Overview

Navigating the world of Social Security benefits can feel overwhelming, especially when faced with the challenges of a disability. It's important to understand that eligibility is determined by your ability to engage in substantial gainful activity (SGA) due to a medically identifiable condition, along with your work history and tax contributions.

To qualify, you'll need to earn sufficient work credits, which reflect your contributions over the years. Additionally, the calculations of Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA) play a crucial role in determining the benefits you may receive. We understand that this process can be daunting, but you are not alone in this journey.

If you have questions or need guidance, remember that we're here to help. Take the first step today towards securing the benefits you deserve.

Introduction

Understanding how disability is calculated for Social Security benefits is crucial for those navigating the complexities of the Social Security Disability Insurance (SSDI) program. We recognize that millions rely on these benefits, and comprehending the calculation methods can empower you to secure the financial support you need.

However, it's common to feel confused and overwhelmed by the intricacies of Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA).

What are the key factors that influence these calculations?

How can you avoid common pitfalls in the application process?

We're here to help you through this journey.

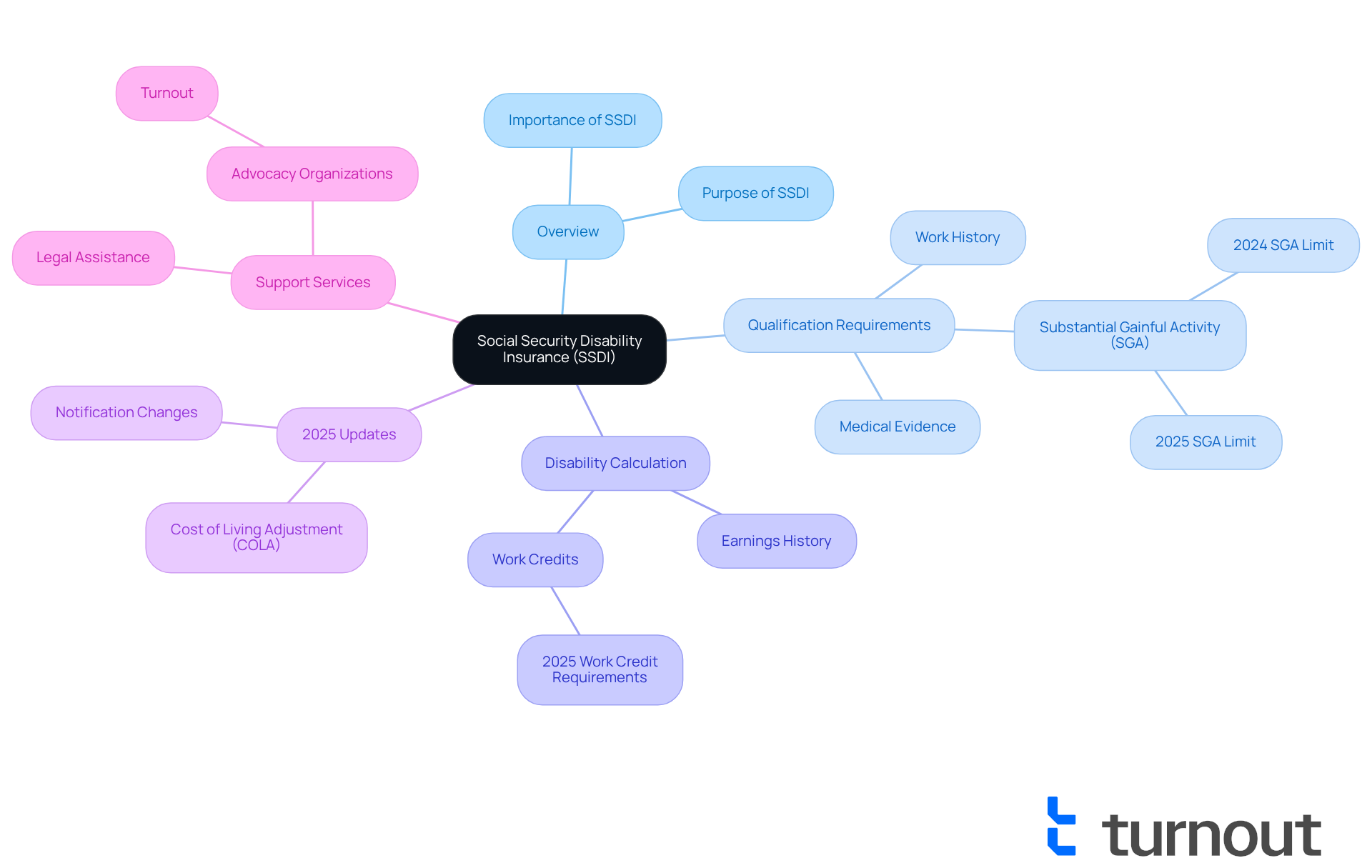

Understand Social Security Disability Insurance (SSDI)

Social Security Disability Insurance is a vital national initiative designed to provide financial assistance to those unable to engage in employment due to a qualifying disability. We understand that the process can be overwhelming, but knowing the requirements can help ease your journey.

To qualify for Social Security Disability Insurance, applicants must demonstrate an adequate work history and understand how disability is calculated for social security based on their contributions through taxes. The Social Security Administration (SSA) defines how disability is calculated for social security as a condition that prevents an individual from engaging in substantial gainful activity (SGA) for at least 12 months. In 2025, the SGA limit is expected to rise to $1,620 per month for non-blind individuals, reflecting necessary adjustments for inflation and wage changes.

Grasping the disability assistance framework is essential for anyone considering a request for support. It lays the groundwork for the subsequent stages in the application process. Approximately 68 million Social Security recipients will see their monthly benefits increase by 2.5% starting in January 2025. This increase is significant for those relying on these funds to manage living expenses, and we want you to be informed about these changes.

To determine how disability is calculated for social security, individuals must have a medically identifiable condition that prevents them from engaging in any significant employment to be eligible for disability benefits. This requirement emphasizes the importance of gathering comprehensive medical evidence and verifying work credits. With the updated criteria for 2025, one work credit will be earned for every $1,810 in covered earnings, allowing a maximum of four credits per year. We believe that understanding these details can empower you in your application process.

Practical examples can help illustrate the qualification process for disability benefits. Many individuals may not have acted to obtain their entitlements, even though they qualify. It's common to feel uncertain, but remaining updated on modifications to the disability program is crucial for impacted individuals. The SSA will distribute revamped notifications in early December, outlining new assistance amounts in clearer language. This will facilitate a better understanding of your rights as a recipient.

Turnout , while not affiliated with any law firm or government agency, offers valuable tools and services to help individuals navigate these processes. Their trained nonlawyer advocates are available to assist clients in ensuring they receive the support they need, all without the complexities of legal representation. Remember, you are not alone in this journey; we're here to help you every step of the way.

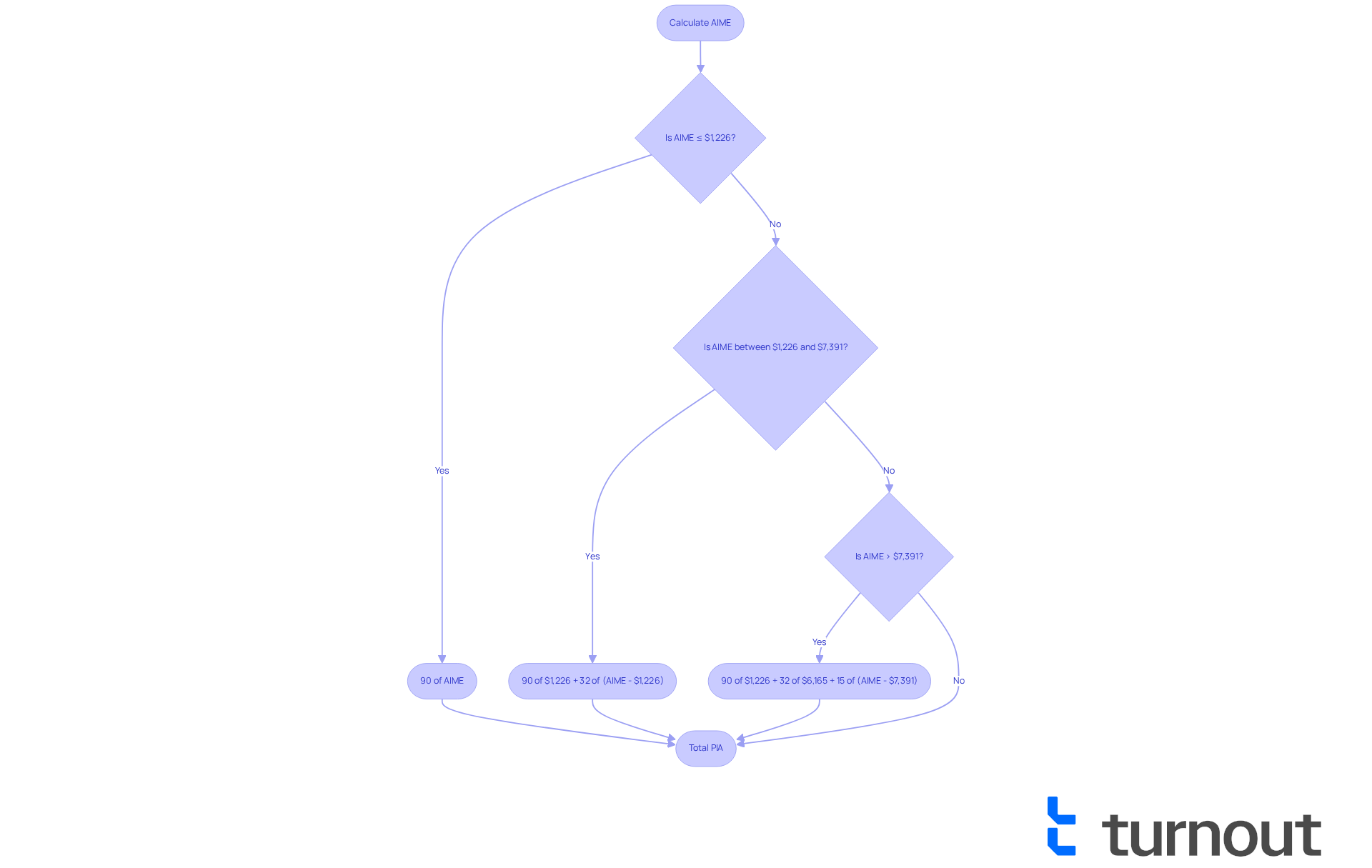

Explore Key Calculation Components: AIME and PIA

Understanding SSDI benefits can feel overwhelming, but we're here to help you navigate this important process. The determination of your benefits relies on two essential elements: Average Indexed Monthly Earnings and Primary Insurance Amount (PIA). The Average Indexed Monthly Earnings is calculated by taking the top 35 years of indexed income, summing these figures, and dividing by the total number of months within those years.

For 2025, the initial bend point is set at $1,226. This means that 90% of the first $1,226 of your Average Indexed Monthly Earnings is used to determine your PIA. Earnings between $1,226 and $7,391 are calculated at 32%, while any amount above $7,391 is calculated at 15%. This progressive formula is designed to ensure that those with lower earnings receive a higher replacement percentage, which is crucial for individuals with limited lifetime earnings.

For example, if your Average Indexed Monthly Earnings is calculated at $4,000, your Primary Insurance Amount would be derived as follows:

- 90% of the first $1,226 equals $1,103.40

- 32% of the amount between $1,226 and $4,000 (which is $2,774) equals $886.68

- 15% of any amount above $4,000 is not applicable in this case.

Thus, your total PIA would be approximately $1,990.08.

Comprehending these calculations is essential for you to assess your potential advantages accurately and prepare for your financial future. Financial consultants often emphasize the importance of providing a thorough employment history. This step can prevent undervaluing your lifetime earnings, which significantly influences how disability is calculated for social security and, consequently, the disability assistance you receive. Remember, you are not alone in this journey, and understanding these details can empower you to take control of your financial well-being.

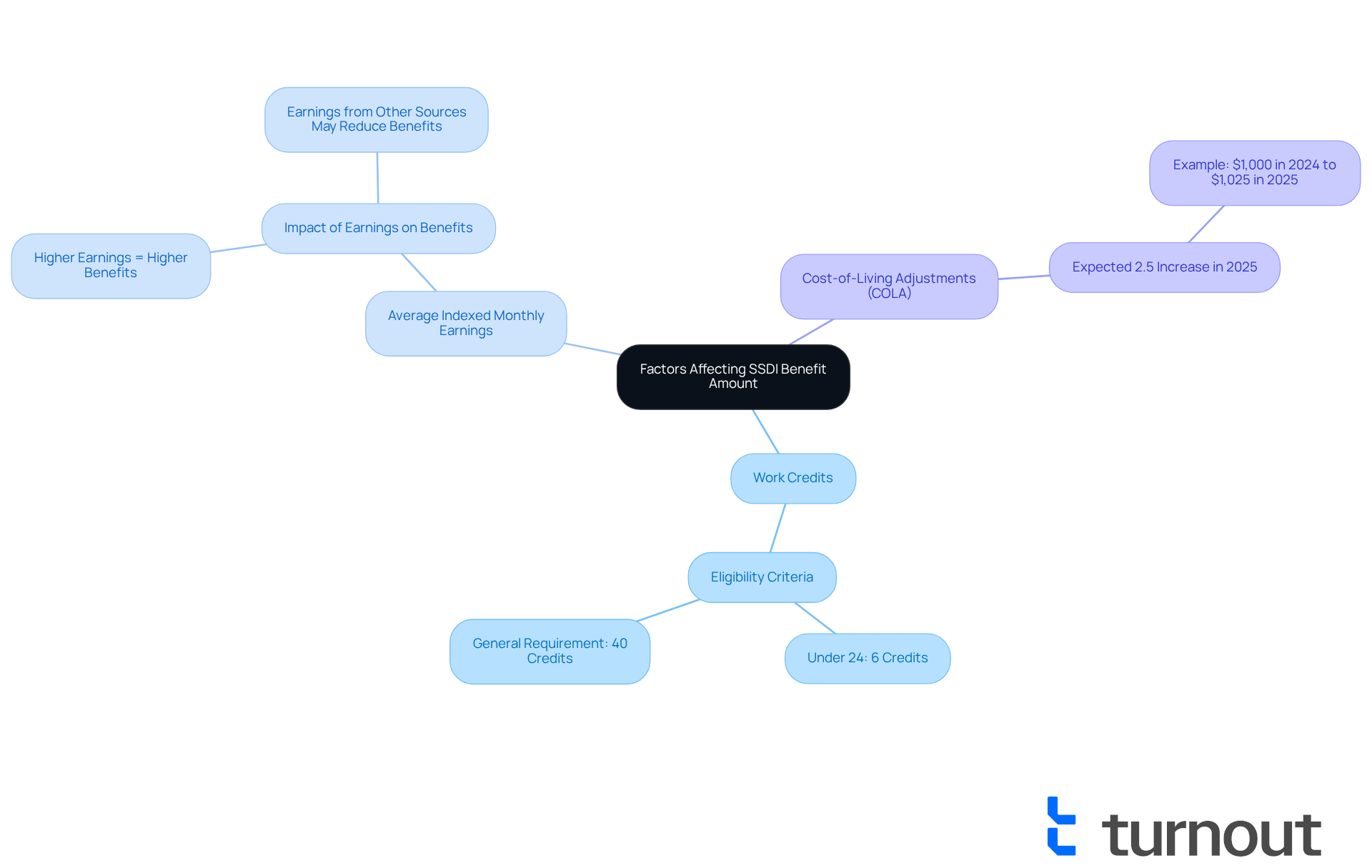

Identify Factors Affecting Your SSDI Benefit Amount

Navigating the complexities of Social Security Disability Insurance can be overwhelming, especially when considering how is disability calculated for social security, as multiple factors influence the level of assistance you may receive. Key elements of how disability is calculated for social security include:

- The number of work credits earned

- Average indexed monthly earnings

- Necessary cost-of-living adjustments (COLA)

In 2025, you can expect a 2.5% increase in monthly payments, which reflects the ongoing need to adjust for inflation. For example, if you receive $1,000 in 2024, your support could rise to $1,025 in 2025, providing essential financial relief.

Work credits play a crucial role in understanding how is disability calculated for social security, as they affect both eligibility and the amount of support you receive. Generally, you need to accumulate 40 credits, with 20 earned in the last 10 years before your disability. However, if you are a younger worker, you may qualify with fewer credits. For instance, if you are under 24, you might only need six credits earned in the three years leading up to your disability.

It's important to understand that earnings from other sources, like workers' compensation or unemployment assistance, can reduce your Social Security Disability Insurance payments. Recognizing these factors is vital as you navigate your claims process. Financial specialists emphasize that understanding how is disability calculated for social security is significant, as earning more during your career can lead to better benefits later.

Real-world examples highlight these adjustments: in 2025, the Substantial Gainful Activity (SGA) limit for non-blind individuals is expected to rise to $1,620 per month. This change allows SSDI recipients to earn more while still receiving support. This flexibility is crucial for those considering returning to work without risking their financial assistance. Moreover, the Trial Work Period (TWP) threshold is anticipated to increase to $1,100 or more in 2025, enabling you to explore job opportunities without losing your assistance. Additionally, the updated COLA notice will present essential details in a single-page format, making it easier for you to understand your compensation amounts.

We understand that seeking assistance can feel daunting. It's important to note that Turnout is not a law firm and does not provide legal representation. Instead, Turnout utilizes trained nonlawyer advocates to help clients like you navigate the intricacies of the SSD claims process effectively. Remember, you're not alone in this journey—we're here to help.

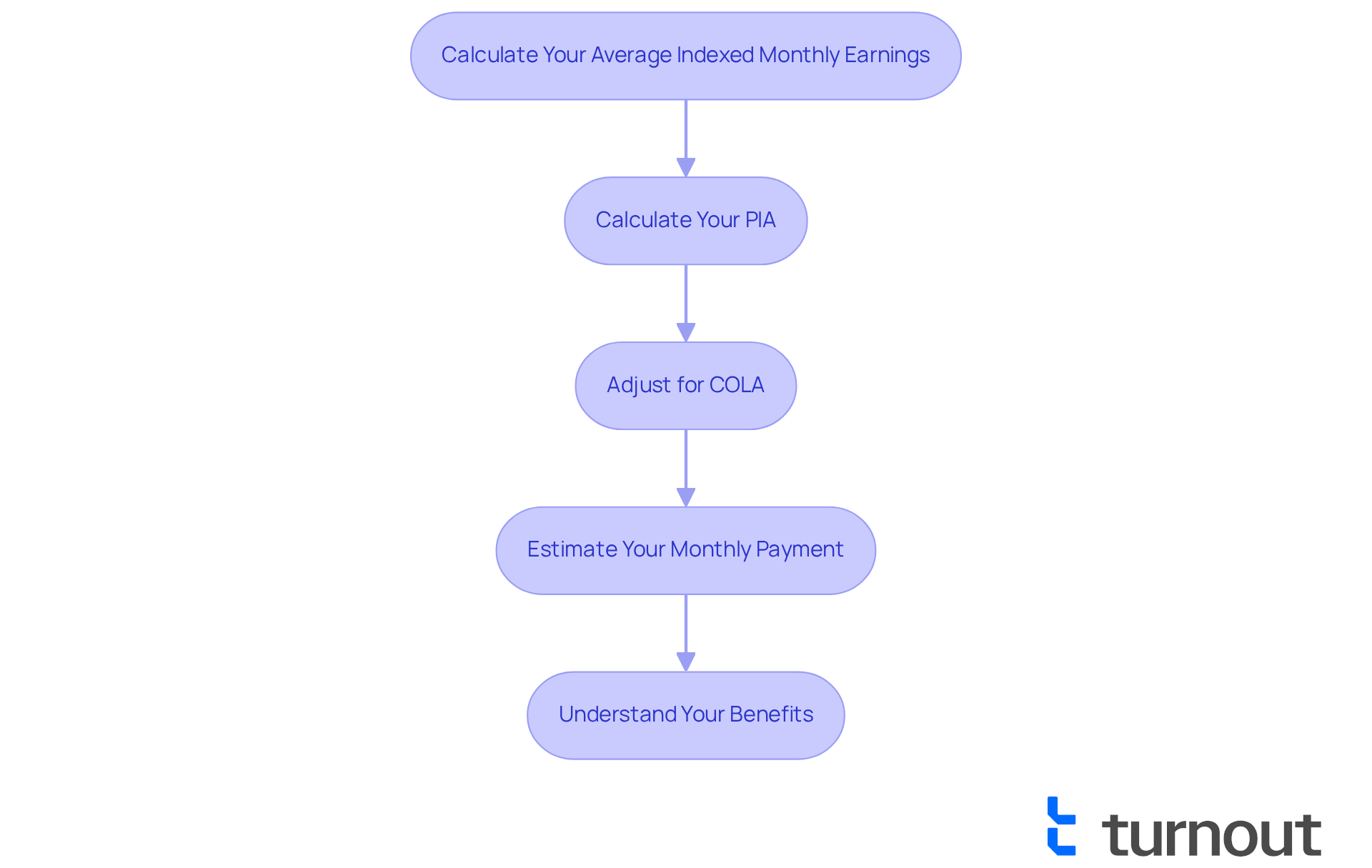

Calculate Your SSDI Benefits: A Step-by-Step Process

Calculating your SSDI benefits can feel overwhelming, but we're here to help you through it. Let's break it down into manageable steps so you can understand what to expect.

-

Calculate Your Average Indexed Monthly Earnings: Begin by gathering your earnings records from the highest 35 years of your work history. It's important to adjust these earnings for inflation using the Social Security Administration's (SSA) indexing factors. Once you’ve added these indexed earnings together, divide by the total number of months (420 months for 35 years) to find your Average Indexed Monthly Income.

-

Calculate Your PIA: Next, apply the SSA's formula to your Average Indexed Monthly Earnings. For the year 2025, the formula is as follows:

- 90% of the first $1,226 of AIME

- 32% of AIME between $1,226 and $7,391

- 15% of AIME over $7,391

For instance, if your AIME is $4,000, here’s how it breaks down:

- 90% of $1,226 equals $1,103.40.

- 32% of the amount between $1,226 and $4,000 (which is $2,774) equals $886.72.

- Therefore, your total PIA would be $1,103.40 + $886.72 = $1,990.12.

-

Adjust for COLA: If applicable, don’t forget to include any cost-of-living adjustments (COLA) that may affect your benefits. In 2025, for example, disability payments increased by 2.5% due to inflation, which can provide additional support for your monthly needs.

-

Estimate Your Monthly Payment: The PIA you calculated will represent your projected monthly disability support amount. So, if your PIA is $1,990.12, that’s what you can expect as your monthly payment.

It is crucial to understand how disability is calculated for social security. Social Security Disability Insurance typically replaces 40-50% of your income before disability, with the average payment in 2025 being around $1,537 monthly. By accurately determining your AIME and applying the PIA formula, you can gain a clearer picture of how disability is calculated for social security benefits you may be entitled to. Remember, you are not alone in this journey, and we are here to support you every step of the way.

Avoid Common Mistakes in the SSDI Application Process

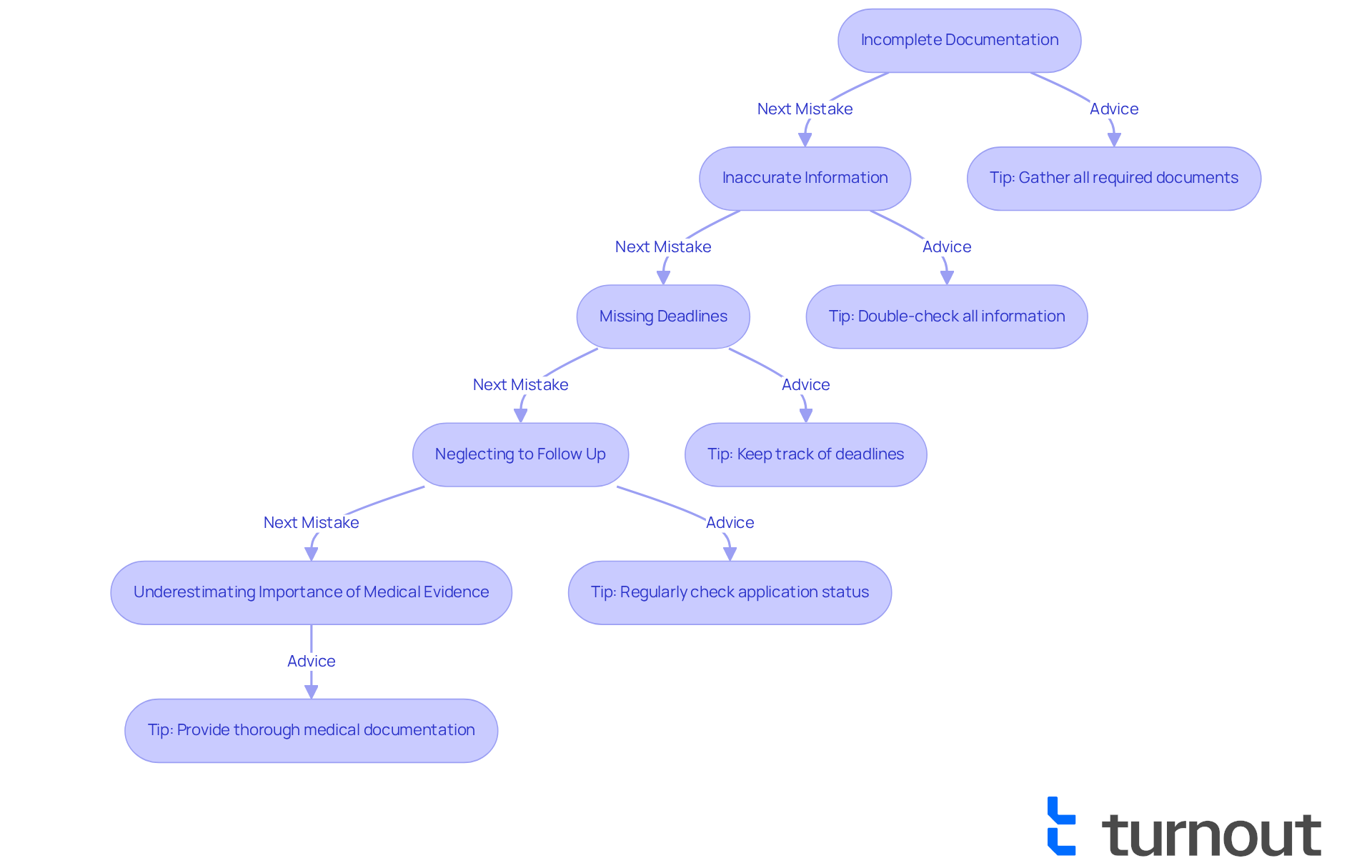

To enhance your chances of a successful SSDI application, it's important to avoid these common mistakes:

-

Incomplete Documentation: We understand that gathering the necessary medical records can be overwhelming. Ensure all required documents are submitted with your application. Insufficient or unclear medical documentation can significantly slow down the approval process, as the Social Security Administration (SSA) requires comprehensive evidence to understand how is disability calculated for social security. Turnout 's trained nonlawyer advocates provide tools and services to help you gather and organize these essential documents effectively.

-

Inaccurate Information: It's common to overlook details. Double-check all personal and medical information for accuracy to prevent discrepancies that could delay processing. Offering inconsistent details across applications, medical records, and employment history can raise red flags and result in denials. Turnout's advocates can assist you in reviewing your application to ensure all information is correct.

-

Missing Deadlines: We know how easy it is to lose track of dates. Be aware of application deadlines and respond promptly to any requests from the SSA. In New Jersey, for instance, you have only 60 days to appeal a denial, making timely action crucial. Turnout can help you keep track of important dates and deadlines to avoid missing critical opportunities.

-

Neglecting to Follow Up: Regularly checking the status of your application can feel daunting, but it’s important. Be proactive in addressing any issues that arise. Failure to cooperate with the SSA's requests for additional information can hinder your application and lead to unnecessary delays. Utilizing Turnout's services can help you stay informed and engaged throughout the process.

-

Underestimating the Importance of Medical Evidence: Providing thorough medical documentation is essential. It should clearly outline your disability and its effect on your capacity to perform tasks. Many SSDI applications are denied due to incomplete documentation, so it is vital for a successful claim to ensure that your medical records are thorough and up-to-date, especially when considering how is disability calculated for social security. As emphasized by advocates, detailed medical records are critical in supporting your case and demonstrating how your condition limits your work capabilities. Turnout's expert guidance can help you understand what medical evidence is necessary to strengthen your application.

Conclusion

Understanding how disability is calculated for Social Security benefits is crucial for individuals seeking financial support due to qualifying disabilities. We recognize that this process can feel overwhelming, but this comprehensive guide aims to illuminate the essential components of Social Security Disability Insurance (SSDI). Key elements such as Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA) play significant roles in determining benefit amounts. By familiarizing yourself with these components, you can navigate the often complex application process with greater confidence.

Throughout this article, we highlight the importance of work history and the calculation methods for AIME and PIA. It’s also vital to understand the adjustments made for cost-of-living increases. We address common pitfalls in the application process and emphasize the necessity of thorough documentation and accurate information. By grasping these factors, you not only prepare a successful claim but also become aware of your rights and entitlements.

Ultimately, the journey to secure SSDI benefits may seem daunting, but it’s essential to approach it with knowledge and clarity. We encourage you to take proactive steps in gathering necessary documentation, understanding calculation methods, and utilizing available resources, such as advocacy services, to enhance your chances of success. Remember, you are not alone in this journey. By empowering yourself with information and support, you can achieve the financial assistance you need and deserve.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance (SSDI) is a federal program that provides financial assistance to individuals who are unable to work due to a qualifying disability.

What are the requirements to qualify for SSDI?

To qualify for SSDI, applicants must demonstrate an adequate work history and have a medically identifiable condition that prevents them from engaging in substantial gainful activity (SGA) for at least 12 months.

How is substantial gainful activity (SGA) defined for 2025?

In 2025, the SGA limit is expected to be $1,620 per month for non-blind individuals.

How is disability calculated for SSDI?

Disability is calculated based on an individual's work history and contributions through taxes, with a focus on their Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA).

What are Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA)?

AIME is calculated by taking the top 35 years of indexed income, summing these figures, and dividing by the total number of months. PIA is determined using a progressive formula based on AIME, ensuring those with lower earnings receive a higher replacement percentage.

What is the formula for calculating PIA for 2025?

For 2025, 90% of the first $1,226 of AIME is used for PIA, 32% of earnings between $1,226 and $7,391, and 15% of any amount above $7,391.

Can you provide an example of how to calculate PIA?

If your AIME is $4,000, your PIA would be calculated as follows: 90% of the first $1,226 equals $1,103.40, 32% of the amount between $1,226 and $4,000 (which is $2,774) equals $886.68, Thus, total PIA would be approximately $1,990.08.

What changes are expected for SSDI recipients in January 2025?

Starting in January 2025, approximately 68 million Social Security recipients will see their monthly benefits increase by 2.5%.

How can individuals get assistance with the SSDI application process?

Organizations like Turnout offer trained nonlawyer advocates who can help individuals navigate the SSDI application process without the complexities of legal representation.

What resources will the SSA provide to help recipients understand their benefits?

The SSA will distribute revamped notifications in early December, outlining new assistance amounts in clearer language to help recipients understand their rights and benefits.