Overview

This article serves as a compassionate step-by-step guide for individuals seeking relief from back tax payments. We understand that dealing with tax issues can be overwhelming, and it’s important to recognize the consequences of non-payment. By exploring various settlement options, you can find a way forward.

We begin by detailing essential processes, such as assessing your tax situation and identifying outstanding balances. It’s common to feel uncertain about your options, but considering alternatives like payment plans and offers in compromise can provide relief. Proactive engagement with tax authorities is key; taking the first step can significantly alleviate your financial burdens.

Remember, you are not alone in this journey. We're here to help you navigate these challenges and find the support you need. Together, we can work towards a brighter financial future.

Introduction

Navigating the complex world of back tax payments can feel overwhelming for many American households, especially as financial burdens escalate in 2025. We understand that the implications of unpaid taxes can be daunting, with stakes that include:

- Severe penalties

- Interest accumulation

- Potential legal action from the IRS

This guide is here to offer you a comprehensive roadmap for seeking relief. We’ll detail essential steps to:

- Assess your tax situation

- Explore settlement options

- Maintain compliance

How can you effectively tackle the challenge of back taxes while ensuring a secure financial future? You're not alone in this journey, and we're here to help.

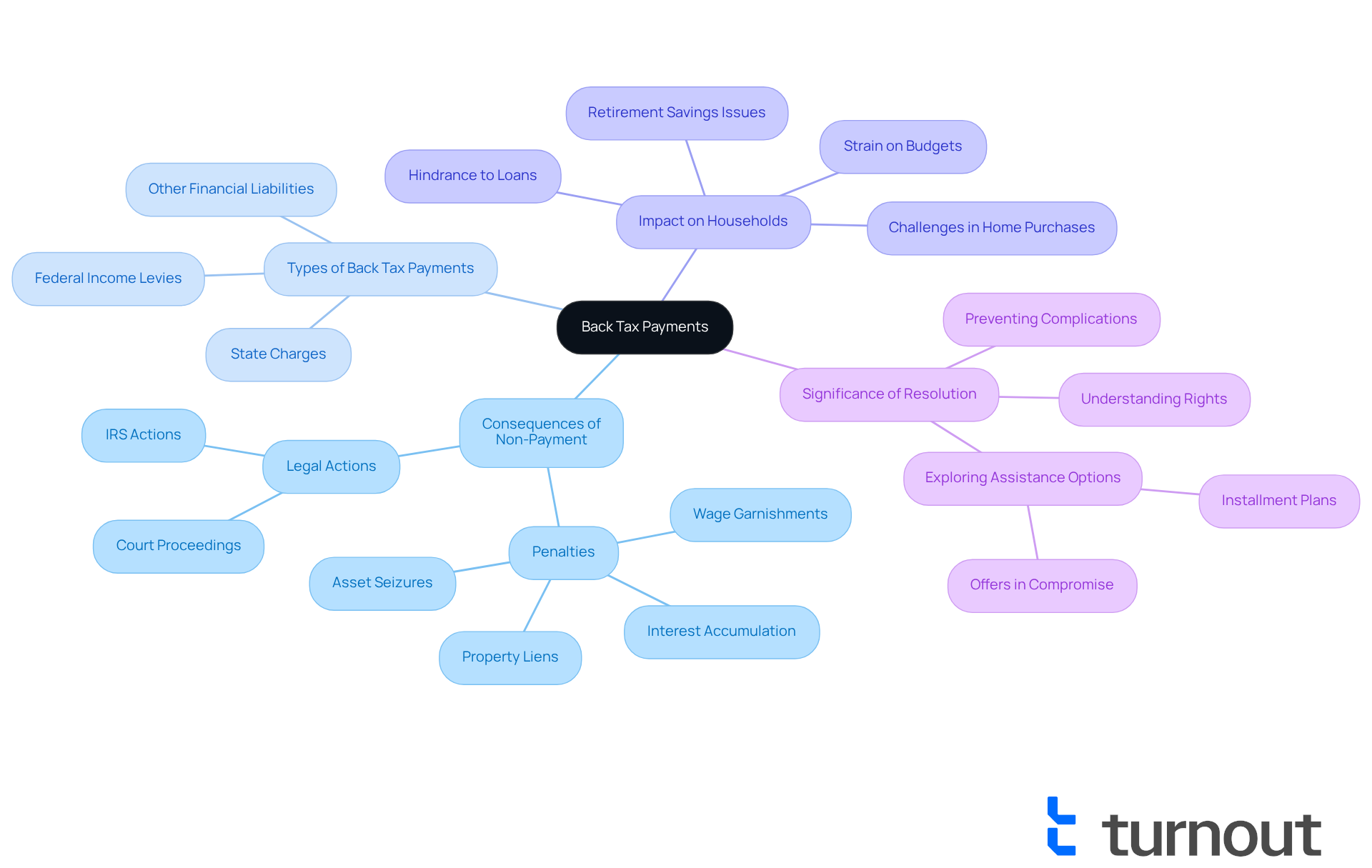

Understand Back Tax Payments and Their Implications

Unpaid dues refer to amounts that have not been settled by their due date. This situation often leads to the accumulation of interest and penalties, creating significant financial burdens for American households in 2025. We understand that comprehending the consequences of overdue payments is crucial for effective administration and resolution.

-

Consequences of Non-Payment: Not repaying owed taxes can lead to serious penalties, interest accumulation, and potential legal actions by the IRS. You might face wage garnishments, property liens, or even asset seizures. Tax experts emphasize that delaying the resolution of back tax payments can lead to more challenging consequences.

-

Types of Back Tax Payments: Back tax payments include various dues, such as federal income levies, state charges, and other financial liabilities that were not fulfilled on time. Each type carries its own penalties and interest rates, which can compound quickly.

-

Impact on American Households: The burden of overdue payments can strain household budgets, affecting everything from daily expenses to long-term financial planning. In 2025, many families are realizing that unresolved back tax payment issues can hinder their ability to secure loans, purchase homes, or save for retirement.

-

Real-World Examples: Imagine a household that failed to pay federal income contributions for several years. They faced escalating penalties that doubled their original tax debt within just a few years. Such situations highlight the importance of prompt resolution of back tax payment to avoid further economic distress.

-

Significance of Resolution: Addressing overdue payments promptly is essential to prevent complications and financial strain. Understanding your rights and options for assistance, such as back tax payment installment plans or offers in compromise, can significantly ease the burden. We recommend proactive engagement with the IRS to explore available solutions and mitigate the impact of back tax payment. Remember, you are not alone in this journey; we're here to help.

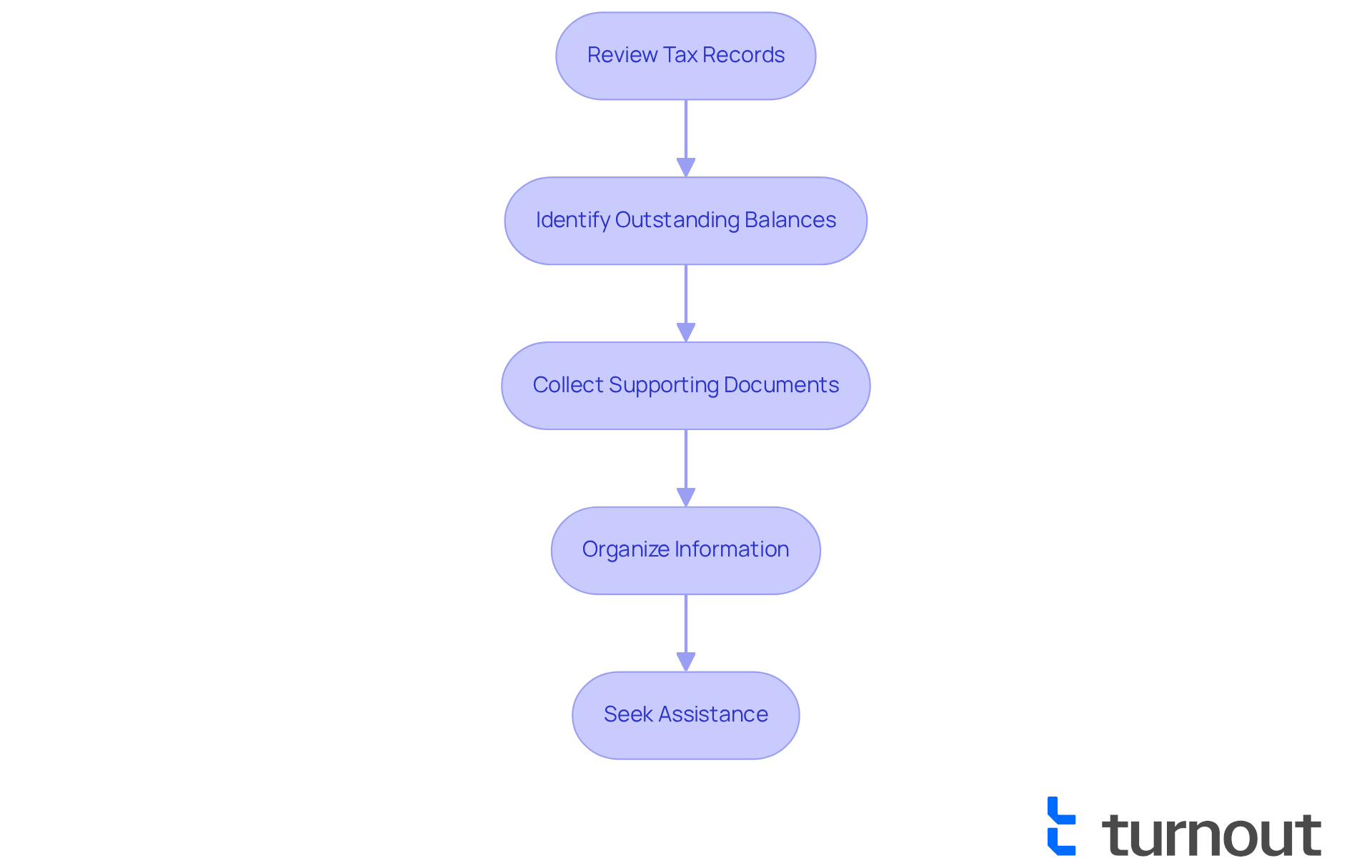

Assess Your Tax Situation and Gather Necessary Documentation

Addressing back tax payment issues can feel overwhelming, but you're not alone in this journey. We understand that navigating tax issues can be stressful, so let's take a compassionate approach to assess your current tax situation together.

First, it's essential to review your tax records. Gather your tax returns from the past few years, including W-2s, 1099s, and any other income statements. This step will help you understand your financial landscape better.

Next, identify any outstanding balances. Check your IRS account online to see how much you owe, including penalties and interest. Knowing this information is crucial as it empowers you to take action on your back tax payment.

Collecting supporting documents is also vital. Prepare any documents that support your income claims and deductions, such as bank statements, receipts, and any correspondence from the IRS. Having these on hand will make the process smoother.

Finally, organize your information. Create a folder—whether physical or digital—to keep all relevant documents together. This organization will make it easier for you to reference them later, reducing stress and uncertainty.

Remember, we're here to help you through this process. Taking these steps can bring you closer to resolving your tax concerns.

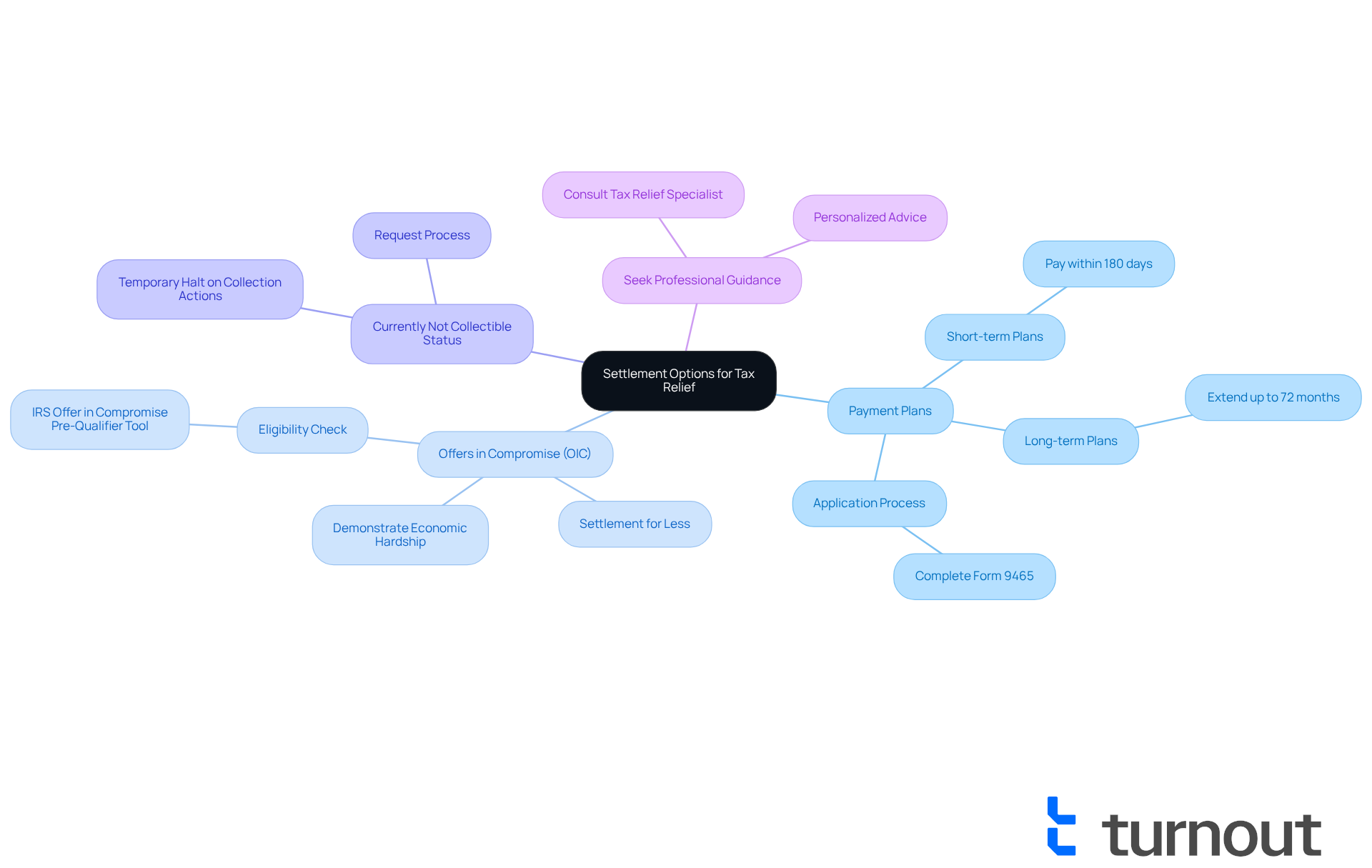

Explore Settlement Options: Payment Plans, Offers in Compromise, and More

Once you have assessed your tax situation, it's important to explore your settlement options with care and understanding:

-

Payment Plans: We know that managing tax payments can be overwhelming. The IRS offers both short-term and long-term payment plans to help ease your back tax payment burden. Short-term plans allow you to pay your balance within 180 days, while long-term options can extend up to 72 months. To apply, simply complete Form 9465.

-

Offers in Compromise (OIC): If you're feeling the weight of your tax debt, an Offer in Compromise might be a viable solution for you. This option allows you to settle your tax debt for less than the full amount owed, provided you can demonstrate economic hardship. To find out if you might qualify, use the IRS Offer in Compromise Pre-Qualifier tool.

-

Currently Not Collectible Status: It's common to feel trapped by financial difficulties. If you're unable to make your back tax payment due to hardship, you can request to be placed in currently not collectible status, which temporarily halts collection actions and gives you some breathing room.

-

Seek Professional Guidance: Remember, you're not alone in this journey. Consulting with a tax relief specialist can provide you with personalized advice tailored to your unique situation. They can guide you through the options available to you, ensuring you feel supported every step of the way.

We understand that navigating tax issues can be daunting, but there are paths to relief. Take the next step toward regaining your peace of mind today.

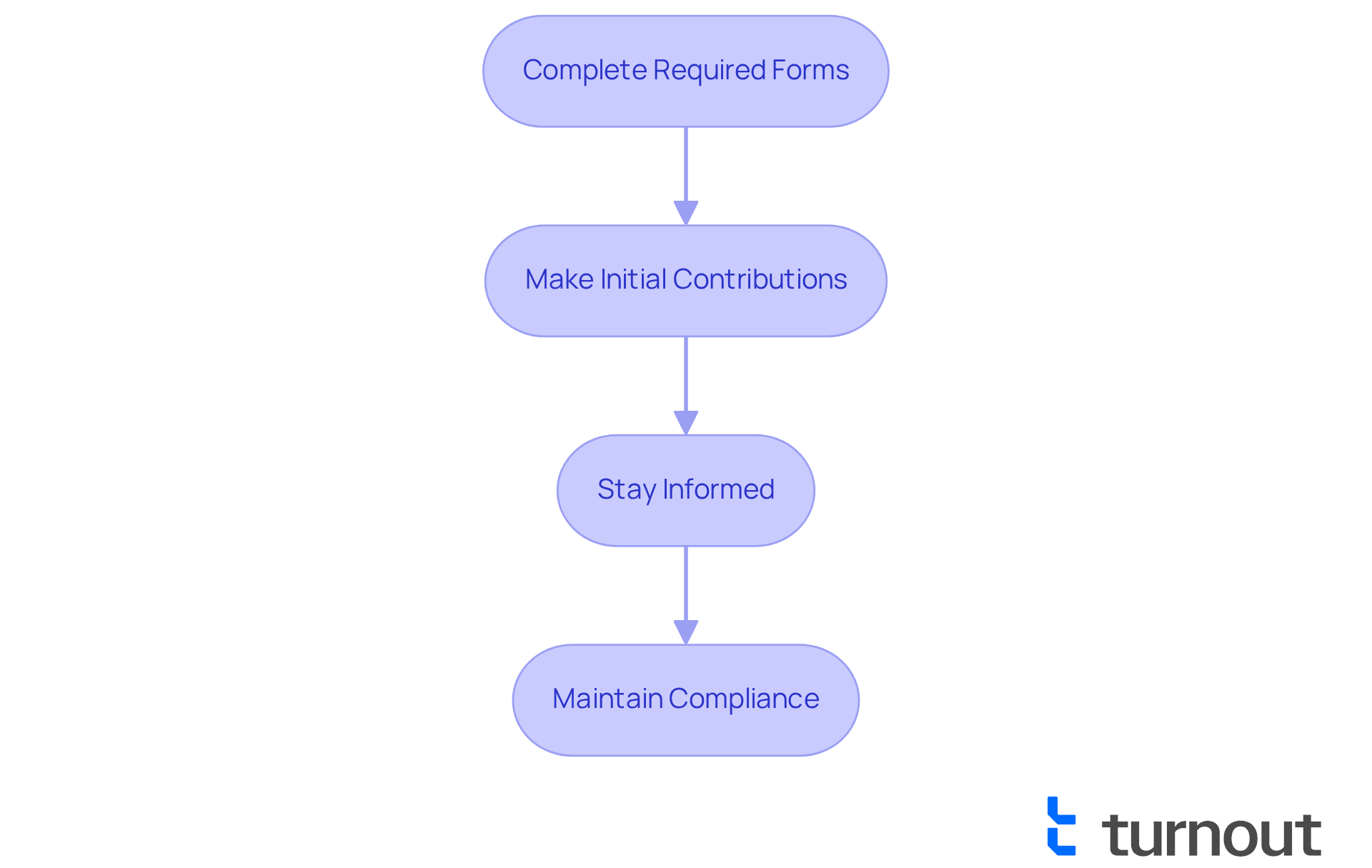

Finalize Your Settlement Agreement and Maintain Compliance

After selecting a settlement option, we understand that finalizing your back tax payment agreement can feel overwhelming. Here are some steps to help you navigate this process with confidence:

-

Complete Required Forms: Take the time to accurately fill out and submit all necessary forms to the IRS. For financing arrangements, use Form 9465; for an Offer in Compromise (OIC), submit Form 656. As you approach 2025, it's important to stay informed about any updates or requirements related to these forms to avoid delays in processing your agreement.

-

Make Initial Contributions: If your agreement necessitates it, consider providing any initial contributions. This shows your good faith and dedication to the settlement. Remember, the typical initial fee for IRS settlement agreements can vary, so being prepared for this upfront expense is wise.

-

Stay Informed: It's common to feel uncertain, so regularly checking your billing schedule and any correspondence from the IRS can help ease your mind. Utilize the IRS online portal to keep track of your account status and ensure you are up to date.

-

Maintain Compliance: After settling your tax debt, it’s crucial to file all future tax returns on time and pay any new tax obligations promptly. Establishing automatic transfers for recurring responsibilities can assist you in preventing a return to debt.

Tax professionals emphasize that maintaining compliance after a back tax payment is vital. One expert notes, "Staying proactive in managing your tax responsibilities is key to preventing future issues." The IRS allows taxpayers to negotiate arrangements tailored to their economic circumstances, facilitating compliance. Moreover, real-world examples show that individuals who adhere to their payment schedules and file timely returns significantly reduce the risk of incurring additional penalties or interest. By following these steps and remaining diligent, you can successfully navigate your tax settlement and maintain a healthy financial future. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Addressing back tax payments is a crucial step for individuals seeking financial stability and peace of mind. We understand that the implications of unpaid taxes, including potential penalties and the strain they can place on household budgets, can be overwhelming. This underscores the importance of proactive management. By recognizing the types of back tax payments and their consequences, you can better navigate your financial obligations.

This article outlines essential steps for resolving back tax issues. Start by:

- Assessing your tax situation and gathering necessary documentation.

- Exploring settlement options such as payment plans and offers in compromise.

Each of these strategies is designed to alleviate the burden of back taxes, allowing you to regain control over your finances. Furthermore, maintaining compliance after settling tax debts is vital to prevent future complications and ensure a healthier financial future.

Ultimately, taking action against back tax payments is not just about resolving current debts; it is about empowering yourself to build a more secure financial foundation. Seeking professional guidance and utilizing available resources can significantly ease your journey toward tax relief. Remember, you are not alone in this journey. By staying informed and proactive, you can take meaningful steps toward financial recovery and stability.

Frequently Asked Questions

What are unpaid dues in the context of back tax payments?

Unpaid dues refer to amounts that have not been settled by their due date, leading to the accumulation of interest and penalties.

What are the consequences of not repaying owed taxes?

Not repaying owed taxes can result in serious penalties, interest accumulation, and potential legal actions by the IRS, including wage garnishments, property liens, or asset seizures.

What types of back tax payments exist?

Back tax payments include federal income levies, state charges, and other financial liabilities that were not fulfilled on time, each carrying its own penalties and interest rates.

How do overdue payments impact American households?

The burden of overdue payments can strain household budgets, affecting daily expenses and long-term financial planning, and can hinder the ability to secure loans, purchase homes, or save for retirement.

Can you provide a real-world example of the consequences of back tax payments?

An example is a household that failed to pay federal income contributions for several years, resulting in escalating penalties that doubled their original tax debt within a few years.

Why is it important to resolve back tax payments promptly?

Prompt resolution of overdue payments is essential to prevent complications and financial strain. Understanding rights and options for assistance can significantly ease the burden.

What options are available for assistance with back tax payments?

Options include back tax payment installment plans or offers in compromise, which can help mitigate the impact of back tax payments. Proactive engagement with the IRS is recommended to explore available solutions.