Overview

Navigating the world of Social Security Disability benefits can feel overwhelming. We understand that many individuals are seeking clarity on how these benefits are calculated, and we're here to help. This article outlines the necessary steps and components involved in determining your payment amounts, offering a supportive guide through the process.

Benefits are calculated using Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA). By gathering your earnings records and applying specific formulas, you can estimate your potential monthly payments. It's common to feel uncertain about what to expect, but knowing that your payments could range from $967 to $4,018 for 2025 can provide some reassurance.

Remember, you are not alone in this journey. We encourage you to take these steps with confidence, knowing that support is available to help you through the process.

Introduction

Understanding Social Security Disability Insurance (SSDI) is a vital step for those grappling with the challenges brought on by life-altering medical conditions. We recognize that this financial lifeline can provide essential support for individuals unable to work, yet the intricacies of eligibility and benefit calculations can often feel overwhelming.

It's common to feel uncertain about how to determine potential benefits or navigate the application process effectively. This article serves as a comprehensive guide to calculating SSDI payments and understanding the necessary steps to secure the financial assistance you rightfully deserve.

You're not alone in this journey; we're here to help.

Understand Social Security Disability Benefits

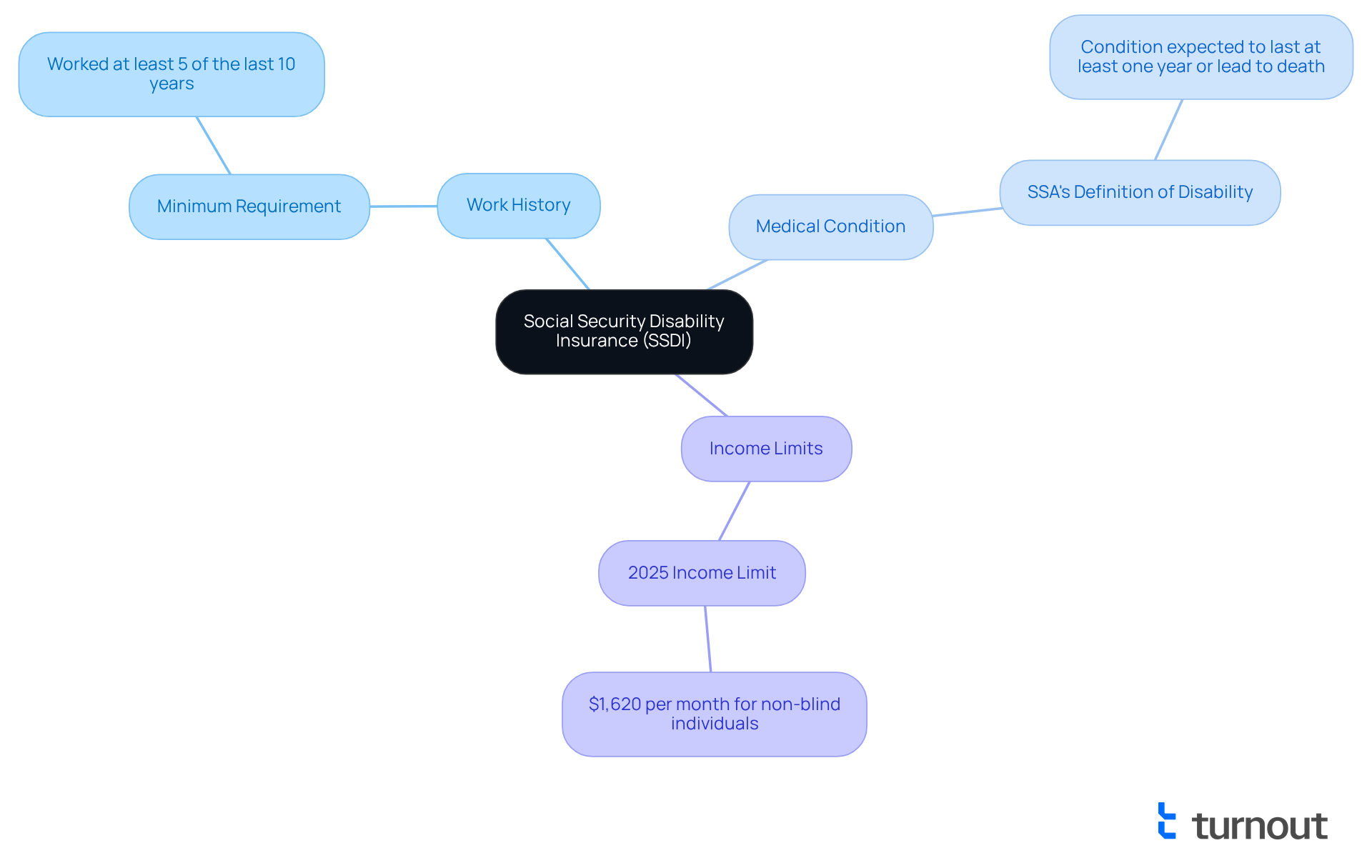

Social Security Disability Insurance (SSDI) offers vital financial assistance to those who find themselves unable to work due to a medical condition that is expected to last at least one year or may lead to death. We understand that navigating this process can be overwhelming. To qualify for SSDI, applicants must have worked in jobs covered by Social Security and possess a sufficient work history. The Social Security Administration (SSA) carefully evaluates applications based on medical evidence and the applicant's ability to engage in any substantial gainful activity.

It's also important to recognize the distinction between SSDI and Supplemental Security Income (SSI). While SSDI requires a work history, SSI is need-based and does not. Familiarizing yourself with the eligibility criteria can empower you in this journey:

- Work History: Generally, you must have worked for at least five of the last ten years.

- Medical Condition: Your condition must meet the SSA's definition of disability.

- Income Limits: For 2025, the income limit for SSDI is $1,620 per month for non-blind individuals.

If you have questions or need more detailed information, remember that you are not alone. We encourage you to visit the SSA's official website or consult with a disability support advocate. We're here to help you through this process.

Calculate Your Social Security Disability Payments

Calculating your Social Security Disability payments can feel overwhelming, but understanding two key components—Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA)—can make the process easier. Here’s a supportive guide to help you navigate this journey:

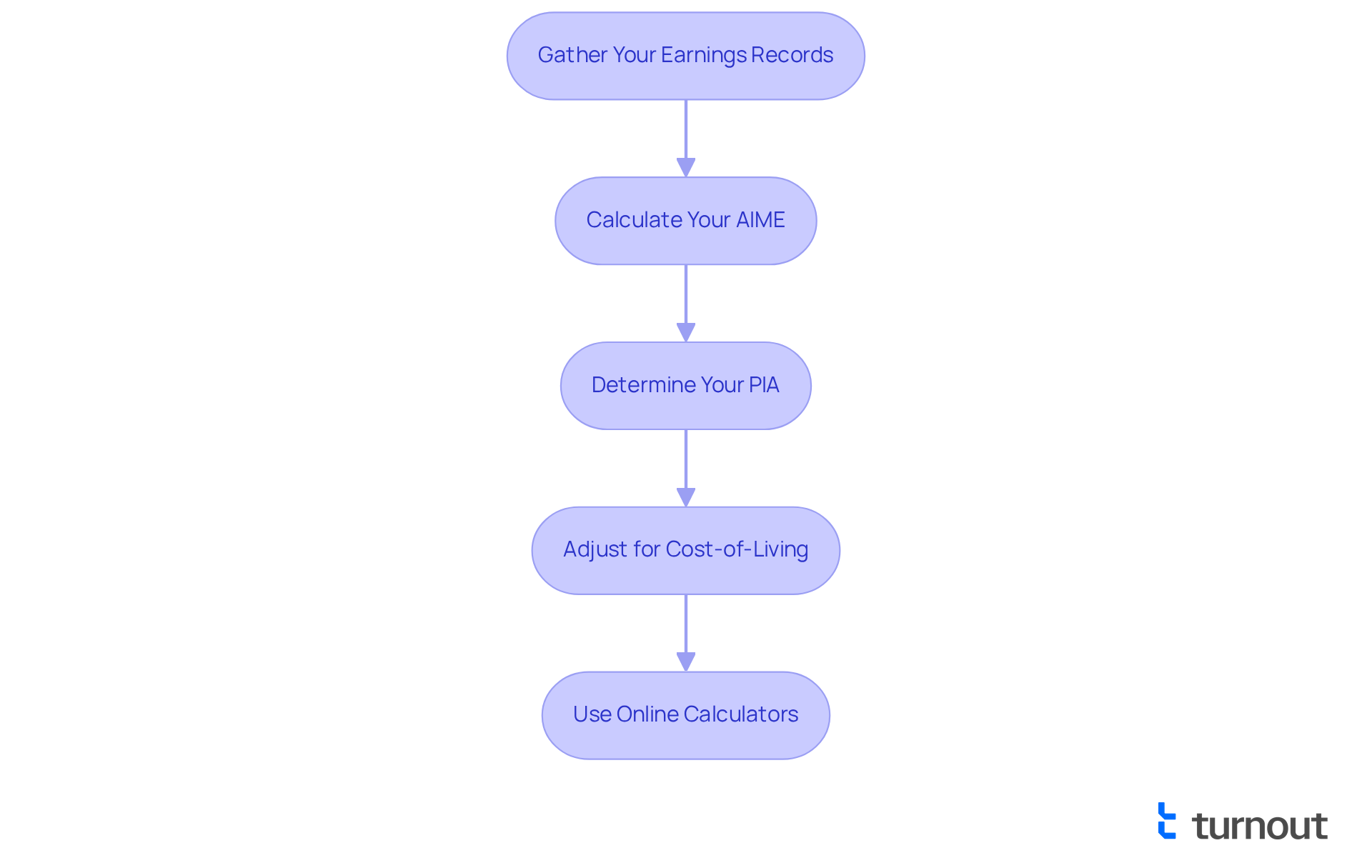

- Gather Your Earnings Records: Start by collecting your earnings history from your Social Security Statement, available online through the SSA website. This step is crucial as it lays the foundation for your calculations.

- Calculate Your AIME: Your AIME is determined by averaging your highest-earning 35 years, adjusted for inflation. If you have fewer than 35 years of earnings, the SSA will average your earnings over the years you worked. We understand that this can be a complex calculation, but it’s an important part of the process.

- Determine Your PIA: Your PIA is calculated from your AIME using a specific formula that applies different percentages to portions of your AIME. For 2025, the formula is as follows:

- 90% of the first $1,115 of your AIME

- 32% of the AIME over $1,115 and up to $6,721

- 15% of the AIME over $6,721

- Adjust for Cost-of-Living: Remember that your benefits are adjusted yearly for inflation through the Cost-of-Living Adjustment (COLA). For 2025, the COLA is set at 2.5%, which will affect your payment amount. Approximately 68 million Social Security recipients will see their monthly payments rise by about $48 starting in January 2025. It’s common to feel uncertain about how these changes will impact you, but rest assured that adjustments are made to help you keep up with rising costs.

- Use Online Calculators: To simplify the process, utilize the SSA's online estimation calculators, which can provide projections based on your input data. These tools are designed to support you in understanding your potential benefits.

By following these steps, you can estimate how much is social security disability for your monthly SSDI payment amount, which for 2025 is expected to range from a minimum of $967 to a maximum of $4,018. Furthermore, the anticipated increase in the Substantial Gainful Activity (SGA) income threshold may allow you to earn more before your assistance is affected. This organized method not only clarifies the calculation steps but also empowers you to grasp your potential benefits more effectively. Remember, you are not alone in this journey—we're here to help you every step of the way.

Navigate the Application Process for Benefits

Navigating the application process for Social Security Disability Insurance (SSDI) benefits can feel overwhelming, but we're here to help you through it. By following these steps, you can streamline your experience and enhance your chances of receiving the benefits you deserve.

-

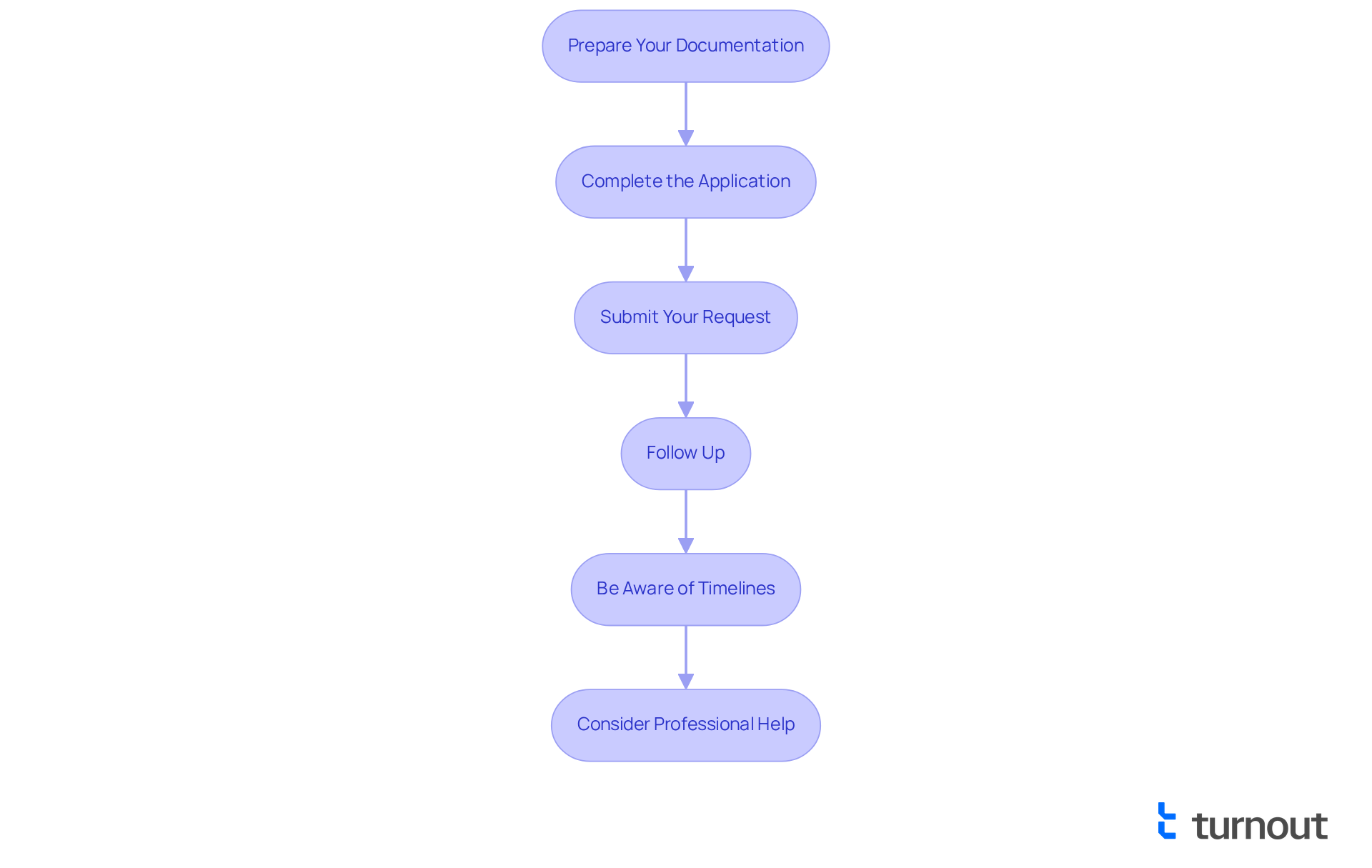

Prepare Your Documentation: Start by gathering all necessary documents. This includes your medical records detailing your condition, work history and earnings records, and personal identification documents.

-

Complete the Application: You can apply online at the SSA website, by phone, or in person at your local SSA office. It’s important to fill out the Adult Disability Report accurately, providing detailed information about your medical condition and work history. In 2025, the SSA will implement new procedures to improve security and reduce identity theft, allowing individuals to use online services without in-person identity verification. This change can simplify the initial steps for many applicants.

-

Submit Your Request: Once you’ve completed the form, send it along with all necessary documentation. Remember to keep copies of everything you send for your records.

-

Follow Up: After submission, it’s essential to keep track of the status of your request. You can check your status online or reach out to the SSA. Be prepared to provide additional information if requested; the SSA may contact you for clarification or further documentation.

-

Be Aware of Timelines: The initial evaluation typically takes 3 to 5 months. If your request is denied, you have the right to appeal, but be mindful of deadlines for submitting appeals. Recent changes indicate that submissions made via a lawyer may encounter fewer verification obstacles, which can be beneficial during the appeal process.

-

Consider Professional Help: If the task feels daunting, consider consulting with a disability benefits advocate. As many supporters highlight, 'Having professional help can create a significant impact in managing the intricacies of the SSDI submission.' These experts can assist you throughout the submission and appeal stages, greatly enhancing your likelihood of success. Additionally, the SSA provides an online field office locator tool to help you find local offices and schedule appointments.

By following these steps, you can navigate the application process more effectively. Remember, you are not alone in this journey, and there are resources available to support you.

Conclusion

Understanding Social Security Disability benefits is crucial for individuals facing the challenges of long-term medical conditions. We understand that the process may seem daunting, but by breaking it down into manageable steps, you can navigate the complexities of eligibility, calculation, and application more effectively. This guide emphasizes the importance of knowing the distinctions between SSDI and SSI, as well as the key factors that influence benefit amounts.

Throughout this article, we've provided essential insights, such as:

- The significance of work history

- The calculation of Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA)

- The necessary documentation for a successful application

It’s common to feel overwhelmed, but remember the importance of following up on your applications and the potential benefits of seeking professional assistance. You are not alone in this journey.

Ultimately, applying for Social Security Disability benefits is not just about understanding numbers and forms; it is about securing the financial support you need for a stable future. By leveraging the resources available, including online calculators and advocacy services, you can take proactive steps toward achieving your rightful benefits. Embracing this knowledge empowers you to navigate the system with confidence and clarity, ensuring that you feel supported every step of the way.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a program that provides financial assistance to individuals who are unable to work due to a medical condition that is expected to last at least one year or may lead to death.

What are the eligibility requirements for SSDI?

To qualify for SSDI, applicants must have worked in jobs covered by Social Security and have a sufficient work history, which generally means working for at least five of the last ten years. Additionally, the applicant's medical condition must meet the SSA's definition of disability.

How does SSDI differ from Supplemental Security Income (SSI)?

SSDI requires a work history for eligibility, while SSI is a need-based program that does not require a work history.

What are the income limits for SSDI in 2025?

For 2025, the income limit for SSDI is $1,620 per month for non-blind individuals.

Where can I find more information or assistance regarding SSDI?

For more detailed information, you can visit the Social Security Administration's official website or consult with a disability support advocate.