Overview

Setting up a payment arrangement with the IRS can feel overwhelming, but you're not alone in this journey. Individuals have the option to choose between short-term or long-term installment agreements that align with their tax obligations and financial situations. We understand that navigating these choices can be challenging.

This article is here to support you. It outlines the eligibility criteria, application steps, and troubleshooting tips to help you along the way. Remember, timely communication is crucial. Utilizing the IRS Online Payment Agreement tool can make this process smoother and more manageable.

Take a moment to reflect: How can this information alleviate your concerns? We're here to help you find the best solution for your needs.

Introduction

Navigating tax obligations can feel overwhelming, often leading to anxiety and confusion. We understand that this journey can be daunting. Fortunately, the IRS offers structured payment arrangements, allowing you to settle your debts over time instead of in one lump sum. In this article, we provide a comprehensive step-by-step guide on how to set up a payment arrangement with the IRS. We will highlight the different types of plans available and the eligibility criteria that can help ease your financial burden.

However, it’s common to encounter unexpected challenges during this process. Understanding how to troubleshoot common issues with IRS payment plans is crucial for maintaining your financial stability and avoiding penalties. Remember, you are not alone in this journey; we’re here to help.

Understand IRS Payment Plans

We understand that managing tax obligations can feel overwhelming. IRS installment arrangements, commonly known as installment agreements, provide guidance on how to set up payment arrangement with IRS to settle your tax responsibilities over time instead of all at once. There are two main types of arrangements to consider:

- Short-term arrangements are designed for those who can pay off their balance within 180 days.

- Long-term options are available for individuals who need more time, typically up to 72 months.

Recognizing these options is an important first step toward effectively managing your tax obligations. You're not alone in this journey; many people find themselves in similar situations. For further guidance, we encourage you to visit the IRS site to understand how to set up payment arrangement with IRS regarding these financial arrangements. Remember, we're here to help you navigate this process with understanding and support.

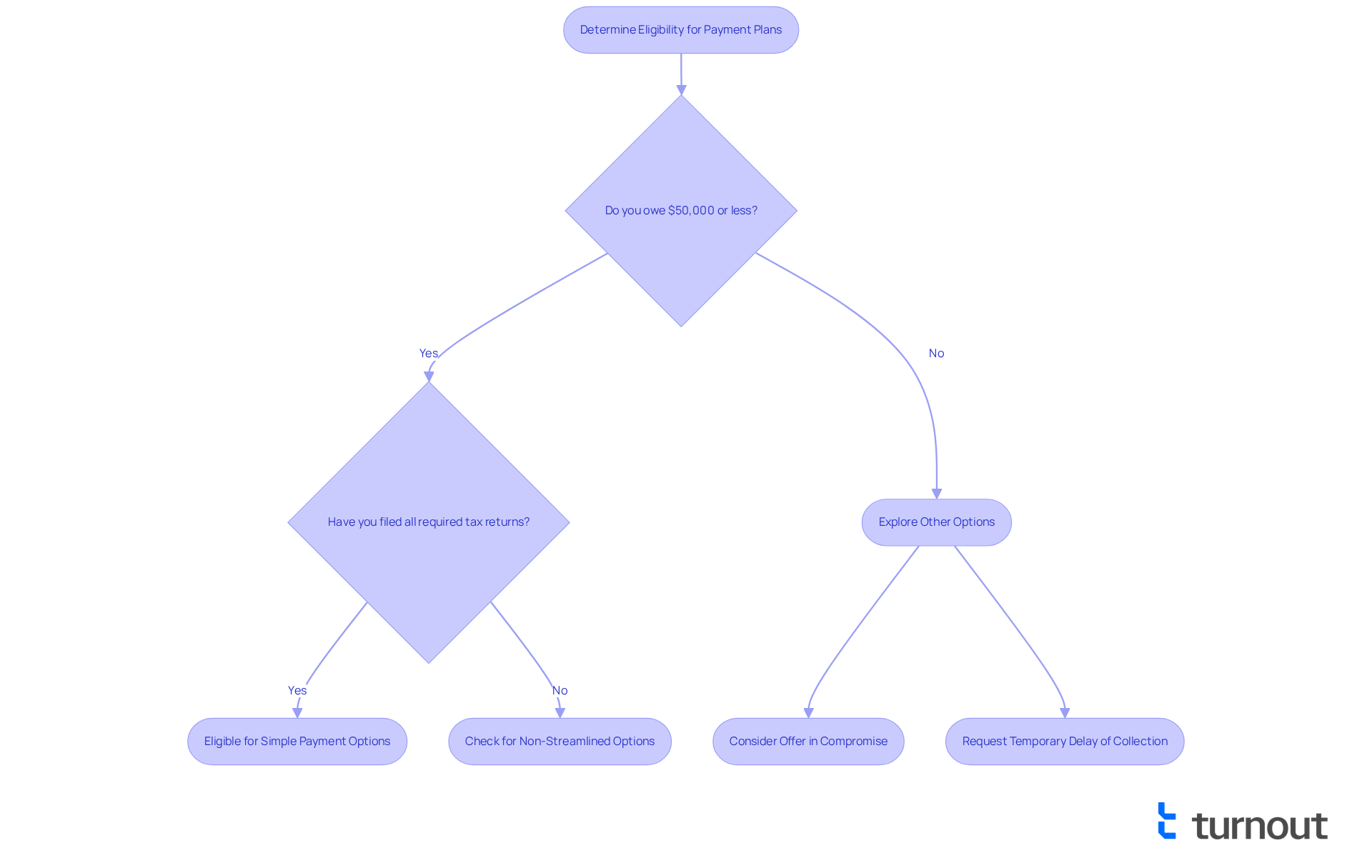

Determine Eligibility for Payment Plans

We understand that navigating tax obligations can be overwhelming. To understand how to set up a payment arrangement with the IRS, you must meet certain criteria. Generally, you should owe $50,000 or less in combined tax, penalties, and interest, and have filed all required tax returns. If your tax debt exceeds this amount, don't lose hope; you can learn how to set up a payment arrangement with the IRS and may still qualify for a non-streamlined installment agreement. It's also important to be current on your tax obligations.

In 2025, the IRS introduced new Simple Payment Options to help individuals learn how to set up a payment arrangement with the IRS in a way that is easier to understand and more accessible. These changes have enabled over 90% of individual taxpayers with tax debt to learn how to set up a payment arrangement with the IRS. We encourage you to use the IRS's Online Payment Agreement tool to check your eligibility and understand how to set up a payment arrangement with the IRS. This tool simplifies the process and provides immediate notification of approval after you submit your application.

It's essential to recognize that certain financing arrangements do not allow for the evasion of penalties. Timely submission is vital to avoid a late submission fee of 5 percent monthly on any outstanding balance. If you owe less than $100,000, there's a temporary financial arrangement available that allows you to settle your balance in full within 180 days. Remember, you are not alone in this journey, and we're here to help you find the best path forward.

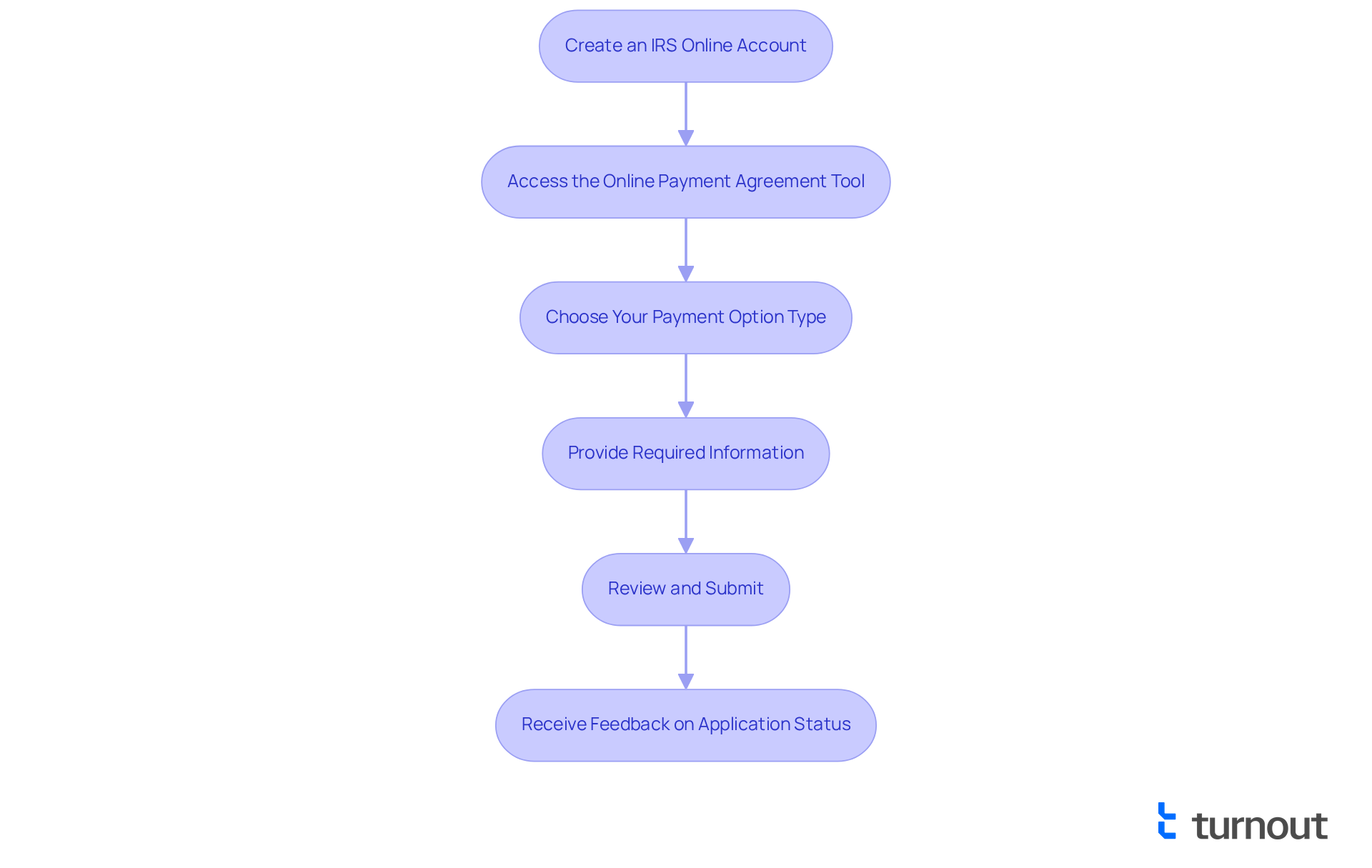

Apply for an IRS Payment Plan

Applying for an IRS payment plan can feel overwhelming, but we're here to guide you on how to set up payment arrangement with IRS. Follow these simple steps to ease your journey:

-

Create an IRS Online Account: Start by visiting the IRS website. If you don’t have an account yet, setting one up is straightforward. You'll need your Social Security number, date of birth, and filing status.

-

Access the Online Payment Agreement Tool: Once you're logged in, navigate to the Online Payment Agreement tool. This tool is designed to simplify how to set up payment arrangement with IRS for most taxpayers, making the process easier for you.

-

Choose Your Payment Option Type: Consider whether a short-term or long-term financial arrangement suits your needs best. Short-term plans typically offer an extra 180 days to pay, while long-term plans can extend up to 72 months for balances under $50,000. If your balance is under $50,000, the streamlined installment agreement (SLIA) allows you to make monthly contributions without extensive financial disclosures.

-

Provide Required Information: Fill out the necessary details, including your tax balance and your suggested monthly contribution amount. If your debts are under $250,000, you can find out how to set up a payment arrangement with IRS by suggesting a monthly plan without the need for extensive financial disclosures, making this step more attainable.

-

Review and Submit: Take a moment to double-check your information for accuracy before submitting your application. You will receive immediate feedback on your application status, usually within just a few minutes.

We understand that submitting your return, even if you can't pay in full, is crucial. Doing so allows the IRS to work with you on how to set up a payment arrangement with IRS or hardship status. Tom O’Saben from the National Association of Tax Professionals reminds us, "The number one takeaway is that owing money is not a reason not to file." Many taxpayers have successfully navigated how to set up payment arrangement with IRS, thereby reducing their financial strain through organized settlement arrangements.

For more detailed guidance, refer to the IRS's application page. Remember, if you're unable to pay, you can request a temporary delay of the collection process. Just keep in mind that penalties and interest will continue to accrue. You're not alone in this journey, and there are options available to help you manage your situation.

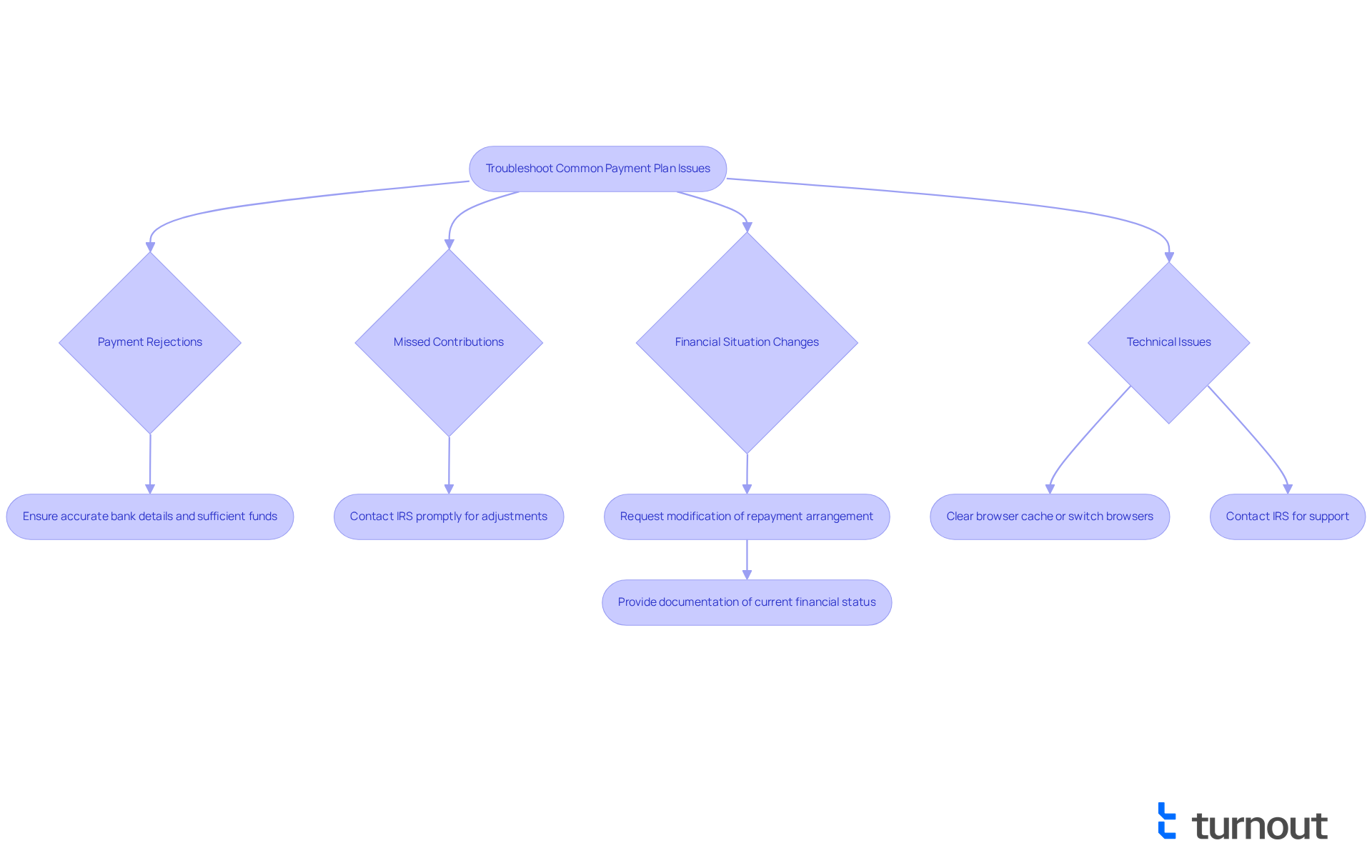

Troubleshoot Common Payment Plan Issues

If you encounter issues with your IRS payment plan, we understand how stressful it can be when trying to learn how to set up a payment arrangement with IRS. Here are some helpful troubleshooting tips to guide you through these challenges:

-

Payment Rejections: It's important to ensure your bank account information is accurate and that sufficient funds are available. Payment rejections often stem from incorrect details or insufficient balances, and we want to help you avoid that.

-

Missed Contributions: If you fail to make a contribution, please reach out to the IRS promptly. Timely communication can assist you in exploring how to set up a payment arrangement with the IRS for adjusting your financial arrangement. The IRS is typically sympathetic to temporary financial difficulties, so don’t hesitate to ask for help.

-

If your financial situation changes, it’s important to know how to set up a payment arrangement with the IRS by requesting a modification of your repayment arrangement. Be prepared to provide documentation that reflects your current financial status, as the IRS evaluates each case individually.

-

Technical Issues: If you experience technical difficulties while applying online, try clearing your browser cache or switching to a different browser. For persistent issues, contacting the IRS directly can provide the necessary support.

In 2025, roughly 25% of taxpayers fail to meet obligations on their IRS arrangements. This statistic underscores the significance of proactive communication and management of your tax duties. If you find yourself unable to pay your tax bill in full, consider exploring an Offer in Compromise. This option allows you to settle your tax debt for less than the total amount owed, particularly if paying the full amount would cause financial hardship.

Keep in mind that the IRS usually corresponds through mail and will not reach out to you by phone, text, or social media for prompt settlement. So, be wary of possible scams. By addressing these common issues promptly, you can maintain your payment plan and avoid additional penalties or complications. Remember, you're not alone in this journey; we're here to help.

Conclusion

Setting up a payment arrangement with the IRS is a crucial step for individuals facing tax obligations. We understand that managing tax debt can feel overwhelming, but knowing your options and eligibility criteria can significantly ease this burden. This guide emphasizes that you have access to both short-term and long-term payment plans, allowing for flexibility based on your financial circumstances.

Throughout this article, we've shared key insights regarding the types of IRS payment plans, eligibility requirements, and the application process. It's essential to create an IRS online account, utilize the Online Payment Agreement tool, and maintain timely communication with the IRS to address any issues that may arise. By following these steps, you can navigate your payment arrangements more effectively and reduce the stress associated with tax obligations.

In conclusion, managing your tax responsibilities does not have to be a daunting task. By taking proactive steps and utilizing the resources available, you can find a manageable path to settle your debts. Whether through the streamlined installment agreement or other options, it’s vital to stay informed and engaged throughout the process. Remember, you are not alone in this journey; exploring these arrangements can lead to a more secure financial future.

Frequently Asked Questions

What are IRS installment arrangements?

IRS installment arrangements, also known as installment agreements, allow taxpayers to set up a payment plan to settle their tax responsibilities over time instead of paying the full amount at once.

What types of payment arrangements are available?

There are two main types of payment arrangements: short-term arrangements for those who can pay off their balance within 180 days, and long-term options for individuals who need more time, typically up to 72 months.

Why is it important to recognize these payment options?

Recognizing these options is an important first step toward effectively managing tax obligations, helping individuals navigate their financial responsibilities.

Where can I find more guidance on setting up an IRS payment arrangement?

For further guidance, you can visit the IRS website to understand how to set up a payment arrangement regarding these financial obligations.