Overview

We understand that navigating the world of taxes can be overwhelming, especially when it comes to contributions received through GoFundMe. Generally, you do not have to pay taxes on these contributions, as they are typically considered personal gifts rather than taxable income. However, it's important to be aware of certain thresholds that could affect your situation.

If the total amount you receive exceeds the annual gift tax exclusion limit of $19,000, or if you get a Form 1099-K because you surpass IRS reporting thresholds, you may need to file a gift tax return or report this income. This highlights the importance of keeping accurate records.

We encourage you to consult a tax professional for personalized guidance. Remember, you are not alone in this journey, and seeking help can make a significant difference.

Introduction

Navigating the world of crowdfunding can feel both exciting and overwhelming, especially when it comes to understanding the tax implications of platforms like GoFundMe. We recognize that many individuals are turning to this popular fundraising tool for personal causes, healthcare expenses, and educational needs. This raises an important question: Are these contributions taxable? In this article, we aim to clarify the complexities surrounding GoFundMe donations, ensuring that both organizers and contributors are well-informed to avoid surprises come tax season.

With various scenarios that could trigger tax obligations, it's common to wonder: How can one effectively manage these financial contributions while ensuring compliance with IRS regulations? We're here to help you navigate this journey with confidence.

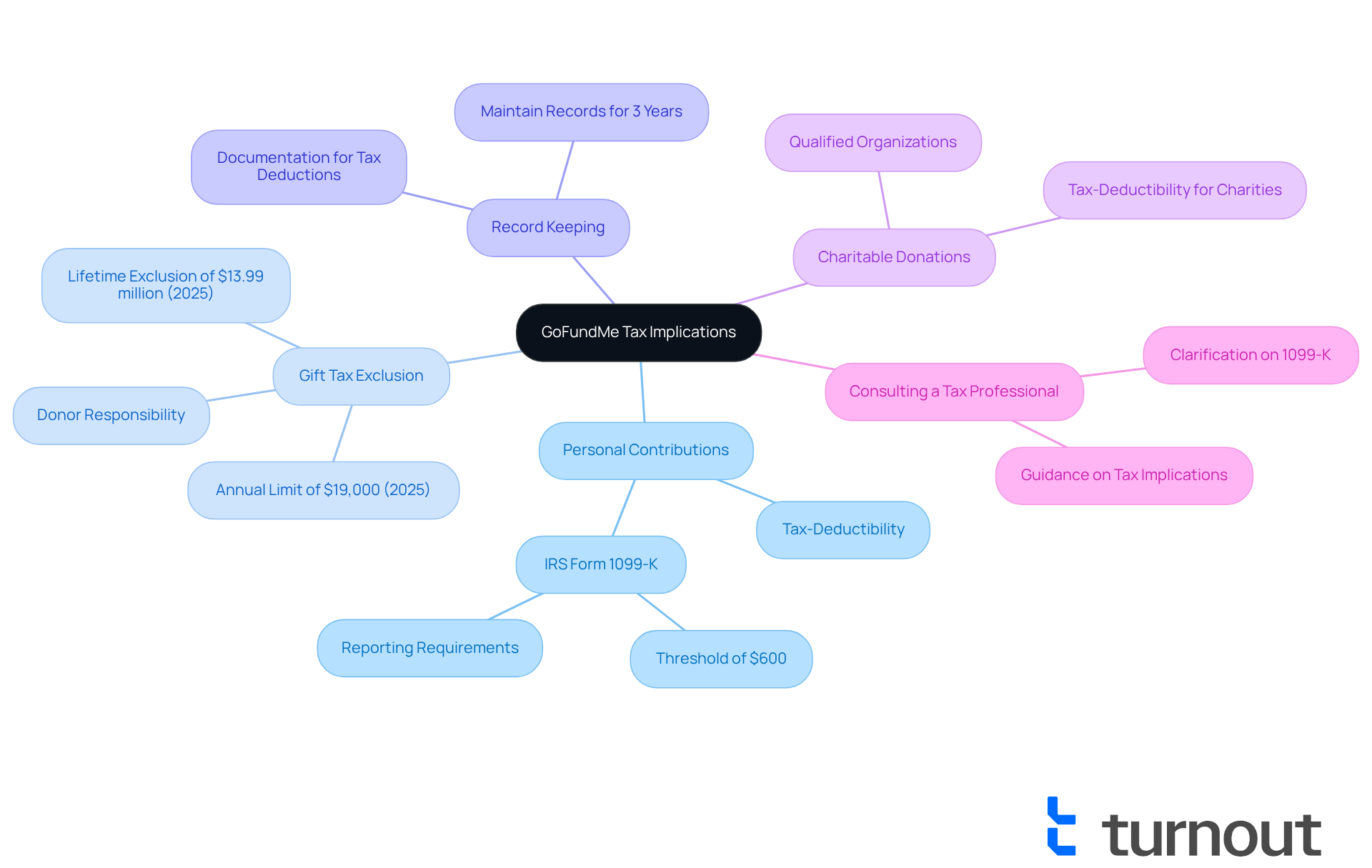

Understand GoFundMe and Its Tax Implications

This widely-used crowdfunding platform allows individuals to gather funds for personal reasons, healthcare costs, education, and more. We understand that navigating the tax implications of funds collected through crowdfunding, such as the question do you have to pay taxes on GoFundMe, can be overwhelming for both organizers and contributors. Generally, contributions made to personal GoFundMe campaigns are considered personal contributions and lead to the question: do you have to pay taxes on GoFundMe, meaning they are usually not tax-deductible. However, it’s important to note that if the total amount received exceeds the annual gift tax exclusion limit of $19,000 in 2025, do you have to pay taxes on GoFundMe, as the recipient may need to file a gift tax return.

It’s essential for both contributors and beneficiaries to keep accurate records of donations and financial distributions for at least three years, as advised by the IRS. This can help alleviate concerns and ensure compliance with regulations. Additionally, money collected for charitable causes may have different tax consequences, especially if it is allocated to a registered 501(c)(3) organization. Consulting a tax professional can provide clarity and support in navigating these complexities. Remember, you are not alone in this journey, and seeking guidance can make a significant difference.

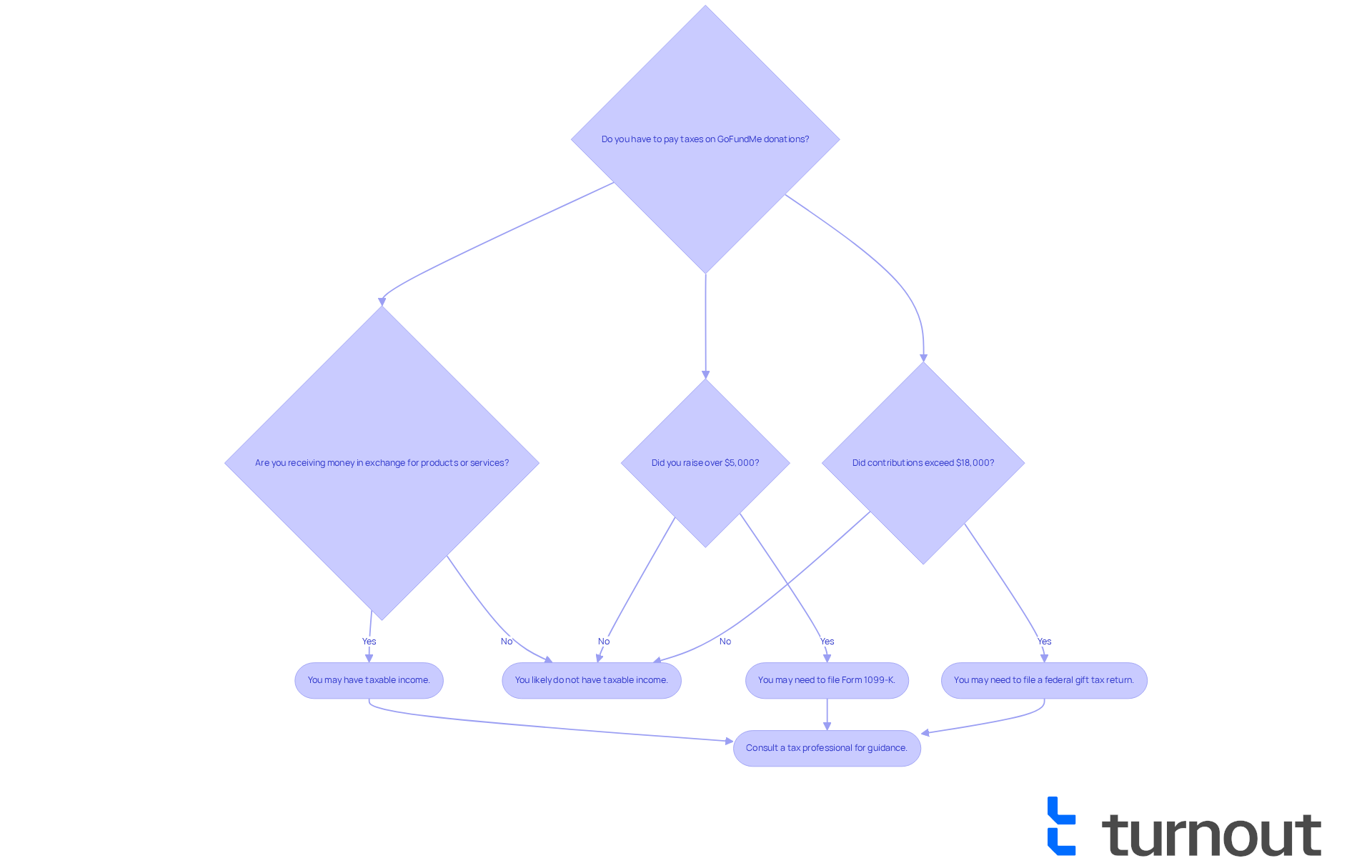

Identify Taxable Situations for GoFundMe Donations

We understand that navigating the world of GoFundMe donations can be challenging, especially when considering do you have to pay taxes on GoFundMe. While many donations are generally not subject to taxation, certain circumstances can lead to tax obligations, which makes one wonder, do you have to pay taxes on GoFundMe? For instance, if you collect money in exchange for products or services, you may wonder, do you have to pay taxes on GoFundMe, as this is considered taxable income. Additionally, if the total amount raised exceeds the IRS reporting threshold of $5,000 in a calendar year, you may wonder, do you have to pay taxes on GoFundMe, as you will likely receive Form 1099-K, indicating that the IRS is aware of the funds you've received.

It's important to note that in 2025, the federal donation tax exclusion limit is set at $19,000. This means that contributors can give up to this amount without triggering donation tax reporting obligations. However, if contributions to personal fundraising campaigns exceed $18,000 (or $36,000 for joint filers), you may wonder do you have to pay taxes on GoFundMe and might need to file a federal gift tax return. Although actual taxes may not be owed unless the lifetime exemption is exhausted, we want you to be aware of the question: do you have to pay taxes on GoFundMe?

Moreover, contributions to personal fundraising campaigns typically do not qualify for tax deductions. Given these complexities, it is crucial to maintain records for at least three years. We encourage you to seek advice from a qualified tax expert to accurately assess whether you have to pay taxes on GoFundMe and ensure compliance with IRS regulations. Remember, you are not alone in this journey, and we're here to help you navigate these challenges.

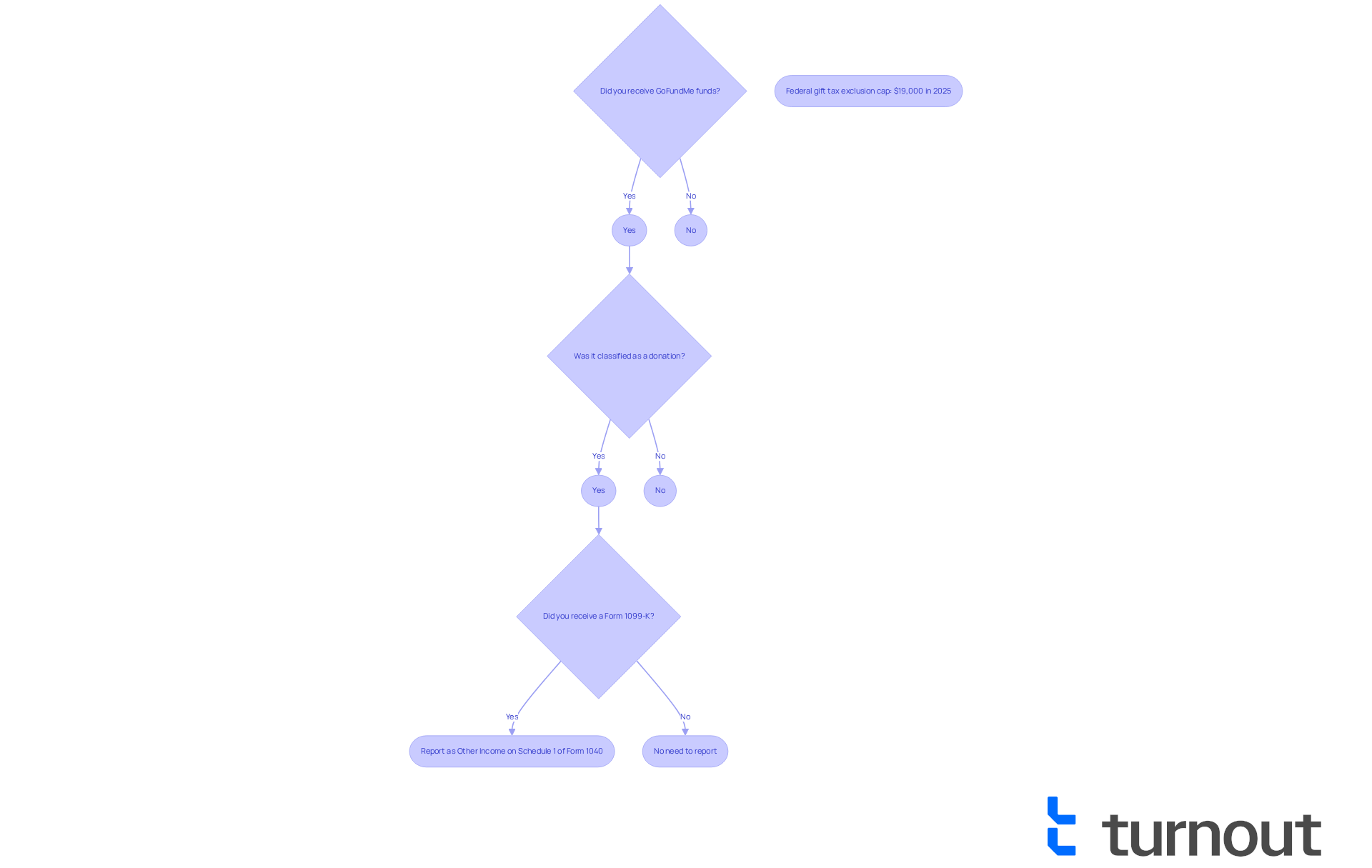

Report GoFundMe Funds on Your Tax Return

When it comes to declaring your GoFundMe contributions on your tax return, many individuals question do you have to pay taxes on GoFundMe, as the precise classification of income can feel overwhelming. It's important to know that contributions may not be considered donations if they aren't made out of detached and disinterested generosity. This distinction can significantly influence their tax treatment.

If your funds are classified as donations, you might wonder, do you have to pay taxes on GoFundMe, since they typically won't need to be reported as taxable earnings? However, if you receive a Form 1099-K, it's essential to report the gross proceeds on your tax return, usually on Schedule 1 of Form 1040 as 'Other Income,' which raises the question: do you have to pay taxes on GoFundMe? We also want to remind you that the federal gift tax exclusion cap is $19,000 in 2025; exceeding this amount could lead to tax obligations.

If you incur expenses related to your fundraising efforts, you may be eligible to deduct those costs, which can effectively lower your taxable income. Maintaining thorough records of your fundraising activities and any associated expenses for at least three years is crucial for ensuring compliance with IRS regulations and facilitating accurate reporting.

We highly recommend consulting a tax professional for guidance on whether you have to pay taxes on GoFundMe amounts received from crowdfunding campaigns. Remember, you're not alone in this journey; we're here to help you navigate these complexities with confidence.

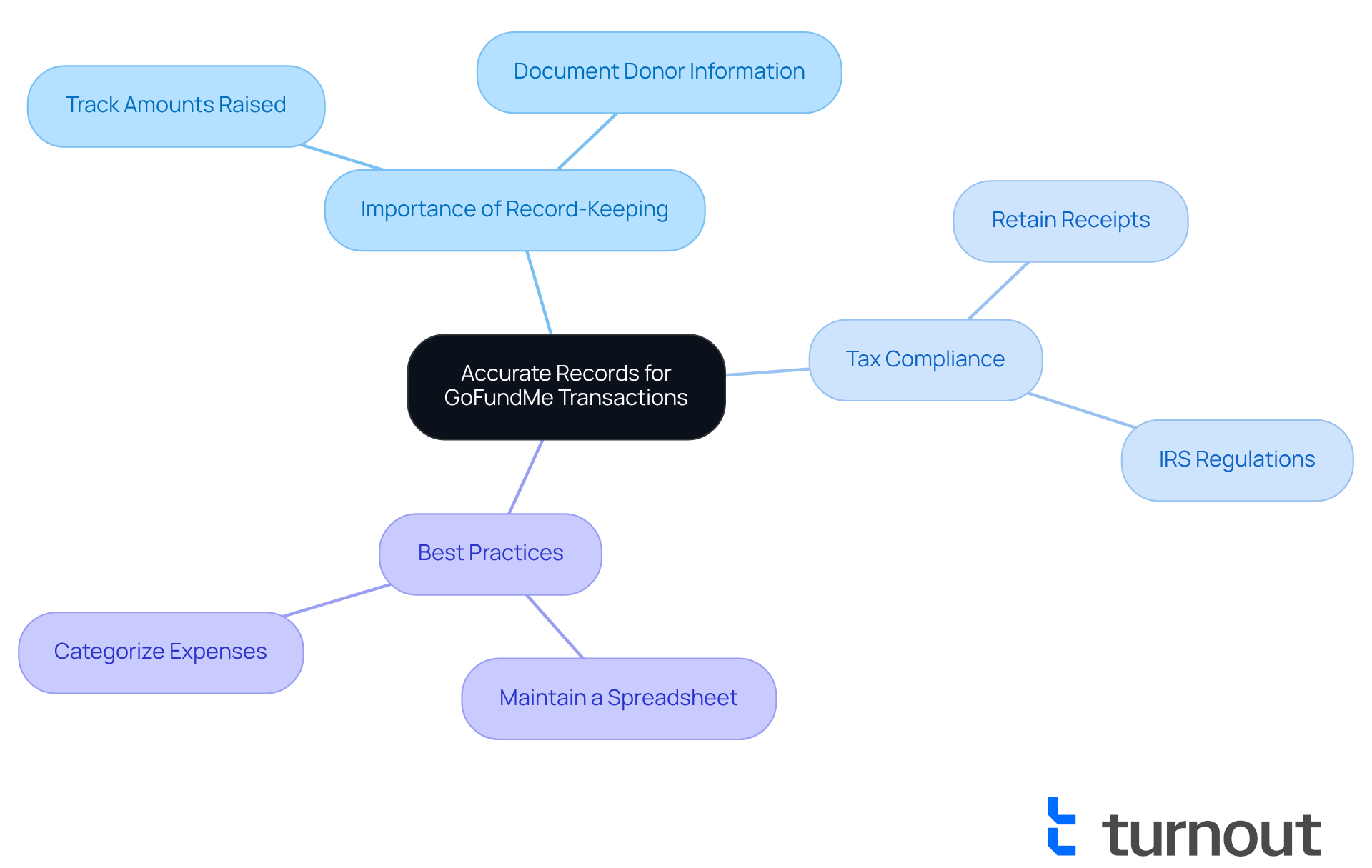

Maintain Accurate Records for GoFundMe Transactions

Keeping precise records of all fundraising transactions is crucial for both organizers and contributors. We understand that managing these details can feel overwhelming, but tracking the amounts raised, the purpose of the funds, and any associated expenses is essential. Organizers should document all donations received, including the names and contact information of donors, as well as any correspondence related to the fundraising campaign.

For tax compliance, it’s common to feel unsure about what to keep, especially when considering do you have to pay taxes on GoFundMe. It's advisable to retain receipts, bank statements, and any forms received from GoFundMe, such as the Form 1099-K, which is required if the campaign exceeds $600 in gross payments. Keeping detailed records not only aids in preparing tax returns but also ensures adherence to IRS regulations, which require that all fundraising activities be documented for at least three years. Additionally, donors pledging over $18,000 may need to file a federal gift tax return.

Best practices include:

- Maintaining a spreadsheet of donations

- Categorizing expenses

- Storing all relevant documentation in a secure location

We’re here to help you navigate these complexities, and consulting a tax professional is also recommended to better understand if you do have to pay taxes on GoFundMe. By following these guidelines, you are not alone in this journey; you can approach your tax obligations related to crowdfunding with confidence.

Conclusion

Understanding the tax implications of GoFundMe donations is essential for both organizers and contributors. We understand that navigating tax obligations can be overwhelming. While many contributions are generally not taxable, specific situations can lead to tax responsibilities. It’s crucial to be aware of the nuances surrounding these funds to effectively manage tax compliance.

Key points to consider include:

- The classification of contributions

- The importance of accurate record-keeping

It’s common to feel uncertain about whether your contributions exceed the annual gift tax exclusion limit, which may require filing a gift tax return. Additionally, funds received in exchange for goods or services are considered taxable income. Maintaining thorough documentation for at least three years is vital to ensure compliance with IRS regulations.

As crowdfunding continues to be a popular means of raising funds, understanding the associated tax obligations is more important than ever. By staying informed and seeking professional guidance, you can confidently manage your GoFundMe campaigns while fulfilling your tax responsibilities. Remember, you are not alone in this journey. Empowerment through knowledge not only alleviates uncertainty but also ensures a smoother financial experience for everyone involved.

Frequently Asked Questions

What is GoFundMe used for?

GoFundMe is a widely-used crowdfunding platform that allows individuals to gather funds for personal reasons, healthcare costs, education, and more.

Are contributions to personal GoFundMe campaigns tax-deductible?

Generally, contributions made to personal GoFundMe campaigns are considered personal contributions and are usually not tax-deductible.

What happens if the total amount received from a GoFundMe campaign exceeds the annual gift tax exclusion limit?

If the total amount received exceeds the annual gift tax exclusion limit of $19,000 in 2025, the recipient may need to file a gift tax return.

How long should contributors and beneficiaries keep records of donations and financial distributions?

Contributors and beneficiaries are advised to keep accurate records of donations and financial distributions for at least three years, as recommended by the IRS.

Do funds collected for charitable causes have different tax implications?

Yes, money collected for charitable causes may have different tax consequences, especially if it is allocated to a registered 501(c)(3) organization.

Should I consult a professional regarding GoFundMe tax implications?

Consulting a tax professional can provide clarity and support in navigating the complexities of tax implications related to GoFundMe campaigns.