Overview

Navigating the complexities of potential disability benefits can be overwhelming, especially when considering programs like Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). We understand that many individuals face challenges in this area, and it’s essential to know how to calculate the benefits you may be entitled to.

The amount you receive is influenced by several factors, including:

- Your work history

- Average Indexed Monthly Earnings (AIME)

- Specific eligibility criteria

Understanding these elements is crucial for accurately estimating your benefits. Remember, you are not alone in this journey; we’re here to help you through it.

If you’re feeling uncertain about your situation, take a moment to reflect on your work history and earnings. It’s common to feel lost, but gathering this information can empower you to take the next steps. By familiarizing yourself with these details, you can better navigate the process and make informed decisions about your future.

We encourage you to reach out for assistance and explore the resources available to you. Together, we can work towards ensuring you receive the benefits you deserve.

Introduction

Navigating the intricacies of disability benefits can feel overwhelming for many individuals. We understand that the complexities of the Social Security system, with its two primary programs—Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)—can create uncertainty. Each program has distinct eligibility criteria and benefit calculations, and the stakes are high for those seeking financial support. Millions rely on these benefits, and you might be wondering: how can you accurately estimate the assistance you will receive?

This article aims to provide you with essential insights into the factors influencing disability benefits. By breaking down these elements, we offer a clear roadmap for calculating your potential entitlements. Our goal is to empower you to make informed decisions as you navigate this journey toward support. Remember, you are not alone in this process, and we’re here to help you every step of the way.

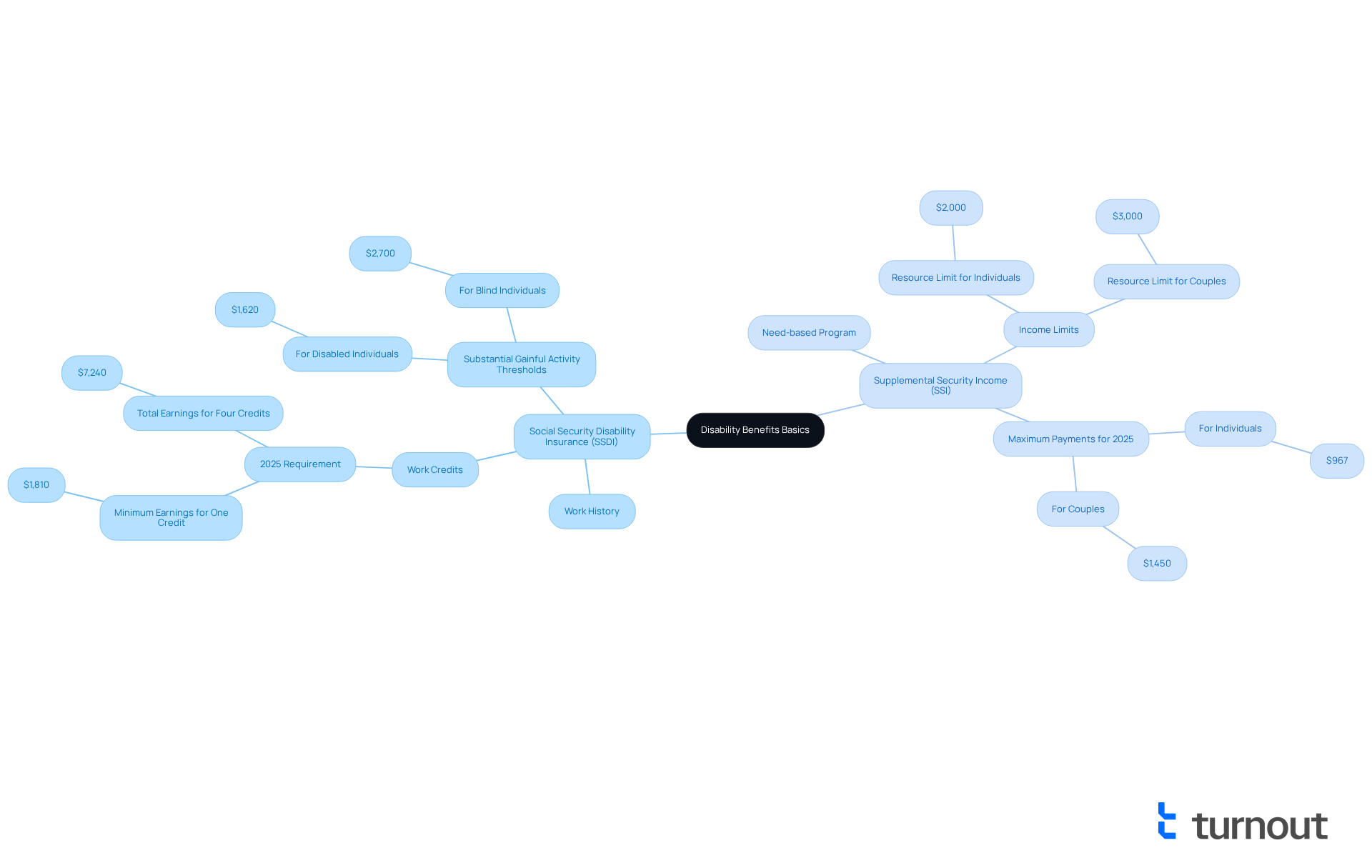

Understand Disability Benefits Basics

Disability benefits in the United States primarily stem from two key programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). SSDI is intended for individuals with a work history who have contributed to Social Security through payroll taxes. To qualify for these benefits, applicants must accumulate a specific number of work credits, which depend on their age and employment history. In 2025, individuals will need to earn at least $1,810 to receive one work credit, totaling $7,240 for four credits. Additionally, the Substantial Gainful Activity (SGA) threshold will increase to $1,620 for those with disabilities and $2,700 for blind individuals in 2025. Understanding these thresholds is vital for grasping how much will I get from disability benefits.

On the other hand, SSI is a need-based program tailored for those with limited income and resources, making it accessible to individuals who may not have a significant work background. Unlike SSDI, SSI does not require work credits but imposes strict income and resource limits. For instance, the resource cap for SSI is $2,000 for individuals and $3,000 for couples. In 2025, the maximum monthly federal payment for SSI will rise to $967 for individuals and $1,450 for couples, reflecting a 2.5% cost-of-living adjustment. This adjustment is crucial for many recipients, helping them manage the rising costs of living. Recognizing the fundamental differences between SSDI and SSI is essential for determining how much I will get from disability and effectively navigating the application process.

Real-world examples reveal the complexities faced by individuals applying for these benefits. Many encounter challenges, such as denied claims or confusion regarding eligibility requirements. Advocacy groups stress the importance of seeking assistance to overcome these bureaucratic hurdles. As disability advocate Shawn Good remarked, "Understanding the nuances of these programs can significantly influence your capacity to obtain the support you deserve."

In conclusion, understanding the fundamentals of SSI and how much will I get from disability assistance is vital for anyone considering applying for support. With millions of Americans eligible for these programs, being informed about the eligibility criteria and application processes can empower individuals to take the necessary steps toward securing their financial support. Moreover, with the Trust Fund potentially running out by 2035, comprehending these benefits has never been more crucial. Remember, you are not alone in this journey; we are here to help.

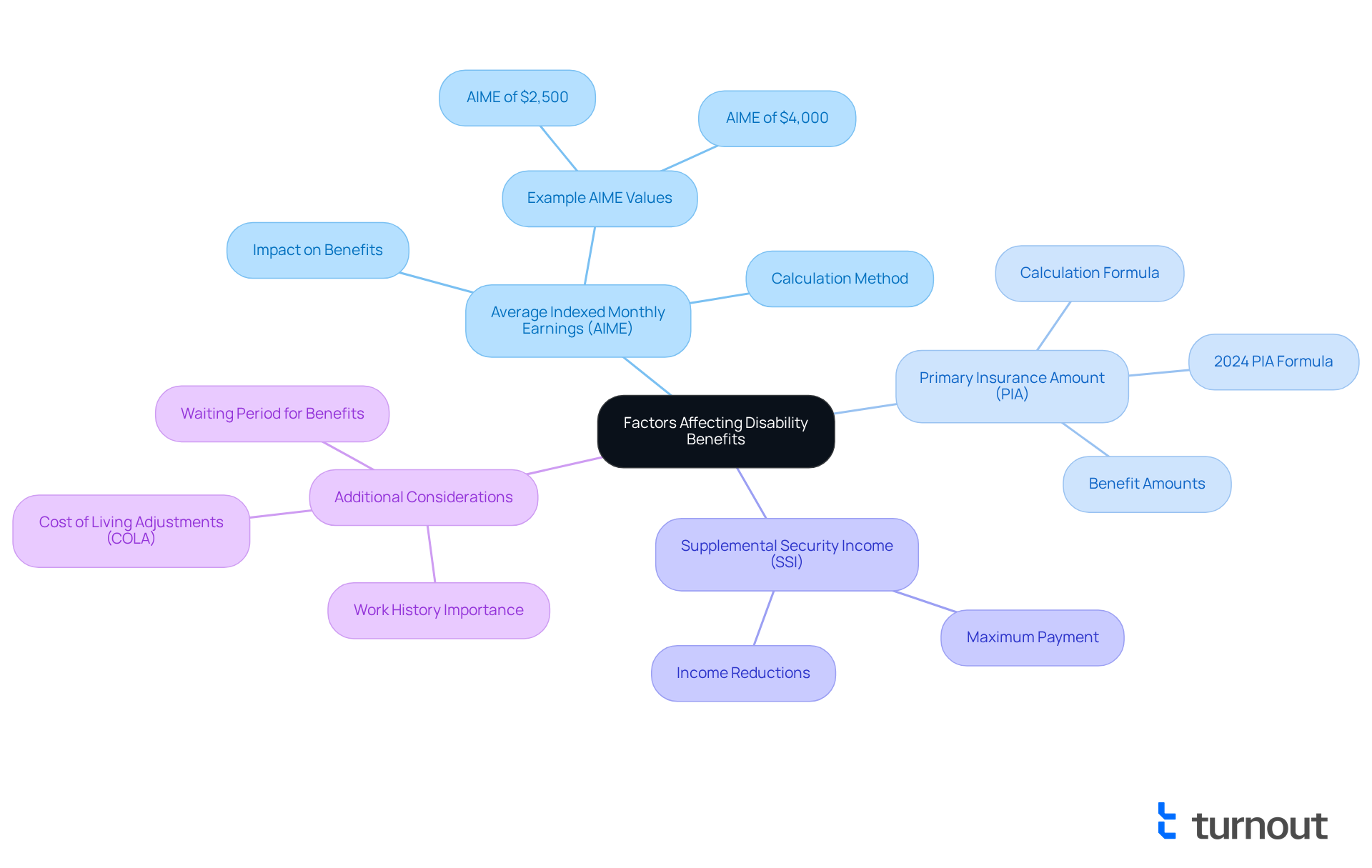

Identify Factors Affecting Benefit Amounts

Navigating disability assistance can be challenging, and we understand that many factors influence the support you receive. One of the most crucial elements is your Average Indexed Monthly Earnings (AIME), particularly for Social Security Disability Insurance (SSDI). This figure is determined by your peak earning years, reflecting your total earnings up to the point of your disability. The Social Security Administration (SSA) uses a specific formula to calculate your Primary Insurance Amount (PIA), which serves as the foundation for your monthly payment. In 2025, SSDI recipients can expect an AIME of approximately $4,000, translating to a monthly payment of around $1,925.70.

Real-life examples illustrate the impact of Average Indexed Monthly Earnings on benefits. For instance, a person with an AIME of $2,500 would receive a lower monthly benefit compared to someone with an AIME of $4,000. This highlights the importance of a robust earnings history. Additionally, for those receiving Supplemental Security Income (SSI), the maximum payment is set at $967 for individuals in 2025. However, this amount may be reduced by other income sources, such as pensions or unemployment benefits.

Understanding how these calculations work is essential for your peace of mind. The SSA averages your highest-earning years, adjusting for inflation, to determine your AIME. Financial advisors often stress the importance of providing a complete work history to ensure accurate calculations. Missing information can lead to underestimations of your lifetime earnings. It's also important to note that there is a waiting period of five months from the date the SSA determines when your disability began before you start receiving assistance.

By grasping these factors, you can better anticipate how much you will get from disability benefits and navigate the complexities of the SSDI system. Remember, you are not alone in this journey, and we are here to help you every step of the way.

Calculate Your Estimated Disability Benefits

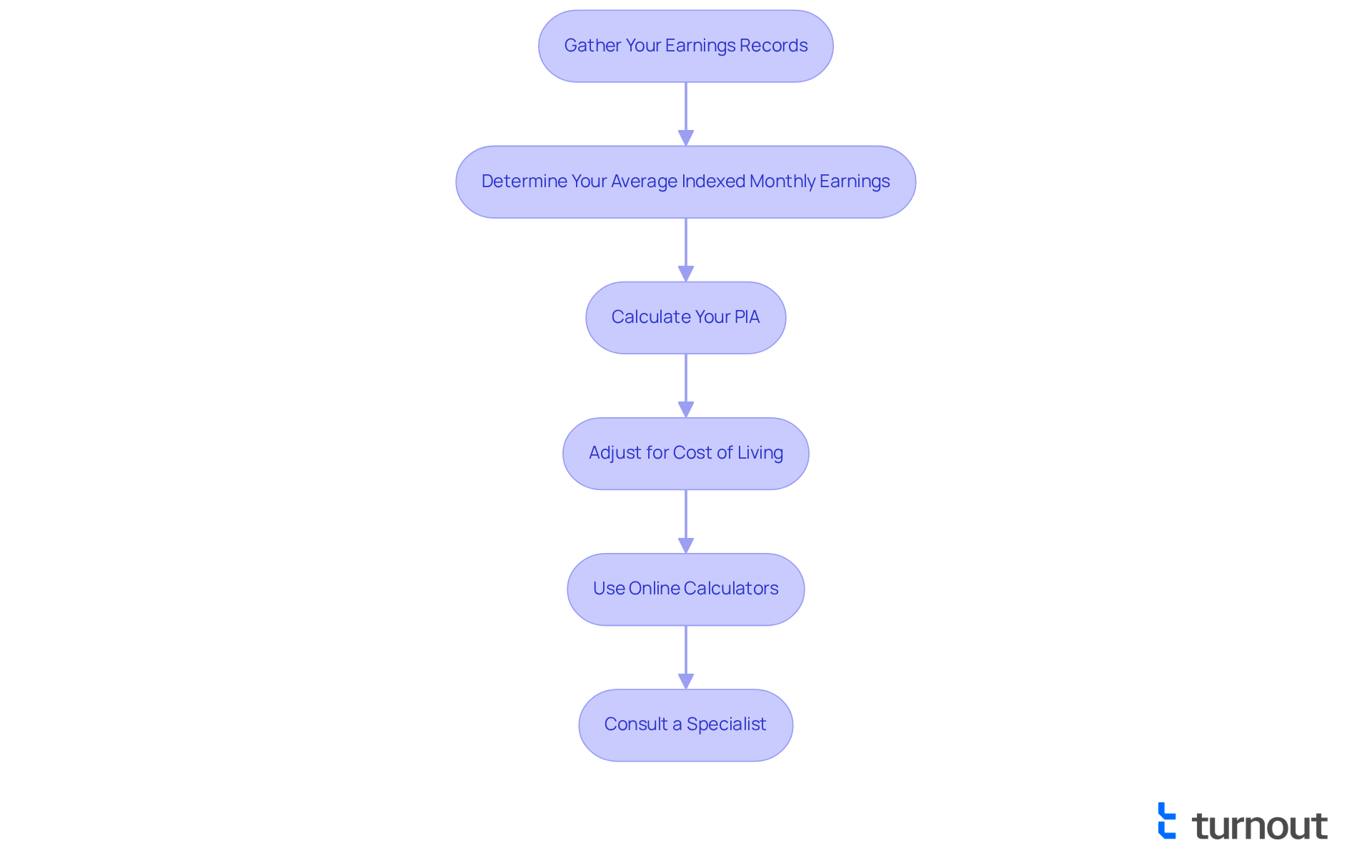

Calculating your estimated disability benefits can feel overwhelming, but we're here to help you through it. Follow these steps to gain a clearer understanding of your potential entitlements:

-

Gather Your Earnings Records: Start by collecting your Social Security Statement, which details your earnings history. This is an important first step in the process.

-

Determine Your Average Indexed Monthly Earnings: The SSA calculates your Average Indexed Monthly Earnings by averaging your highest 35 years of indexed earnings. If you have less than 35 years of work history, don’t worry; they will average your actual earnings instead.

-

Calculate Your PIA: Next, use the SSA's formula to determine your Primary Insurance Amount (PIA) based on your Average Indexed Monthly Earnings. For 2025, the formula is:

- 90% of the first $1,115 of your AIME

- 32% of the AIME over $1,115 and up to $6,721

- 15% of the AIME over $6,721

-

Adjust for Cost of Living: Remember, your entitlements may be modified annually for cost-of-living increases. For 2025, a 2.5% adjustment is anticipated, which can make a difference in your benefits.

-

Use Online Calculators: Take advantage of tools like the SSA's Benefit Calculators. By inputting your earnings, you can obtain an estimate of your entitlements, simplifying the process significantly.

-

Consult a Specialist: It’s common to feel uncertain about the application process. We recommend discussing your situation with a knowledgeable Social Security disability lawyer. They can ensure that your application comprehensively records your condition and your legal entitlement to support, significantly enhancing your chances of approval.

By following these steps, you can achieve a clearer understanding of how much you will get from disability payments and how they are computed. Remember, you are not alone in this journey, and there are resources available to support you.

Access Tools and Resources for Accurate Calculations

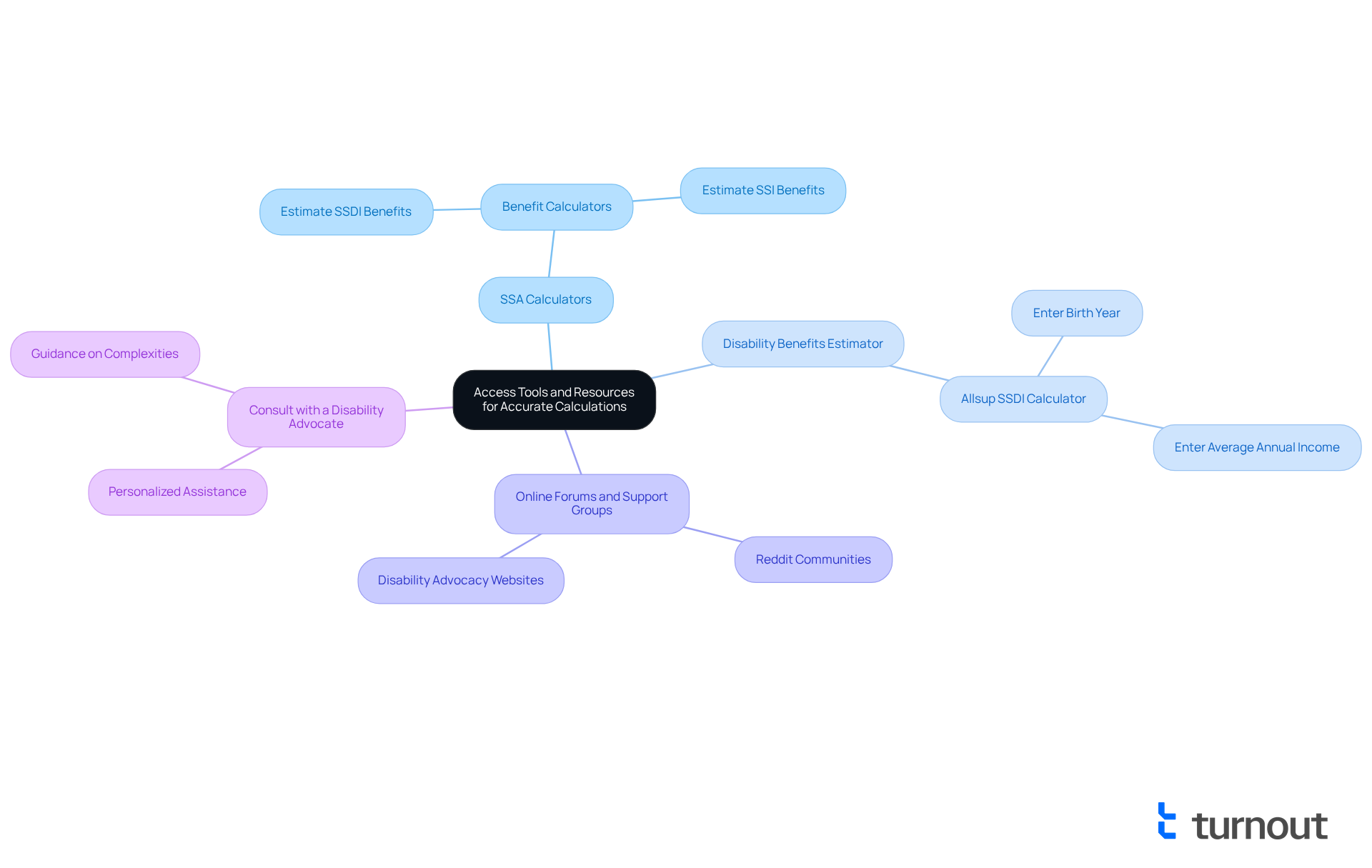

To help you navigate the process of calculating your disability benefits, we want to share some valuable resources that can make this journey a little easier for you:

- Social Security Administration (SSA) Calculators: The SSA provides a variety of calculators on their website, including Benefit Calculators that can estimate your SSDI and SSI benefits based on your earnings history. You can find them at SSA Benefit Calculators.

- Disability Benefits Estimator: Tools like the Allsup SSDI Calculator allow you to enter your birth year and average annual income for a quick estimate of your benefits.

- Online Forums and Support Groups: Connecting with communities on platforms like Reddit or disability advocacy websites can provide insights and shared experiences that may clarify the process for you.

- Consult with a Disability Advocate: If you’re feeling overwhelmed, reaching out to a disability support advocate can be a great step. They offer personalized assistance and guidance tailored to your unique situation. Research shows that individuals who work with representatives are significantly more likely to receive benefits, as advocates understand the complexities of the system.

As we look ahead to 2025, it's important to stay informed about updates to the SSA calculators, which will reflect changes in eligibility criteria and compensation calculations, including increases in the Substantial Gainful Activity (SGA) limits. By utilizing these resources, you can empower yourself to make informed decisions about your disability benefits. Remember, you are not alone in this journey—we're here to help.

Conclusion

Understanding the intricacies of disability benefits is crucial for anyone seeking financial support due to a disability. We understand that navigating this landscape can be overwhelming. This article delves into the essential distinctions between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), highlighting the importance of knowing eligibility requirements and benefit calculations. By grasping these concepts, individuals can better prepare themselves for the application process and gain insight into the financial assistance available to them.

Key points discussed include:

- The necessity of work credits for SSDI eligibility

- The income limits associated with SSI

- The significance of Average Indexed Monthly Earnings (AIME) in determining benefit amounts

It’s common to feel uncertain about where to start, but practical steps for calculating estimated benefits and resources for assistance are available. Utilizing these tools and seeking expert guidance can help you navigate the complexities of the system with confidence.

Ultimately, being informed and proactive can significantly enhance the likelihood of receiving the benefits you deserve. As the landscape of disability benefits evolves, particularly with anticipated changes in 2025, staying updated on eligibility criteria and calculation methods is vital. Remember, empowerment through knowledge not only aids in securing financial support but also fosters a sense of community for those facing similar challenges. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are the main disability benefits programs in the United States?

The two primary disability benefits programs in the United States are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

Who qualifies for Social Security Disability Insurance (SSDI)?

SSDI is intended for individuals with a work history who have contributed to Social Security through payroll taxes. Applicants must accumulate a specific number of work credits based on their age and employment history.

How are work credits calculated for SSDI?

In 2025, individuals will need to earn at least $1,810 to receive one work credit, totaling $7,240 for four credits.

What is the Substantial Gainful Activity (SGA) threshold for 2025?

In 2025, the SGA threshold will increase to $1,620 for individuals with disabilities and $2,700 for blind individuals.

What is Supplemental Security Income (SSI)?

SSI is a need-based program designed for individuals with limited income and resources, making it accessible to those who may not have a significant work background.

Does SSI require work credits?

No, SSI does not require work credits but has strict income and resource limits.

What are the resource limits for SSI?

The resource cap for SSI is $2,000 for individuals and $3,000 for couples.

What will the maximum monthly federal payment for SSI be in 2025?

In 2025, the maximum monthly federal payment for SSI will rise to $967 for individuals and $1,450 for couples.

Why is understanding the differences between SSDI and SSI important?

Understanding the differences between SSDI and SSI is essential for determining eligibility and navigating the application process effectively.

What challenges do individuals face when applying for disability benefits?

Many individuals encounter challenges such as denied claims or confusion regarding eligibility requirements.

What do advocacy groups recommend for those facing challenges with disability benefits?

Advocacy groups stress the importance of seeking assistance to overcome bureaucratic hurdles when applying for disability benefits.

Why is it important to understand disability benefits now?

With the Trust Fund potentially running out by 2035, understanding these benefits is crucial for those considering applying for support.