Overview

We understand that navigating Disability Social Security can be challenging. The amount you receive is primarily determined by your Average Indexed Monthly Earnings (AIME), and it's projected to be around $2,800 monthly in 2025, following a cost-of-living adjustment of 2.5%. This calculation is deeply rooted in your work history and earnings.

It's essential to recognize how eligibility criteria, work credits, and adjustments can influence your benefit amounts. Understanding these factors can empower you in this journey. Remember, you're not alone in this process, and we’re here to help you every step of the way.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can often feel overwhelming, like finding your way through a labyrinth. For many, SSDI serves as a crucial support system, providing financial assistance to those unable to work due to disabilities. However, understanding how payments are calculated and what changes may be on the horizon can leave many feeling uncertain. With important updates expected in 2025, including increased payment amounts and revised eligibility criteria, it’s natural to wonder: how can you ensure you receive the maximum benefits you deserve?

In this guide, we’ll explore the key elements of SSDI calculations. Our goal is to provide you with clarity and actionable steps that can help secure your financial stability. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

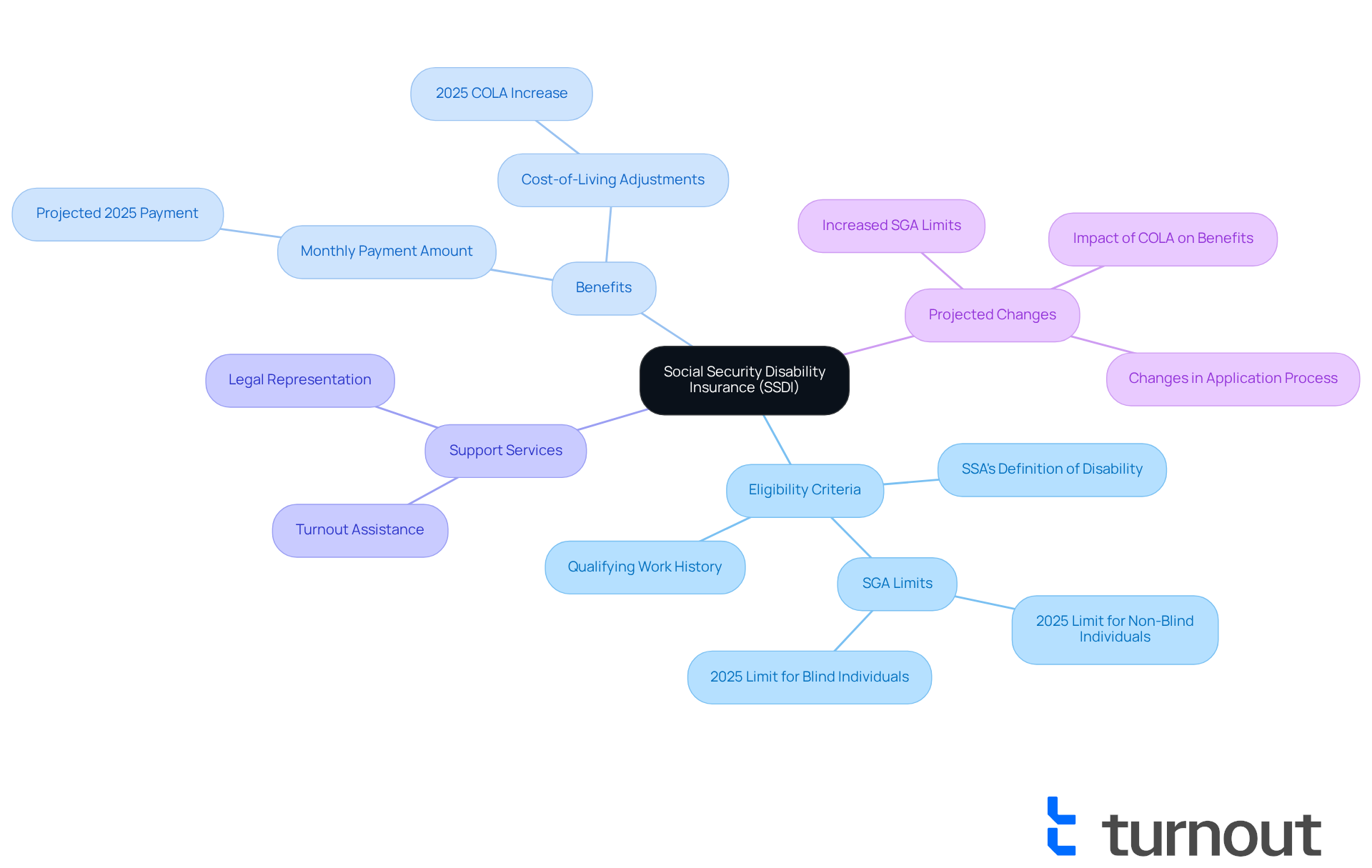

Understand Social Security Disability Insurance (SSDI)

Social Insurance Disability Benefits is a national initiative designed to provide financial assistance to individuals who are unable to work due to qualifying disabilities. We understand that navigating this process can be overwhelming. To qualify for Social Security Disability Insurance, applicants need a work history in positions covered by Social Security, along with a medical issue that aligns with the Social Security Administration's (SSA) definition of disability. This definition typically requires that the condition is expected to last at least one year or result in death. Importantly, having sufficient medical evidence is crucial for a successful disability claim, as it substantiates the applicant's condition and its impact on their ability to work.

Turnout offers valuable tools and services to assist consumers in managing the complexities of disability claims. While Turnout is not a law firm and does not provide legal representation, they utilize trained nonlawyer advocates who can help clients understand the SSDI process and gather the necessary documentation. This assistance is essential for individuals who may feel overwhelmed by the intricacies of governmental aid.

In 2025, the Substantial Gainful Activity (SGA) threshold for non-blind individuals will rise to $1,620 monthly. This change enables recipients to earn more while still meeting qualification requirements. It’s a significant modification, reflecting a 2.5% increase, which is important for those seeking to enhance their earnings without jeopardizing their disability benefits status.

It is crucial to understand how much do you get for disability social security benefits and how they are calculated. The amount you receive is determined by how much you get for disability social security based on your average lifetime earnings before your disability began. In 2025, the typical monthly disability payment is expected to rise to around $2,800, due to a cost-of-living adjustment (COLA) of 2.5%. This increase is vital for beneficiaries facing rising living costs and healthcare expenses.

Real-world examples illustrate the impact of Social Security Disability Insurance. For instance, the Smith Family from Waco, TX, expressed their gratitude for the endorsement of their disability support application. They emphasized how these provisions can greatly enhance the quality of life for individuals with disabilities.

Key eligibility criteria for Social Security Disability Insurance include:

- Having a qualifying work history

- Meeting the SSA's definition of disability

- Complying with the SGA limits

By 2025, it is projected that more than 5 million Americans will advocate for disability assistance programs. This highlights the importance of understanding this initiative and its prerequisites. Remember, you are not alone in this journey, and support is available to help you navigate these challenges.

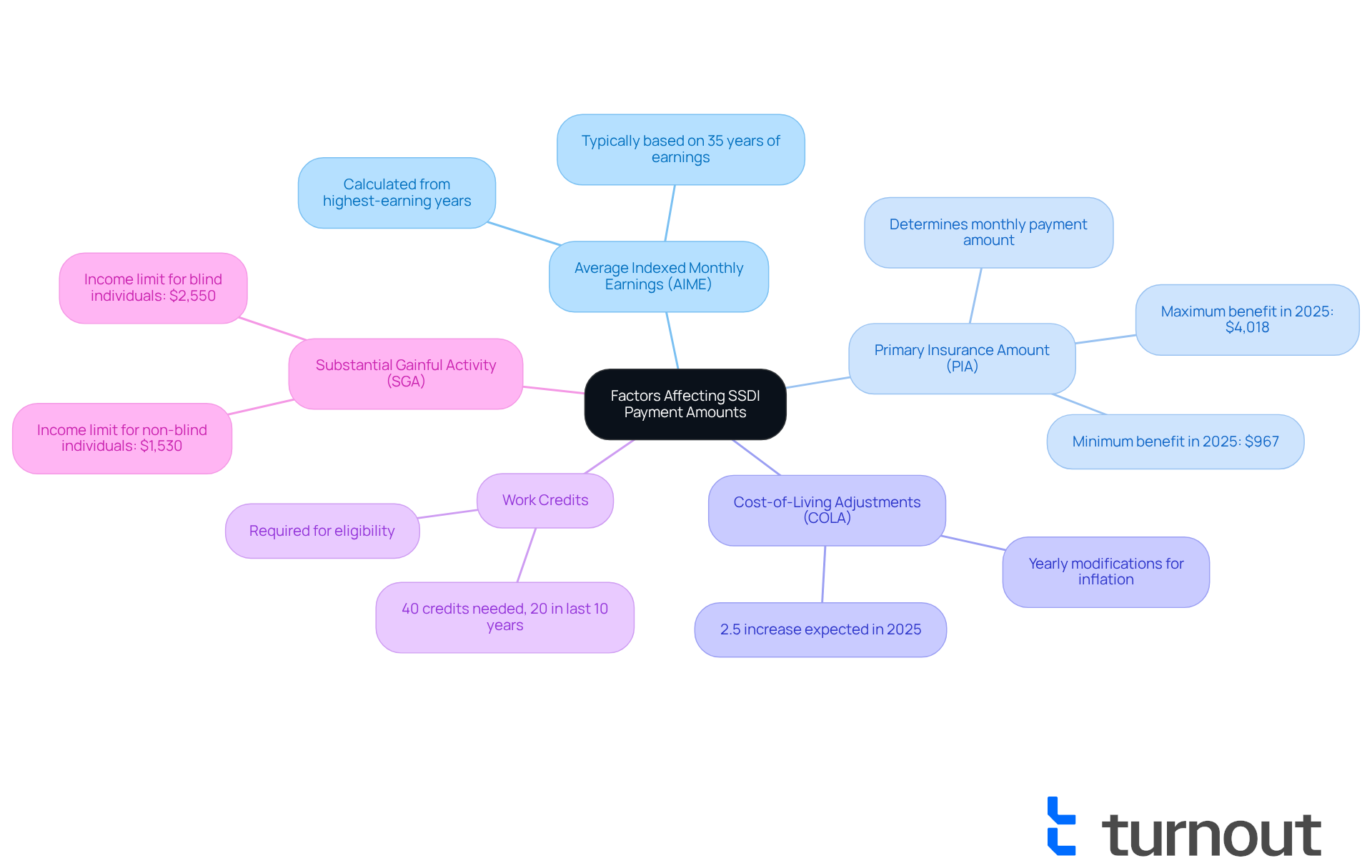

Identify Factors Affecting SSDI Payment Amounts

Several factors can influence how much do you get for disability social security, and understanding them is essential for your journey.

- Average Indexed Monthly Earnings (AIME): This figure is calculated based on your highest-earning years, typically the 35 years in which you earned the most. AIME plays a crucial role in determining your benefits.

- Primary Insurance Amount (PIA): Derived from your AIME, the PIA determines your monthly payment amount. In 2025, the highest monthly assistance for disability support is expected to reach $4,018, while the lowest will be $967.

- Cost-of-Living Adjustments (COLA): These yearly modifications consider inflation and can significantly affect your overall compensation amount. For instance, recipients of disability benefits will experience a 2.5% rise in their monthly payments in the year following 2024 due to the most recent cost-of-living adjustment.

- Work Credits: To be eligible for disability benefits, you need a specific number of work credits earned through your employment history. In 2025, you typically require 40 credits, with a minimum of 20 obtained in the last 10 years prior to the onset of your disability.

- Substantial Gainful Activity (SGA): In 2025, the SGA limit for non-blind individuals is expected to rise to $1,530 each month, allowing recipients to earn more income while still receiving assistance.

We understand that grasping these elements can feel overwhelming, but it's crucial for optimizing your disability support and understanding how much do you get for disability social security to ensure you receive the assistance you need. Turnout simplifies access to these benefits by utilizing trained nonlegal advocates who are here to guide you through the SSD claims process. They will help you navigate the complexities effectively.

Furthermore, it's important to recognize that Turnout is not connected to any legal firms or governmental organizations. Understanding the distinctions between Social Security Disability Insurance and Supplemental Income is vital for navigating these resources efficiently. Remember, you are not alone in this journey; we're here to help.

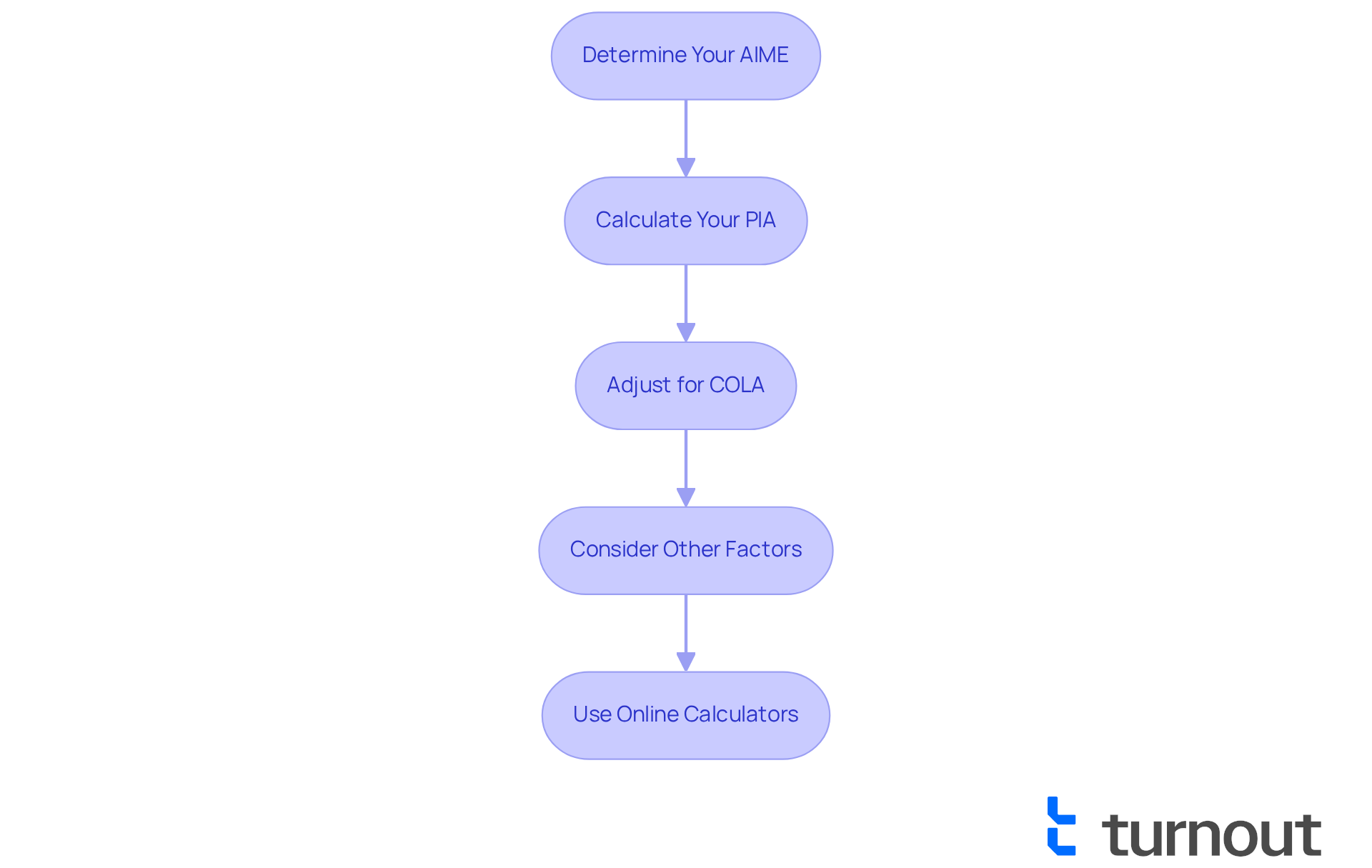

Calculate Your SSDI Benefits: A Step-by-Step Process

Calculating your SSDI benefits can feel overwhelming, but with the support of Turnout, you can navigate this process with confidence. Here’s how to get started:

-

Determine Your AIME: Begin by gathering your earnings documents from the Social Services Administration (SSA). Your Average Indexed Monthly Earnings (AIME) reflects your work history and contributions to Social Security, calculated by averaging your highest 35 years of indexed earnings.

-

Calculate Your PIA: Next, apply the SSA's formula to find your Primary Insurance Amount (PIA) based on your AIME. This formula uses specific percentages assigned to segments of your AIME, known as 'bend points', which for this year are $1,226 and $7,391, to determine your compensation amount.

-

Adjust for COLA: It's important to consider the current Cost-of-Living Adjustment (COLA) for the year. For 2025, the COLA is set at 2.5%. By multiplying your PIA by this percentage, you can adjust your payment amount accordingly, ensuring it keeps pace with inflation.

-

Consider Other Factors: If applicable, take into account any additional income or benefits that may affect your SSDI payment, such as workers' compensation or other disability assistance. These factors can significantly influence your overall entitlement.

-

Use Online Calculators: For a more accurate estimate, consider utilizing the SSA's online compensation calculators. These tools provide personalized estimates based on your specific earnings history, helping you understand your potential benefits more clearly. Moreover, creating a my Social Security account at ssa.gov allows you to access tailored disability assistance estimates.

By following these steps, you can gain a clearer understanding of your social security benefits, specifically regarding how much do you get for disability social security and how they are calculated. Remember, Turnout is here to support you, but we are not a law firm, and the information provided does not constitute legal advice. With the guidance of Turnout's trained nonlawyer advocates, you can make informed decisions about your financial future. You are not alone in this journey; we’re here to help.

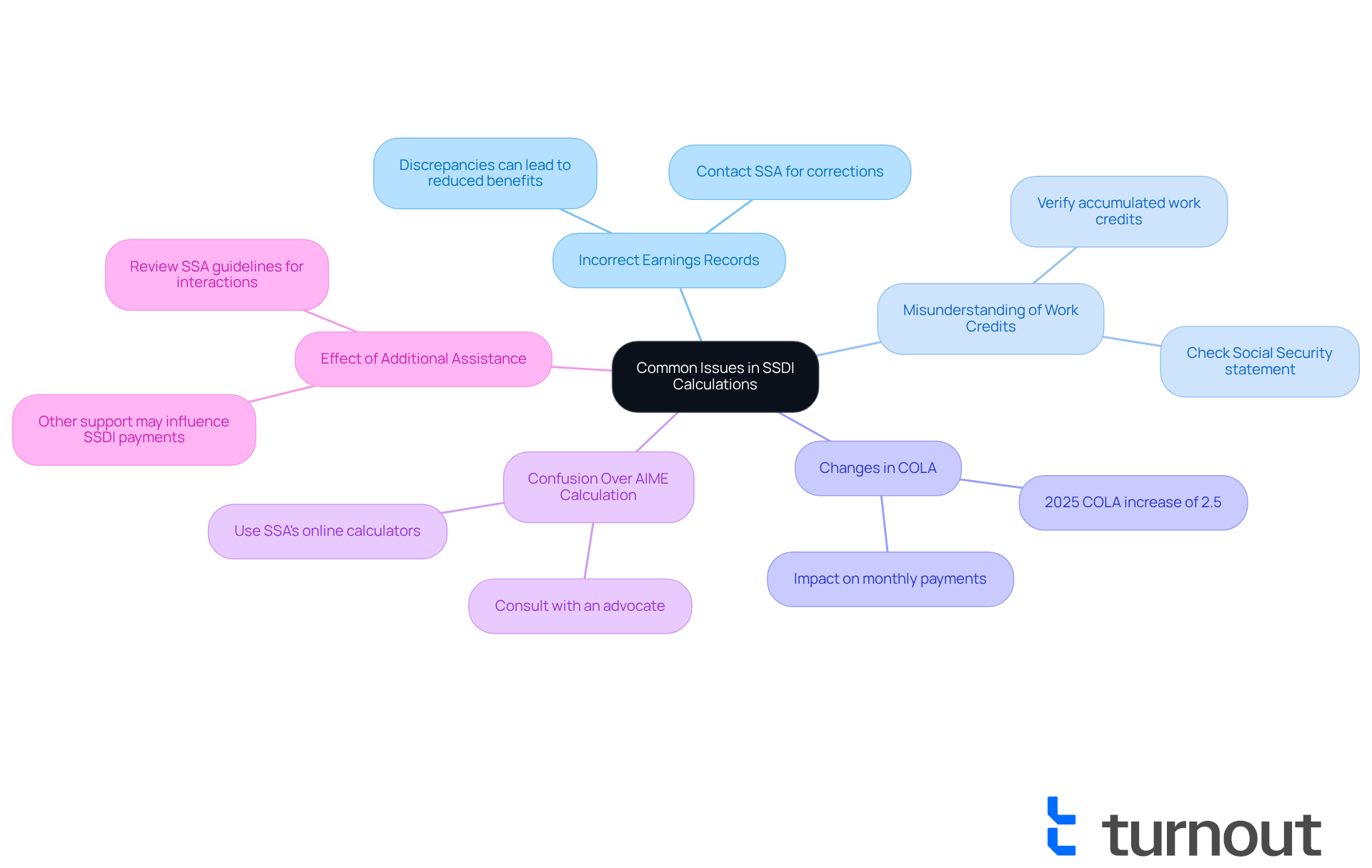

Troubleshoot Common Issues in SSDI Calculations

When calculating your SSDI benefits, it's common to encounter several issues that can feel overwhelming. We understand that navigating this process can be challenging, and we're here to help you through it.

-

Incorrect Earnings Records: It's crucial to ensure your earnings history is accurate. Discrepancies can lead to reduced benefits, so if you discover any mistakes, reach out to the Social Security Administration (SSA) quickly to request a correction. Many disability benefit applicants face problems with erroneous earnings records, which can delay their benefits.

-

Misunderstanding of Work Credits: Verify that you have accumulated enough work credits to qualify for SSDI. If you're unsure, check your Social Security statement for your credit history. Understanding the requirements is essential, as many applicants mistakenly believe they have sufficient credits when they do not.

-

Changes in COLA: Stay informed about annual Cost-of-Living Adjustments (COLA), as these can significantly affect your payout amount. For 2025, disability beneficiaries will experience a 2.5% rise in their monthly payments, which is vital for preserving purchasing power amidst rising living expenses.

-

Confusion Over AIME Calculation: If you're unsure about how to calculate your Average Indexed Monthly Earnings (AIME), consider using the SSA's online calculators or consult with an advocate for assistance. Precise AIME calculations are essential for assessing your disability support entitlements.

-

Effect of Additional Assistance: Understand that obtaining other disability support may influence your Social Security Disability Insurance payment. Examine the SSA guidelines to comprehend how these interactions function, as they can lead to unexpected decreases in your social security payments. Monitoring all your benefits is crucial for accurate financial planning.

By addressing these common issues proactively, you can ensure that you understand how much do you get for disability social security and receive the full benefits you are entitled to under the SSDI program. Remember, you are not alone in this journey, and taking these steps can make a significant difference.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for those seeking financial assistance due to qualifying disabilities. We recognize that navigating this complex system can be overwhelming. This guide has illuminated the key components of SSDI, from eligibility requirements to the calculation of benefits, ensuring that individuals are better equipped to find their way.

The article outlined critical factors that influence SSDI payment amounts, such as:

- Average Indexed Monthly Earnings (AIME)

- Primary Insurance Amount (PIA)

- Cost-of-Living Adjustments (COLA)

It's common to feel uncertain about how these elements apply to your situation. By having accurate earnings records and understanding work credits, you can maximize your benefits. Following the step-by-step process for calculating SSDI benefits can provide clarity on your potential support and the necessary documentation required.

Ultimately, the significance of this information cannot be overstated. For millions of Americans advocating for disability assistance, understanding SSDI is a vital step toward securing the financial support they deserve. Taking proactive measures, such as utilizing available resources and seeking guidance from trained advocates, can make a meaningful difference in navigating the SSDI landscape. Remember, empowerment through knowledge is key. With the right tools and support, you can confidently pursue your disability benefits. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a national program designed to provide financial assistance to individuals who cannot work due to qualifying disabilities.

What are the requirements to qualify for SSDI?

To qualify for SSDI, applicants must have a work history in positions covered by Social Security and a medical condition that meets the Social Security Administration's (SSA) definition of disability, which typically requires the condition to last at least one year or result in death.

Why is medical evidence important for an SSDI claim?

Sufficient medical evidence is crucial for a successful disability claim as it substantiates the applicant's condition and its impact on their ability to work.

How can Turnout assist with the SSDI process?

Turnout provides tools and services to help consumers navigate the complexities of disability claims. They employ trained nonlawyer advocates who can assist clients in understanding the SSDI process and gathering necessary documentation.

What is the Substantial Gainful Activity (SGA) threshold for 2025?

In 2025, the SGA threshold for non-blind individuals will rise to $1,620 monthly, allowing recipients to earn more while still qualifying for benefits.

How is the amount for disability social security benefits calculated?

The amount received is determined by the applicant's average lifetime earnings before the disability began. In 2025, the typical monthly disability payment is expected to rise to around $2,800 due to a 2.5% cost-of-living adjustment (COLA).

What are the key eligibility criteria for SSDI?

Key eligibility criteria include having a qualifying work history, meeting the SSA's definition of disability, and complying with the SGA limits.

What is the projected number of Americans advocating for disability assistance programs by 2025?

It is projected that more than 5 million Americans will advocate for disability assistance programs by 2025.