Overview

Navigating the path to disability benefits can feel overwhelming, and we understand that. To secure the support you need, it’s essential to grasp the eligibility requirements, gather the necessary documentation, and effectively navigate the application process. This article offers you critical steps to guide you through this journey.

First, it’s important to distinguish between Disability Insurance and Supplemental Income. Knowing the difference can empower you in your decision-making. Next, we detail the required medical and financial documentation that will strengthen your claim.

Finally, we provide a step-by-step guide for submitting your applications. By following these steps, you can enhance your likelihood of a successful claim. Remember, you are not alone in this process; we’re here to help you every step of the way.

Introduction

Navigating the maze of disability benefits can feel overwhelming. Many individuals are seeking financial support while facing significant health challenges. It's important to understand the various types of benefits available, such as Disability Insurance and Supplemental Income, to secure the assistance you deserve.

However, the journey to obtaining these benefits is often filled with obstacles. Stringent eligibility criteria and the need for comprehensive documentation can make the process daunting. We understand that this can be frustrating, but there are ways to effectively navigate the complex application process.

How can you increase your chances of approval? By being informed and prepared, you can take proactive steps toward securing the support you need. Remember, you are not alone in this journey, and we’re here to help guide you through it.

Understand Disability Benefits: Types and Importance

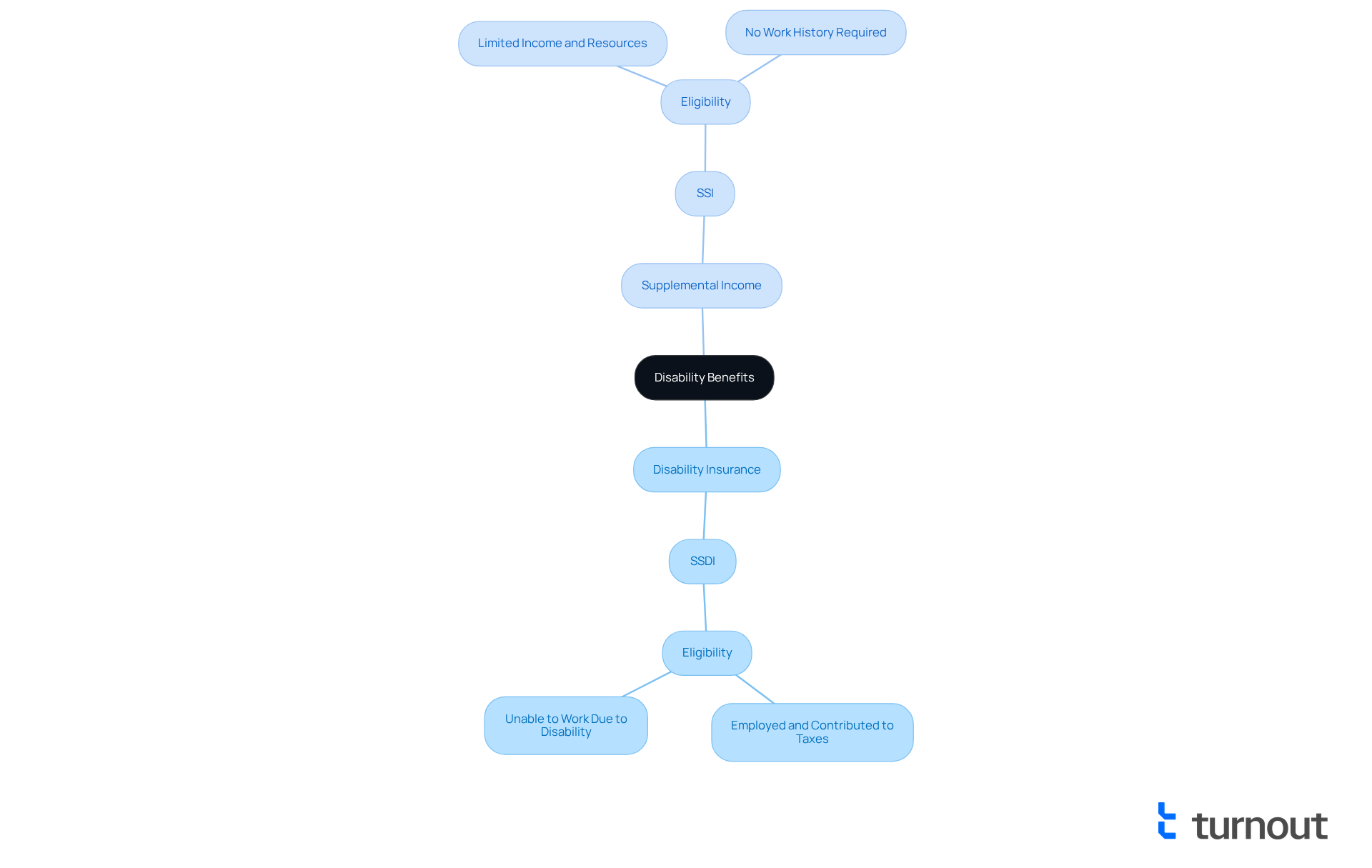

Navigating the world of disability benefits can be overwhelming, especially when trying to understand how to get on disability, and we understand that you may have many questions. Disability benefits mainly divide into two types:

- Disability Insurance

- Supplemental Income

SSDI is designed for those who have been employed and contributed to taxes but can no longer work due to a disability. In contrast, SSI offers financial assistance to individuals with limited income and resources, regardless of their work history.

Understanding these distinctions is vital for determining how to get on disability, as it directly impacts the application process and eligibility requirements. These benefits are essential for providing financial stability and access to necessary medical care for individuals facing disabilities. Remember, you are not alone in this journey, and we're here to help you through the process.

Determine Eligibility: Key Criteria for Disability Benefits

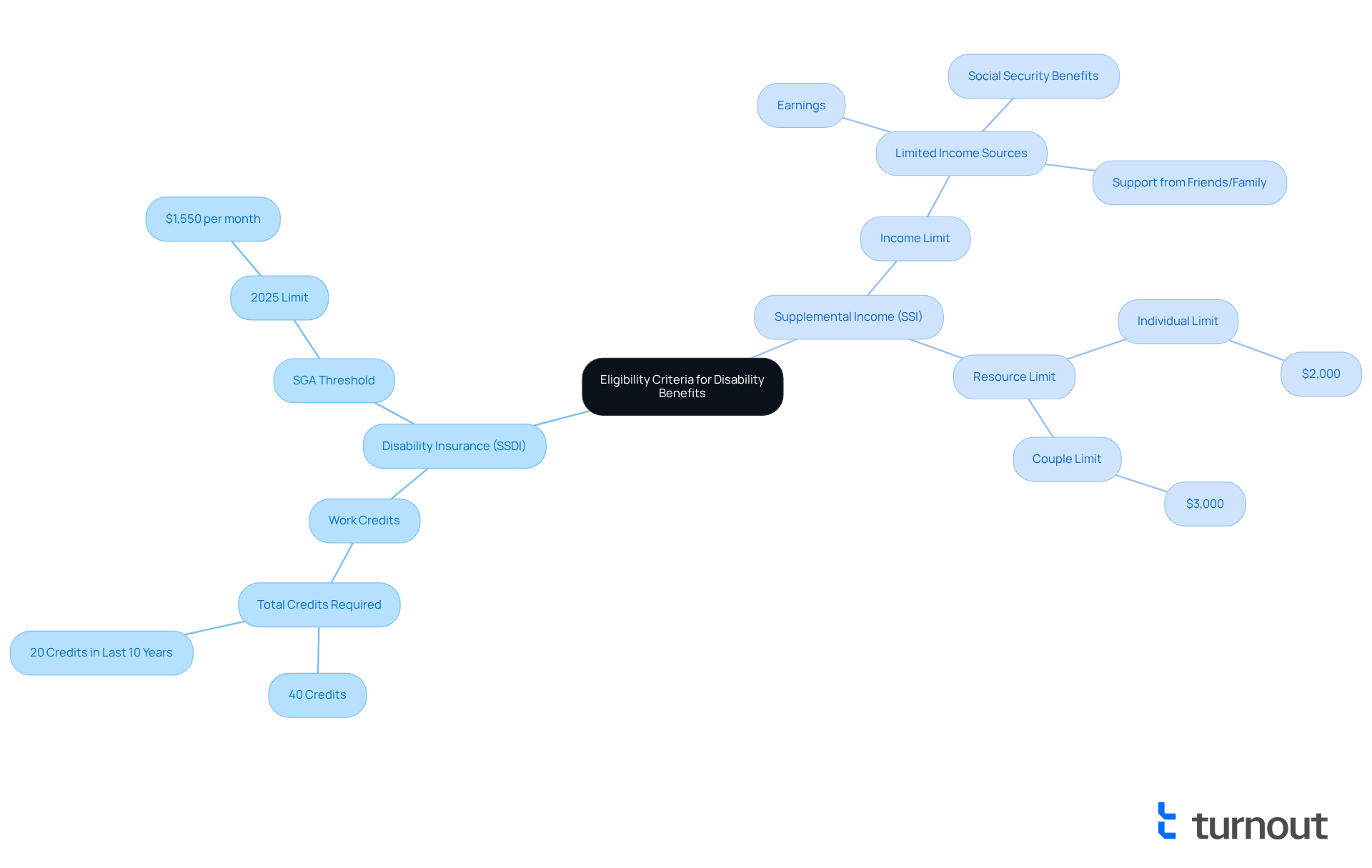

Navigating the path to disability benefits can feel overwhelming, but understanding the eligibility requirements is a crucial first step. To qualify for disability benefits, candidates must meet specific standards set by the Social Security Administration (SSA). For Disability Insurance (SSDI), individuals typically need to accumulate 40 work credits, with at least 20 of those credits earned within the last 10 years. This ensures that applicants have a solid work history to support their claims.

Moreover, it’s essential for applicants to demonstrate a medical condition that significantly limits their ability to perform substantial gainful activity (SGA). In 2025, the SGA threshold for non-blind individuals is expected to be $1,550 per month, reflecting necessary adjustments for inflation.

When it comes to Supplemental Income (SSI), eligibility hinges on your income and resources. Applicants must have limited income, which includes earnings, Social Security benefits, and support from friends or family. Currently, the resource limit for SSI is set at $2,000 for individuals and $3,000 for couples, with potential increases anticipated in 2025 due to inflation.

We understand that this process can be daunting. It’s vital to thoroughly review the SSA's guidelines, including the detailed Listing of Impairments, to ensure you meet these criteria before submitting your request. Did you know that around two-thirds of initial disability claims are declined? Understanding these requirements can significantly improve your chances of a successful application or appeal. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Gather Required Documentation: Essential Papers for Your Application

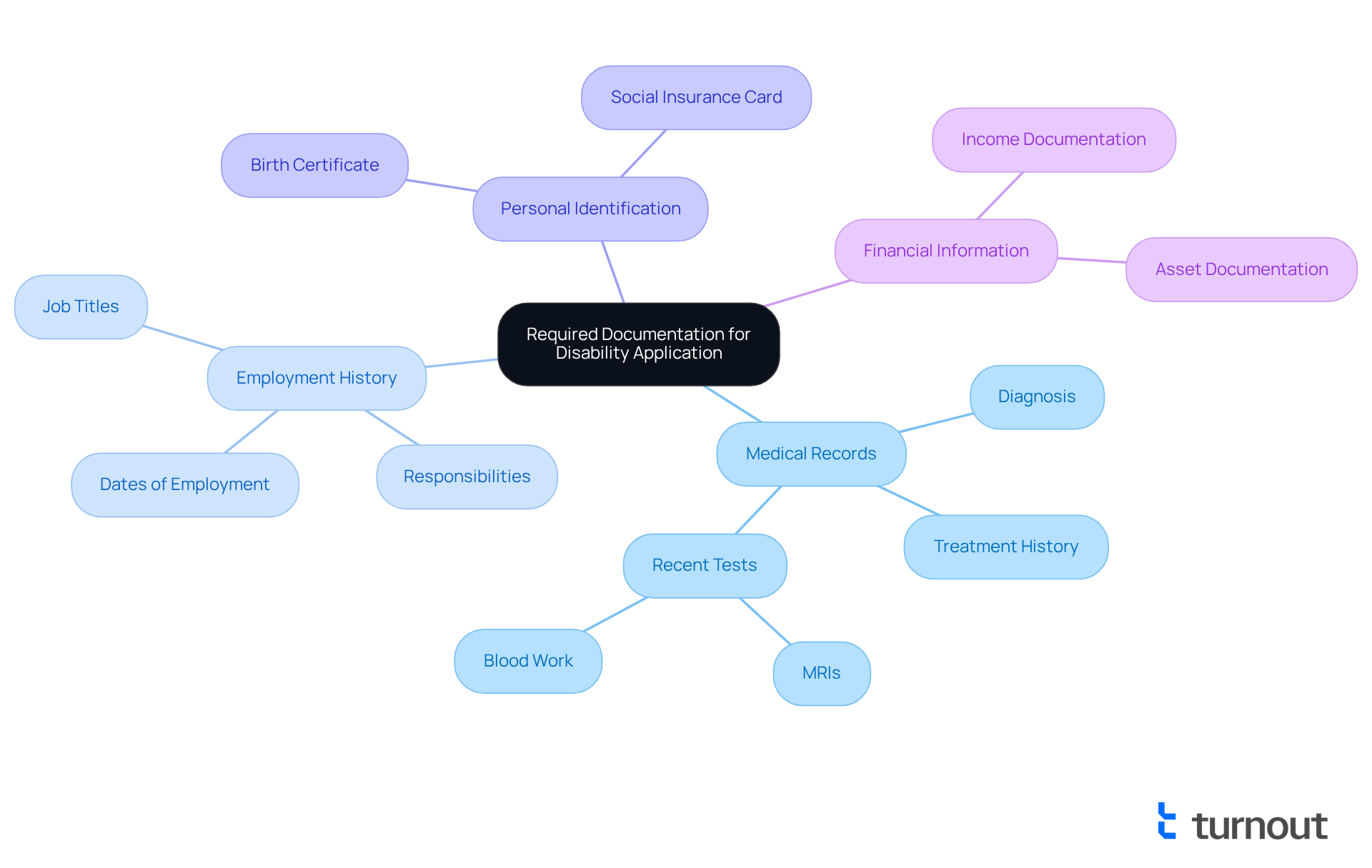

When applying for how to get on disability benefits, we understand that gathering all necessary documentation can feel overwhelming. However, knowing how to get on disability is essential for a successful claim. Here are the key documents you will need:

- Medical Records: It's important to obtain detailed documentation from your healthcare providers that outlines your diagnosis, treatment history, and any limitations caused by your condition. Recent diagnostic tests, such as MRIs or blood work, can significantly strengthen your case by demonstrating the severity of your disability. Frequent appointments with healthcare professionals ensure they possess current records, which can assist in your disability claims.

- Employment History: Compile a comprehensive record of your work history, including job titles, responsibilities, and dates of employment. This information is essential for determining your work credits, particularly for Disability Insurance (SSDI), which requires adequate work history.

- Personal Identification: Make sure you have proof of identity, such as a birth certificate or Social Insurance card. This documentation is necessary for verifying your identity during the enrollment process.

- Financial Information: For Supplemental Security Income (SSI) applicants, providing documentation of your income and assets is crucial. This information helps determine eligibility based on financial need.

Having these documents arranged and easily accessible can simplify the submission process and greatly enhance your likelihood of understanding how to get on disability. We recognize that the average time taken to gather necessary documentation can vary, but understanding how to get on disability by staying proactive and maintaining communication with your healthcare providers can expedite this process. Furthermore, seeking advice from expert witnesses or legal professionals can offer valuable insights into the necessary documentation, ensuring that your submission is as persuasive as possible.

Remember, well-supported programs can significantly improve your understanding of how to get on disability, enabling examiners to make informed decisions without unnecessary delays and ultimately enhancing your chances of receiving the benefits you deserve. We also want you to be aware that delays may still occur due to incomplete records or inconsistent medical care, so thorough preparation is key. Applications can be submitted online or in person at local government offices, with online submission often being more convenient. You are not alone in this journey; we're here to help you navigate the process.

Navigate the Application Process: Step-by-Step Instructions

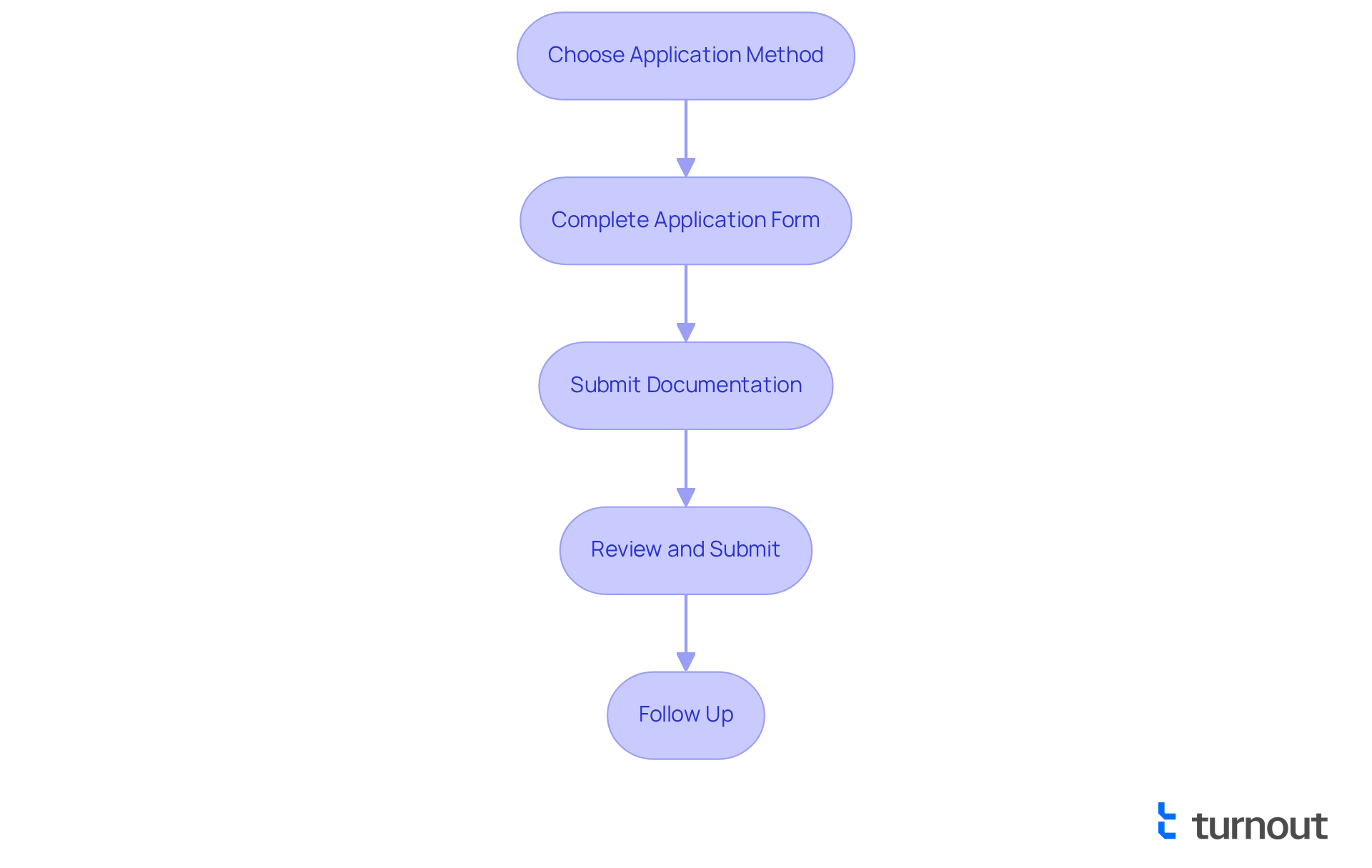

Navigating the application process for Social Security Disability Insurance (SSDI) can feel overwhelming, but we're here to help. By following these essential steps, you can approach this journey with confidence:

-

Choose Your Application Method: You have options when applying—online through the SSA website, by phone, or in person at your local Social Security office. Many find that applying online is the most efficient choice.

-

Complete the Application Form: It's important to fill out the required forms, including the Adult Disability Report (Form SSA-3368) and the Application for Disability Insurance Benefits (Form SSA-16). Be sure to provide detailed information about your medical condition and work history; this clarity is crucial.

-

Submit Your Documentation: Attach all necessary documentation, such as comprehensive medical records, treatment history, and employment details. Thorough documentation significantly impacts your likelihood of approval. Remember, the SSA may request additional medical examinations to assess your condition, so being prepared for that possibility can ease your mind.

-

Review and Submit: Before sending your application, take a moment to carefully examine your submission for accuracy and completeness. Incomplete or flawed submissions are a common reason for initial rejections, and we want to help you avoid that.

-

Follow Up: After submitting your request, keep an eye on its status through your My Social Security account or by contacting the SSA directly. Regular follow-ups can help you address any issues that may arise during the review process. And remember, it’s important to respond promptly to any letters from the SSA while waiting for a decision.

The average processing duration for SSDI requests typically ranges from three to six months. However, many initial claims face rejection. Therefore, ensuring that your submission is thorough and well-documented is vital for enhancing your chances of success. You are not alone in this journey, and taking these steps can make a significant difference.

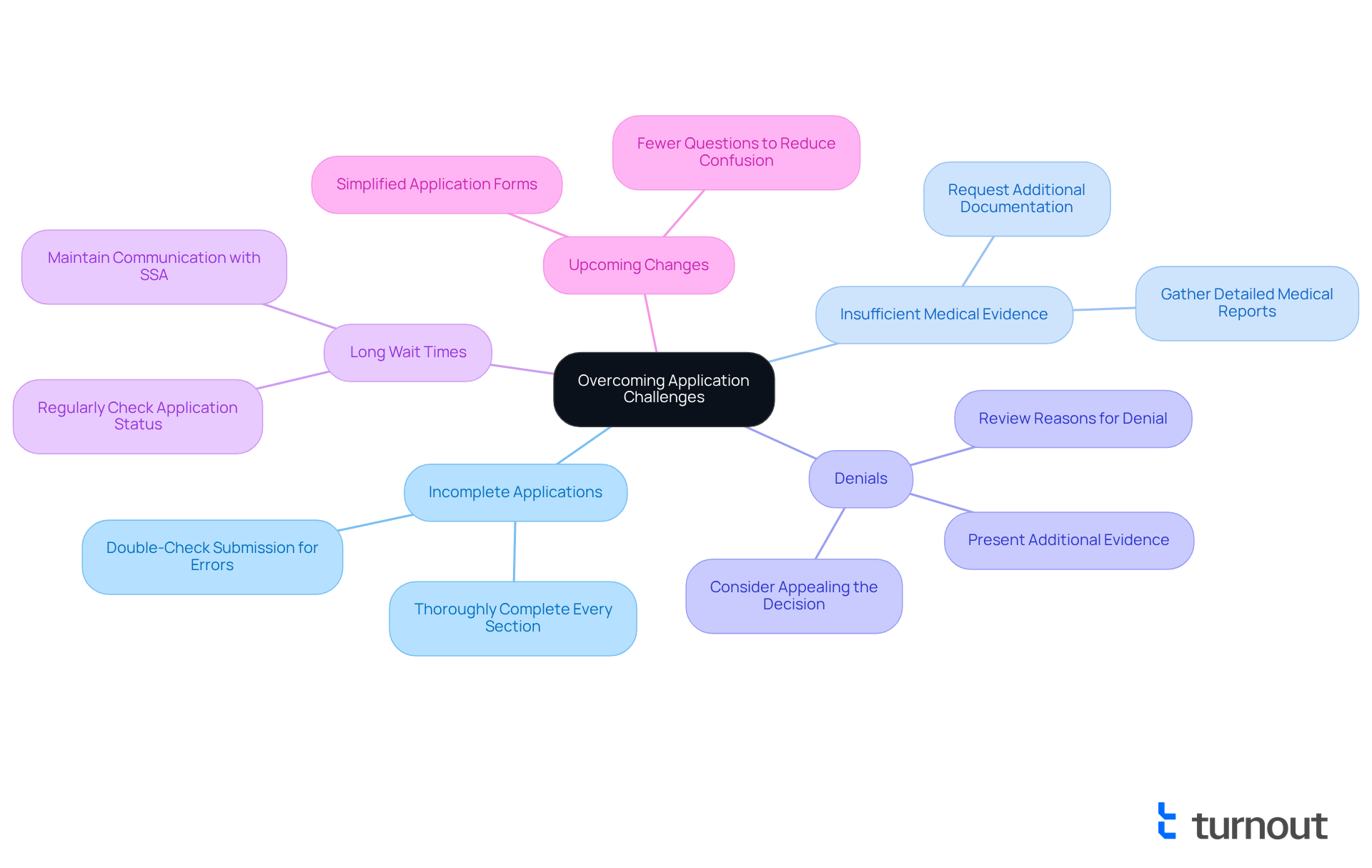

Troubleshoot Common Issues: Overcoming Application Challenges

Many candidates experience significant challenges when they are figuring out how to get on disability benefits. We understand that the process of how to get on disability can feel overwhelming, and we’re here to help. Here are some common issues you might face and strategies to address them:

-

Incomplete Applications: It’s vital to ensure that every section of your application is thoroughly completed. In 2025, about 65-70% of initial SSDI requests are rejected due to frequent errors, such as missing information and submission deadlines. Double-checking your submission can help you avoid unnecessary delays and stress.

-

Insufficient Medical Evidence: Comprehensive medical documentation is crucial to support your claim. If your initial submission lacks detail, consider requesting additional letters or reports from your healthcare providers. This can significantly strengthen your case and provide the clarity needed for understanding how to get on disability successfully.

-

Denials: If your request is denied, take a moment to carefully review the reasons provided by the Social Security Administration (SSA). It’s common to feel disheartened, but consider appealing the decision and gathering more evidence on how to get on disability if necessary. Many applicants have successfully overturned denials by presenting additional documentation or clarifying their medical conditions, showing that persistence can pay off.

-

Long Wait Times: Processing times can vary significantly, with the average wait for an initial disability decision currently at 232 days and over 1 million initial disability claims pending. It’s understandable to feel anxious during this waiting period. Be patient and proactive; regularly check your status and maintain communication with the SSA to understand how to get on disability and receive updates. Staying informed can help alleviate some of the stress associated with long wait times.

-

Upcoming Changes: In 2025, the SSDI request forms will be simplified from 54 questions to just 12 essential questions. This change aims to make the process more accessible for applicants, reducing confusion and streamlining the application process. We hope this will ease some of your concerns and make your experience smoother.

Remember, you are not alone in this journey. We’re here to support you every step of the way.

Conclusion

Understanding how to access disability benefits is a crucial step for individuals facing challenges due to disabilities. We recognize that this journey can be complex, yet it can lead to essential financial support and access to necessary healthcare services. By grasping the types of benefits available, determining eligibility, gathering required documentation, and navigating the application process, you can significantly enhance your chances of securing the assistance you need.

This guide has outlined the essential types of disability benefits, including:

- Disability Insurance

- Supplemental Income

It has emphasized the importance of meeting the eligibility criteria set by the Social Security Administration. Additionally, we have detailed the necessary documentation and provided a step-by-step approach to the application process, highlighting common issues and strategies to overcome them. Being aware of these factors can empower you to navigate the system more effectively and avoid pitfalls that often lead to application denials.

Ultimately, pursuing disability benefits is not merely a bureaucratic task; it is a vital lifeline for many individuals and families. By staying informed and proactive, you can transform a daunting process into a manageable one. It is essential to approach this journey with patience and determination, knowing that support is available every step of the way. Taking action today by gathering the required documents and understanding the application process can lead to a more secure and stable future. Remember, you are not alone in this journey, and we are here to help.

Frequently Asked Questions

What are the two main types of disability benefits?

The two main types of disability benefits are Disability Insurance (SSDI) and Supplemental Income (SSI).

Who is eligible for Disability Insurance (SSDI)?

SSDI is designed for individuals who have been employed, contributed to taxes, and can no longer work due to a disability. Applicants typically need to accumulate 40 work credits, with at least 20 earned within the last 10 years.

What is the eligibility requirement for Supplemental Income (SSI)?

SSI eligibility is based on limited income and resources. Applicants must have limited income, which includes earnings, Social Security benefits, and support from friends or family. The resource limit is currently set at $2,000 for individuals and $3,000 for couples.

What is the Substantial Gainful Activity (SGA) threshold for 2025?

The SGA threshold for non-blind individuals in 2025 is expected to be $1,550 per month.

Why is it important to understand the distinctions between SSDI and SSI?

Understanding the distinctions is vital for determining how to apply for disability benefits, as it directly impacts the application process and eligibility requirements.

What should applicants do before submitting their request for disability benefits?

Applicants should thoroughly review the Social Security Administration's (SSA) guidelines, including the detailed Listing of Impairments, to ensure they meet the eligibility criteria before submitting their request.

What is the approximate rate of initial disability claims that are declined?

Around two-thirds of initial disability claims are declined.

How can understanding eligibility requirements help applicants?

Understanding the eligibility requirements can significantly improve an applicant's chances of a successful application or appeal.