Overview

Navigating debt challenges can feel overwhelming, but there is hope. This article shines a light on seven tax relief firms that are dedicated to helping individuals like you. Firms such as Turnout, Precision Tax Relief, and Optima Tax Relief are here to support you on your financial recovery journey.

These firms leverage technology and personalized support to offer effective solutions for your tax issues. We understand that you may feel lost during this process, but rest assured, you are not alone. With the right assistance, you can find your way back to financial stability.

Imagine having a compassionate team by your side, guiding you through each step. These firms ensure that you feel supported, providing the reassurance you need as you tackle your challenges head-on. If you're ready to take the first step towards relief, now is the time to reach out for help. Together, we can navigate this journey and find the best path forward.

Introduction

Navigating the complex world of tax relief can feel like an uphill battle. We understand that many individuals are grappling with mounting debts and overwhelming obligations. As the demand for effective assistance grows, more people are seeking reliable firms that can provide the support they need to regain control of their finances.

However, with so many options available, how can you discern which firms truly deliver value and effective solutions? In this article, we explore seven standout tax relief firms, highlighting their unique offerings and how they can help you successfully navigate your tax challenges.

Remember, you are not alone in this journey—we're here to help.

Turnout: AI-Powered Tax Relief Advocacy for Consumers

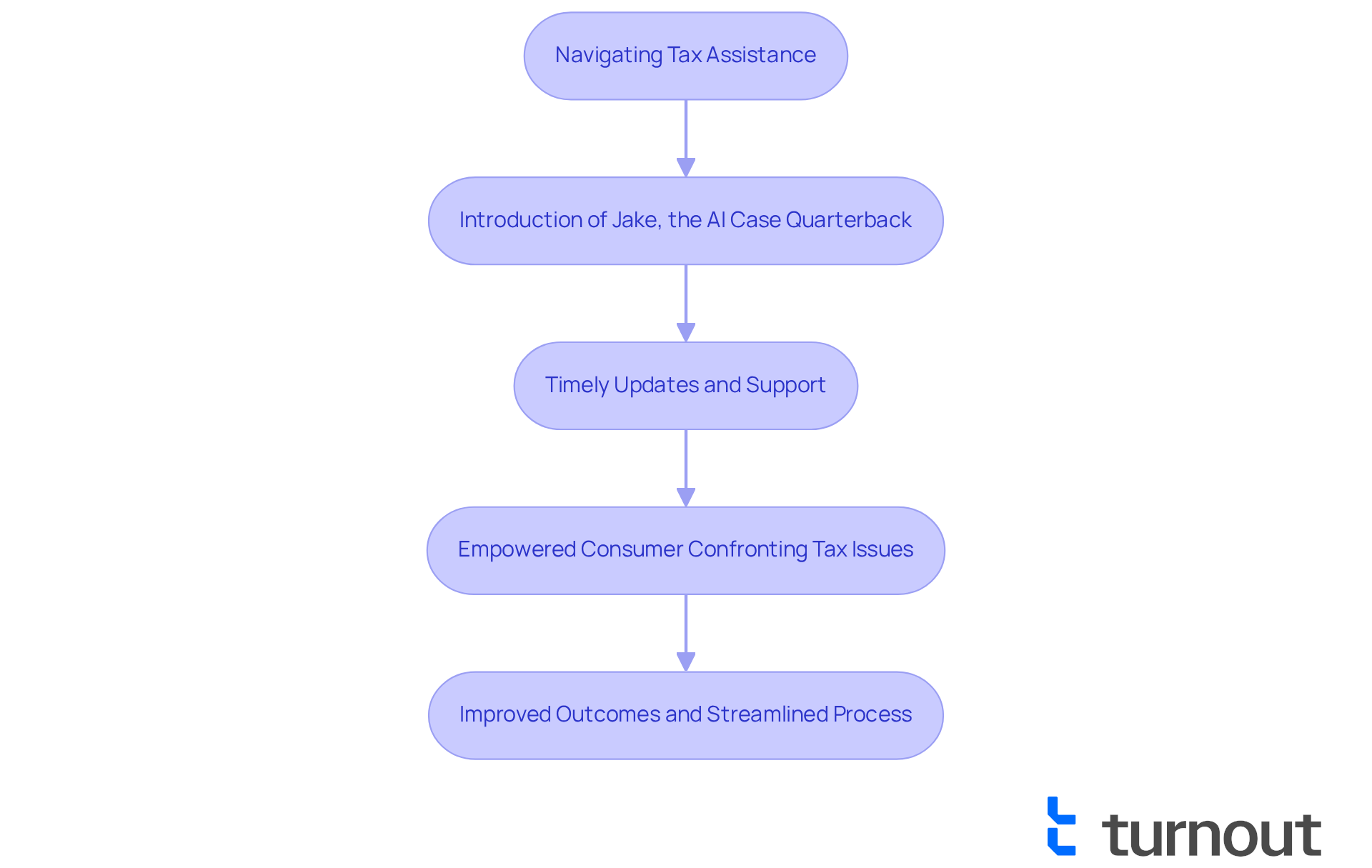

Navigating tax assistance can be challenging, and we understand how overwhelming it may feel. Turnout is here to help, utilizing advanced AI technology to enhance your experience. At the heart of this innovation is Jake, the AI case quarterback, who provides you with timely updates and support throughout your journey.

This proactive approach not only boosts efficiency but also empowers you to confront your tax issues with confidence. You are not alone in this journey. Turnout stands out in the tax relief landscape among tax relief firms, offering a modern solution that addresses the complexities of tax debt with clarity and compassion.

The integration of AI in consumer advocacy is reshaping how individuals manage their tax obligations. This leads to improved outcomes and a more streamlined process, ensuring that you have the support you need every step of the way. Remember, we're here to guide you through this process.

Precision Tax Relief: Comprehensive Services and Customer Support

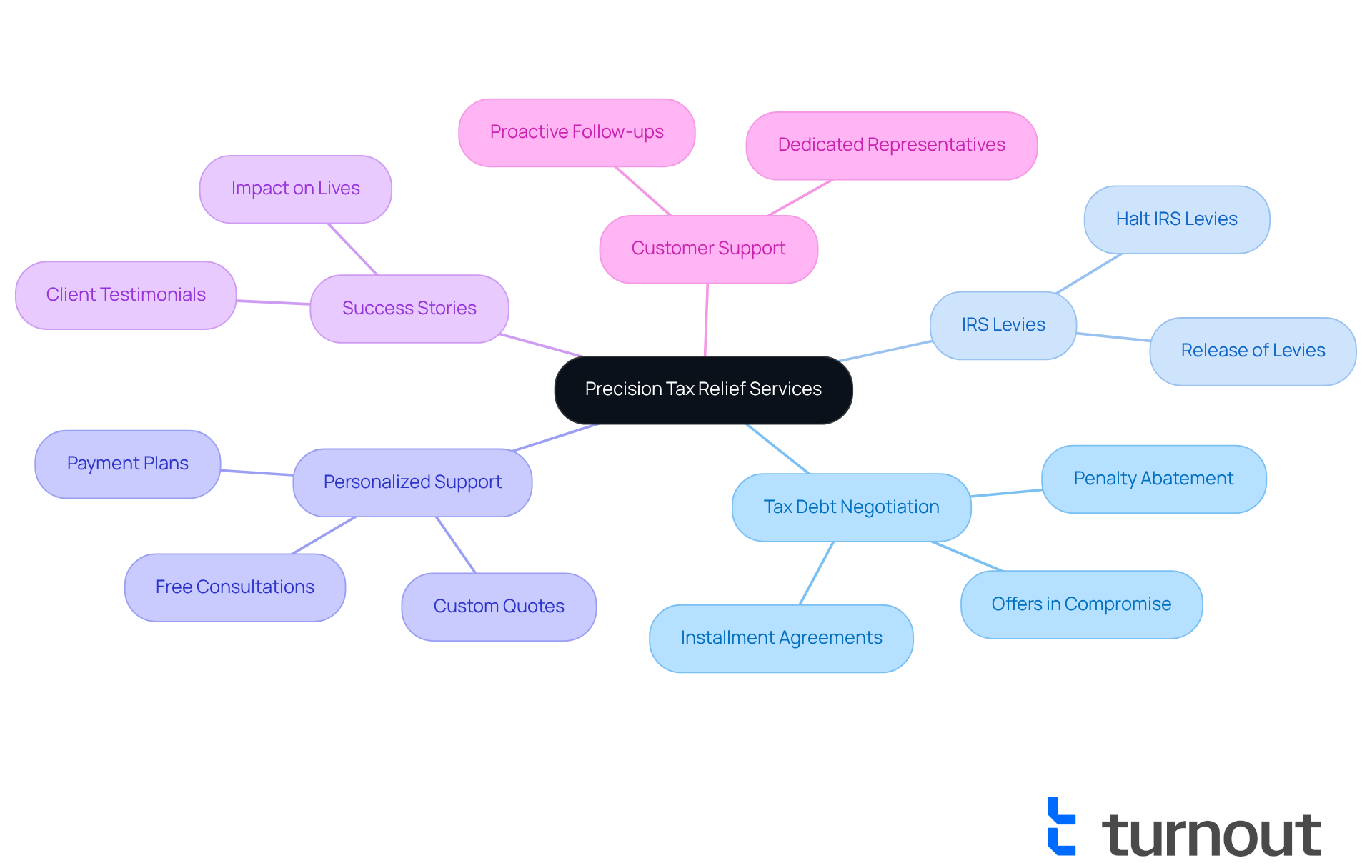

At tax relief firms like Precision Tax Relief, we understand the myriad challenges individuals face when dealing with tax issues. Our extensive range of offerings, provided by tax relief firms, is designed to address diverse tax concerns, from tax debt negotiation to assistance with IRS levies. We provide personalized support tailored to your unique circumstances, ensuring that you feel cared for at every stage of the process. Our dedication to customer care establishes us as a dependable option for those encountering tax difficulties.

Many clients have shared their success stories, highlighting how Precision Tax Relief has made a difference in their lives. We have proudly assisted nearly 80,000 customers in managing their tax challenges. For example, we often halt IRS levies against property, bank accounts, or wages within just 24 hours. This showcases our effectiveness in providing timely solutions. While the typical resolution duration for tax matters varies based on complexity, you can expect to receive an estimated timeline during your complimentary consultation, allowing you to prepare accordingly.

Tax experts emphasize the importance of customer support within tax relief firms. Effective communication and tailored help provided by tax relief firms can significantly influence the resolution process. At Precision Tax Relief, our commitment to client satisfaction is evident in our proactive follow-ups and the assignment of individual representatives to each case. We want you to feel supported throughout your journey to financial recovery.

As the tax assistance sector continues to grow, with tax relief firms projected to contribute to its worth of USD 22.1 billion by 2033, we are well-positioned to meet the increasing demand for expert help in managing tax responsibilities. With our comprehensive services and unwavering commitment to customer support, we are here to help you overcome your tax challenges. Remember, you are not alone in this journey; we are here to support you every step of the way.

Optima Tax Relief: User-Friendly Technology for Easy Navigation

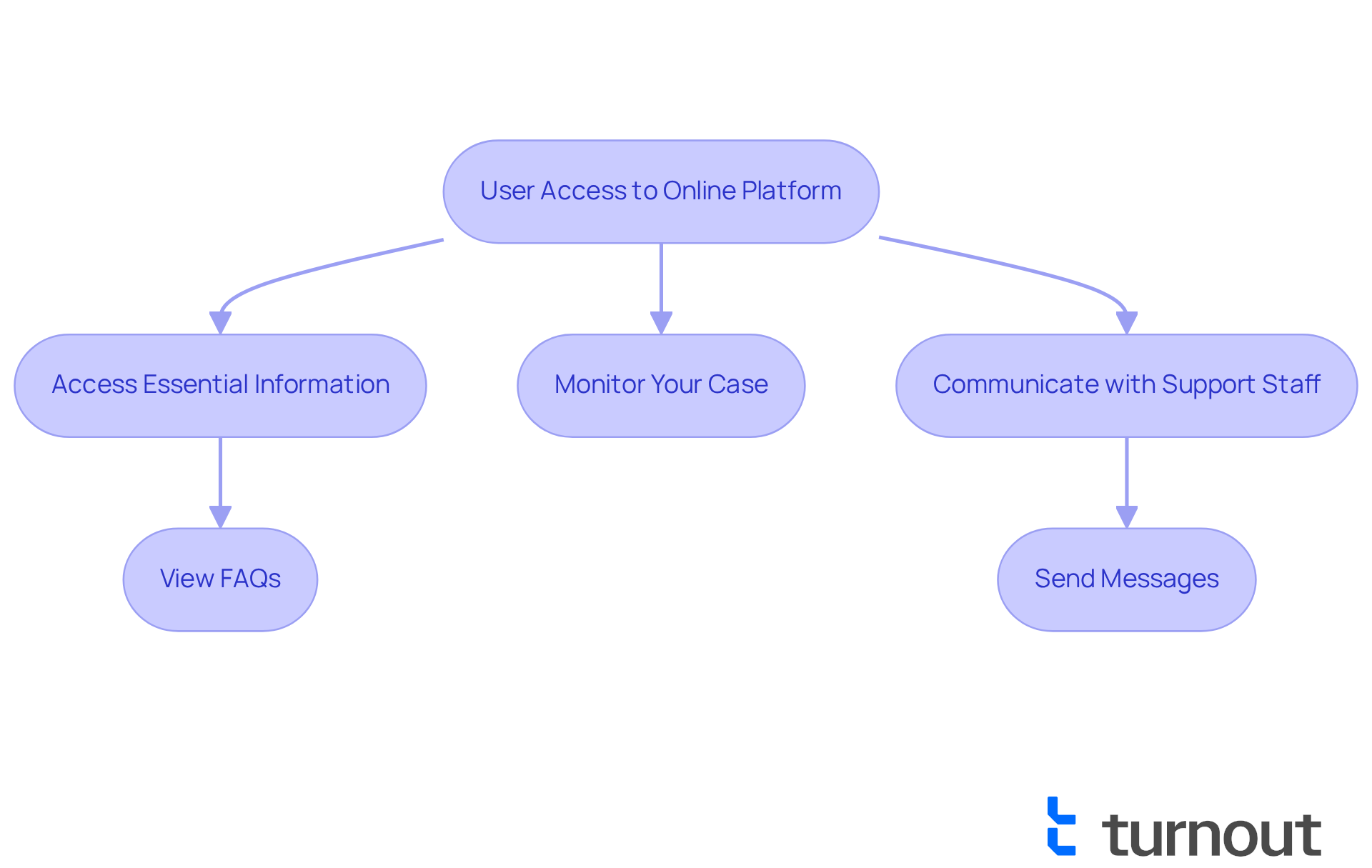

At Optima Tax Relief, we understand that navigating issues with tax relief firms can be overwhelming. That's why we have crafted user-friendly technology designed to simplify the tax assistance process. Our online platform allows you to effortlessly access essential information, monitor your case, and communicate with our caring support staff.

This focus on technology not only enhances your experience but also ensures you remain informed and actively involved throughout your tax relief journey. With over $1 billion in tax obligations settled for our customers, our innovative digital solutions significantly improve the efficiency of our offerings. We strive to make the often challenging task of managing tax debt more feasible and less daunting for individuals seeking help from tax relief firms.

Additionally, our integration of Unblu's Co-Browsing feature allows our support staff to guide you securely through the platform. We're here to help you every step of the way, ensuring that your experience is as smooth and supportive as possible. You are not alone in this journey.

Community Tax Relief: Best Value Proposition for Consumers

Turnout truly stands out with its competitive pricing and a heartfelt dedication to delivering value to consumers. We understand that many individuals grapple with tax challenges and SSD claims, and Turnout collaborates with tax relief firms to offer a comprehensive suite of services at accessible rates. This means you can receive the necessary assistance without adding to your financial strain.

Turnout employs trained non-legal advocates for SSD claims and collaborates with tax relief firms that include IRS-licensed enrolled agents for tax debt assistance. This ensures that you receive qualified support, even without legal representation. Their commitment to community support not only enhances their reputation but also positions them as a leading choice for budget-conscious consumers.

With recent budget proposals designating substantial resources for tax assistance—$600 billion targeted at everyday Americans—tax relief firms like Turnout are well-equipped to help you navigate these financial landscapes effectively. Financial advisors emphasize that utilizing affordable tax relief firms can lead to significant savings. One advisor noted, 'Choosing the right tax relief firms can save families thousands, especially in light of the projected $1,700 average tax hike for a family of four if tax cuts are not extended.'

If you are seeking assistance, remember that reaching out to tax relief firms can be a wise step towards managing your tax burdens efficiently. You are not alone in this journey; we’re here to help you find the support you need.

Victory Tax Lawyers: Expertise in Complex Tax Cases

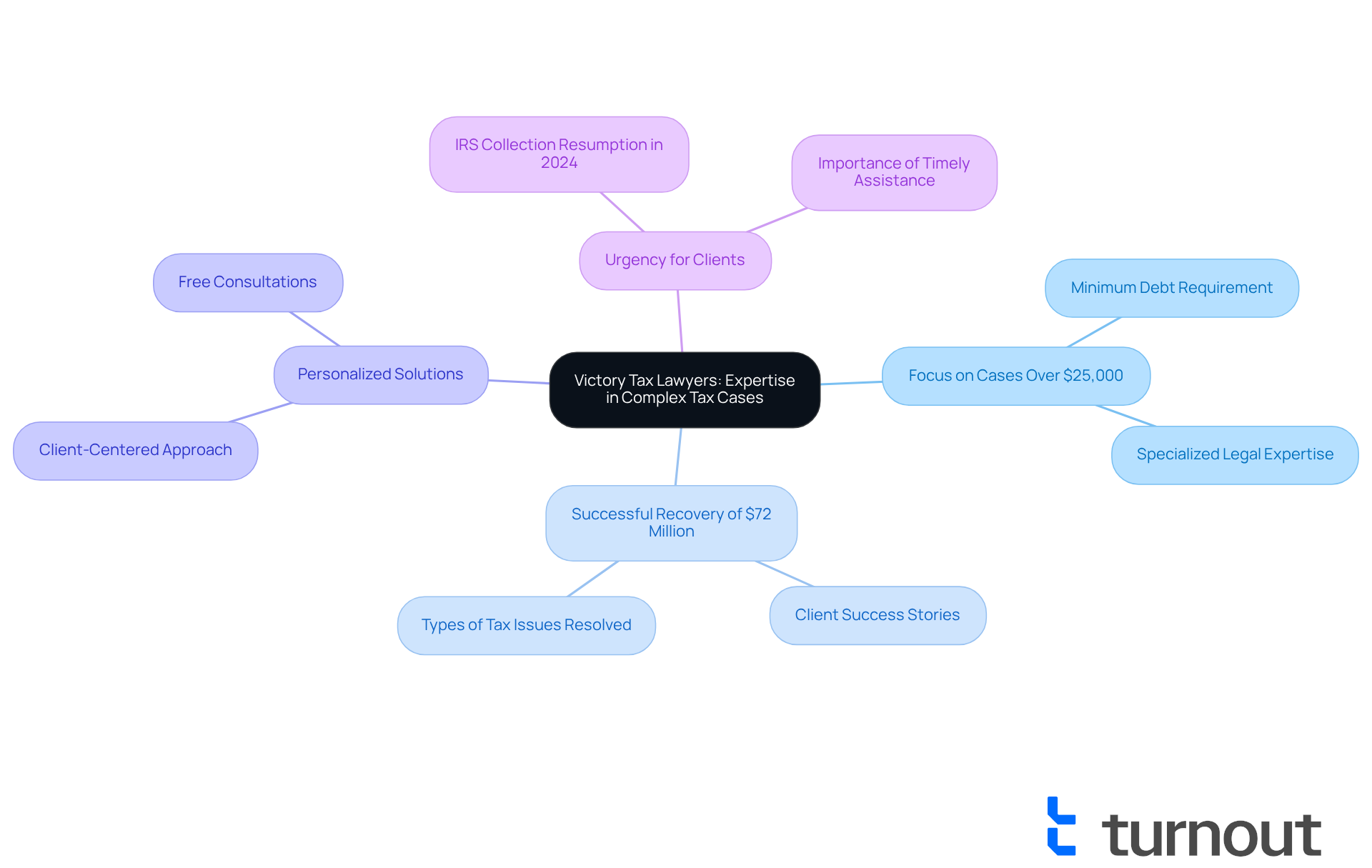

At Victory Tax Specialists, we understand that navigating intricate tax matters can be overwhelming. Our dedicated team is here to provide you with a wealth of knowledge and experience, ensuring you achieve the best possible outcomes. With a focus on cases involving a minimum debt threshold of $25,000, we concentrate on situations where our professional involvement can truly make a difference.

We have successfully retained over $72 million for our customers through our specialized tax resolution offerings. This highlights our commitment to producing advantageous outcomes for individuals like you. As Parham Khorsandi expressed, 'At Victory Tax Lawyers, our mission is to provide personalized, effective solutions to taxpayers across the United States.'

If you are grappling with complicated tax issues, know that the expertise of tax relief firms, such as Victory Tax Lawyers, can be a vital asset in securing resolution and alleviating your financial burdens. Remember, you are not alone in this journey. It's crucial to act now, especially with the IRS resuming collection efforts in 2024. Timely assistance is more important than ever for those facing tax challenges. We're here to help you every step of the way.

Tax Defense Network: Diverse Services for Tax Relief

At Turnout, we understand that navigating tax challenges can be overwhelming. That's why we offer a wide array of services designed to meet your unique needs. Whether you're seeking assistance with Social Security Disability (SSD) claims or need help managing tax debt, our tax relief firms are here to support you every step of the way.

Our comprehensive approach ensures that you receive the necessary guidance without the need for legal representation, as we are not a law office. Our skilled nonlawyer advocates are dedicated to assisting with SSD claims, while our IRS-licensed enrolled agents at tax relief firms specialize in tax debt support. You can trust that our qualified professionals will efficiently help you maneuver through the intricate governmental procedures.

You are not alone in this journey. We invite you to reach out and discover how Turnout can help you find the relief you deserve.

IRS Offer in Compromise: Settle Your Tax Debt for Less

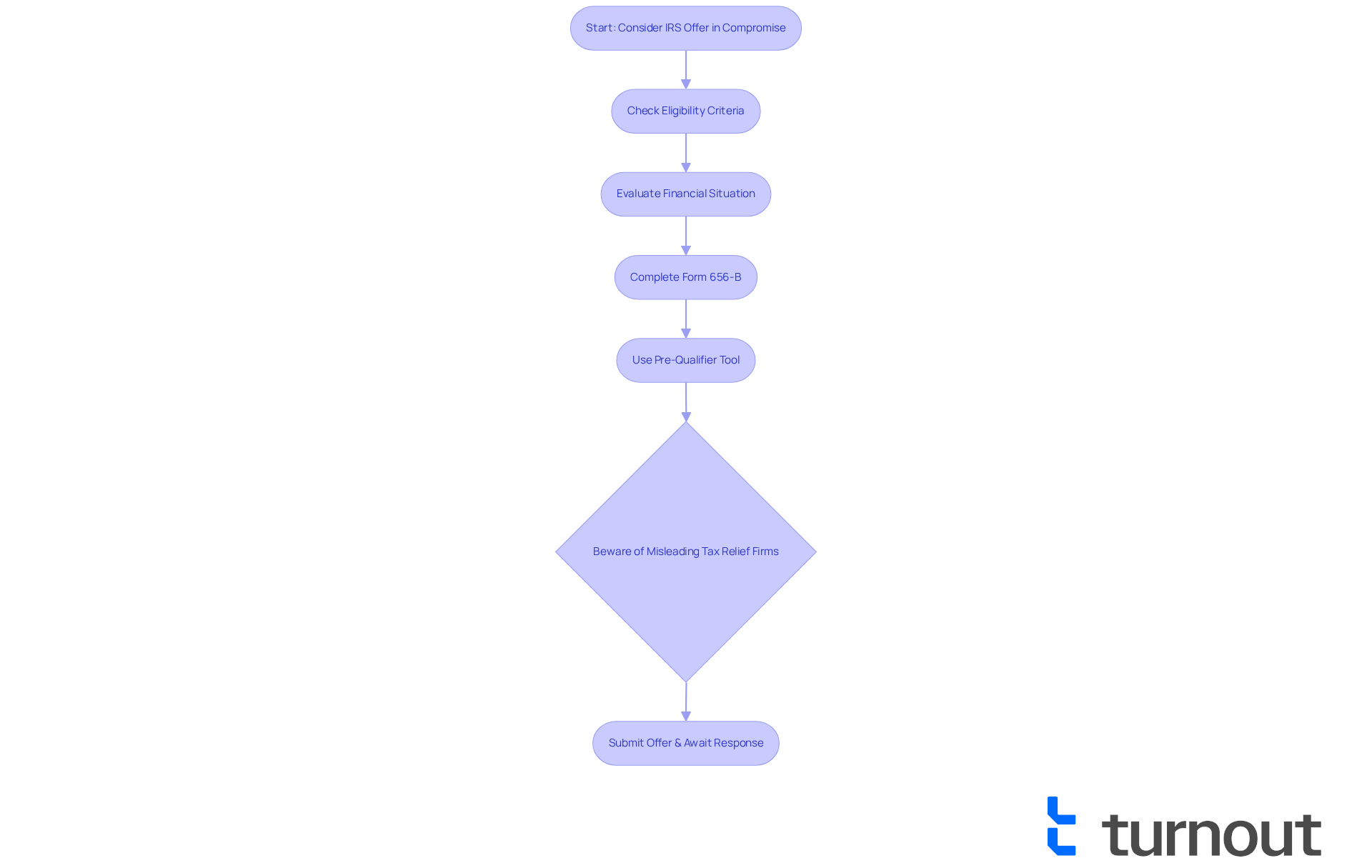

The IRS Offer in Compromise (OIC) program is designed to help eligible taxpayers settle their tax debts for less than the total amount owed. This program specifically targets those facing financial hardship who cannot pay their tax liabilities in full. If you find yourself overwhelmed by tax burdens, this resource could be a lifeline for you.

To qualify for the OIC, it's essential to meet specific eligibility criteria. The IRS evaluates these based on your unique financial circumstances, including income, expenses, and asset equity. Importantly, if you are a low-income taxpayer, you are exempt from the $205 application fee and initial payment, making this option more accessible for those in need. We encourage you to review Form 656-B instructions to see if you qualify for waiving initial costs.

It's important to note that not everyone qualifies for the OIC program. Some individuals may be misled by aggressive marketing tactics from tax relief firms that promote OIC services. These 'tax relief firms' often charge excessive fees for assistance that you can obtain directly from the IRS. Therefore, we recommend utilizing the IRS Offer in Compromise Pre-Qualifier tool to assess your eligibility for free and prepare a preliminary proposal.

Real-world examples demonstrate the effectiveness of the OIC program. Many taxpayers have successfully settled their debts for significantly less than they owed, alleviating financial stress and allowing them to regain control of their finances. By understanding the application procedure and utilizing accessible resources—such as the IRS's free how-to video series on the OIC—you can navigate the complexities of tax assistance and work towards a more sustainable financial future. Remember, as the IRS states, 'The goal is a compromise that's in the best interest of both the taxpayer and the agency.' You're not alone in this journey; we're here to help you find the support you need.

CFPB: Resources to Avoid Tax Relief Scams

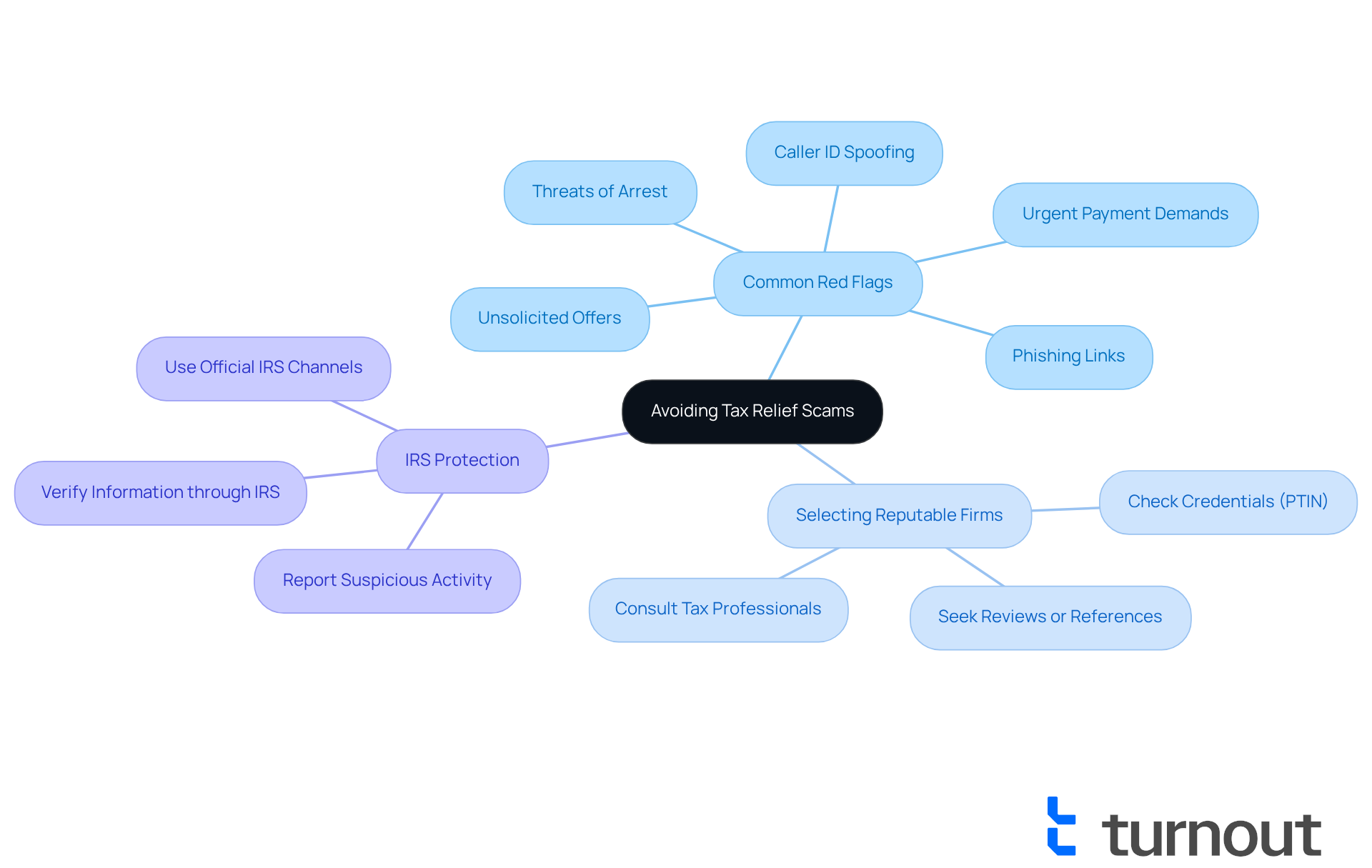

The Consumer Financial Protection Bureau (CFPB) is here to help you recognize and avoid tax fraud schemes. We understand that navigating tax season can be overwhelming. That's why the CFPB provides valuable resources, highlighting common red flags—like unsolicited offers and urgent payment demands. By sharing tips for selecting reputable tax relief firms, the CFPB empowers you to make informed choices and safeguard your financial well-being.

It's common to feel anxious during tax season, especially with scammers lurking. As Terry Lemons, an IRS communications senior adviser, reminds us, "Scammers are relentless, and they use the guise of tax season to try tricking taxpayers into falling into a variety of traps." This statement underscores the importance of staying vigilant and educated.

The IRS has successfully protected millions of taxpayers and billions of dollars from refund fraud. This reinforces the need for thorough research and caution. Before making payments to third-party companies, we recommend consulting tax relief firms. Remember, you are not alone in this journey; we are here to support you in safeguarding your financial future.

TaxCure: Evaluating Tax Relief Services for Better Choices

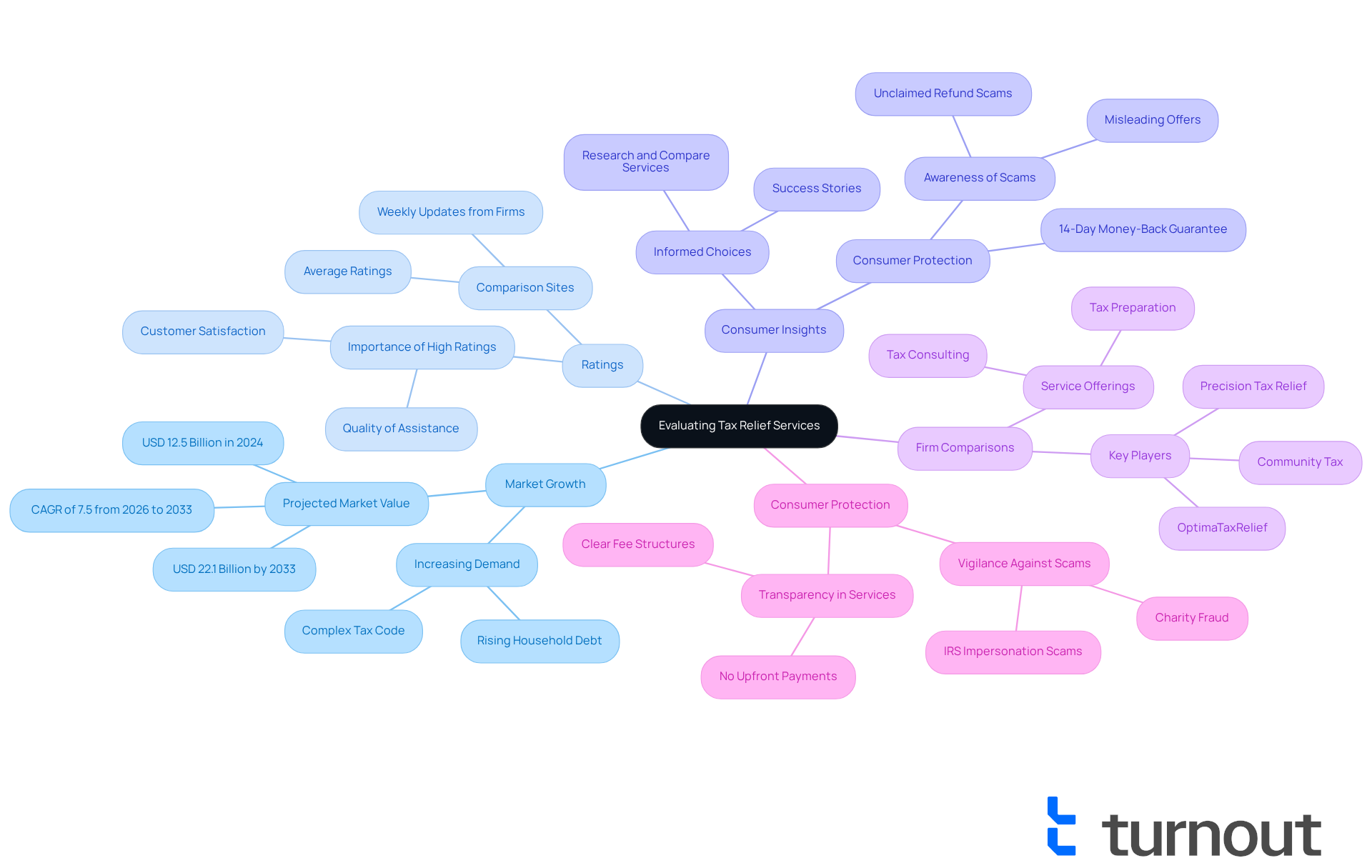

TaxCure is an invaluable resource for consumers seeking to evaluate tax assistance options with ease and confidence. By offering comprehensive comparisons, detailed reviews, and insights into various firms, TaxCure empowers individuals to make informed choices tailored to their unique situations. We understand that navigating tax complexities can be overwhelming, especially in a market where the Tax Relief Services Market is projected to grow from USD 12.5 billion in 2024 to USD 22.1 billion by 2033. This reflects an increasing demand for expert guidance, with a CAGR of 7.5% from 2026 to 2033.

When evaluating tax relief firms, consider their average ratings on comparison sites. These ratings can provide a glimpse into customer satisfaction and the quality of assistance offered. High-rated firms often maintain clear communication with clients, providing weekly updates even when there is no new IRS action. It's common to feel uncertain, but success stories abound for those who have made knowledgeable choices based on comparisons of offerings, illustrating how thoughtful assessment can lead to positive outcomes.

As we approach 2025, updates in tax relief firms comparison show a growing emphasis on transparency and personalized assistance. For instance, companies like Precision Tax Relief are recognized for their exceptional client support, assigning dedicated representatives to each case. This level of attention can significantly impact the resolution of tax issues. Additionally, the Tax Hardship Center highlights consumer protection with their 14-day money-back guarantee, reinforcing trust in your selection process.

Consumer advocates stress the importance of making informed choices about tax relief firms in this intricate landscape. They encourage potential clients to thoroughly research and compare services, ensuring they choose a firm that aligns with their specific needs and financial situations. By utilizing resources such as TaxCure, you can navigate the complex realm of tax assistance with clarity and confidence. However, it's essential to remain vigilant against potential scams, such as unclaimed refund scams or misleading offers for IRS debt settlement, which can complicate your decision-making process. Remember, you are not alone in this journey, and we're here to help you every step of the way.

FTC: Consumer Alerts on Tax Relief Companies

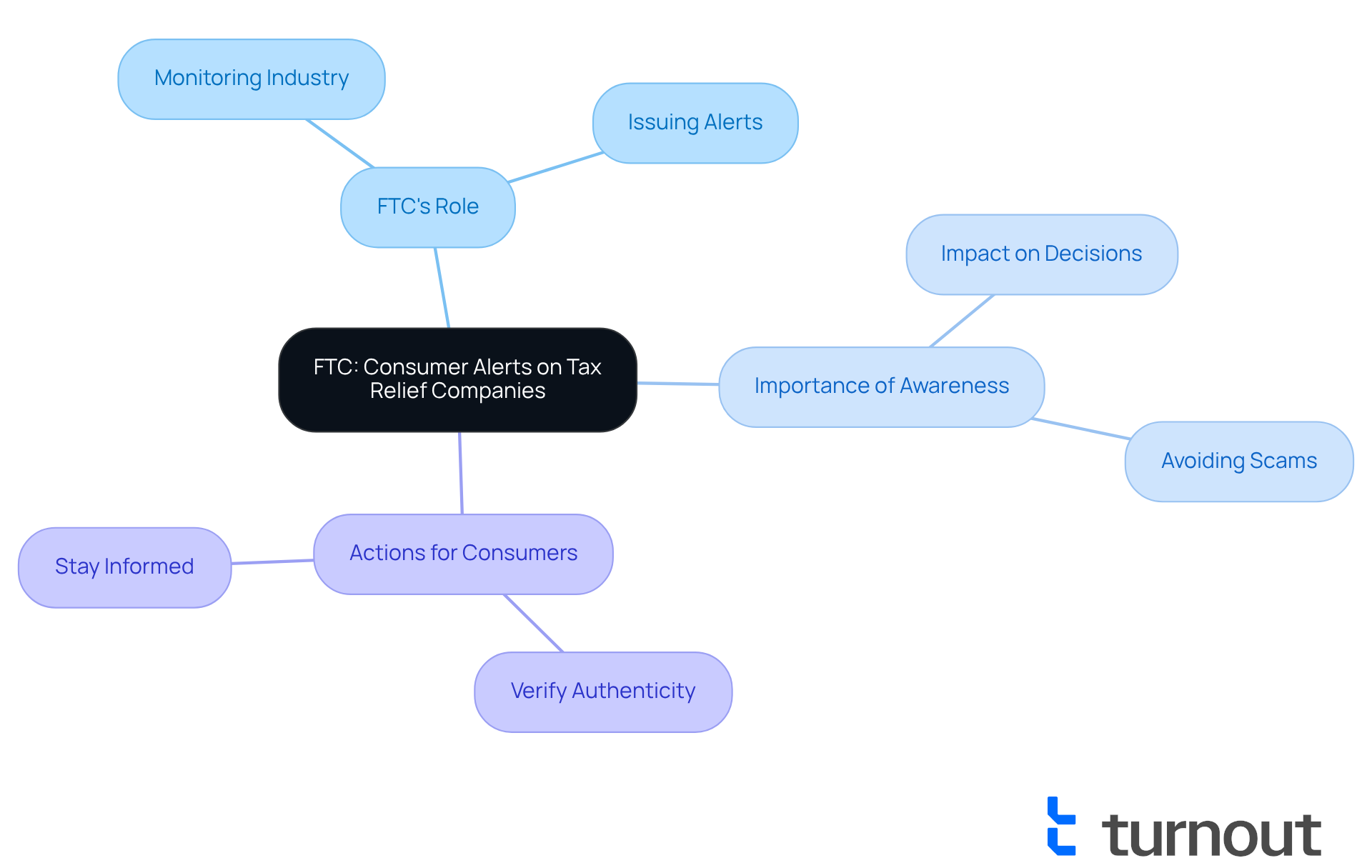

The Federal Trade Commission (FTC) understands that navigating tax assistance options can be overwhelming. That's why they actively issue consumer alerts about tax assistance companies, providing you with essential information to identify potential scams and fraudulent practices. By closely monitoring the industry and sharing warnings, the FTC plays a crucial role in protecting consumers like you from exploitation.

Remaining aware of these notifications is vital for anyone seeking help with taxes. Statistics show that being informed about FTC alerts can significantly impact your decisions, with many individuals successfully avoiding scams by utilizing these valuable resources. Experts highlight the importance of being attentive, recommending that you confirm the authenticity of tax relief firms before using their services.

As scams tend to proliferate, especially during tax season, the FTC's efforts to educate the public are more important than ever. They are here to promote consumer protection and help you feel secure in your financial decisions. Remember, you are not alone in this journey, and staying informed is your best defense against potential scams.

Conclusion

Navigating the complexities of tax relief can feel overwhelming, but remember, the right support is here to make a difference. This article highlights several tax relief firms that offer essential services designed to alleviate financial burdens and empower you to regain control over your tax obligations. With innovative technology solutions and personalized customer support, these firms are dedicated to guiding you through your tax challenges with compassion and expertise.

It’s important to leverage technology for easier navigation, as seen with firms like Optima Tax Relief. Additionally, comprehensive services from companies such as Precision Tax Relief and Victory Tax Lawyers can provide invaluable assistance. Moreover, consumer protection resources from organizations like the CFPB and FTC remind us of the importance of vigilance against scams, ensuring that you can make informed decisions when selecting tax relief services.

Ultimately, seeking out reputable firms that prioritize your needs and offer transparent support is crucial. By utilizing the resources and insights presented, you can navigate your financial difficulties more effectively and take proactive steps toward achieving financial stability. Remember, there is a path to relief, and the right support is available to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it assist consumers with tax relief?

Turnout is an AI-powered tax relief advocacy platform that helps consumers navigate tax assistance by utilizing advanced AI technology. It features Jake, the AI case quarterback, who provides timely updates and support throughout the tax relief journey.

How does Turnout enhance the tax relief experience?

Turnout enhances the tax relief experience by offering a proactive approach that boosts efficiency and empowers consumers to confront their tax issues with confidence, ensuring they have support every step of the way.

What services does Precision Tax Relief provide?

Precision Tax Relief offers a comprehensive range of services designed to address various tax concerns, including tax debt negotiation and assistance with IRS levies, all tailored to individual circumstances.

How many customers has Precision Tax Relief assisted, and what are some outcomes?

Precision Tax Relief has assisted nearly 80,000 customers, often halting IRS levies against property, bank accounts, or wages within just 24 hours, showcasing their effectiveness in providing timely solutions.

What role does customer support play in tax relief firms like Precision Tax Relief?

Customer support is crucial in tax relief firms, as effective communication and personalized assistance significantly influence the resolution process. Precision Tax Relief emphasizes proactive follow-ups and assigns individual representatives to each case to ensure client satisfaction.

How is Optima Tax Relief utilizing technology to assist clients?

Optima Tax Relief employs user-friendly technology to simplify the tax assistance process, allowing clients to access essential information, monitor their cases, and communicate with support staff easily.

What features does Optima Tax Relief offer to improve client experience?

Optima Tax Relief offers an online platform for easy navigation and integrates Unblu's Co-Browsing feature, enabling support staff to guide clients securely through the platform.

What is the projected worth of the tax assistance sector by 2033?

The tax assistance sector is projected to be worth USD 22.1 billion by 2033, indicating a growing demand for expert help in managing tax responsibilities.