Overview

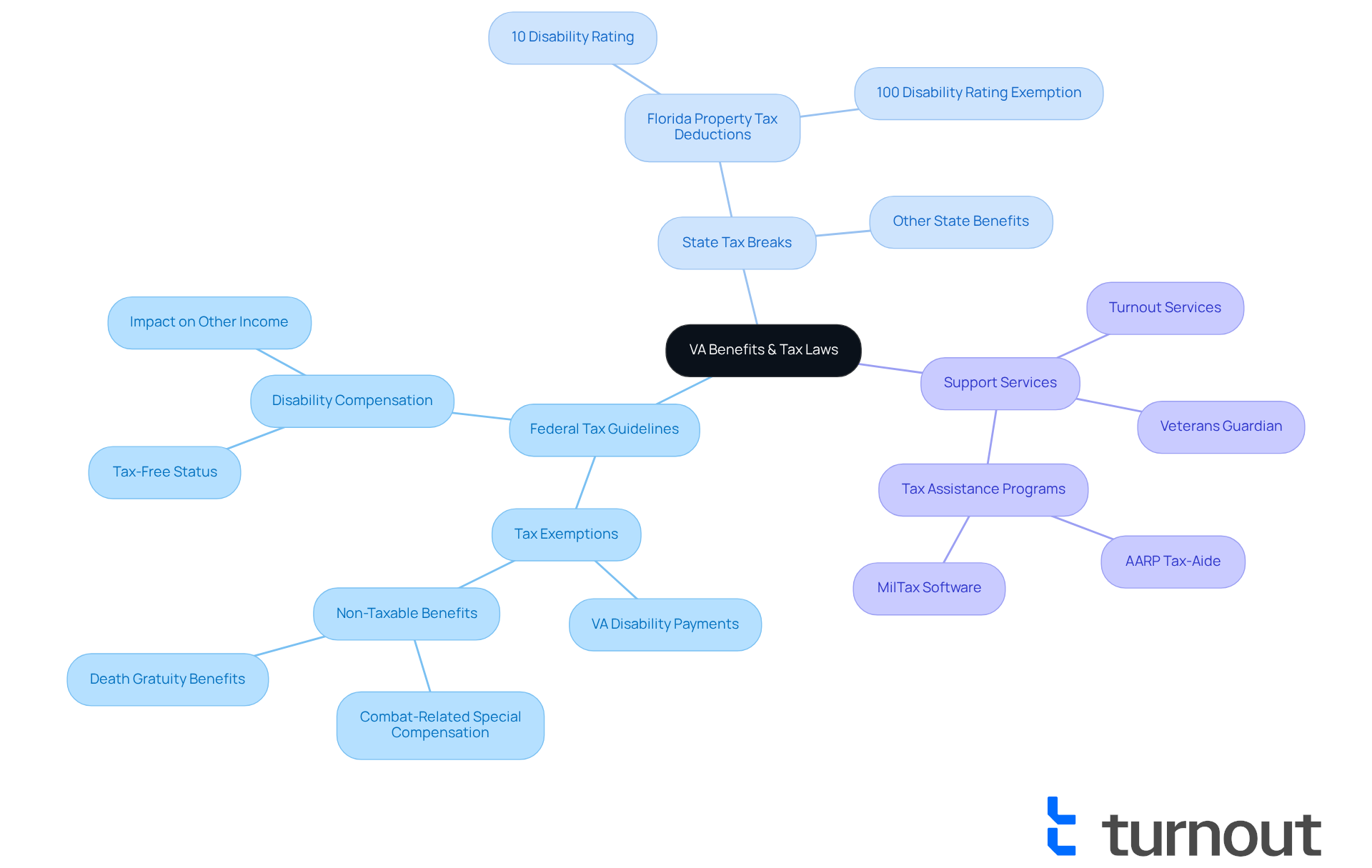

VA benefits are generally non-taxable, which includes disability compensation, pension payments, and educational assistance. This means that veterans do not need to declare these as income on their tax filings.

We understand that navigating tax implications can be challenging. That's why it's crucial for veterans to grasp these details to maximize their financial security.

The IRS guidelines explicitly state that VA disability payments are exempt from taxation. This allows veterans to retain the full value of their benefits, ensuring they have the support they deserve.

Introduction

Understanding the intricacies of Veterans Affairs (VA) benefits is crucial for millions of former service members. These benefits provide essential support as they navigate civilian life, honoring the sacrifices made by veterans. They encompass a variety of financial and non-financial assistance, including resources for healthcare, education, and housing.

However, it's common to feel uncertain about one pressing question: Are these benefits taxable? As veterans seek to maximize their financial well-being, unraveling the tax implications of VA assistance becomes paramount. This journey presents both opportunities and challenges that can significantly impact their financial security.

We understand that navigating these complexities can be overwhelming, but you're not alone in this journey. We're here to help you find clarity and support as you explore your options.

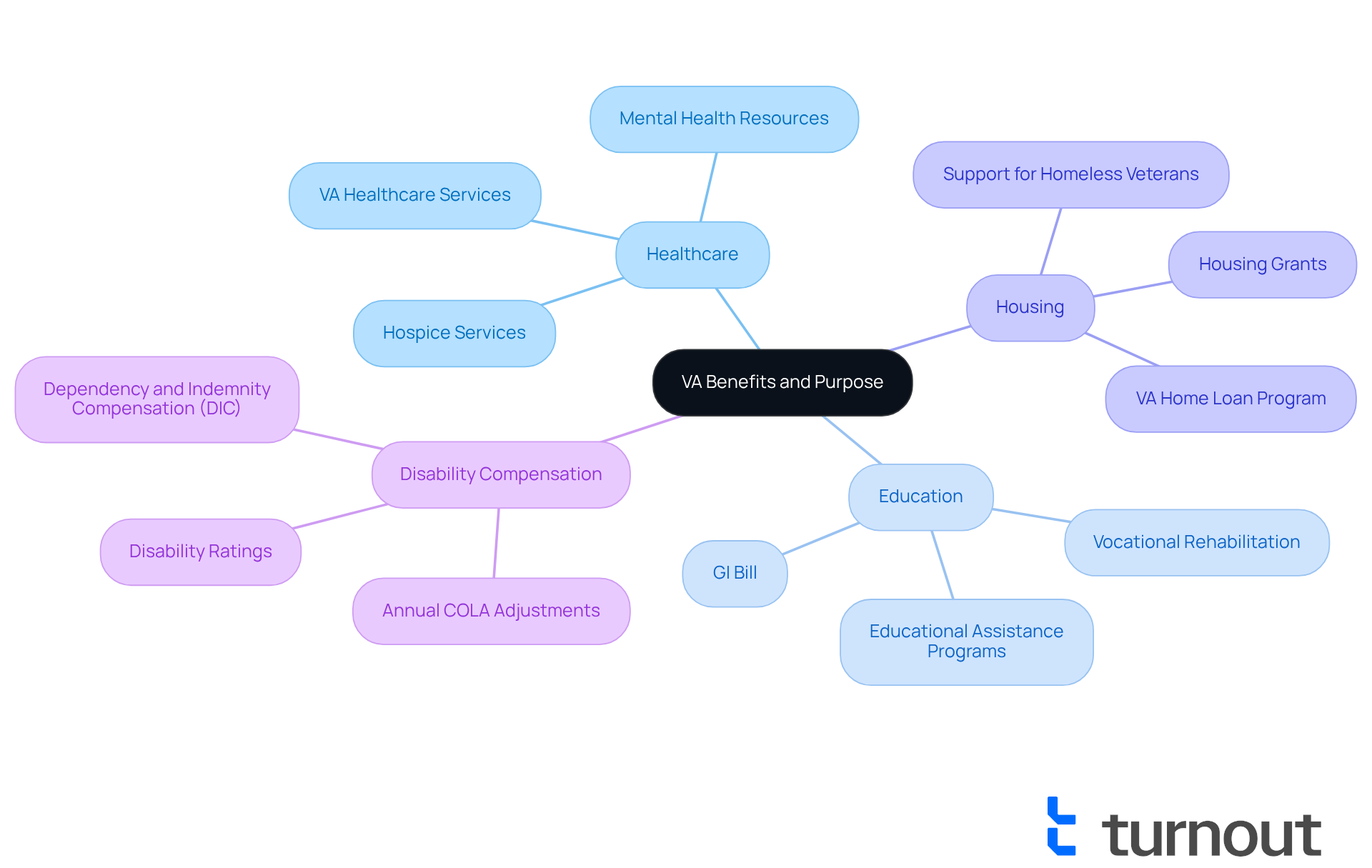

Define VA Benefits and Their Purpose

VA assistance, or Veterans Affairs support, encompasses a wide array of monetary and non-monetary aid services available to qualified military personnel. These benefits are thoughtfully designed to support former service members in various aspects of life, including healthcare, education, housing, and compensation for disabilities. The primary goal of VA assistance is to honor the contributions of our veterans by ensuring they receive the essential support needed to lead fulfilling lives after their service. This includes financial aid for those with service-related disabilities, educational resources for furthering their education, and healthcare services tailored to their unique needs.

In 2025, millions of former service members are expected to receive VA assistance, reflecting our ongoing commitment to support those who have served. The importance of these benefits cannot be overstated; they provide crucial resources that help veterans navigate the challenges of civilian life. Successful programs, such as the VA's housing grants and educational aid through the GI Bill, demonstrate how these resources can significantly improve the quality of life for veterans and their families.

Many veterans have shared how vital these benefits are in their lives. Numerous individuals depend on them to meet essential expenses like food, housing, and healthcare. For example, the annual increase in disability compensation, adjusted for inflation, is crucial for maintaining purchasing power amidst rising costs. As one veteran expressed, "The assistance I receive from the VA has been transformative, allowing me to focus on my health and well-being without the constant worry of financial strain."

Additionally, organizations like Turnout are dedicated to simplifying access to government assistance and financial aid, helping former service members understand their entitlements and navigate the complexities of SSD claims and tax relief without needing legal representation. It's important to clarify that Turnout is not a law firm and does not provide legal advice. This support is especially critical as the VA addresses urgent issues like homelessness and suicide risks among veterans, underscoring the importance of these provisions. Ultimately, VA assistance is a vital lifeline for former service members, ensuring they receive the support they rightfully deserve after their service. Understanding whether VA benefits are taxable and their implications is essential for veterans to enhance their financial security and fully utilize the resources available to them.

Identify Taxable and Non-Taxable VA Benefits

Understanding the advantages provided by the VA can feel overwhelming, but we're here to help. These advantages can be categorized into taxable and non-taxable groups, and understanding whether VA benefits are taxable is crucial for your financial well-being. Non-taxable advantages include:

- Compensation for incapacity

- Pension payments

- Educational assistance, such as those offered under the G.I. Bill

These benefits are excluded from federal income tax, meaning you don't have to declare them as income on your tax filings.

On the other hand, military retirement pay based on age or length of service raises the question of whether VA benefits are taxable as income. For instance, individuals with a VA 100% disability rating receive roughly $3,332.06 each month, which adds up to around $39,984.72 yearly, and this amount is not subject to taxes. Grasping these distinctions is essential for former service members to accurately declare their earnings and maximize their financial advantages.

As one tax specialist insightfully notes, "Disability payments received from the VA are not included as part of a Veteran's gross income and are exempt from taxation." This knowledge empowers you to navigate your financial landscape effectively. Remember, you are not alone in this journey, and understanding these benefits can significantly ease your financial concerns.

Examine VA Benefits in the Context of Tax Laws

Navigating tax regulations can be challenging, especially for former service members. We understand that VA assistance is a crucial support system, and it's heartening to know that this aid is generally viewed positively. According to IRS guidelines, disability compensation and other forms of VA assistance, which are VA benefits taxable, are not included in gross income, meaning they are tax-exempt. This exemption is vital, allowing you to retain the full value of your benefits without the burden of taxation, especially considering whether VA benefits are taxable.

Moreover, many states offer additional tax breaks for former military personnel, which can significantly enhance your financial stability. For instance, in Florida, service members with a minimum 10 percent disability rating can receive a property tax deduction of up to $5,000. Those rated 100 percent may even qualify for a complete property tax exemption. Understanding these legal protections is essential for effectively navigating your financial landscape.

At Turnout, we’re here to help you comprehend these advantages and manage the complexities of government processes, including SSD claims and tax relief. You are not alone in this journey; we provide the tools and services you need to feel empowered and informed.

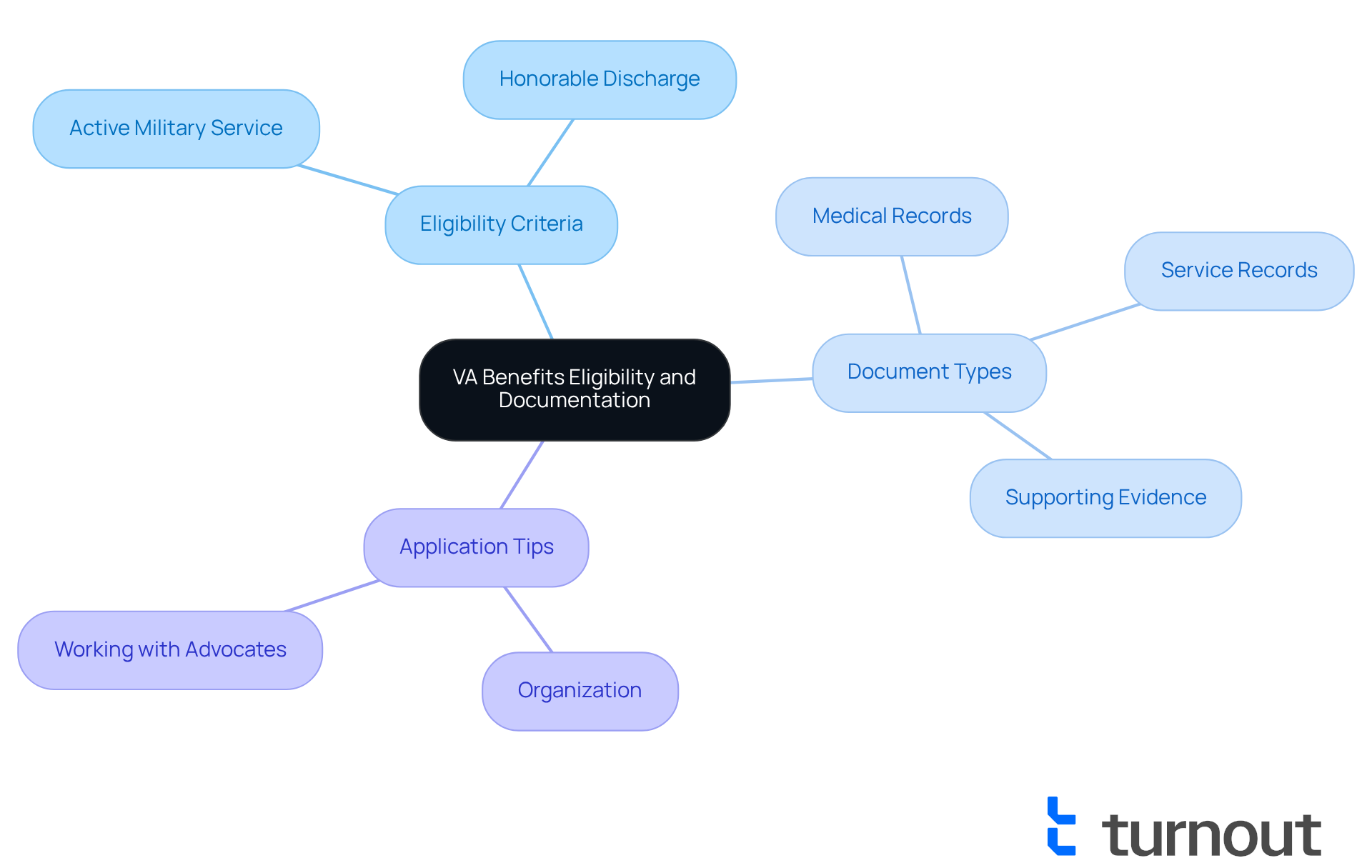

Outline Eligibility and Documentation Requirements for VA Benefits

It is important to understand if VA benefits are taxable for former military personnel to qualify, as they must meet specific eligibility criteria. This generally includes having served in active military, naval, or air service and receiving an honorable discharge. For those seeking disability compensation, it’s crucial to provide documentation that substantiates a service-connected disability. This documentation typically includes medical records, service records, and other pertinent information.

We understand that the application process can be intricate. Therefore, former service members are strongly encouraged to compile all necessary paperwork to facilitate a smooth application experience. As noted by a representative from the VA, "Submitting complete and accurate documentation remains essential for improved processing times." Grasping these criteria is essential for former service members to effectively utilize the entitlements they have obtained, particularly in understanding if VA benefits are taxable.

Common documentation required for VA benefits applications includes:

- Medical records detailing the service-connected disability.

- Service records verifying active duty and discharge status.

- Any additional evidence supporting the claim, such as lay statements or employment records.

Veterans should also be aware of new deadlines and submission requirements that may come into effect. It’s common to feel overwhelmed, but careful organization can help avoid missing critical timelines. Partnering with knowledgeable advocates can assist veterans in staying organized and meeting these stricter deadlines, ensuring they do not miss out on the benefits they deserve. Remember, you are not alone in this journey—we're here to help.

Conclusion

Understanding the tax implications of VA benefits is crucial for veterans seeking to maximize their financial security. These benefits serve as a vital support system for former service members, providing assistance that is generally exempt from federal income tax. By grasping which benefits are taxable and which are not, veterans can better navigate their financial responsibilities and ensure they receive the full value of the aid available to them.

We understand that navigating these complexities can be overwhelming. The article has highlighted the distinction between non-taxable benefits, such as disability compensation and educational assistance, and the intricacies surrounding military retirement pay. It is essential for veterans to be aware of these differences to accurately report their income and leverage the benefits they have earned through their service. Furthermore, understanding eligibility requirements and the necessary documentation for VA benefits applications can significantly ease the process and enhance accessibility to these crucial resources.

In light of this information, we encourage veterans to stay informed about their rights and the benefits available to them. By taking proactive steps to understand the tax treatment of VA benefits and seeking assistance when needed, former service members can secure their financial future and focus on leading fulfilling lives after their military service. Engaging with organizations that specialize in veteran affairs can provide invaluable support in navigating these complexities, ensuring that veterans receive the recognition and assistance they deserve. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are VA benefits?

VA benefits, or Veterans Affairs support, are a range of monetary and non-monetary aid services available to qualified military personnel. They are designed to support former service members in areas such as healthcare, education, housing, and disability compensation.

What is the purpose of VA benefits?

The primary purpose of VA benefits is to honor the contributions of veterans by providing essential support to help them lead fulfilling lives after their service. This includes financial aid, educational resources, and tailored healthcare services.

How many veterans are expected to receive VA assistance in 2025?

In 2025, millions of former service members are expected to receive VA assistance, reflecting the ongoing commitment to support those who have served.

Why are VA benefits important for veterans?

VA benefits are crucial as they provide resources that help veterans navigate civilian life challenges, including financial support for essential expenses like food, housing, and healthcare. They significantly improve the quality of life for veterans and their families.

What are some examples of successful VA programs?

Successful VA programs include housing grants and educational aid through the GI Bill, which have been shown to significantly enhance the quality of life for veterans.

How do VA benefits impact veterans' financial security?

VA benefits, such as annual increases in disability compensation adjusted for inflation, are essential for maintaining purchasing power and alleviating financial strain, allowing veterans to focus on their health and well-being.

What is the role of organizations like Turnout in relation to VA benefits?

Organizations like Turnout help simplify access to government assistance and financial aid for veterans, aiding them in understanding their entitlements and navigating SSD claims and tax relief. However, Turnout does not provide legal advice.

What urgent issues does the VA address for veterans?

The VA addresses urgent issues such as homelessness and suicide risks among veterans, highlighting the critical importance of the assistance they provide.

Why is it important for veterans to understand the tax implications of VA benefits?

Understanding whether VA benefits are taxable and their implications is essential for veterans to enhance their financial security and fully utilize the resources available to them.