Overview

Navigating disability income can be challenging, and understanding the potential tax implications is crucial. Disability income may be taxable, depending on the type of benefits you receive and your overall earnings. For instance, if your total earnings exceed certain thresholds, Social Security Disability Insurance payments may be subject to taxation. On the other hand, Supplemental Security Income benefits are typically non-taxable.

We understand that managing your finances can feel overwhelming. It's essential to take the time to understand your specific situation to effectively manage your tax obligations. Remember, you're not alone in this journey; we're here to help you navigate these complexities. By staying informed, you can make empowered decisions that support your financial well-being.

Introduction

Navigating the complexities of disability income and its tax implications can feel overwhelming for many individuals. We understand that millions of Americans rely on various forms of disability support, and knowing whether these payments are taxable is crucial for effective financial planning.

As the landscape of disability benefits evolves, it's common to have questions:

- How do Social Security Disability Insurance and Supplemental Security Income differ in their tax treatment?

- What happens when additional earnings push recipients over the taxable limit?

This article delves into these critical questions, offering insights and comparisons that illuminate the often-overlooked financial responsibilities tied to disability income. We're here to help you understand these important aspects, ensuring you feel supported on your journey.

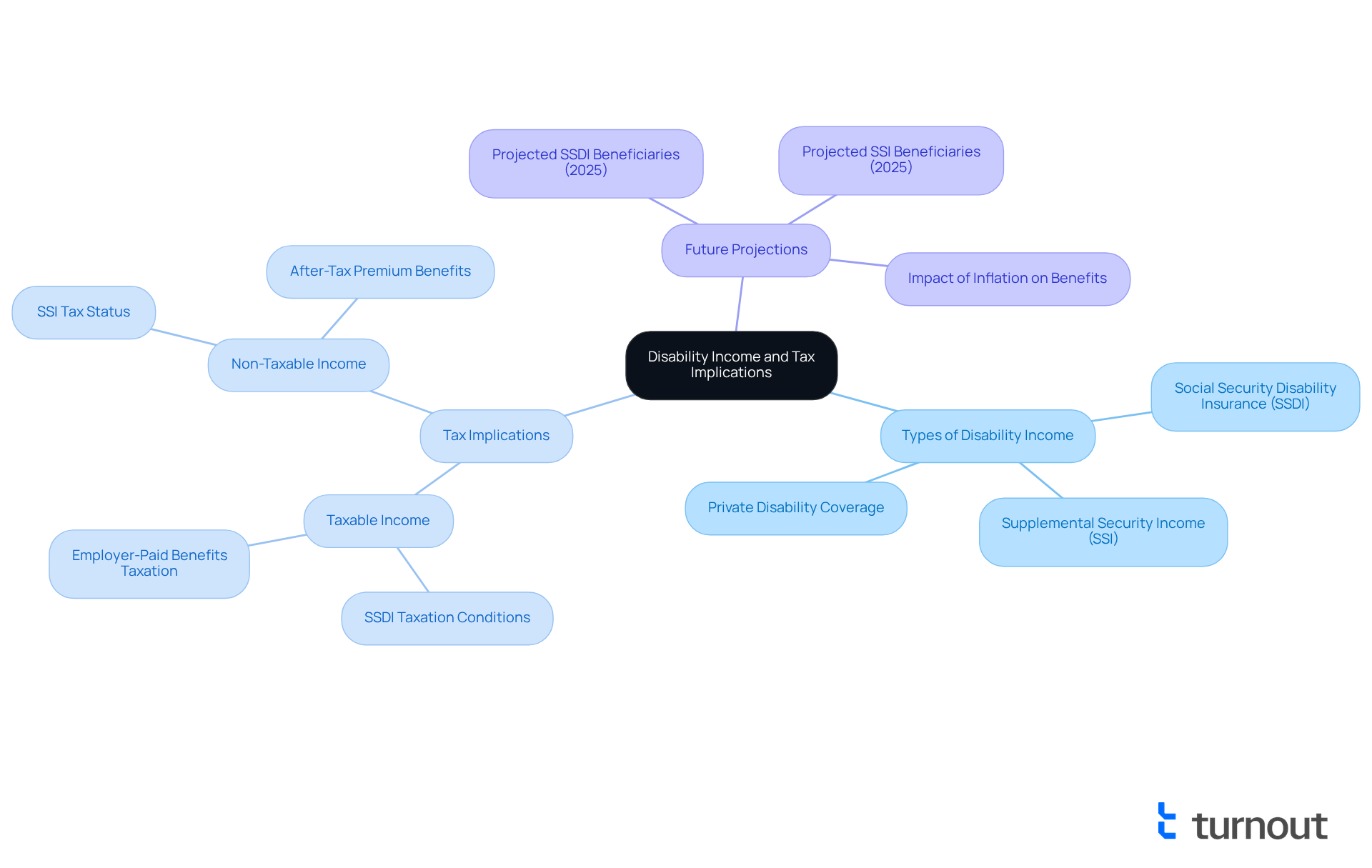

Understanding Disability Income and Its Tax Implications

Disability compensation provides essential payments to individuals unable to work due to a disability. These payments come from sources like Social Security Disability Benefits, Supplemental Security Income, and private disability coverage. Understanding if disability income is taxable is crucial, as the tax implications of these payments can vary significantly. For instance, a consideration to keep in mind is whether disability income is taxable, as Social Security Disability Insurance payments may be subject to federal income tax if the recipient's total earnings exceed specific limits. Conversely, SSI payments are typically not taxable, offering a vital lifeline for many.

As we look ahead to 2025, approximately 8.5 million Americans will benefit from Social Security Disability Insurance, while around 8 million will rely on Supplemental Security Income. This highlights the importance of comprehending if disability income is taxable and the tax implications of these allowances. With disability support rates increasing by 2.5% this year and inflation rising by 3%, understanding how these changes affect purchasing power is essential.

Consider this: if a person receives disability support and has additional earnings that push their total over the taxable limit, they may find themselves liable for taxes on part of their assistance. On the other hand, those solely relying on SSI can rest assured that their assistance remains untaxed, allowing them to manage their limited resources more effectively.

Looking forward to 2025, it is important to consider whether disability income is taxable, as the specifics will vary based on individual circumstances, including income sources and amounts. We encourage you to consult with a financial advisor who can provide tailored insights into managing these tax obligations. Remember, you are not alone in this journey; seeking guidance can empower you to navigate your financial planning with confidence.

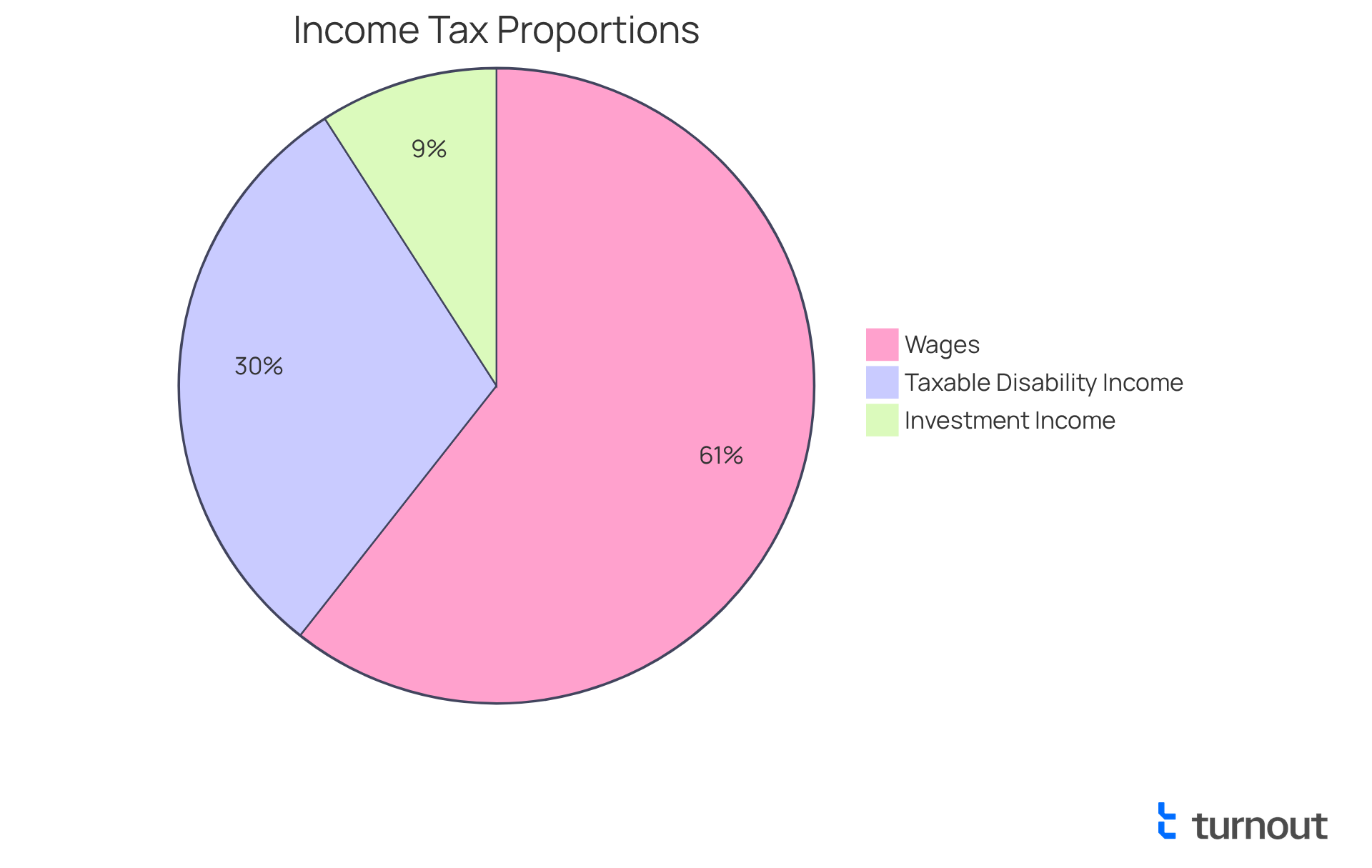

Comparing Disability Income Taxation with Wages and Investment Income

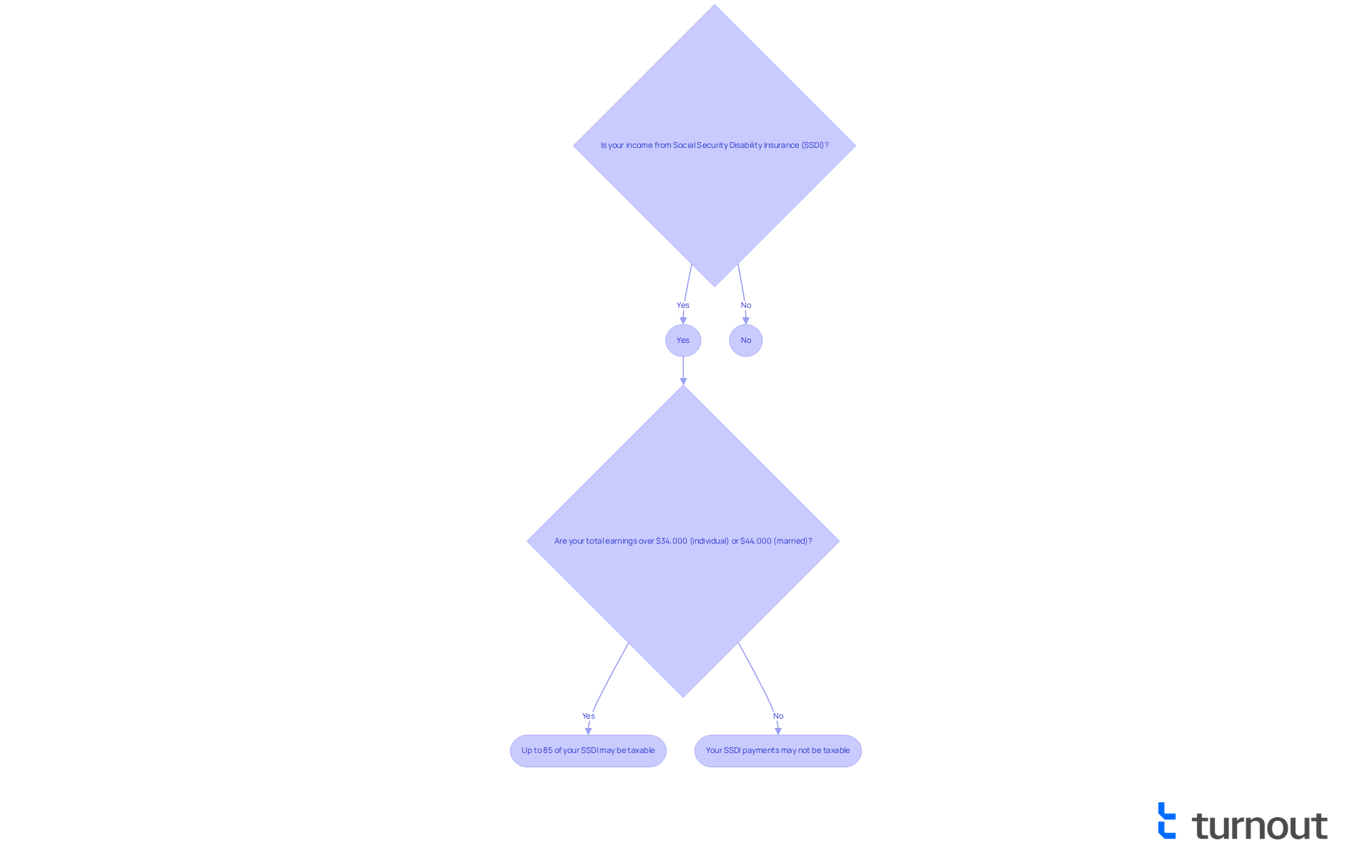

When considering the taxation of disability payments compared to wages, it’s important to recognize that wages are fully taxable as regular earnings. However, the tax status of disability benefits, including whether disability income is taxable, can vary based on the recipient's total earnings level. For 2025, if your total earnings exceed $34,000 for single filers or $44,000 for joint filers, you may find that up to 85% of your disability support raises the question of whether disability income is taxable for federal income tax purposes.

We understand that navigating these tax implications can feel overwhelming. It's also worth noting that investment earnings, such as dividends and capital gains, are taxable but generally follow different rates and regulations. This can complicate your financial planning even further. For instance, if a taxpayer has provisional earnings of $40,000, they might discover that the question of whether disability income is taxable means that 50% of their SSDI benefits are taxable. Conversely, someone with provisional earnings of $50,000 could see up to 85% of their benefits taxed, which leads to the important question: is disability income taxable?

This comparison underscores the importance of understanding how different types of income interact with tax regulations, particularly regarding whether disability income is taxable. These variations can significantly impact your net earnings and overall financial strategy. Remember, you're not alone in this journey; we're here to help you navigate these complexities and find the best path forward.

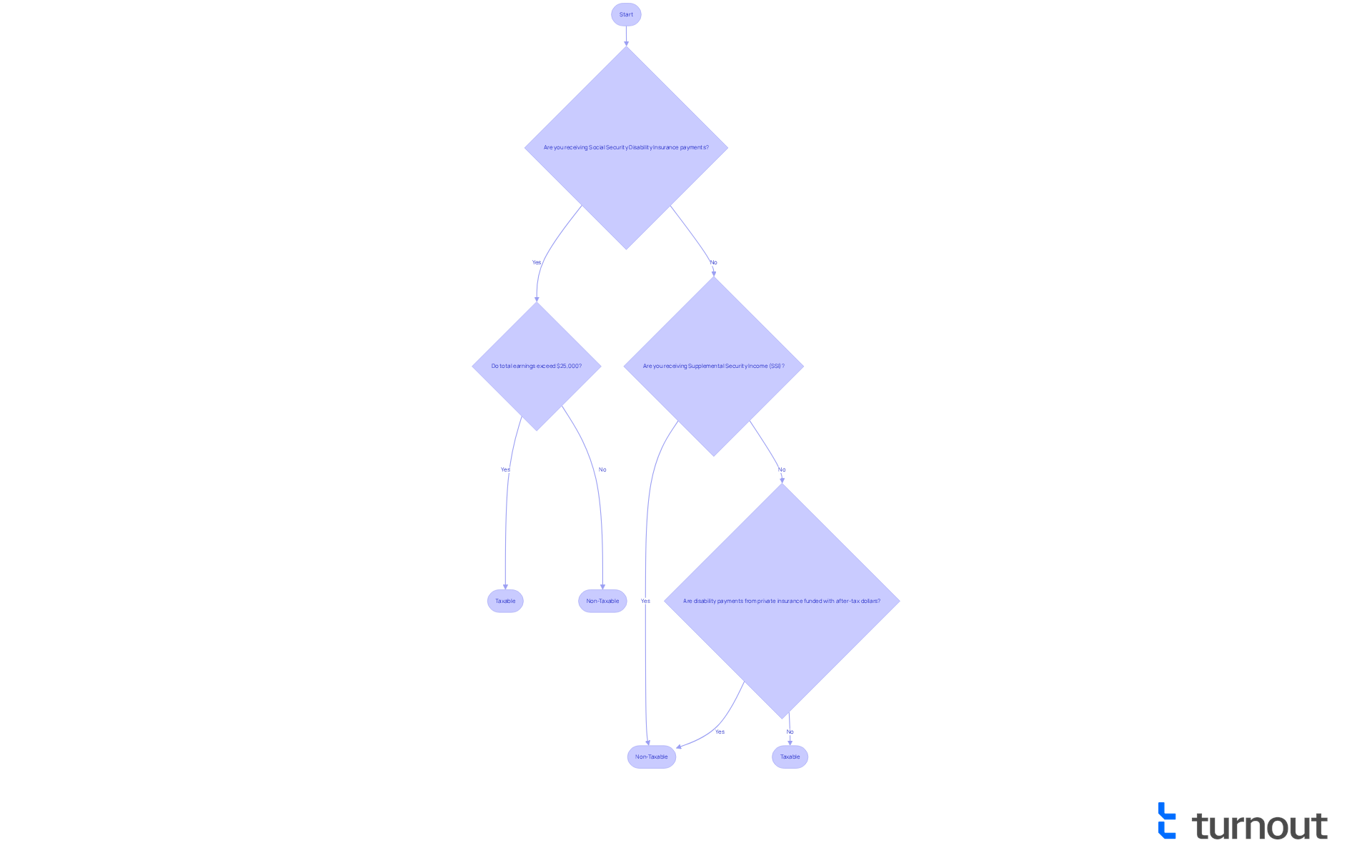

Taxability Scenarios: When Disability Income Is Taxable vs. Non-Taxable

Disability payments can indeed be subject to taxation, and it's important to understand the circumstances surrounding this issue. For example:

- If you are receiving Social Security Disability Insurance payments, you may find that if your total earnings exceed $25,000 (or $32,000 for married couples filing jointly), you will need to pay taxes on a portion of those payments.

- On the other hand, Supplemental Security Income (SSI) benefits are always non-taxable.

- Additionally, if you have disability payments from private insurance policies that were funded with after-tax dollars, those are generally not taxable.

We understand that navigating these scenarios is crucial for accurately assessing your tax obligations and avoiding any unexpected liabilities. As we look ahead to 2025, when cost of living adjustments (COLA) will be implemented, many recipients of disability benefits may find themselves exceeding these earnings limits, which could lead to tax consequences. With around 65% of SSDI applications being denied initially, it's essential for you to be aware of your financial situation and how it may impact your tax responsibilities.

Turnout offers valuable tools and services, including trained nonlawyer advocates and IRS-licensed enrolled agents, to help you navigate these complexities, especially if you're dealing with SSD claims and tax debt relief. For instance, consider Alison W., who receives $185 in Social Security payments; after Medicare deductions, only $35 remains. This highlights the importance of understanding how assistance interacts with your tax responsibilities. As housing costs continue to rise, it's vital to navigate these financial complexities carefully, ensuring that you are prepared and informed come tax season.

Key Takeaways on Disability Income Taxation and Financial Planning

Understanding if disability income is taxable is essential for effective financial planning. We know that navigating these complexities can feel overwhelming. If you are receiving Social Security Disability Insurance, it's important to consider your overall earnings, as this directly impacts the taxation of your assistance. Unlike regular wages, which are fully taxable, disability payments can have different tax obligations based on your specific situation. For instance, individual taxpayers earning over $34,000 may find that up to 85% of their disability payments are taxable. Similarly, married couples filing together with earnings exceeding $44,000 face comparable tax consequences.

Recognizing when disability income is taxable versus non-taxable allows you to prepare for tax season with confidence. If your SSDI assistance constitutes a significant portion of your income, planning to reduce your tax obligations is crucial. You might consider seeking guidance from a knowledgeable representative to help you manage these complexities. By understanding these nuances, you can align your financial strategies with your unique circumstances, ensuring compliance with tax regulations while maximizing your benefits. Remember, you are not alone in this journey; we’re here to help you navigate through it.

Conclusion

Understanding the tax implications of disability income is crucial for effective financial planning. We recognize that the complexities surrounding whether disability payments are taxable can significantly impact your financial situation, especially as we approach 2025. It's important to know that while Social Security Disability Insurance (SSDI) may be subject to taxation based on total earnings, Supplemental Security Income (SSI) remains non-taxable, providing necessary support without adding financial burdens.

This article explores various scenarios that highlight the nuances of disability income taxation. Key points include:

- The thresholds for taxable SSDI payments

- The differences between disability income and regular wages

- The implications of private insurance payments

As you navigate your financial landscape, understanding these distinctions is vital to avoid unexpected tax liabilities and to make informed decisions regarding your benefits.

Ultimately, awareness and proactive planning are essential for those receiving disability income. We encourage you to seek guidance from financial advisors or tax professionals, as this can empower you to confidently navigate these complexities. By staying informed about the taxability of disability income, you can better prepare for tax season and ensure that you maximize your benefits while remaining compliant with tax regulations. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is disability income?

Disability income refers to payments provided to individuals who are unable to work due to a disability. These payments can come from sources such as Social Security Disability Benefits, Supplemental Security Income (SSI), and private disability coverage.

Is disability income taxable?

The taxability of disability income can vary. Social Security Disability Insurance (SSDI) payments may be subject to federal income tax if the recipient's total earnings exceed specific limits. In contrast, SSI payments are typically not taxable.

How many Americans are expected to benefit from Social Security Disability Insurance by 2025?

Approximately 8.5 million Americans are expected to benefit from Social Security Disability Insurance by 2025.

How many individuals will rely on Supplemental Security Income by 2025?

Around 8 million individuals are projected to rely on Supplemental Security Income by 2025.

What recent changes have affected disability support rates?

Disability support rates have increased by 2.5% this year, while inflation has risen by 3%. Understanding these changes is essential for managing purchasing power.

What should individuals consider regarding their total earnings and disability income?

Individuals receiving disability support should be aware that if their additional earnings push their total income over the taxable limit, they may be liable for taxes on part of their assistance.

What should someone do if they have questions about their tax obligations related to disability income?

It is recommended to consult with a financial advisor for tailored insights into managing tax obligations related to disability income. Seeking guidance can help individuals navigate their financial planning effectively.