Overview

Navigating the process of filing for Social Security Disability Insurance (SSDI) can feel overwhelming, and we understand that. This article serves as a comprehensive step-by-step guide to help you through this journey. It's crucial to meet eligibility criteria and ensure thorough documentation, as this can significantly impact your application’s success.

Start by gathering the necessary documents. Understanding the application process is essential, and we’re here to support you every step of the way. It's common to encounter issues during the application, but troubleshooting these challenges is vital, especially considering that about 67% of SSDI applications are denied without proper preparation.

Remember, you are not alone in this process. We’re here to help you succeed in your application and to provide the guidance you need. Take a deep breath, and let’s begin this journey together.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming for many individuals facing debilitating conditions. We understand that this essential program offers crucial financial support, but knowing how to effectively file for SSDI is vital for securing the benefits that can help maintain stability during these challenging times.

It's common to feel uncertain about the process, especially when a significant number of applicants face denials. So, what steps can you take to enhance your chances of approval and successfully navigate the application process? We're here to help you through this journey.

Understand Social Security Disability Insurance (SSDI)

Disability Insurance is a vital national program designed to provide financial support to individuals unable to work due to an eligible disability. We understand that navigating how to file for SSDI can be a daunting process. To qualify for Social Security Disability Insurance, applicants need a work history that includes paying Social Security taxes, along with evidence that their disability prevents them from engaging in substantial gainful activity (SGA).

In 2025, the SGA threshold is expected to rise to $1,620 for non-blind individuals and $2,700 for those who are statutorily blind. This change will affect eligibility criteria for many applicants, making it crucial to stay informed. Disability benefits aim to replace a portion of lost earnings, helping individuals maintain financial stability during challenging times.

Understanding how to file for SSDI is essential for applicants to navigate the disability benefits framework. It provides them with knowledge on how to file for SSDI, including the advantages they may receive and the responsibilities they hold during the application process. Currently, around 30% of disability applicants qualify for benefits, which underscores the importance of careful preparation and thorough documentation.

Real-world examples illustrate the profound impact of disability financial support. Many beneficiaries share that these benefits are crucial for managing basic living expenses, such as housing and healthcare. As the Government Administration continues to revise its policies, it’s essential to stay updated on changes, like the anticipated increase in monthly benefits due to a 3.2% cost-of-living adjustment (COLA) in 2025.

Advocacy services, such as Turnout, play a pivotal role in assisting individuals to understand these changes. Remember, you are not alone in this journey. We’re here to help you navigate the complexities of securing the support you need.

Determine Your Eligibility for SSDI Benefits

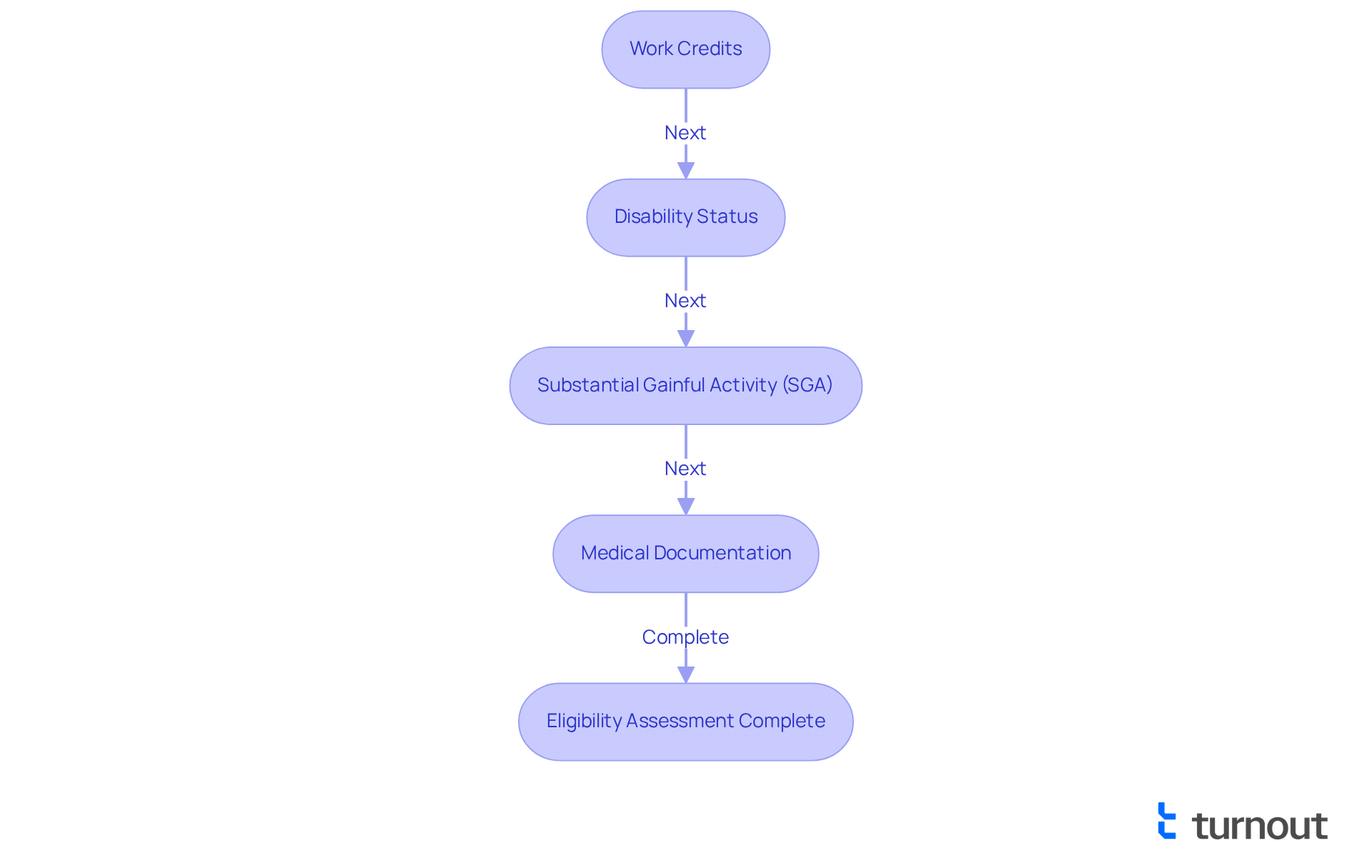

Determining how to file for SSDI benefits can feel overwhelming, but we are here to assist you. Consider these important criteria:

-

Work Credits: You need to have earned enough work credits, which typically means at least 20 credits in the last 10 years. Each year of work allows you to earn up to four credits. In 2025, the Administration of Public Assistance emphasizes that these credits are crucial for your eligibility.

-

Disability Status: Your condition must be recognized as a disability by the Social Security Administration (SSA). This means it should significantly hinder your ability to work and is expected to last at least 12 months or result in death.

-

Substantial Gainful Activity (SGA): It's essential that you are not engaging in SGA, which refers to earning more than a specific monthly amount. For 2025, this threshold is $1,620 for non-blind individuals. This reflects the SSA's commitment to ensuring benefits reach those who truly need them.

-

Medical Documentation: You will need to gather thorough medical records that outline your condition and its effects on your work ability. This includes your treatment history, diagnoses, and relevant test results.

By carefully assessing these factors, you can better understand how to file for SSDI and determine if you meet the eligibility criteria for disability benefits. Remember, successful applications often hinge on meeting these criteria, especially the work credits, which are pivotal in the approval process. You're not alone in this journey, and taking these steps can lead you toward the support you need.

Follow the Step-by-Step Application Process for SSDI

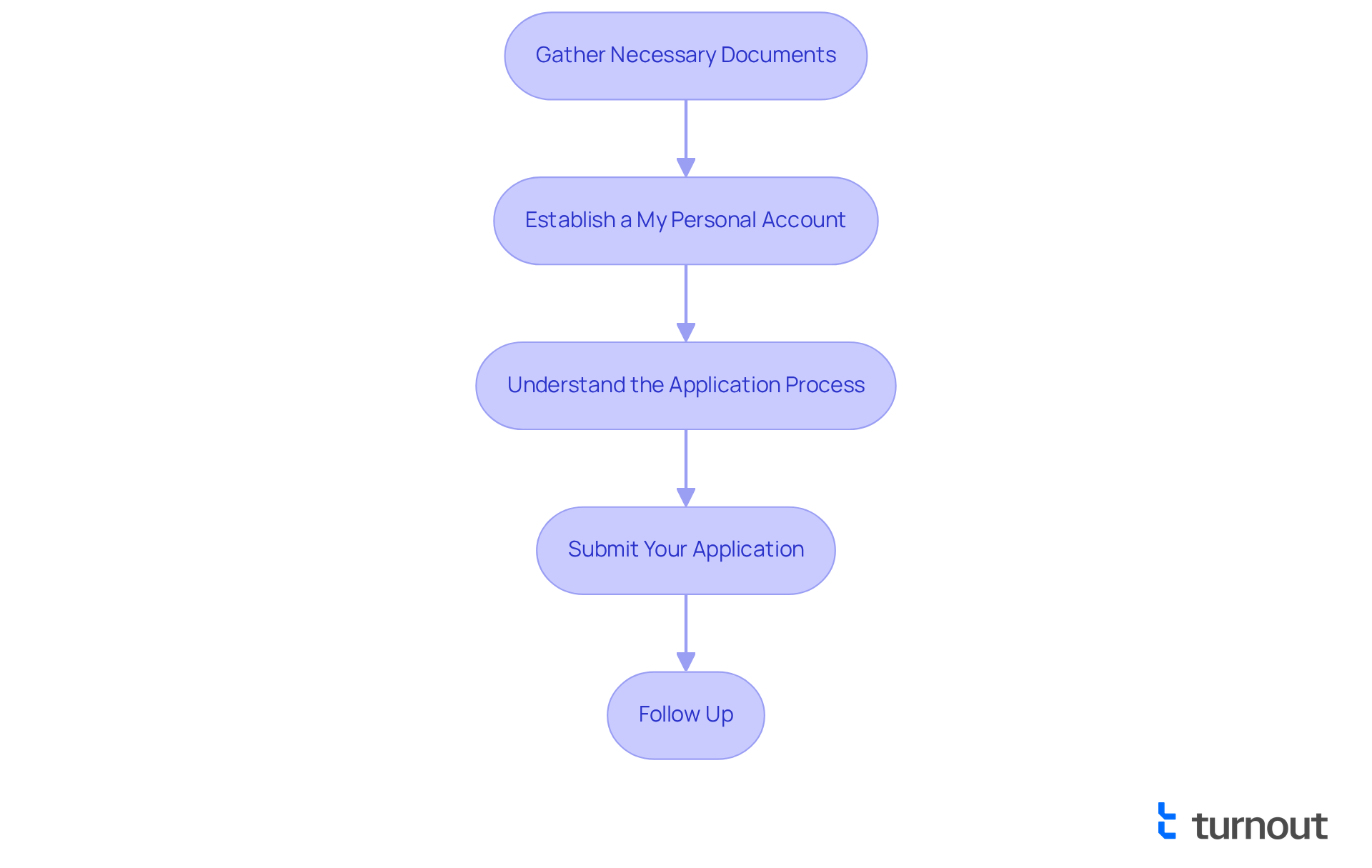

Applying for SSDI benefits can feel overwhelming, especially when figuring out how to file for SSDI, but we're here to help. By following these steps on how to file for SSDI, you can simplify the process and enhance your chances of approval.

-

Gather Necessary Documents: Start by collecting all required documentation. This includes your Social Security number, birth certificate or proof of citizenship, medical records detailing your condition, work history for the past 15 years, and recent W-2 forms or tax returns. Remember, statistics show that 5% of applicants reported the entire process took between two and three years. Having complete documentation is crucial to avoid delays.

-

Establish a My Personal Account: We understand that keeping track of your application is important. Setting up an account at www.ssa.gov allows you to oversee your request online. This way, you can monitor your submission status and receive updates. The overall average duration from submission to decision was 27 months, so staying informed can make a difference.

-

Understand the Application Process: To understand how to file for SSDI, you can complete the application online, by phone, or in person at your local Social Security office. If you choose to apply online, head to the 'Apply for Benefits' section and complete the SSDI request form (SSA-16). Recent modifications have simplified online submissions, making it easier to finalize your request.

-

Submit Your Application: Before submitting, ensure all information is accurate and complete. Double-check for any missing documents or signatures. Experts emphasize that even minor errors can lead to significant delays, so thoroughness is key.

-

Follow Up: After submission, it's common to feel anxious. Monitor your status through your My Social Security account or by contacting the SSA. Be prepared to provide additional information if requested. Approximately 40% of applicants receive a decision within three months after a hearing, but staying proactive can help expedite your case.

By following these steps, you can navigate the process of how to file for SSDI with confidence. Remember, you are not alone in this journey, and taking these actions can lead to positive outcomes.

Troubleshoot Common Application Issues

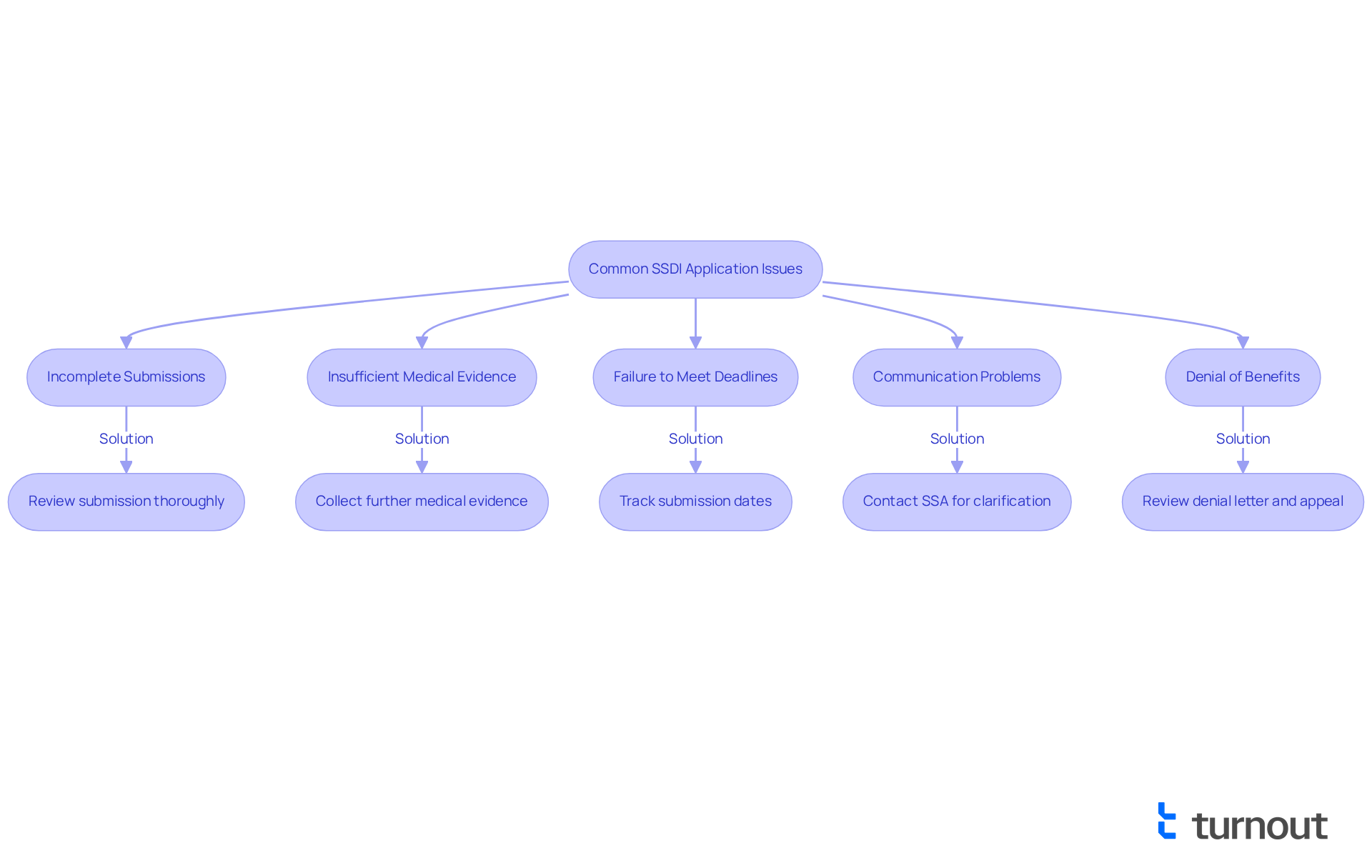

When considering how to file for SSDI, it’s common to face several challenges. We understand that this process can be overwhelming, but here’s how to troubleshoot effectively:

-

Incomplete Submissions: It’s essential to ensure that every section of your submission is fully completed. Missing information can lead to significant delays or outright denials. Take a moment to review your submission thoroughly before sending it in. This small step can help you avoid potential pitfalls.

-

Insufficient Medical Evidence: Many requests are denied due to a lack of sufficient medical documentation. If your request is denied for this reason, don’t lose hope. Collect further evidence from your healthcare providers, including updated medical records, treatment plans, and assessments from specialists. This documentation is crucial in demonstrating that you meet the disability criteria.

-

Failure to Meet Deadlines: Adhering to deadlines is critical in the SSDI submission process. Remember, you have 60 days to contest a rejected request. Keeping track of all submission dates and responses to SSA inquiries is vital. Consider using reminders or a calendar to help you stay organized and ensure timely submissions.

-

Communication Problems: If you have questions or need clarification regarding your submission, please don’t hesitate to contact the SSA directly. Their toll-free number (1-800-772-1213) is available for assistance, though be prepared for potential wait times. Clear communication can help resolve any uncertainties you may have.

-

Denial of Benefits: If your request is denied, take a moment to carefully review the denial letter to understand the specific reasons for the decision. Remember, you have the right to appeal. It may be beneficial to seek assistance from a disability advocate to strengthen your case. Additionally, if all other options are exhausted, consider filing a lawsuit in federal court within 60 days of receiving notice that your appeal was denied.

By being proactive about these common issues and understanding how to file for SSDI, you can navigate the disability benefits process more effectively. Remember, you are not alone in this journey—approximately 67% of SSDI applications are denied, and only 21% to 23% of initial claims are approved. This highlights the importance of thorough preparation and understanding of the process. We're here to help you every step of the way.

Conclusion

Understanding how to file for Social Security Disability Insurance (SSDI) is crucial for those seeking financial support due to a disability. We understand that the process may seem daunting, but with the right information and preparation, you can navigate the system effectively. By familiarizing yourself with eligibility criteria, gathering necessary documentation, and following a structured application process, you can increase your chances of receiving the benefits you need.

Key points to consider include:

- The importance of work credits

- The necessity of comprehensive medical documentation

- The steps involved in submitting your application

It's common to feel overwhelmed by challenges such as incomplete submissions or insufficient medical evidence, but addressing these issues is essential for overcoming obstacles that may arise during the application process. With approximately 67% of SSDI applications being denied, careful attention to detail and proactive measures are vital to achieving a successful outcome.

Ultimately, the journey to secure SSDI benefits is not one that you must undertake alone. Resources such as advocacy services can provide invaluable support, helping you navigate the complexities of the application process. By staying informed and taking the necessary steps, you can work towards obtaining the financial stability you deserve. Remember, we’re here to help, and it is imperative to act with determination and utilize available resources to ensure a smoother path to securing SSDI benefits.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a national program that provides financial support to individuals who are unable to work due to an eligible disability.

What are the eligibility requirements for SSDI?

To qualify for SSDI, applicants must have a work history that includes paying Social Security taxes and must provide evidence that their disability prevents them from engaging in substantial gainful activity (SGA).

What is the expected SGA threshold for 2025?

In 2025, the SGA threshold is expected to rise to $1,620 for non-blind individuals and $2,700 for those who are statutorily blind.

How do disability benefits help individuals?

Disability benefits aim to replace a portion of lost earnings, helping individuals maintain financial stability during challenging times.

What percentage of disability applicants currently qualify for benefits?

Currently, around 30% of disability applicants qualify for benefits, highlighting the importance of careful preparation and thorough documentation.

How do beneficiaries view the impact of disability financial support?

Many beneficiaries report that these benefits are crucial for managing basic living expenses, such as housing and healthcare.

What upcoming changes should applicants be aware of regarding SSDI?

Applicants should stay informed about changes such as the anticipated increase in monthly benefits due to a 3.2% cost-of-living adjustment (COLA) in 2025.

How can advocacy services assist individuals with SSDI?

Advocacy services, like Turnout, help individuals understand changes in SSDI policies and navigate the complexities of securing the support they need.