Overview

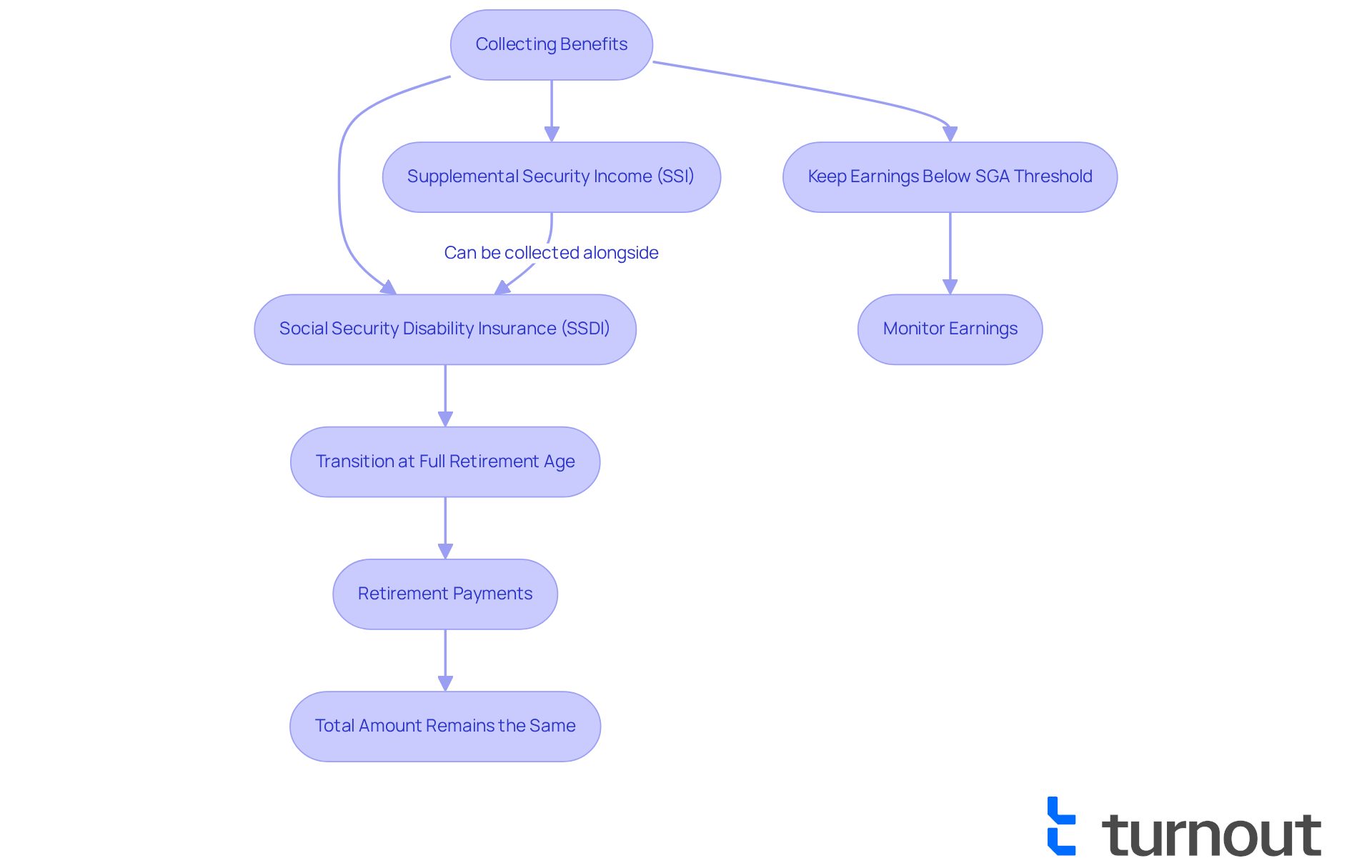

Navigating the world of Social Security benefits can feel overwhelming. We understand that many individuals rely on both Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) for financial support. It’s important to know that you can collect both simultaneously. As you approach full retirement age, your SSDI benefits will transition to retirement payments, and rest assured, the total amount you receive will remain unchanged.

This dual collection is not uncommon, and it highlights the significance of understanding your eligibility and the timing of these benefits. By being informed, you can make effective financial plans that support your needs. Remember, you're not alone in this journey, and we're here to help you navigate these important decisions.

Introduction

Navigating the complexities of Social Security and Disability benefits can be overwhelming, particularly for those facing the challenges of a disability. We understand that this journey can feel daunting. This article aims to shed light on the essential details regarding the possibility of collecting both Social Security and Disability benefits simultaneously. We will explore eligibility criteria and the potential financial implications involved.

As you seek to maneuver through this intricate landscape, you may find yourself wondering: how can you effectively manage these benefits to ensure financial stability while confronting the uncertainties that come with a disability? You're not alone in this journey, and we’re here to help you find the support you need.

Define Social Security and Disability Benefits

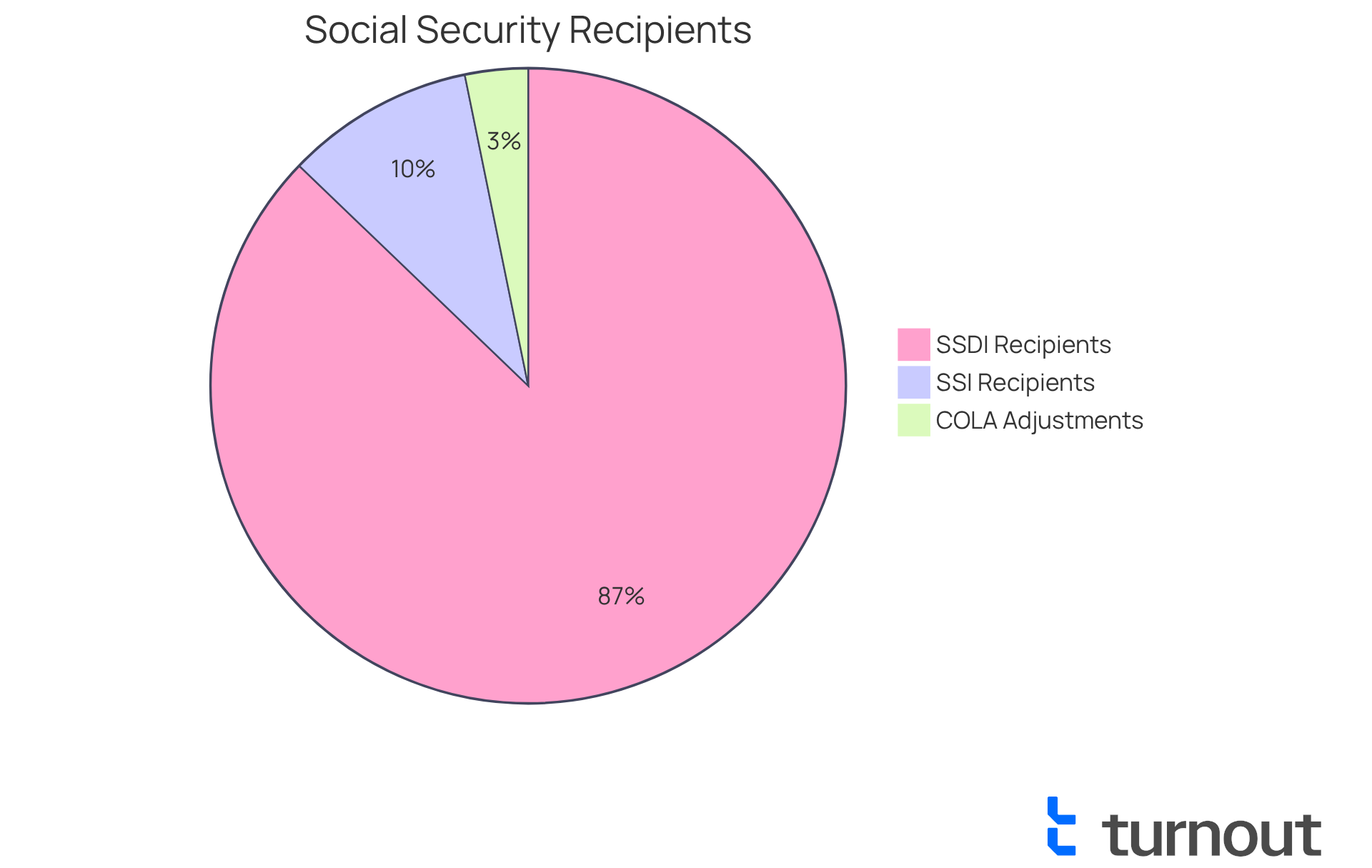

Social Welfare is a federal initiative that provides essential financial support to individuals who are retired, disabled, or survivors of deceased workers. We understand that navigating these challenges can be overwhelming. Specifically, Disability Insurance is designed for individuals who cannot work due to a medical issue that is expected to last for at least one year or lead to death, raising the question, can you collect social security and disability? Funded through payroll taxes, SSDI aims to replace a portion of lost income due to disability, offering a lifeline during tough times. In 2025, approximately 68 million Social Insurance recipients will benefit from a 2.5% cost-of-living adjustment (COLA), translating to an increase of about $25 for those receiving $1,000 each month.

Supplemental Income (SSI) further enhances this support by providing financial assistance to individuals with limited income and resources, regardless of their employment history. This program focuses on those who are aged, blind, or disabled. We recognize the importance of this assistance, with nearly 7.5 million SSI recipients expected to see their payments adjusted starting December 31, 2024. The maximum monthly payment for SSI will rise from $943 to $967 in 2025, reflecting our ongoing commitment to support vulnerable populations amid rising living costs.

The purpose of these benefits is to address whether individuals facing significant challenges due to disability can you collect social security and disability to maintain a basic standard of living. As the Social Benefits Administration continues to adapt to changing economic conditions, we want to remind you that staying informed about updates and adjustments is crucial for beneficiaries. Remember, you are not alone in this journey; we are here to help you navigate these important changes.

Eligibility Requirements for Social Security and Disability Benefits

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming, especially when you’re facing challenges due to a disability. To qualify, it’s essential to understand that applicants typically need 40 work credits, with at least 20 earned in the last 10 years before their disability began. In 2025, the Substantial Gainful Activity (SGA) threshold is set at $1,620 monthly for non-blind individuals. This means that you’ll need to demonstrate how your condition significantly impacts your ability to work at this level. For those who are blind, the SGA threshold is higher, at $2,590 monthly.

When it comes to Supplemental Security Income (SSI), eligibility is determined by your income and resources. In 2025, individuals must have limited income, which is less than $987 per month, and resources that generally do not exceed $2,000. Both SSDI and SSI require thorough medical documentation to support your claim, highlighting the vital role that medical evidence plays in this process.

We understand that grasping these prerequisites is crucial for managing the complexities of obtaining assistance. It’s important to note that approximately two-thirds of initial disability claims are rejected, which can be disheartening. However, you are not alone in this journey. Turnout, an organization not affiliated with any law firm or government agency, offers valuable tools and services to help you navigate these processes. They utilize trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, ensuring that you receive the support you need without the necessity of legal representation.

Remember, we’re here to help you every step of the way.

Can You Collect Both Social Security and Disability Benefits?

Navigating the world of Social Security can be challenging, particularly when trying to determine can you collect social security and disability benefits like Social Security Disability Insurance (SSDI) and retirement payments. Typically, individuals wonder, can you collect social security and disability payments at the same time? Once you reach full retirement age, your disability payments will automatically transition to retirement payments, but rest assured, the total amount remains the same. This means you can receive disability assistance while working, but once you reach retirement age, your payments will shift to retirement benefits.

It’s also worth noting that you can receive Supplemental Security Income (SSI) alongside SSDI. SSI is designed to assist those with financial need, rather than being based solely on work history. Currently, around 10.9 million disabled workers and dependents in the United States rely on these benefits, often depending on both SSDI and SSI for financial support. Understanding the timing and eligibility for benefits, such as can you collect social security and disability, is crucial for effective financial planning.

For instance, in 2025, the maximum federal SSI assistance will increase from $943 to $967 for individuals. This change offers additional support for those transitioning from disability benefits. Many individuals who have successfully made this shift emphasize the importance of keeping accurate records of their earnings. This diligence helps ensure they do not exceed the Substantial Gainful Activity (SGA) threshold, which will rise to $1,620 in 2025. By managing their earnings carefully, they protect their benefits during this transition.

Financial advisors stress that preparing for this transition is vital, as it significantly impacts financial stability in retirement. Staying informed about updates in entitlements and eligibility criteria can empower you to maximize your Social Security benefits. We understand that this process can feel overwhelming, but organizations like Turnout are here to help. While Turnout is not a law firm and does not provide legal representation, it employs trained nonlawyer advocates who assist clients with SSD claims. Their support can be invaluable for individuals seeking clarity about their options and ensuring they receive the benefits they are entitled to. Remember, you are not alone in this journey, and help is available.

Conclusion

Navigating the complexities of Social Security and Disability benefits can indeed feel overwhelming. We understand that for many, these programs represent a crucial step toward financial stability. The possibility of collecting Social Security and Disability benefits together offers a vital lifeline for those facing significant challenges due to disabilities. By clarifying eligibility requirements and the nuances of each program, you can better prepare for your financial future.

Key points to consider include:

- The eligibility criteria for Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

- The transition from disability benefits to retirement payments

It's important to maintain accurate records and stay informed about changes in benefits, such as the anticipated increases in 2025. Organizations like Turnout are here to provide crucial support, helping you navigate these processes and ensuring you receive the benefits you are entitled to.

Ultimately, being aware and proactively managing your Social Security and Disability benefits can significantly impact your financial well-being. We encourage you to explore your options, seek assistance when needed, and remain vigilant about updates to eligibility and benefits. Remember, empowerment through knowledge is key to maximizing support during challenging times. Help is available, and you are not alone in this journey.

Frequently Asked Questions

What is Social Security and Disability Benefits?

Social Security and Disability Benefits are federal initiatives that provide financial support to individuals who are retired, disabled, or survivors of deceased workers. Disability Insurance specifically assists those unable to work due to a medical issue expected to last at least one year or lead to death.

What is Disability Insurance (SSDI)?

Disability Insurance (SSDI) is designed to replace a portion of lost income for individuals who cannot work due to a disability. It is funded through payroll taxes and aims to provide essential financial support during difficult times.

Can you collect Social Security and Disability Benefits simultaneously?

The article raises the question of whether individuals can collect both Social Security and Disability Benefits, indicating that it is a common concern among beneficiaries.

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a program that provides financial assistance to individuals with limited income and resources, regardless of their employment history. It specifically focuses on those who are aged, blind, or disabled.

How many people are expected to benefit from Social Security adjustments in 2025?

Approximately 68 million Social Insurance recipients are expected to benefit from a 2.5% cost-of-living adjustment (COLA) in 2025, which will result in an increase of about $25 for those receiving $1,000 each month.

What changes are expected for SSI payments in 2025?

Starting December 31, 2024, nearly 7.5 million SSI recipients are expected to see their maximum monthly payment increase from $943 to $967 in 2025.

Why are these benefits important?

These benefits are crucial for individuals facing significant challenges due to disability, as they help maintain a basic standard of living amid rising living costs.

How should beneficiaries stay informed about changes to Social Security and Disability Benefits?

Beneficiaries are encouraged to stay informed about updates and adjustments from the Social Benefits Administration, as these changes can significantly impact their financial support.