Overview

Navigating Social Security Disability Insurance (SSDI) can feel overwhelming, but understanding how your benefits are determined is a crucial step. The amount you receive hinges on factors like your Average Indexed Monthly Earnings (AIME) and your Primary Insurance Amount (PIA). These elements are shaped by your work history and earnings.

We know that keeping accurate earnings records is vital. This article will guide you through a step-by-step calculation process for determining your SSDI benefits. By exploring potential strategies—such as delaying claims or seeking additional support options—you can maximize your benefits.

Remember, you are not alone in this journey. We're here to help you every step of the way. Take a moment to reflect on your situation and consider how these insights can empower you to make informed decisions about your SSDI benefits.

Introduction

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for millions of Americans who rely on this program for financial support during challenging times. We understand that navigating this landscape can be overwhelming. With over 5 million individuals seeking assistance, the stakes are high. Knowing how to accurately calculate potential benefits can significantly impact your financial stability. Yet, many face confusion regarding the factors that influence SSDI payment amounts and the steps necessary to determine eligibility. It's common to feel uncertain about what comes next.

How can you navigate this complex landscape to ensure you receive the benefits you rightfully deserve? We're here to help you through this journey.

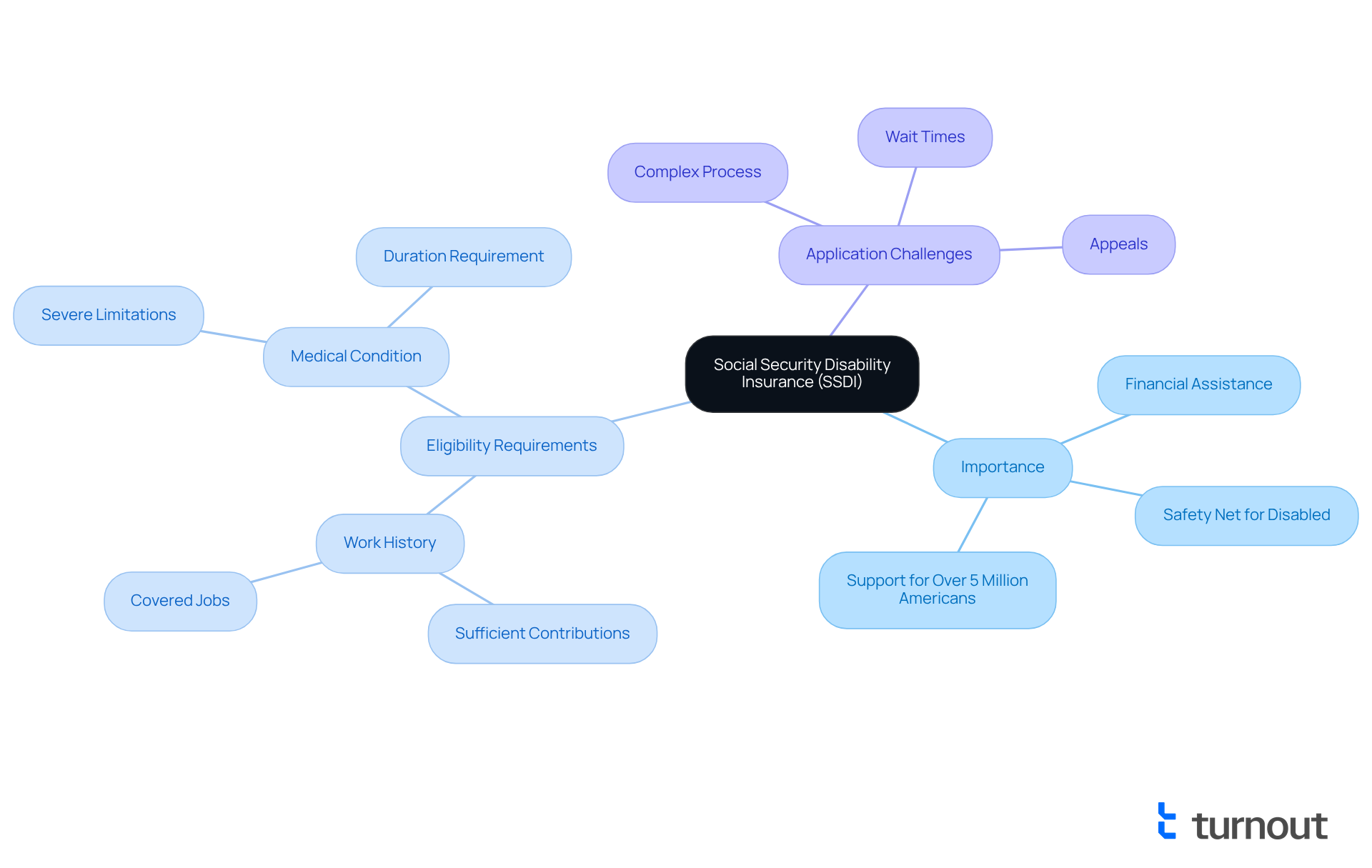

Understand Social Security Disability Insurance (SSDI)

Social Disability Insurance is a vital national program that offers financial assistance to individuals who are unable to work due to a disability. In 2025, Turnout supports over 5 million Americans seeking disability benefits, highlighting the program's crucial role in providing a safety net for those in need. To qualify for these benefits, applicants must have contributed to the Social Security program through their employment and must demonstrate a medical condition that aligns with the Social Security Administration's (SSA) definition of disability. This definition generally requires that the condition is expected to last at least one year or result in death.

Key eligibility requirements include:

- A sufficient work history in jobs covered by Social Security.

- A medical condition that severely limits your ability to perform work-related tasks.

We understand that the application process can be complex. It often requires comprehensive medical documentation and a detailed work history. Many applicants encounter challenges, such as lengthy wait times and the need for appeals after initial denials. For instance, a case study involving a disabled veteran illustrates how Turnout's advocacy simplified the disability application process. By providing tailored support and guidance, they helped the individual navigate bureaucratic obstacles and secure assistance more effectively than through conventional approaches.

As disability advocate Angela Robinson states, "Disability awareness quotes are sayings that highlight the challenges the disabled face in the professional world and call for equity and equality in the workplace and world at large."

By understanding the basics of Social Security Disability Insurance, you can better navigate the intricacies of the application process and determine how much would I get on SSDI. Remember, we're here to help you improve your chances of understanding how much would I get on SSDI benefits that you deserve. You are not alone in this journey.

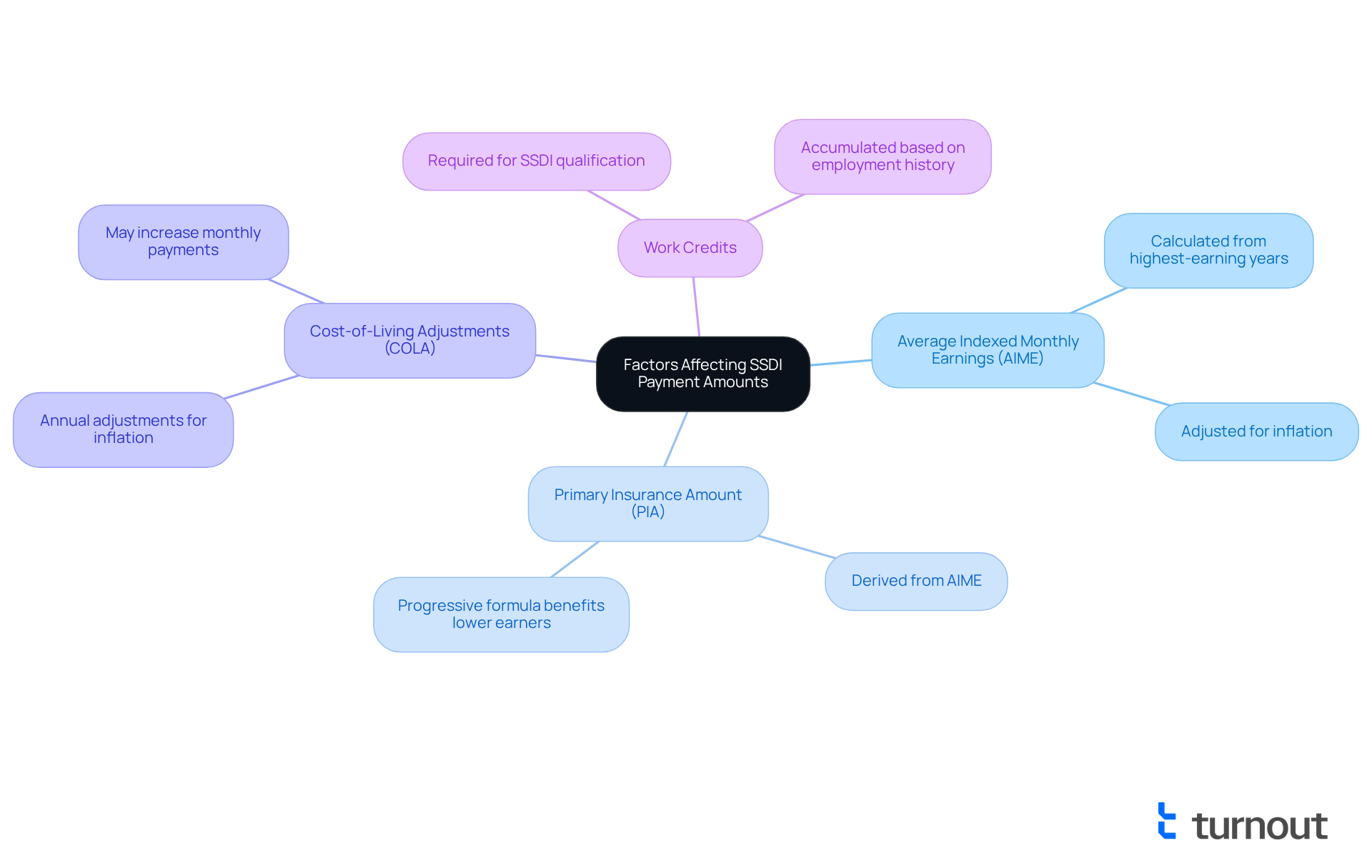

Identify Factors Affecting SSDI Payment Amounts

Several factors influence how much would I get on SSDI, and understanding them can feel overwhelming. Let's explore these together:

-

Average Indexed Monthly Earnings (AIME): This figure is calculated based on your highest-earning years—typically the 35 years when you earned the most. The SSA adjusts these earnings for inflation, ensuring they reflect current economic conditions.

-

Primary Insurance Amount (PIA): Derived from your AIME, the PIA serves as the foundation for your monthly payment. The formula used to determine PIA is progressive, offering a greater percentage of benefits to those who earn less.

-

Cost-of-Living Adjustments (COLA): Each year, disability payments are modified to account for inflation, which may increase your monthly amount, providing some peace of mind.

-

Work Credits: To qualify for Social Security Disability Insurance, you need a specific number of work credits, which you accumulate based on your employment history.

We understand that navigating these elements can be challenging. However, comprehending them will empower you to assess how much you would get on SSDI as well as how it may evolve over time. Remember, you are not alone in this journey; we’re here to help you every step of the way.

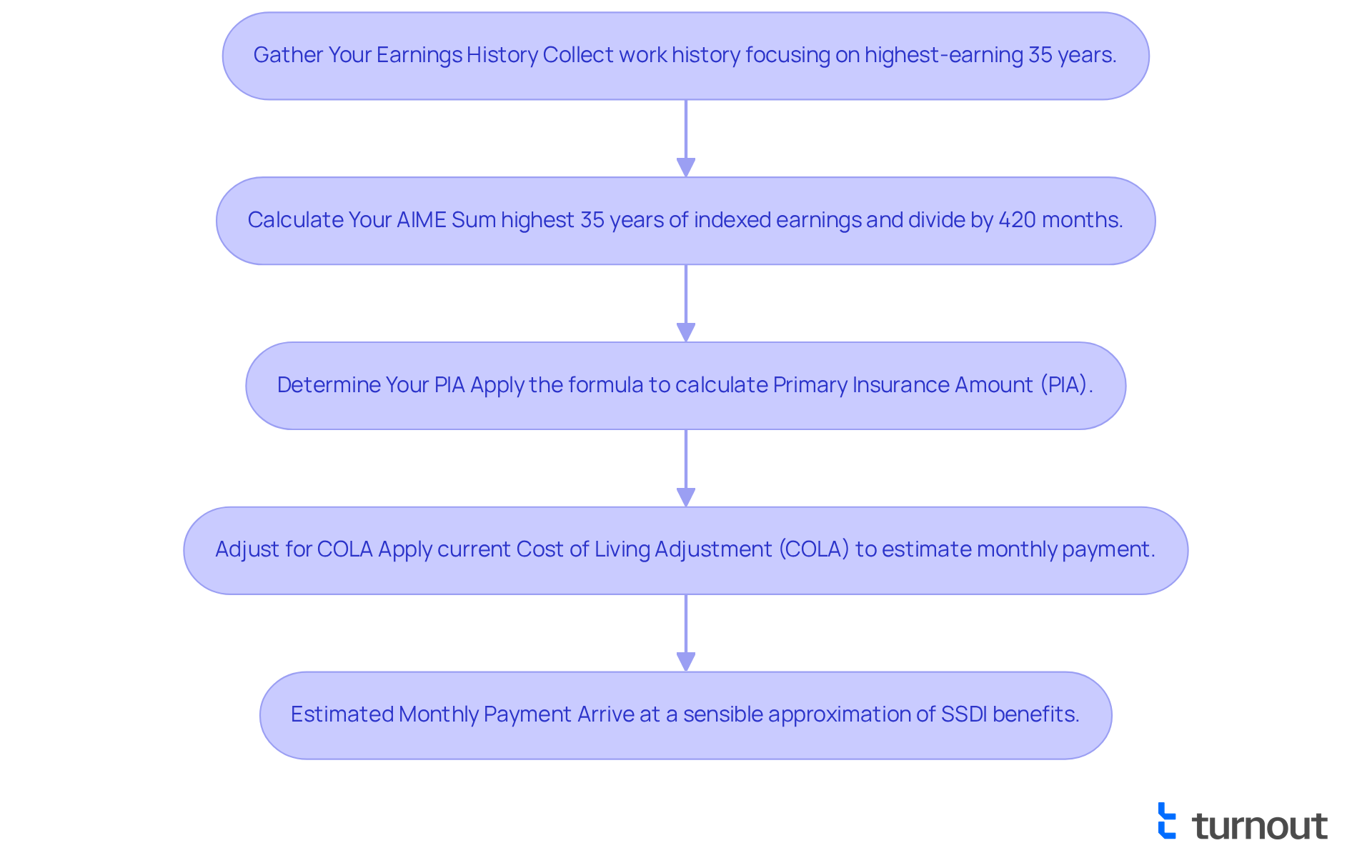

Calculate Your SSDI Benefits Step-by-Step

Calculating how much would I get on SSDI benefits can feel overwhelming, but we're here to help you navigate this process with care. Follow these steps to gain clarity:

-

Gather Your Earnings History: Start by collecting your work history, focusing on your highest-earning 35 years. You can find this information on your Social Security statement or through the SSA website.

-

Calculate Your AIME:

- Sum your highest 35 years of indexed earnings.

- Divide this total by 420 months (the number of months in those years).

- This will give you your Average Indexed Monthly Income.

-

Determine Your PIA: Use the following formula:

- 90% of the first $1,174 of your AIME

- 32% of the AIME over $1,174 and up to $7,078

- 15% of the AIME over $7,078

- Add these amounts together to find your Primary Insurance Amount (PIA).

-

Adjust for COLA: If applicable, apply the current Cost of Living Adjustment (COLA) to your PIA to estimate your monthly payment. In 2024, disability benefit recipients will see a 3.2% rise in payments due to COLA adjustments.

By following these steps, you can arrive at a sensible approximation of how much you would get on SSDI. Remember, having an accurate earnings history is crucial, as it directly influences your benefit calculation. Individuals often wonder how much would I get on SSDI, as those with extended employment records and greater lifetime incomes generally receive larger disability payments, averaging between $1,300 and $1,600 monthly. As Allsup mentions, "Understanding how your disability payment amount is determined can provide reassurance as you prepare for the future." Grasping this process can empower you to navigate the intricacies of disability benefits effectively. If you need further assistance, please consider reaching out to Turnout or a qualified disability attorney. You are not alone in this journey.

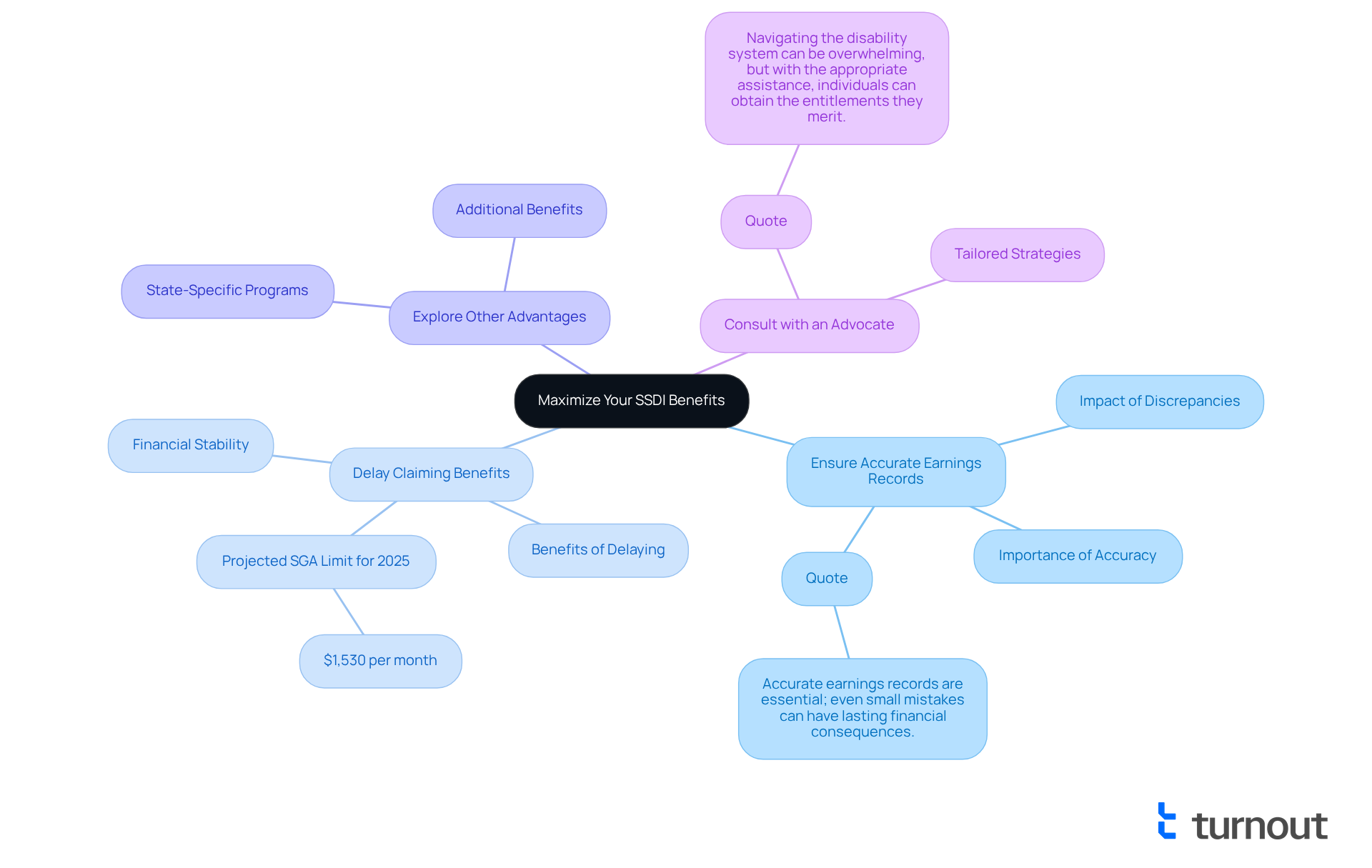

Maximize Your SSDI Benefits

To maximize your SSDI benefits, consider these compassionate strategies:

-

Ensure Accurate Earnings Records: We understand that navigating Social Security can be daunting. Regularly reviewing your Social Security statement for accuracy is vital. Discrepancies can significantly influence your Average Indexed Monthly Earnings (AIME), impacting your payment amounts. Precise documentation is essential, as even small mistakes can lead to decreased advantages. As disability advocates remind us, "Accurate earnings records are essential; even small mistakes can have lasting financial consequences."

-

Delay Claiming Benefits: If possible, consider postponing your SSDI claim until you reach full retirement age. We know that this can be challenging, but delaying can lead to greater monthly advantages, providing enhanced financial assistance over time. For instance, individuals who postpone their claims may observe significant increases in their benefits, which can greatly improve their overall financial stability. In 2025, the anticipated Substantial Gainful Activity (SGA) limit for non-blind individuals is $1,530 per month, allowing for increased earnings potential while receiving assistance.

-

Explore Other Advantages: It's common to feel overwhelmed, but investigating eligibility for additional benefits, such as Supplemental Security Income (SSI) or state-specific programs, can be beneficial. These options can enhance your disability benefits and provide additional financial support, ensuring you have a comprehensive support system in place.

-

Consult with an Advocate: Engaging with a disability assistance advocate can provide you with tailored strategies specific to your situation. We recognize that navigating the intricacies of the disability support system can be complex. Advocates can help you make informed choices that optimize your advantages. As one supporter shared, "Navigating the disability system can be overwhelming, but with the appropriate assistance, individuals can obtain the entitlements they merit."

By implementing these strategies, you can determine how much would I get on SSDI, which can make a significant difference in your quality of life. Remember, accurate earnings records and timely claims are essential components in securing the benefits you deserve. Additionally, many beneficiaries will receive a one-time retroactive payment by the end of March 2025, which can further assist in your financial planning. You're not alone in this journey; we're here to help you every step of the way.

Conclusion

Understanding how much one can receive from Social Security Disability Insurance (SSDI) is essential for individuals navigating the complexities of disability benefits. It’s common to feel overwhelmed by the process, but you are not alone. This article has outlined the foundational aspects of SSDI, emphasizing the importance of eligibility, the calculation of benefits, and strategies to maximize those benefits. By grasping these concepts, individuals can better prepare themselves for the financial support they may need.

Key points discussed include the eligibility requirements for SSDI, which hinge on work history and medical conditions. We understand that these factors can be daunting. Additionally, payment amounts are influenced by Average Indexed Monthly Earnings (AIME) and Cost-of-Living Adjustments (COLA). The step-by-step guide provided empowers readers to calculate their potential benefits accurately. Remember, maintaining precise earnings records and considering the timing of claims can significantly optimize your financial support.

Ultimately, the journey through the SSDI process can feel daunting, but individuals are not alone. By leveraging the insights and strategies shared in this article, those seeking assistance can take proactive steps toward securing the benefits they deserve. Engaging with advocates and exploring additional support options can further enhance your financial stability. The importance of understanding and navigating SSDI cannot be overstated, as it plays a crucial role in ensuring a safety net for countless individuals facing disabilities. We’re here to help you through this journey.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a national program that provides financial assistance to individuals who are unable to work due to a disability.

How many Americans are supported by SSDI?

In 2025, SSDI supports over 5 million Americans seeking disability benefits.

What are the key eligibility requirements for SSDI?

To qualify for SSDI, applicants must have a sufficient work history in jobs covered by Social Security and a medical condition that severely limits their ability to perform work-related tasks.

What defines a medical condition under SSDI?

The medical condition must align with the Social Security Administration's (SSA) definition of disability, which typically requires that the condition is expected to last at least one year or result in death.

What challenges do applicants face when applying for SSDI?

Applicants often encounter lengthy wait times, the need for comprehensive medical documentation, and the possibility of appeals after initial denials.

How can advocacy organizations assist with the SSDI application process?

Advocacy organizations, like Turnout, provide tailored support and guidance to help individuals navigate bureaucratic obstacles and improve their chances of securing assistance effectively.

What is the role of disability awareness quotes in the context of SSDI?

Disability awareness quotes highlight the challenges faced by disabled individuals in the professional world and advocate for equity and equality in the workplace and society.

How can I find out how much I would get on SSDI?

Understanding the basics of SSDI and seeking assistance can help you determine the benefits you deserve, as resources are available to support you in this process.