Overview

Navigating the complexities of forgiven tax debt can be overwhelming. We understand that many individuals face significant financial hardships, and finding relief may feel daunting. This article serves as a compassionate, step-by-step guide to help you explore the Offer in Compromise (OIC) program, a valuable option that allows you to negotiate a lower payment based on your unique circumstances.

You'll discover the essential steps to:

- Determine your eligibility

- Complete the necessary forms

- Submit your application

We emphasize the importance of thorough preparation and professional guidance throughout this process. Remember, you are not alone in this journey; we’re here to help you every step of the way.

As you embark on this path, take comfort in knowing that with the right support, relief from tax debt is achievable. We encourage you to reflect on your situation and consider how the OIC program might offer the relief you seek. Together, we can navigate these challenges and work towards a brighter financial future.

Introduction

Navigating the complexities of tax debt can feel like an uphill battle. We understand that the various programs available for relief may seem overwhelming. Forgiven tax debt offers a lifeline for those grappling with financial hardship. It allows individuals to negotiate lower payments or even eliminate certain penalties. However, the path to achieving tax debt forgiveness is often fraught with challenges and uncertainties.

How can you effectively maneuver through these intricate steps to secure the relief you desperately need? You're not alone in this journey, and we're here to help.

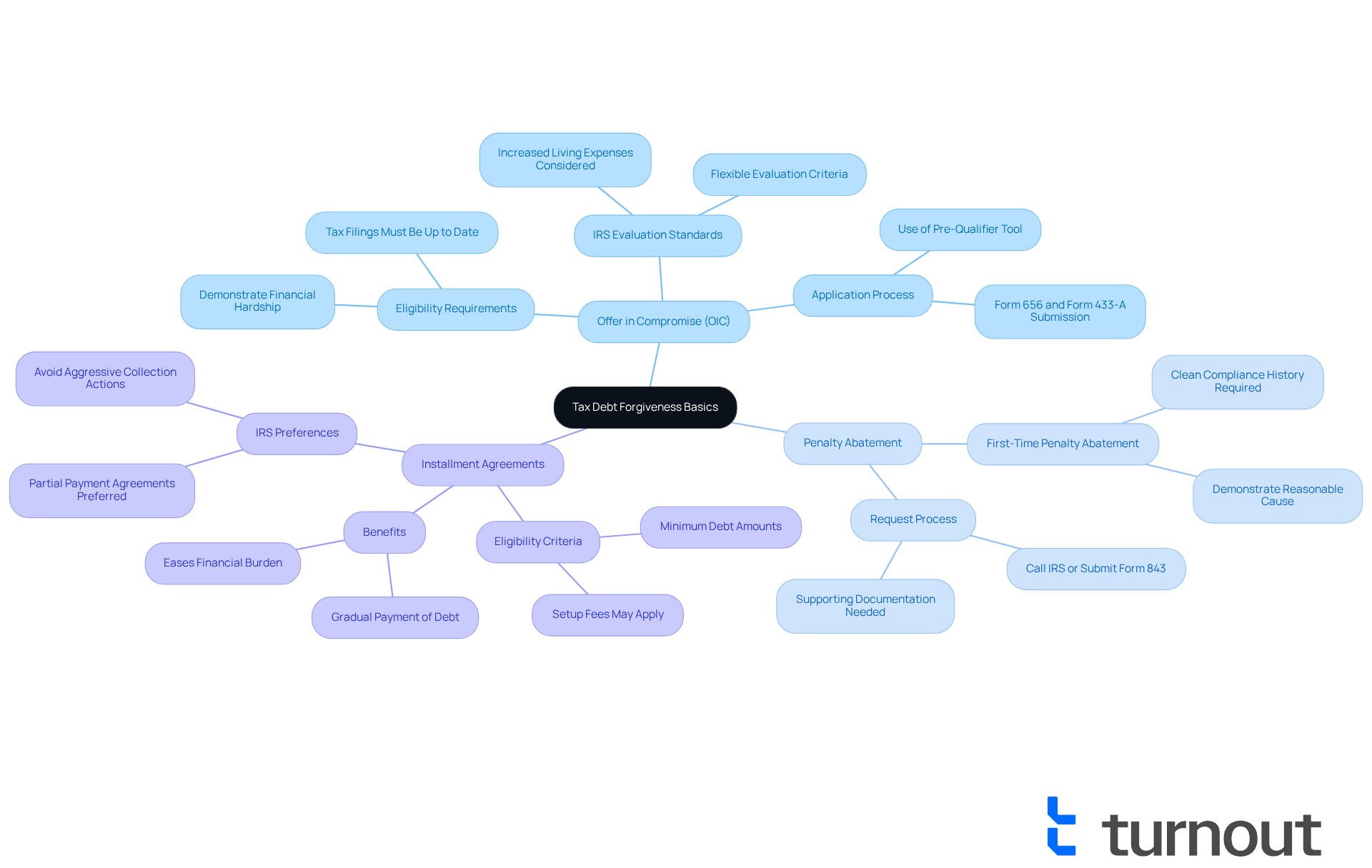

Understand Tax Debt Forgiveness Basics

Programs designed to help you settle your debts for less than what you owe are part of forgiven tax debt forgiveness. One notable method is the Offer in Compromise (OIC), which allows individuals to negotiate a lower payment based on their financial situation. We understand that qualifying for an OIC can be challenging; it's essential to demonstrate financial hardship and ensure that all your tax filings are up to date. In 2025, the IRS has made significant strides to simplify the OIC process, introducing updated evaluation standards that take increased living expenses into account. This change may open the door for more taxpayers to access this much-needed relief. The IRS's Offer in Compromise Pre-Qualifier tool is available to help you determine your eligibility, making the process more approachable.

Additionally, terms like 'penalty abatement' and 'installment agreements' are vital in reducing your overall tax burden. The IRS's First-Time Penalty Abatement policy provides relief from certain penalties if you can demonstrate reasonable cause for your tax issues. Meanwhile, installment agreements allow you to settle your financial obligations gradually, easing the burden over time. Resources like the IRS website offer comprehensive information on these programs, including the Fresh Start initiative, which aims to assist taxpayers in managing their financial responsibilities more effectively.

Success stories from individuals who have navigated the OIC process highlight the potential for significant reductions in forgiven tax debt. As Angelica Leicht, a senior editor for CBSNews.com, notes, "Tax relief companies can provide valuable assistance for taxpayers facing substantial debt or complex situations, but success depends on choosing the right firm for your specific circumstances." This underscores the importance of professional guidance in achieving favorable outcomes. Remember, you are not alone in this journey; we're here to help you find the best path forward.

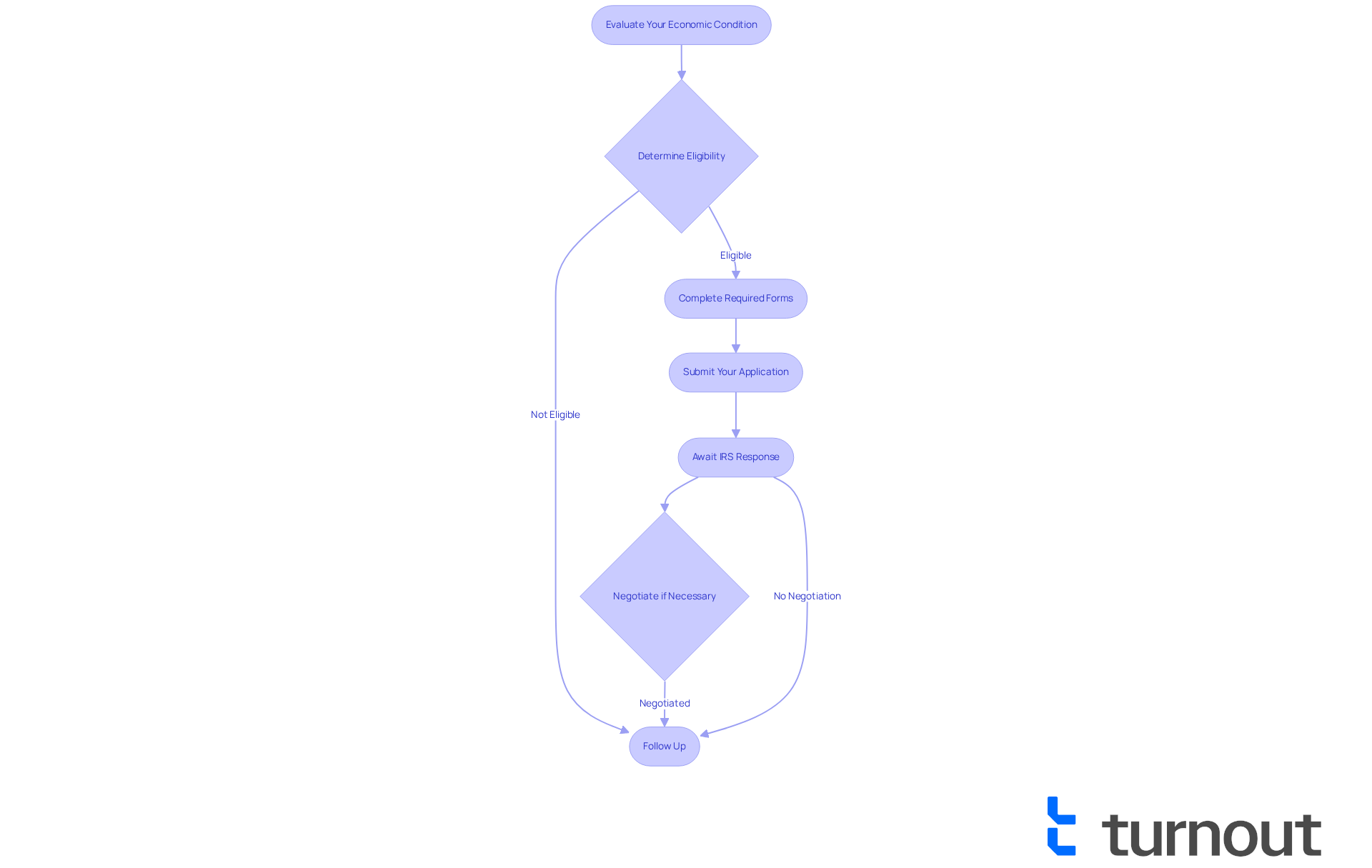

Follow the Step-by-Step Process for Forgiveness

-

Evaluate Your Economic Condition: Start by gathering all your important financial documents, such as income statements, expense reports, and any tax notices. This will give you a clear picture of your financial situation and help you understand your eligibility for tax forgiveness programs.

-

Determine Eligibility: We understand that this can be overwhelming. Use the IRS Offer in Compromise Pre-Qualifier tool to see if you qualify for an OIC. To be eligible, you should have submitted all required tax returns and demonstrate that forgiven tax debt would create financial hardship.

-

Complete Required Forms: If you find that you meet the eligibility criteria, fill out Form 656 (Offer in Compromise) and Form 433-A (OIC) to provide a detailed financial statement. It's crucial that all information is accurate and complete to avoid delays in processing.

-

Submit Your Application: Once your forms are ready, send them along with any necessary documentation and the application fee to the designated IRS address. Remember to keep copies of everything for your records.

-

Await IRS Response: After you submit your application, the IRS will review it. This process can take several months, so patience is key. It's common to feel anxious during this time, so be prepared for the possibility of being contacted for additional information.

-

Negotiate if Necessary: If the IRS counters your offer, it's important to be ready to negotiate. Understanding your financial limits will empower you to respond effectively and work towards a favorable outcome.

-

Follow Up: Keep the lines of communication open with the IRS and respond quickly to any requests for information. Staying engaged can help speed up the process and ensure your application is handled smoothly.

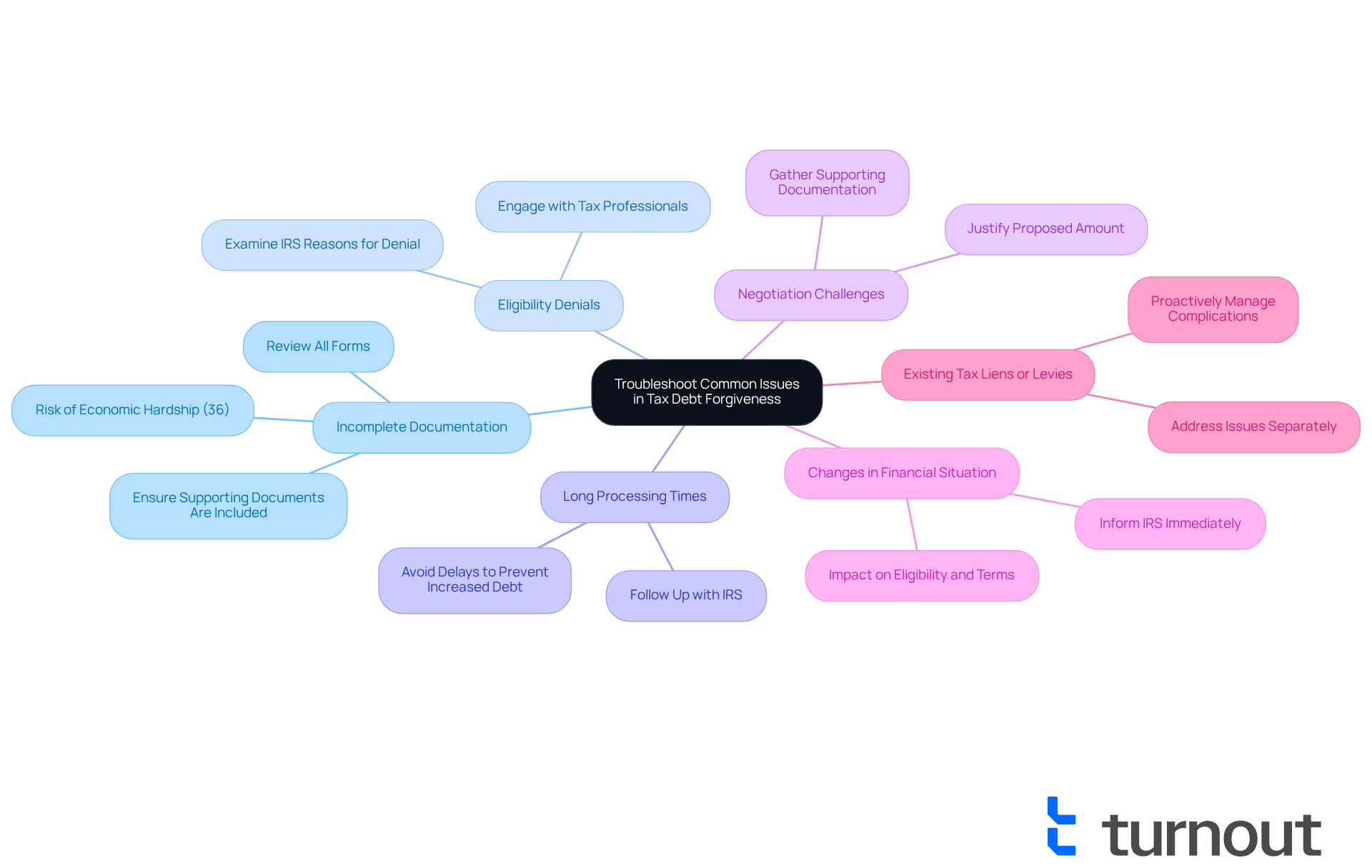

Troubleshoot Common Issues in Tax Debt Forgiveness

-

Incomplete Documentation: We understand that navigating the process of forgiven tax debt can be overwhelming, and one common hurdle is the submission of incomplete or inaccurate documentation. It's essential to meticulously review all forms and ensure that every required monetary statement and supporting document is included. Did you know that approximately 36% of taxpayers entering streamlined installment agreements were at risk of economic hardship? This statistic underscores the importance of thorough preparation.

-

Eligibility Denials: If your application is denied, it's important to carefully examine the reasons provided by the IRS. Typically, denials arise from not satisfying eligibility requirements or not sufficiently demonstrating economic difficulty. Engaging with a tax professional can offer valuable insights on how to strengthen your case and improve your chances of approval. As Tax Law Advocates states, "By collaborating with us, taxpayers gain from personalized advice customized to their unique monetary circumstances."

-

Long Processing Times: We understand it can be frustrating to wait, as the IRS often requires several months to process applications. If you haven't received a response within a reasonable timeframe, we encourage you to follow up with the IRS to inquire about the status of your application. This ensures that your case remains active. Remember, delaying communication can lead to increased tax debt due to penalties and interest. As the IRS warns, "The longer you wait, the more your tax debt grows through penalties and interest — and the fewer options you may have available."

-

Negotiation Challenges: If the IRS counters your offer, it's crucial to be prepared to justify your proposed amount. Gather additional documentation that supports your monetary situation, as this can greatly enhance your negotiation stance and promote a more favorable outcome.

-

Changes in Financial Situation: If your financial circumstances change after submitting your application, it's vital to inform the IRS immediately. Such changes can impact your eligibility and the terms of your offer, making timely communication essential.

-

Existing tax liens or levies can complicate your application process for forgiven tax debt. It's important to address these issues separately, as they may affect your overall tax situation and eligibility for forgiveness. Proactively managing these complications can help streamline your path to relief. Remember, you are not alone in this journey; we're here to help you every step of the way.

Conclusion

Navigating the complexities of forgiven tax debt can feel overwhelming, but understanding the options and processes available is essential for achieving the financial relief you deserve. This guide emphasizes the significance of programs like the Offer in Compromise (OIC), penalty abatement, and installment agreements, which together offer pathways for individuals to ease their tax burdens. With recent updates from the IRS aimed at simplifying these processes, more taxpayers may find themselves eligible for the assistance they need.

Key insights from this guide highlight the importance of:

- Thorough documentation

- Understanding eligibility requirements

- Being ready for negotiations

By following a structured step-by-step process, you can effectively position yourself for success in obtaining tax debt forgiveness. Engaging with tax professionals can also enhance your chances of favorable outcomes, ensuring that your case is handled with the care it deserves.

Ultimately, the journey toward tax debt relief is not one you have to face alone. By taking proactive steps, utilizing available resources, and staying informed about common pitfalls, you can navigate this challenging landscape more effectively. The path to financial freedom is within reach; it’s essential to take action and explore the options available for tax debt forgiveness today.

Frequently Asked Questions

What is tax debt forgiveness?

Tax debt forgiveness refers to programs designed to help individuals settle their debts for less than what they owe, with one notable method being the Offer in Compromise (OIC).

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) allows individuals to negotiate a lower payment to the IRS based on their financial situation, particularly in cases of financial hardship.

What are the requirements to qualify for an OIC?

To qualify for an OIC, individuals must demonstrate financial hardship and ensure that all their tax filings are up to date.

What changes did the IRS make to the OIC process in 2025?

In 2025, the IRS simplified the OIC process by introducing updated evaluation standards that take increased living expenses into account, potentially allowing more taxpayers to access relief.

How can I determine my eligibility for an OIC?

The IRS provides an Offer in Compromise Pre-Qualifier tool to help individuals determine their eligibility for the program.

What is penalty abatement?

Penalty abatement is a term used to describe the relief from certain penalties, which the IRS offers if individuals can demonstrate reasonable cause for their tax issues.

What are installment agreements?

Installment agreements allow taxpayers to settle their financial obligations gradually, easing the burden of paying their tax debts over time.

What is the Fresh Start initiative?

The Fresh Start initiative is a program by the IRS aimed at assisting taxpayers in managing their financial responsibilities more effectively.

How can tax relief companies assist with tax debt?

Tax relief companies can provide valuable assistance for taxpayers facing substantial debt or complex situations, but success depends on choosing the right firm for specific circumstances.

Where can I find more information about tax debt forgiveness programs?

Comprehensive information on tax debt forgiveness programs can be found on the IRS website, which details various resources and initiatives available to taxpayers.