Overview

The article titled "8 Insights into Social Security Cost of Living Increase History" aims to shed light on the historical context and significance of Social Security cost-of-living adjustments (COLA). We understand that navigating financial concerns can be daunting, especially when it comes to ensuring your purchasing power amidst inflation. Since 1975, these adjustments have played a vital role in helping beneficiaries maintain their financial stability.

This article discusses the Consumer Price Index (CPI) and how various economic conditions have influenced the adjustments made over the years. It's common to feel uncertain about how these changes affect your financial well-being. By exploring this history, we hope to provide you with supportive information that can guide you through your concerns. Remember, you are not alone in this journey; we’re here to help you understand the implications of these adjustments and what they mean for your future.

Introduction

The history of Social Security cost-of-living adjustments (COLA) since 1975 reveals a complex interplay between inflation, economic conditions, and the financial stability of millions of Americans. We understand that as beneficiaries face the challenge of maintaining their purchasing power amidst rising living costs, understanding these adjustments becomes crucial for effective financial planning.

With inflation rates fluctuating and healthcare expenses rising, it’s common to feel overwhelmed. How can recipients navigate the intricacies of COLA to ensure their benefits meet their needs? This article delves into the historical insights, calculation methods, and future projections of Social Security COLA, equipping you with the knowledge to make informed decisions about your financial future.

Remember, you are not alone in this journey; we’re here to help.

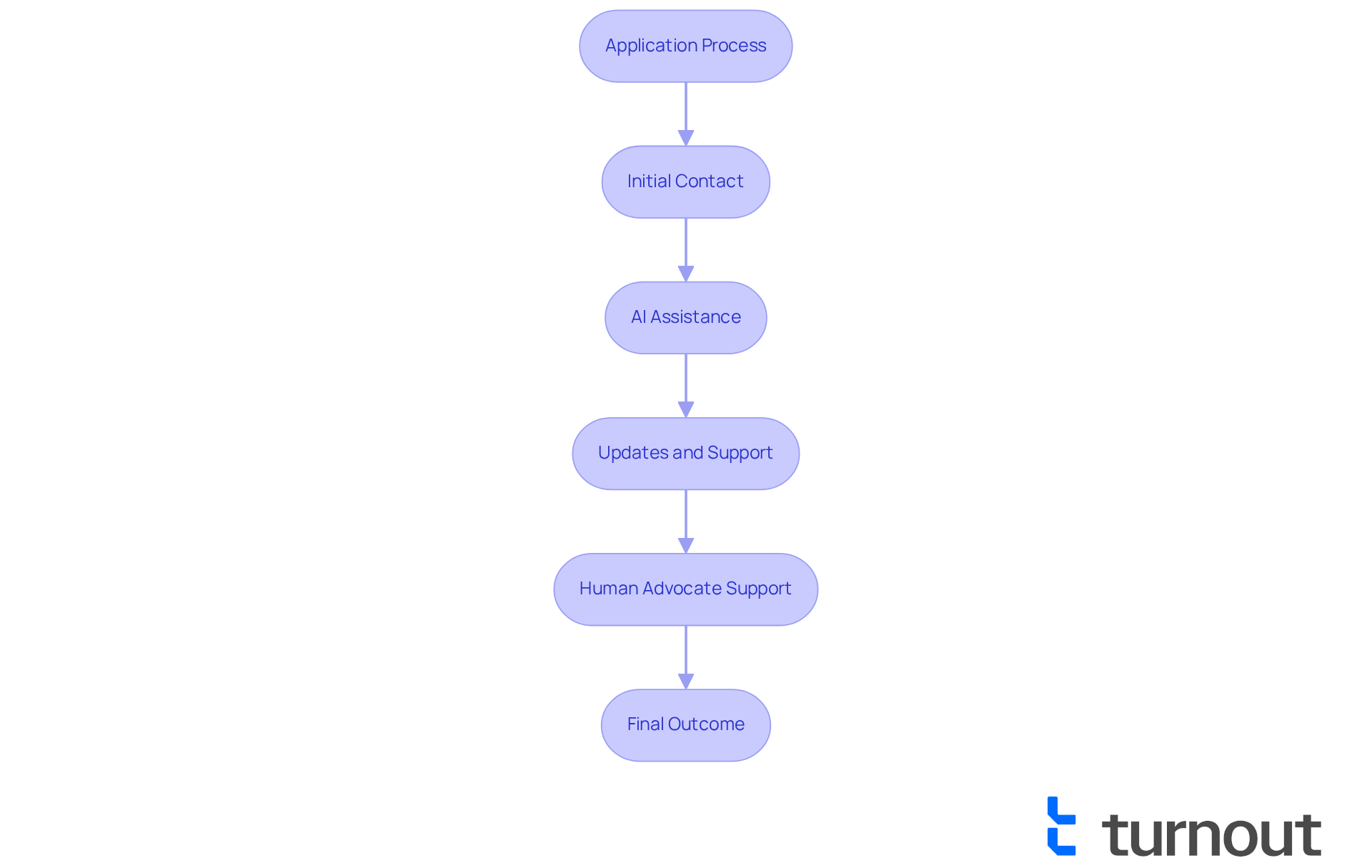

Turnout: Streamlining Access to Social Security Benefits

We understand that navigating the application process for security benefits can be overwhelming. Turnout is changing how individuals access these vital resources by utilizing AI technology to streamline the application process. With Jake, our AI case quarterback, consumers receive timely updates and support, making this often daunting task more manageable.

This modern approach not only boosts efficiency but also ensures that applicants feel supported throughout their journey. You are not alone in this process; we are here to help. By utilizing trained nonlawyer advocates alongside AI, Turnout exemplifies how technology can enhance consumer advocacy, making the system more navigable for millions of Americans in need.

Imagine receiving the assistance you deserve with the support of a compassionate team. We believe that everyone should have access to the help they need, and together, we can improve outcomes for those seeking assistance.

Historical Overview of Social Security COLA Adjustments Since 1975

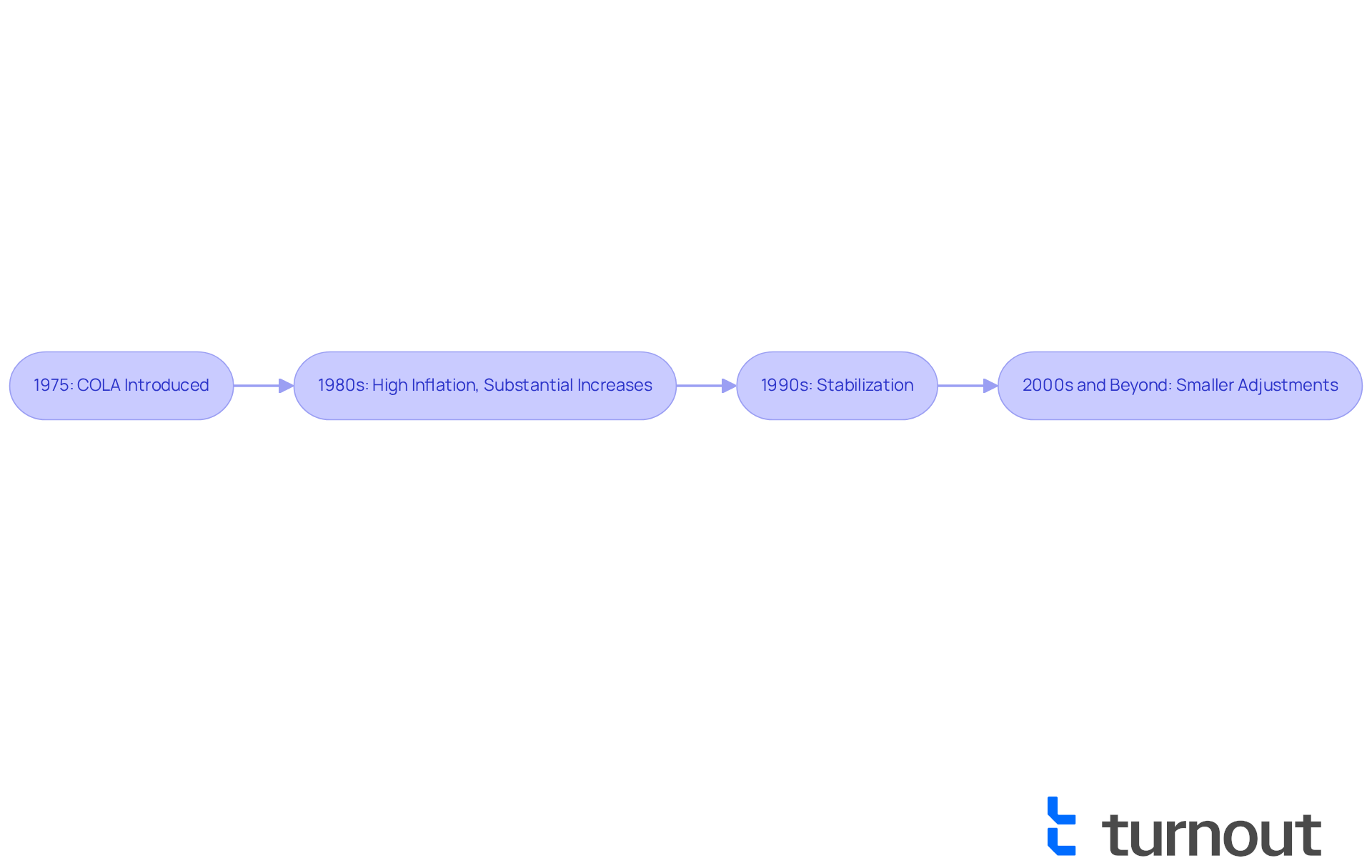

Since 1975, the social security cost of living increase history shows that yearly adjustments have been implemented to help beneficiaries keep pace with inflation. We understand that navigating these changes can be challenging, especially when they directly impact your financial well-being.

Originally linked to the Consumer Price Index (CPI), these adjustments have varied significantly based on economic conditions. For instance, in the early 1980s, cost-of-living increases were substantial due to high inflation rates. In contrast, more recent years have seen smaller modifications as inflation has stabilized.

It's common to feel uncertain about what these changes mean for your future. Understanding the social security cost of living increase history is vital for recipients like you to anticipate upcoming adjustments and plan accordingly. Remember, you are not alone in this journey, and we’re here to help you understand the implications of these adjustments on your life. Together, we can navigate these changes with confidence.

How Social Security COLA Is Calculated: Key Methods Explained

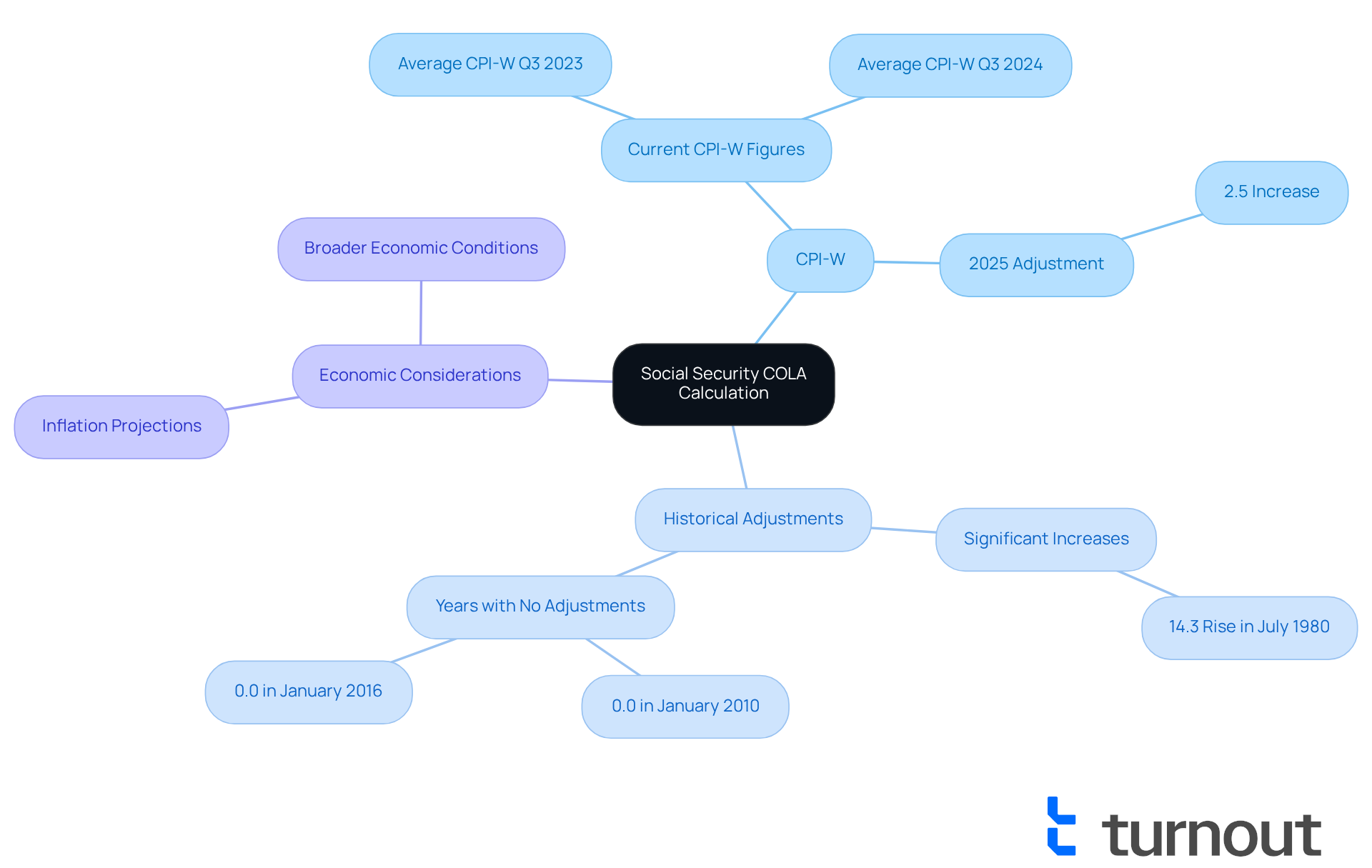

Understanding the social security cost of living increase history and the computation of Social Security Cost-of-Living Adjustments (COLA) can be vital for many. It mainly depends on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the price changes of a selected basket of goods and services, reflecting the cost of living. When the CPI-W increases, beneficiaries usually receive a related cost-of-living adjustment. For instance, the latest adjustment for 2025 is set at 2.5%, effective for benefits starting in December 2024 and payable in January 2025. This adjustment is based on the CPI-W's increase from the third quarter of 2023 to that of 2024, where the average CPI-W rose from 301.236 to 308.729.

We understand that navigating these adjustments can feel overwhelming. Alongside the CPI-W, the Social Security Administration may also consider broader economic conditions and inflation projections when deciding the final COLA. This multifaceted approach helps create a more comprehensive understanding of the economic environment impacting recipients. Financial analysts emphasize that the CPI-W is essential in ensuring that Social Security payments keep pace with rising living expenses, thus preserving recipients' purchasing power.

The social security cost of living increase history shows the variations in cost-of-living allowances over the years, highlighting periods of significant inflation, such as the 14.3% rise in July 1980, compared to years when no adjustments were made. It’s common to feel uncertain about how these changes might affect your financial future. Understanding these calculation methods equips beneficiaries with the knowledge to anticipate potential changes in their benefits, allowing for better planning.

You're not alone in this journey. We’re here to help you navigate these complexities and ensure you feel supported every step of the way.

The Relationship Between Inflation Rates and Social Security COLA

Inflation rates significantly impact the social security cost of living increase history, and we understand how concerning this can be for many. When inflation rises, the purchasing power of fixed benefits declines, making it essential to adjust these benefits. The cost-of-living adjustment aims to help recipients maintain their quality of life amidst these changes.

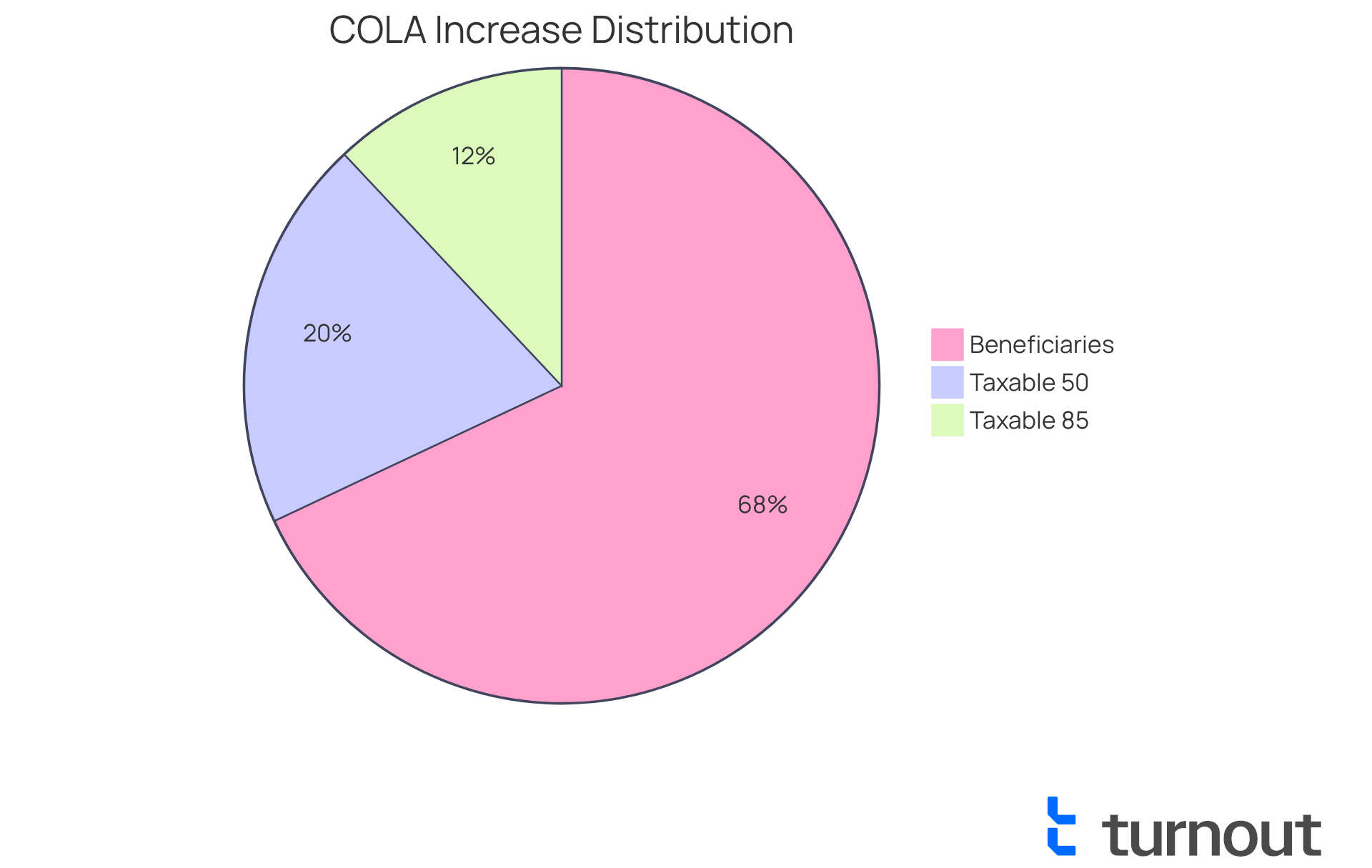

For instance, the Retirement Security Administration has announced a 2.5% cost-of-living increase for 2025, which will directly benefit around 68 million individuals, translating to about $50 more per month. This adjustment is particularly important as it reflects the ongoing challenges inflation brings to many families.

As Chris Duderstadt noted, 'On October 10, the Administration for Security Benefits announced that over 72.5 million Americans will receive a 2.5% cost-of-living increase to their benefits in 2025.' It’s crucial to understand that these adjustments can make a difference in your daily life.

Furthermore, being aware of the tax implications of Social Security benefits is vital. If your provisional income exceeds $34,000, you might find that up to 85% of your benefits could be taxable. Meanwhile, if your income falls between $25,000 and $34,000, up to 50% may be taxable.

Looking back at the social security cost of living increase history, it is evident that during periods of high inflation, such as the late 1970s, substantial cost-of-living adjustments were made. This illustrates the pressing need to protect recipients from rising expenses. Understanding this relationship can help you anticipate how economic changes may affect your benefits, allowing you to adapt accordingly. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

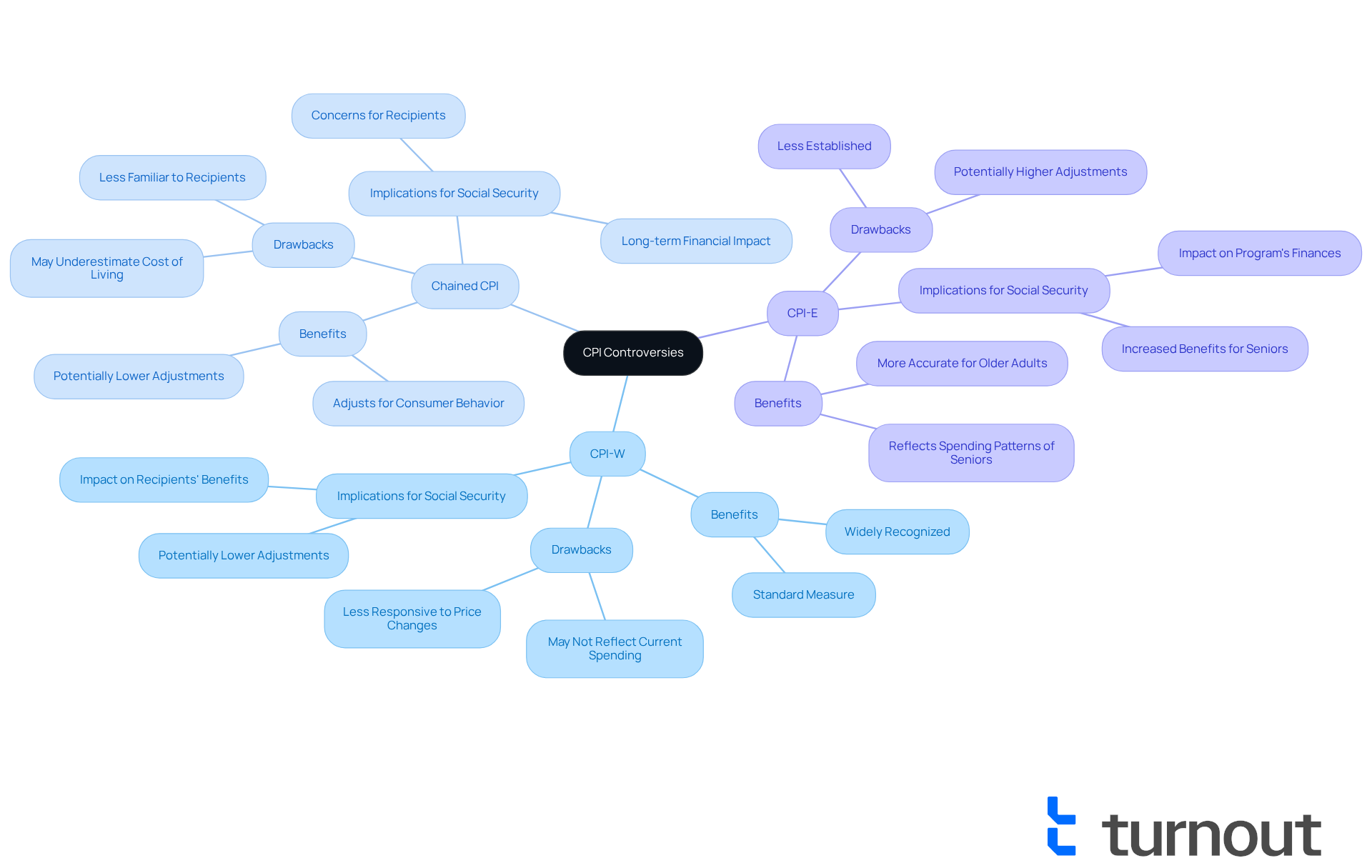

CPI Controversies: CPI-W vs. Chained CPI vs. CPI-E in COLA Calculations

The computation of the social security cost of living increase history can be confusing, leading to understandable questions about which Consumer Price Index (CPI) should be used. Traditionally, the CPI for Wage Earners and Clerical Workers (CPI-W) has been the standard measure. However, some experts suggest considering the Chained CPI, which adjusts for changes in consumer behavior as prices fluctuate. This could lead to lower adjustments over time, which might be concerning for many.

Others advocate for the CPI for the Elderly (CPI-E), specifically designed to reflect the spending patterns of older adults. This index may offer a more accurate representation of their cost of living, which is crucial as expenses can vary significantly. Each index has its own benefits and drawbacks, and the choice of an index can greatly impact the social security cost of living increase history for the amounts recipients receive.

As the leading actuary of the Security Administration noted, the ongoing discussions regarding the 'Big Beautiful Bill' will have 'material effects' on recipients. Given the financial challenges facing the Security program, understanding these differences is essential for recipients to stay aware of potential changes to their benefits. We understand that navigating these complexities can feel overwhelming.

To help you manage this situation, we encourage you to regularly check for updates from the Security Administration. Consider how various CPI adjustments may influence your financial planning. Remember, you're not alone in this journey; we're here to help you make informed decisions.

How Medicare Costs Affect Social Security COLA Adjustments

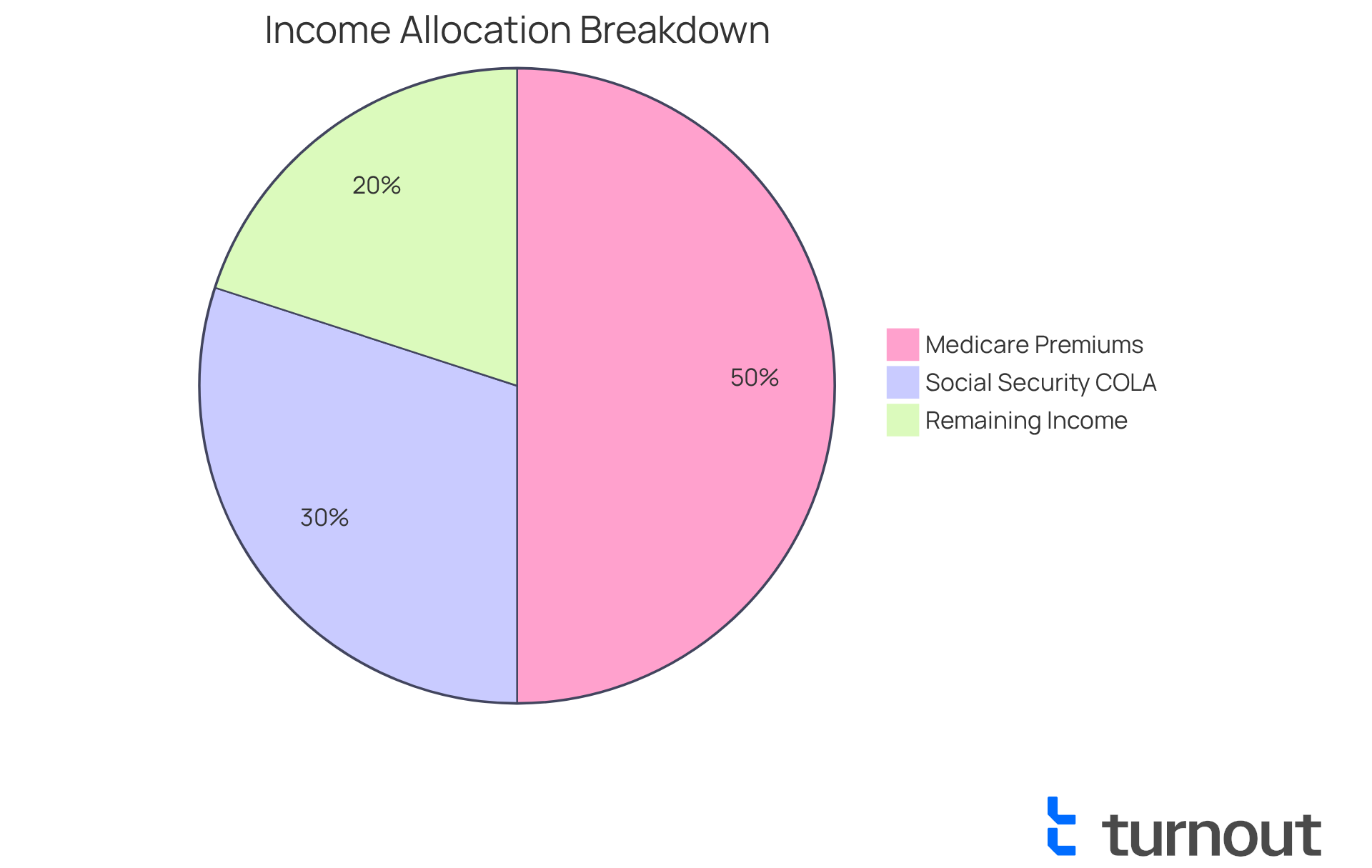

Medicare expenses significantly influence the social security cost of living increase history and its effectiveness. We understand that as Medicare premiums rise, recipients often find that their social security cost of living increase history is diminished by increasing healthcare costs. For example, if a cost-of-living adjustment is set at 2.6% to 2.7%, but Medicare premiums increase by 3%, recipients may ultimately see a decrease in their net income. This situation highlights the importance of considering healthcare expenses when evaluating the adequacy of the social security cost of living increase history.

Recent projections indicate that the standard Medicare Part B premium is expected to rise from $185 to $206.50 in 2026, marking an 11.6% increase. Such significant hikes can severely impact low-income beneficiaries, who may already be grappling with limited financial resources. Experts emphasize that while cost-of-living adjustments aim to provide relief, the social security cost of living increase history shows that increasing Medicare expenses can negate these benefits, leaving many retirees with minimal funds for other essential costs. Mary Johnson, an independent Medicare and retirement policy analyst, observed, "It’s not unusual for Part B premiums to consume a significant portion or even all of the yearly cost-of-living adjustment, leaving little remaining to address other major expense increases."

Beneficiaries are encouraged to remain vigilant regarding changes in both Social Security and Medicare to manage their finances effectively. Understanding the interplay between these two systems is vital for navigating the complexities of retirement income and healthcare costs. Remember, you are not alone in this journey; we’re here to help you find your way.

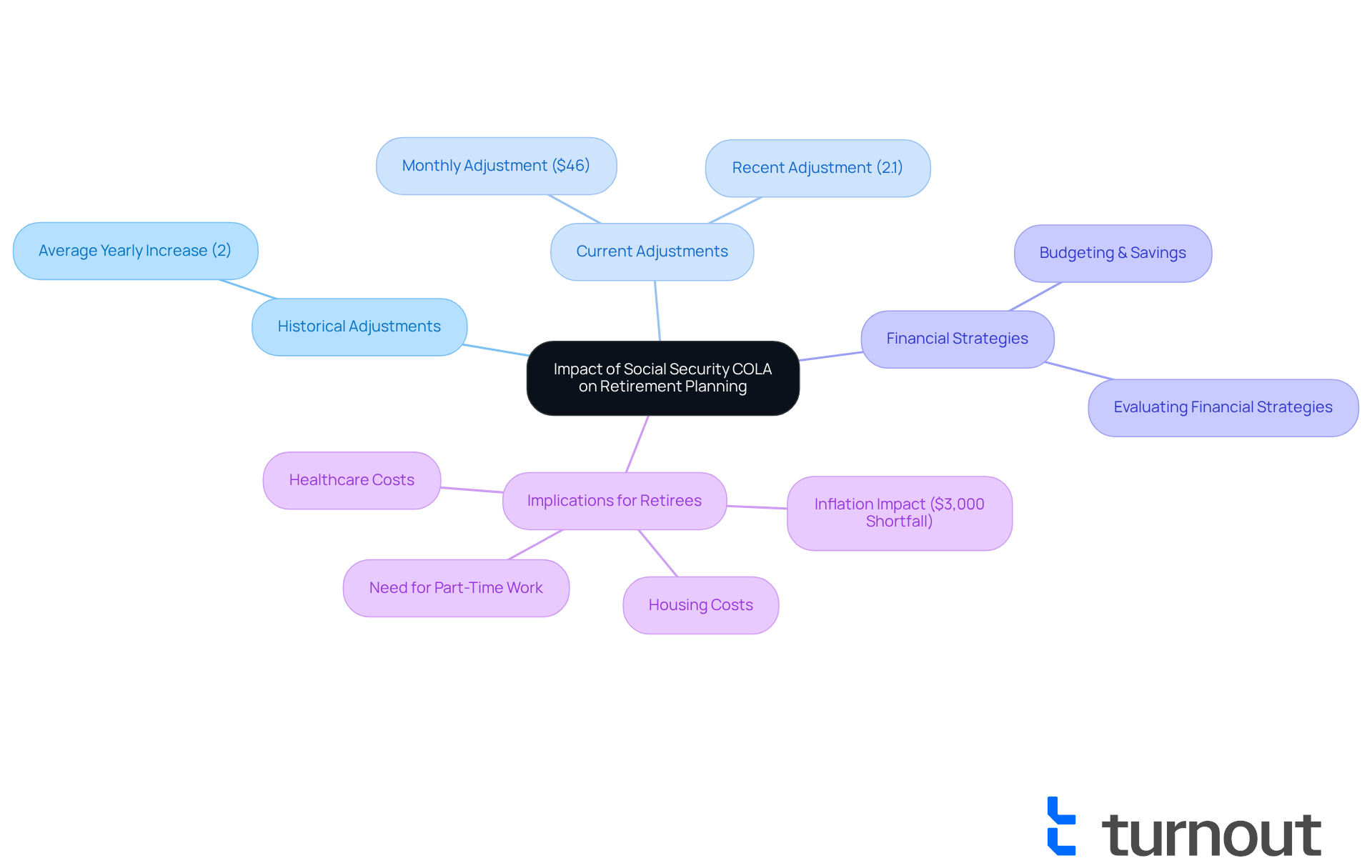

Impact of Social Security COLA on Retirement Planning Strategies

The social security cost of living increase history plays a vital role in shaping effective retirement planning strategies. We understand that anticipating these adjustments can help beneficiaries better estimate their long-term financial needs. Historical patterns indicate that the average yearly cost-of-living adjustment aligns with the social security cost of living increase history of around 2%. By incorporating this figure into budgeting and savings plans, retirees can foster a more realistic financial outlook.

Moreover, grasping how cost-of-living adjustments interact with other income sources, such as pensions and personal savings, is essential for crafting a comprehensive retirement plan. It's common to feel uncertain about the future, but consistently evaluating financial strategies with potential adjustments in mind can help retirees adapt to their evolving financial landscape.

The recent 2.1% cost-of-living adjustment, noted in the social security cost of living increase history as translating to about $46 more each month, underscores the importance of proactive financial planning. As Shannon Benton, executive director of the Senior Citizens League, wisely points out, "If housing and even healthcare costs continue to climb, a $2,000 benefit isn’t going to do your retired senior much good." Given that retirees often face an annual shortfall of about $3,000 due to inflation—particularly in housing and healthcare—it's crucial for them to adjust their financial strategies accordingly.

Many retirees are already feeling the strain. Some may find themselves having to forgo medical treatments or seek part-time work to manage rising costs. Therefore, anticipating cost-of-living changes is not just a matter of financial wisdom; it is essential for ensuring a stable and secure retirement. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

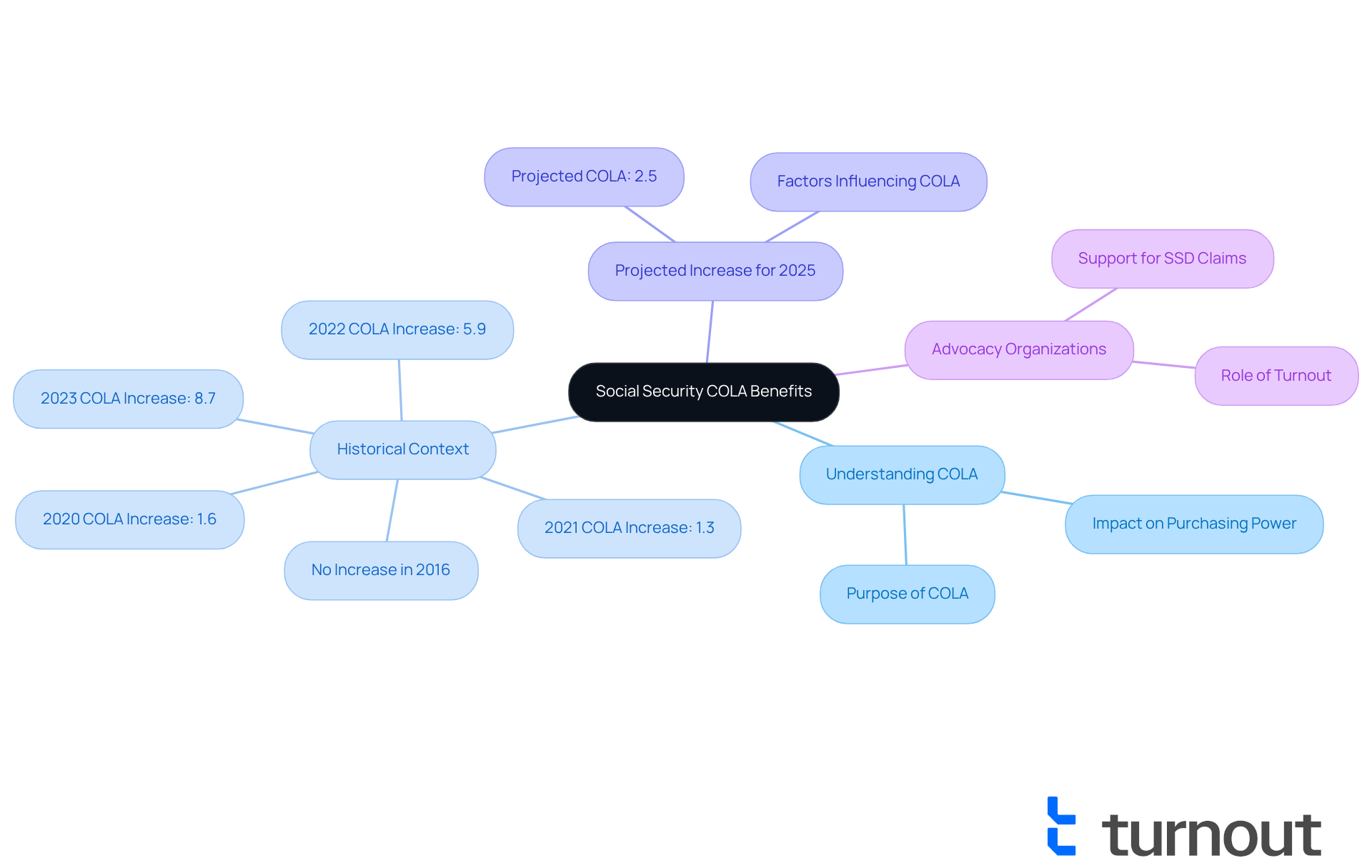

Navigating Challenges: Understanding Your Social Security COLA Benefits

Navigating the social security cost of living increase history can feel overwhelming, especially for those who may not be familiar with the system's intricacies. We understand that it’s important for beneficiaries to take proactive steps to grasp their cost-of-living changes. Regularly reviewing benefit statements and staying updated on the social security cost of living increase history that influences these adjustments can make a significant difference.

The Security Administration emphasizes that the purpose of the cost-of-living adjustment, which is detailed in the social security cost of living increase history, is to ensure that recipients' purchasing power remains stable over time, particularly as living expenses rise. For 2025, the projected cost of living adjustment increase is 2.5%. While this is lower than in previous years, it still offers valuable support for individuals relying on these benefits.

Advocacy organizations like Turnout are here to help simplify access to government benefits and financial assistance. They support individuals with Disability (SSD) claims and tax debt relief, guiding them through understanding these changes and optimizing their benefits without the need for professional legal assistance. By staying informed and proactive, you can effectively navigate the complexities of your cost-of-living adjustment benefits, ensuring you receive the support necessary to manage essential expenses. Remember, you are not alone in this journey; help is available, and we’re here to assist you.

Future Projections: What to Expect from Social Security COLA Adjustments

We understand that navigating the future of Cost of Living Adjustments can be challenging. These adjustments depend on various economic indicators, particularly inflation rates and overall economic growth. The social security cost of living increase history is established by Social Security analyzing three months of government inflation data from July, August, and September, comparing it to the same months from the previous year. As the economy stabilizes, analysts suggest that these adjustments may become more predictable, potentially averaging around 2% annually.

However, it's common to feel uncertain due to unexpected economic events that can disrupt these forecasts. For example, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) recently showed a 2.5% increase over the past year, reflecting current inflation trends. Additionally, factors like tariff effects on consumer prices could influence upcoming cost-of-living adjustments, especially if inflation rates fluctuate.

It's important to recognize that the historical accuracy of cost-of-living projections, as reflected in the social security cost of living increase history, compared to actual modifications indicates that flexibility is key. We encourage recipients to frequently evaluate their financial plans to account for possible shifts in cost-of-living changes. Staying informed about economic trends will empower you to prepare for the future with confidence. Remember, you are not alone in this journey, and we’re here to help you navigate these changes.

Key Takeaways: Essential Facts About Social Security COLA History

-

Since 1975, the history of Social Security cost of living increase has included implementations to help beneficiaries keep pace with inflation. This adjustment mechanism is crucial for ensuring that benefits reflect the social security cost of living increase history, providing a safety net for those who rely on it.

-

The cost-of-living adjustment is primarily determined by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index includes over 200 price categories, each with distinct weightings to accurately calculate inflation. Other indices, such as Chained CPI and CPI-E, offer a broader perspective on how inflation affects recipients.

-

Inflation rates have a direct impact on cost-of-living increases, influencing the purchasing power of recipients. For instance, in 2023, more than 22 million individuals were lifted above the federal poverty threshold thanks to Social Security payments. This underscores the significance of these adjustments for those who depend on them.

-

It's important to recognize that rising Medicare expenses can offset cost-of-living adjustments, potentially diminishing net income for recipients. This interplay between healthcare costs and benefit modifications highlights the need for careful financial planning.

-

Understanding the social security cost of living increase history is essential for effective retirement planning and financial management. Beneficiaries who comprehend how these adjustments function can navigate their financial futures more confidently and make informed decisions.

-

Projections for future cost-of-living adjustments depend on current economic conditions, with analysts anticipating an average increase of around 2% each year. The next announcement regarding these adjustments is expected in October 2025, and staying informed about potential changes is essential for recipients.

-

Staying knowledgeable and proactive is key for recipients as they navigate the complexities of their Social Security benefits. Engaging with available resources and updates can empower individuals to maximize their benefits and adapt to any changes in the system.

-

The significance of the social security cost of living increase history cannot be overstated; it plays a crucial role in ensuring the financial stability of millions. Experts from The Senior Citizens League emphasize that these adjustments are designed to protect beneficiaries from losing purchasing power over time. This reflects the ongoing need for advocacy and awareness in the realm of Social Security. Remember, you are not alone in this journey, and we're here to help.

Conclusion

Understanding the history of social security cost-of-living increases is essential for beneficiaries as they navigate the complexities of their financial futures. We recognize that this journey can be challenging. This article has explored various factors influencing cost-of-living adjustments (COLA), from historical trends since 1975 to the intricate calculations based on the Consumer Price Index (CPI). By examining the interplay between inflation rates, Medicare costs, and the methods used to determine COLA, it becomes clear that these adjustments are vital for maintaining the purchasing power of millions of Americans.

Key insights reveal how inflation directly impacts the financial well-being of recipients, with specific adjustments made to alleviate the burden of rising living costs. It's common to feel uncertain about these changes. The discussion around different CPI indices, such as CPI-W, Chained CPI, and CPI-E, sheds light on the ongoing debates regarding the most accurate measures for calculating these vital adjustments. Additionally, we emphasize the importance of proactive financial planning in light of potential COLA changes and the necessity of staying informed about future projections and healthcare-related expenses.

Ultimately, the significance of understanding social security COLA cannot be overstated. As economic conditions evolve, beneficiaries must remain vigilant and engaged with resources that can help them navigate these changes. Remember, you are not alone in this journey. By staying informed and taking proactive steps, you can better prepare for your financial future, ensuring you maintain your quality of life amid fluctuating economic circumstances. Support is available, and together, we can work towards more secure outcomes for those relying on social security benefits.

Frequently Asked Questions

What is Turnout and how does it assist individuals with Social Security benefits?

Turnout is a service that streamlines access to Social Security benefits by utilizing AI technology. It helps individuals navigate the application process and provides timely updates and support through an AI case quarterback named Jake, making the process more manageable.

How does Turnout enhance consumer advocacy?

Turnout enhances consumer advocacy by combining trained nonlawyer advocates with AI technology. This approach improves the navigability of the Social Security system for millions of Americans in need, ensuring they feel supported throughout their journey.

What is the historical context of Social Security cost-of-living adjustments (COLA) since 1975?

Since 1975, Social Security COLA adjustments have been implemented yearly to help beneficiaries keep pace with inflation. These adjustments, originally linked to the Consumer Price Index (CPI), have varied significantly based on economic conditions, with substantial increases in the early 1980s and smaller modifications in recent years.

How is the Social Security COLA calculated?

The Social Security COLA is primarily calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). When the CPI-W increases, beneficiaries typically receive a related cost-of-living adjustment. The latest adjustment for 2025 is set at 2.5%, based on the CPI-W's increase from the third quarter of 2023 to that of 2024.

Why is understanding the COLA adjustments important for beneficiaries?

Understanding COLA adjustments is vital for beneficiaries as it helps them anticipate upcoming changes and plan their finances accordingly. It provides insight into how adjustments impact their purchasing power and financial well-being.

What should beneficiaries do if they feel overwhelmed by these adjustments?

Beneficiaries who feel overwhelmed by COLA adjustments are encouraged to seek support and guidance. Organizations like Turnout are available to help individuals navigate the complexities of Social Security benefits and ensure they feel supported throughout the process.