Overview

We understand that navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming. The amount you receive is primarily determined by your Average Indexed Monthly Earnings (AIME) and your Primary Insurance Amount (PIA). These figures reflect your earnings history and contributions to the Social Security system.

It's important to know that various factors also play significant roles in calculating your benefits:

- Cost-of-living adjustments

- Family maximum assistance

These are just a couple of elements that can impact the support you receive. By understanding these factors, you can better plan for your financial future.

Remember, you are not alone in this journey. We are here to help you navigate these challenges and ensure you have the information you need to make informed decisions about your benefits.

Introduction

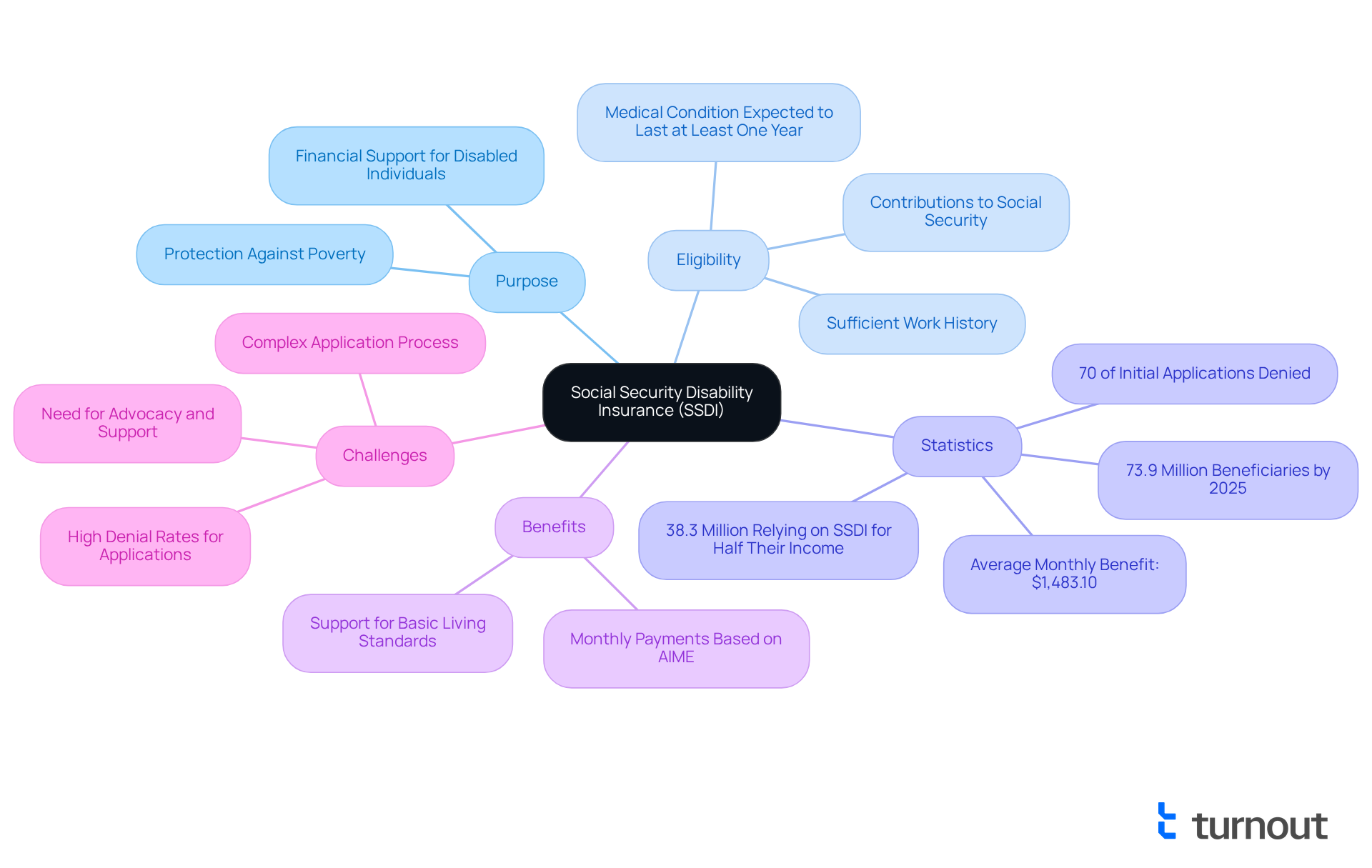

Social Security Disability Insurance (SSDI) is a vital financial lifeline for millions of Americans facing long-term medical conditions that make it difficult to work. As we look ahead, projections suggest that approximately 73.9 million individuals will depend on Social Security programs by 2025. Understanding the intricacies of SSDI payments is crucial for those seeking support during these challenging times.

We understand that the journey can be overwhelming, especially when nearly 70% of applicants experience initial denials. It’s common to feel discouraged, but there is hope. By learning how to navigate the complexities of SSDI calculations, you can take important steps toward receiving the benefits you deserve. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Overview of Social Security Disability Insurance (SSDI)

Social Security Disability Insurance is a vital national program designed to provide financial support to those unable to work due to a medical condition that is expected to last at least one year or result in death. If you are seeking disability benefits, it’s important to know that you must demonstrate a sufficient work history and have contributed to Social Security through payroll taxes. This program is especially crucial for individuals who have invested in the system during their working years, ensuring they receive the support they need during challenging health issues.

As we look to 2025, approximately 73.9 million Americans will be receiving assistance from Social Security programs, with Disability Insurance being a key component of their financial stability. The benefits you receive, which determine how much SSDI do I get, are based on your average indexed monthly earnings (AIME) throughout your working life, reflecting your contributions to the Social Security system. In 2025, the average monthly disability benefit is expected to be around $1,483.10, prompting many to ask how much SSDI do I get to help individuals maintain a basic standard of living.

Recent changes to the eligibility criteria for disability benefits aim to enhance access for those in need. Advocates emphasize the significance of Social Security Disability Insurance, highlighting its role as a lifeline for many disabled individuals. For example, a survey found that 38.3 million people relied on Social Security assistance for at least half of their total personal income in 2022. This statistic illustrates the program's critical role in preventing poverty among its recipients.

As the work environment evolves, particularly with the rise of the gig economy, the demand for disability benefits remains essential. It ensures that those who have contributed to the workforce can receive the support they deserve during tough times. However, it’s important to recognize that nearly 70% of initial disability applications are denied, which can be disheartening for many applicants. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Key Factors Affecting SSDI Payment Amounts

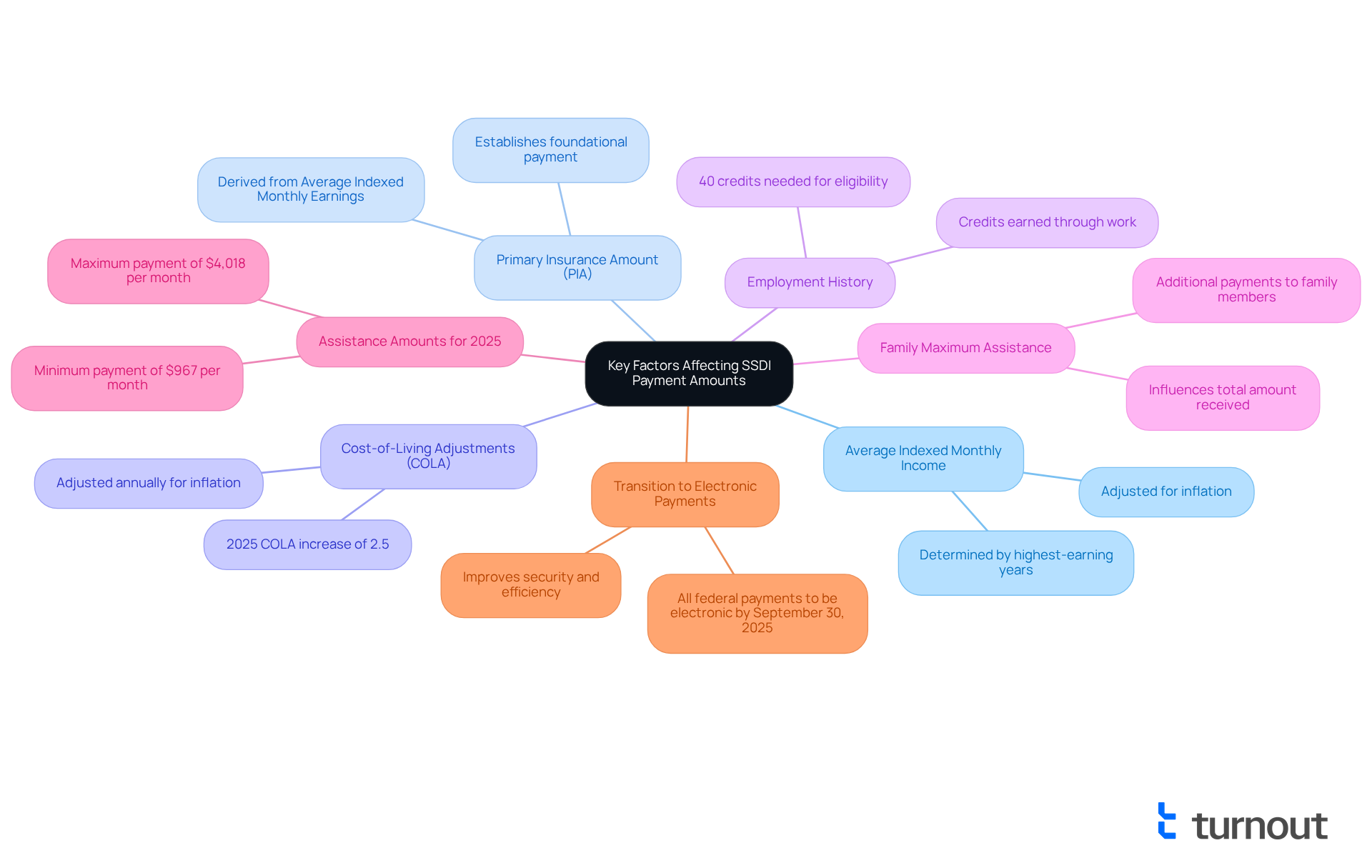

Several key factors influence the amount of SSDI benefits you may receive, and understanding them can empower you on your journey:

-

Average Indexed Monthly Income: This figure is determined by your highest-earning years, adjusted for inflation. If you had substantial income during your top 35 years of work, those amounts would reflect current wage standards, helping to calculate your average indexed monthly earnings.

-

Primary Insurance Amount (PIA): The PIA is derived from your Average Indexed Monthly Earnings and establishes the foundational payment you will receive. Understanding how AIME translates into PIA is essential for determining how much SSDI do I get in potential benefits.

-

Cost-of-Living Adjustments (COLA): Your disability payments are adjusted each year to account for inflation. For example, in 2025, the COLA will increase by 2.5%, benefiting around 68 million recipients and aiding them in managing rising living costs.

-

Employment History: The number of credits earned through work directly affects your eligibility and benefit levels. Typically, you need 40 credits, with at least 20 earned in the last 10 years before becoming disabled. This work history is crucial for qualifying for assistance.

-

Family Maximum Assistance: Social Security Disability Insurance allows additional payments to family members, which can influence the total amount you receive. For instance, if your PIA is $2,000, your relatives may receive a portion, helping families maximize their benefits together.

-

Assistance Amounts for 2025: In 2025, the minimum disability support payment will be $967 per month, while the maximum will reach $4,018 per month. Knowing how much SSDI do I get can help you assess the potential benefits you might receive.

-

Transition to Electronic Payments: Starting September 30, 2025, all federal payments, including disability support, will be made electronically. This change aims to improve security and efficiency in the payment process.

By understanding these factors, you can navigate the complexities of Social Security Disability Insurance with greater confidence. Remember, you are not alone in this journey, and we’re here to help you make informed decisions about your benefits.

Calculating Your SSDI Payments: A Step-by-Step Guide

Calculating how much SSDI do I get can feel overwhelming, but we're here to guide you through the process step by step. Understanding these calculations is essential for your financial planning, especially as you navigate this journey.

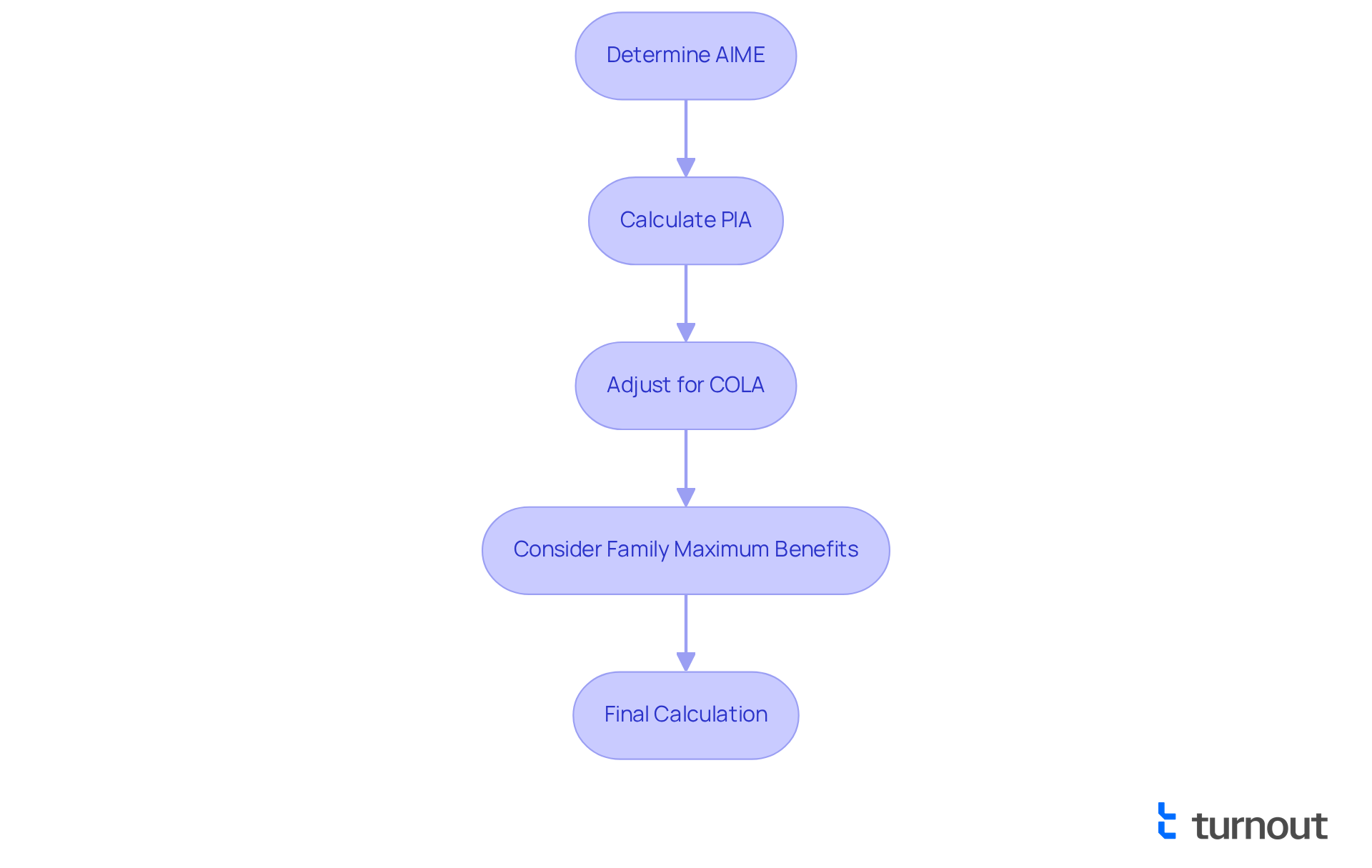

1. Determine Your Average Indexed Monthly Earnings (AIME):

- Start by gathering your earnings records for the years you worked. This is the foundation of your calculation.

- Next, adjust your earnings for inflation using the Social Security Administration's (SSA) indexing factors. This ensures your figures reflect current values.

- Finally, determine your AIME by averaging your top 35 years of indexed earnings and dividing by 420, the number of months in 35 years. This gives you a clearer picture of your monthly earnings.

2. Calculate Your Primary Insurance Amount (PIA):

- The formula based on your AIME is as follows:

- Take 90% of the first $1,226 of your AIME.

- Then, calculate 32% of the AIME between $1,226 and $7,391.

- Lastly, apply 15% to the AIME over $7,391.

- By summing these amounts, you'll find your PIA, which is crucial for understanding your benefits.

3. Adjust for Cost-of-Living Adjustments (COLA):

- It's common to wonder about increases in benefits. Check the SSA's annual COLA announcement to see if your benefits will rise. For 2025, the COLA is set at 2.5%, which will enhance your monthly payments.

- Apply this COLA percentage to your PIA to determine your adjusted payment amount, ensuring you stay informed about your financial situation.

4. Consider Family Maximum Benefits:

- If you have family members who may qualify, calculate any additional benefits based on the family maximum benefit provision. This can provide further support during challenging times.

5. Final Calculation:

- To finalize your benefit amount, round to the nearest $0.10. This simple step will help you determine your monthly SSDI payment.

It's important to grasp these computations, particularly when considering how much SSDI do I get, since the average monthly disability payment for 2025 is anticipated to be around $1,580. This figure illustrates the adjustments made for inflation and cost-of-living increases. Moreover, the highest potential support for new applicants in 2025 raises the question of how much SSDI do I get, which is approximately $3,822 each month. Staying informed about these elements is crucial, particularly as the Trust Fund may face depletion by 2035, potentially impacting future assistance.

Additionally, the expected rise in the Substantial Gainful Activity (SGA) threshold for 2025 will allow recipients to earn more while still receiving support. Remember, you are not alone in this journey; staying knowledgeable about these factors can significantly influence your financial planning and overall advantages.

Maximizing Your SSDI Benefits: Tips and Common Mistakes

To maximize how much SSDI do I get, it's important to consider a few key tips and be mindful of common pitfalls. We understand that navigating this process can be overwhelming, but you’re not alone in this journey.

-

File Early: Apply for SSDI as soon as you become disabled. Delays can lead to missed advantages, and we want to help you avoid that.

-

Keep Precise Records: Maintaining detailed documentation of your medical conditions, treatments, and employment history can significantly support your application. It's essential to have everything in order.

-

Understand Work Incentives: Familiarize yourself with how much SSDI do I get, as it will help you assess your capacity to work without forfeiting benefits. Knowing your options can empower you.

-

Avoid Common Mistakes:

- Incomplete Applications: Make sure all sections of your application are filled out completely. Every detail matters.

- Missing Deadlines: Respond promptly to any requests from the SSA to avoid delays. Staying on top of timelines can make a difference.

- Ignoring Appeals: If your claim is denied, don’t hesitate to appeal the decision; many initial claims face denial, but persistence is key.

-

Consult with an Advocate: Consider working with a disability benefits advocate. They can help you navigate the complexities of the application process and maximize your chances of approval. Remember, we're here to help you every step of the way.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for anyone navigating the complexities of disability benefits. We recognize that this program serves as a crucial financial support system for individuals unable to work due to long-term medical conditions. It ensures that those who have contributed to Social Security can receive necessary assistance during challenging times.

Throughout this article, we've explored key factors influencing SSDI payments, including:

- Average Indexed Monthly Earnings (AIME)

- Primary Insurance Amount (PIA)

- The impact of cost-of-living adjustments

We also highlighted the importance of a solid work history and understanding family maximum benefits, which play a significant role in determining the amount of assistance one may receive. Additionally, we provided practical steps for calculating SSDI benefits and strategies for maximizing support, along with common pitfalls to avoid during the application process.

The significance of SSDI cannot be overstated. It acts as a lifeline for millions of Americans. By staying informed and proactive, you can navigate the application process more effectively and secure the benefits you deserve. It's common to feel overwhelmed, but we encourage you to approach this journey with knowledge and support. Remember, you are not alone in this journey. Together, we can ensure that the financial stability provided by SSDI remains a reliable resource in the face of adversity.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance is a national program that provides financial support to individuals unable to work due to a medical condition expected to last at least one year or result in death.

What are the eligibility requirements for SSDI?

To qualify for SSDI, you must demonstrate a sufficient work history and have contributed to Social Security through payroll taxes.

How does SSDI benefit those who have contributed to the system?

SSDI is crucial for individuals who have invested in the system during their working years, ensuring they receive financial support during challenging health issues.

How many Americans are expected to receive assistance from Social Security programs by 2025?

Approximately 73.9 million Americans are projected to receive assistance from Social Security programs by 2025.

How are SSDI benefits determined?

SSDI benefits are based on your average indexed monthly earnings (AIME) throughout your working life, reflecting your contributions to the Social Security system.

What is the expected average monthly disability benefit in 2025?

The average monthly disability benefit is expected to be around $1,483.10 in 2025.

Why is SSDI considered a lifeline for many individuals?

SSDI is seen as a lifeline because it plays a critical role in preventing poverty among recipients, with many relying on it for a significant portion of their income.

What percentage of initial disability applications are denied?

Nearly 70% of initial disability applications are denied.

How does the rise of the gig economy impact the demand for SSDI?

The evolving work environment, particularly with the rise of the gig economy, increases the demand for disability benefits, ensuring that those who have contributed to the workforce receive necessary support during tough times.