Overview

We understand that navigating tax matters can be overwhelming. It's important to recognize the difference between tax evasion and tax avoidance.

- Tax evasion is illegal and can lead to serious consequences, including hefty fines and even imprisonment.

- On the other hand, tax avoidance is a legal way to reduce your tax liabilities, and it involves strategies like claiming deductions and credits.

This distinction is crucial for your peace of mind. Engaging in tax evasion can result in criminal charges, which can be frightening. However, knowing that tax avoidance strategies are legitimate financial practices can empower you. We encourage you to explore these strategies, as they are designed to help you manage your finances more effectively.

Remember, you are not alone in this journey. Many individuals face similar challenges, and there are resources available to assist you. By understanding these concepts, you can make informed decisions that support your financial well-being. We're here to help you navigate these complexities with confidence.

Introduction

Navigating the intricate landscape of tax responsibilities can feel overwhelming for both individuals and businesses, especially as tax regulations continue to evolve. It's common to feel uncertain about the differences between tax evasion and tax avoidance, and many may unknowingly find themselves in a precarious situation.

In this article, we will explore the critical distinctions between these two concepts, providing you with the legal strategies available to minimize your tax liabilities while steering clear of the severe penalties associated with evasion.

With the stakes higher than ever, we understand that you may be asking: how can you navigate these complexities to ensure compliance and protect your financial integrity? We're here to help you on this journey.

Define Tax Evasion and Tax Avoidance

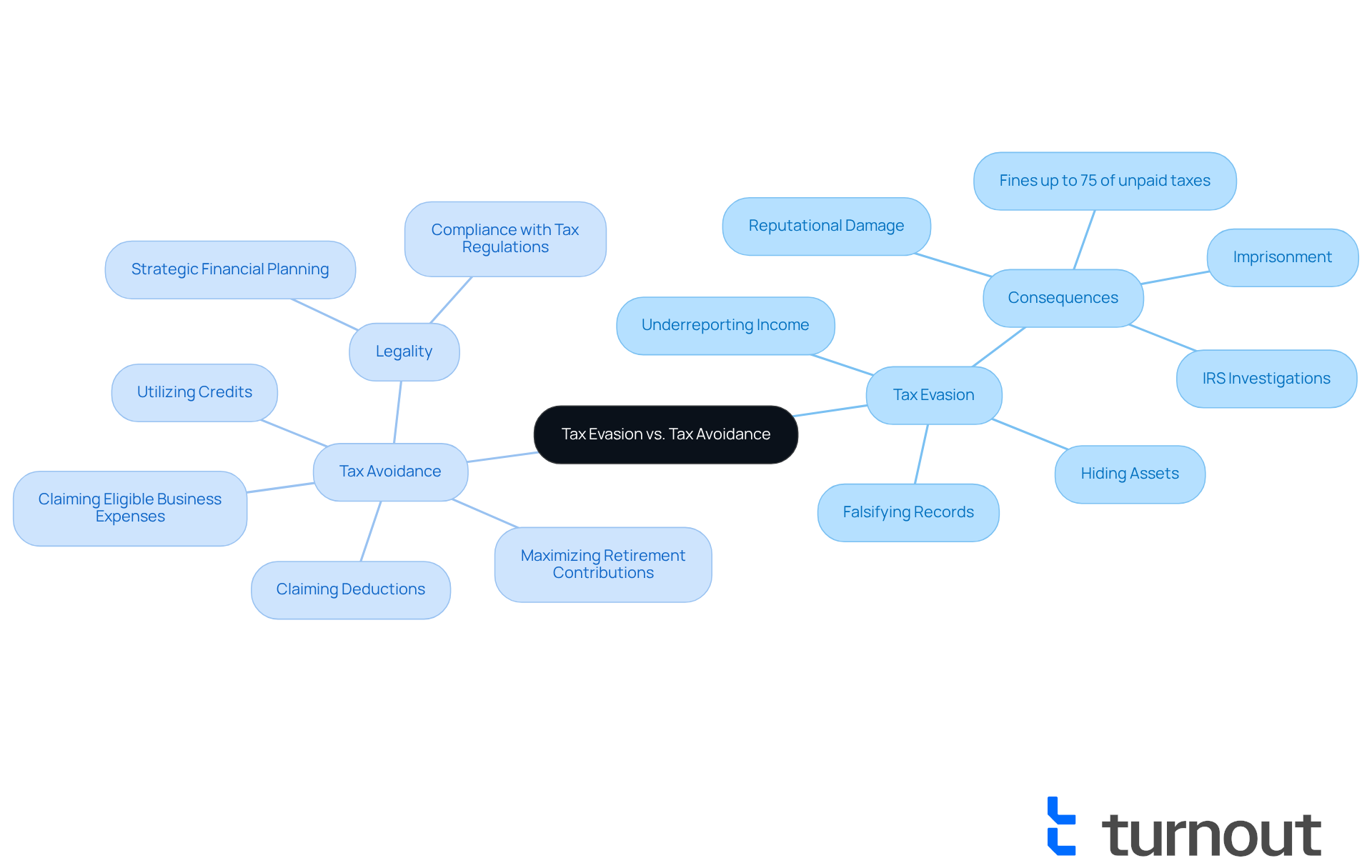

Tax avoidance can often be misunderstood. It includes unlawful activities aimed at escaping tax responsibilities, such as:

- Underreporting income

- Falsifying records

- Hiding assets

In contrast, tax avoidance is a legal practice that minimizes tax liabilities through legitimate strategies, like:

- Claiming deductions

- Utilizing credits

It’s essential to note that tax evasion is classified as a criminal offense, carrying severe penalties, including fines of up to 75% of unpaid taxes and potential imprisonment. However, tax avoidance is recognized as a lawful method of financial planning that complies with tax regulations.

We understand that many Americans struggle to differentiate between the concepts of evasion vs avoidance. Recent studies show that only about 25% demonstrate a clear understanding of the differences in evasion vs avoidance. This confusion can lead to serious consequences. Participating in tax evasion can trigger IRS investigations and result in reputational damage.

Consider the prominent cases of tax fraud that have underscored the dangers. Individuals have faced significant penalties and even incarceration for their actions. On the other hand, tax avoidance strategies, like:

- Maximizing retirement contributions

- Claiming eligible business expenses

are not only permissible but also encouraged as prudent financial practices. As authorities strengthen the implementation of tax regulations, it’s vital for individuals and companies to emphasize ethical tax practices to avoid the pitfalls associated with the concepts of evasion vs avoidance.

As Ishan Jetley pointed out, "The ethical and regulatory distinctions between the two are clear, and it is crucial for people and businesses to comprehend these differences to ensure adherence to tax regulations and maintain their financial integrity." Remember, you are not alone in this journey, and we’re here to help you navigate these complexities.

Examine Legal Consequences of Evasion and Avoidance

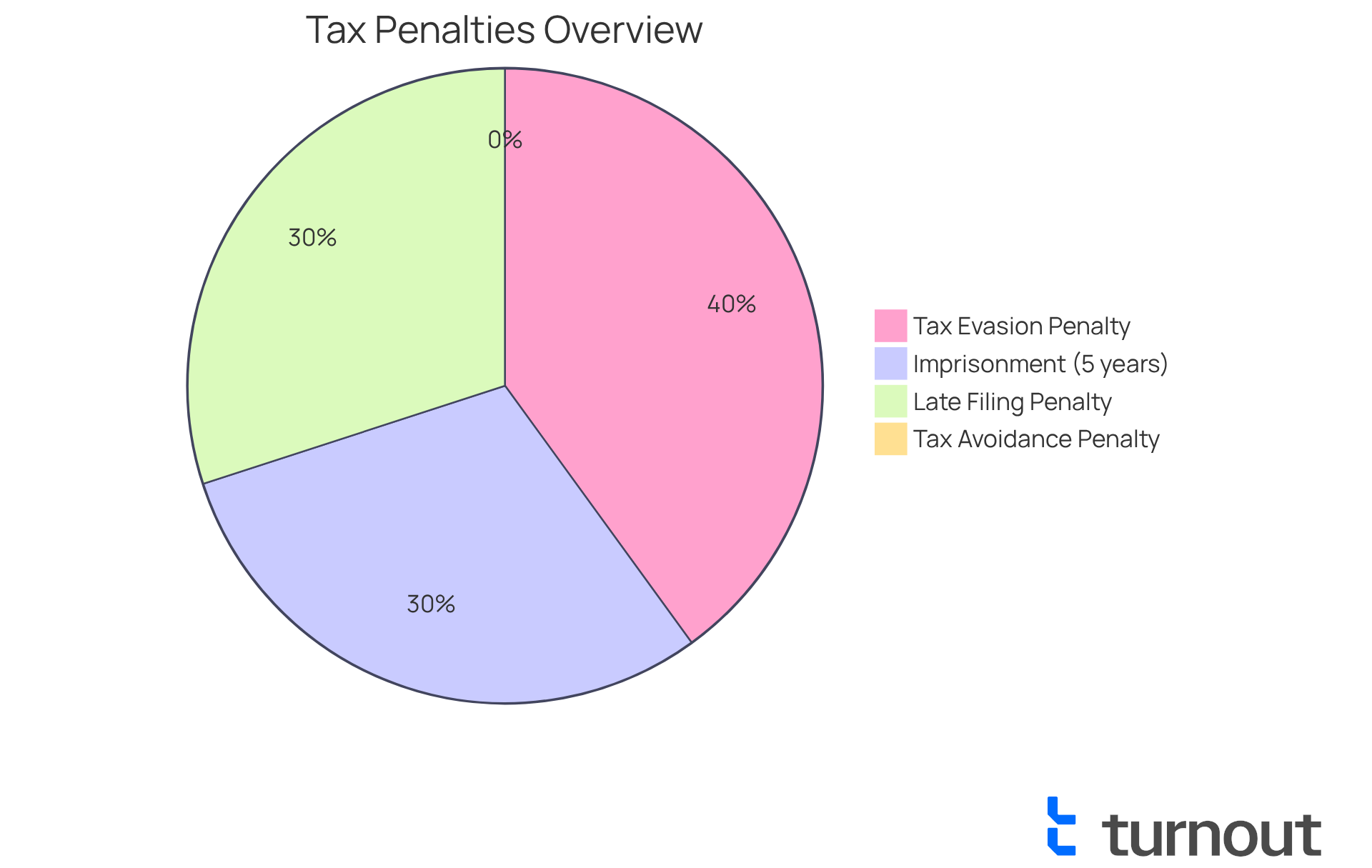

We understand that the ramifications of tax evasion vs avoidance can be quite serious, involving substantial penalties and even the possibility of incarceration. For instance, individuals found guilty of tax evasion vs avoidance may face penalties that can reach $100,000 and imprisonment for as long as five years. It's important to recognize that the distinction between tax evasion vs avoidance, when conducted within the boundaries of regulations, does not incur penalties. However, we must also acknowledge that aggressive strategies regarding evasion vs avoidance might draw scrutiny from tax authorities, potentially leading to audits or investigations.

As of 2025, the minimum penalty for individual taxpayers who file over 60 days late has increased to $525. This change emphasizes the financial implications of late filings, which can add to the stress many taxpayers feel. Comprehending these regulatory implications is vital for managing responsibilities without overstepping boundaries. Remember, you are not alone in this journey; understanding your obligations can help you navigate these challenges with confidence.

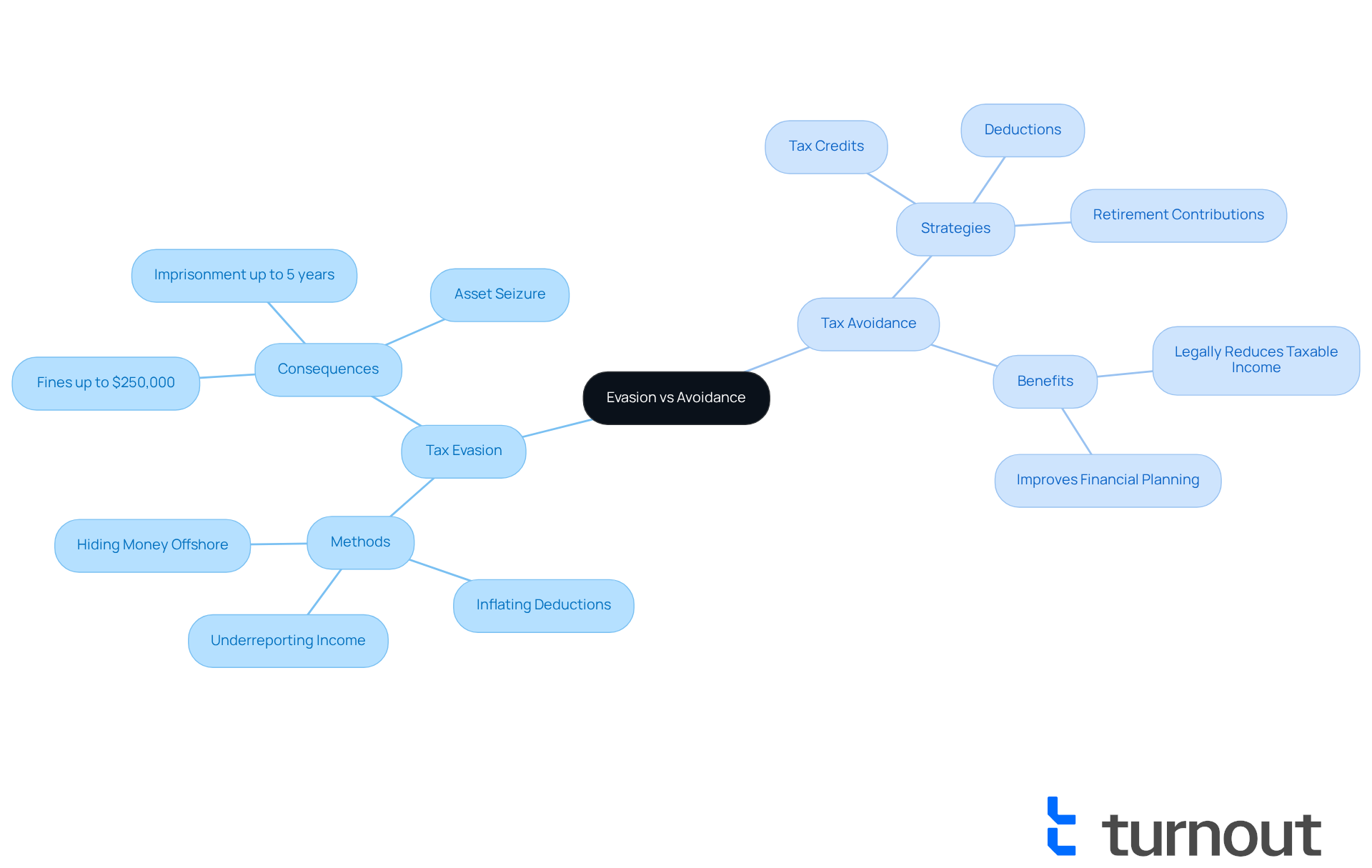

Contrast Methods of Evasion and Avoidance

Tax evasion methods can often feel overwhelming and involve deceitful practices like underreporting income, inflating deductions, or hiding money in offshore accounts. These actions mislead tax authorities and evade obligations, leading to severe penalties, including imprisonment for up to 5 years and fines reaching $250,000. For instance, a Massachusetts man recently pleaded guilty to a decade-long tax fraud scheme, highlighting the serious consequences of such actions.

On the other hand, tax avoidance offers lawful strategies that can ease your financial burden. Utilizing tax credits, deductions, and tax-efficient investment vehicles can make a significant difference. For example, contributing to retirement accounts can legally reduce your taxable income. By contrasting evasion vs avoidance, you can gain a clearer understanding of how to ethically and legally reduce your tax liabilities.

As tax strategists highlight, grasping the ethical and regulatory differences between evasion vs avoidance is essential for adherence. Utilizing available credits and deductions is much like using coupons at a grocery store—saving money without breaking the law. By emphasizing these distinctions, you can manage your tax responsibilities wisely while steering clear of the traps of unlawful avoidance. Remember, we're here to help you navigate this complex landscape. You are not alone in this journey.

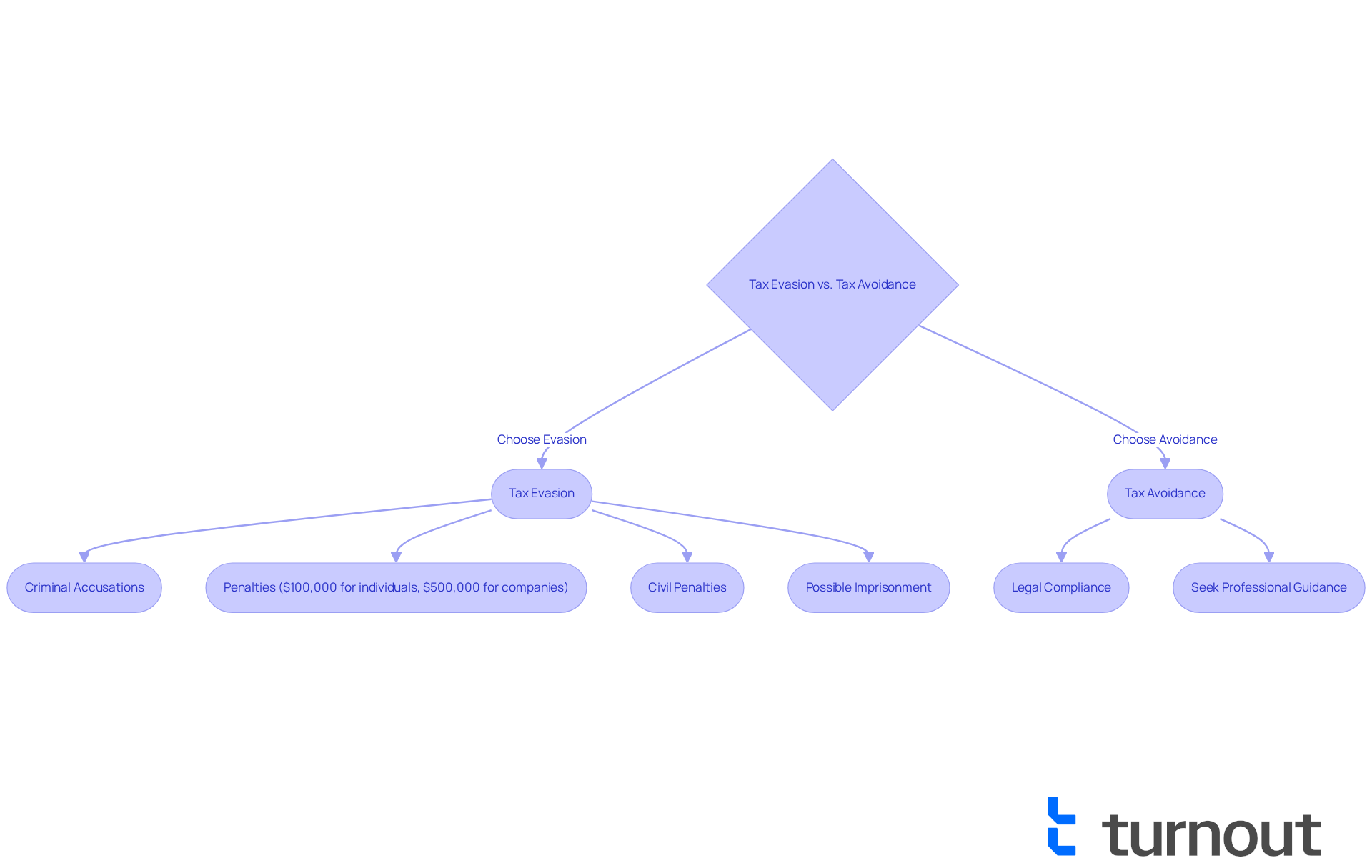

Assess Risks and Penalties of Tax Evasion

The risks associated with tax evasion vs avoidance can be daunting. It's essential to understand the difference between evasion vs avoidance of financial obligations, as both can lead to severe financial and legal repercussions. If someone is found to have evaded taxes, they may face criminal accusations, with penalties that can reach $500,000 for companies and $100,000 for individuals. Additionally, the IRS imposes civil penalties, which include interest on unpaid taxes and extra fines for fraudulent activities.

We understand that navigating these complexities can be overwhelming. In 2025, the IRS has increased its scrutiny of taxpayers trying to hide assets in offshore accounts and digital assets. It's crucial to remember that taxpayers are legally responsible for the accuracy of their returns, not just the promoters of questionable schemes. The potential for imprisonment underscores the seriousness of tax evasion vs avoidance. For instance, the IRS has successfully prosecuted numerous cases where individuals attempted to conceal income through offshore accounts, resulting in significant penalties and jail time.

Financial advisors consistently warn that the distinction between tax evasion vs avoidance is crucial, as engaging in evasion can lead to devastating consequences. They urge taxpayers to seek reputable guidance to navigate their obligations legally. As one tax professional wisely advises, "Your best bet is to get in touch with a tax professional." Understanding these risks is vital for taxpayers to avoid the pitfalls of illegal tax practices. Remember, you are not alone in this journey, and we're here to help you find the right path forward.

Conclusion

Understanding the distinctions between tax evasion and tax avoidance is crucial for anyone navigating their financial responsibilities. We understand that financial matters can feel overwhelming, and it’s important to clarify these terms. While tax evasion involves illegal activities aimed at escaping tax obligations, tax avoidance encompasses legal strategies to minimize tax liabilities. This clear differentiation is essential not only for compliance but also for maintaining your financial integrity and avoiding severe penalties.

Throughout this article, we’ve explored various aspects of tax evasion and avoidance. The legal repercussions of evasion can be daunting, including hefty fines and even imprisonment. In stark contrast, avoidance strategies are permissible and can be a source of relief. We emphasize the importance of ethical financial practices, highlighting how legitimate tax planning can lead to significant savings without crossing legal boundaries. It’s common to feel anxious about tax obligations, but understanding these strategies can empower you. Additionally, the risks associated with tax evasion were outlined, including scrutiny from tax authorities and the potential for serious legal consequences.

Ultimately, the message is clear: understanding tax risks and consequences is vital for both individuals and businesses. Engaging in tax avoidance through legitimate means is not only lawful but also encouraged. Remember, you are not alone in this journey. Tax evasion, on the other hand, can lead to devastating repercussions. Therefore, seeking guidance from tax professionals and staying informed about tax regulations can empower you to make informed decisions, ensuring compliance and financial well-being. We’re here to help you navigate these complexities with confidence.

Frequently Asked Questions

What is tax evasion?

Tax evasion refers to unlawful activities aimed at escaping tax responsibilities, such as underreporting income, falsifying records, and hiding assets. It is classified as a criminal offense with severe penalties, including fines of up to 75% of unpaid taxes and potential imprisonment.

What is tax avoidance?

Tax avoidance is a legal practice that minimizes tax liabilities through legitimate strategies, such as claiming deductions and utilizing credits. It is recognized as a lawful method of financial planning that complies with tax regulations.

How do tax evasion and tax avoidance differ?

The main difference is that tax evasion involves illegal actions to avoid paying taxes, while tax avoidance involves legal strategies to reduce tax liabilities. Tax evasion can lead to criminal charges, whereas tax avoidance is permissible and encouraged.

What are the consequences of tax evasion?

Consequences of tax evasion can include IRS investigations, significant financial penalties, reputational damage, and potential incarceration for individuals found guilty of tax fraud.

What are some examples of legal tax avoidance strategies?

Legal tax avoidance strategies include maximizing retirement contributions and claiming eligible business expenses. These practices are not only permissible but also encouraged as prudent financial practices.

Why is it important to understand the difference between tax evasion and tax avoidance?

Understanding the difference is crucial to ensure adherence to tax regulations and maintain financial integrity. Misunderstanding these concepts can lead to serious consequences, including legal issues and financial penalties.

What percentage of Americans understand the differences between tax evasion and tax avoidance?

Recent studies show that only about 25% of Americans demonstrate a clear understanding of the differences between tax evasion and tax avoidance.