Overview

Finding the best tax relief program for your unique needs can feel overwhelming. We understand that navigating options like:

- Offers in Compromise

- Installment Agreements

- Penalty Abatement

- Currently Not Collectible status

may seem daunting. Each of these options is designed to cater to specific financial situations, and knowing the right choice can make a significant difference in your journey.

It's essential to grasp the eligibility requirements for these programs. Seeking professional guidance can provide clarity and reassurance, helping you to effectively navigate these options. Remember, you are not alone in this process; there are resources available to support you.

By understanding your circumstances and the available solutions, you can choose the most suitable option tailored to your needs. We’re here to help you take that next step with confidence.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially as economic pressures mount. We understand that many individuals and businesses are seeking ways to alleviate their financial burdens. Tax relief programs have emerged as crucial lifelines during these challenging times. This article explores the various tax relief options available, highlighting their unique benefits and eligibility criteria.

You might be wondering: How can you effectively choose the right program to meet your specific needs? Understanding these options is essential for achieving financial stability and avoiding common pitfalls in the tax relief landscape. Remember, you're not alone in this journey; we're here to help you find the support you need.

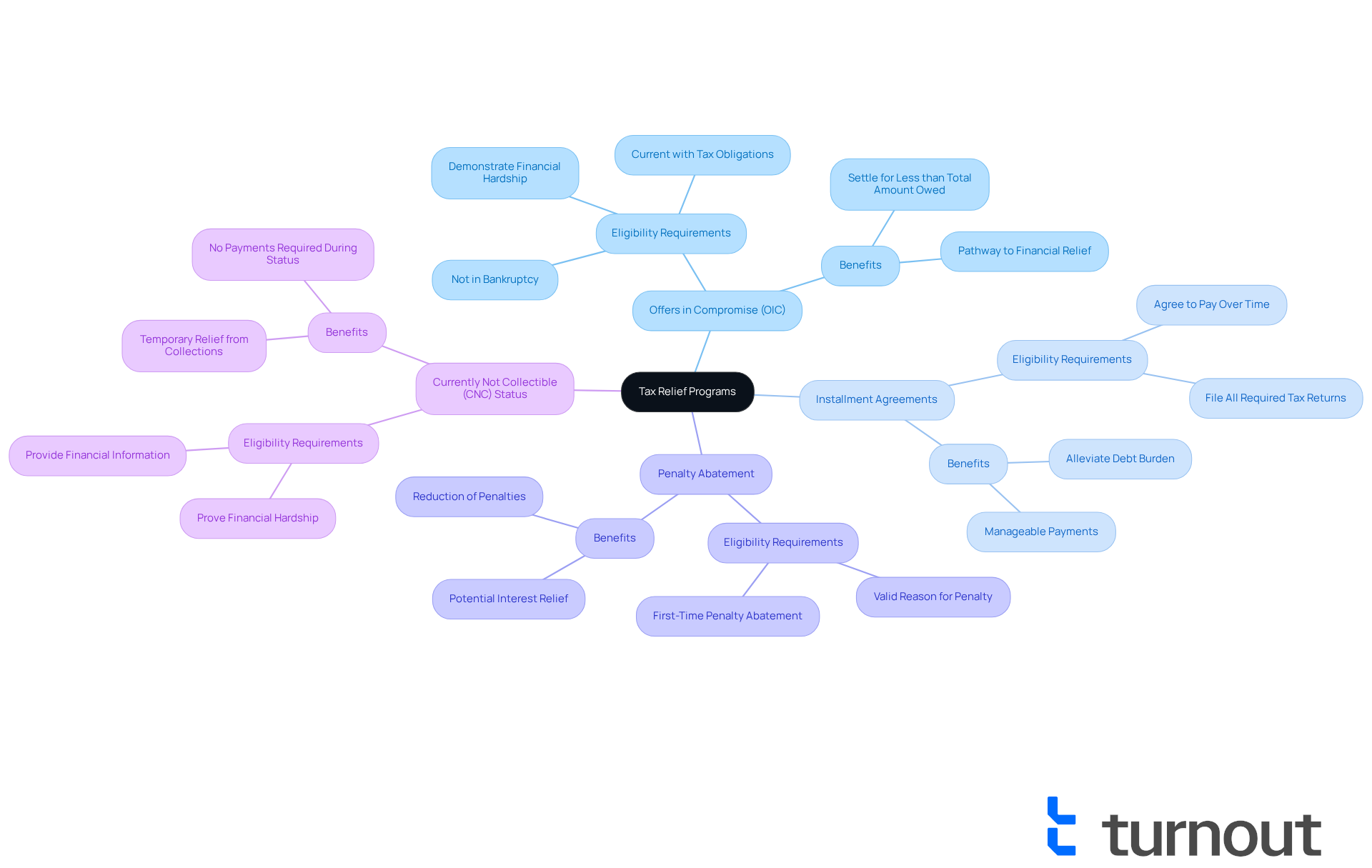

Overview of Tax Relief Programs

The best tax relief program serves as a vital resource for individuals and businesses navigating their tax obligations, especially during challenging economic times. These initiatives are part of the best tax relief program and offer a range of options, including:

- Offers in Compromise (OIC)

- Installment Agreements

- Penalty Abatement

- Currently Not Collectible (CNC) status

Each program, such as the best tax relief program, comes with specific eligibility requirements and benefits, making it essential for taxpayers to understand their choices.

For instance, the OIC allows taxpayers to settle for less than the total amount owed, providing a pathway to financial relief. Similarly, Installment Agreements enable manageable payments over time, alleviating the burden of substantial debts. As we approach 2025, these initiatives are more relevant than ever, with nearly 5 million tax returns receiving penalty assistance from the IRS between 2020 and 2021. This highlights the ongoing need for effective tax management solutions.

Turnout plays a crucial role in this landscape by connecting individuals with trained nonlawyer advocates and IRS-licensed enrolled agents. These professionals can guide clients through complex processes without the need for legal representation. It's important to note that Turnout is not a law firm and does not offer the best tax relief program or have any affiliations with any government agency. This ensures that clients receive tailored support without legal implications. This approach streamlines access to government benefits and financial assistance, allowing everyone, including those with disabilities, to effectively pursue the best tax relief program.

Furthermore, the Tennessee property tax assistance program, operational since 1973, aids over 100,000 individuals annually, distributing more than $41 million to qualifying homeowners, particularly low-income elderly and disabled individuals. This illustrates the tangible impact of the best tax relief program in assisting consumers with managing their financial responsibilities. Additionally, it's crucial to recognize that an applicant's partner's income is necessary to determine eligibility for tax assistance, regardless of residency or ownership.

Lastly, we encourage taxpayers to be vigilant about potential scams related to tax relief calls, especially if they do not owe any amount to the IRS or state tax authority. Understanding these options is vital for managing tax liabilities effectively and selecting the best tax relief program to achieve financial stability. Remember, you are not alone in this journey; we’re here to help.

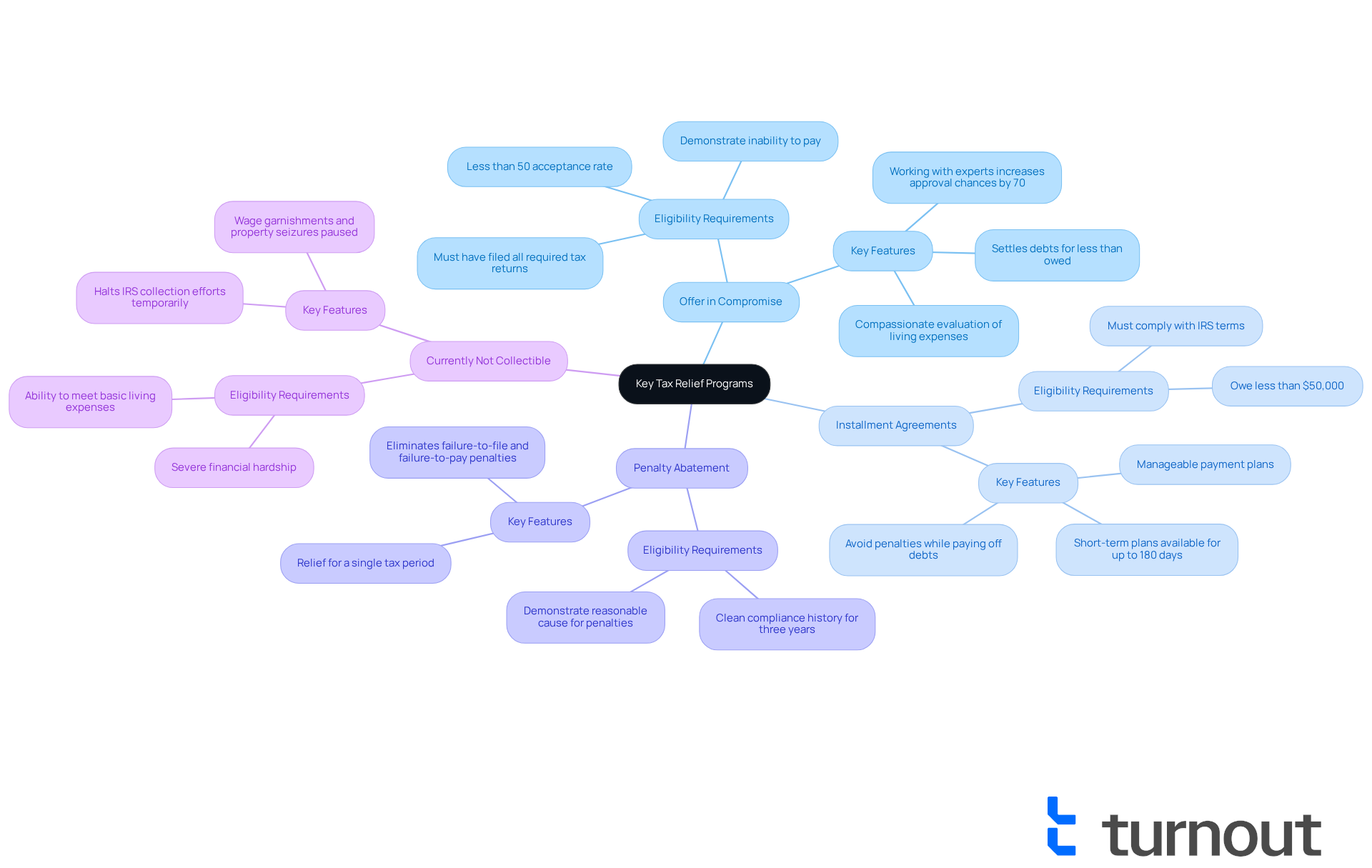

Key Tax Relief Programs: Features and Eligibility

-

If you're feeling overwhelmed by your tax obligations, the best tax relief program, which is the Offer in Compromise initiative, might be a lifeline for you. This program allows taxpayers to settle their debts for less than what they owe, but it requires demonstrating a genuine inability to pay. In 2025, the IRS has made this option even more accessible, with average settlements significantly lower than the original amounts. This reflects a compassionate approach to evaluating living expenses. However, it's important to remember that less than half of all OIC applications are accepted. Partnering with a qualified expert can significantly boost your chances of approval in the best tax relief program by as much as 70%. We understand how daunting this process can feel, but you're not alone in this journey.

-

Installment Agreements: If you're facing challenges in paying your taxes all at once, consider an installment agreement. This option allows you to create a manageable payment plan, especially if you owe less than $50,000. In 2025, streamlined agreements have become easier to access, helping you avoid penalties while paying off your debts over time. The IRS also offers short-term payment plans for up to 180 days, providing additional flexibility. Imagine alleviating the stress of immediate payment demands while staying compliant with IRS requirements. You deserve peace of mind.

-

If late payments or filings have caused you distress, the best tax relief program, which is Penalty Abatement, could offer you relief. By demonstrating reasonable cause, such as a medical emergency, you may qualify for assistance with penalties. The IRS's First-Time Penalty Abatement policy is particularly helpful for individuals with a clean compliance history over the past three years, allowing you to request relief for a single tax period. This could significantly lighten your overall tax burden.

-

If you're experiencing severe financial hardship, you might qualify for the best tax relief program, which is Currently Not Collectible (CNC) status. This status temporarily halts IRS collection efforts, including wage garnishments and property seizures, giving you essential breathing room to meet your basic living expenses. While this doesn’t erase your obligation, it provides a necessary pause during tough times.

Each of these initiatives has distinct eligibility criteria and application procedures. We encourage you to evaluate your individual circumstances thoroughly before moving forward. Remember, you are not alone in this process, and there are options available to help you navigate your tax challenges.

Pros and Cons of Each Tax Relief Option

-

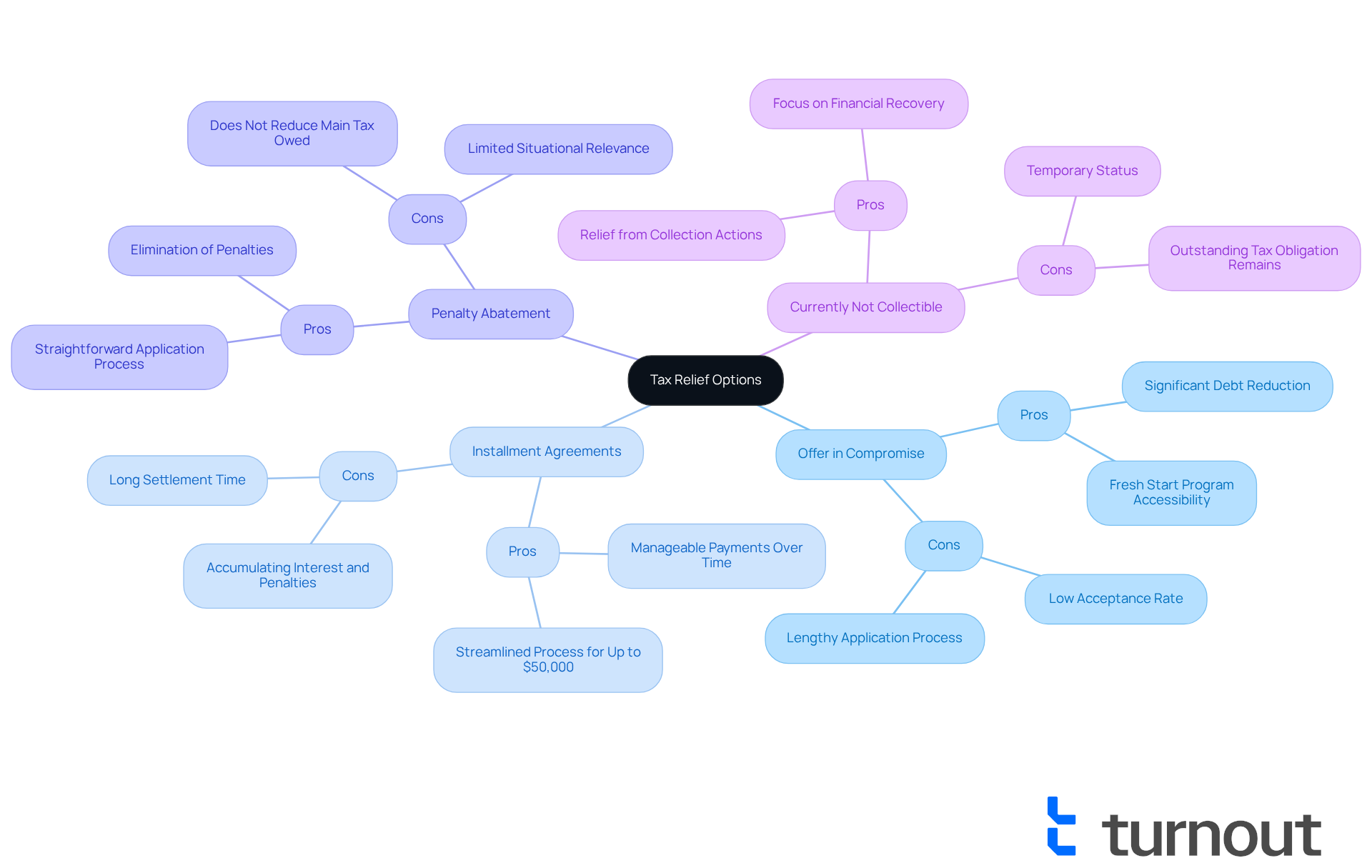

Offer in Compromise (OIC):

- Pros: If you're feeling overwhelmed by tax debt, the OIC can be a lifeline. This option may significantly reduce what you owe, offering a fresh start for those who qualify. The IRS has made the OIC provisions more accessible under the Fresh Start program, allowing more individuals to resolve their obligations for less than the total amount due. However, it’s important to recognize that the acceptance rate for OIC remains low, even with expanded criteria, presenting challenges for many applicants.

- Cons: The application process can be lengthy, often taking six to 24 months, and requires extensive documentation. Many applications face rejection due to financial qualification issues or errors, such as hiding assets or underreporting income. Additionally, the first month's payment must be included with the offer, which can affect your ability to apply.

-

Installment Agreements:

- Pros: If managing your tax debt feels daunting, installment agreements may offer a manageable path forward. These agreements allow you to pay off your debts over time, making it easier to qualify compared to an OIC. Taxpayers owing up to $50,000 can set up streamlined agreements with minimal documentation, facilitating quicker access to relief.

- Cons: However, it’s crucial to understand that interest and penalties continue to accumulate until the obligation is fully settled. This can lead to paying considerably more than your initial tax amount. It may take years to settle the obligation, with ongoing interest fees applying to unpaid balances, which can be as high as 5% of the borrowed amount for bank loans.

-

Penalty Abatement:

- Pros: If penalties are weighing heavily on you, penalty abatement can help lighten that load. This option can reduce your overall tax liability by eliminating penalties, and the application process is relatively straightforward. The IRS offers a first-time penalty abatement policy that can significantly alleviate financial burdens for eligible taxpayers. Additionally, you may qualify for penalty assistance under the Fresh Start program, enhancing the benefits of this option.

- Cons: Keep in mind that penalty reduction is only relevant in certain situations and does not lessen the main tax owed. This means you still need to resolve the underlying obligation.

-

Currently Not Collectible (CNC):

- Pros: If you’re facing immediate financial hardship, the CNC status can provide relief from collection actions. This allows you to focus on recovering financially without the pressure of ongoing IRS enforcement.

- Cons: However, it’s important to note that the CNC status is temporary and must be renewed periodically. It does not remove your tax obligation, which remains outstanding, potentially leading to future collection actions once the status expires.

Choosing the Right Tax Relief Program for Your Situation

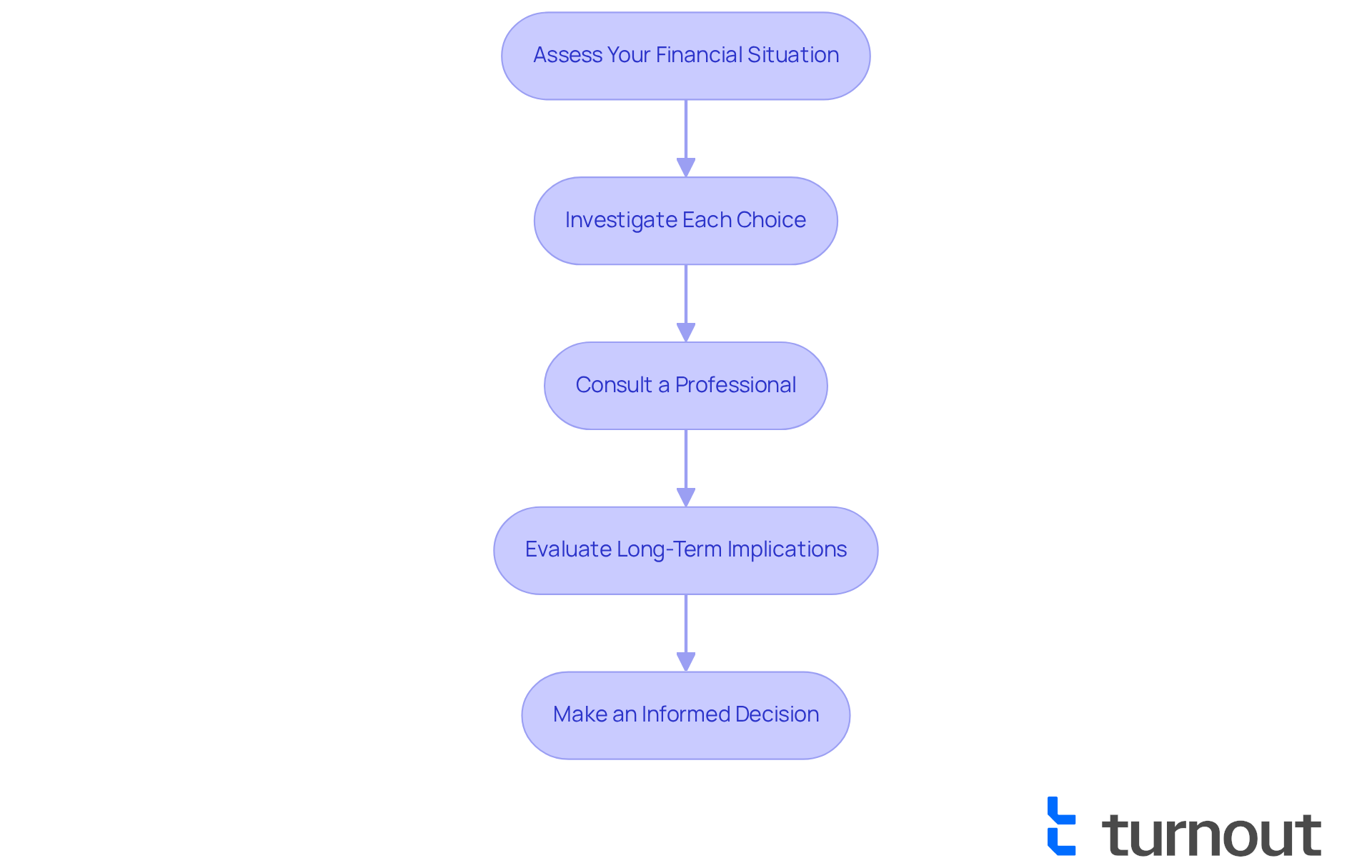

When selecting a tax relief program, it's important to follow these essential steps with care:

-

Assess Your Financial Situation: Start by taking a close look at your total tax debt, income, expenses, and any assets you may have. This comprehensive overview will help clarify what you can afford and which programs you might qualify for. Understanding your financial situation is vital, as it directly impacts your eligibility for different assistance options. Remember, unpaid taxes and penalties can accumulate interest, increasing your total debt over time.

-

Investigate Each Choice: Familiarize yourself with the features, eligibility criteria, and potential outcomes of each tax assistance initiative. This knowledge empowers you to make informed choices based on your unique circumstances.

-

Consult a Professional: Connecting with a tax resolution expert can provide you with personalized guidance tailored to your situation. Experts can help you navigate the complexities of each program, ensuring you understand the nuances that may influence your support options. As specialists often say, 'Collect your financial paperwork — pay stubs, expenses, assets, and debts — since any IRS assistance initiative will depend on what you can realistically afford.'

-

Evaluate Long-Term Implications: Think about how each option will affect your financial future, including any potential tax liabilities that may arise once assistance is granted. A thorough evaluation helps you avoid unexpected consequences down the road.

-

Make an Informed Decision: Carefully weigh the pros and cons of each option against your financial goals. Choose the program that best aligns with your needs, ensuring that the best tax relief program offers a viable path toward resolving your tax issues.

In 2025, understanding your financial circumstances is more crucial than ever, as tax assistance services can vary significantly in cost and effectiveness. Average consultation fees with tax specialists generally range from $700 to $10,000, depending on the complexity of your situation. Therefore, gathering financial records like pay stubs, expenses, assets, and debts is essential, as any IRS assistance program will rely on what you can genuinely afford. By following these steps, you can navigate the tax relief landscape with confidence and clarity. Remember, you are not alone in this journey; we're here to help.

Conclusion

Navigating the complexities of tax obligations can feel overwhelming, and we understand that. However, discovering the best tax relief programs available can illuminate a pathway to financial stability. By exploring options like:

- Offers in Compromise

- Installment Agreements

- Penalty Abatement

- Currently Not Collectible status

both individuals and businesses can uncover tailored solutions to alleviate their tax burdens. Each program presents unique benefits and eligibility criteria, highlighting the importance of assessing your personal financial situation before making a decision.

Key insights reveal the significance of professional guidance in successfully navigating these programs. It's essential to consider the potential risks and rewards associated with each option. For example, while an Offer in Compromise may offer substantial debt relief, it also comes with challenges related to acceptance rates and application complexity. Similarly, Installment Agreements can ease immediate financial pressure but may lead to higher overall costs due to accruing interest. Understanding these nuances empowers you to make informed decisions.

Ultimately, the journey toward tax relief is not one you have to face alone. Engaging with tax resolution experts and diligently evaluating your circumstances can significantly enhance the likelihood of finding the right program for you. As the landscape of tax relief evolves, particularly in 2025, taking proactive measures and making informed choices will be vital in achieving financial peace. Remember, taking that first step toward understanding and utilizing these resources can transform a daunting situation into an opportunity for recovery and growth. We're here to help you on this journey.

Frequently Asked Questions

What is the purpose of tax relief programs?

Tax relief programs serve as vital resources for individuals and businesses to navigate their tax obligations, particularly during challenging economic times.

What types of options are available under tax relief programs?

Available options include Offers in Compromise (OIC), Installment Agreements, Penalty Abatement, and Currently Not Collectible (CNC) status.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) allows taxpayers to settle their tax debt for less than the total amount owed, providing a pathway to financial relief.

How do Installment Agreements work?

Installment Agreements enable taxpayers to make manageable payments over time, helping to alleviate the burden of substantial debts.

Why are tax relief programs particularly relevant as we approach 2025?

Tax relief programs are increasingly relevant due to the significant number of tax returns receiving penalty assistance from the IRS, highlighting the ongoing need for effective tax management solutions.

What role does Turnout play in tax relief?

Turnout connects individuals with trained nonlawyer advocates and IRS-licensed enrolled agents who can guide clients through complex processes without the need for legal representation.

Is Turnout a law firm?

No, Turnout is not a law firm and does not offer tax relief programs or have affiliations with any government agency.

What is the Tennessee property tax assistance program?

The Tennessee property tax assistance program has been operational since 1973, aiding over 100,000 individuals annually by distributing more than $41 million to qualifying homeowners, particularly low-income elderly and disabled individuals.

How is eligibility for tax assistance determined?

An applicant's partner's income is necessary to determine eligibility for tax assistance, regardless of residency or ownership.

What should taxpayers be cautious about regarding tax relief calls?

Taxpayers should be vigilant about potential scams related to tax relief calls, especially if they do not owe any amount to the IRS or state tax authority.