Overview

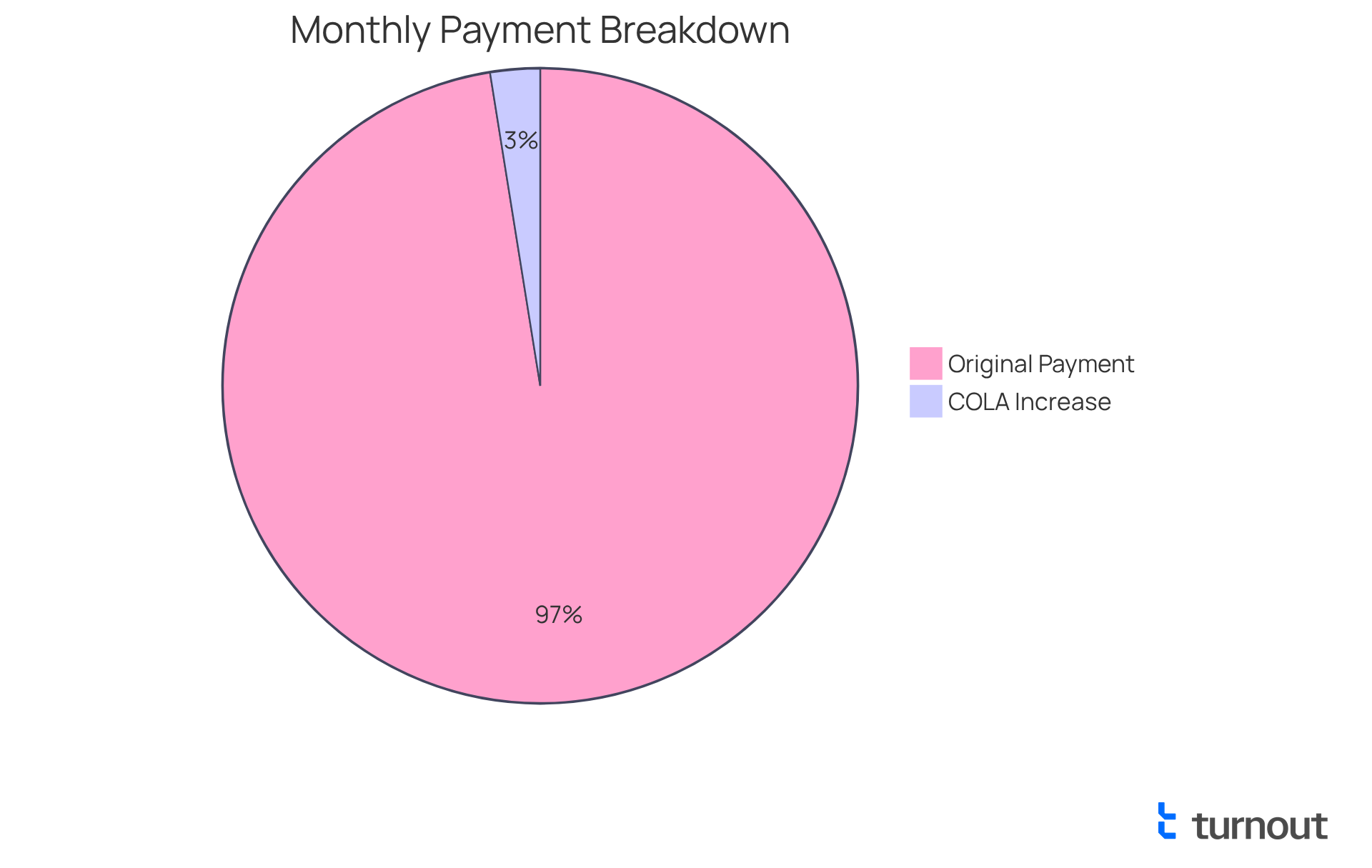

The 2025 Social Security COLA increase for disability benefits brings a 2.5% adjustment, which translates to an average monthly boost of about $50 for recipients. This increase is crucial for helping to offset rising living costs. However, we understand that this adjustment may not fully alleviate the financial pressures you face. With Medicare premiums also set to rise, the overall benefit impact may be diminished amid ongoing inflation.

It's common to feel concerned about how these changes will affect your financial situation. While the increase is a step in the right direction, we recognize that many beneficiaries are still navigating challenging circumstances. Remember, you are not alone in this journey. We're here to help you find the support you need as you adapt to these changes.

Introduction

Navigating the complexities of government assistance can feel overwhelming, especially with the upcoming changes surrounding the 2025 Social Security COLA increase for disability benefits. As millions of Americans prepare for a 2.5% boost in their monthly payments, it's essential to understand the full implications of this adjustment. However, it's common to feel that the relief offered by this cost-of-living adjustment may not fully offset the mounting pressures of inflation and rising healthcare costs.

How can beneficiaries effectively navigate these changes to ensure they receive the support they need? We're here to help you through this journey.

Turnout: Streamlining Access to 2025 Social Security COLA Benefits

Navigating government assistance can often feel overwhelming, particularly with the impending 2025 social security cola increase disability. We understand that seeking help during such times can be daunting. That's where Turnout comes in. By harnessing the power of AI technology, Turnout simplifies the application process, making it easier for you to find your way through the complexities of government assistance.

This streamlined approach not only saves you valuable time but also increases the chances of successful claims. Imagine being able to receive the support you need without the stress and confusion that often accompanies the process. You're not alone in this journey; Turnout is here to help you every step of the way.

With Turnout, accessing the assistance you deserve has never been more straightforward. We are committed to ensuring that you receive the support you need during this critical time, especially with the upcoming 2025 social security cola increase disability, and we believe that everyone should have the opportunity to thrive.

2.5% COLA Increase: Impact on Disability Benefits in 2025

In 2025, public assistance beneficiaries will see a 2.5% increase in their monthly payments due to the 2025 social security cola increase disability, translating to an average boost of about $50. For those relying on disability benefits, the 2025 social security cola increase disability is essential as it helps to ease the burden of rising living costs. The typical monthly payment for retired employees stood at $1,925.46 in November 2024, underscoring the importance of this adjustment.

However, while this Cost of Living Adjustment (COLA) provides some relief, it may not fully alleviate the challenges posed by inflation, leaving many beneficiaries still feeling the strain. For example, the maximum federal payout for Supplemental Security Income (SSI) in 2025 will be affected by the 2025 social security cola increase disability, rising to $967 per month, up from $943. This illustrates the specific impact of the 2025 social security cola increase disability on SSI recipients.

It's important to note that a quarter of older adults depend on their government assistance payments for at least 90% of their income. This highlights the essential role these funds play in their daily lives. Financial experts emphasize that even modest adjustments like this COLA are crucial for maintaining purchasing power amid ongoing inflationary pressures.

As costs for essentials such as groceries and healthcare continue to rise, the 2025 social security cola increase disability may provide some benefit, but it might still fall short for many disabled individuals facing these economic challenges. Recipients will receive a newly designed and simplified COLA notice, which will help them better understand their benefits.

To stay informed, we encourage you to check your personal my account and view your COLA notice online. Remember, you are not alone in this journey, and we're here to help you navigate these changes.

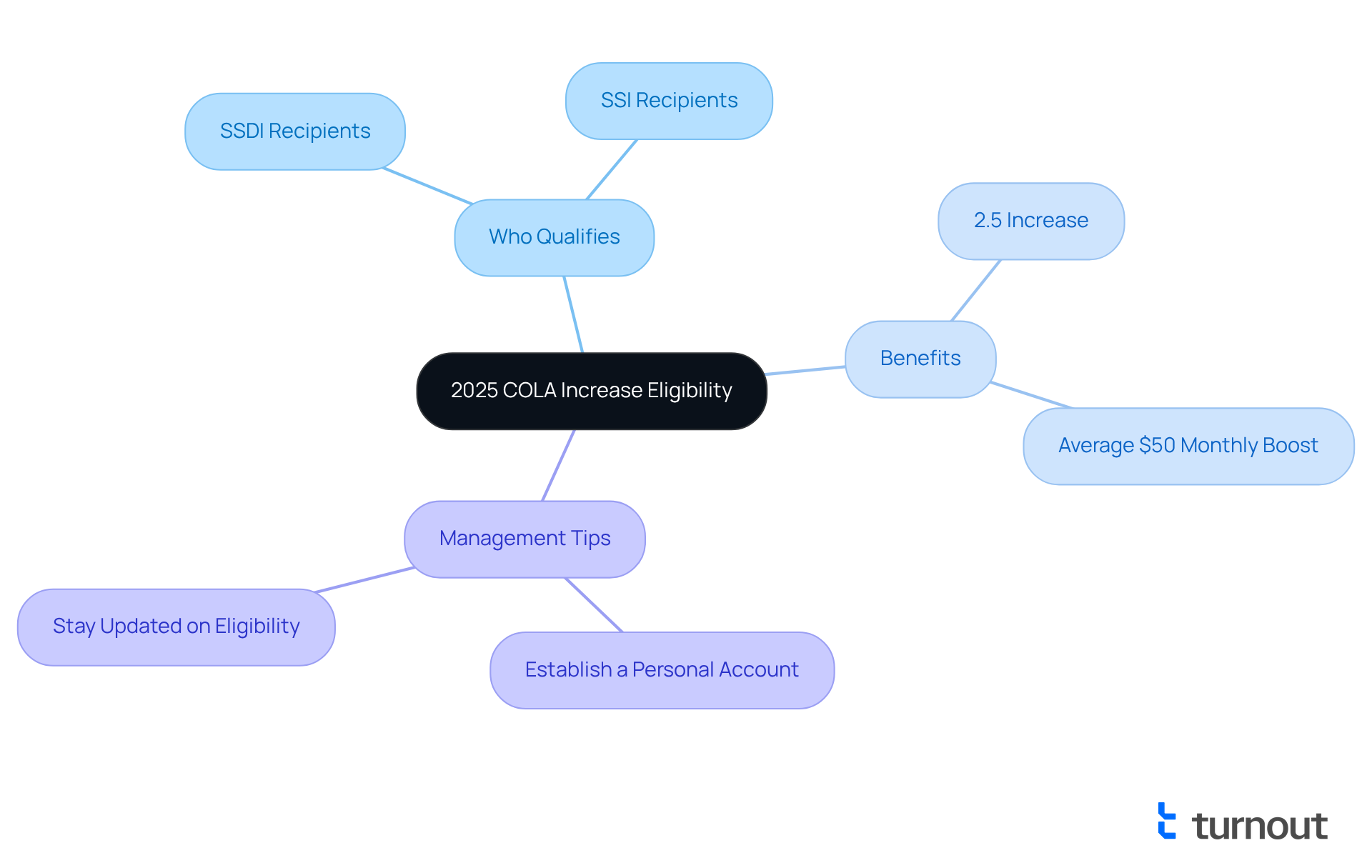

Eligibility Requirements: Who Qualifies for the 2025 COLA Increase?

We understand that navigating financial assistance can be challenging. To qualify for the 2025 social security cola increase disability, you must be receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) payments. This increase, set at 2.5%, will be automatically applied to all eligible beneficiaries as part of the 2025 social security cola increase disability, meaning no additional application is necessary. Approximately 72.5 million Americans, including both SSDI and SSI recipients, will benefit from the 2025 social security cola increase disability adjustment. On average, SSDI recipients can anticipate a $50 per month boost from the 2025 social security cola increase disability as part of the overall COLA adjustment.

It's important to stay updated about your assistance status and any potential changes in eligibility criteria that may arise in the future. Remember, the 2025 social security cola increase disability is less than a third of the record-high COLA increase observed in 2023. To manage your benefits effectively, we encourage you to establish a personal account with the administration. This can help you track your status and receive timely updates. You are not alone in this journey; we’re here to help you every step of the way.

Medicare Premium Adjustments: What to Expect in 2025

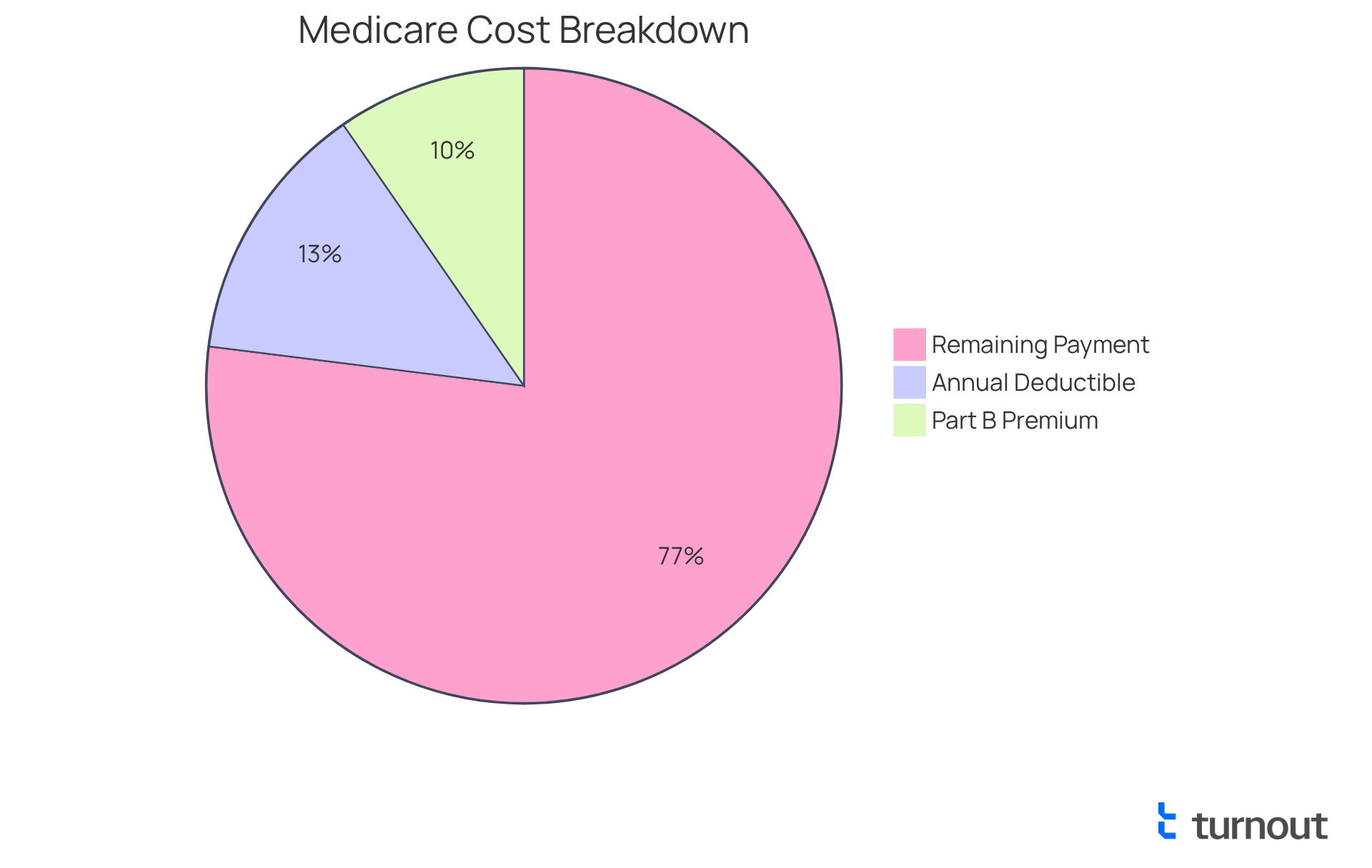

In 2025, Medicare premiums are set to rise significantly, with the standard monthly premium for Part B increasing to $185, reflecting a $10.30 hike from the previous year. We understand that this adjustment will directly affect many public assistance beneficiaries, as these premiums are usually deducted from their monthly payments. With the average Social Security payment around $1,920, the rise in Medicare costs could strain budgets, particularly for those who depend heavily on these funds for essential expenses.

It's common to feel overwhelmed by these changes. Beneficiaries should proactively assess their financial plans to accommodate this shift, as the rising costs of healthcare can diminish the purchasing power of their benefits. Financial advisors emphasize the importance of understanding these adjustments, noting that:

- The increase in Medicare premiums often outpaces the annual cost-of-living adjustment (COLA).

- The 2025 Social Security COLA increase for disability is smaller compared to previous years.

Additionally, the annual deductible for all Medicare Part B recipients will be $257 in 2025, further affecting financial planning. It's also important to note that about 8% of Medicare Part B enrollees will be subject to the Income-Related Monthly Adjustment Amount (IRMAA), which could impact higher-income recipients. As beneficiaries navigate these changes, it is crucial to consider how rising Medicare premiums may affect their overall financial stability and access to necessary healthcare services.

Remember, you are not alone in this journey. We’re here to help you understand these changes and find ways to manage your healthcare costs effectively.

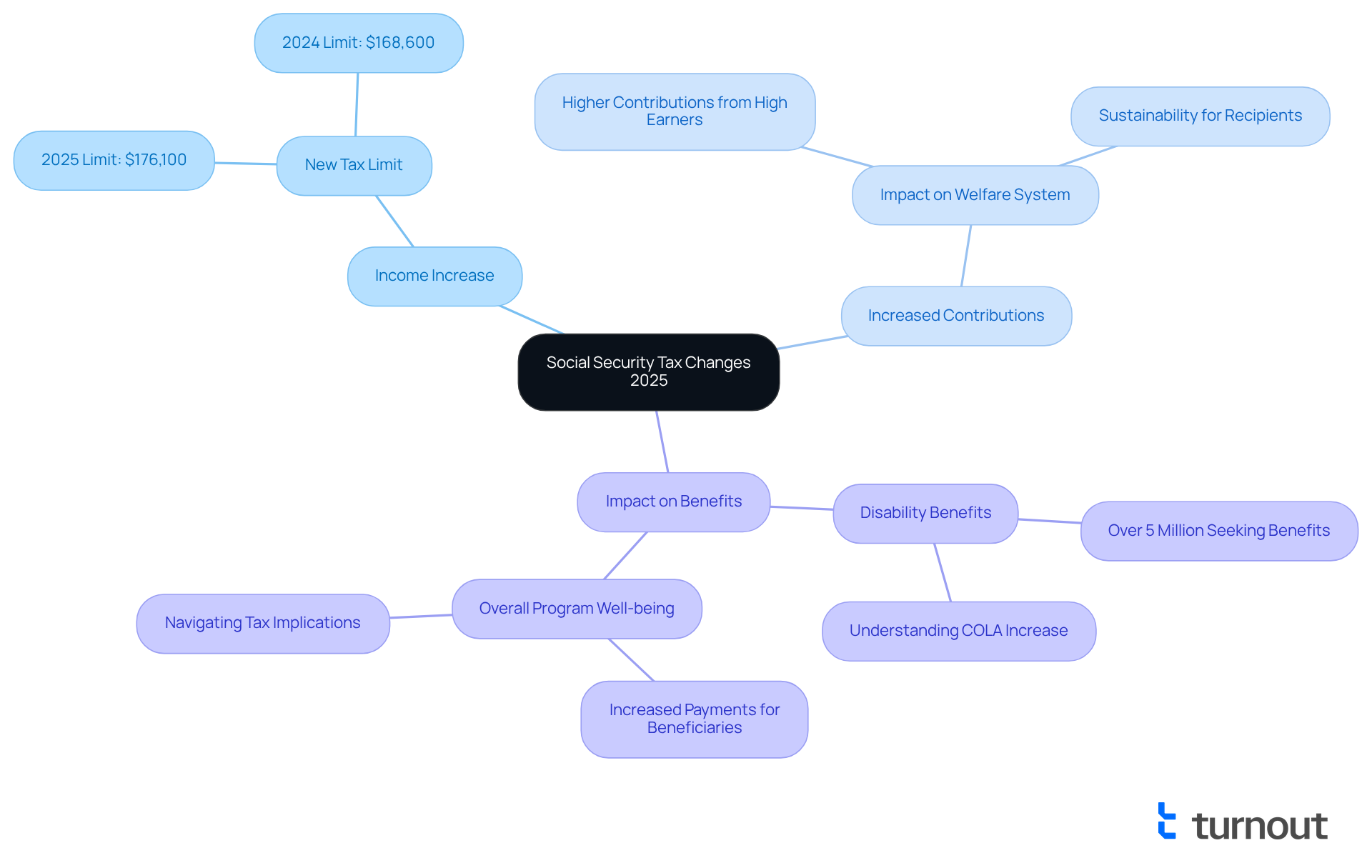

Social Security Tax Changes: Implications for 2025 Benefits

In 2025, the highest income liable to federal taxes will increase to $176,100, up from $168,600 in 2024. This change means that individuals with higher incomes will contribute more to the welfare system. This support is vital for ensuring sustainability for all recipients. We understand that navigating these tax implications can feel overwhelming. As Kelley R. Taylor emphasizes, grasping these changes is crucial for consumers as they plan their financial futures.

The rise in taxable income not only affects personal contributions but also significantly impacts the overall well-being of the program. With over 5 million Americans seeking Disability benefits, understanding the 2025 social security cola increase disability is essential for effective financial planning. It's common to feel uncertain about how increased contributions may influence future advantages. Remember, you are not alone in this journey. We’re here to help you understand and prepare for these important adjustments.

Service Delivery Changes: Navigating Social Security Offices in 2025

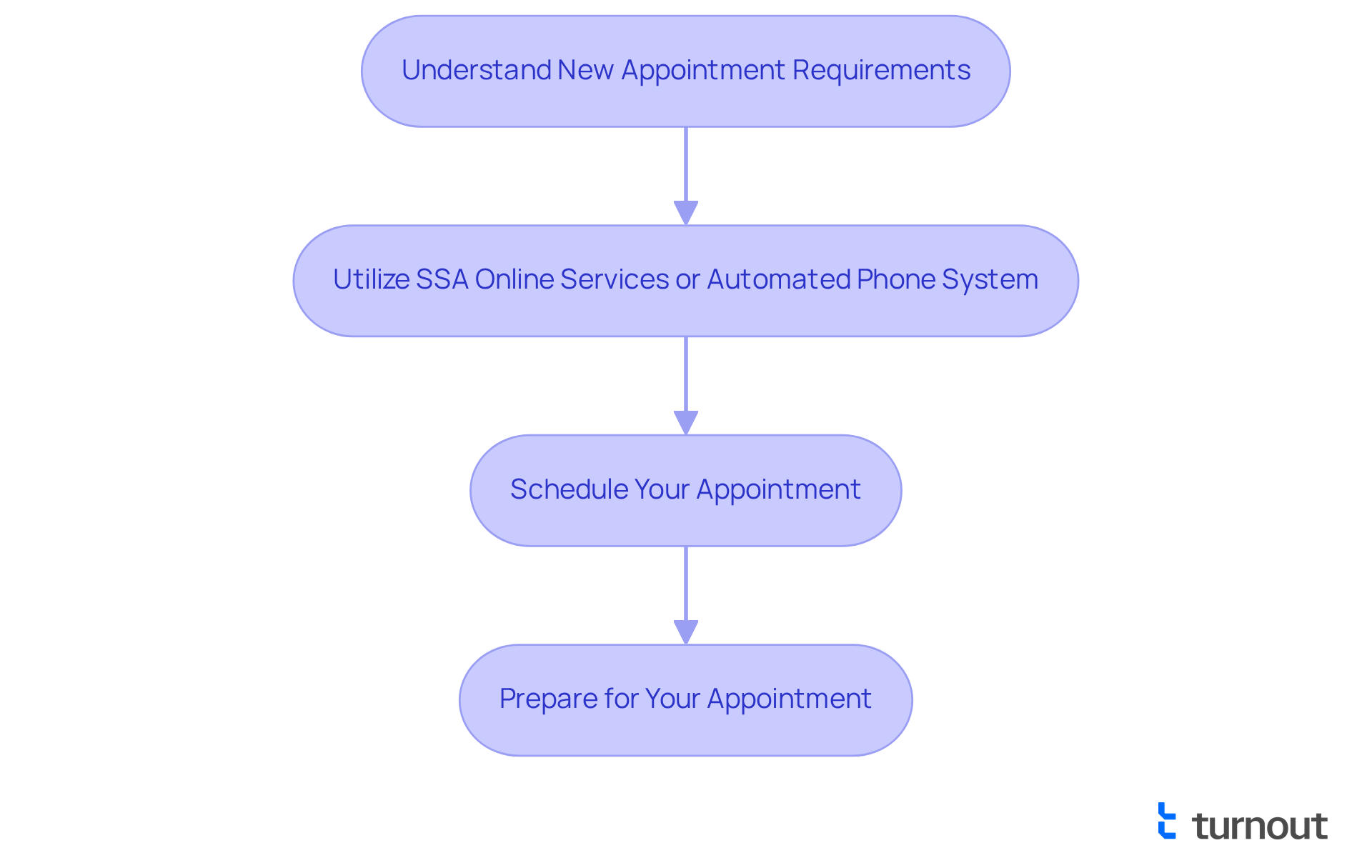

Starting January 6, 2025, public assistance offices will transition to a new service delivery model that requires appointments for in-person visits. We understand that changes like this can be challenging, but this significant shift is part of a two-phase rollout aimed at enhancing efficiency and reducing wait times, which have historically caused frustration. In fact, the implementation of appointment-based services has already shown promising results in nearly 400 offices, leading to shorter wait times and improved customer satisfaction.

We strongly encourage beneficiaries to familiarize themselves with these new procedures. This knowledge is essential to ensure timely assistance and to avoid unnecessary delays in claims. The Administration for Public Welfare (SSA) assures that this change will not exclude at-risk groups or individuals needing immediate help, guaranteeing that vital services remain accessible. As SSA officials noted, "This change reflects the SSA’s commitment to improving service efficiency and customer satisfaction."

To navigate these new appointment requirements effectively, consider utilizing SSA’s online services or the automated telephone system to schedule your visits. This proactive approach will not only enhance your experience but also ensure you are prepared for your appointments. Ultimately, this will lead to a more efficient process in obtaining the benefits you deserve. Given that SSA estimates between 75,000 and 85,000 additional Americans will need to visit social services offices each week, adjusting to this new system is crucial for receiving timely support. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Full Retirement Age: Effects of the 2025 COLA on Retirement Planning

In 2025, the full retirement age will rise to 66 years and 10 months for individuals born in 1959. We understand that this change can feel overwhelming, especially as you approach retirement. The anticipated 2.5% cost-of-living adjustment (COLA), known as the 2025 social security cola increase disability, is crucial in shaping your retirement strategies. This adjustment requires a thoughtful assessment of benefit calculations, as it directly impacts the purchasing power of your welfare benefits amid ongoing inflation concerns.

Financial planning experts emphasize the importance of adapting your retirement strategies to account for COLA changes. It’s essential to reassess your income needs and spending habits to ensure long-term financial stability. As Kiplinger notes, "It’s likely to rise again in 2025, but that hasn’t been announced yet either." This uncertainty can add to your worries, but you are not alone in this journey.

Moreover, with the trust fund projected to be depleted by 2033, understanding the implications of the 2025 social security cola increase disability is crucial now more than ever. By grasping these factors, you can make informed decisions that enhance your overall financial security in retirement. Remember, we’re here to help you navigate these changes and secure your financial future.

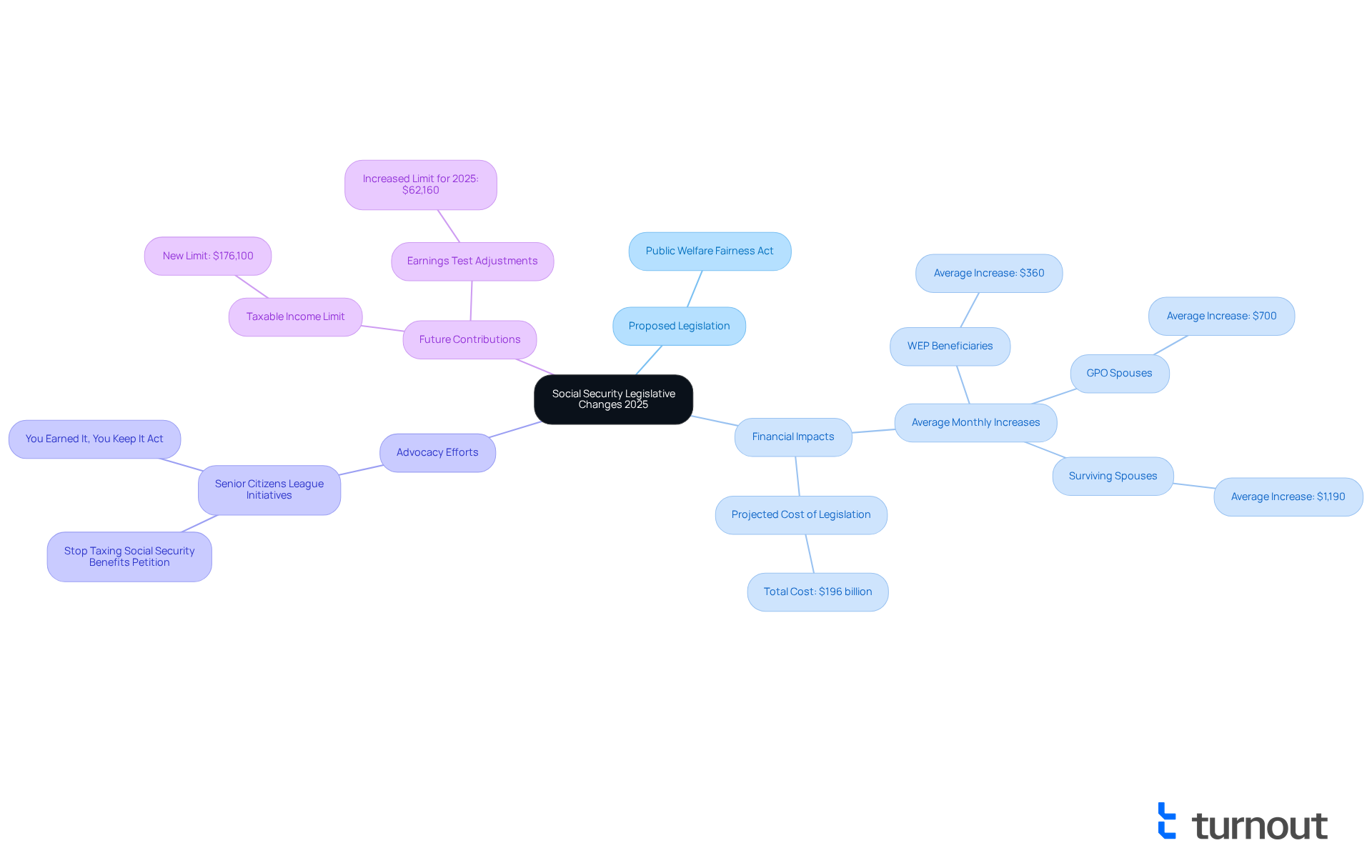

Legislative Changes: What to Watch for in Social Security in 2025

In 2025, significant legislative changes are on the horizon that could profoundly impact the 2025 social security cola increase disability benefits you receive. We understand that navigating these shifts can be daunting, so it's crucial to stay informed about proposed legislation aimed at reforming the social support system. These changes may affect eligibility standards and compensation calculations, which can directly impact your financial well-being.

For instance, the recently enacted Public Welfare Fairness Act is expected to bring substantial increases in benefits for millions, particularly for those affected by the Windfall Elimination Provision and Government Pension Offset. According to the Congressional Budget Office, beneficiaries impacted by WEP can anticipate an average monthly increase of $360. Spouses previously affected by GPO may see an increase of $700, while surviving spouses could receive an average of $1,190. However, it’s important to note that this measure is projected to cost $196 billion over the next decade, raising concerns about the long-term viability of the trust fund.

Policy analysts stress that these reforms are vital for ensuring public sector employees receive fair compensation for their contributions. As President Biden expressed, "The Fairness Act concerning assistance is the first expansion of such support in two decades." This highlights the importance of these changes. Senate Majority Leader Chuck Schumer also noted, "Millions of retired teachers and firefighters... have waited decades for this moment."

Moreover, advocacy efforts are gaining momentum, with organizations like the Senior Citizens League actively collecting petitions to eliminate taxes on retirement payments. This initiative reflects a growing demand for reforms that prioritize your financial security.

Additionally, the highest taxable income subject to payroll taxes will rise to $176,100 in 2025, which may affect your contributions, future benefits, and the 2025 social security cola increase disability. By staying informed about these developments, you can better advocate for your rights and ensure you receive the support you deserve in this evolving landscape. Remember, you are not alone in this journey; we’re here to help.

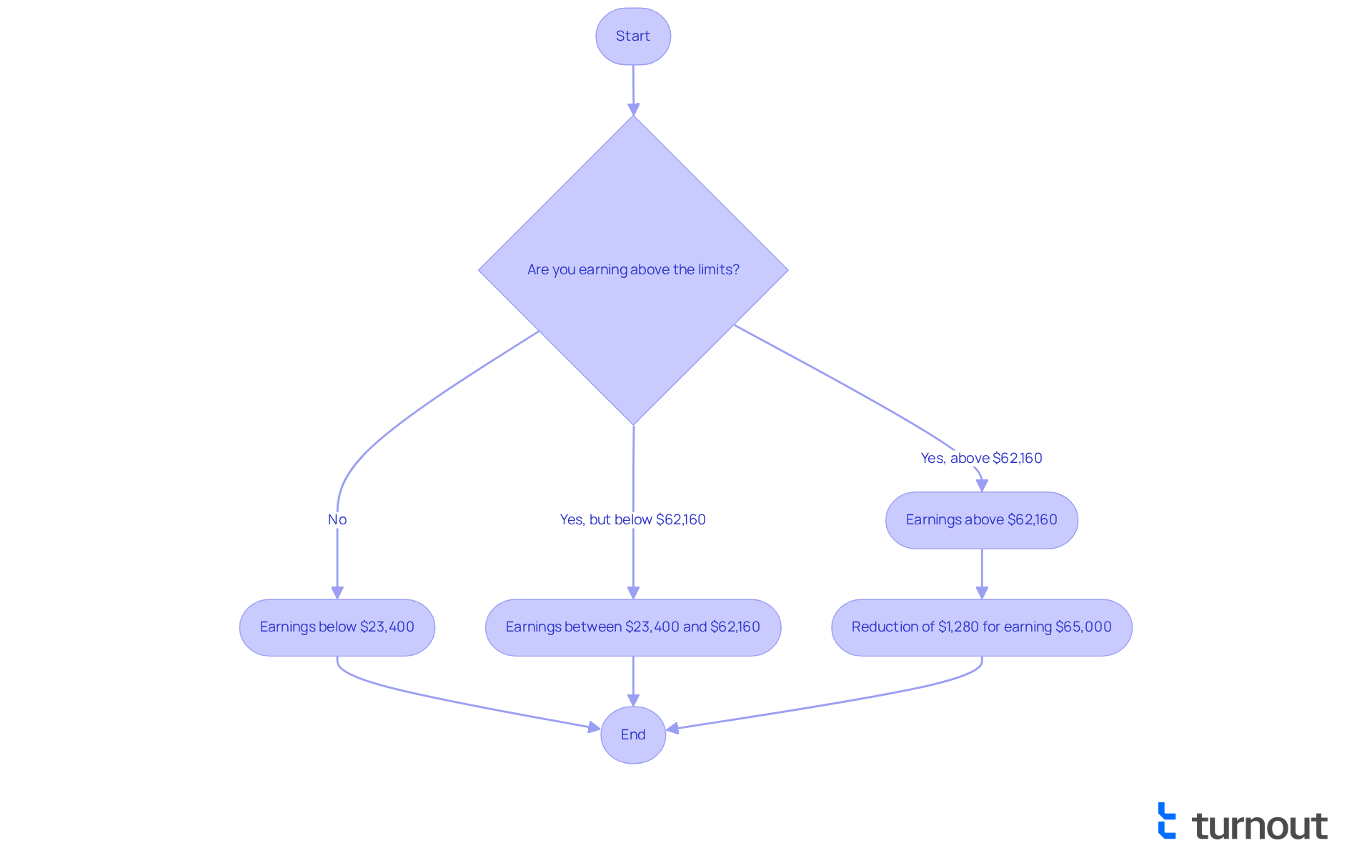

Social Security Earnings Test: Updates for 2025 Beneficiaries

In 2025, the earnings limit for individuals reaching full retirement age will rise to $62,160. This change allows recipients to earn up to this amount without seeing a reduction in their Social Security benefits. However, it’s important to understand that for every $3 earned above this limit, $1 will be deducted from their support. For those still below full retirement age, the stakes are higher: $1 in benefits will be withheld for every $2 earned over $23,400.

We understand that navigating these limits can be daunting. Exceeding the earnings threshold can significantly impact your financial stability. That’s why financial consultants often emphasize the importance of strategic planning. They encourage you to think carefully about how additional income might affect your benefits and tax obligations.

For instance, if you find yourself earning $65,000, you could face a reduction of $1,280 in your retirement benefits due to the earnings test. This highlights the need for informed financial choices. Additionally, the 2.5% cost-of-living adjustment (COLA) for the 2025 social security cola increase disability payments will also influence your overall financial situation.

Understanding these dynamics is essential for anyone looking to optimize their earnings while managing the complexities of social welfare. Remember, it’s crucial to inform the administration of any changes in your work status or income to avoid overpayment issues. You are not alone in this journey; we’re here to help you navigate these challenges.

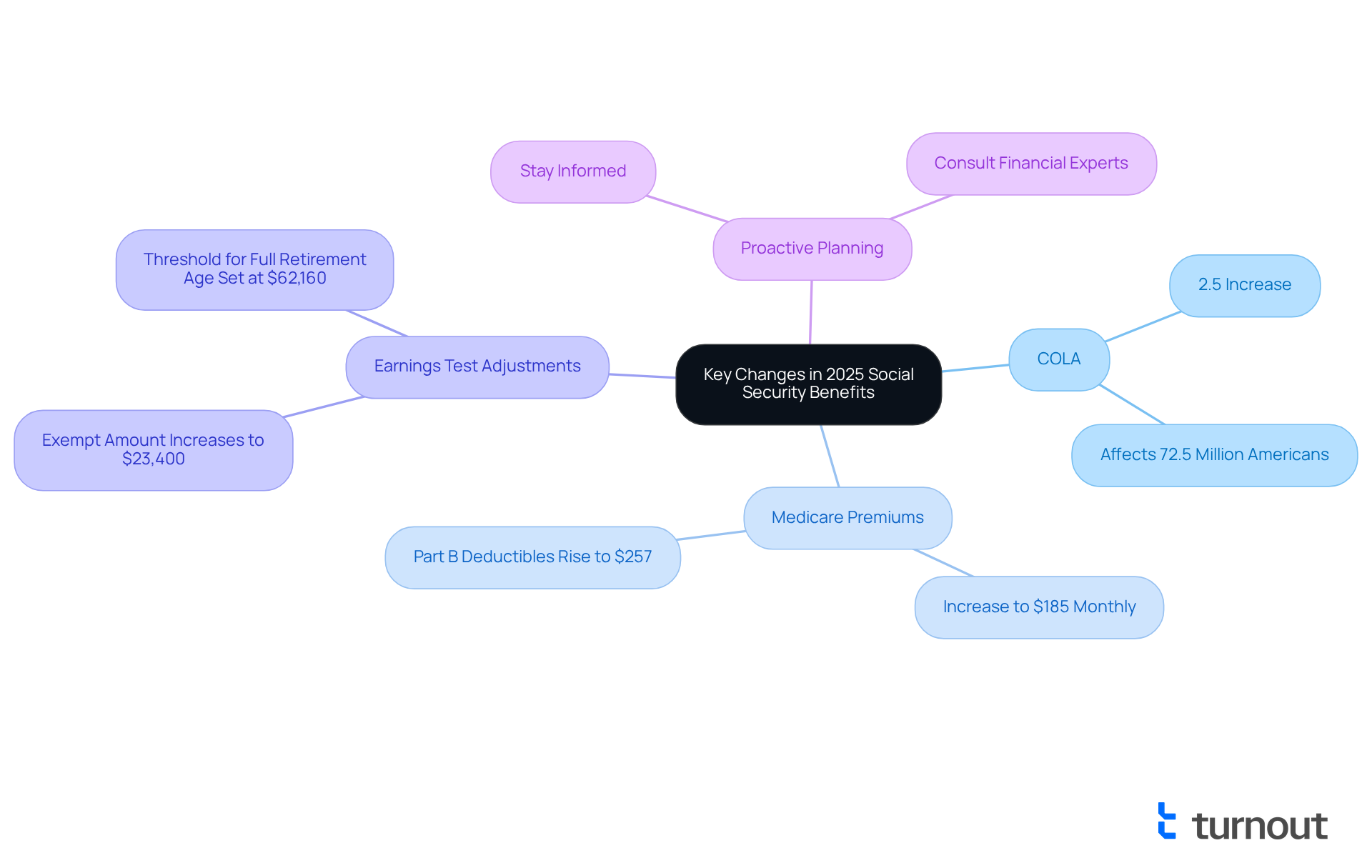

Comprehensive Overview: Key Changes in 2025 Social Security Benefits

In 2025, the 2025 social security cola increase disability will result in significant changes to public assistance payments. This includes the 2025 social security cola increase disability, which is a 2.5% Cost-of-Living Adjustment (COLA) aimed at helping recipients keep pace with inflation. This adjustment will affect over 72.5 million Americans, including those receiving Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), as well as the 2025 social security cola increase disability. Additionally, Medicare premiums will rise to $185 monthly, up from $174.70 in 2024, which may influence the net benefits many individuals receive.

We understand that navigating these changes can be daunting. The earnings test will also be adjusted, with the exempt amount for those under full retirement age increasing to $23,400. For individuals reaching standard retirement age, the threshold will be set at $62,160. This allows for greater flexibility in earning while still receiving payments. These adjustments reflect ongoing efforts to simplify the social benefits system and reduce delays in claims processing, aiming to provide quicker resolutions for applicants.

It's important to stay informed about these updates. Proactive planning can significantly enhance your financial stability. As the Disability Law Group advises, "With the 2025 social security cola increase disability approaching, remaining knowledgeable and proactive is the most effective method to enhance your advantages and sustain financial stability." Financial specialists emphasize understanding how these changes impact your personal situation. We recommend regularly reviewing your statements and seeking guidance from experts when needed. By adapting to these changes, you can navigate the complexities of the Social Security system more effectively and secure the benefits you deserve.

Conclusion

The 2025 Social Security COLA increase represents a crucial adjustment for millions of Americans relying on disability benefits. With a 2.5% boost, it aims to alleviate the financial strain caused by inflation. While this increase is beneficial, we understand that beneficiaries continue to face ongoing challenges as they navigate rising living costs and healthcare expenses. It is essential to grasp eligibility, navigate service changes, and plan for the future, as these elements significantly contribute to ensuring financial stability.

Key insights from the article highlight the direct impacts of the COLA increase on disability payments, Medicare premiums, and upcoming changes in service delivery models. Approximately 72.5 million Americans are set to benefit from this adjustment, making it vital for recipients to stay informed about their rights and available resources. The article also emphasizes the importance of strategic financial planning in light of new earnings limits and legislative changes that could further affect benefits.

Ultimately, the 2025 Social Security COLA increase serves as a reminder of the importance of proactive engagement with the social security system. We encourage beneficiaries to utilize available resources, stay informed about changes, and seek assistance when needed. By doing so, you can better navigate the complexities of your benefits and secure the support you deserve during these challenging times.

Frequently Asked Questions

What is the 2025 social security COLA increase?

The 2025 social security COLA increase is a 2.5% adjustment to monthly payments for beneficiaries, aimed at helping ease the burden of rising living costs.

How much will the monthly payments increase due to the 2025 COLA?

Beneficiaries can expect an average increase of about $50 per month due to the 2025 COLA.

Who qualifies for the 2025 social security COLA increase?

To qualify, you must be receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) payments. The increase will be automatically applied to all eligible beneficiaries.

How many people will benefit from the 2025 COLA increase?

Approximately 72.5 million Americans, including both SSDI and SSI recipients, will benefit from the 2025 COLA increase.

What is the maximum federal payout for Supplemental Security Income (SSI) in 2025?

The maximum federal payout for SSI in 2025 will rise to $967 per month, up from $943.

How does the 2025 COLA increase impact those relying on disability benefits?

The COLA increase is essential for helping ease the financial strain caused by inflation, although it may not fully alleviate the challenges posed by rising living costs.

What resources are available to help navigate the COLA increase?

Turnout offers assistance by streamlining the application process for government assistance, making it easier for individuals to access the support they need.

Will recipients receive any information about their COLA increase?

Yes, recipients will receive a newly designed and simplified COLA notice to help them understand their benefits better.

How can beneficiaries stay informed about their assistance status?

Beneficiaries are encouraged to check their personal accounts online to view their COLA notice and stay updated about their assistance status.