Overview

Navigating disability benefits and taxes can feel overwhelming, especially when considering your total income. It's important to know that these benefits may be taxable, with specific thresholds in place. For example, if you earn over $25,000, you might need to include up to 50% of your SSDI benefits as taxable income. We understand that this can raise many questions about your financial situation.

Understanding these income limits is crucial, as they can significantly impact your tax outcomes. Additionally, if you have other earnings, it’s essential to consider how they affect your benefits. Keeping accurate documentation and exploring potential deductions can help optimize your tax situation. Remember, you are not alone in this journey; we’re here to help you navigate these complexities with confidence.

Introduction

Understanding the tax implications of disability benefits can feel overwhelming. We recognize that the rules and thresholds vary significantly based on individual circumstances, which can add to your concerns. This checklist article aims to demystify the complexities surrounding the taxability of disability payments. Our goal is to provide you with essential insights into how your earnings may impact your tax obligations.

It's common to wonder whether your benefits are taxable, and the stakes can be high—especially when unexpected lump-sum payments or additional income come into play. Navigating these financial waters can be challenging, but you are not alone in this journey. Together, we can explore how to ensure compliance and minimize your tax burdens. Remember, we're here to help.

Determine Taxability of Disability Benefits

Navigating your overall earnings can be challenging, especially when it comes to understanding how your disability payments factor in. First, consider incorporating half of your disability payments into your total earnings. It's important to check if your total earnings exceed the limit for your filing status—$25,000 for single filers or $32,000 for married couples filing jointly—and to understand whether disability benefits are taxable.

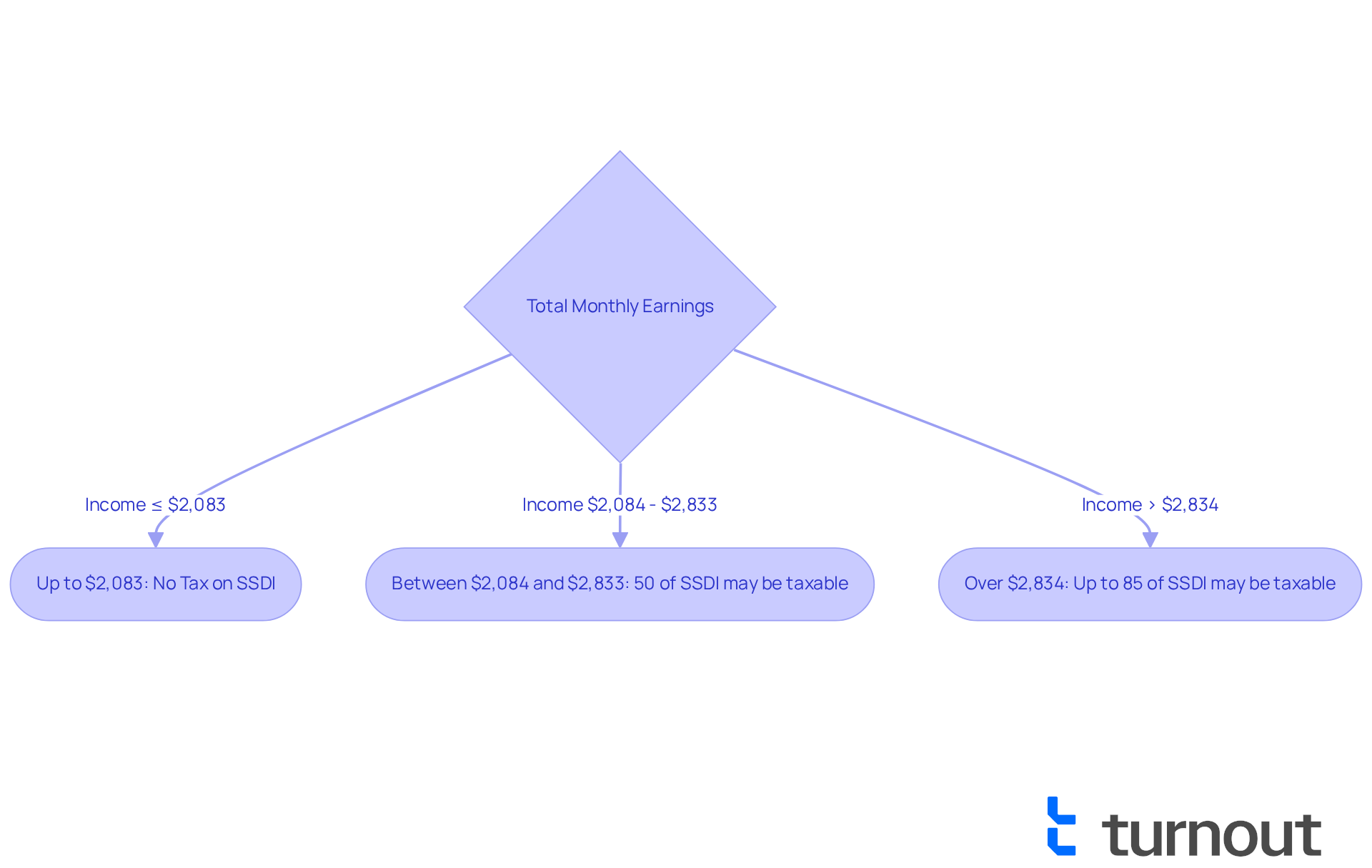

For those with monthly earnings up to $2,083 (yearly earnings up to $25,000), you’ll be relieved to know that no part of your SSDI payments is subject to tax. However, if your monthly earnings fall between $2,084 and $2,833 (yearly earnings from $25,000 to $34,000), it raises the question of whether disability benefits are taxable, as 50% of your benefits may be subject to tax. For monthly earnings exceeding $2,834 (yearly earnings surpassing $34,000), you should determine if disability benefits are taxable, as up to 85% of your assistance could be taxable.

We understand that receiving substantial lump-sum SSDI back payments can complicate your financial situation, potentially increasing your income for the year received and leading to higher taxes. To ensure you report any assessable benefits accurately, utilize IRS Form 1040. If you're feeling uncertain about your specific situation—especially regarding the implications of back payments—consulting IRS guidelines or a tax professional can provide clarity.

It's worth noting that while most states do not tax Social Security disability payments, there are states where the question of whether disability benefits are taxable arises, including Connecticut, Colorado, and Minnesota. Therefore, it's wise to verify your state's regulations. Additionally, remember that the standard deduction for individuals under 65 is $15,750 annually, which can help reduce your tax burden. SSDI recipients who are blind may even qualify for a higher standard deduction.

As an SSDI recipient, you are required to file an annual tax return by April 15, even if no tax is due. For more detailed guidance, refer to IRS Publication 915.

At Turnout, we’re here to assist you in navigating these complex financial processes. Our trained nonlawyer advocates and IRS-licensed enrolled agents are dedicated to ensuring you understand your rights and options without the need for legal representation. Please remember, Turnout is not a law firm and does not provide legal advice. You are not alone in this journey, and we’re here to help you every step of the way.

Identify Types of Disability Benefits and Their Tax Rules

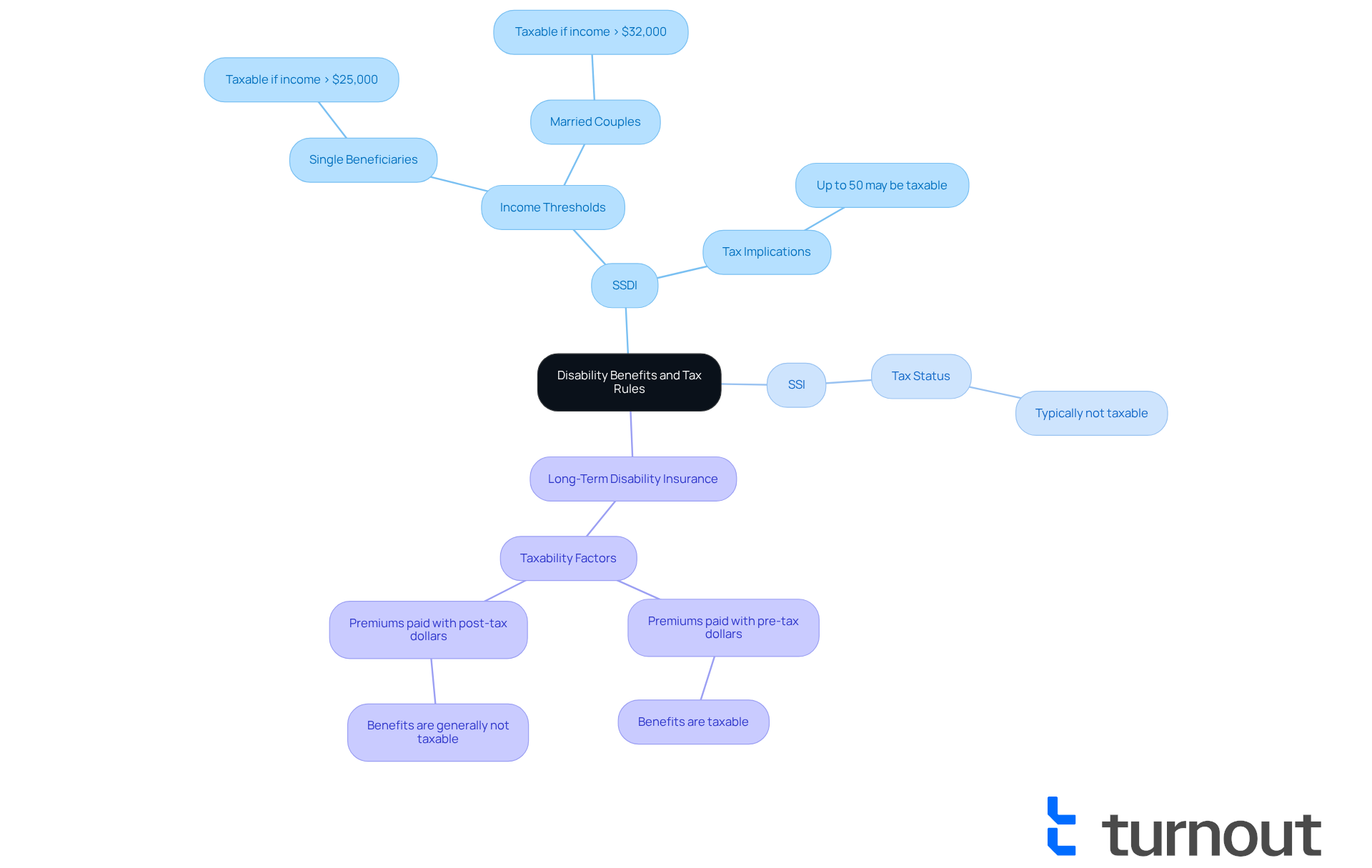

We understand that navigating disability assistance can be overwhelming, but knowing your options is a crucial first step. Here are the types of assistance you might receive: SSDI, SSI, and long-term disability insurance.

It's important to research if disability benefits are taxable according to the tax rules for each type. The question of whether SSDI benefits are taxable arises if your combined income exceeds $25,000 for individuals or $32,000 for couples filing jointly. If your overall earnings exceed these limits, you may need to consider how disability benefits are taxable, which may require factoring in up to 50% of your SSDI payments in your taxable income.

On the other hand, SSI assistance is typically not subject to taxation. This means you can receive financial support without the burden of extra tax obligations. The taxability of long-term disability assistance can vary based on how the premiums were paid, leading to the question of whether disability benefits are taxable. If premiums were paid with pre-tax dollars, one might wonder, are disability benefits taxable? However, if they were paid with post-tax dollars, the benefits are generally not taxable.

We encourage you to maintain comprehensive records of all benefits received. This will be crucial for accurate tax filing and ensuring adherence to tax regulations.

Lastly, it's common to feel uncertain about changes on the horizon. Be aware of the upcoming adjustments to SSDI eligibility criteria and compensation calculations in 2025. These changes could impact your support and tax obligations, but remember, you are not alone in this journey. We're here to help you navigate these complexities.

Assess Impact of Additional Income on Disability Benefit Taxes

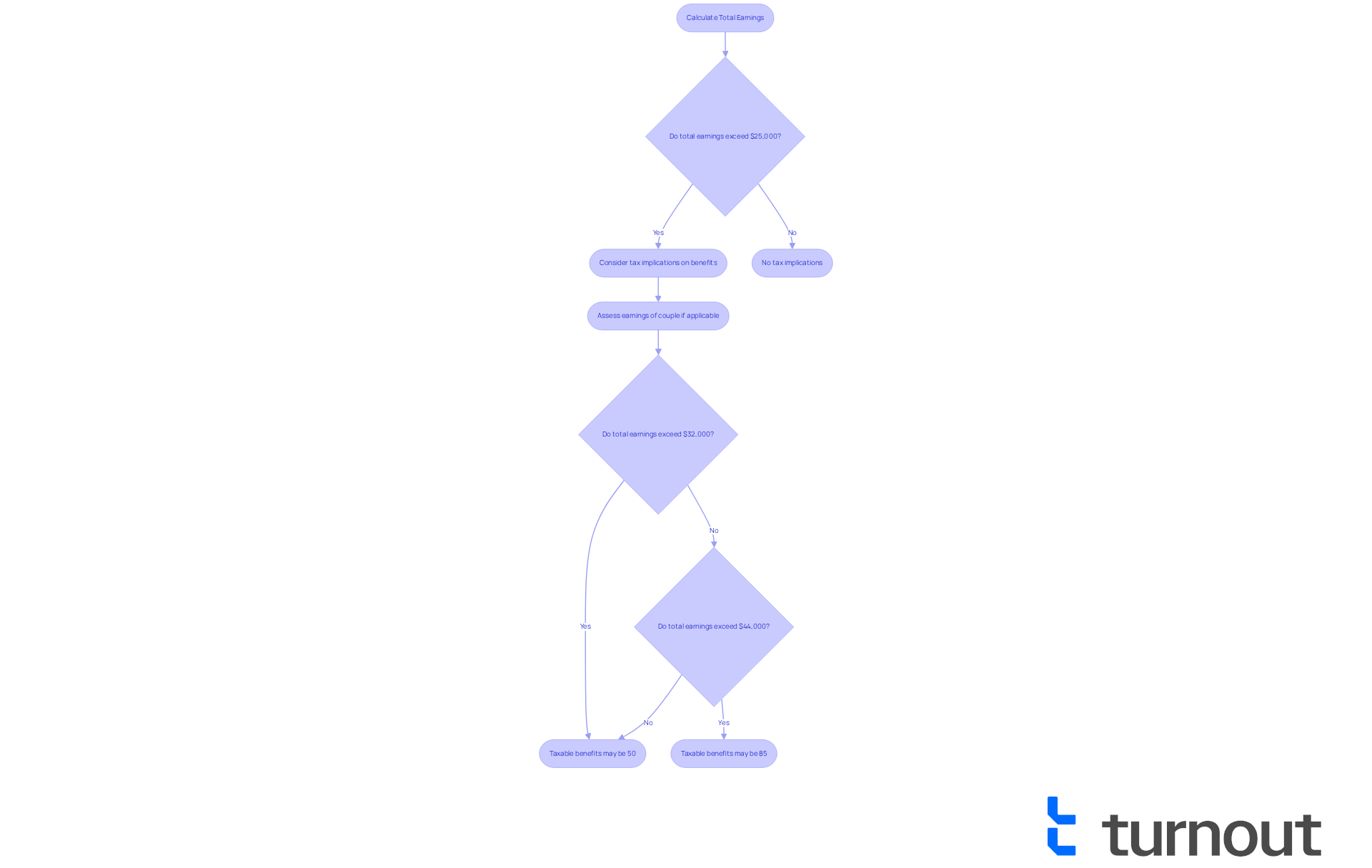

Calculating your total earnings is a vital step in understanding your tax obligations. This includes not just your wages, but also investment returns and any other sources of income. We understand that this can feel overwhelming, but knowing your total is the first step toward clarity.

Next, consider how your overall earnings, combined with half of your disability support, will determine if your disability benefits are taxable against the tax limit. For instance, if you’re an individual taxpayer earning over $25,000, you may wonder if your disability benefits are taxable, as part of your benefits might be subject to taxation. It's common to feel uncertain about these thresholds, but awareness is empowering.

Additionally, think about the financial implications of having a working partner or other sources of revenue. If a married couple’s total earnings exceed $32,000, they could face taxes on as much as 50% of their benefits. Furthermore, couples filing jointly with earnings over $44,000 may find that the question of whether their disability benefits are taxable could affect up to 85% of their payments. We’re here to help you navigate these complexities.

It’s important to adjust your withholding or estimated tax payments to avoid underpayment penalties. The Social Security Administration allows for federal tax withholdings of up to 22% from SSDI payments, which can help you manage your tax responsibilities more effectively. Remember, taking proactive steps can ease your financial worries.

Finally, we encourage you to seek expert advice to accurately determine your total earnings for tax purposes. Consulting with professionals who understand state regulations can ensure you maximize deductions and comply with tax laws. You are not alone in this journey; support is available to guide you every step of the way.

Gather Required Documentation and Explore Deductions

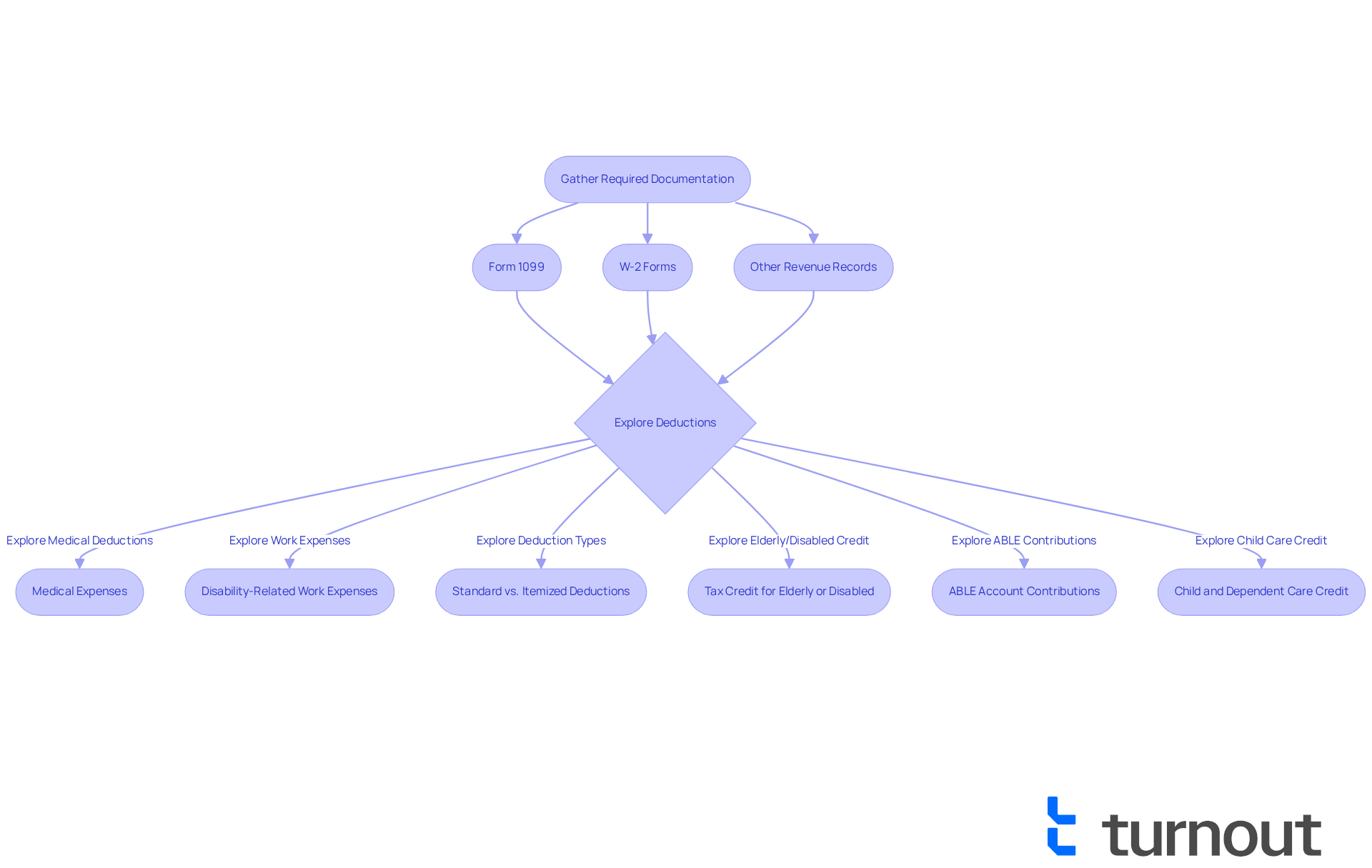

Gathering your tax documents can feel overwhelming, but we're here to help you through this process. Start by collecting all relevant tax documents:

- Form 1099 for any disability benefits you received.

- W-2 forms for any employment earnings.

- Records of any other revenue sources you may have.

Next, let’s explore potential deductions that could ease your financial burden:

- Medical expenses related to your disability may be deductible if they exceed 10% of your adjusted gross income if you’re under 65, or 7.5% if you’re 65 or older (check Publication 502 for more details).

- You can also deduct disability-related work expenses without the usual 10% threshold requirement.

- Consider whether the standard deduction or itemized deductions are more beneficial for your situation, especially with the increased standard deductions available for legally blind individuals.

- If you are 65 or older or permanently disabled, don't forget about the Tax Credit for the Elderly or Disabled, which offers additional financial relief.

- Contributions to ABLE accounts allow you to save up to $19,000 in 2025 without jeopardizing your benefits.

- Lastly, the Child and Dependent Care Credit lets caregivers claim up to $3,000 for one dependent or $6,000 for two or more, depending on income.

Organizing your documents for easy access during tax preparation is essential. By ensuring you have all necessary paperwork, you can maximize your deductions and credits. Remember, you are not alone in this journey, and taking these steps can help lighten your load.

Conclusion

Understanding the tax implications of disability benefits is crucial for effective financial planning. We recognize that navigating these complexities can be overwhelming. This article outlines the intricacies surrounding the taxability of various disability payments, emphasizing the importance of knowing how your earnings interact with these benefits. By clarifying the thresholds for taxation and the types of benefits available, we hope to empower you to make informed decisions regarding your financial obligations.

Key insights include:

- The clear thresholds for SSDI payments

- The distinctions between SSDI, SSI, and long-term disability insurance

- The necessity of accurate record-keeping

It’s common to feel uncertain about these details, but remember that there are potential deductions that can alleviate tax burdens. Consulting tax professionals for personalized guidance is also a vital step in this journey. Each of these points reinforces the need for awareness and preparation in managing your finances effectively.

In light of these considerations, it is essential to take proactive steps in understanding and managing the tax implications of disability benefits. Staying informed about potential changes in tax regulations and eligibility criteria, especially as they evolve in 2025, can significantly impact your financial well-being. By gathering the necessary documentation and exploring available deductions, you can navigate your tax responsibilities with confidence. Ultimately, being proactive and informed is the key to ensuring that disability benefits serve their intended purpose without unexpected financial strain. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

How should I determine the taxability of my disability benefits?

To determine the taxability of your disability benefits, incorporate half of your disability payments into your total earnings and check if your total earnings exceed the limit for your filing status—$25,000 for single filers or $32,000 for married couples filing jointly.

Are my SSDI payments taxable if I earn less than $25,000 per year?

If your monthly earnings are up to $2,083 (yearly earnings up to $25,000), no part of your SSDI payments is subject to tax.

What if my earnings are between $25,000 and $34,000?

If your monthly earnings fall between $2,084 and $2,833 (yearly earnings from $25,000 to $34,000), 50% of your benefits may be subject to tax.

What happens if my earnings exceed $34,000?

If your monthly earnings exceed $2,834 (yearly earnings surpassing $34,000), up to 85% of your disability assistance could be taxable.

How do lump-sum SSDI back payments affect my taxes?

Receiving substantial lump-sum SSDI back payments can complicate your financial situation, potentially increasing your income for the year received and leading to higher taxes. It's important to report any assessable benefits accurately using IRS Form 1040.

Do I need to file a tax return if I have no tax due?

Yes, as an SSDI recipient, you are required to file an annual tax return by April 15, even if no tax is due.

Are disability benefits taxable in all states?

Most states do not tax Social Security disability payments, but some states, including Connecticut, Colorado, and Minnesota, may have regulations regarding the taxation of these benefits. It's advisable to verify your state's regulations.

How can I reduce my tax burden as an SSDI recipient?

The standard deduction for individuals under 65 is $15,750 annually, which can help reduce your tax burden. SSDI recipients who are blind may qualify for a higher standard deduction.

Where can I find more detailed guidance on disability benefits and taxes?

For more detailed guidance, refer to IRS Publication 915 or consult IRS guidelines or a tax professional for clarity on your specific situation.