Overview

Navigating Social Security Disability Insurance (SSDI) benefits can be daunting, but understanding how they are calculated can ease some of your concerns. SSDI benefits are determined by your Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA). This involves a step-by-step process that requires gathering income records, indexing them for inflation, and applying a specific formula to determine your monthly payments.

We understand that factors such as lifetime earnings, the age at which you became disabled, and cost-of-living adjustments can significantly influence the final benefit amount. This illustrates the complexities involved in accurately calculating SSDI benefits. Remember, you are not alone in this journey; we’re here to help you navigate through these challenges and ensure you receive the support you deserve.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that the roles of Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA) in determining your benefits are critical. This guide aims to clarify the calculation process, offering you a supportive pathway to grasp how these essential metrics shape your financial future.

It's common to feel uncertain with so many factors influencing SSDI payments—from your lifetime earnings to changes in legislation. How can you ensure that you are making informed decisions about your entitlements? Remember, you are not alone in this journey. We're here to help you understand your options and navigate this important aspect of your life.

Understand Key Concepts: AIME and PIA

Understanding your SSDI benefits can feel overwhelming, but we're here to guide you through the essential concepts of Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA). You don't have to navigate these complexities alone; Turnout is here to help you every step of the way.

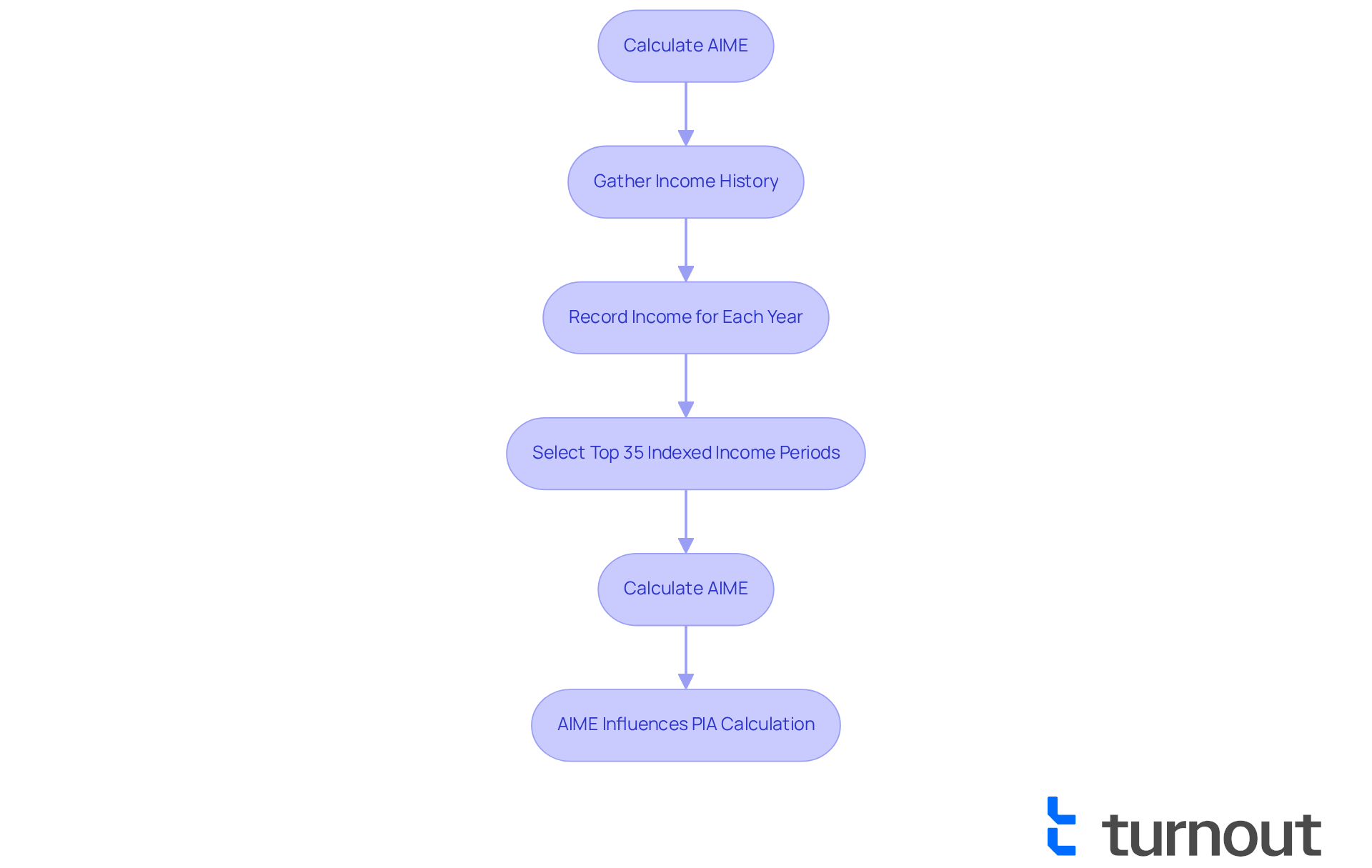

Average Indexed Monthly Income (AIMI) is a vital number that reflects your average monthly income during your peak earning years, adjusted for inflation. The Social Security Administration (SSA) considers up to 35 years of your income to calculate this average. Here’s how you can determine your AIME:

- Gather your income history from your Social Security Statement.

- Record your income for each year, accounting for salary increases.

- Select the top 35 periods of indexed income.

- Add these earnings together and divide by the total number of months in those years (420 months for 35 years).

Primary Insurance Amount (PIA) is the monthly payment you would receive if you start your SSDI payments at your full retirement age. The PIA is calculated using a formula that applies different percentages to portions of your AIME. For 2025, the highest PIA will range from $2,831 to $5,108, reflecting updated thresholds to ensure adjustments align with wage growth and inflation. Additionally, beneficiaries will receive a 2.5% cost-of-living adjustment (COLA) in 2025, which is crucial for maintaining your purchasing power.

Grasping how AIME translates to PIA is essential for accurately calculating your benefits. We understand that navigating these details can be challenging, especially with the earnings limits for the retirement earnings test (RET) in 2025 set at $23,400 for those not yet at full retirement age and $62,160 for those who will reach it during the year. By familiarizing yourself with these concepts, you can better navigate the intricacies of Turnout's assistance and make informed decisions about your financial future. Remember, you're not alone in this journey; we’re here to support you.

Calculate Your SSDI Benefits: Step-by-Step Process

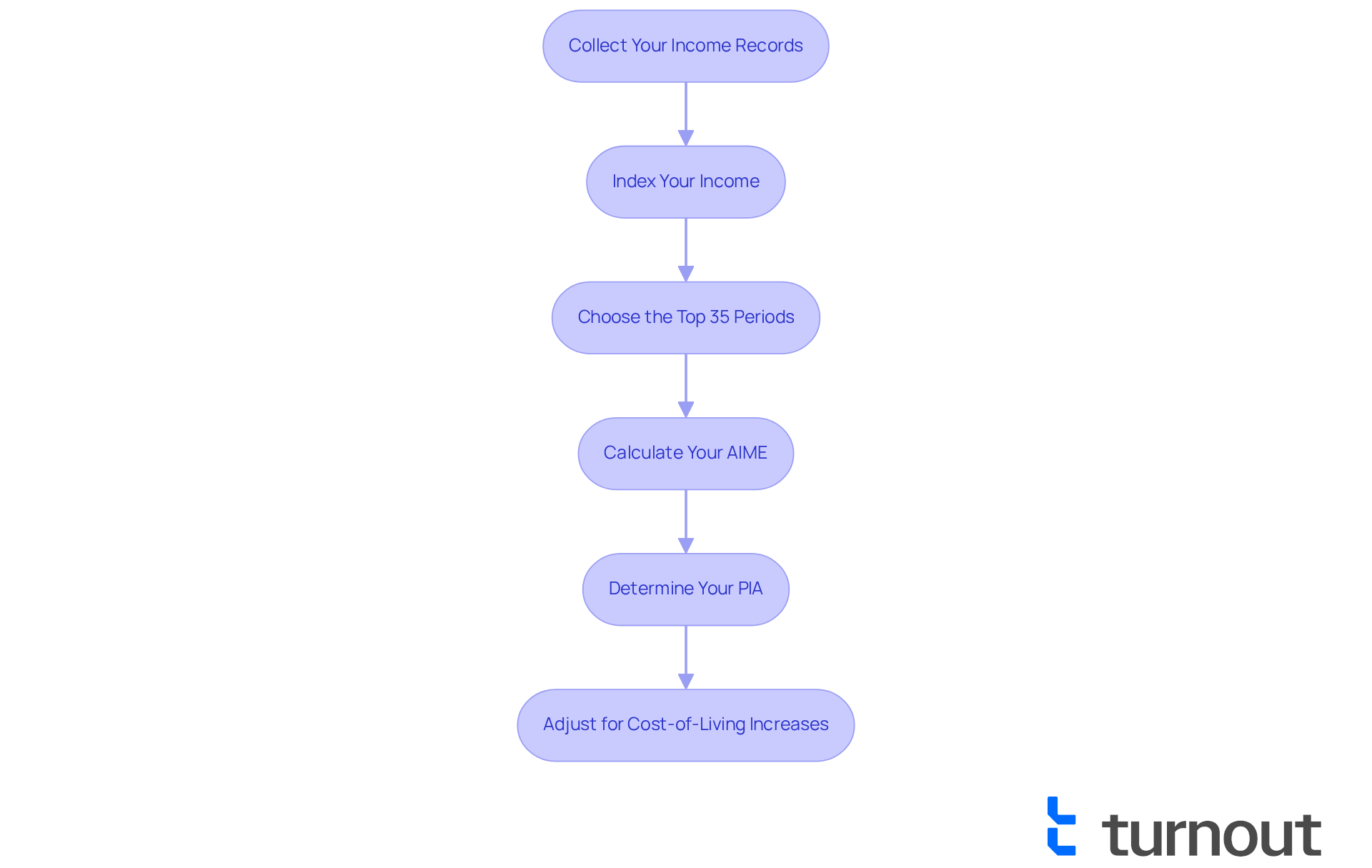

Calculating your SSDI benefits can feel overwhelming, but with the support of Turnout, you can navigate this process with confidence. Here’s a step-by-step guide to help you understand how to determine your benefits.

-

Collect Your Income Records: Begin by acquiring your income history from your Social Security Statement. This document provides a thorough summary of your contributions, detailing your income for each period you were employed.

-

Index Your Income: It’s important to adjust your past income for inflation. The SSA offers an indexing element for each year, which you can find on their website or in your income statement. This adjustment ensures that your historical income accurately reflects current economic conditions.

-

Choose the Top 35 Periods: From your recorded income, select the 35 periods during which you earned the highest amounts. If you have less than 35 years of work experience, include all your periods of income. This choice is crucial as it directly affects your compensation calculations.

-

Calculate Your AIME: Add the indexed earnings from your top 35 years and divide the total by 420 (the number of months in 35 years). This calculation gives you your Average Indexed Monthly Earnings (AIME), an essential figure in assessing your entitlements.

-

Determine Your PIA: To calculate your Primary Insurance Amount (PIA), use the following formula:

- 90% of the first $1,226 of your AIME

- 32% of the AIME between $1,226 and $7,391

- 15% of the AIME above $7,391

Add these amounts together to find your PIA, which represents the monthly benefit you will receive. For 2025, the projected average monthly disability payment for impaired workers is around $1,580, with a maximum amount of $4,018.

-

Adjust for Cost-of-Living Increases: Remember, your entitlements may be modified each year for inflation, impacting your final monthly payment. For 2025, a 2.5% cost-of-living adjustment is expected, helping beneficiaries maintain their purchasing power amid rising living costs. Additionally, be aware that SSD beneficiaries face a two-year waiting period for Medicare eligibility, which can affect your financial planning.

By following these steps, you can gain a clearer understanding of how social security disability is calculated and what to expect regarding financial assistance. Turnout is here to simplify this process, utilizing trained nonlawyer advocates to guide you through your SSD claims effectively. For example, if your AIME is calculated to be $2,000, your PIA would be established using the formula, leading to a monthly payment that reflects your work history and contributions. Remember, Turnout is not a law firm and does not provide legal representation, but we’re here to help you every step of the way.

Identify Factors Affecting SSDI Payments

Several factors can influence the amount of your SSDI payments, and we understand that navigating this process can be challenging:

-

Lifetime Earnings: Higher lifetime earnings typically lead to higher SSDI benefits. The Social Security Administration (SSA) determines your advantages based on your peak income periods, which relates to how is social security disability calculated, since steady, elevated income can greatly influence your Average Indexed Monthly Income (AIME) and Primary Insurance Amount (PIA). For instance, in 2025, the minimum disability payment is established at $967 monthly, whereas the maximum can attain $4,018. This clearly demonstrates how your income history is considered when determining how is social security disability calculated in relation to payment amounts.

-

Age at Disability Onset: The age at which you become disabled can affect your AIME. If you become disabled at a younger age, you may have fewer years of earnings to consider, which could lower your AIME and, consequently, your compensation.

-

Cost-of-Living Adjustments (COLA): Disability payments are subject to annual adjustments based on inflation. The 2025 COLA introduced a 2.5% rise in monthly payment checks, which will add roughly $48 to the average payment check, raising it from $1,542 to $1,580. This adjustment is crucial for helping beneficiaries cope with rising living expenses.

-

Work Activity: If you go back to work while receiving disability payments, your income may influence your support. The SSA has specific income thresholds, and surpassing these thresholds can result in a decrease or cessation of your assistance. Understanding how social security disability is calculated is vital for maintaining your financial support while exploring employment opportunities.

-

Changes in Legislation: Modifications in laws can also affect disability support payments. Staying informed about any changes in laws or regulations is essential, as they may affect your eligibility or payment amounts. For example, the SSA frequently revises its programs to cater to existing and new participants, which can impact assistance assessments and eligibility standards.

-

Grasping the differences between SSDI and SSI: It's important to understand the distinctions between SSDI and Supplemental Security Income (SSI) to enhance your benefits and prevent issues. This knowledge can be vital for individuals navigating the complexities of disability support.

-

Sequential Evaluation Process: SSDI claims are evaluated using a sequential evaluation process defined by the U.S. Code of Federal Regulations. Familiarizing yourself with this process can help you understand how is social security disability calculated and how your claim will be assessed along with the factors that will be considered. Turnout provides tools and services to assist you in navigating this process effectively, utilizing trained nonlawyer advocates to support your SSD claims. Importantly, Turnout is not a law firm and does not provide legal representation, ensuring that clients understand the nature of the assistance available.

-

New Payment Notification Process: The SSA will issue revamped notifications outlining new payment amounts, which seek to clarify comprehension of revised amounts and deductions. This will help beneficiaries stay informed about their benefits and any changes that may occur.

We’re here to help you through this journey, ensuring you understand your SSDI benefits and how they can support you.

Conclusion

Understanding how Social Security Disability Insurance (SSDI) benefits are calculated is crucial for anyone navigating the complexities of financial support. We recognize that this journey can be overwhelming, and by demystifying the processes behind Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA), we hope to provide you with clarity on what to expect from your benefits. This guide has illuminated the necessary steps and factors that play a significant role in determining SSDI payments, empowering you to make informed decisions about your financial future.

Key insights shared throughout the article include:

- The importance of accurately collecting and indexing income records

- Selecting the top 35 earning periods

- Understanding the calculation of AIME and PIA

- Considering how cost-of-living adjustments, age at disability onset, and legislative changes impact SSDI payments

These multifaceted calculations can seem daunting, but grasping these concepts can help you better prepare for your financial needs as you navigate disability support.

Ultimately, staying informed about the nuances of SSDI calculations is essential for maximizing your benefits and ensuring financial stability. If you’re seeking assistance, consider leveraging resources like Turnout, which offers guidance through the SSDI claims process. By understanding how various factors influence SSDI payments and keeping abreast of any changes in regulations or benefits, you can take proactive steps towards securing your financial well-being in the face of disability. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are Average Indexed Monthly Earnings (AIME)?

AIME is a crucial figure that represents your average monthly income during your highest earning years, adjusted for inflation. The Social Security Administration (SSA) uses up to 35 years of your income to calculate this average.

How is AIME calculated?

To determine your AIME, you need to gather your income history from your Social Security Statement, record your income for each year, select the top 35 periods of indexed income, add these earnings together, and then divide by the total number of months in those years (420 months for 35 years).

What is Primary Insurance Amount (PIA)?

PIA is the monthly payment you would receive if you start your Social Security Disability Insurance (SSDI) payments at your full retirement age. It is calculated using a formula that applies different percentages to portions of your AIME.

What are the estimated PIA ranges for 2025?

For 2025, the highest PIA will range from $2,831 to $5,108, reflecting updated thresholds that align with wage growth and inflation.

Will there be any cost-of-living adjustments (COLA) for 2025?

Yes, beneficiaries will receive a 2.5% cost-of-living adjustment (COLA) in 2025, which is important for maintaining purchasing power.

What are the earnings limits for the retirement earnings test (RET) in 2025?

In 2025, the earnings limits for the RET are set at $23,400 for those not yet at full retirement age and $62,160 for those who will reach it during the year.

How can understanding AIME and PIA help me?

Familiarizing yourself with AIME and PIA can help you better navigate the complexities of SSDI benefits, make informed decisions about your financial future, and utilize assistance from organizations like Turnout.