Overview

Navigating the world of disability benefits can be overwhelming, and we understand that many individuals face challenges along the way. This article sheds light on how to calculate disability benefits, focusing on the important differences between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). These distinctions are crucial in determining your eligibility and the amount of benefits you may receive.

To help you through this process, we provide guidance on:

- Gathering the necessary documentation

- Utilizing online calculators for estimates

It’s common to feel uncertain about the next steps, but remember, you are not alone in this journey. We also address common issues that may arise, offering troubleshooting tips to empower you as you navigate the complexities of the disability benefits system.

Our goal is to support you every step of the way, ensuring you have the information and resources needed to make informed decisions. Together, we can work towards securing the benefits you deserve.

Introduction

Navigating the intricacies of disability benefits can often feel like wandering through a labyrinth, particularly for those unable to work due to medical conditions. You might find yourself wondering about the financial support available to you. With two primary programs—Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)—each offering different eligibility criteria and benefits, it’s understandable to feel overwhelmed. As the landscape of disability assistance evolves, the challenge remains: How can you accurately calculate your potential benefits amidst the complexities of eligibility requirements and documentation?

We understand that this journey can be daunting. This guide aims to unravel these questions, providing clarity and support for you as you embark on this essential path. Remember, you are not alone in this process; we’re here to help you every step of the way.

Understand Disability Benefits Basics

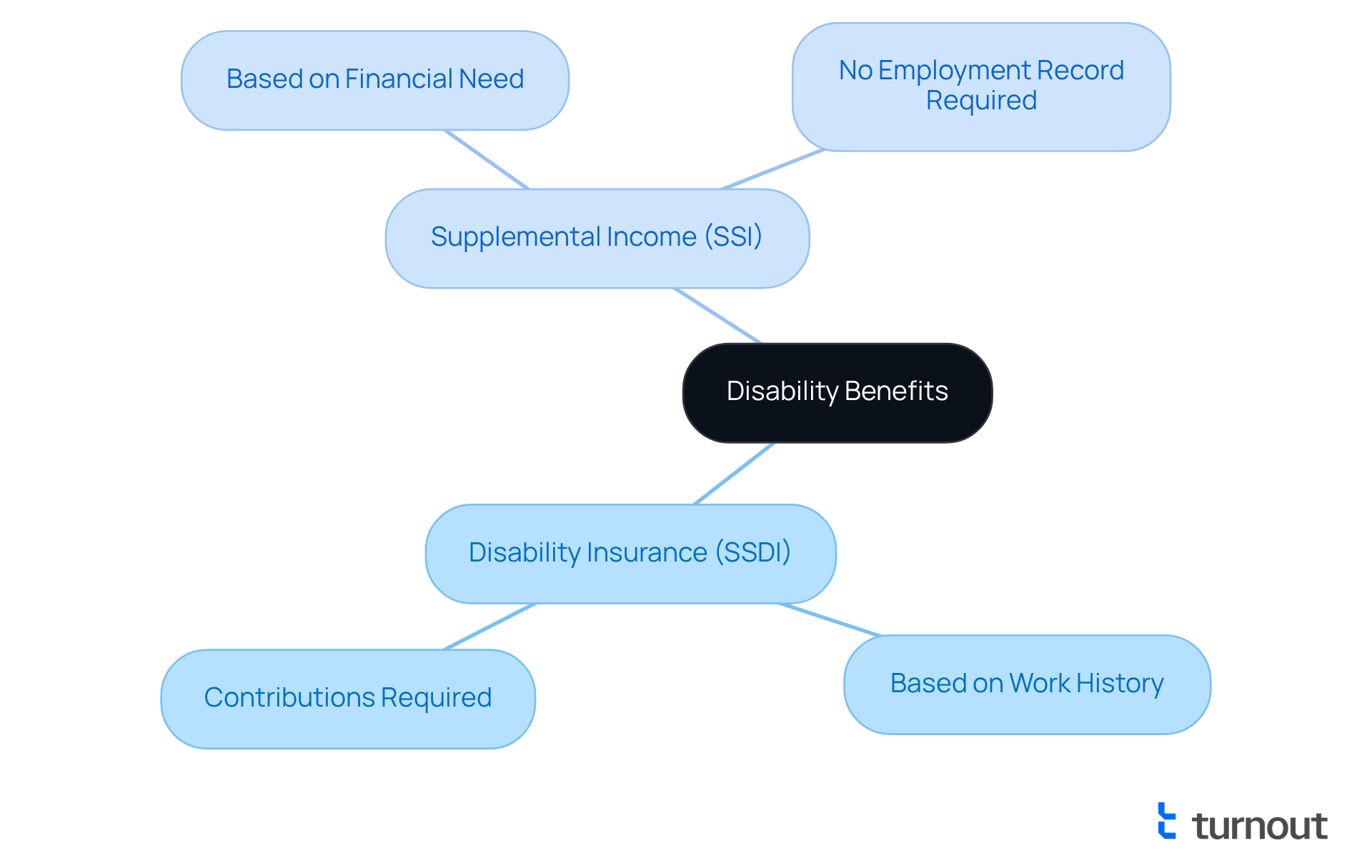

If you find yourself unable to work due to a medical condition, know that you are not alone. Disability benefits are financial payments that can help individuals determine how much would I get on disability. In the U.S., there are two primary programs available: Disability Insurance (SSDI) and Supplemental Income (SSI).

SSDI is based on your work history and the contributions you've made to the system. On the other hand, SSI focuses on financial need and does not require an employment record. Understanding these differences is crucial for determining how much would I get on disability and which benefits you may qualify for.

We understand that navigating these options can be overwhelming. For more detailed information, we encourage you to visit the Administration's website. We're here to help you through this journey and ensure you receive the support you deserve.

Determine Your Eligibility for Disability Benefits

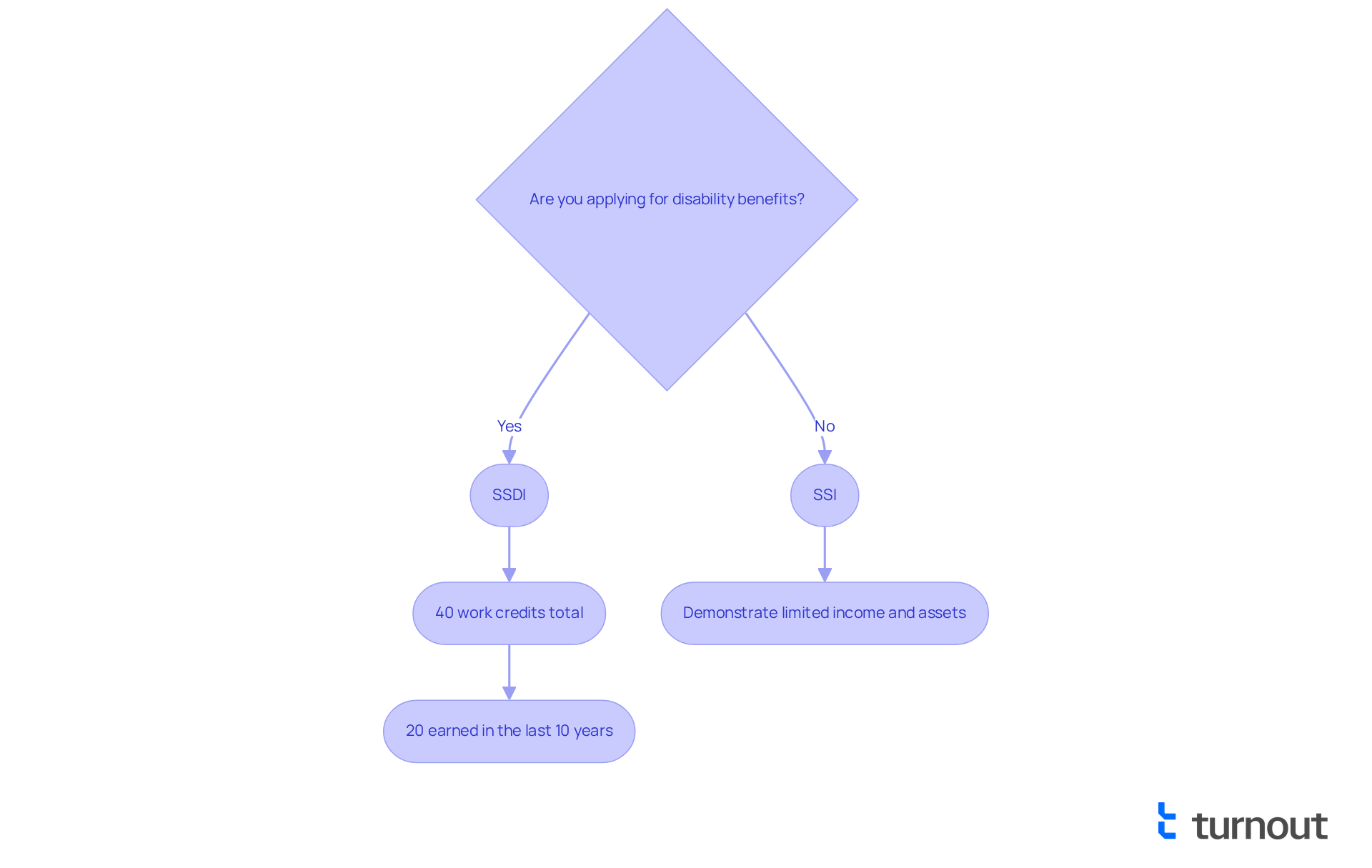

Navigating the world of Social Security Disability Insurance (SSDI) can be overwhelming. To qualify, it’s essential to have worked in positions covered by federal insurance and accumulated sufficient work credits—typically 40 credits, with at least 20 earned in the last 10 years. We understand that this can feel daunting, especially when considering the complexities involved.

In contrast, Supplemental Security Income (SSI) eligibility is based on your income and resources. Applicants must demonstrate limited income and assets. As of 2025, around 30% of SSDI applicants receive approval for assistance. This statistic highlights the competitive nature of the application process, particularly since Turnout supports over 5 million Americans pursuing this aid.

It’s common to feel uncertain about the recent changes in disability assistance eligibility. Staying informed about evolving criteria is crucial for applicants. With the bureaucratic hurdles faced by millions, it’s important to remember that you are not alone in this journey.

For a more customized evaluation of your circumstances, consider using the government administration's eligibility tool. Additionally, consulting with Turnout—a contemporary consumer advocacy organization—can be invaluable. They employ AI to improve assistance for applicants, offering individualized guidance and support throughout the application process. Remember, we’re here to help you every step of the way.

Gather Required Documentation for Calculation

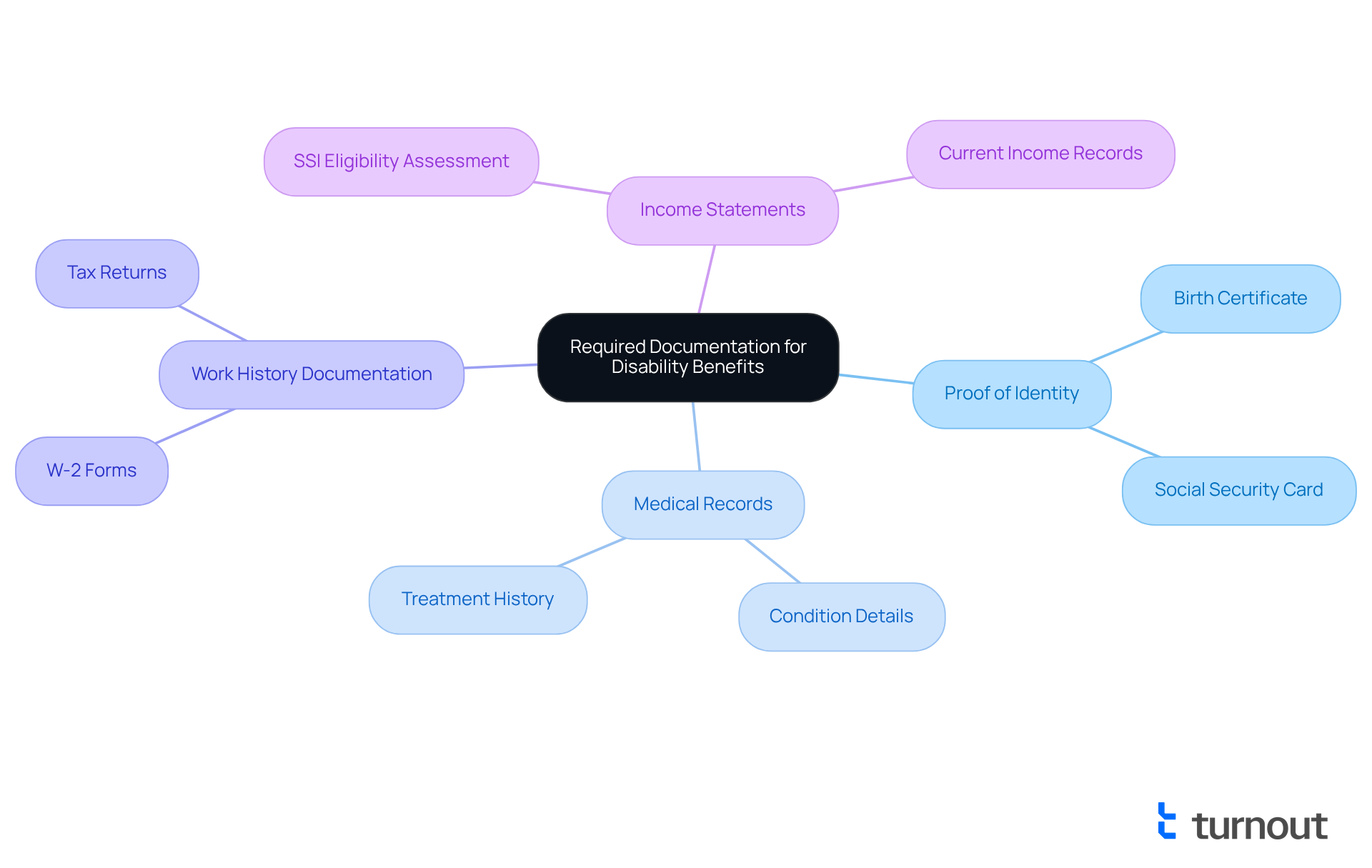

We understand that navigating the process of calculating how much you would get on disability benefits can feel overwhelming. To ease this journey, it’s essential to gather several key documents that will help you along the way:

- Proof of identity (e.g., birth certificate, Social Security card)

- Medical records that detail your condition and treatment

- Work history documentation, including W-2 forms or tax returns for the past few years

- Income statements to assess eligibility for SSI.

Ensure all documents are current and accurate to facilitate the calculation process. Remember, we’re here to help you every step of the way. For more information on the required documents, please visit the SSA's documentation page. You are not alone in this journey.

Calculate Your Estimated Disability Benefit Amount

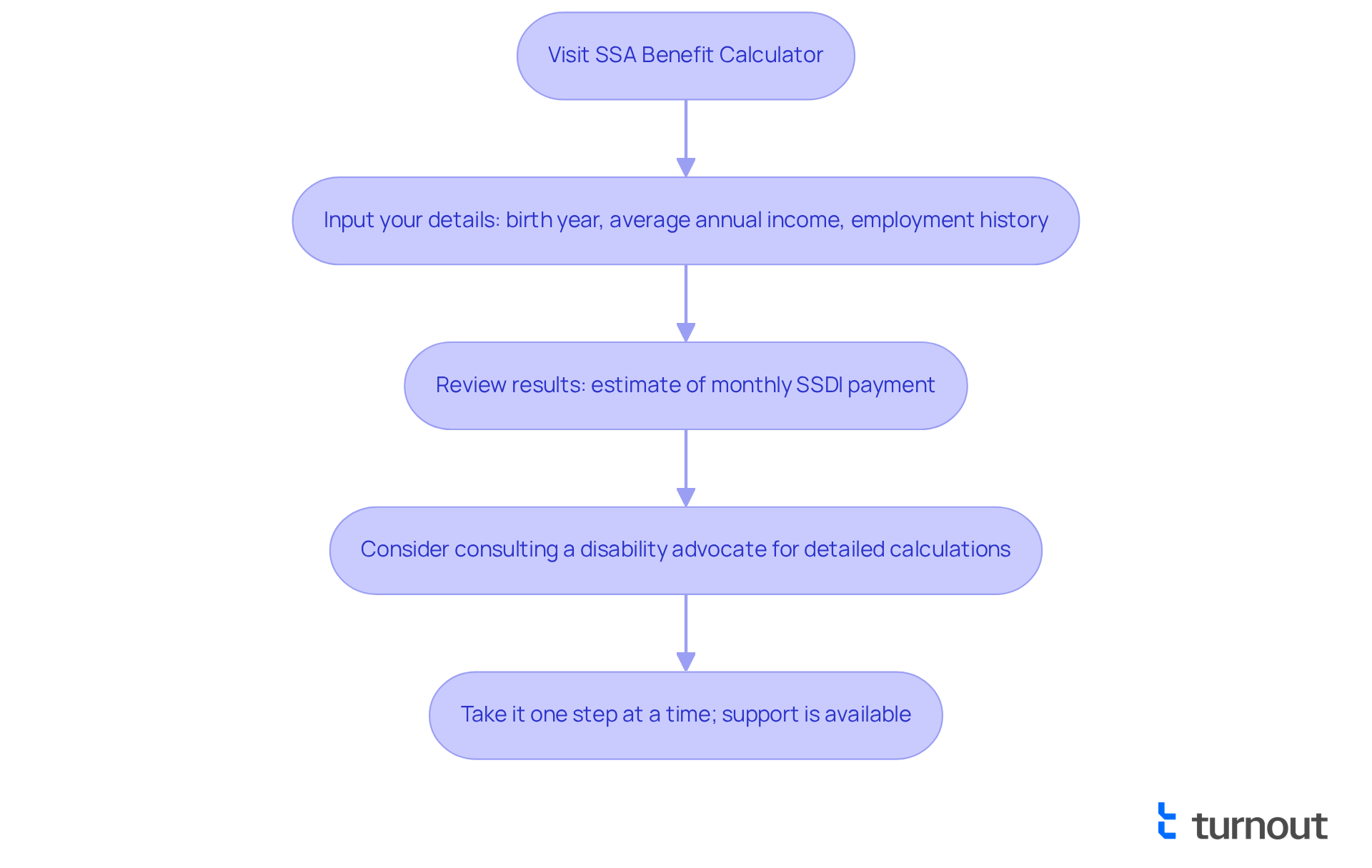

Estimating how much would I get on disability can feel overwhelming, but we're here to help guide you through the process. You can use online calculators offered by the SSA or other reliable sources to get started. Here’s how:

- Visit the SSA Benefit Calculator: Take a moment to go to the SSA's Benefit Calculators page.

- Input your details: Enter your birth year, average annual income, and employment history. This information is crucial in understanding how much would I get on disability for an accurate estimate.

- Review the results: The calculator will provide an estimate of your monthly SSDI payment based on your Average Indexed Monthly Earnings (AIME). Remember, for more detailed calculations regarding how much would I get on disability, it might be beneficial to consult with a disability advocate or use specific calculators like the one from Allsup.

We understand that navigating this process can be challenging, but you are not alone in this journey. Take it one step at a time, and know that support is available to help you along the way.

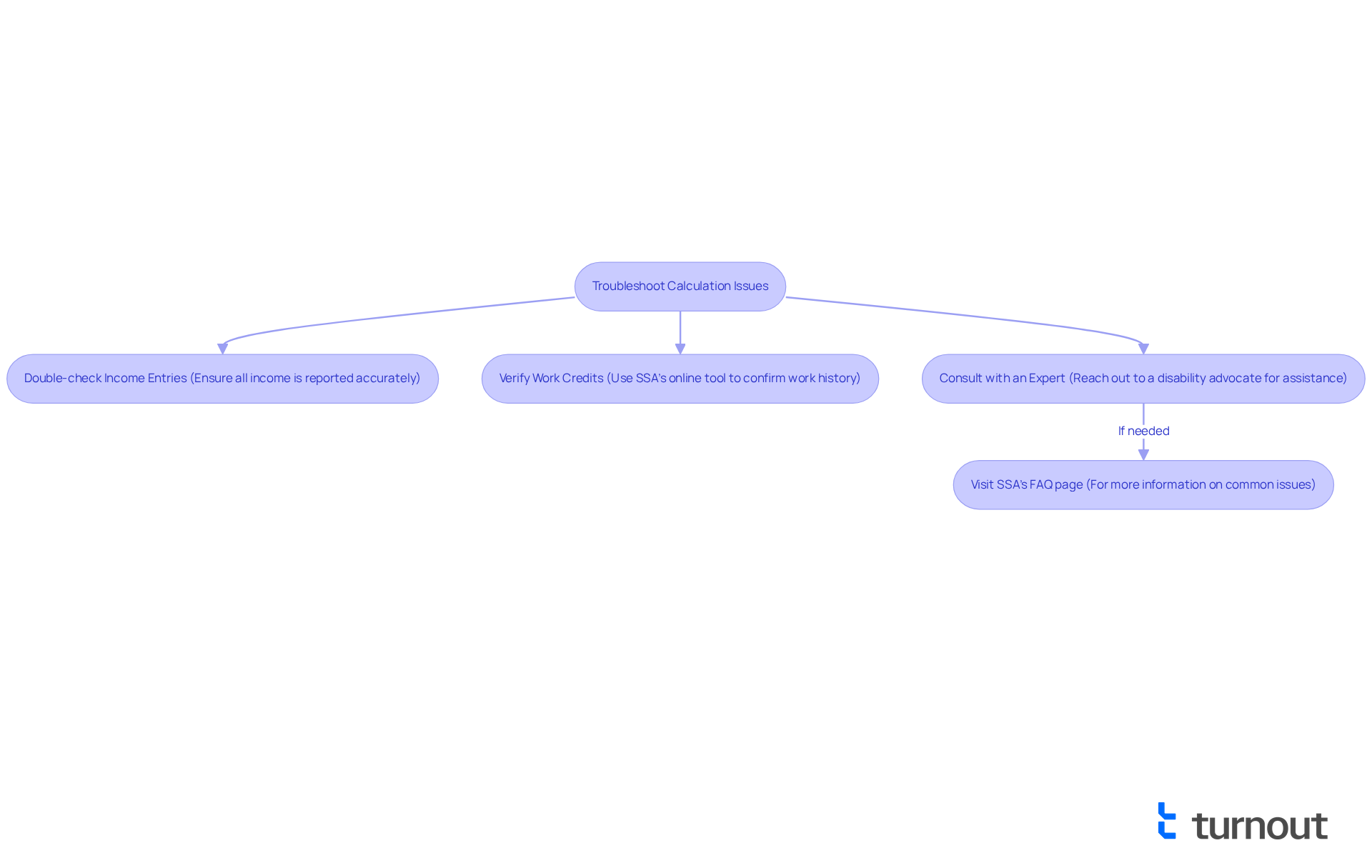

Troubleshoot Common Calculation Issues

If you find yourself facing challenges while calculating your estimated benefits, we understand how overwhelming that can be. Here are some helpful troubleshooting tips to guide you through the process:

- Double-check your income entries: It’s important to ensure that all income is reported accurately, including any self-employment income.

- Verify your work credits: You can use the SSA's online tool to confirm your work history and credits, giving you peace of mind.

- Consult with an expert: If your calculations seem off, don’t hesitate to reach out to a disability advocate for assistance. They can help clarify any discrepancies and ensure you are using the correct formulas.

For more information on common issues, we encourage you to visit the SSA's FAQ page. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Navigating the complexities of disability benefits can feel overwhelming, especially for those unable to work due to medical conditions. This guide has aimed to provide a clear overview of the two primary programs—SSDI and SSI—highlighting their differences and the importance of determining eligibility. Understanding which program aligns with your unique circumstances is essential for accessing the support you need.

We've discussed key insights, including:

- The eligibility requirements for both SSDI and SSI

- The importance of gathering accurate documentation

- The steps to calculate estimated benefits using online tools

It’s common to encounter challenges, but troubleshooting common calculation issues can empower you to navigate the process with greater confidence.

Remember, the journey to securing disability benefits may seem daunting, but support and resources are available. By taking proactive steps, such as utilizing calculators and consulting with experts, you can significantly improve your understanding and maximize potential benefits. You are not alone in this journey; by being informed and prepared, you can take control of your situation and work towards obtaining the financial assistance you deserve.

Frequently Asked Questions

What are the main types of disability benefits available in the U.S.?

The two primary types of disability benefits in the U.S. are Disability Insurance (SSDI) and Supplemental Income (SSI).

How does SSDI differ from SSI?

SSDI is based on your work history and the contributions you've made to the system, while SSI focuses on financial need and does not require an employment record.

What are the eligibility requirements for SSDI?

To qualify for SSDI, you must have worked in positions covered by federal insurance and accumulated sufficient work credits—typically 40 credits, with at least 20 earned in the last 10 years.

What are the eligibility requirements for SSI?

SSI eligibility is based on your income and resources; applicants must demonstrate limited income and assets.

What is the approval rate for SSDI applicants?

As of 2025, around 30% of SSDI applicants receive approval for assistance.

How can I determine my eligibility for disability benefits?

You can use the government administration's eligibility tool for a customized evaluation of your circumstances. Consulting with organizations like Turnout can also provide valuable guidance.

What support is available for navigating the disability benefits process?

Turnout is a contemporary consumer advocacy organization that employs AI to improve assistance for applicants, offering individualized guidance and support throughout the application process.