Overview

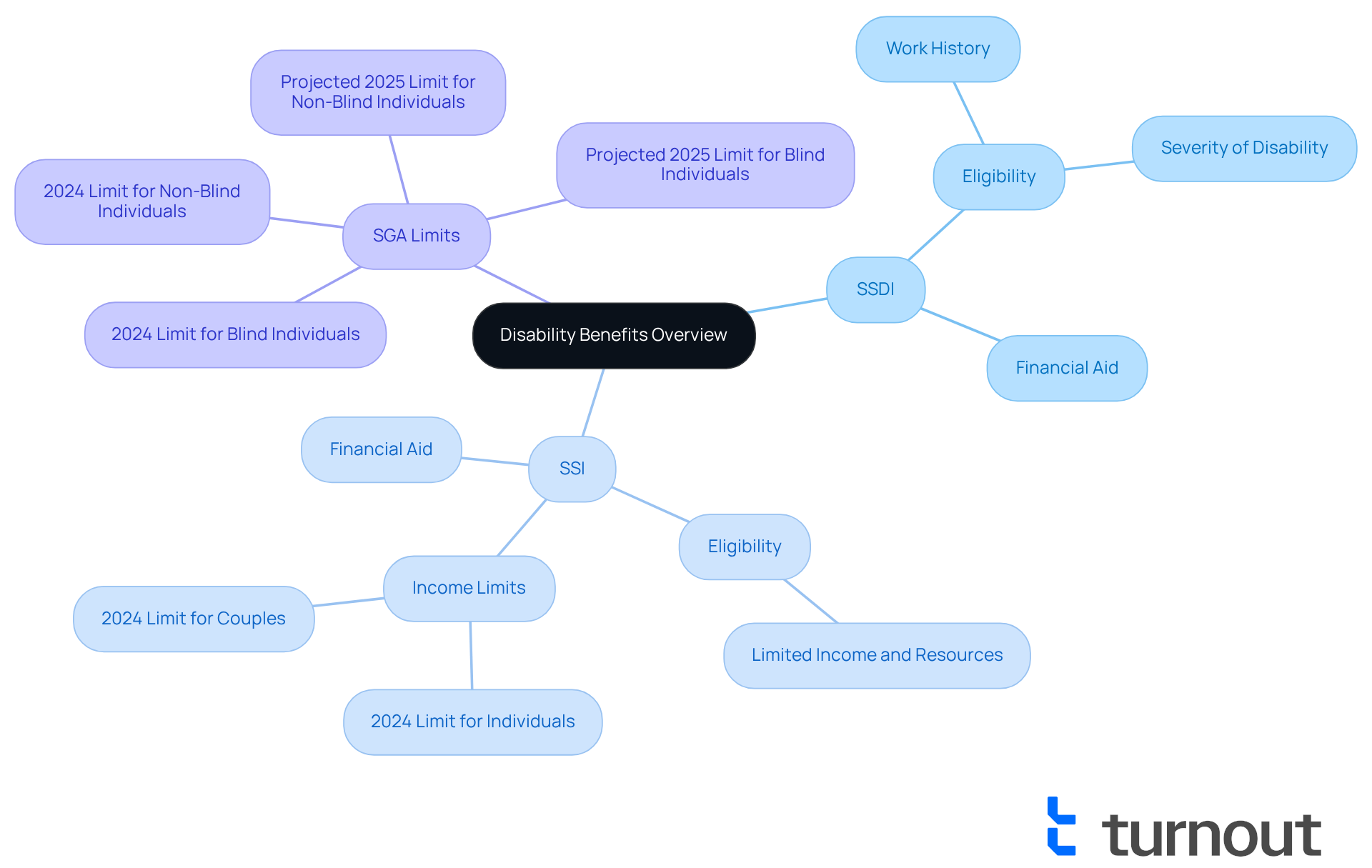

Navigating the world of disability benefits can be overwhelming, and we understand that you may have many questions. The amount of financial support you can receive varies based on several factors, including your work history, the type of disability program you qualify for—whether it's SSDI or SSI—and adjustments for cost-of-living.

For instance, SSDI payments are projected to average around $1,537 per month in 2025, while SSI offers a maximum of $967 monthly for individuals. It's essential to grasp the nuances of eligibility and documentation to ensure you secure the financial support you deserve.

Remember, you are not alone in this journey. We’re here to help you understand your options and navigate the process. By taking the time to gather the necessary information, you can find the assistance that best meets your needs.

Introduction

Understanding the financial landscape of disability benefits is essential for individuals facing health challenges that hinder their ability to work. We recognize that navigating this system can feel overwhelming. These benefits not only provide crucial support but also pave the way for a more stable and manageable life during difficult times. It's common to feel uncertain about eligibility, documentation, and benefit calculations.

How can you navigate this intricate system to ensure you receive the financial assistance you deserve? We're here to help you through this journey.

Understand Disability Benefits and Their Importance

Disability support serves as essential financial aid for individuals unable to work due to health issues, helping to determine how much money can you get from disability. Understanding how much money can you get from disability is crucial, as it can significantly alleviate financial pressures, allowing individuals to focus on their health and recovery.

Social Security Disability Insurance (SSDI) is designed for those with a work history who have contributed to Social Security taxes. Eligibility is based on both work history and the severity of the disability. On the other hand, Supplemental Security Income (SSI) offers monetary assistance to individuals with limited income and resources, regardless of their employment background.

We understand that navigating these options can be overwhelming. That’s where Turnout comes in. They play a vital role in simplifying access to these government benefits by providing various tools and services. With the help of trained nonlawyer advocates, Turnout assists clients in understanding their options and the application process, ensuring they can secure the financial assistance they need.

Recent changes to the Substantial Gainful Activity (SGA) limits, which dictate how much individuals can earn while still qualifying for benefits, promise greater flexibility for applicants. In 2025, the SGA limit for non-blind individuals is expected to rise to $1,530 per month, while for blind individuals, it will increase to $2,550. These adjustments reflect ongoing efforts to help disabled individuals achieve financial stability while exploring employment opportunities.

Real-world examples illustrate the transformative impact of these benefits. Many individuals have shared that understanding how much money can you get from disability benefits or supplemental income has empowered them to manage living costs, access essential medical services, and improve their overall quality of life. By understanding the differences between SSDI and SSI, you can better navigate the application process and secure the support you deserve.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Identify Eligibility Requirements for Disability Benefits

Navigating the process of qualifying for disability benefits can be overwhelming. We understand that many applicants face significant challenges, and it’s essential to know the specific eligibility criteria that can help you on this journey.

-

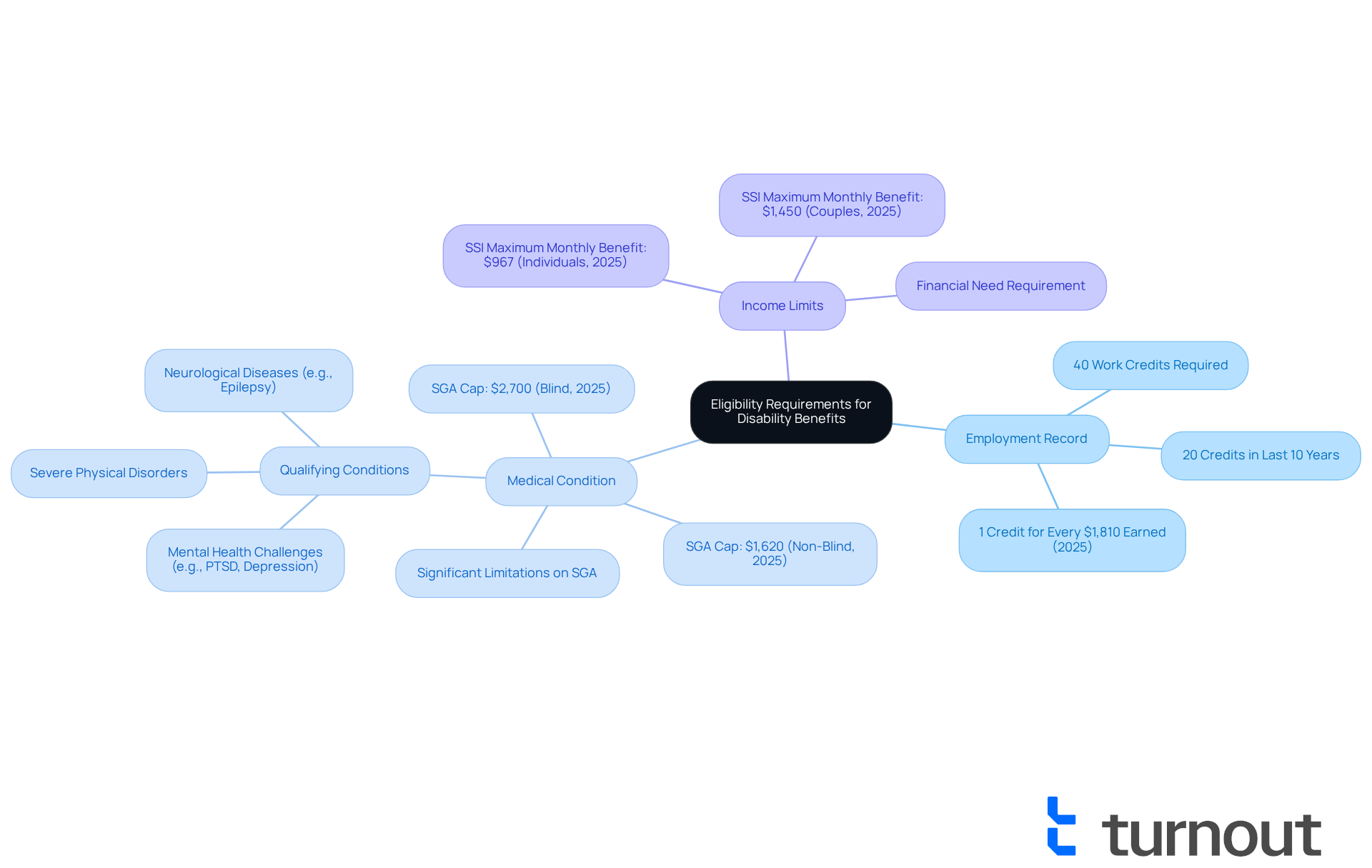

Employment Record: To qualify for disability benefits, it’s generally required to have accumulated a minimum of 40 work credits, with at least 20 of those earned in the last 10 years. In 2025, one credit is earned for every $1,810 in wages or self-employment income. Tracking your earnings over time is crucial.

-

Medical Condition: Your disability must significantly limit your ability to engage in substantial gainful activity (SGA). Starting in 2025, the SGA cap is set at $1,620 monthly for non-blind individuals and $2,700 for those who are blind. Qualifying conditions for SSDI include severe physical disorders, mental health challenges like PTSD and depression, and neurological diseases such as epilepsy.

-

Income Limits: If you are applying for SSI, it’s important to demonstrate limited income and resources. The maximum monthly benefit for SSI in 2025 is $967 for individuals and $1,450 for couples. This program is designed to assist those in financial need, so understanding your financial situation in relation to these limits is essential.

Understanding these requirements is vital to determining how much money can you get from disability and ensuring that you don’t waste time on applications you may not qualify for. It’s common to feel discouraged, as many people encounter difficulties in managing the application process, with around two-thirds of initial disability benefit applications being rejected.

Remember, you are not alone in this journey. Turnout is not a law firm and does not provide legal advice; instead, we utilize trained nonlawyer advocates to help clients gather comprehensive medical evidence and verify work credits—both vital steps in improving your chances of approval. If your application is denied, it’s important to request a reconsideration within 60 days and prepare additional medical evidence to enhance your chances of success. We're here to help you every step of the way.

Gather Necessary Documentation for Your Application

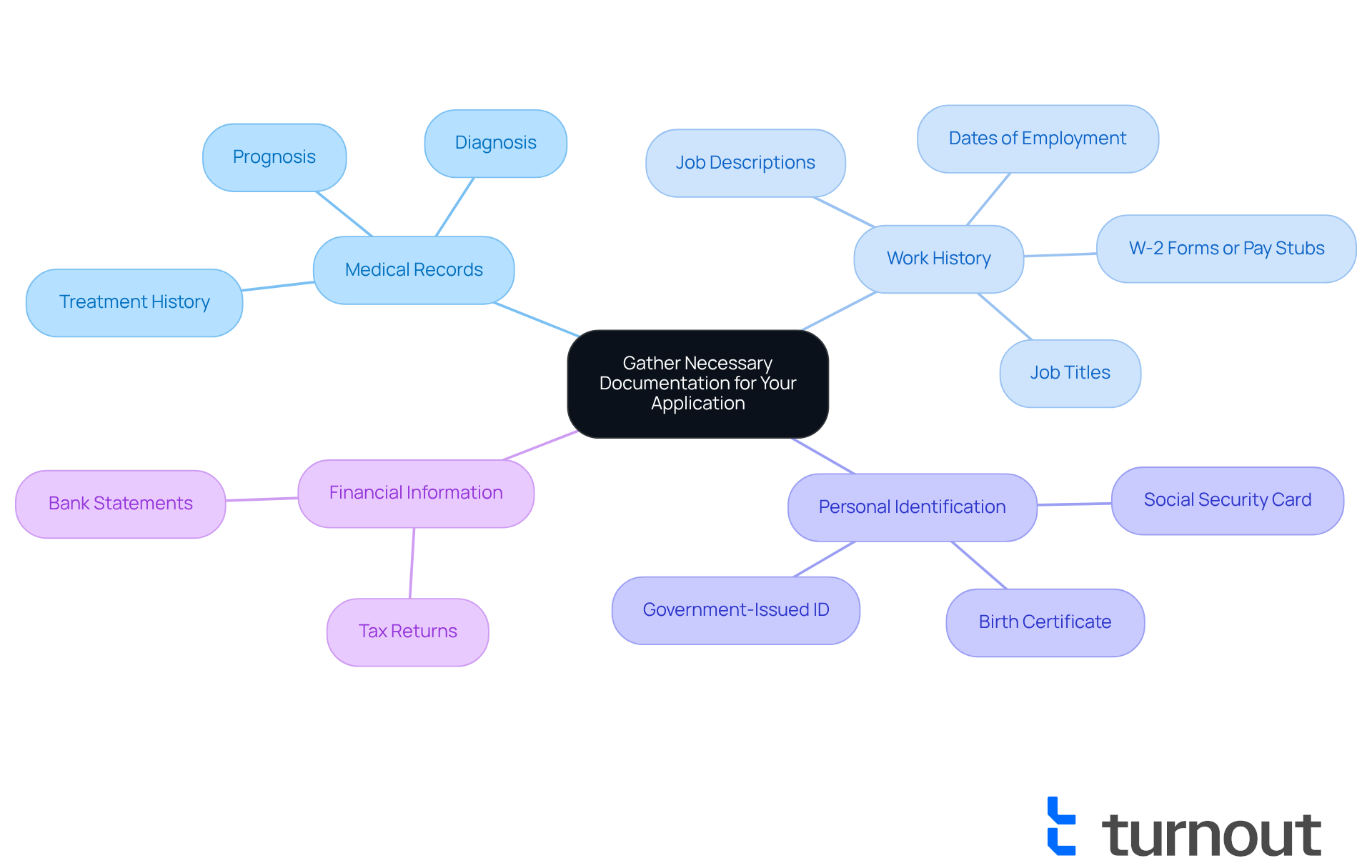

Applying for disability benefits can be a challenging journey, and gathering the right documentation is crucial for a successful outcome. We understand that this process can feel overwhelming, but having the right documents can make a significant difference. Here are the key documents you should prepare:

-

Medical Records: It's essential to obtain detailed medical documentation from your healthcare providers that outlines your diagnosis, treatment history, and prognosis. This evidence is vital, as proper medical records significantly improve your chances of approval for Social Security Disability Insurance (SSDI) claims.

-

Work History: Compile information about your past employment, including job titles, dates of employment, and descriptions of job duties. Relevant documents may include W-2 forms or pay stubs, which help establish your work history and eligibility.

-

Personal Identification: Providing proof of identity is necessary to verify who you are during the application process. This can include a Social Security card, birth certificate, or government-issued ID.

-

Financial Information: If you are applying for Supplemental Security Income (SSI), be sure to include documentation of income and resources, such as bank statements and tax returns. This information is essential to demonstrate your financial need.

Having these documents organized and ready can streamline the application process and significantly increase your chances of approval. As highlighted by professionals in the field, thorough documentation not only supports your eligibility but also expedites the decision-making process. For instance, a client who had been out of work for nearly a decade successfully proved her disability by combining old medical records with current documentation. This showcases the importance of comprehensive evidence.

By effectively communicating with your healthcare providers and ensuring they are prepared to release necessary records, you can alleviate some of the burdens associated with gathering evidence for your claims. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Calculate Your Potential Disability Benefit Amount

Calculating how much money you can get from disability benefits can feel overwhelming, but we're here to guide you through the process. Follow these steps to better understand your benefits:

-

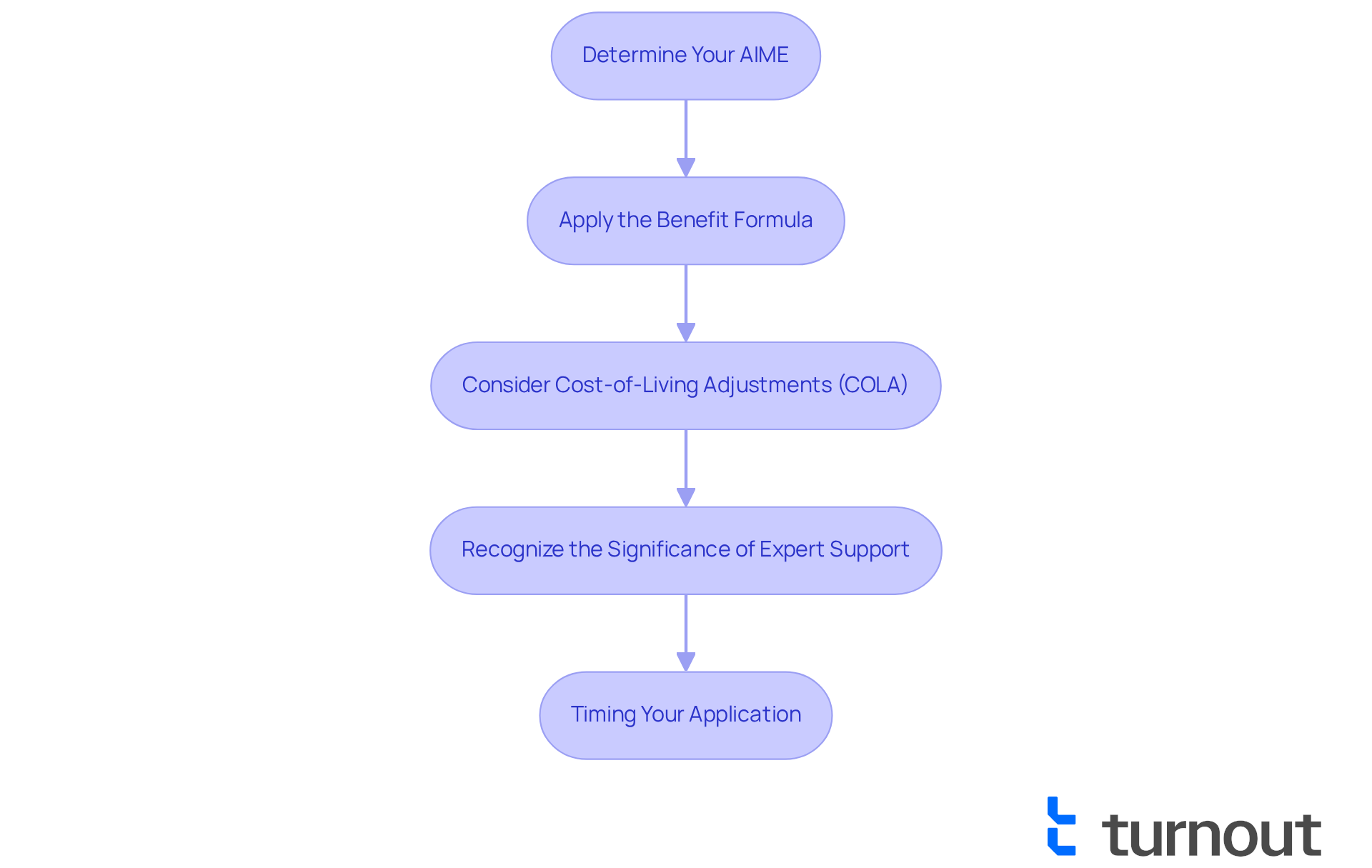

Determine Your Average Indexed Monthly Earnings (AIME): This important figure is based on your highest-earning years—typically the 35 years when you earned the most. The Social Security Administration (SSA) adjusts these earnings for inflation using a specific formula, ensuring your benefits reflect your contributions.

-

Apply the Benefit Formula: Your AIME is used by the SSA to compute your Primary Insurance Amount (PIA), which serves as the foundation for your monthly payment. In 2025, how much money can you get from disability as the highest payment is approximately $4,018 each month, showing a rise from previous years.

-

Consider Cost-of-Living Adjustments (COLA): Each year, benefits are adjusted to keep pace with inflation. For 2025, the COLA is set at 2.5%, which can influence your final payment amount.

-

Recognize the Significance of Expert Support: It's common for initial disability claims to be rejected, which is why seeking help can be invaluable. Turnout offers trained nonlawyer advocates who can assist you in navigating the complexities of SSD claims without requiring legal representation.

-

Timing Your Application: Remember, applying promptly after your disability onset is crucial to ensure you receive all eligible payments.

Using online calculators provided by the SSA or other reliable sources can enhance the accuracy of your estimates. Understanding these calculations is essential for effective budgeting and financial planning. In 2025, the average SSDI payment is around $1,537 per month, which raises the question of how much money can you get from disability, with many recipients receiving between $1,200 and $1,800 monthly. By grasping how AIME and PIA work, along with Turnout's expert guidance, you can navigate the complexities of disability benefits more effectively. Remember, you are not alone in this journey, and we are here to help you secure the support you deserve.

Conclusion

Understanding the intricacies of disability benefits is essential for individuals facing health challenges that impede their ability to work. We recognize that navigating this landscape can be overwhelming. The financial support provided through programs like SSDI and SSI can significantly ease the burden of medical expenses and everyday living costs. By grasping the eligibility criteria and the application process, you can find your way to securing the assistance you need.

Throughout this article, we discussed key points, including:

- The differences between SSDI and SSI

- The importance of gathering the necessary documentation

- The steps to calculate potential benefit amounts

Real-world examples highlight the transformative impact that these benefits can have. They empower individuals to manage their finances and improve their quality of life. Additionally, the role of organizations like Turnout is emphasized, showcasing how expert support can enhance your chances of successfully obtaining benefits.

Ultimately, the significance of understanding disability benefits cannot be overstated. By taking proactive steps to educate yourself about eligibility, documentation, and calculation methods, you can better position yourself to receive the assistance you deserve. We understand that the journey may be challenging, but with the right resources and support, it's possible to achieve financial stability and focus on your recovery. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What are disability benefits and why are they important?

Disability benefits provide essential financial aid for individuals unable to work due to health issues, helping to alleviate financial pressures and allowing them to focus on their health and recovery.

What is Social Security Disability Insurance (SSDI)?

SSDI is a program designed for individuals with a work history who have contributed to Social Security taxes. Eligibility is based on both work history and the severity of the disability.

What is Supplemental Security Income (SSI)?

SSI offers monetary assistance to individuals with limited income and resources, regardless of their employment background.

How can Turnout assist individuals in navigating disability benefits?

Turnout simplifies access to government benefits by providing tools and services, along with trained nonlawyer advocates who help clients understand their options and the application process.

What are the Substantial Gainful Activity (SGA) limits and how do they affect benefits?

SGA limits dictate how much individuals can earn while still qualifying for benefits. In 2025, the SGA limit for non-blind individuals is expected to rise to $1,530 per month, and for blind individuals, it will increase to $2,550, providing greater flexibility for applicants.

How do disability benefits impact individuals' lives?

Many individuals report that understanding their disability benefits has empowered them to manage living costs, access essential medical services, and improve their overall quality of life.

Why is it important to understand the differences between SSDI and SSI?

Understanding the differences between SSDI and SSI can help individuals better navigate the application process and secure the financial support they deserve.