Overview

Mastering IRS Form 433 is crucial for taxpayers seeking economic relief. We understand that navigating tax obligations can be overwhelming, but this form enables you to communicate your financial situation effectively to the IRS. By accurately completing this form, you significantly enhance your chances of favorable outcomes, such as:

- Lower payment amounts

- Currently not collectible status

It provides a thorough and honest representation of your financial circumstances, which is essential in these negotiations. Remember, you're not alone in this journey; we're here to help you every step of the way.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, and we understand that many individuals struggle with this challenge. IRS Form 433 is particularly significant—it not only gives the IRS a comprehensive view of your financial situation but also serves as a vital tool for negotiating tax relief and establishing manageable payment plans. However, the stakes are high; inaccuracies or omissions can lead to serious consequences.

It’s common to wonder how you can ensure your submission is thorough and effective. This guide delves into the intricacies of IRS Form 433, offering step-by-step instructions and valuable insights to empower you on your journey toward financial stability. Remember, you are not alone in this process, and we're here to help.

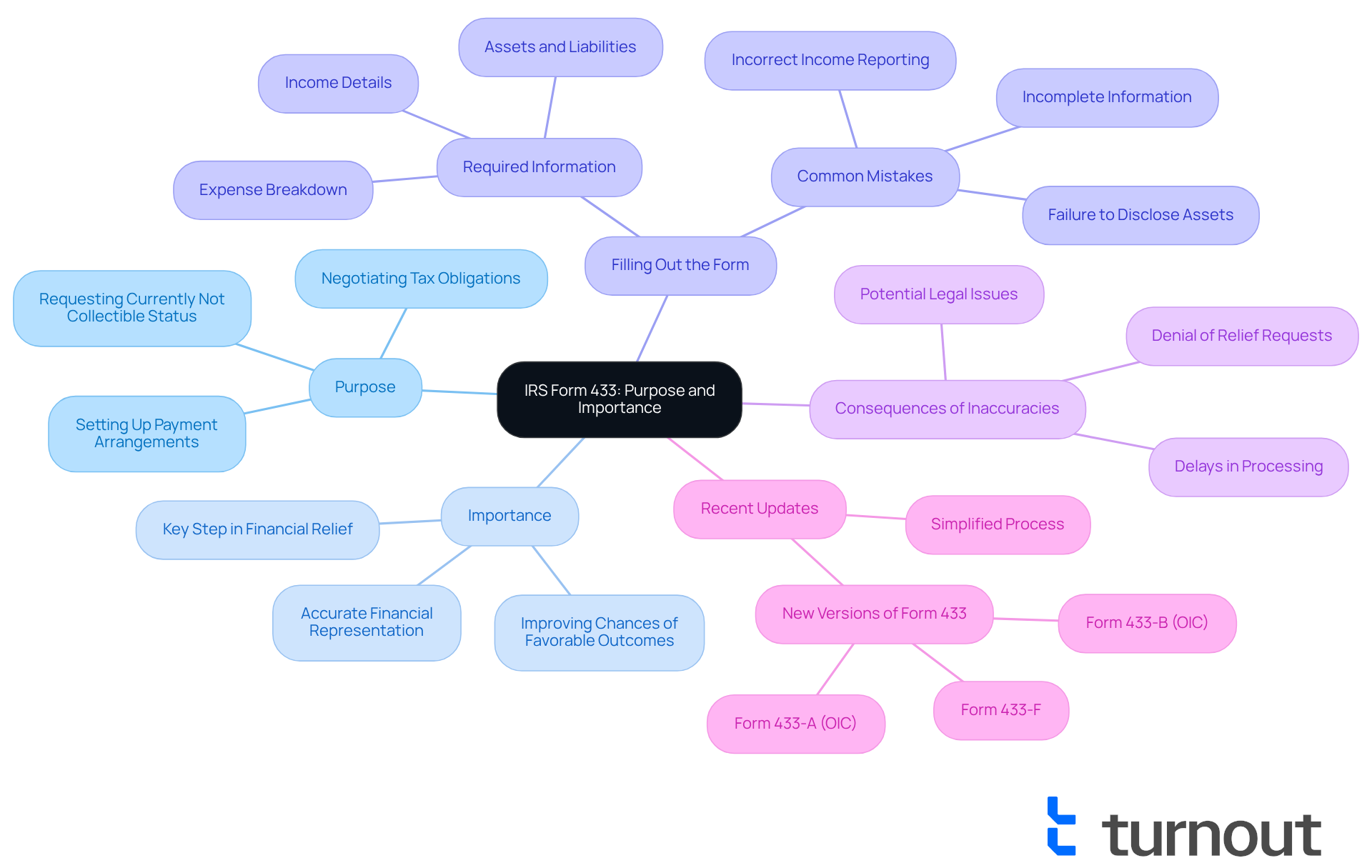

Understand IRS Form 433: Purpose and Importance

The IRS Form 433 is a Collection Information Statement that plays a vital role in helping taxpayers share their financial information with the IRS. If you’re looking to negotiate your tax obligations, set up payment arrangements, or request currently not collectible status, this document is essential. By carefully filling it out, you can provide the IRS with a clear picture of your financial situation, including your income, expenses, assets, and liabilities. Understanding its purpose is key; this form is not just a bureaucratic requirement, but a crucial step towards achieving the economic relief and stability you deserve.

Accurately completing IRS Form 433 can significantly influence your success in negotiating tax debt. When taxpayers provide thorough and honest information, they greatly improve their chances of favorable outcomes, such as lower payment amounts or extended payment terms. Many individuals facing financial hardships have effectively used the IRS Form 433 to demonstrate their inability to pay, resulting in the IRS granting them currently not collectible status, which pauses collection efforts temporarily.

Tax experts emphasize that filling out the IRS Form 433 is more than just a bureaucratic hurdle; it’s an important step in advocating for your financial relief. They stress the importance of honesty and accuracy—any inconsistencies can lead to delays or even denial of relief requests. Not complying with the requirements of IRS Form 433 can lead to serious consequences, including fines and interest charges. Thankfully, recent updates to the IRS Collection Information Statement have simplified the process, making it easier for you to manage your obligations effectively.

In summary, understanding the purpose and significance of IRS Form 433 is vital for anyone seeking economic relief. It empowers you to take control of your financial situation and engage with the IRS confidently, ultimately paving the way for a more manageable tax experience. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

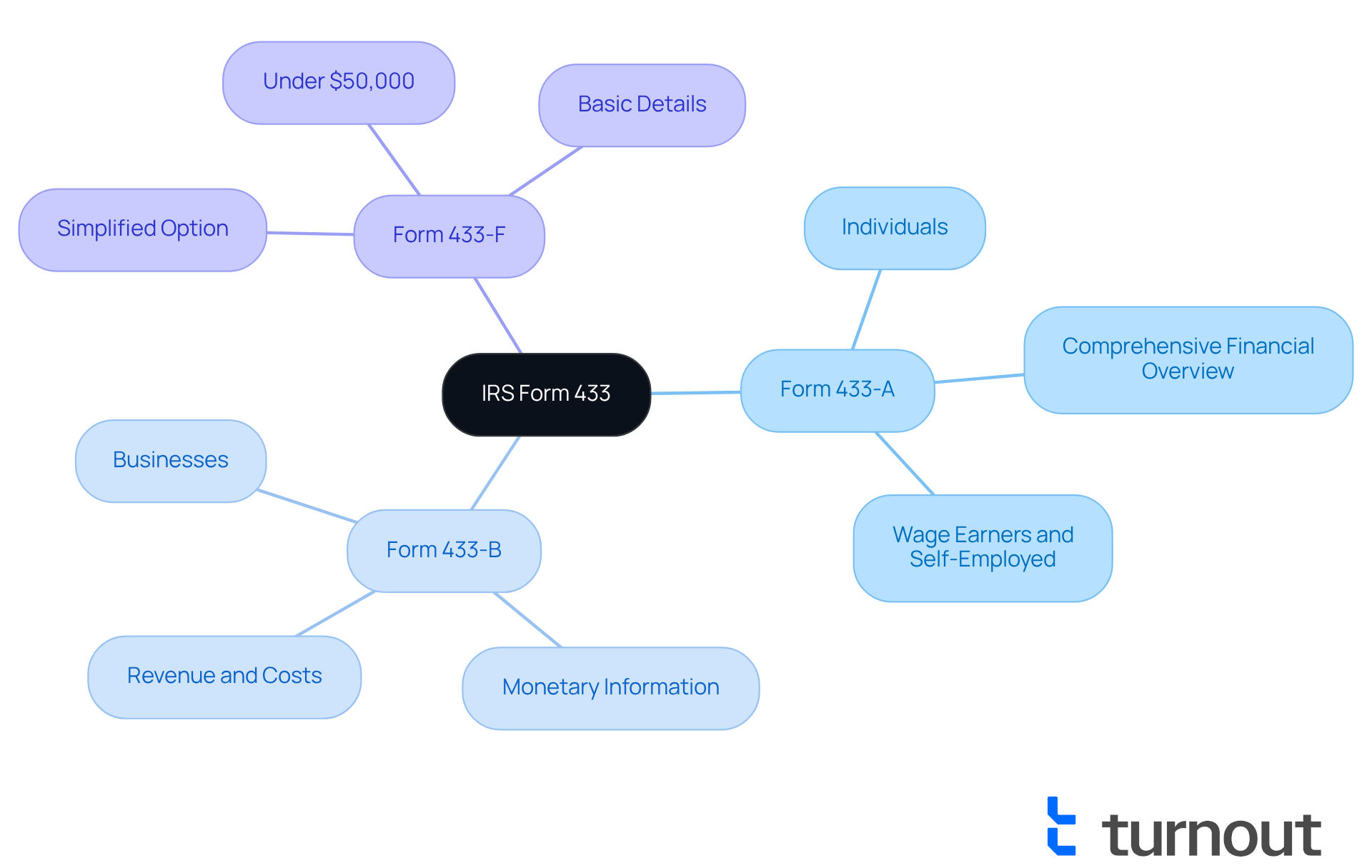

Identify the Right Version of Form 433: A, F, or B?

Navigating tax obligations can be overwhelming, and understanding the right IRS Form 433 for your specific situation is crucial. There are three primary versions: Form 433-A, Form 433-B, and Form 433-F, each tailored for distinct financial circumstances.

-

Form 433-A is essential for individuals seeking any type of resolution to their IRS tax liability. It’s designed for wage earners and self-employed individuals, requiring a comprehensive overview of personal finances, including assets, income, and monthly expenses. This document is particularly important for those carrying significant tax debt or managing mixed business and personal expenses.

-

Form 433-B is created for businesses, gathering comprehensive monetary information pertinent to business activities, such as revenue, costs, and asset specifics. If you’re a business owner seeking tax relief, this form is crucial for accurately portraying your financial status.

-

Form 433-F serves as a simplified option for individuals who owe under $50,000. It allows you to submit basic monetary details without the extensive information required by the other forms.

The IRS utilizes IRS Form 433, along with Forms 433-A and 433-B, to gather detailed financial information from taxpayers, which is essential for evaluating their ability to settle tax obligations. When deciding which form to utilize, consider your employment status and the complexity of your financial situation. For instance, self-employed individuals with significant tax responsibilities should opt for Form 433-A, while business proprietors must utilize Form 433-B to accurately represent their financial standing. Conversely, if your tax debt is under $50,000, you might find Form 433-F sufficient.

We understand that seeking advice from tax experts can offer valuable guidance on which document best meets your needs. Many taxpayers find that expert assistance ensures the accurate completion of these forms, significantly impacting their ability to negotiate tax relief effectively. As highlighted by the Tax Defense Network, providing substantial documentation to support your financial information is essential; mistakes can lead to delays or unfavorable outcomes in tax discussions. Additionally, if you have a good compliance history, you may be eligible for penalty abatement, further enhancing your options for relief.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges with confidence.

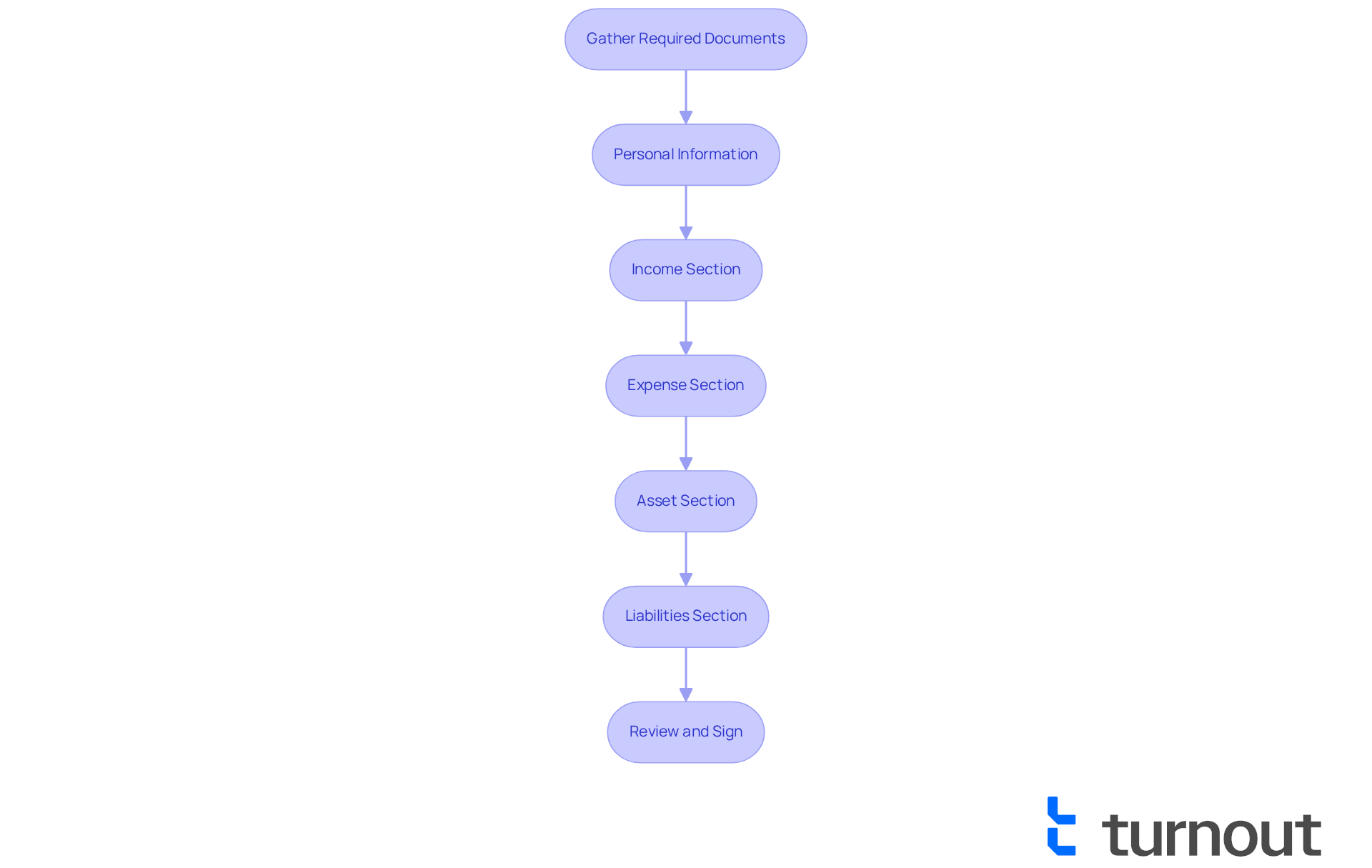

Complete IRS Form 433: Step-by-Step Instructions

To effectively complete the IRS Form 433, we understand that it can feel overwhelming. Here are some detailed steps to guide you through the process:

- Gather Required Documents: Start by collecting essential monetary documents, including pay stubs, bank statements, and records of monthly expenses. This will help you feel organized and prepared.

- Personal Information: At the top of the form, accurately fill in your name, address, and Social Security number. Taking this step ensures that your information is clear and correct.

- Income Section: Report all sources of income, such as wages, self-employment earnings, and any additional income. Ensure that you include all relevant details for clarity. Remember, every bit of information counts.

- Expense Section: List your monthly expenses, covering categories like housing, utilities, food, and transportation. Use precise figures to reflect your actual spending habits. This transparency is vital.

- Asset Section: Provide a detailed account of your assets, including bank accounts, real estate, and vehicles. It's important to include current values for each asset to provide a clear economic picture. This helps in understanding your financial situation better.

- Liabilities Section: Document any debts you owe, such as credit card balances, loans, and other financial obligations. Acknowledging these can be a crucial step in your financial journey.

- Review and Sign: Carefully double-check all entries for accuracy, ensuring that no information is missing. Finally, sign and date the form before submission. This final step is essential for a complete submission.

Furthermore, think about seeking help from a tax expert regarding the IRS Form 433. They can offer important advice and confirm that your submission is correct. You can also use the IRS Offer in Compromise Pre-Qualifier tool to check your eligibility for offers in compromise. This can be a helpful resource in assessing your situation.

It's essential to recognize that failing to submit the IRS Form 433 when requested can lead to significant repercussions, including collection actions. By carefully adhering to these steps and using available resources, you can improve the precision of your IRS Form 433, greatly increasing your likelihood of a positive result. Financial experts emphasize that thoroughness in documentation is key to navigating the IRS processes successfully. Remember, you are not alone in this journey, and we’re here to help.

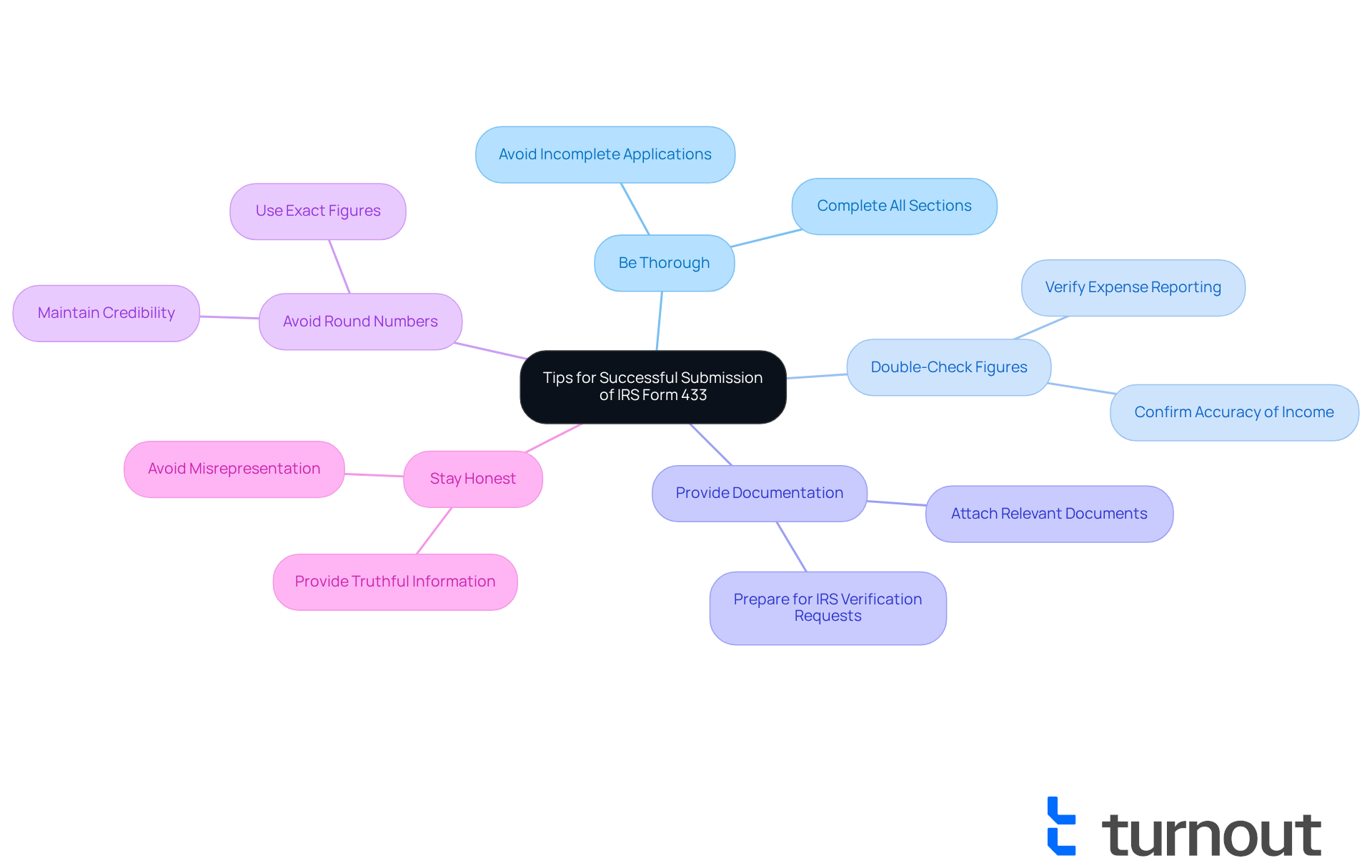

Avoid Common Mistakes: Tips for Successful Submission

To enhance your chances of a successful submission of the IRS Form 433, we understand that the process can be daunting. Here are some supportive tips to keep in mind:

- Be Thorough: Ensure that all sections of the form are completed. Incomplete applications are frequently dismissed, resulting in avoidable delays. We know how frustrating that can be.

- Double-Check Figures: Confirm that all monetary figures are accurate and represent your current situation. Mistakes in income or expenses can lead to incorrect assessments and potential rejection, which can be disheartening.

- Provide Documentation: While Form 433-A does not require substantial supporting documentation upon submission, it's important to note that the IRS may request verification after receiving the form. Attaching any relevant documents, such as bank statements or proof of income, can substantiate your claims and facilitate the review process.

- Avoid Round Numbers: Use exact figures rather than rounding up or down, as this can raise questions about the accuracy of your reporting. Providing precise numbers helps maintain credibility and can prevent scrutiny from the IRS.

- Stay Honest: Misrepresenting your financial situation can lead to serious consequences, including penalties. Always provide truthful information to avoid complications with the IRS.

By adhering to these guidelines, you can minimize the risk of errors and improve the likelihood of a favorable response when submitting the IRS Form 433. Remember, you are not alone in this journey. Statistics indicate that many submissions are rejected due to common errors, emphasizing the importance of accuracy and thoroughness in your application. We're here to help you navigate this process with confidence.

Conclusion

Understanding IRS Form 433 is essential for taxpayers navigating their financial obligations. This form is a critical tool for sharing financial information with the IRS, allowing individuals to negotiate tax debts, establish payment plans, or request currently not collectible status. By accurately completing this form, taxpayers can advocate for their financial relief and gain a clearer path toward economic stability.

We recognize that selecting the appropriate version of Form 433—whether it be Form 433-A, 433-B, or 433-F—can feel overwhelming. It's important to prepare thoroughly and report honestly throughout the completion process. Key steps include:

- Gathering required documents

- Detailing income and expenses

- Avoiding common pitfalls that could jeopardize your submission

Each of these elements plays a vital role in ensuring a successful outcome when dealing with the IRS.

Ultimately, this journey is about empowerment and support. By understanding the nuances of IRS Form 433 and adhering to best practices for its completion, you can significantly enhance your chances of achieving favorable results. Seeking professional advice and remaining diligent in documentation are crucial steps in this process. Embracing these strategies not only aids in personal financial management but also fosters confidence in managing tax obligations, paving the way for a more secure financial future. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is IRS Form 433?

IRS Form 433 is a Collection Information Statement that allows taxpayers to share their financial information with the IRS, which is essential for negotiating tax obligations, setting up payment arrangements, or requesting currently not collectible status.

Why is it important to fill out IRS Form 433 accurately?

Accurately completing IRS Form 433 is crucial as it significantly influences the success of negotiating tax debt. Providing thorough and honest information improves the chances of favorable outcomes, such as lower payment amounts or extended payment terms.

What can happen if I do not comply with the requirements of IRS Form 433?

Not complying with the requirements of IRS Form 433 can lead to serious consequences, including fines and interest charges, as well as delays or denial of relief requests.

How can IRS Form 433 help those facing financial hardship?

Individuals facing financial hardships can use IRS Form 433 to demonstrate their inability to pay, which may result in the IRS granting them currently not collectible status, temporarily pausing collection efforts.

What recent changes have been made to IRS Form 433?

Recent updates to the IRS Collection Information Statement have simplified the process, making it easier for taxpayers to manage their obligations effectively.

What is the overall significance of understanding IRS Form 433?

Understanding the purpose and significance of IRS Form 433 is vital for anyone seeking economic relief, as it empowers individuals to take control of their financial situation and engage with the IRS confidently.