Overview

We understand that navigating tax deadlines can be overwhelming. The question of how far back one can file taxes is important for many individuals. Typically, you have up to three years from the original submission deadline to file overdue returns for a potential refund. However, it's crucial to note that the IRS has no statute of limitations for collecting owed taxes.

Timely filing is essential to avoid accumulating penalties and interest. Gathering necessary documentation and following a structured process is key to ensuring compliance and maintaining your financial well-being. Remember, you're not alone in this journey; we're here to help you every step of the way.

Introduction

Navigating the complexities of tax filing can feel overwhelming, especially when you're uncertain about how far back you can file your taxes. We understand that the stakes are high; missing deadlines can result in significant penalties and lost refunds. This guide is here to clarify the time limits for filing back taxes and to walk you through essential steps that can help you navigate this intricate process.

It's common to feel anxious about how far back you can go. However, understanding the critical importance of timely submissions can alleviate some of that stress. By complying with tax regulations, you can unlock potential benefits that come with being proactive. Remember, you're not alone in this journey—we're here to help you every step of the way.

Understand the Importance of Filing Taxes

Submitting your returns is more than just a legal obligation; it’s an essential aspect of your financial well-being. We understand that navigating taxes can be overwhelming. By finalizing your financial returns, you not only comply with federal and state regulations but also protect yourself from accumulating penalties and interest on any outstanding dues. This proactive approach can significantly impact your financial health, especially for those who may rely on various forms of assistance.

Moreover, submitting your returns opens the door to various credits and refunds that can provide vital financial support. For example, the Earned Income Tax Credit (EITC) can offer substantial benefits, particularly for low-income families. Imagine a Black mother earning around $15,000 annually; she could receive approximately $4,930 from the EITC and Child Tax Credit. This showcases how tax credits can alleviate financial burdens and improve overall quality of life.

The importance of tax compliance is highlighted by the staggering statistic that Americans will spend over 7.9 billion hours in 2024 managing IRS tax submission and reporting obligations. It’s common to feel lost in this complexity, which can lead to significant out-of-pocket costs, estimated at $133.3 billion. This emphasizes the need for individuals to fully understand their tax obligations.

Real-world examples illustrate the transformative power of tax credits. For many families, the financial assistance from these credits isn’t just a one-time refund; it’s crucial for covering everyday expenses like groceries, rent, and transportation. By submitting their returns, individuals can access these advantages, enabling them to manage their financial circumstances and avoid the traps of debt.

In conclusion, recognizing the significance of submitting returns is vital for ensuring financial well-being. It not only ensures compliance with tax laws but also provides access to valuable credits and refunds that can greatly enhance your financial stability. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Identify Time Limits for Filing Back Taxes

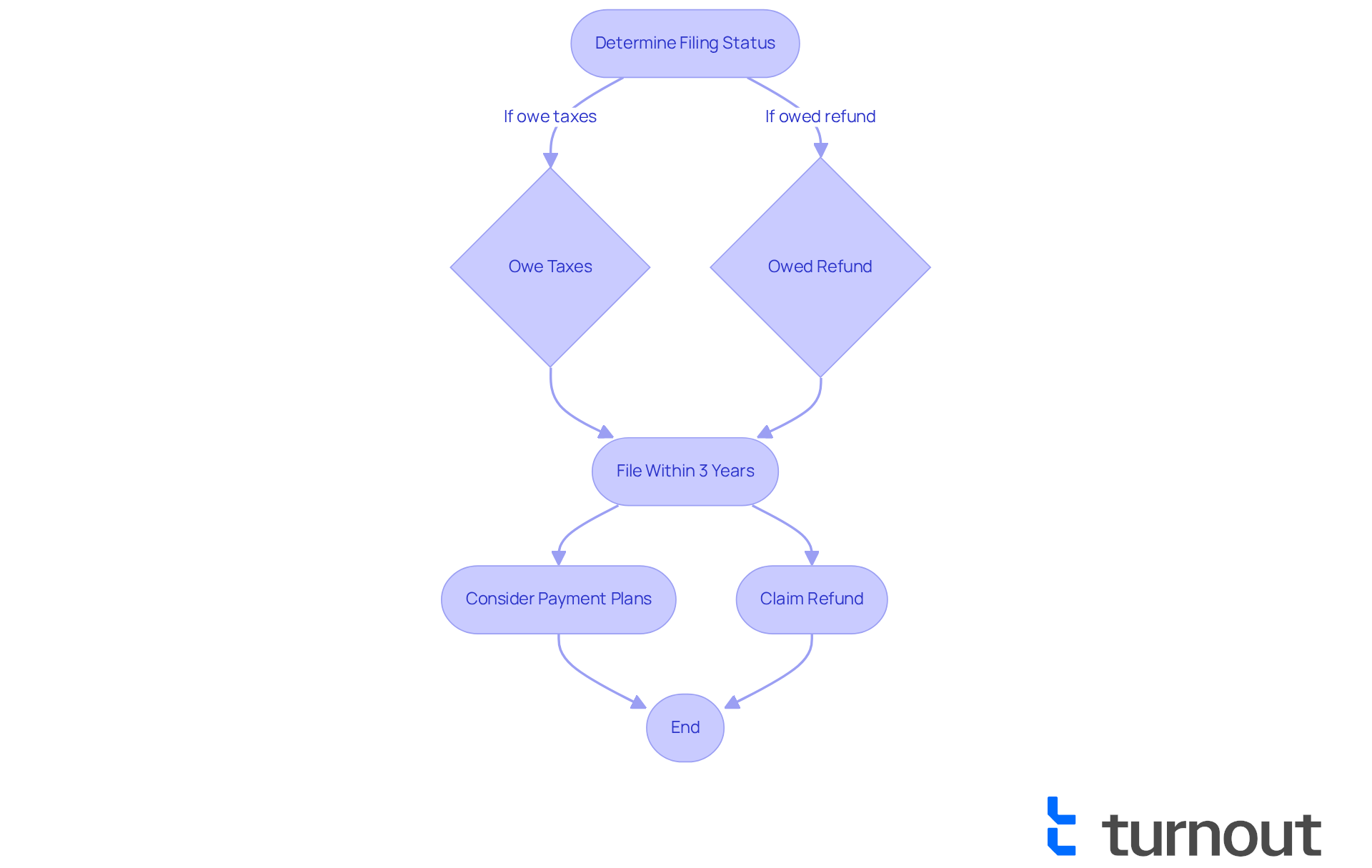

Understanding how far back you can file taxes is crucial for anyone who owes taxes and needs to be aware of the time constraints for submitting overdue returns. You typically have up to three years from the original submission deadline to determine how far back you can file taxes. If you are owed a refund, it's vital to file within this three-year window to claim it; otherwise, you risk losing that money. However, if you owe taxes, it's important to note that the IRS has no statute of limitations on collecting, which leads to the question of how far back can you file taxes, making timely action essential to avoid accruing charges and interest.

We understand that facing these deadlines can be daunting. Individuals who miss their submission dates may encounter significant consequences, including late-filing charges that can accumulate quickly. Data indicates that it usually takes about six weeks to process a properly completed overdue tax submission, underscoring the importance of filing as early as possible.

Even if you're unable to pay the full amount due, submitting your return is essential to minimize penalties and protect your financial well-being. Remember, you're not alone in this journey. The IRS provides payment plans and installment programs for late tax bills, offering options for those who may need help managing their tax obligations. We're here to help you navigate this process and find the best solution for your situation.

Gather Required Documentation for Past Tax Returns

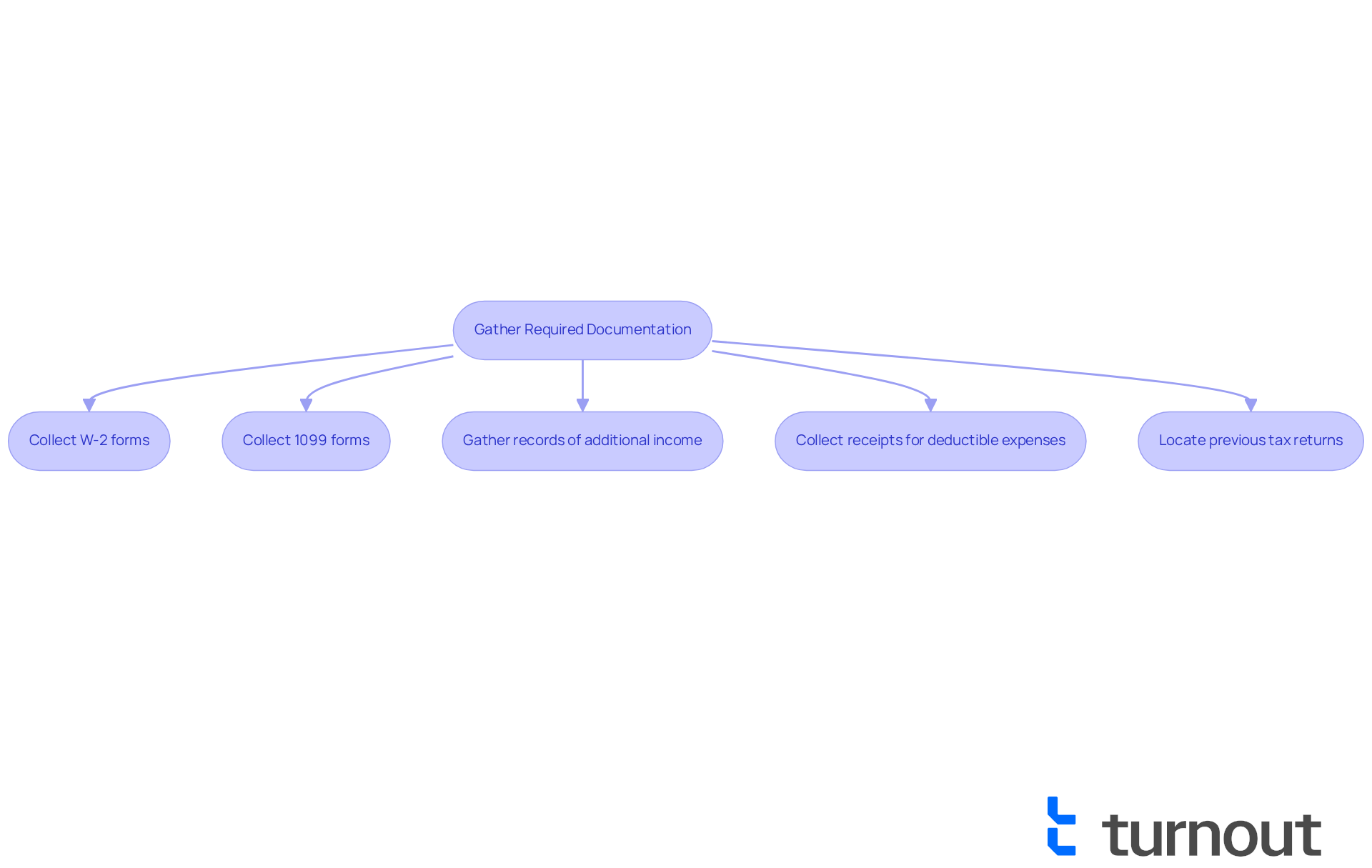

Before submitting your back taxes, we understand how far back you can file taxes and the importance of collecting all required documentation to ensure a smooth process. Start by gathering these essential items:

- W-2 forms from employers for each year you are filing.

- 1099 forms for any freelance or contract work.

- Records of additional income, such as rental income or investment earnings.

- Receipts for deductible expenses, including medical costs or business-related expenses.

- Previous tax returns, if accessible, to assist with your current submission.

Arranging these documents not only simplifies the sorting process but also helps reduce common mistakes. In 2025, 58% of respondents anticipate a tax refund, which suggests that many taxpayers are actively organizing their submissions. This highlights the importance of preparation, as a significant percentage of taxpayers have made mistakes due to disorganized records. Tax professionals recommend creating a dedicated folder for each tax year, making it easier to locate documents when needed.

For instance, individuals who effectively arranged their tax documents reported feeling more assured and less anxious during the submission process. Moreover, neglecting to submit overdue returns can lead to fines and collection measures from the IRS, making it increasingly vital to collect and organize your documentation. If you find that you cannot meet your tax responsibilities after submitting, you can request an additional 60-120 days to pay, providing some relief during this process. By investing time and effort into collecting and arranging your paperwork, you can enhance the accuracy of your tax submission and potentially avoid penalties linked to mistakes.

File Your Back Taxes: Step-by-Step Process

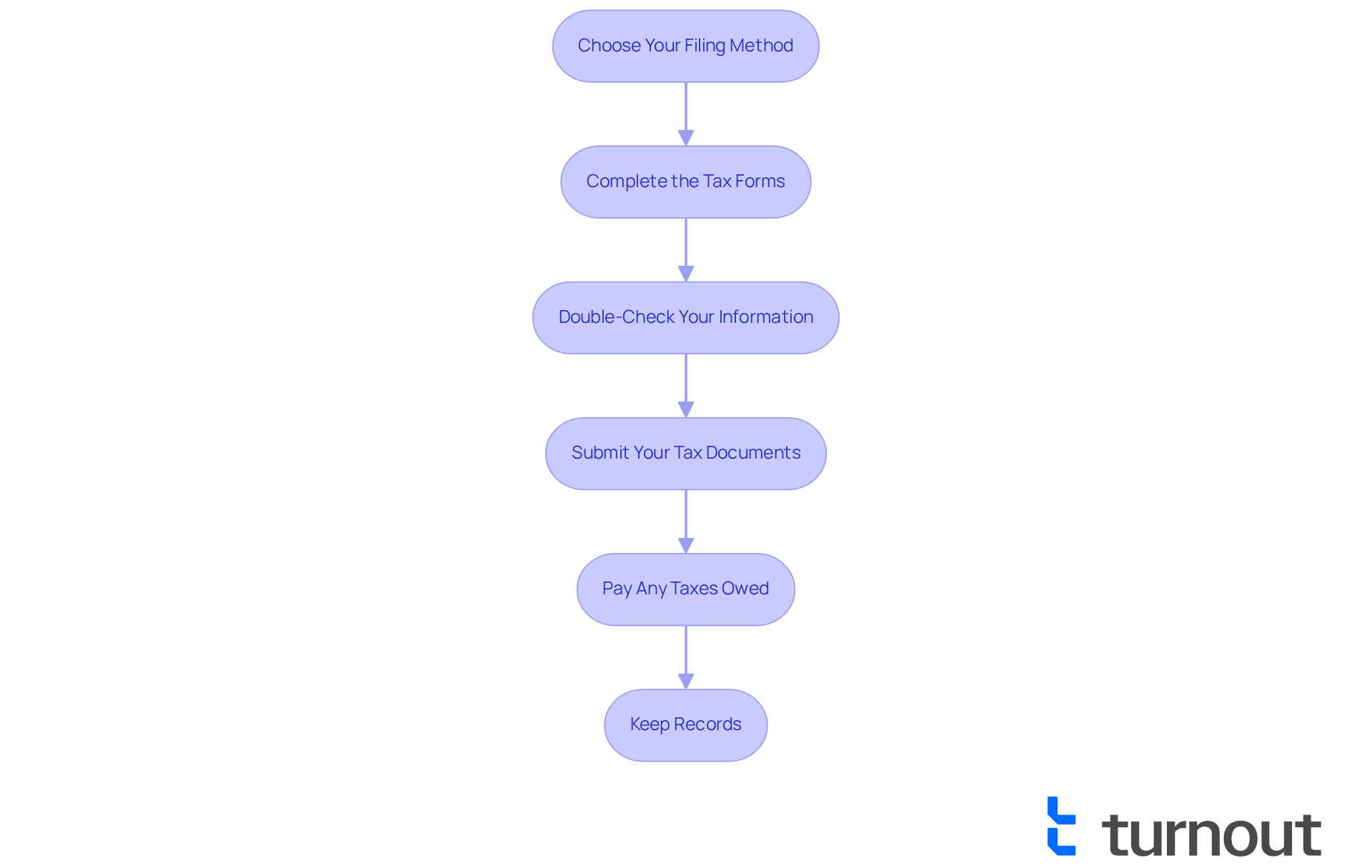

Filing your back taxes can feel overwhelming, especially when considering how far back you can file taxes, but we're here to help. Follow these essential steps to navigate the process with confidence:

-

Choose Your Filing Method: Decide whether to file online using tax software or by mailing paper forms. Online submission is typically quicker and more effective. Data shows a notable rise in e-filed returns from 2010 to 2023, reflecting an increasing preference for this approach.

-

Complete the Tax Forms: Take your time to fill out the appropriate tax forms for each year you are submitting. It's important to accurately include all income and deductions to avoid complications down the road.

-

Double-Check Your Information: We understand that mistakes can happen. Review your forms for any errors or omissions. Thoroughness is essential, as errors can lead to delays or consequences.

-

Submit Your Tax Documents: If you choose to submit online, follow the software's guidelines to send your documents electronically. If mailing, ensure you send your forms to the correct IRS address for your state, using the latest mailing guidelines.

-

Pay Any Taxes Owed: If you owe taxes, it's best to arrange to pay them promptly to minimize penalties and interest. Options like payment plans can help you manage your tax obligations effectively.

-

Keep Records: After submitting, retain copies of your tax returns and any supporting documents. This is crucial for future reference or in case of an audit.

Experts highlight that submitting online not only streamlines the process but also lowers the risk of mistakes. For instance, tax expert Adam Brewer observed that electronic submission reduces the risk of delays and complications with payment processing. Individuals who filed back taxes online reported quicker processing times compared to those who opted for paper submissions. In fact, the IRS has noted that e-filing continues to increase, with millions of submissions made electronically each year, indicating a transition towards more efficient tax submission methods.

It's crucial to remember that if you do not submit your overdue declaration, the IRS may proceed with their suggested evaluation, which could result in extra fines. Additionally, tax refunds need to be requested within three years of the original return's due date, and late submission penalties can build up at a rate of 4.5% per month of the tax amount owed. Therefore, it is vital to know how far back you can file taxes and to do so as soon as possible to avoid unnecessary complications.

Conclusion

Filing taxes is not just a requirement; it is a vital step toward achieving financial stability. We understand that navigating the complexities of tax filing can be overwhelming. Knowing how far back you can file taxes is essential to avoid penalties and to access potential refunds. By taking proactive steps to file overdue returns, you can protect your financial well-being and access valuable credits that may ease your economic burdens.

In this article, we have shared important insights about the significance of timely tax submissions, the consequences of neglecting tax responsibilities, and the necessary documentation for filing back taxes. The process outlined emphasizes careful preparation—from gathering required forms to selecting the right filing method. Each step is designed to empower you to face tax filing with confidence and accuracy.

The importance of submitting your taxes on time cannot be overstated. It ensures compliance with IRS guidelines while opening doors to financial relief through credits and refunds. If you are dealing with overdue tax returns, we encourage you to take action now. This can lead to a brighter financial future. Embrace the opportunity to understand your tax obligations and take control of your financial health—every step you take today can lead to a more secure tomorrow. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

Why is filing taxes important?

Filing taxes is crucial not just for legal compliance, but also for your financial well-being. It helps you avoid penalties and interest on unpaid dues and can significantly impact your financial health.

What are the benefits of submitting tax returns?

Submitting tax returns can lead to access to various credits and refunds, such as the Earned Income Tax Credit (EITC), which can provide substantial financial support, especially for low-income families.

How can tax credits like the EITC help individuals?

Tax credits like the EITC can alleviate financial burdens. For instance, a low-income family earning around $15,000 annually could receive approximately $4,930 from the EITC and Child Tax Credit, improving their overall quality of life.

What is the estimated time Americans will spend on tax-related tasks in 2024?

Americans are expected to spend over 7.9 billion hours managing IRS tax submission and reporting obligations in 2024.

What are the potential financial consequences of not understanding tax obligations?

Not understanding tax obligations can lead to significant out-of-pocket costs, estimated at $133.3 billion, and can result in penalties and missed opportunities for credits and refunds.

How do tax credits impact everyday expenses for families?

Tax credits provide essential financial assistance that helps families cover everyday expenses such as groceries, rent, and transportation, enabling them to manage their financial situations more effectively.

What support is available for individuals navigating tax challenges?

There are resources and support available to help individuals navigate tax challenges, ensuring they understand their obligations and can access available credits and refunds.