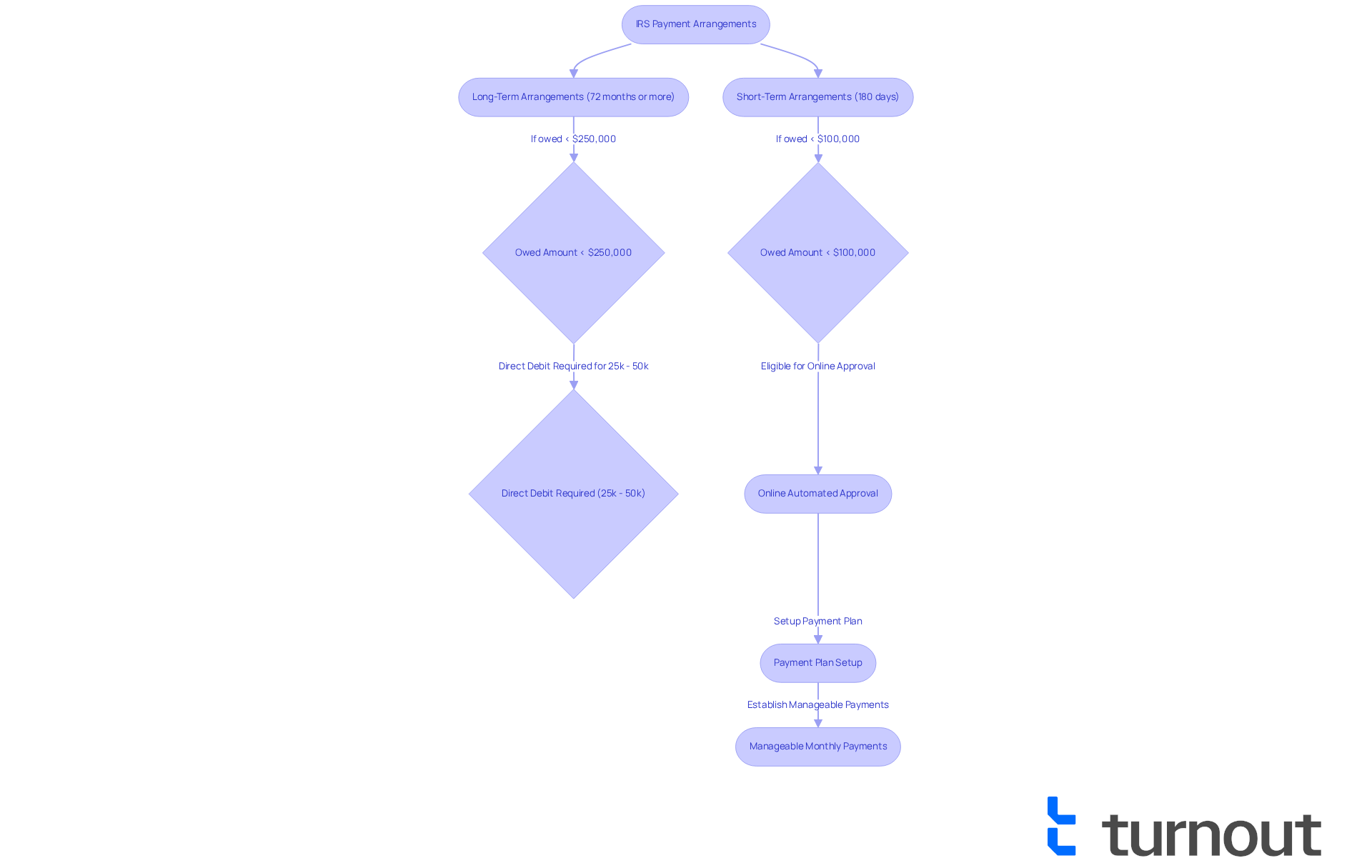

IRS payments arrangements, often referred to as installment agreements, enable taxpayers to gradually settle their tax obligations instead of confronting them all at once. This flexibility is crucial for individuals who may find it challenging to pay their tax bill in full. Payment arrangements can vary in duration, typically ranging from a few months to several years, depending on the amount owed and the taxpayer's financial situation. Understanding the different types of financial arrangements available, including both short-term and long-term options, is the first step in effectively managing tax obligations.

For instance, short-term arrangements enable repayment within 180 days, while long-term options can extend up to 72 months or more, based on the total tax obligation. Importantly, taxpayers who owe up to $250,000 now have an easier path to IRS payments arrangements, which broadens their options for managing tax liabilities. Familiarizing yourself with these choices can significantly alleviate stress and provide a clear direction for resolving tax debts.

Tax professionals emphasize the value of these agreements, highlighting that they offer a structured approach to debt management. As one expert wisely noted, 'These problems don’t get better with time.' By utilizing installment agreements, taxpayers can sidestep the anxiety of immediate financial demands and create a clear path toward fulfilling their tax obligations.

In practice, many taxpayers have successfully navigated their tax debts through IRS payments arrangements. For example, individuals who can pay their entire tax liability within six months and have a total balance of less than $100,000 can benefit from the IRS's online automated approval process, simplifying their experience and avoiding complex forms. Additionally, taxpayers with amounts between $25,000 and $50,000 are required to use direct debit for their transactions, which is an important consideration when establishing a repayment plan. Furthermore, taxpayers can resolve their debt directly with the IRS, avoiding high fees from third-party organizations, underscoring the advantages of utilizing IRS settlement options directly.

Overall, becoming familiar with these financing choices can greatly reduce stress and provide clarity in managing tax debts, ultimately paving the way for a more manageable financial future. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Determine Your Eligibility for Payment Plans

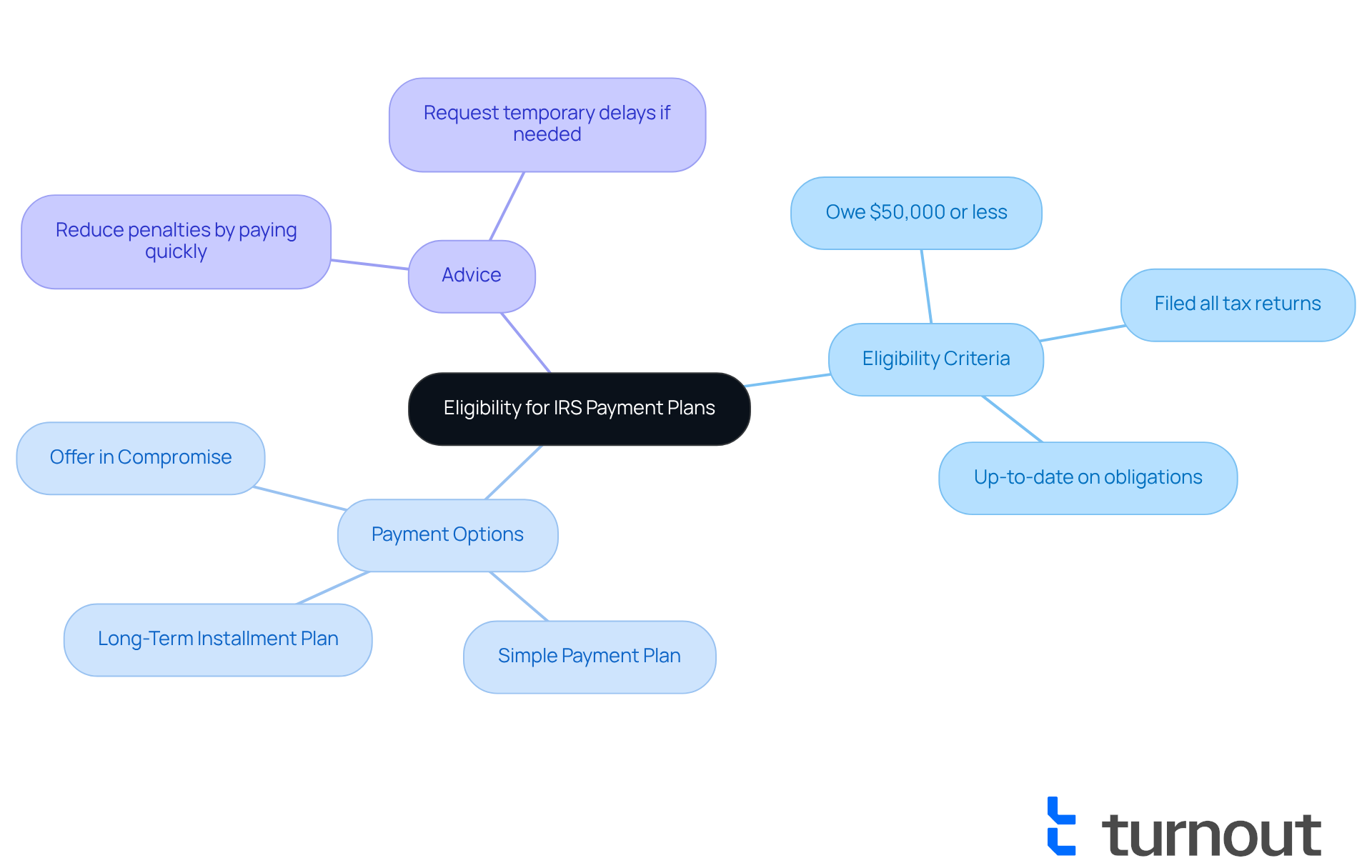

We understand that navigating tax obligations can be overwhelming. To qualify for IRS payments arrangements, it's important to know that you must meet specific criteria. Generally, you are eligible if you owe $50,000 or less in combined tax, penalties, and interest, and have filed all required tax returns. Additionally, being up-to-date on your tax obligations is crucial.

If your tax obligation exceeds this amount, you may still have options. An IRS payments arrangements Long-Term Installment Plan allows for monthly installments for up to 10 years, although extra documentation might be necessary. It's essential to assess your financial situation honestly. The IRS may request information about your income, expenses, and assets to determine your ability to pay.

To ease this process, consider utilizing the IRS's Online Payment Agreement tool. This can help you quickly check your eligibility and understand the options available to you. Notably, over 90% of individual taxpayers with a balance due qualify for IRS payments arrangements through a Simple Payment Plan. This option could be a viable solution for many.

Tax consultants often advise that contributing as much as you can, as swiftly as possible, can help reduce interest and penalties. Currently, these accumulate at a rate of 7% annually, along with a late fee of 0.5% monthly. If you're facing financial hardship, remember that you can request a temporary delay of the collection process.

For those who do not qualify for a Simple Payment Plan, exploring the Offer in Compromise option may be beneficial. You're not alone in this journey; we're here to help you find the best path forward.

Gather Required Documentation for Your Application

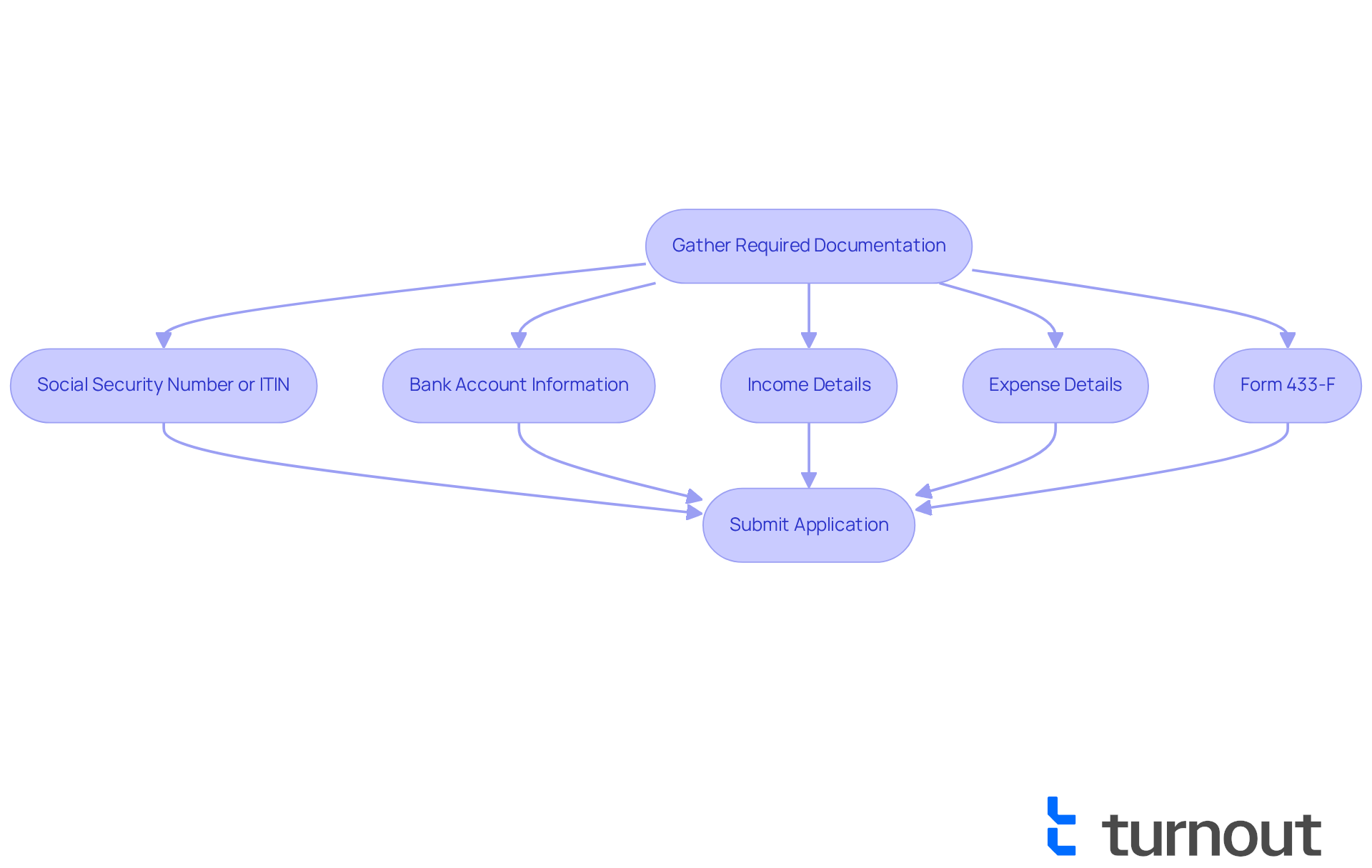

Before requesting an IRS payments arrangements, we understand that collecting all essential documentation can feel overwhelming. It's vital to gather your Social Security number or Individual Taxpayer Identification Number (ITIN), bank account information, and details about your income and expenses. For extended financial arrangements, you may need to submit Form 433-F, the Collection Information Statement, which provides the IRS a snapshot of your financial situation. Having these documents ready will not only streamline the application process but also enable the IRS to assess your request more efficiently. If you choose a direct debit arrangement, please ensure you supply your bank account and routing numbers.

Statistics indicate that nearly 3 million taxpayers successfully set up IRS payments arrangements in recent years, often due to thorough preparation of required documentation. Furthermore, it's reassuring to know that 88% of individual taxpayers have debts lower than $25,000 to the IRS, making IRS payment arrangements a viable choice for many. Tax professionals emphasize that being organized and proactive in gathering these documents can significantly improve your chances of approval for IRS payments arrangements. For instance, individuals who carefully organize their financial details often encounter easier processes when requesting IRS payments arrangements. By preparing in advance, you not only facilitate a quicker review by the IRS payments arrangements but also position yourself for a more favorable outcome.

It's important to remember that penalties and interest continue to accrue until the full amount is paid, even during a temporary delay. Additionally, consider utilizing the Online Payment Agreement (OPA) for an efficient arrangement of your financial schedule. Remember, specific kinds of IRS financial arrangements may entail setup fees, so being informed is key. We're here to help you navigate this journey, and you are not alone in seeking assistance.

Apply for Your IRS Payment Arrangement

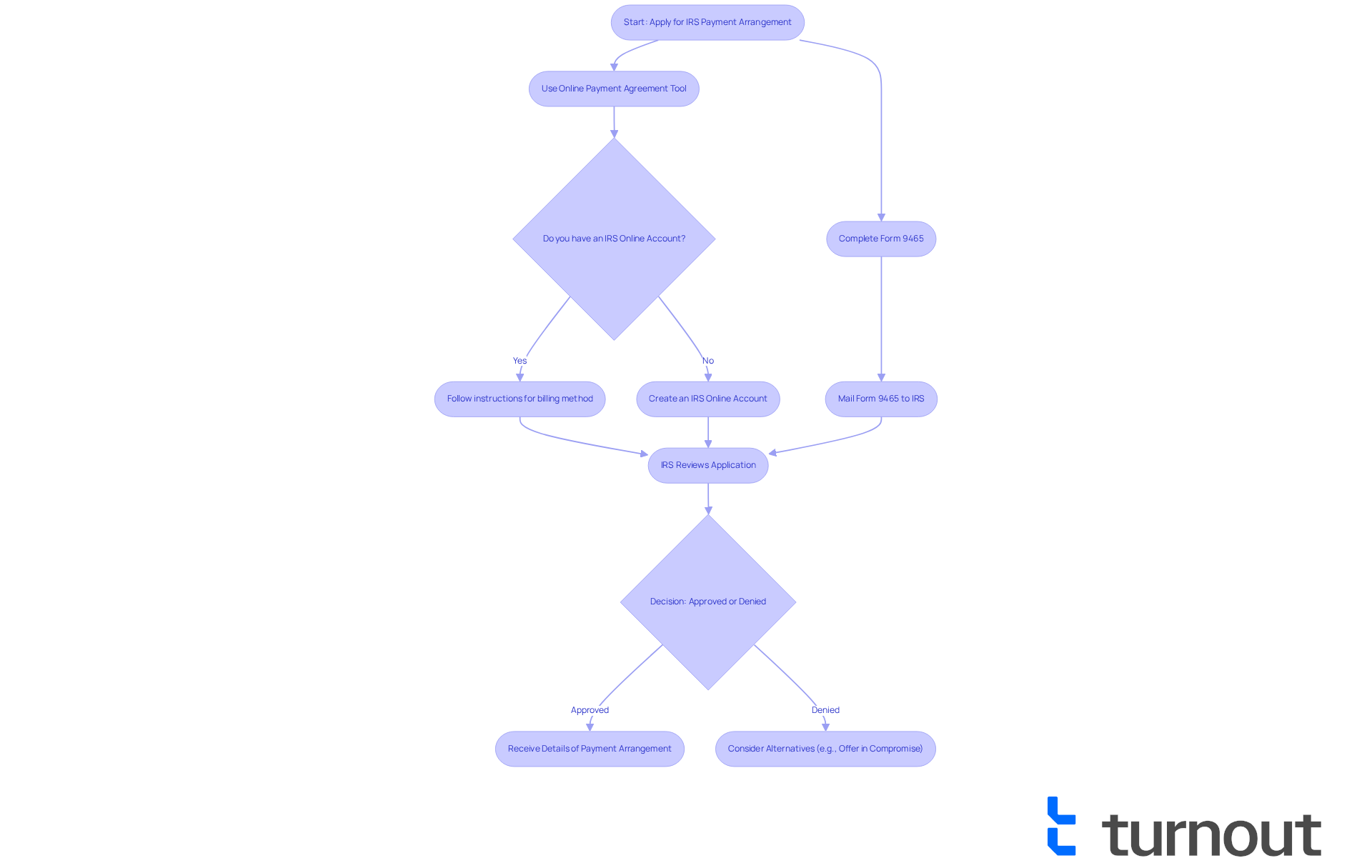

If you're looking to request IRS payments arrangements, we understand that navigating this process can be overwhelming. The Online Payment Agreement tool on the IRS website is a great starting point. If you don't have an IRS Online Account yet, creating one is simple. Once you're signed in, just follow the instructions to select your preferred billing method. For those who prefer a paper application, you can complete Form 9465, Installment Agreement Request, and mail it to the IRS. Remember, providing accurate information and including any necessary documentation is crucial. After you submit your application, the IRS will review it and inform you of their decision. If approved, you’ll receive details about your financial arrangement, including the monthly installment amount and due dates.

Tax experts emphasize that using the Online Payment Agreement tool is the quickest way to set up IRS payments arrangements, offering instant notifications of approval for qualified candidates. Most individual taxpayers are eligible for IRS payments arrangements, providing relief for those considering this option. Recent updates show that the IRS has streamlined the application process, making it more accessible for taxpayers. Success rates for online applications have been encouraging, with many taxpayers successfully establishing IRS payments arrangements without needing extensive documentation or phone calls. This efficiency is particularly beneficial for those facing financial difficulties, allowing them to manage their tax liabilities with ease.

It's important to be aware that failing to file or pay taxes on time can lead to penalties, which may accumulate during any temporary delay in collection. We encourage you to consider the long-term financing option available for balances under $50,000, as it allows for manageable monthly installments over an extended period. Furthermore, if you find you may not meet the criteria for a financing option, exploring an Offer in Compromise could be a viable alternative to resolve tax obligations for less than the total amount due. Lastly, please remember that the IRS will never contact you via phone, text, or social media to request immediate funds. You are not alone in this journey, and we’re here to help you find the best path forward.

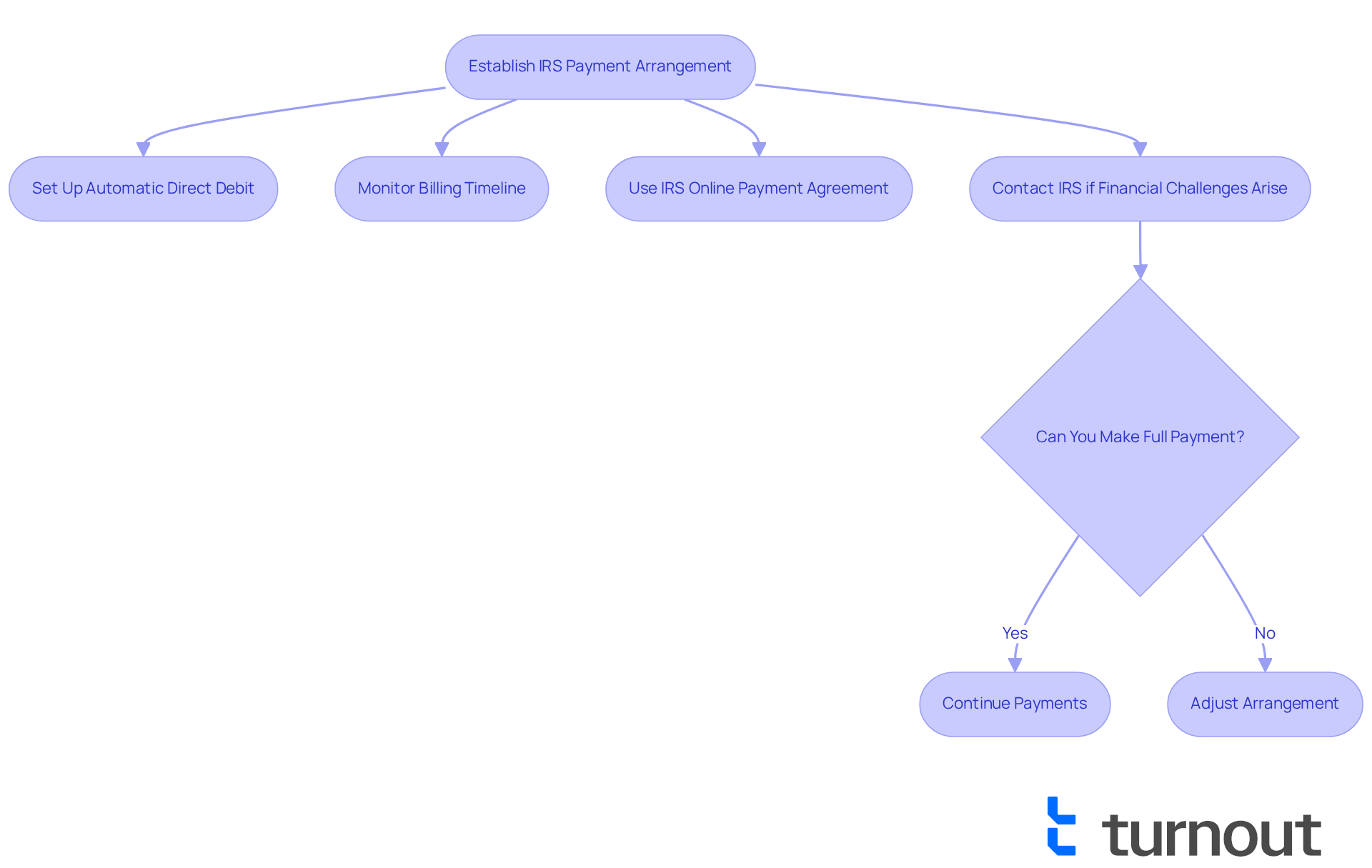

Manage and Maintain Your Payment Plan Effectively

Once your IRS payments arrangements are established, we understand that effective management is crucial to avoid default. Establishing automatic transactions via direct debit is a dependable method to ensure timely payments, alleviating the risk of oversight. The IRS reminds us, "Making a timely remittance, even a partial remittance, will help limit those penalty and interest charges." Consistently overseeing your billing timeline is essential. Utilize the IRS Online Payment Agreement to track your account status and make necessary modifications.

If you encounter financial challenges, it's important to reach out to the IRS promptly. They may allow you to temporarily halt contributions or adjust your arrangement. Remember, staying compliant with all tax filing obligations during your arrangement is vital; failing to fulfill these responsibilities can jeopardize your agreement. Additionally, if you've made efforts to comply with tax laws but faced uncontrollable circumstances, you may qualify for penalty relief.

By staying organized and proactive, you can successfully navigate your IRS payments arrangements and work towards resolving your tax debt. Many taxpayers have maintained their installment agreements by following these practices. With diligence, managing your tax obligations is not only achievable but can lead to peace of mind.

Conclusion

Navigating IRS payment arrangements can be a significant relief for those facing tax obligations. We understand that the burden of settling debts can feel overwhelming. By exploring the various types of payment plans available, you can tailor your approach to fit your unique financial situation, ensuring a manageable path toward compliance and resolution.

This guide has highlighted essential steps to help you on this journey. From determining eligibility to gathering necessary documentation, applying for payment arrangements, and effectively managing the established plans, each step is designed to empower you. Whether you choose short-term solutions or long-term installment agreements, staying informed and organized is crucial.

We encourage you to utilize resources like the IRS Online Payment Agreement tool and seek professional advice when needed. These resources can help streamline your experience and improve outcomes. Remember, you are not alone in this process; support is always available.

Ultimately, taking proactive steps to address your tax liabilities not only alleviates stress but also fosters a sense of control over your financial future. By mastering the intricacies of IRS payment arrangements, you can embark on a journey toward financial stability and peace of mind. Embrace the resources available, stay compliant, and know that assistance is always within reach as you navigate these tax obligations.

Frequently Asked Questions

What are IRS payment arrangements?

IRS payment arrangements, also known as installment agreements, allow taxpayers to gradually settle their tax obligations instead of paying the full amount at once. This flexibility is particularly helpful for individuals who may struggle to pay their tax bill in full.

What is the duration of IRS payment arrangements?

The duration of IRS payment arrangements can vary, typically ranging from a few months to several years. Short-term arrangements allow repayment within 180 days, while long-term options can extend up to 72 months or more, depending on the amount owed and the taxpayer's financial situation.

Who is eligible for IRS payment arrangements?

Generally, you are eligible for IRS payment arrangements if you owe $50,000 or less in combined tax, penalties, and interest, and have filed all required tax returns. Additionally, being current on your tax obligations is essential.

What options are available for taxpayers who owe more than $50,000?

Taxpayers who owe more than $50,000 may still have options, such as the Long-Term Installment Plan, which allows for monthly installments for up to 10 years. However, additional documentation may be required.

How can I check my eligibility for IRS payment arrangements?

You can check your eligibility for IRS payment arrangements by utilizing the IRS's Online Payment Agreement tool, which helps you understand the options available to you.

What is the Simple Payment Plan?

The Simple Payment Plan is a straightforward option available to many taxpayers. Over 90% of individual taxpayers with a balance due qualify for this plan, which allows for manageable payment arrangements.

What should I do if I cannot pay my tax obligation in full?

If you cannot pay your tax obligation in full, it is advisable to contribute as much as you can as quickly as possible to reduce interest and penalties, which currently accumulate at a rate of 7% annually, plus a late fee of 0.5% monthly.

What if I face financial hardship?

If you are facing financial hardship, you can request a temporary delay in the collection process from the IRS.

What is the Offer in Compromise option?

The Offer in Compromise is an option for those who do not qualify for a Simple Payment Plan, allowing them to settle their tax debt for less than the full amount owed.