Overview

We understand that facing IRS tax levies can be overwhelming. These legal actions are used by the IRS to confiscate your property or assets in order to settle unpaid tax debts. The consequences can be severe, including wage garnishment and asset seizures. It’s important to acknowledge your feelings during this challenging time.

Understanding the levy process is crucial. Knowing your rights as a taxpayer can empower you to take control of your situation. There are options available, such as:

- Payment plans

- Offers in compromise

These can help you navigate these challenges.

You are not alone in this journey. Many individuals have found relief by exploring these alternatives. Remember, we’re here to help you through this process. Take the first step towards resolving your tax issues today.

Introduction

Understanding the complexities of IRS tax levies is crucial for anyone facing potential financial turmoil due to unpaid tax obligations. We understand that these legal actions can lead to severe consequences, such as wage garnishments and asset seizures. This often leaves taxpayers feeling overwhelmed and vulnerable.

This article offers a comprehensive guide to navigating the intricacies of IRS tax levies. We will highlight your rights as a taxpayer and share effective strategies for resolution. It's common to feel anxious about the IRS's assertive approach to tax collection. So, the pressing question remains: how can you protect your financial future while addressing these daunting challenges?

You are not alone in this journey, and we’re here to help you explore your options. Together, we can work towards a resolution that brings you peace of mind.

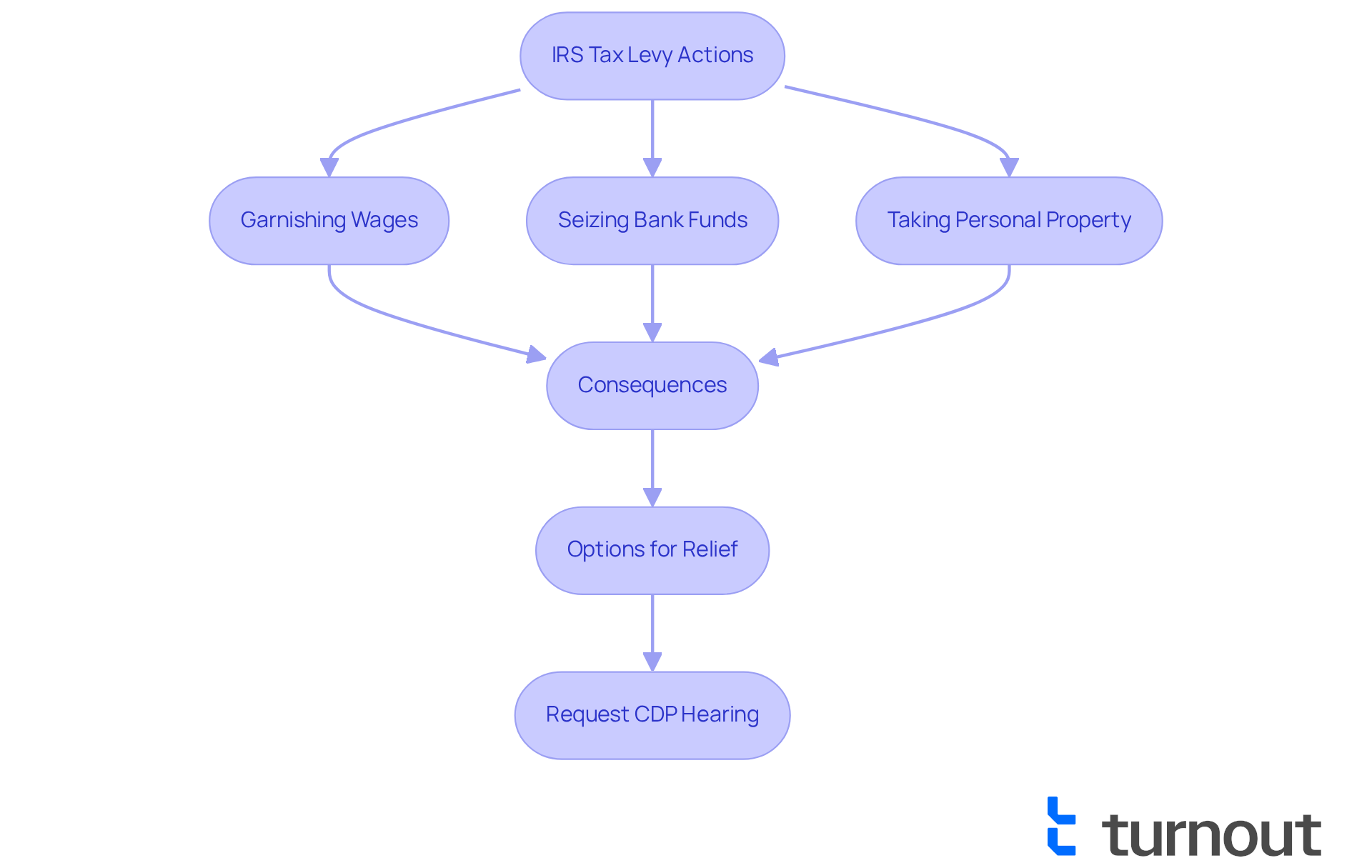

Define IRS Tax Levies and Their Purpose

An IRS tax enforcement action, such as IRS tax levies, is a legal method the Internal Revenue Service uses to confiscate an individual's property or assets to address unpaid tax responsibilities. We understand that this can be a daunting situation, especially if you have received notices about your tax debts and feel overwhelmed. The IRS has the authority to impose a tax charge without prior court judgment, which can feel intimidating.

The consequences of such actions can be severe. They may involve:

- Garnishing wages

- Seizing funds from bank accounts

- Taking possession of personal property

In fiscal year 2024 alone, the IRS issued over 48,535 garnishments, reflecting their commitment to enforcing tax compliance. It’s crucial to grasp the seriousness of IRS tax levies, as they underscore the importance of resolving tax matters swiftly.

If you find yourself facing these charges, remember that you have options. You can request a Collections Due Process (CDP) hearing to suspend the charge, offering a potential path for relief. It’s common to feel anxious about these situations, but taking action can help prevent further financial complications, including the loss of essential income or assets. As a tax professional wisely noted, "Addressing tax issues promptly is vital to avoid severe financial repercussions."

You are not alone in this journey, and we're here to help you navigate these challenges. Taking steps now can make a significant difference in your financial future.

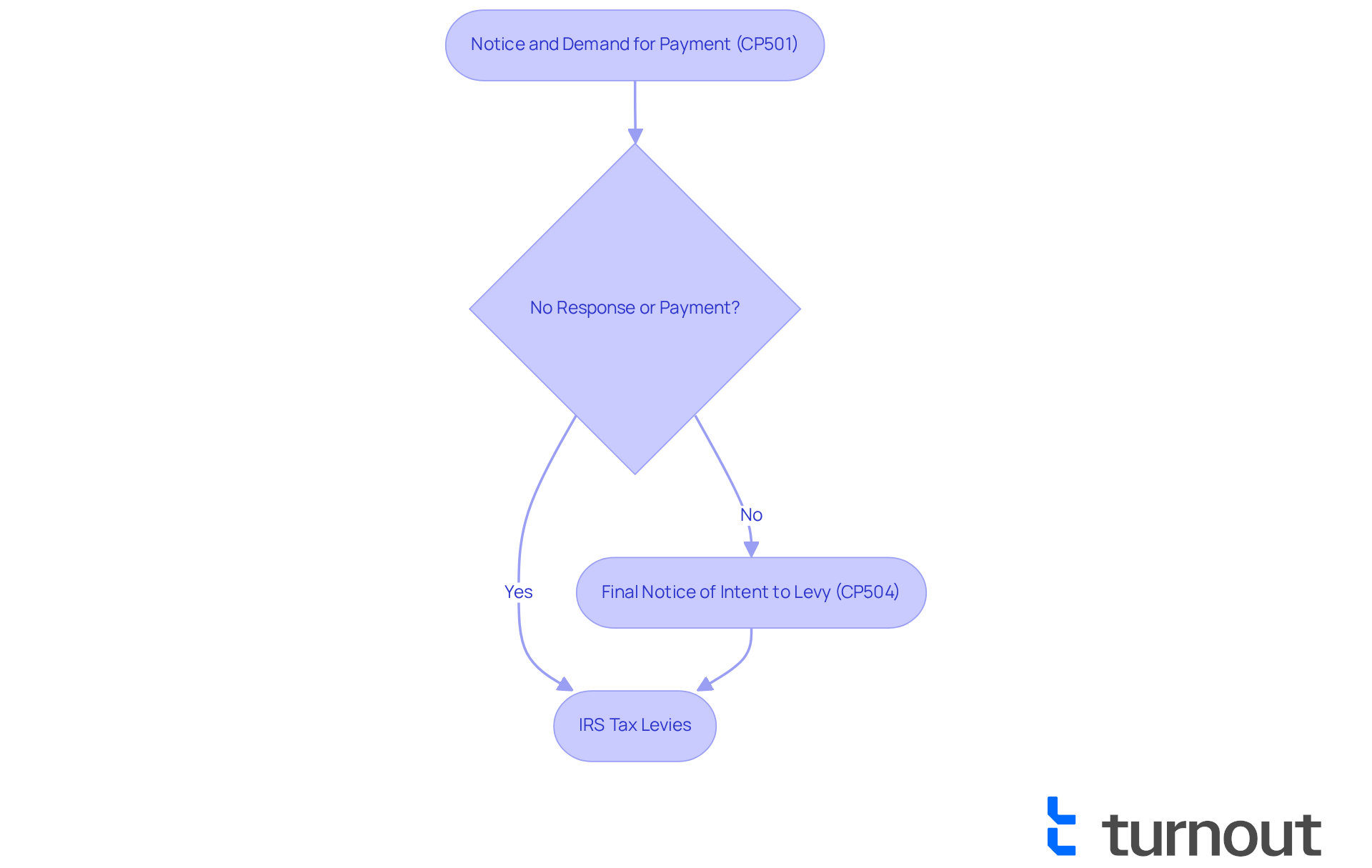

Explain How IRS Tax Levies Are Issued

We understand that dealing with tax obligations can be overwhelming. The IRS follows a systematic procedure before initiating tax collection, starting with a Notice and Demand for Payment (CP501) that informs you of any unpaid balance. If there is no response or payment, the IRS escalates the situation by sending a Final Notice of Intent to Levy (CP504), potentially resulting in IRS tax levies. This crucial final notice serves as your last opportunity to address your debt. Typically, this notification is sent out at least 30 days before any assessment becomes applicable, giving you important time to prepare or seek assistance.

It's common to feel anxious when receiving these alerts, but ignoring them can lead to serious consequences. These may include increased penalties and interest, ultimately resulting in asset seizures. Remember, the IRS sends a total of five notices before executing IRS tax levies. This emphasizes the importance of engaging proactively with the agency to avoid IRS tax levies and enforced collection actions.

Recent updates indicate that the IRS has begun using Form 668-W to direct employers to garnish wages for unpaid tax obligations, marking a more assertive approach to tax collection in 2025. As Margarita Stone wisely points out, 'When these notices arrive, the seizure machinery is in motion.' This highlights the urgency for you to respond promptly.

Understanding these steps is crucial for navigating the complexities of IRS enforcement effectively. You're not alone in this journey, and we're here to help you find the best way forward.

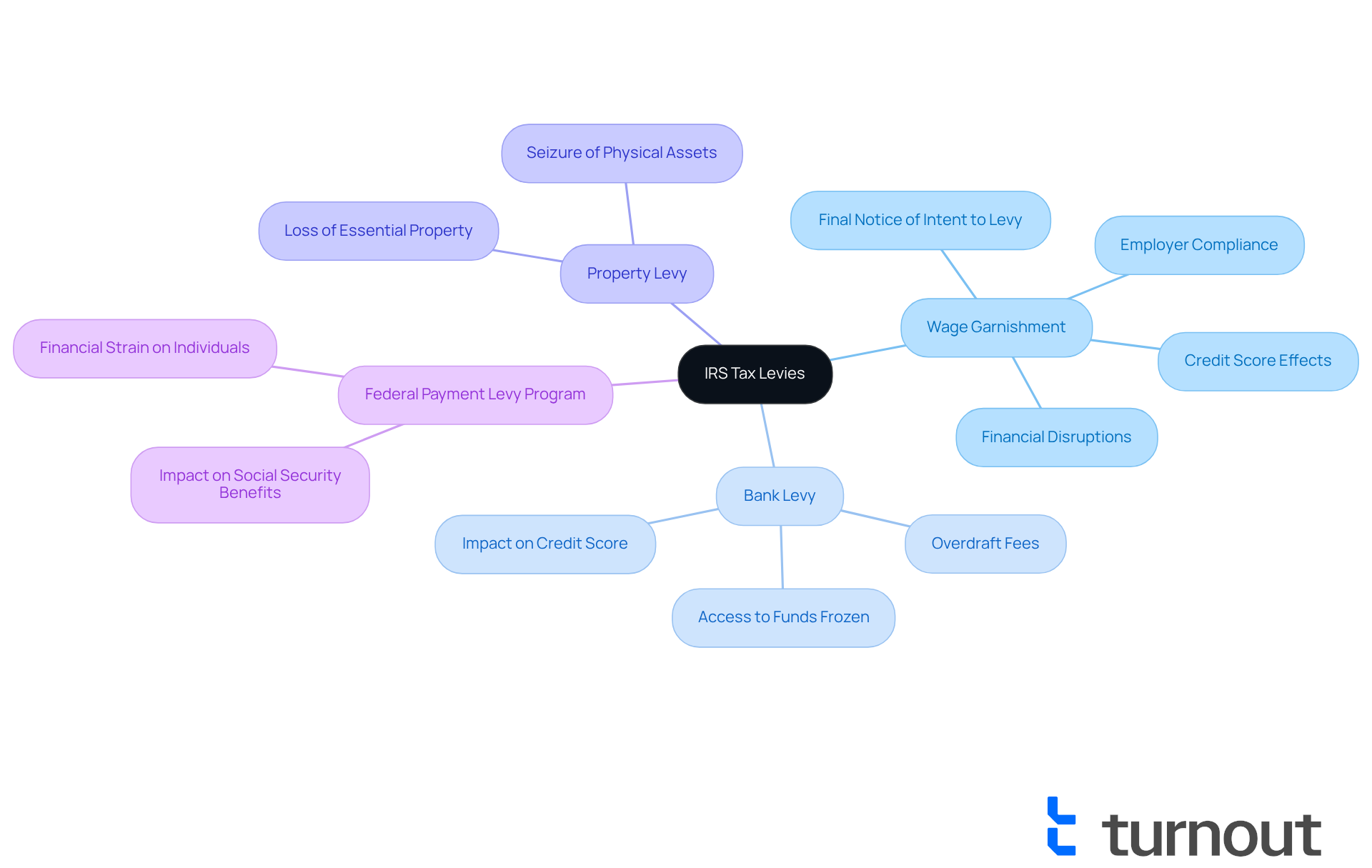

Identify Different Types of IRS Tax Levies

The IRS employs several types of tax levies that can significantly impact your financial situation, and we understand how overwhelming this can feel:

-

Wage Garnishment: The IRS can directly garnish a portion of your wages from your employer to satisfy tax debts. This process can begin almost immediately after your employer receives the IRS notice, often leading to substantial disruptions in your household's financial balance. The IRS sends Form 668-W to employers to initiate this wage garnishment, highlighting the urgency of the situation.

-

Bank Levy: This allows the IRS to seize funds directly from your bank account, temporarily freezing your access to those funds. Such actions can lead to overdraft fees and late payments, severely impacting your credit score and overall financial health.

-

Property Levy: The IRS can take physical possessions, including vehicles or real estate, to sell and recover owed revenue. This can result in significant losses for taxpayers who may not be prepared to lose essential property.

-

Federal Payment Levy Program: This program enables the IRS to automatically collect overdue taxes from certain federal payments, such as Social Security benefits. This can create additional financial strain for individuals relying on these payments.

Understanding IRS tax levies is essential for recognizing their potential impact on your finances and assets. For instance, wage garnishment can continue until the tax balance is paid in full or a resolution is negotiated, making it crucial to act quickly upon receiving any IRS notices. In fact, the IRS sends a Final Notice of Intent to Levy, allowing you 30 days to pay your debt or request a hearing. It's important to note that the IRS considers the Final Notice delivered even if you do not receive it, underscoring the need to respond promptly to IRS communications. Additionally, wage garnishment can lead to missed payments and credit issues, further complicating your financial situation.

We encourage you to consult a tax professional who can provide valuable insights into your rights and options regarding IRS bank garnishment. Remember, you are not alone in this journey, and there are resources available to help you navigate these challenges effectively.

Clarify Your Rights as a Taxpayer Facing a Levy

As a taxpayer facing IRS tax levies, it's essential to understand your rights. We recognize that this can be a challenging time, and knowing what you are entitled to can make a difference.

-

The Right to Be Informed: You should receive clear information about your tax obligations and the levy process. This includes the recent use of Form 668-W by the IRS to implement IRS tax levies that garnish wages or other income for unpaid taxes.

-

The Right to Challenge the Charge: If you believe the charge was issued incorrectly or have valid reasons for not paying, you can appeal through the IRS Office of Appeals. It's common to feel overwhelmed, but many individuals successfully contest IRS claims, often demonstrating financial difficulties or questioning the legitimacy of the tax owed.

-

The Right to Request a Hearing: Taxpayers can request a Collection Due Process (CDP) hearing to discuss their case and present relevant information. Remember, LT11 notifications inform you of the IRS's intent to impose unpaid taxes if not settled within 30 days, underscoring the urgency to act.

-

The Right to Seek Assistance: You can seek help from tax experts or advocacy organizations to navigate the process and explore resolution options. There are alternatives available, such as installment agreements or offers in compromise, that can halt aggressive actions like IRS tax levies.

Understanding these rights is crucial for taking the right steps to protect your interests. By utilizing these rights and strategies, you can effectively navigate the complexities of IRS collections. Remember, you are not alone in this journey, and there are paths toward a resolution that aligns with your financial situation.

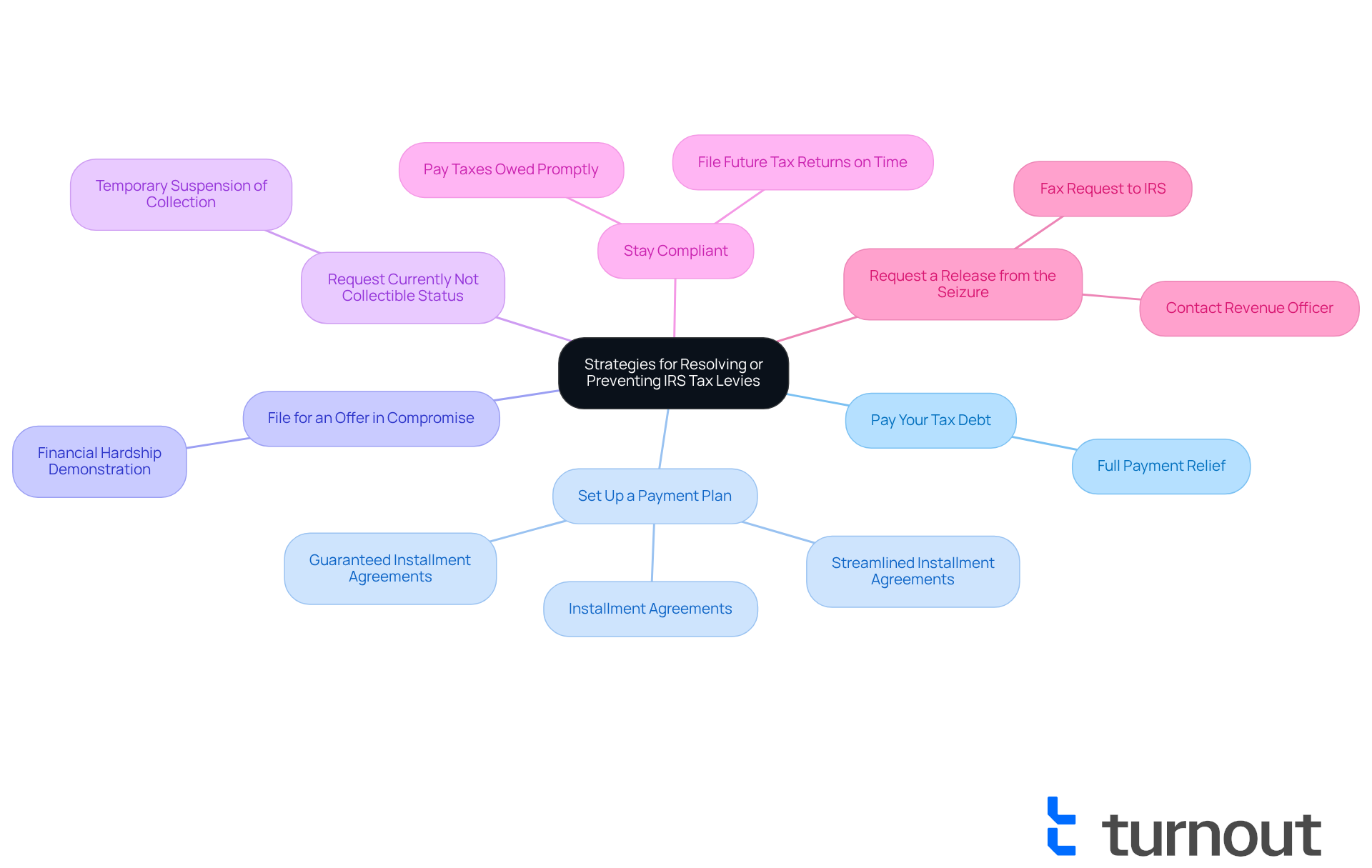

Outline Strategies for Resolving or Preventing IRS Tax Levies

If you're facing IRS tax levies, it’s important to know that there are effective strategies to help you navigate this challenging situation. Here are some options to consider:

-

Pay Your Tax Debt: The most straightforward way to stop a levy is to pay the owed amount in full. We understand that this might not always be possible, but it's the quickest method to find relief.

-

Set Up a Payment Plan: If paying the full amount isn't feasible, you can negotiate a payment plan with the IRS. This allows you to pay off your debt over time. Taxpayers who owe up to $250,000 now have an easier path to establishing such plans, which can help avoid aggressive collection actions. If your debt exceeds $100,000, be prepared to provide financial disclosure when setting up these plans.

-

File for an Offer in Compromise: This option enables you to settle your tax debt for less than the total amount owed, provided you can demonstrate financial hardship. Many taxpayers have successfully used this route, making it a viable option for those in need.

-

Request Currently Not Collectible Status: If you're experiencing significant financial difficulties, you can request that the IRS temporarily suspend collection efforts. This status can offer immediate relief from financial claims and garnishments, allowing you a moment to breathe.

-

Stay Compliant: It's essential to file all future tax returns on time and pay any taxes owed to avoid further issues. Staying compliant can help you prevent future charges, and we’re here to support you in this journey.

-

Request a Release from the Seizure: If you are facing a seizure, don’t hesitate to reach out to your revenue officer or fax your request to the IRS to seek a release.

By implementing these strategies, you can effectively manage your tax obligations and significantly reduce the risk of future IRS tax levies. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Understanding IRS tax levies can feel overwhelming, especially when faced with the prospect of tax enforcement actions. These legal measures—such as wage garnishment, bank levies, or property seizures—underscore the urgency of addressing unpaid tax responsibilities. Recognizing the seriousness of these actions empowers you to take proactive steps toward resolving your tax issues and safeguarding your financial well-being.

Throughout this article, we’ve shared key insights, including:

- The procedural steps the IRS follows before issuing levies

- The different types of levies that can impact your finances

- The rights you hold when confronted with such actions

It’s important to remember that options are available to you, such as requesting a Collections Due Process hearing or negotiating payment plans. These can provide relief from aggressive IRS actions. Acting swiftly and seeking professional assistance is crucial; timely responses can significantly mitigate potential financial consequences.

As you navigate the complexities of IRS tax levies, staying informed and proactive is essential. By understanding your rights, exploring available strategies, and seeking help when needed, you can effectively manage your tax obligations and reduce the risk of future levies. While the journey may seem daunting, remember that with the right knowledge and support, a resolution is within reach. Taking the first step today can lead to a more secure financial future and peace of mind. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are IRS tax levies?

IRS tax levies are legal actions taken by the Internal Revenue Service to confiscate an individual's property or assets to address unpaid tax responsibilities. This can include garnishing wages, seizing funds from bank accounts, or taking possession of personal property.

What is the purpose of IRS tax levies?

The purpose of IRS tax levies is to enforce tax compliance by collecting unpaid taxes from individuals. This action underscores the importance of resolving tax matters promptly to avoid severe financial consequences.

How many garnishments did the IRS issue in fiscal year 2024?

In fiscal year 2024, the IRS issued over 48,535 garnishments, highlighting their commitment to enforcing tax compliance.

What steps does the IRS take before issuing a tax levy?

The IRS follows a systematic procedure that begins with a Notice and Demand for Payment (CP501) for any unpaid balance. If there is no response, they send a Final Notice of Intent to Levy (CP504), which is the last opportunity for the taxpayer to address the debt before a levy is executed.

How many notices does the IRS send before executing a tax levy?

The IRS sends a total of five notices before executing IRS tax levies, emphasizing the importance of engaging with the agency to avoid enforced collection actions.

What is the significance of the Final Notice of Intent to Levy?

The Final Notice of Intent to Levy serves as the last opportunity for taxpayers to address their debt before the IRS proceeds with tax levies. It is typically sent at least 30 days before any assessment becomes applicable.

What recent updates have been made regarding IRS wage garnishment?

Recent updates indicate that starting in 2025, the IRS has begun using Form 668-W to direct employers to garnish wages for unpaid tax obligations, marking a more assertive approach to tax collection.

What options do individuals have if they receive a tax levy notice?

Individuals can request a Collections Due Process (CDP) hearing to suspend the charge, which may provide a potential path for relief from the tax levy.

What should individuals do if they feel overwhelmed by tax obligations?

It is important to engage proactively with the IRS and seek assistance to address tax issues promptly, as ignoring notices can lead to increased penalties, interest, and asset seizures.