Overview

This article highlights the anticipated 2.5% increase in SSDI payments for 2025, a change that many beneficiaries may find significant. We understand that navigating these changes can feel overwhelming, especially with adjustments in eligibility criteria and administrative processes. This increase, along with updates in income thresholds and Medicare premiums, is designed to help recipients manage the challenges of inflation and rising living costs.

It's common to feel uncertain about how these changes will impact your daily life. We encourage you to utilize advocacy resources that can assist you in understanding and navigating these updates effectively. Remember, you are not alone in this journey; there are people and organizations ready to support you.

As you prepare for these adjustments, keep in mind that being informed is key. We're here to help you through this process, ensuring that you have the tools and knowledge you need to thrive. Together, we can face these changes with confidence.

Introduction

As the landscape of Social Security Disability Insurance (SSDI) evolves, we understand that the anticipated payment increase in 2025 brings both opportunities and challenges for millions of beneficiaries. With a 2.5% adjustment on the horizon, it’s crucial to grasp the implications of this change for effective financial planning and advocacy.

It’s common to feel uncertain amidst these adjustments, especially when questions arise about:

- Eligibility criteria

- Potential delays in payments due to administrative cuts

- The overall sustainability of support systems

How can you navigate this complex terrain to ensure you receive the benefits you deserve? We're here to help you through this journey.

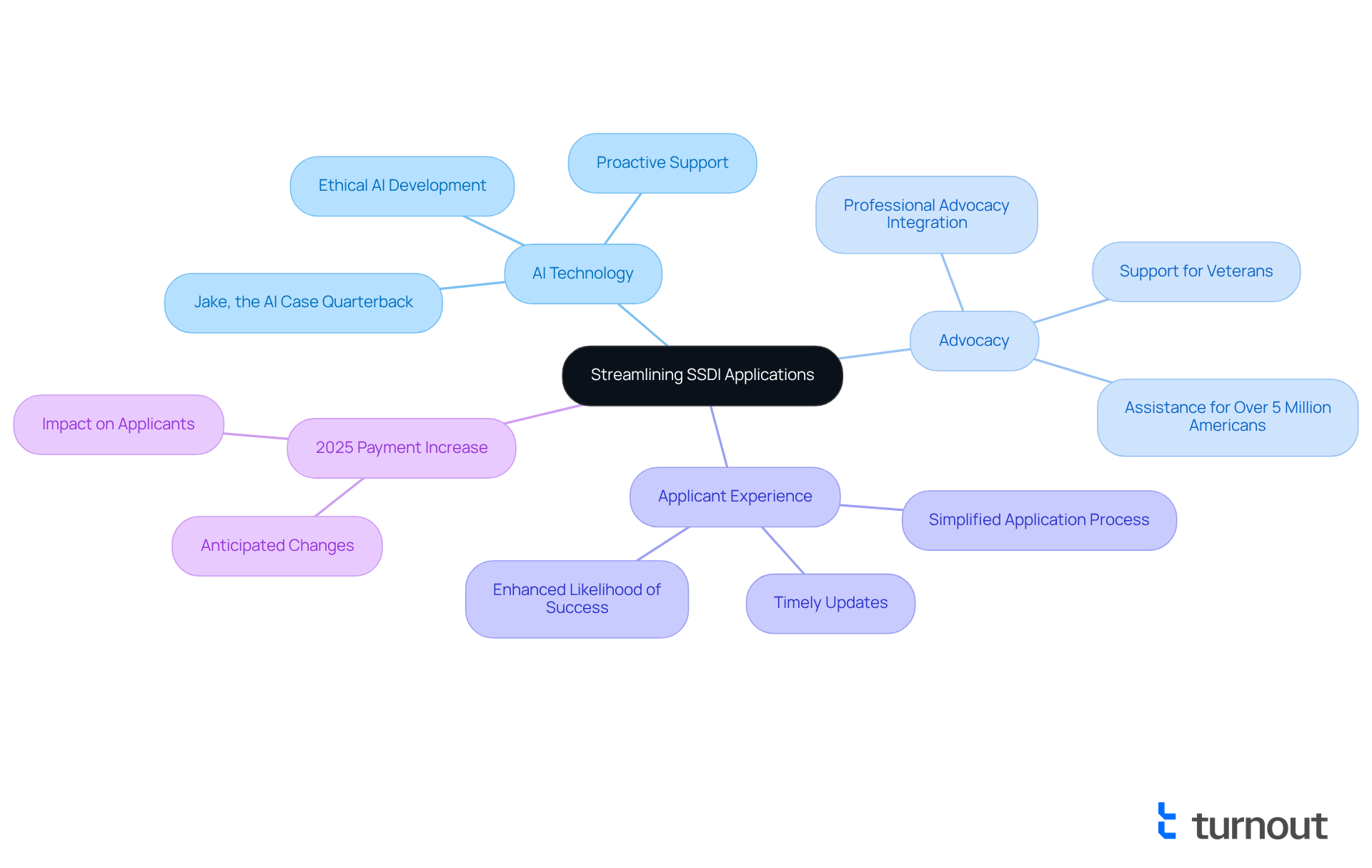

Turnout: Streamlining SSDI Applications for 2025 Payment Increases

Turnout is transforming the disability benefits application process by utilizing AI technology to enhance the experience for applicants. We understand that applying for benefits can feel overwhelming, and with the introduction of Jake, the AI case quarterback, Turnout ensures that you receive timely updates and support throughout your journey. This proactive strategy not only lessens the administrative load on candidates but also improves your likelihood of effectively handling the intricacies of disability benefit applications, especially with the anticipated SSDI payment increase in 2025.

More than 5 million Americans seek advocacy for Social Security Disability assistance, highlighting the urgent need for effective support in this area. As Satya Nadella, CEO of Microsoft, emphasizes, AI must be developed in a way that reflects human values and serves the greater good, which is precisely what Turnout aims to achieve. By merging AI technology with professional advocacy, Turnout is set to greatly enhance the results for disability applicants, ensuring you obtain the benefits you are entitled to. Remember, you are not alone in this journey; we're here to help.

2.5% COLA: Understanding the Impact on SSDI Payments in 2025

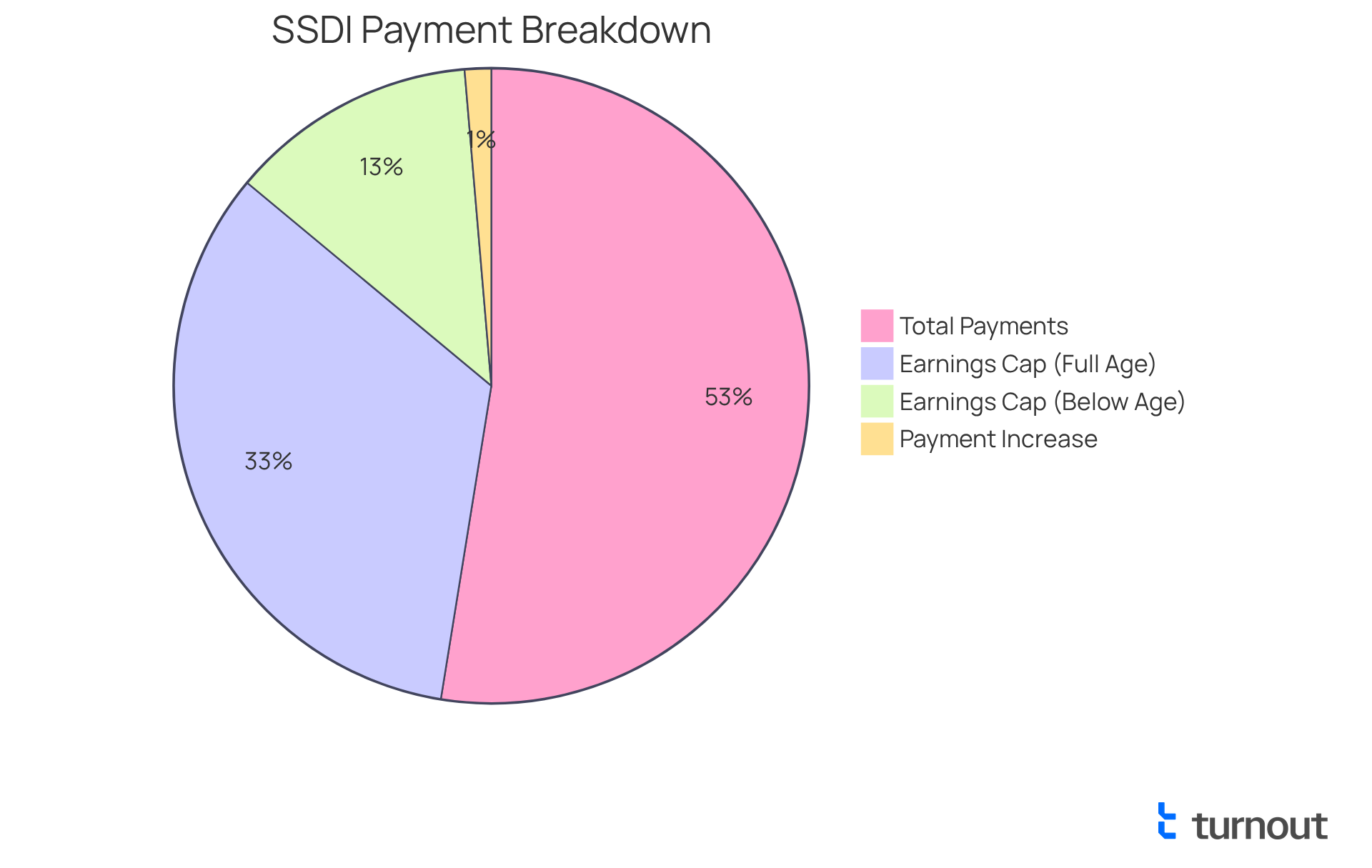

In 2025, there will be an SSDI payment increase of 2.5% for recipients due to the Cost-of-Living Adjustment (COLA). We understand that this adjustment is crucial for helping you keep up with inflation and rising living costs, which can feel overwhelming at times. For nearly 68 million Social Security beneficiaries, the SSDI payment increase can significantly ease your monthly budget, providing much-needed relief in these challenging economic times.

We encourage you to review your updated payment amounts, which will be available online in December 2024. Understanding how this adjustment impacts your financial situation is important. Additionally, we want to highlight that:

- The earnings cap for individuals reaching full retirement age in the coming years will be $62,160.

- For those below full retirement age, it will be $23,400.

Recognizing these details is essential for effective financial planning and management. Remember, the purpose of the COLA is to help maintain your purchasing power against inflation. You are not alone in this journey; we're here to help you navigate these changes.

Eligibility Changes: What SSDI Applicants Need to Know for 2025

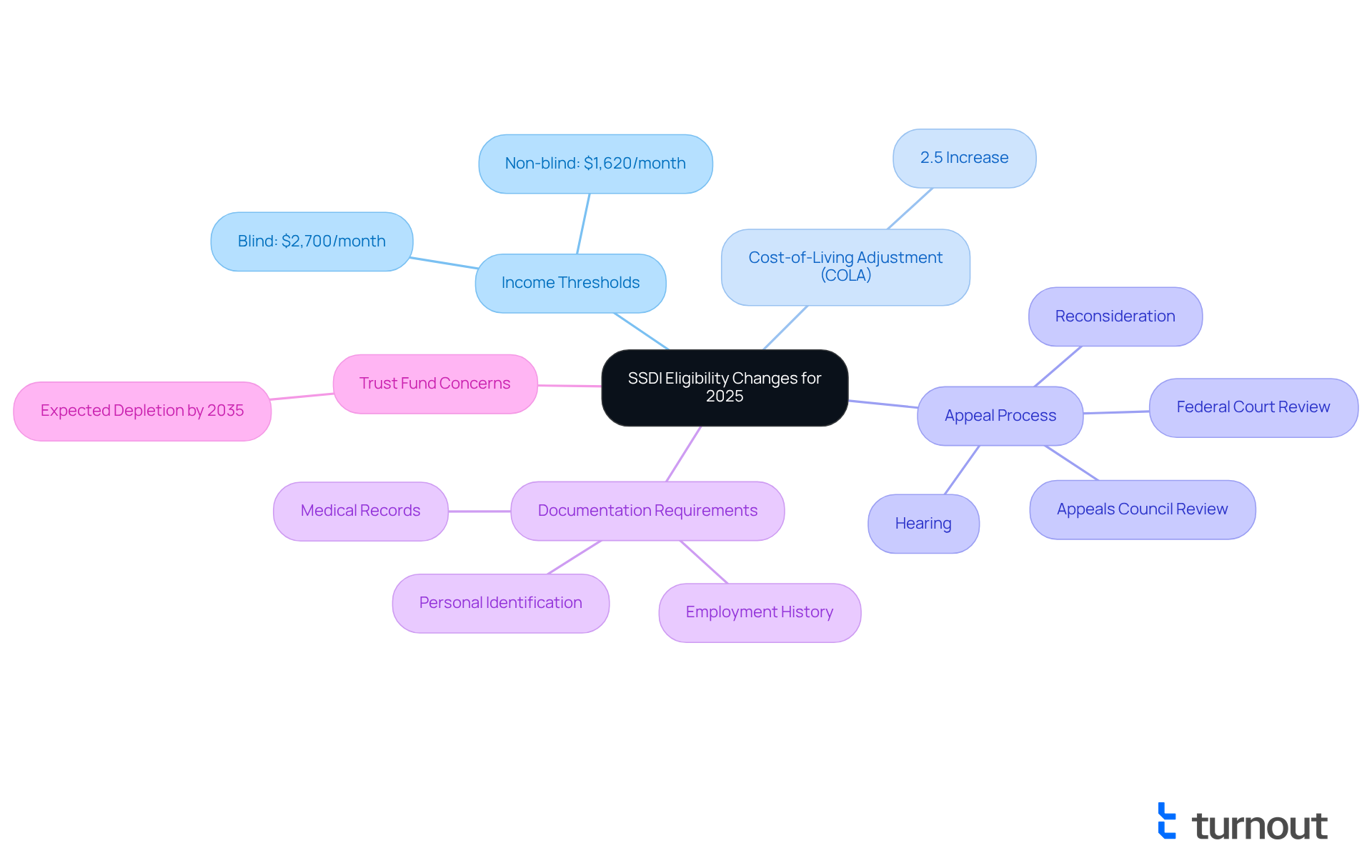

As we approach the year 2025, it's important for SSDI applicants to be aware of significant changes in eligibility standards, particularly regarding income thresholds and employment history requirements. In 2025, the significant gainful activity (SGA) threshold will rise to $1,620 per month for non-blind individuals, while blind applicants will be able to earn up to $2,700 monthly without jeopardizing their entitlements. Understanding these adjustments is crucial, as they can directly influence eligibility and impact your claims.

Additionally, a 2.5% cost-of-living adjustment (COLA) is expected with the SSDI payment increase in 2025, which will further affect the financial landscape for recipients. Many individuals have successfully navigated these changes by seeking guidance from advocates or utilizing resources like Turnout. By staying informed and consulting certified experts, you can enhance your chances of meeting the revised criteria for assistance.

Gathering comprehensive documentation—such as medical records, employment history, and personal identification—is essential for effectively supporting your claims. Understanding the intricacies of Social Security Disability Insurance eligibility is vital, especially as the Social Security Administration (SSA) continues to refine its processes. Moreover, being aware of the potential ramifications of the Trust Fund's expected depletion by 2035 is important, as it raises questions about the sustainability of support.

Given these updates, we encourage applicants for disability support to engage with advocacy services. This will help ensure compliance with the new requirements and maximize your chances of receiving the assistance you need. If you encounter a denial, it's helpful to know the four stages of the appeal process:

- Reconsideration

- Hearing

- Appeals Council Review

- Federal Court Review

Understanding these steps can lead to a more favorable outcome. Remember, you are not alone in this journey; we’re here to help you every step of the way.

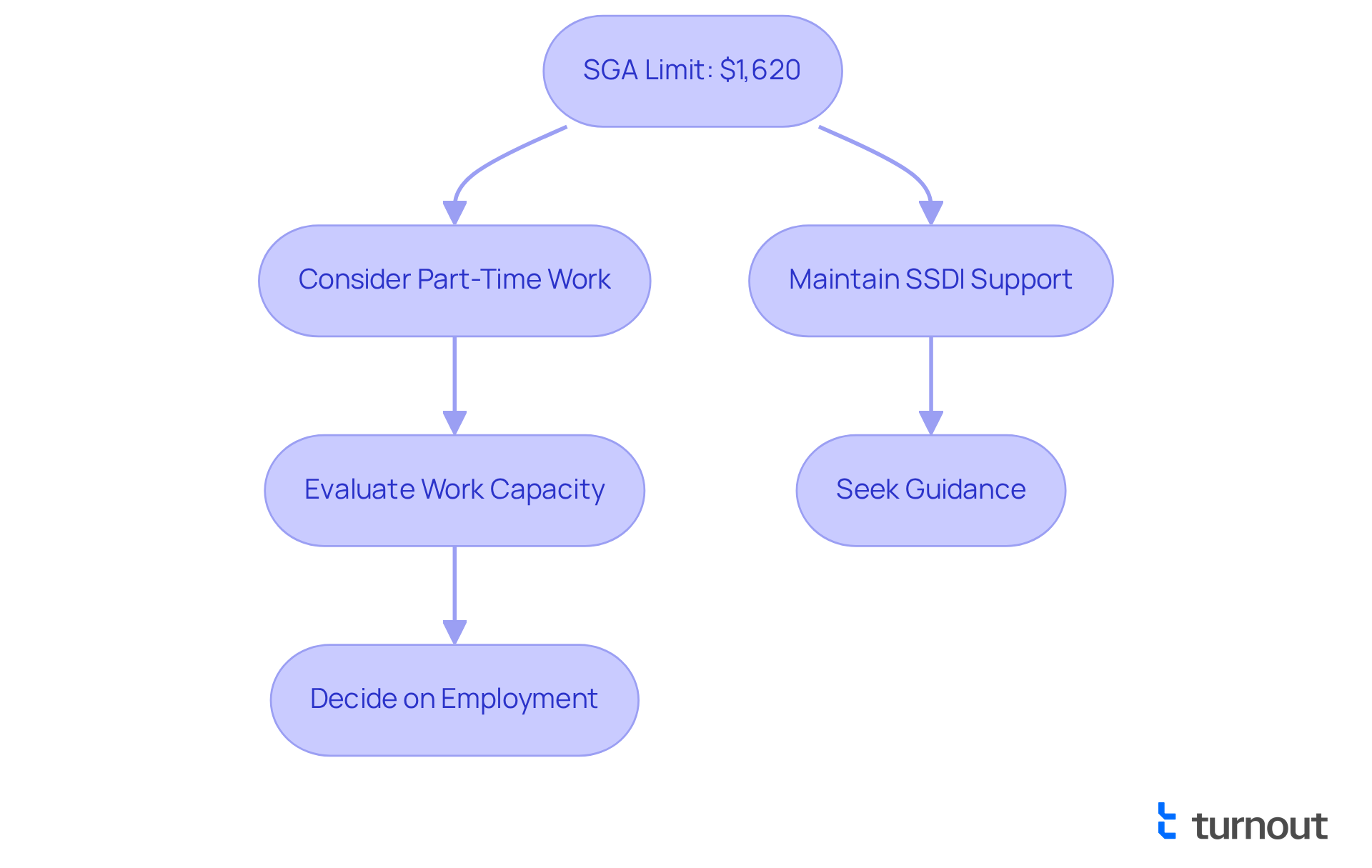

Substantial Gainful Activity (SGA) Limits: New Thresholds for 2025

In 2025, the SSDI payment increase will result in the Substantial Gainful Activity (SGA) limit for non-blind individuals increasing to $1,620 per month. This change is significant for those receiving disability insurance, as it allows you to explore your capacity to work without jeopardizing your assistance.

We understand that navigating these limits can be challenging. It's essential for recipients who may wish to engage in part-time employment while still receiving support from Social Security Disability Insurance.

Remember, you are not alone in this journey, and we're here to help you make informed decisions.

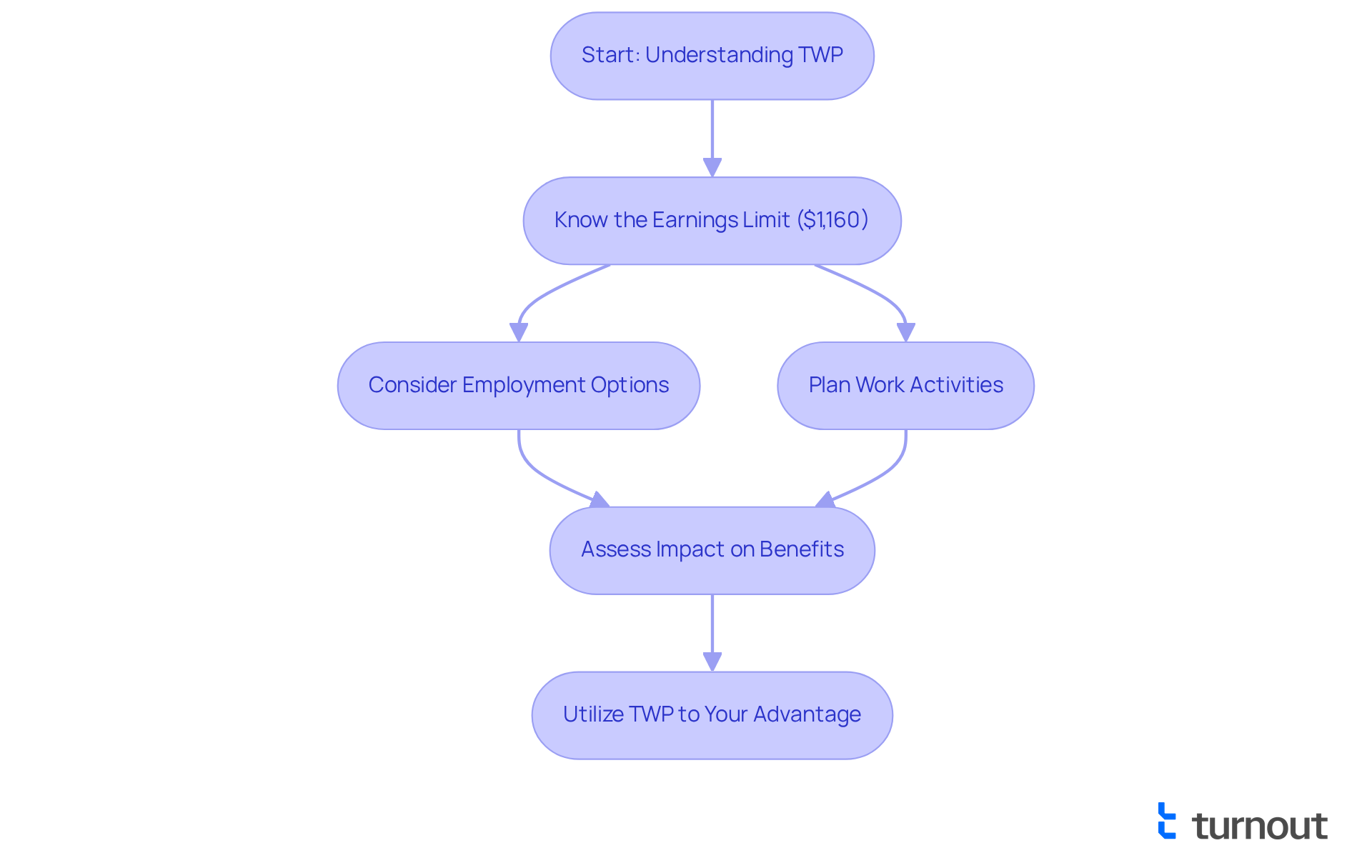

Trial Work Period (TWP) Changes: Implications for SSDI Recipients in 2025

The Trial Work Period (TWP) is a valuable opportunity for SSDI recipients to explore their ability to work without the fear of losing benefits. For the year 2025, the SSDI payment increase 2025 will establish the earnings limit to activate a TWP at $1,160 per month. This adjustment encourages you to consider employment options while still safeguarding your financial stability.

We understand that navigating work while receiving benefits can feel daunting. It’s essential to grasp how the TWP operates and to thoughtfully plan your work activities. Remember, you are not alone in this journey. We’re here to help you make informed decisions that align with your goals.

Take this time to reflect on how you can utilize the TWP to your advantage. By understanding its mechanics, you can confidently step into the workforce, knowing that your benefits are protected during this trial period.

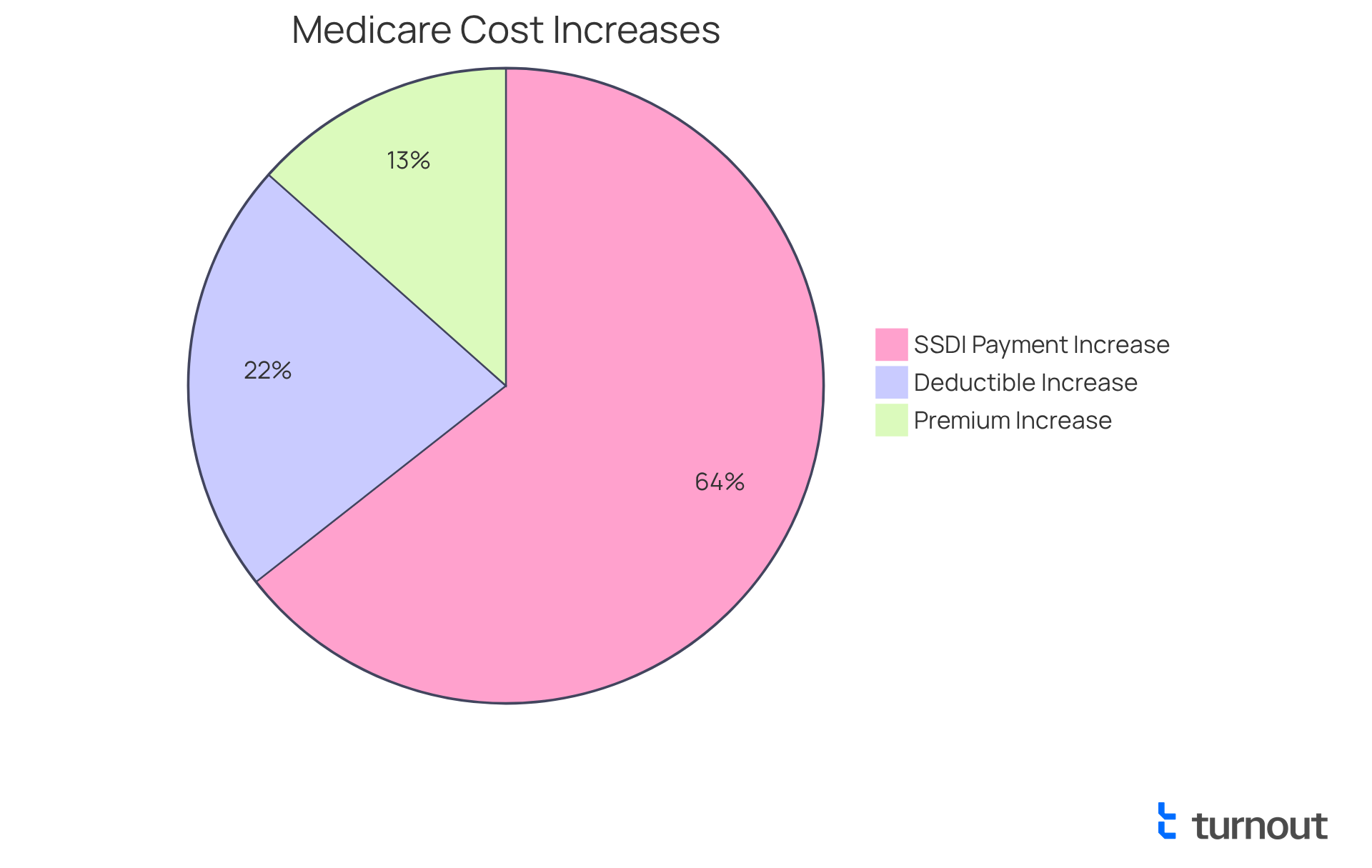

Medicare Premium Adjustments: What SSDI Beneficiaries Should Expect in 2025

In 2025, recipients of disability benefits will notice an increase in Medicare Part B premiums, rising to $185 per month—a $10.30 increase from the previous year. This adjustment is essential for beneficiaries to consider when planning their healthcare budgets, as it highlights the ongoing rise in healthcare expenses. Additionally, the annual deductible for Medicare Part B will increase to $257, reflecting a $17 rise from 2024, which will further impact out-of-pocket costs.

We understand that comprehending these premium adjustments is crucial for disability benefit recipients, as they can significantly influence financial planning. Beneficiaries will be responsible for 25% of the coinsurance costs until their out-of-pocket spending reaches $2,000. After that point, Medicare will cover 80% of drug costs. This cost-sharing framework underscores the importance of efficiently managing healthcare expenses, especially as the typical SSDI payment increase in 2025 is projected to rise by 2.5%, reaching an average monthly payment of roughly $1,976. While this increase in benefits may help alleviate some of the rising healthcare costs, careful budgeting will still be necessary.

Moreover, starting in 2025, annual out-of-pocket Medicare Part D drug costs will be capped at $2,000, offering significant relief for beneficiaries managing their medication expenses. Many SSDI recipients are navigating these changes with proactive strategies. Some are enrolling in Medicare Advantage plans that may provide additional benefits, while others are utilizing the new feature that allows them to spread out-of-pocket drug costs throughout the year. These steps can help reduce the financial impact of rising premiums and ensure that recipients can access the care they need without excessive financial burden.

Remember, you are not alone in this journey. We’re here to help you navigate these changes and find the best solutions for your healthcare needs.

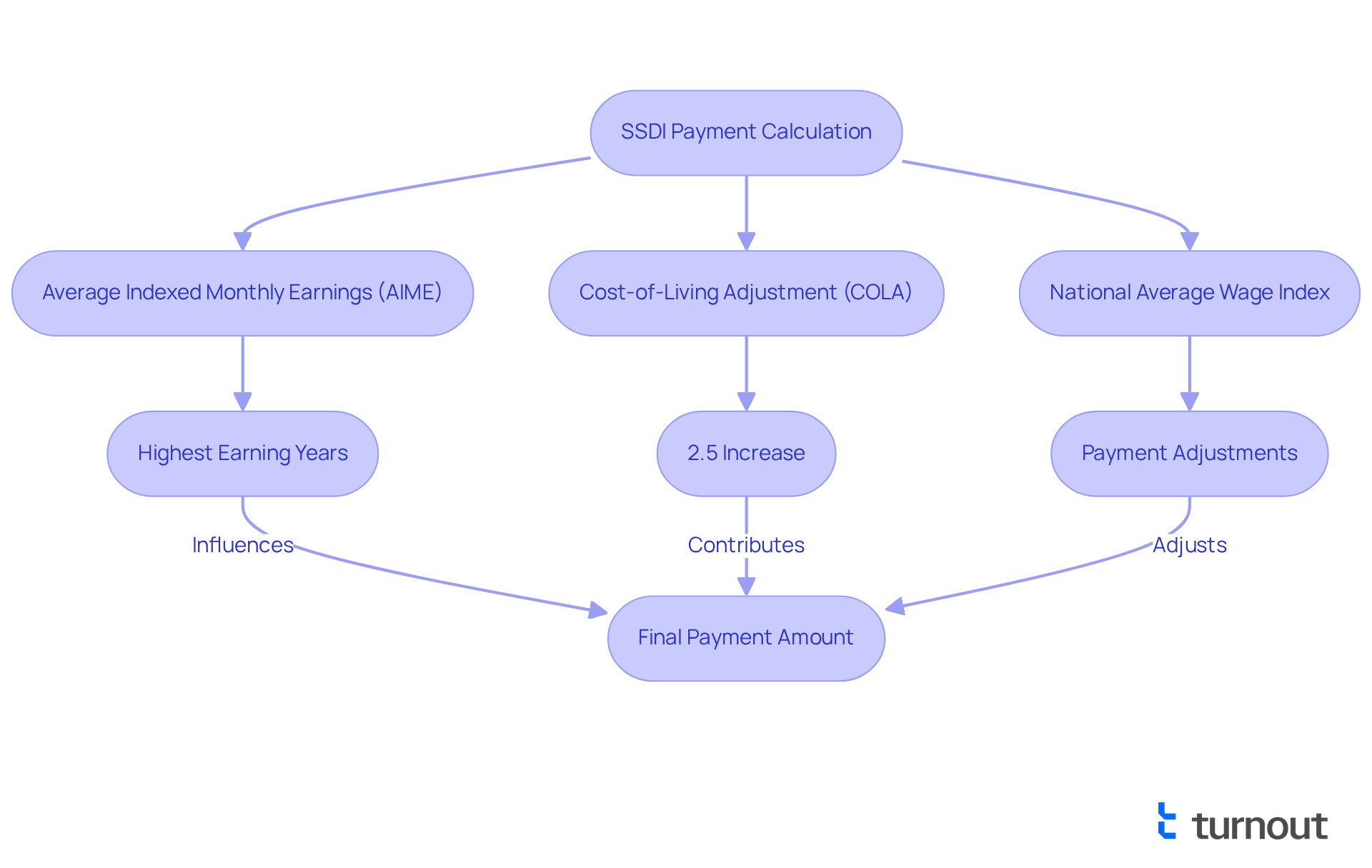

SSDI Payment Calculations: Key Factors for 2025

Navigating disability payments can be challenging, but understanding how they are determined can provide some clarity. Payments are based on the Average Indexed Monthly Earnings (AIME) of beneficiaries, reflecting their highest-earning years. In 2025, the cost-of-living adjustment (COLA) will rise by 2.5%, contributing to an SSDI payment increase in 2025 that directly impacts monthly payments. For example, this adjustment reflects the expected SSDI payment increase in 2025, meaning that the average monthly payment will be approximately $1,537. The maximum SSDI benefit will experience an SSDI payment increase in 2025, reaching $4,018, up from $3,822 in 2024.

It's important to note that changes in the national average wage index also play a crucial role in these calculations. We understand that comprehending these factors is essential for recipients, as they can significantly influence the financial assistance you receive. Payments are issued on specific Wednesdays of each month based on birth dates. Therefore, familiarizing yourself with your payment schedule can help you manage your finances more effectively.

If you find yourself needing additional help in understanding disability support, remember that you are not alone in this journey. We encourage you to reach out to Turnout for assistance. We're here to help you navigate this process with compassion and care.

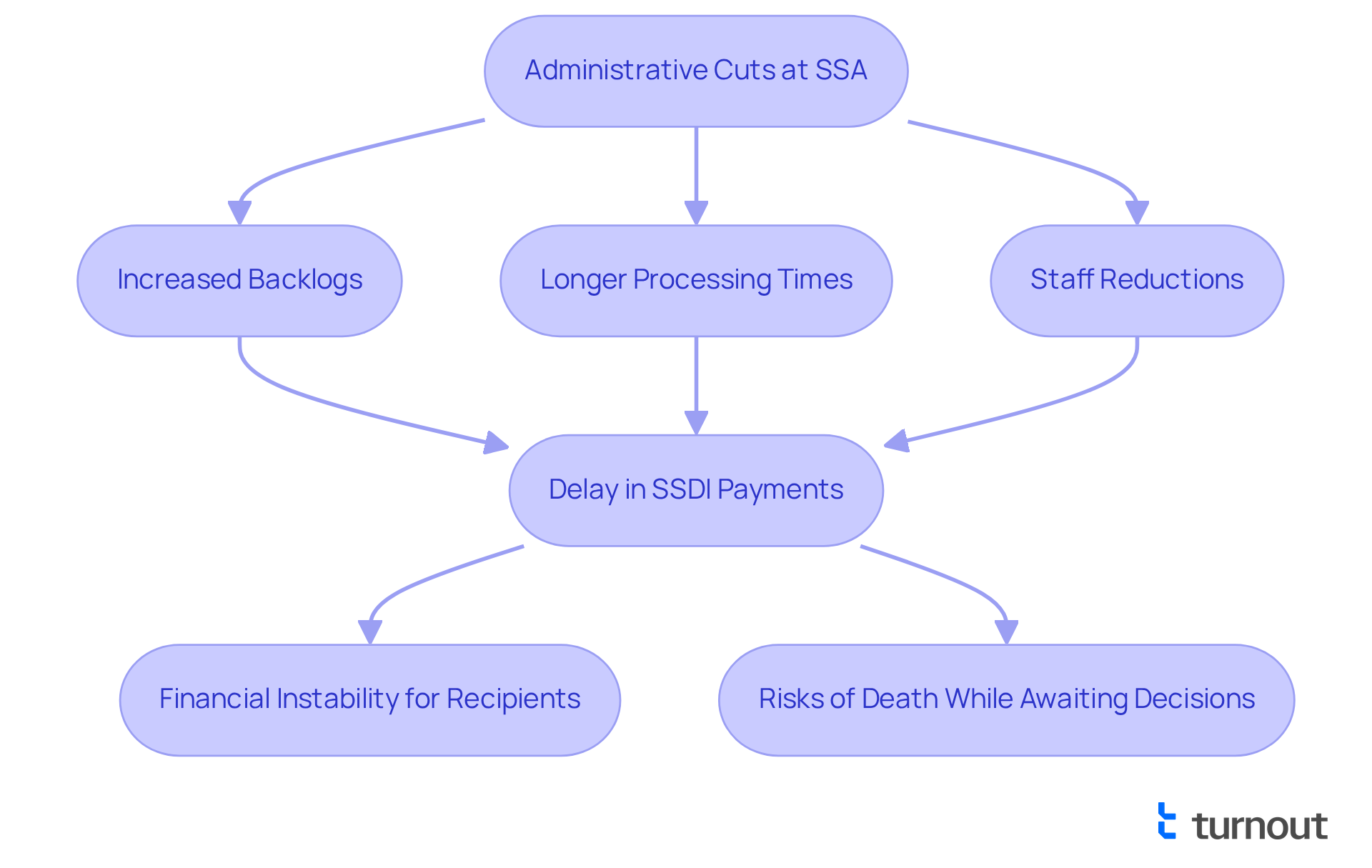

Administrative Cuts: Risks of Payment Delays for SSDI Recipients

Recent administrative cuts within the Social Security Administration (SSA) have raised significant concerns about potential delays in SSDI payments. With over 11 million disabled Americans depending on these aids, the consequences of such delays can be severe. We understand that 19% of Disability Insurance recipients would find it difficult to substitute lost assistance after just one month of delay. This situation could worsen with prolonged wait times. Currently, more than 1 million individuals are awaiting initial determinations on their disability claims. While the average wait for an SSA appointment is 32 days, wait times for initial decisions on claims have doubled, now averaging over six months in many cases.

The SSA's plans to cut over 7,000 employees and close regional offices threaten to exacerbate these delays. Staffing shortages have already led to increased backlogs and longer processing times. For instance, in Georgia, the average wait time for disability claims has reached a staggering 370 days, significantly longer than the national average. Such operational changes not only obstruct prompt access to assistance but also put vulnerable populations at higher risk of financial instability. Tragically, 30,000 people died while waiting for a decision on their disability claim in fiscal year 2023, underscoring the severity of the situation.

Advocacy groups, including Turnout, emphasize the importance of staying informed about these developments. Turnout's resources can assist recipients in navigating the complexities of the system during these uncertain times. As the SSA faces mounting pressure from budget cuts and staffing reductions, the need for effective advocacy has never been more critical. As Kathleen Romig from the Center on Budget and Policy Priorities noted, delays will only worsen as SSA cuts thousands of staff and millions more people need to make appointments. Remember, you are not alone in this journey; we’re here to help.

Legislative Changes: Staying Informed About SSDI Rights in 2025

As 2025 progresses, we understand that individuals receiving disability support—more than 5 million Americans—must stay alert to legislative changes, especially regarding the ssdi payment increase 2025, that could impact their rights and assistance. Engaging with advocacy organizations and utilizing resources from Turnout can empower recipients to navigate these shifts effectively. It's essential to understand new laws and regulations to ensure that you receive the support you are entitled to. Legislative amendments can significantly change how disability benefits function, particularly with the ssdi payment increase 2025 affecting eligibility requirements, benefit calculations, and administrative procedures.

Recent discussions have highlighted proposals aimed at enhancing procedural transparency and addressing backlog issues. These changes are crucial for individuals seeking timely assistance. As Christy observes, "The terrain of Social Security Disability Insurance continues to evolve, significantly shaped by legislative actions." By remaining knowledgeable, you can more effectively support your rights and navigate the intricacies of the disability benefits system. Remember, you are not alone in this journey. Turnout's AI case quarterback, Jake, simplifies the process and keeps you updated at every stage. Together, we can ensure you receive the assistance you deserve.

Resources for SSDI Applicants: Navigating the 2025 Changes

In 2025, we understand that navigating the changing environment of assistance, particularly with the SSDI payment increase 2025, can feel overwhelming for SSDI applicants. That's why resources like Turnout are here to help. This user-friendly app is designed to streamline the application process, connecting you with licensed advocates who offer personalized support. By simplifying complex procedures and providing timely updates, this innovative platform enhances your chances of a successful application.

Additionally, the Social Security Administration's website serves as a crucial resource. It offers comprehensive information on eligibility criteria, application steps, and legislative changes. Remember, by utilizing these tools, you can significantly improve your chances of securing the benefits you deserve. You're not alone in this journey; we're here to support you every step of the way.

Conclusion

As we look ahead to 2025, the landscape of Social Security Disability Insurance (SSDI) is set to evolve, bringing with it both challenges and opportunities for beneficiaries. We understand that navigating the complexities of eligibility, payment calculations, and administrative decisions can feel overwhelming. That’s why it’s crucial for both applicants and recipients to stay informed about these changes, ensuring they receive the support they need during this pivotal time.

Key insights into the SSDI payment increase, such as the 2.5% Cost-of-Living Adjustment (COLA), revised Substantial Gainful Activity (SGA) limits, and changes in Medicare premiums, highlight the importance of being proactive. Familiarizing yourself with the new eligibility criteria and understanding the implications of the Trial Work Period (TWP) can empower you to maximize your benefits while exploring employment opportunities. Engaging with advocacy services and utilizing available resources can significantly enhance your chances of navigating these changes successfully.

Ultimately, staying connected with advocacy groups is essential for SSDI recipients as they face potential delays and administrative cuts. Remember, you are not alone in this journey. By leveraging tools and support systems, you can advocate for your rights and ensure you receive the benefits you deserve. Embracing these changes with knowledge and support can lead to a more secure financial future for all SSDI beneficiaries.

Frequently Asked Questions

How is Turnout improving the SSDI application process?

Turnout is enhancing the SSDI application process by utilizing AI technology, specifically through an AI case quarterback named Jake, who provides timely updates and support to applicants, reducing their administrative burden and improving their chances of navigating the complexities of disability benefit applications.

What is the SSDI payment increase for 2025?

In 2025, there will be a 2.5% increase in SSDI payments due to the Cost-of-Living Adjustment (COLA), which aims to help recipients keep up with inflation and rising living costs.

When can SSDI recipients expect to see their updated payment amounts?

SSDI recipients can review their updated payment amounts online in December 2024.

What are the new earnings caps for SSDI recipients in 2025?

In 2025, the significant gainful activity (SGA) threshold will rise to $1,620 per month for non-blind individuals, while blind applicants can earn up to $2,700 monthly without losing their benefits.

Why is it important to understand the changes in SSDI eligibility standards for 2025?

Understanding the changes in SSDI eligibility standards, such as income thresholds and employment history requirements, is crucial as they directly affect eligibility and impact claims for assistance.

What should applicants do to support their SSDI claims effectively?

Applicants should gather comprehensive documentation, including medical records, employment history, and personal identification, to support their claims effectively.

What are the stages of the appeal process for SSDI claims?

The four stages of the appeal process for SSDI claims are: 1. Reconsideration 2. Hearing 3. Appeals Council Review 4. Federal Court Review

What is the significance of the Trust Fund's expected depletion by 2035?

The expected depletion of the Trust Fund by 2035 raises concerns about the sustainability of support for SSDI applicants, making it important for individuals to stay informed about potential changes in benefits.

How can applicants navigate the changes in SSDI eligibility and application processes?

Applicants can enhance their chances of meeting the revised criteria for assistance by seeking guidance from advocates or utilizing resources like Turnout, which help ensure compliance with new requirements.