Overview

Tracking your disability back pay can feel overwhelming, but you’re not alone in this journey. To effectively manage this process, we recommend:

- Creating or logging into your my Social Security account.

- Checking your payment history regularly.

It's also important to follow up with the SSA regarding your application status, as this can provide peace of mind.

The article provides a step-by-step guide that highlights the importance of monitoring your benefits. By staying informed, you can ensure timely and accurate compensation.

We understand that common issues may arise, but don’t worry. The article also outlines solutions that can help facilitate a smoother tracking experience. Remember, we're here to help you navigate this process with compassion and understanding.

Introduction

Navigating the complexities of disability back pay can feel overwhelming for many individuals seeking Social Security benefits. We understand that this crucial financial support is more than just a lifeline during tough times; it is vital for ensuring stability for families awaiting approval.

As the stakes rise, with average retroactive payments often reaching thousands of dollars, the urgency to track these funds becomes essential.

How can you effectively monitor your owed compensation and navigate potential hurdles in this process? You're not alone in this journey, and we're here to help you find the answers.

Understand Disability Back Pay: Definition and Importance

Disability retroactive compensation is a lifeline for individuals approved for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits. This crucial support covers the time between the onset of a condition and the approval of benefits, making it an essential part of financial planning for those affected. Understanding how to track my disability back pay is vital, as it can significantly enhance financial security by providing resources for months when individuals qualified but had not yet received their funds.

In 2025, the importance of disability back pay on financial stability is especially evident. For instance, beneficiaries received an average retroactive compensation of approximately $6,710, with a total of $7.5 billion allocated to over 1.1 million recipients. Such financial support can alleviate monetary pressures, allowing families to manage essential expenses like medical bills and daily living costs.

Real-life stories highlight this impact vividly. One family struggled to afford groceries while caring for a bedridden child, underscoring the urgent need for timely compensation. Another individual faced a daunting financial burden while waiting for $16,000 in back compensation, illustrating the stress that delays in the application process can cause.

Experts emphasize the significance of compensation for individuals with disabilities. Many advocates point out that these payments not only provide financial relief but also serve as a crucial support system for families navigating the challenges of disability. Statistics show that changes in monthly benefits can exceed $1,000 for certain recipients, further emphasizing the importance of understanding and monitoring owed payments.

In conclusion, knowing how to track my disability back pay is a vital aspect of financial stability for people with disabilities. By recognizing its definition and importance, beneficiaries can better navigate the application process and manage their expectations regarding the timing and amount of payments they may receive. Remember, you are not alone in this journey—we're here to help you every step of the way.

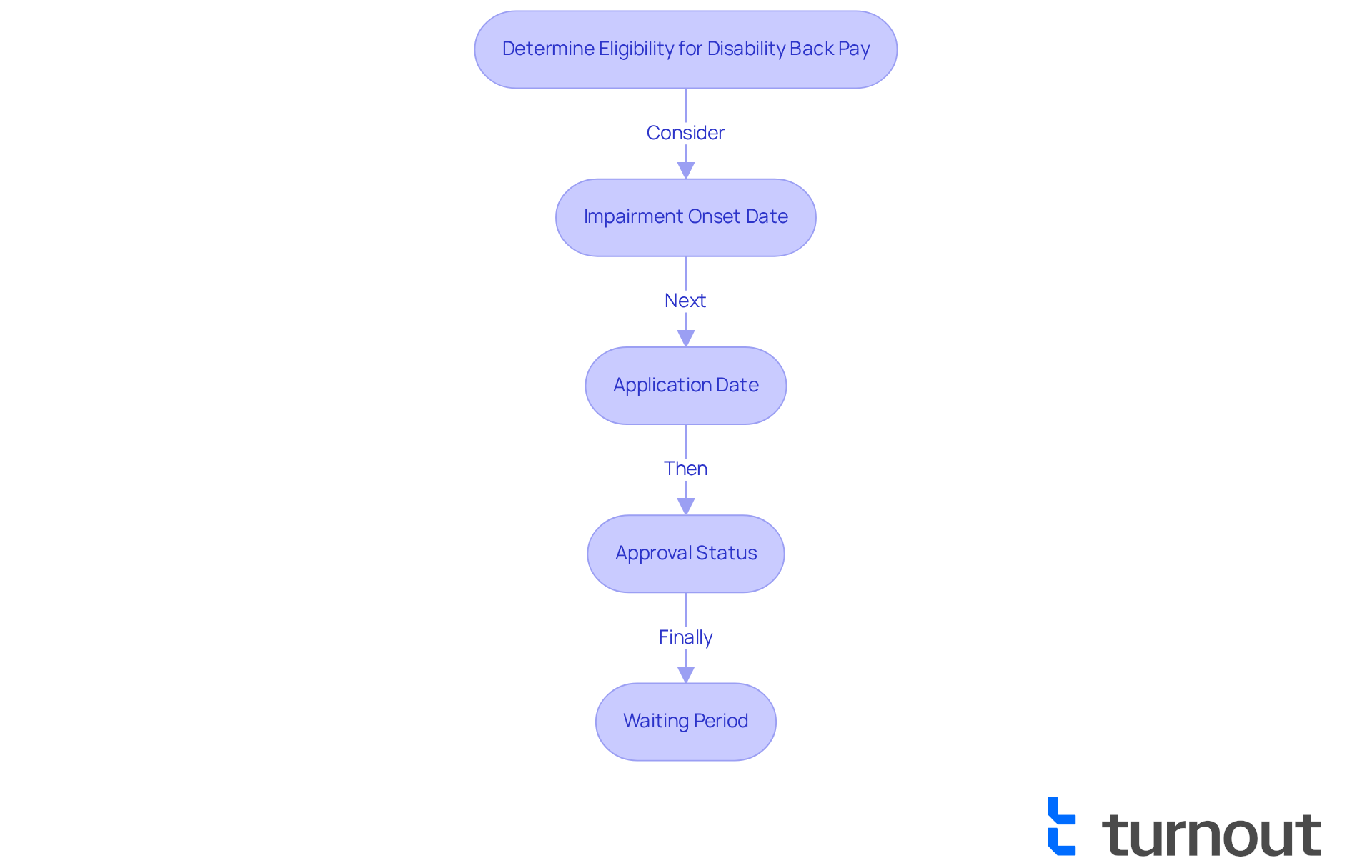

Determine Eligibility for Disability Back Pay

Determining your eligibility for disability back pay can feel overwhelming, but understanding the following criteria can help ease your concerns:

- Impairment Onset Date: Knowing when your impairment began is crucial. This date marks the start of your eligibility for benefits, and we understand how important this is for you.

- Application Date: It’s essential to submit your application for benefits to the Social Security Administration (SSA). Back pay is calculated from the onset date to the approval date, minus any applicable waiting periods. We know this process can be daunting, but you’re taking the right steps.

- Approval Status: Approval for your benefits is necessary. If your application is still pending or has been denied, you will not qualify for retroactive payment until approval is granted. Remember, you are not alone in navigating this.

- Waiting Period: Generally, there is a five-month waiting period after your condition onset date before you can start receiving benefits. This means retroactive payment won’t cover the initial five months of your condition.

Understanding these standards can empower you to evaluate your eligibility and prepare for the next steps in monitoring your owed payments. For instance, if your condition started in January 2023 and you applied in June 2023, you might receive retroactive payment for the months following your approval, which could occur in April 2025. It’s important to know that most applicants approved for SSDI or SSI benefits receive retroactive payments, helping to support them during the waiting period. Remember, we’re here to help you through this journey.

Track Your Disability Back Pay: Step-by-Step Process

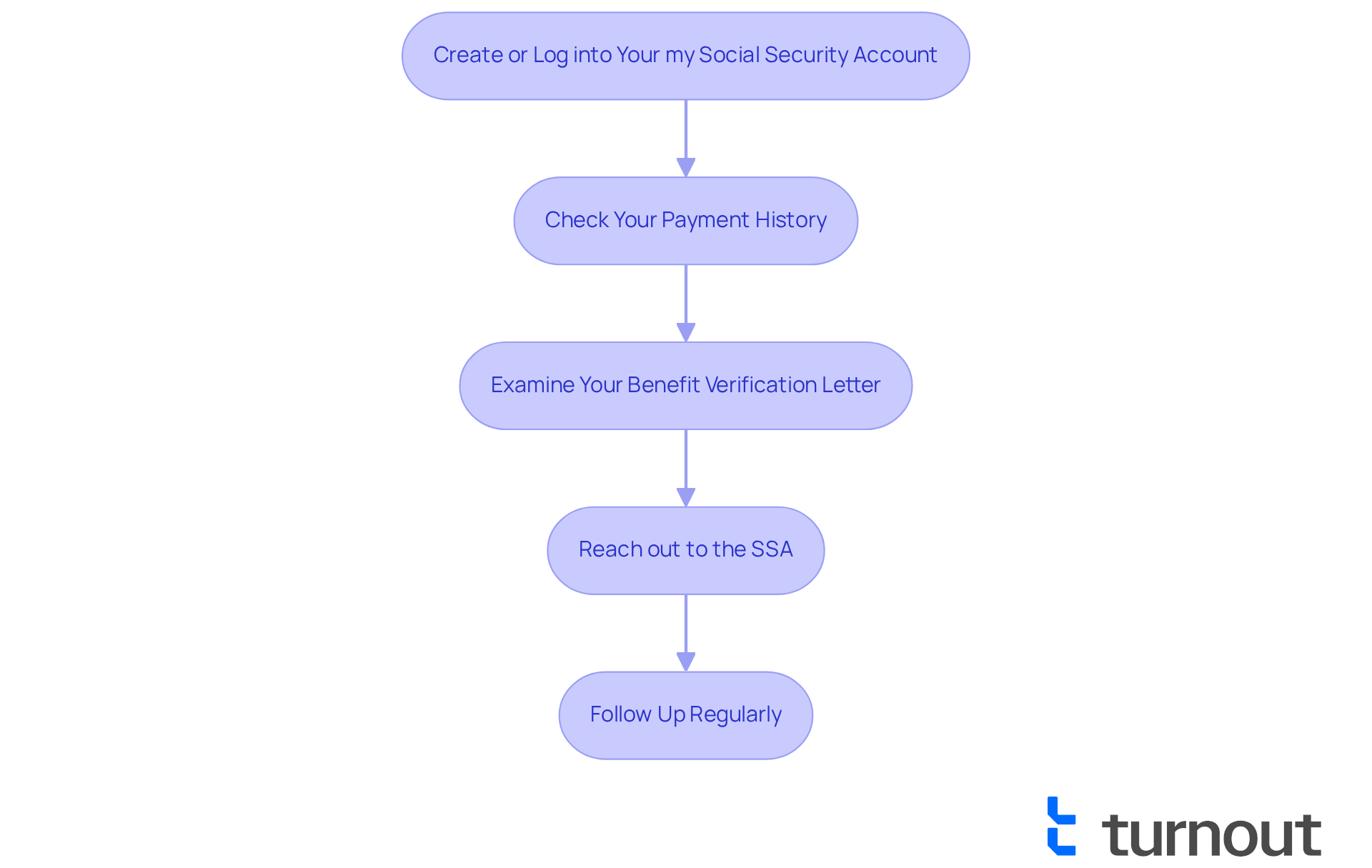

While it can feel overwhelming, we’re here to guide you on how to track my disability back pay. Follow these steps to ensure you receive the benefits you deserve:

-

Create or Log into Your my Social Security Account: Begin by visiting the SSA website. If you already have an account, simply log in. If not, creating one is easy—just provide your personal information.

-

Check Your Payment History: Once logged in, head to the 'Payment History' section. Here, you’ll find your planned transactions and any overdue compensation processed. Many users find this feature essential for managing their benefits effectively, and you might too.

-

Examine Your Benefit Verification Letter: This important document outlines your benefit amount and payment schedule, helping you understand your retroactive pay status. Keeping it handy can clarify any discrepancies you might encounter.

-

Reach out to the SSA: If you have any questions or concerns about overdue payments, don’t hesitate to call the SSA at 1-800-772-1213. Be ready to provide your Social Security number and other identifying information to help expedite the process.

-

Follow Up Regularly: It’s common to feel anxious about your application status. Regularly checking your account and contacting the SSA can keep you informed about your payment schedule. Consistent follow-ups allow you to catch any changes or delays early on.

By following these steps, you can effectively learn how to track my disability back pay and ensure you receive the benefits you are entitled to. Utilizing your my Social Security account not only simplifies tracking but also enhances your ability to manage your financial support efficiently. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Troubleshoot Common Issues in Tracking Back Pay

While monitoring your compensation arrears, you may encounter some common challenges. We understand that this process can be overwhelming, but here’s how to troubleshoot effectively:

-

Delayed Payments: If your retroactive pay is delayed, first check your application status online. If it shows as pending, please reach out to the Social Security Administration (SSA) for clarification on the delay. Many individuals report waiting several months for back compensation. With an average denial rate of 68% for disability claims, it’s crucial to follow up promptly. While Turnout is not a law firm and is not affiliated with any law firm or government agency, we’re here to assist you in navigating these complexities. Our trained nonlawyer advocates can help you understand your rights and options.

-

Incorrect Amounts: If you suspect the amount is inaccurate, take a close look at your benefit verification letter. Discrepancies can happen, and if you find any, don’t hesitate to contact the SSA to resolve the issue. Remember, as of April 2025, the average disability benefit is only $1,582, while the maximum benefit is $4,018 per month. Ensuring accuracy in your transaction amounts is vital to meet your needs, and our advocates can provide guidance on addressing these discrepancies effectively.

-

Access Issues with Your Account: If you’re having trouble logging into your my Social Security account, try using the 'Forgot Password' feature or contact SSA support for assistance. We understand that access issues can be frustrating, but the SSA offers resources to help you regain access quickly.

-

Unclear Remittance Schedule: If your remittance schedule is unclear, refer to the SSA’s remittance schedule page or contact them directly for detailed information. Knowing when to expect payments can alleviate anxiety and help you plan your finances better.

-

General Confusion About the Process: If you feel overwhelmed by the process, consider reaching out to Turnout for personalized assistance and guidance. Many individuals have successfully navigated similar challenges by seeking help from our trained advocates, ensuring they receive the benefits they deserve.

By being proactive and addressing these common issues, you can ensure a smoother experience in how to track my disability back pay. Remember, you are not alone in this journey; we’re here to help.

![]()

Conclusion

Understanding how to effectively track disability back pay is essential for individuals relying on Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). This process not only aids in financial planning but also ensures that beneficiaries receive the vital support they are entitled to during challenging times. By grasping the significance of disability back pay, individuals can navigate the complexities of the application and tracking processes with greater confidence.

We understand that this journey can feel overwhelming. Throughout the article, key insights were provided on:

- Determining eligibility

- Tracking payments

- Troubleshooting common issues

It is crucial to understand the criteria for eligibility, such as the impairment onset date and the application date. Additionally, a step-by-step guide was presented to help beneficiaries monitor their payments efficiently, including utilizing the my Social Security account and reaching out to the SSA when necessary. Addressing potential challenges, such as delayed payments or incorrect amounts, was also covered, equipping individuals with the tools to resolve issues proactively.

In light of these insights, it is clear that being informed and proactive in tracking disability back pay is vital for ensuring financial stability. Those affected by disabilities should not hesitate to seek assistance and utilize available resources to navigate this process effectively. Remember, you are not alone in this journey. By taking these steps, individuals can alleviate financial stress and focus on what truly matters—managing their health and well-being.

Frequently Asked Questions

What is disability back pay?

Disability back pay refers to the retroactive compensation provided to individuals approved for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits, covering the time between the onset of a condition and the approval of benefits.

Why is disability back pay important?

Disability back pay is crucial for financial planning as it provides essential support for individuals during the period they qualified for benefits but had not yet received their funds, enhancing their financial security.

How much disability back pay did beneficiaries receive in 2025?

In 2025, beneficiaries received an average retroactive compensation of approximately $6,710, with a total of $7.5 billion allocated to over 1.1 million recipients.

What financial pressures can disability back pay alleviate?

Disability back pay can help families manage essential expenses such as medical bills and daily living costs, reducing monetary pressures during difficult times.

Can you provide examples of the impact of disability back pay?

One family struggled to afford groceries while caring for a bedridden child, highlighting the urgent need for timely compensation. Another individual faced a significant financial burden while waiting for $16,000 in back compensation, illustrating the stress caused by delays in the application process.

What do experts say about the significance of disability back pay?

Experts emphasize that these payments provide not only financial relief but also serve as a crucial support system for families navigating the challenges of disability.

How can changes in monthly benefits affect recipients?

Changes in monthly benefits can exceed $1,000 for certain recipients, underscoring the importance of understanding and monitoring owed payments.

How can individuals track their disability back pay?

Understanding how to track disability back pay is vital for financial stability, allowing beneficiaries to navigate the application process and manage their expectations regarding the timing and amount of payments they may receive.